United States Tax Forms and Templates

Related Articles

Documents:

2432

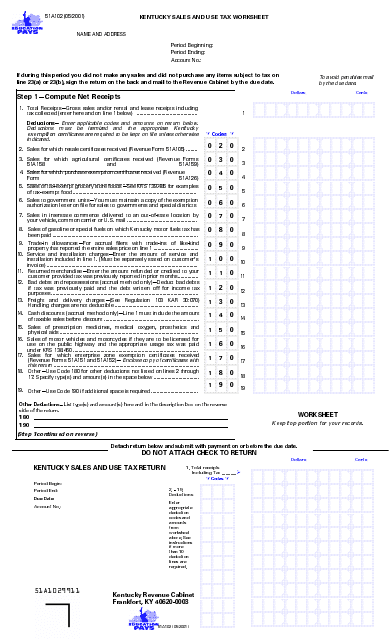

This Form is used for calculating sales and use tax in the state of Kentucky. It helps individuals and businesses determine the amount of tax owed based on their sales and use of taxable items.

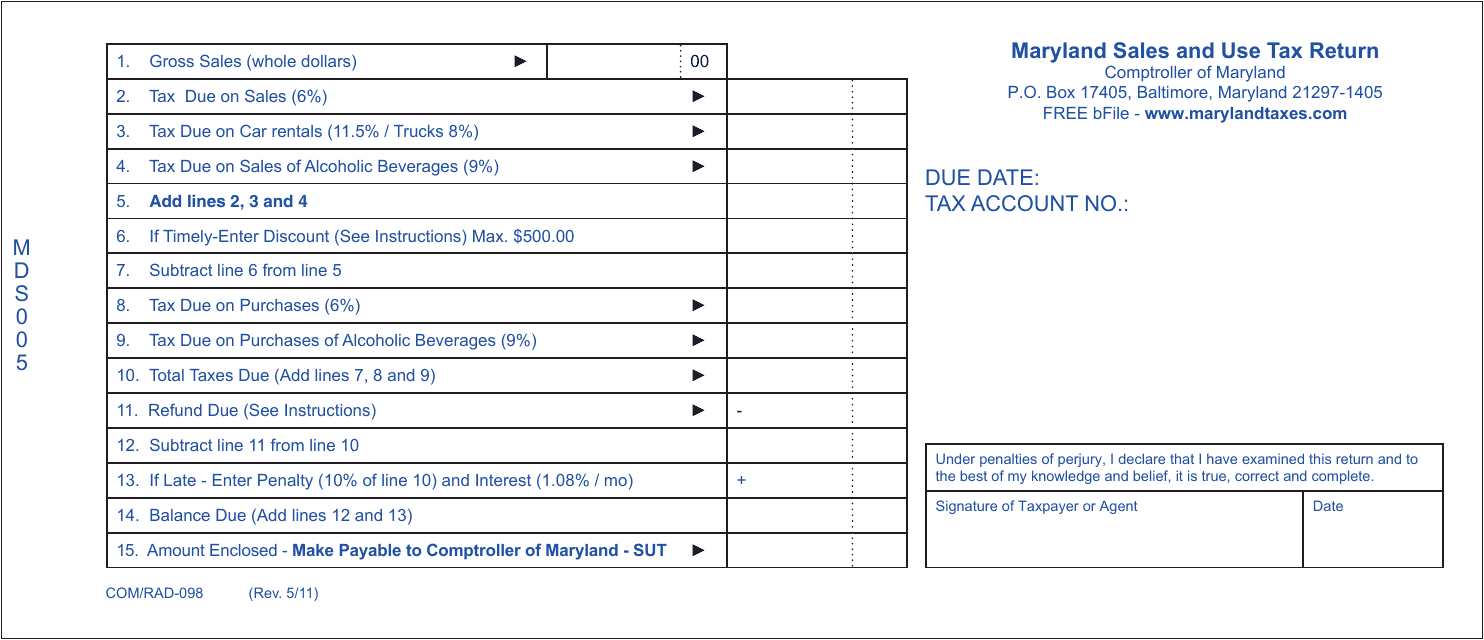

This form is used for reporting sales and use tax in the state of Maryland. It is used by businesses to calculate and pay their tax obligations related to sales of goods and services.

