United States Tax Forms and Templates

Related Articles

Documents:

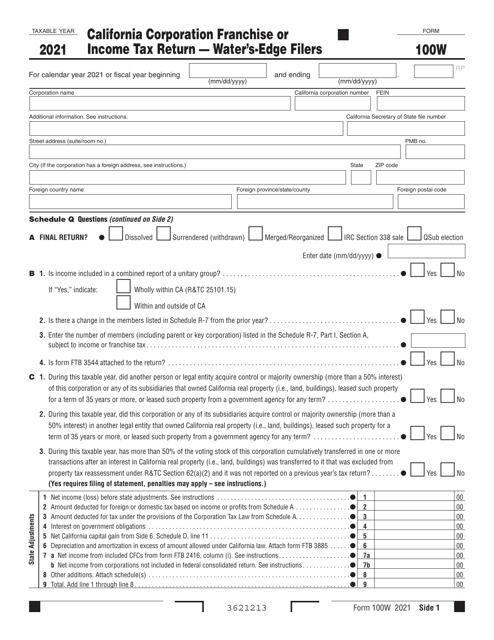

2432

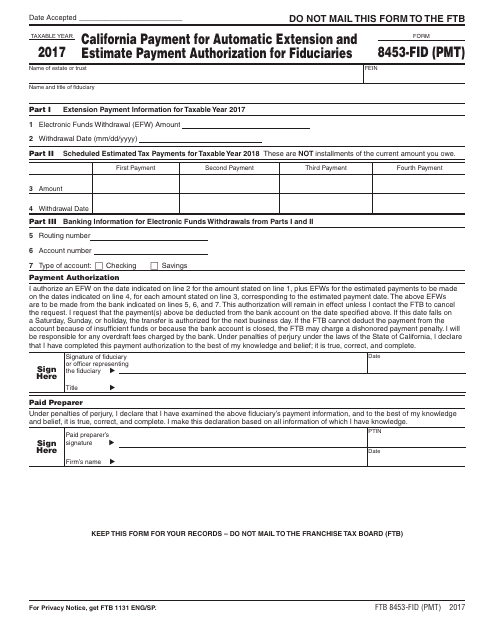

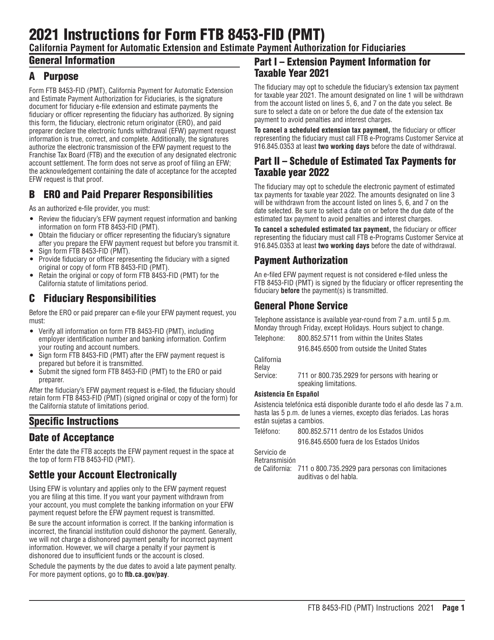

This form is used for making payment for the automatic extension and estimate payment authorization for fiduciaries in California.