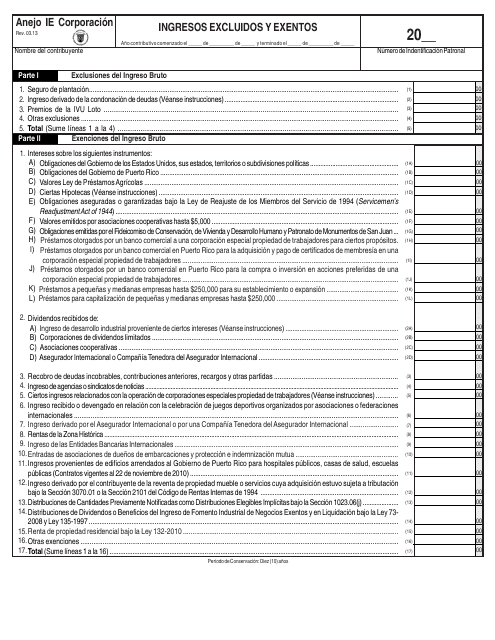

This document is for the inclusion and exemption of excluded and exempted income for corporations in Puerto Rico.

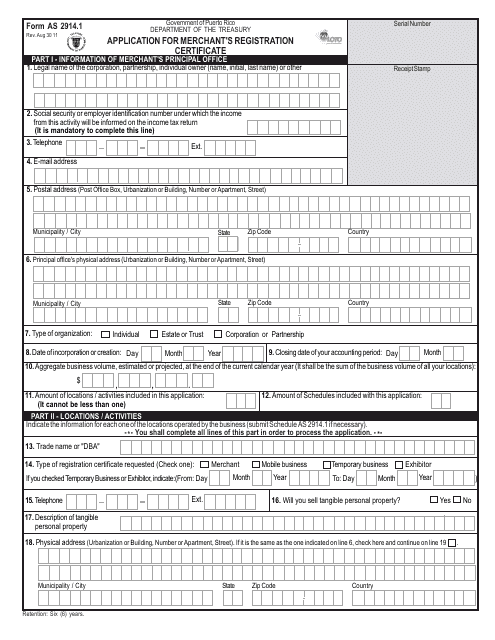

This form is used for applying for a Merchant's Registration Certificate in Puerto Rico. It is required for individuals or businesses engaging in commercial activities on the island.

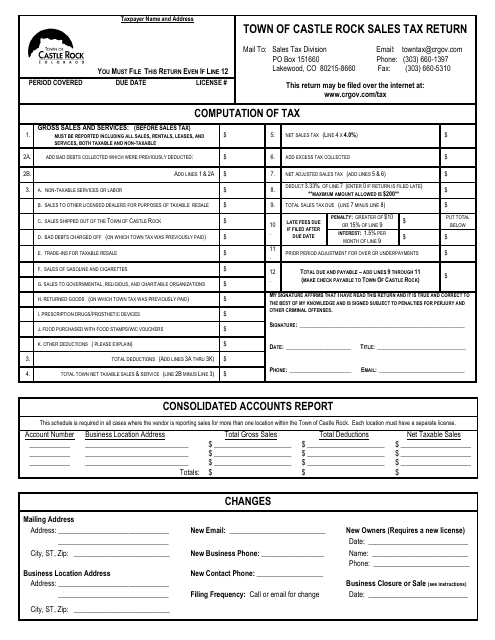

This document is used for reporting and remitting sales tax in the Town of Castle Rock, Colorado. Businesses must submit this form to the town's tax department on a regular basis to comply with local tax regulations.

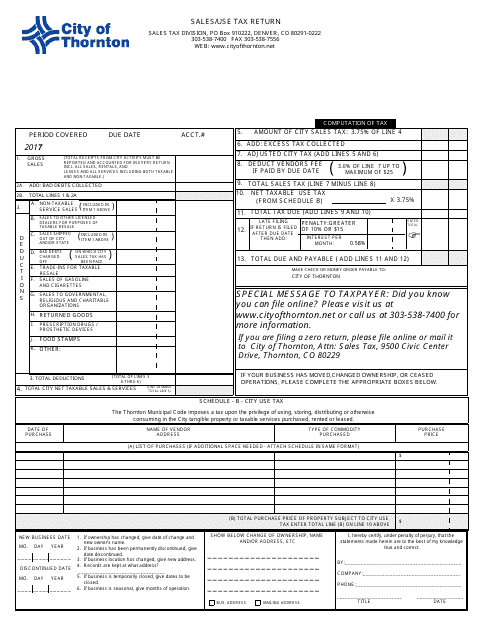

This form is used for reporting and remitting sales or use tax to the City of Thornton, Colorado.

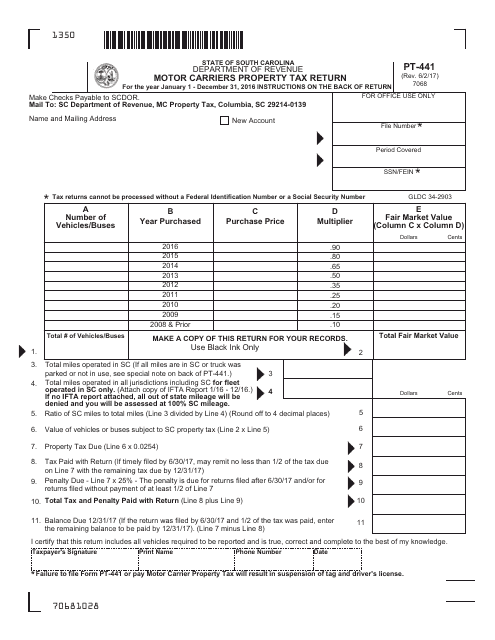

This form is used for South Carolina motor carriers to report and pay property taxes related to their operations.

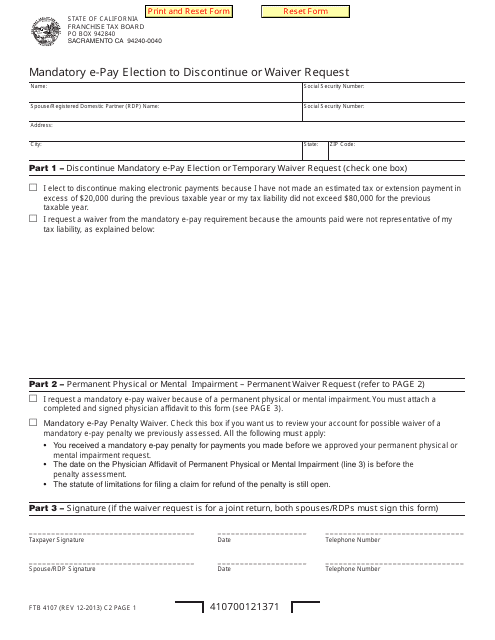

This form is used for making a mandatory electronic payment election and requesting to discontinue or waive the requirement in California.

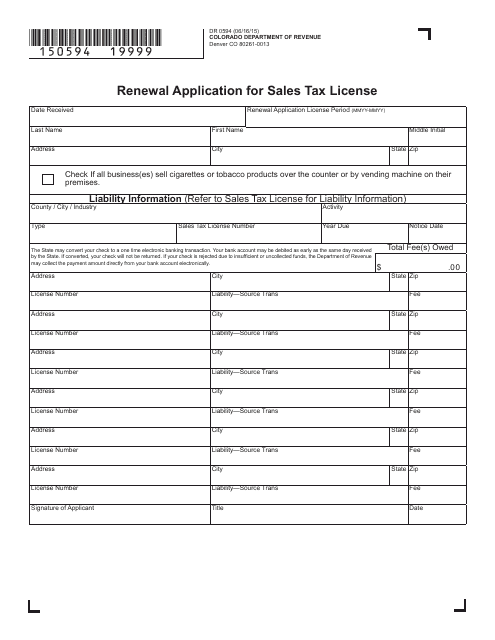

This form is used for renewing a sales tax license in Colorado.

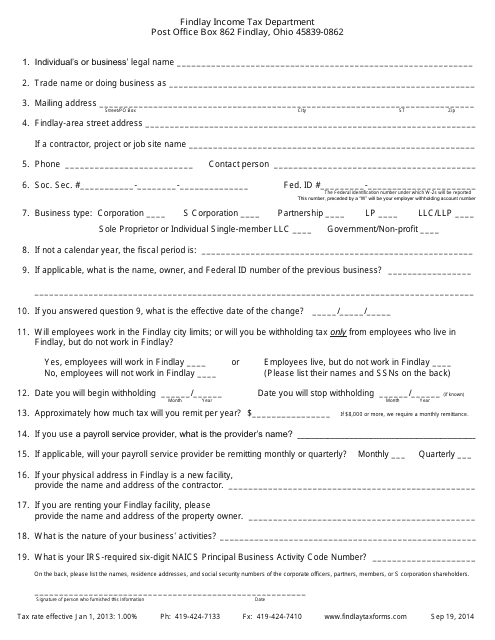

This type of document is a Business Questionnaire Form used by the City of Findlay, Ohio. It is used to collect information from businesses in the city for various purposes such as licensing, tax assessment, and community development.