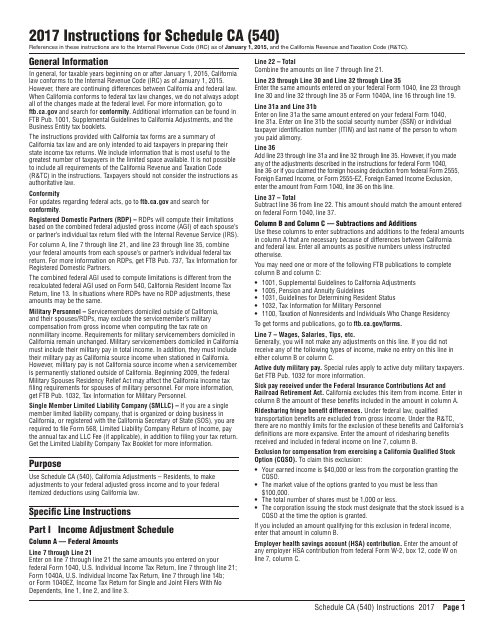

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

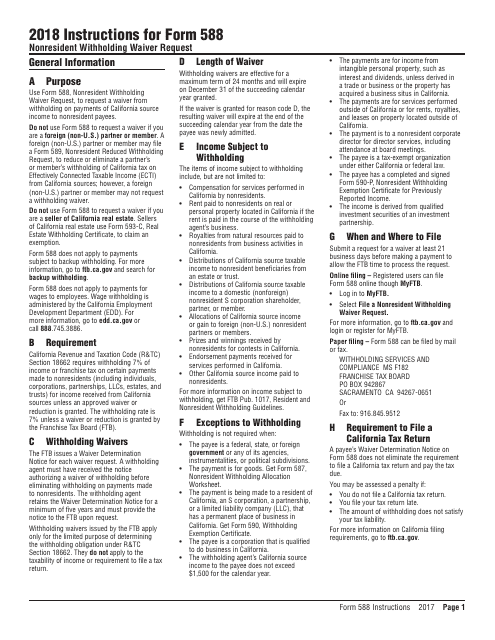

This form is used for requesting a waiver of nonresident withholding taxes in the state of California.

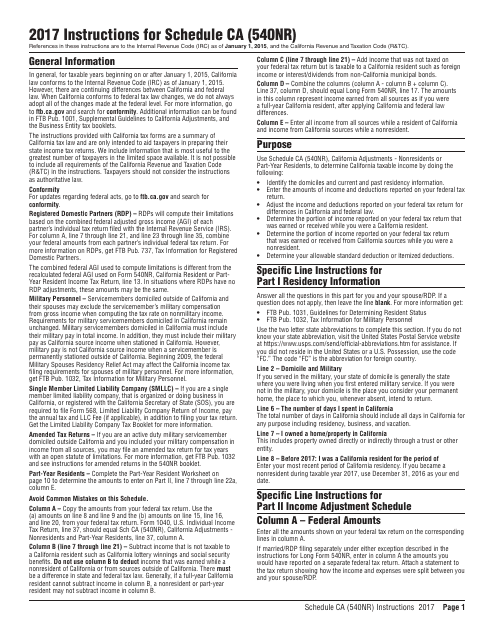

This document is used to provide instructions for completing Form 540NR Schedule CA for nonresidents or part-year residents of California. It specifies the adjustments that need to be made to the income, deductions, and credits reported on the tax return.

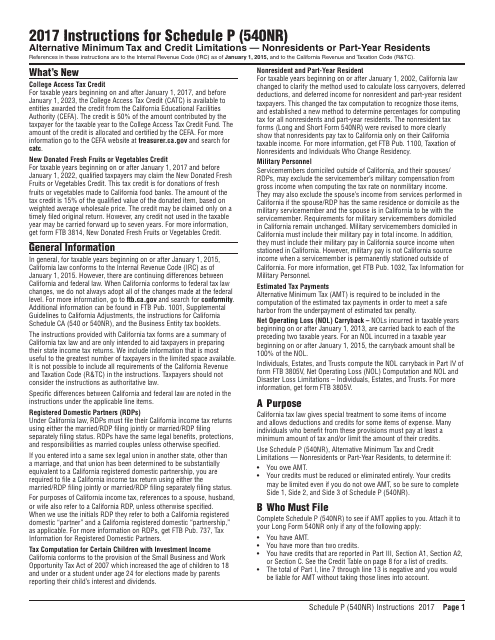

This Form is used for nonresidents or part-year residents of California to calculate their alternative minimum tax and credit limitations, as required by Form 540NR Schedule P.