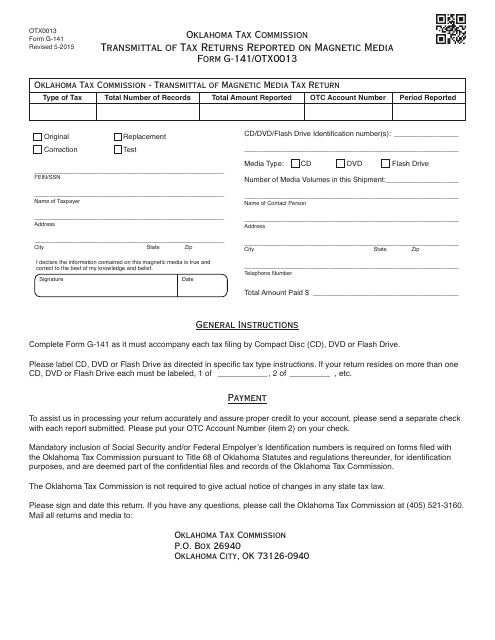

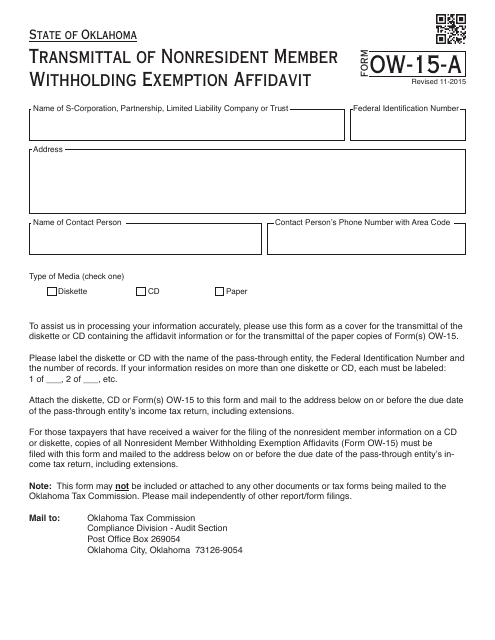

This document is used for transmitting tax returns reported on magnetic media to the Oklahoma Tax Commission (OTC).

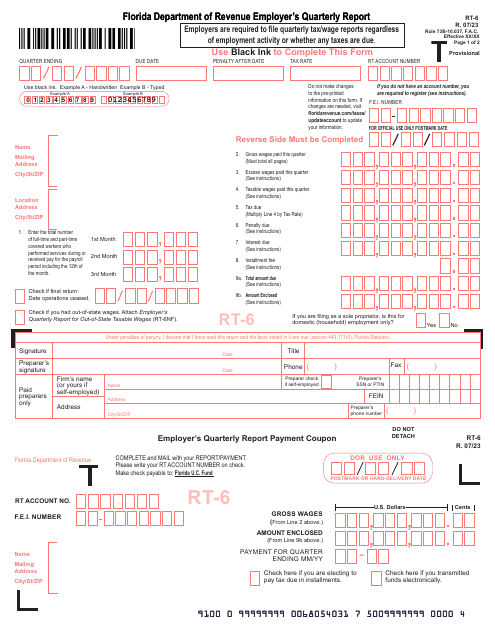

This is a legal document used to inform the Florida Department of Revenue (DOR) about the total number of all employees who performed services or received pay, their gross, excess, and taxable wages.

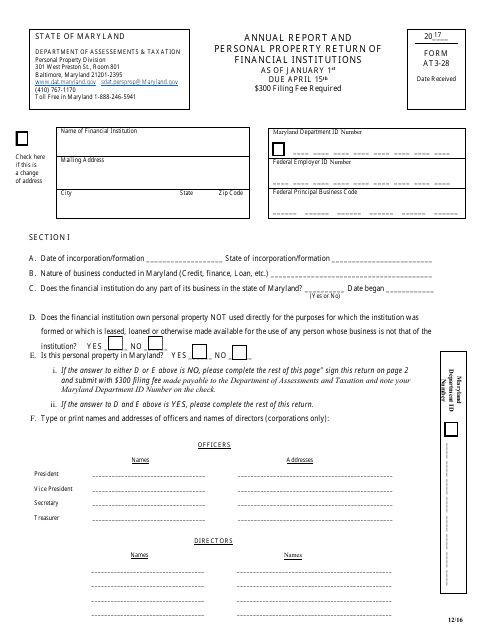

This Form is used for financial institutions in Maryland to file their annual report and personal property return.

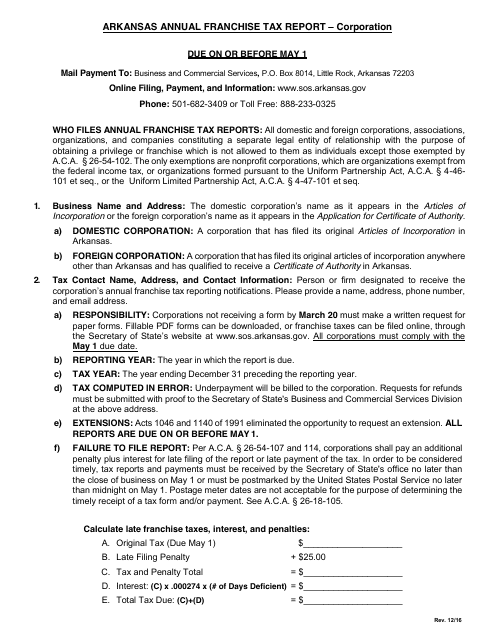

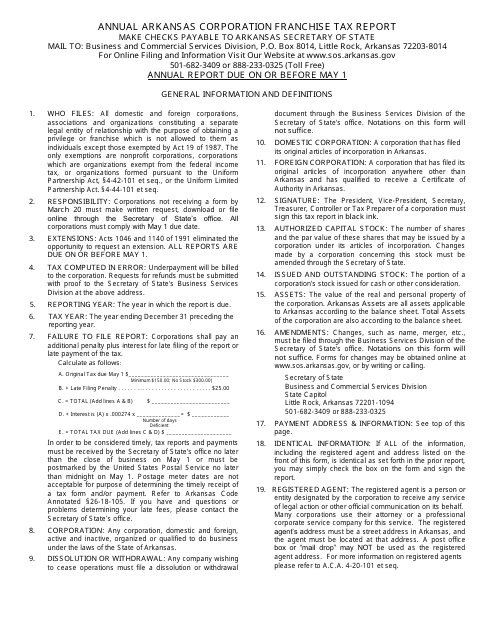

This document provides instructions for filling out the Annual Corporation Franchise Tax Report in Arkansas. It guides corporations on how to accurately report their taxes and includes step-by-step instructions for each section of the form.

This document is used for transmitting the Nonresident Member Withholding Exemption Affidavit in Oklahoma.

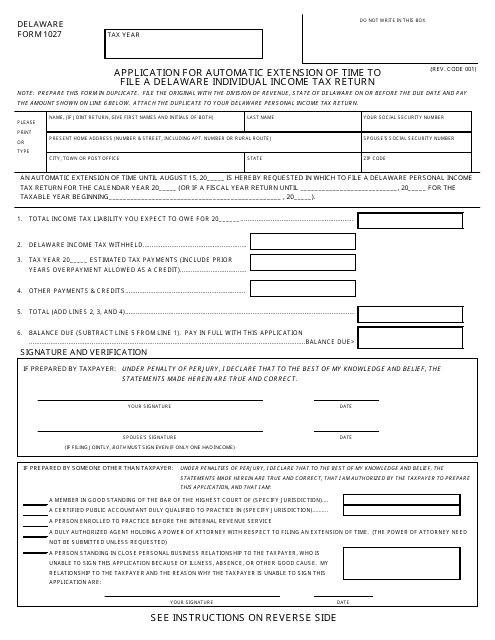

This Form is used for requesting an automatic extension of time to file a Delaware individual income tax return.

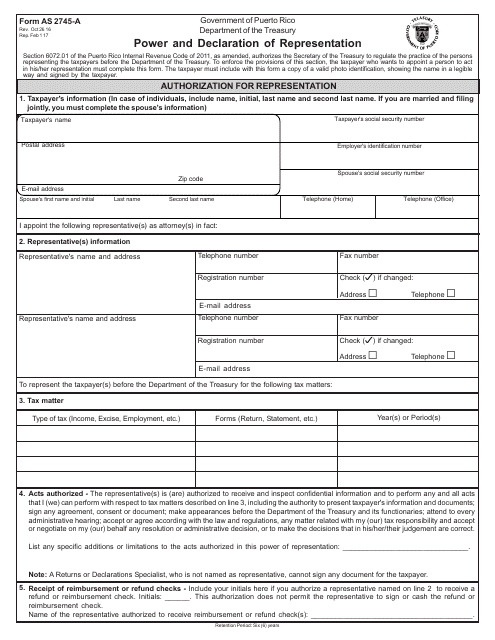

This Form is used for power and declaration of representation in Puerto Rico.

This type of document provides instructions on how to fill out the Annual Arkansas Corporation Franchise Tax Report for corporations in Arkansas. It explains the necessary steps and information required for completing the tax report accurately.

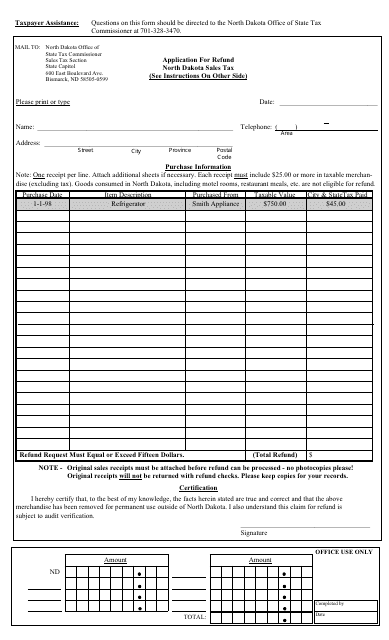

This Form is used for requesting a refund in the state of North Dakota.

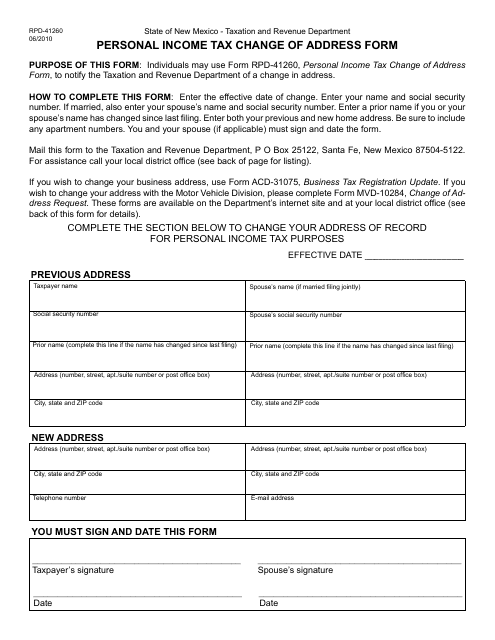

This Form is used for changing your address for personal income tax purposes in the state of New Mexico.

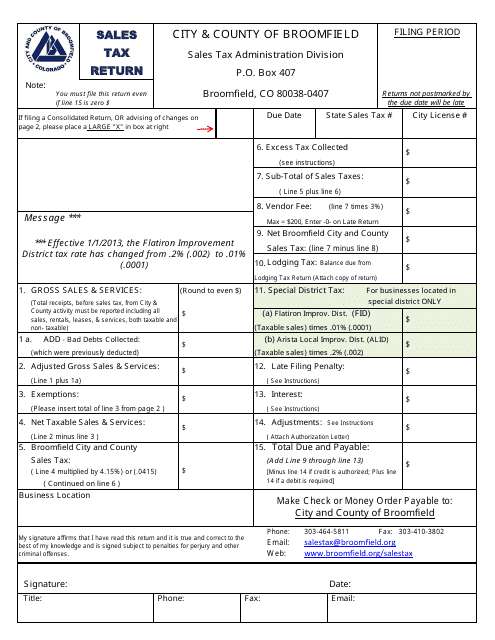

This form is used for filing sales tax returns for the City and County of Broomfield, Colorado.

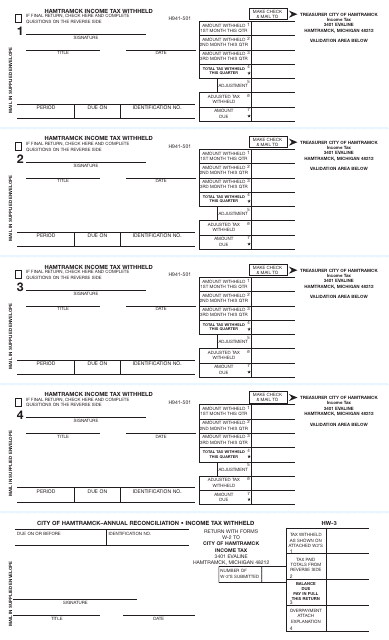

This Form is used for reporting income tax that has been withheld from wages in Hamtramck, Michigan.

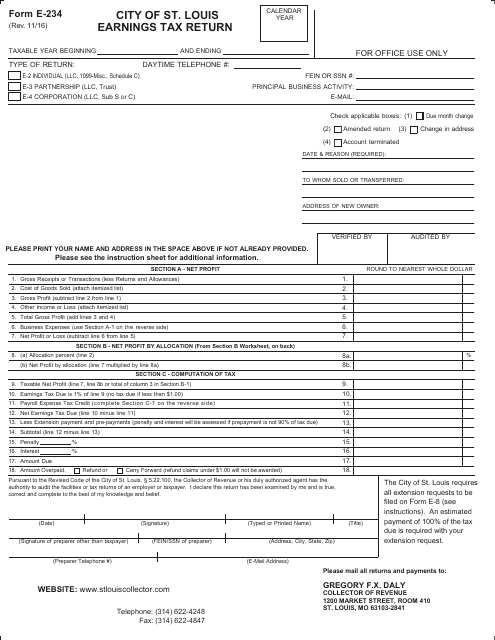

This form is used for filing the City of St. Louis earnings tax return in Missouri.

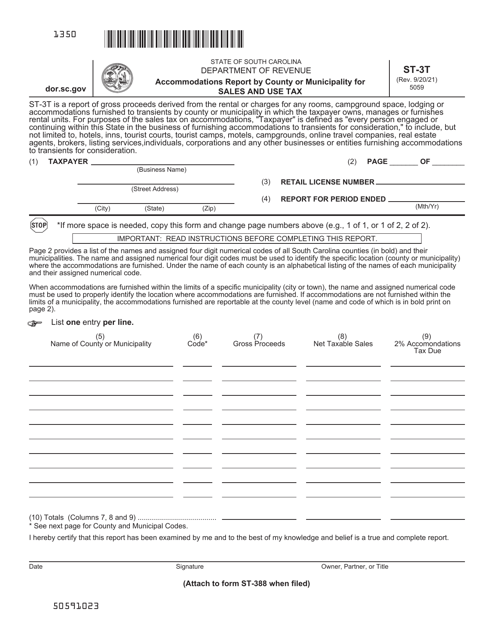

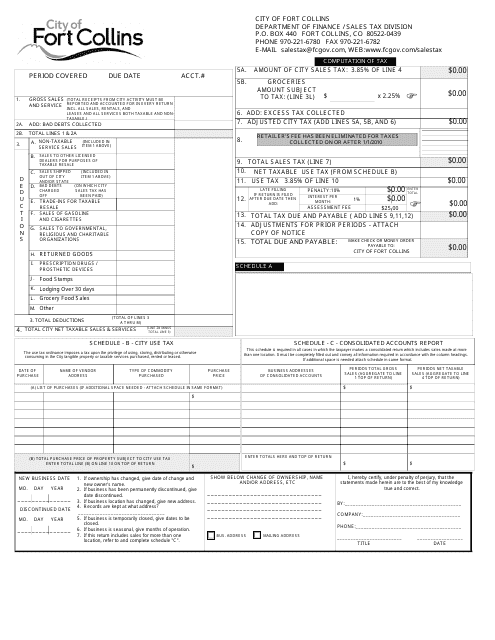

This form is used for reporting sales and use tax to the City of Fort Collins, Colorado. Businesses in the city are required to fill out this form to remit their tax obligations.

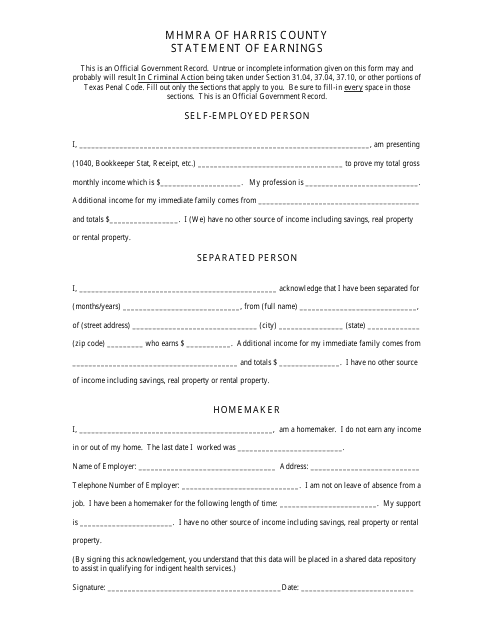

This form is used in Texas to provide a statement of earnings. It is used to report and document an individual's income and earnings.

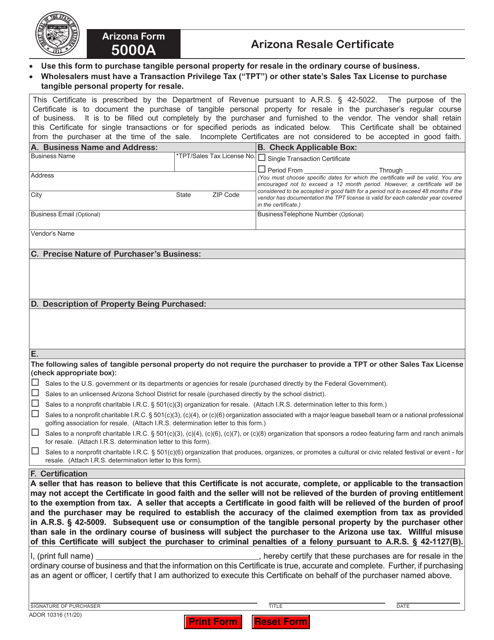

This form is released by Arizona's Department of Revenue and is supposed to be completely filled out and signed by a purchaser, and provided to a seller in order to document the purchase of a physical piece of personal property for resale.

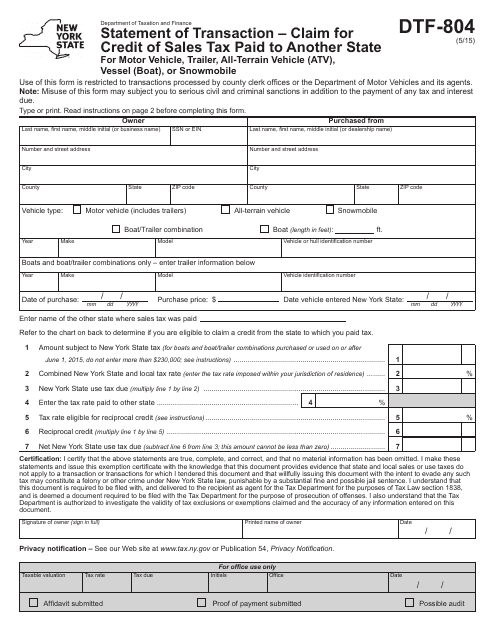

This Form is used for claiming credit of sales tax paid in another state for purchasing motor vehicles, trailers, all-terrain vehicles (ATV), vessels (boat), or snowmobiles in New York.

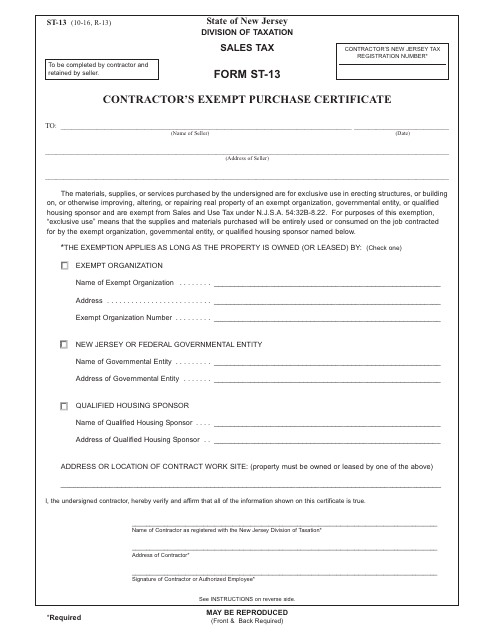

This Form is used for contractors in New Jersey to claim exemption on purchases made for construction projects.

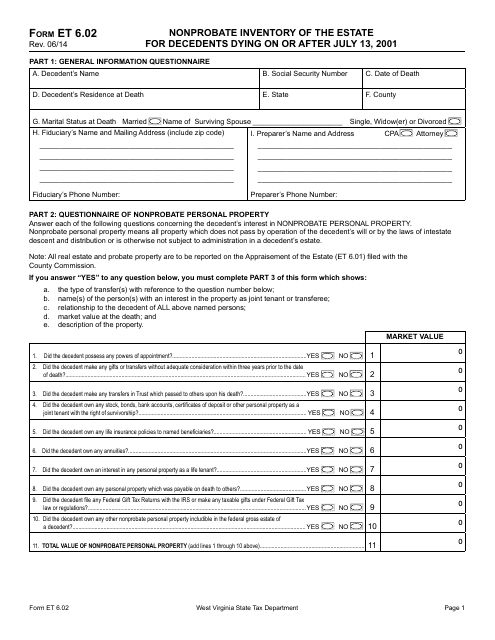

This Form is used for creating a Nonprobate Inventory of the Estate for Decedents Dying on or After July 13, 2001 in West Virginia.

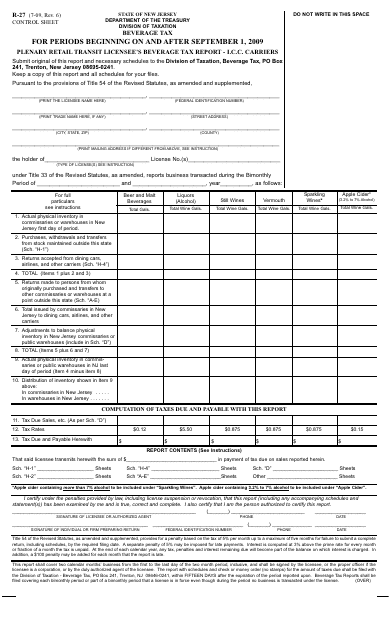

This form is used for New Jersey retailers to report and pay beverage taxes for the months of September and after.

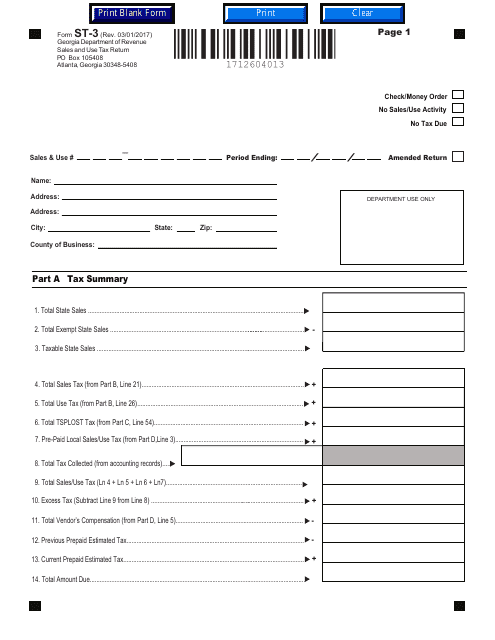

Georgia-registered organizations may use this form to report the sales and use tax they owe in the state of Georgia.