This Form is used for claiming the Low-Income Housing Credit in the state of California. It provides instructions on how to complete and submit the form to the California Franchise Tax Board.

This document provides instructions on how to complete Form FTB3531, which is used to claim the California Competes Tax Credit in California. It guides taxpayers on what information to include and how to calculate their credit amount.

This Form is used for applying and electing to amortize a certified pollution control facility in California. It provides instructions on how to complete the application process.

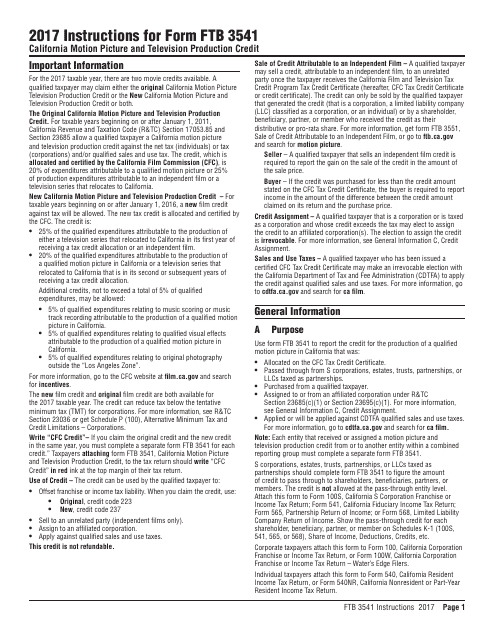

This form is used for claiming the California Motion Picture and Television Production Credit in California. It provides instructions on how to complete the form and what documentation needs to be included.

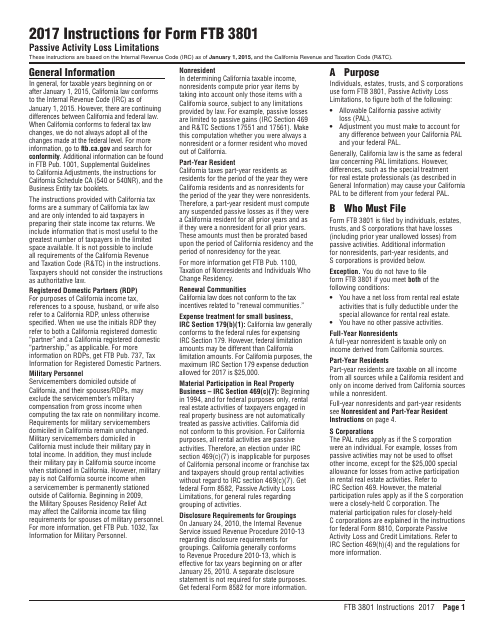

This document provides instructions for completing Form FTB3801, which is used to calculate and report passive activity loss limitations for individuals and businesses in California. The form helps taxpayers determine the amount of passive activity losses they can deduct on their state tax returns.

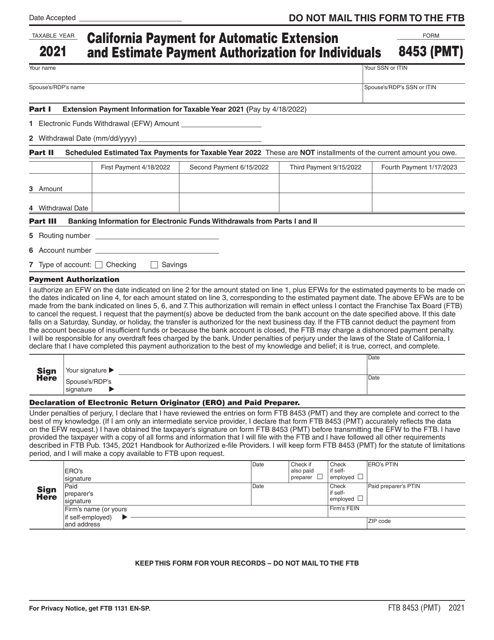

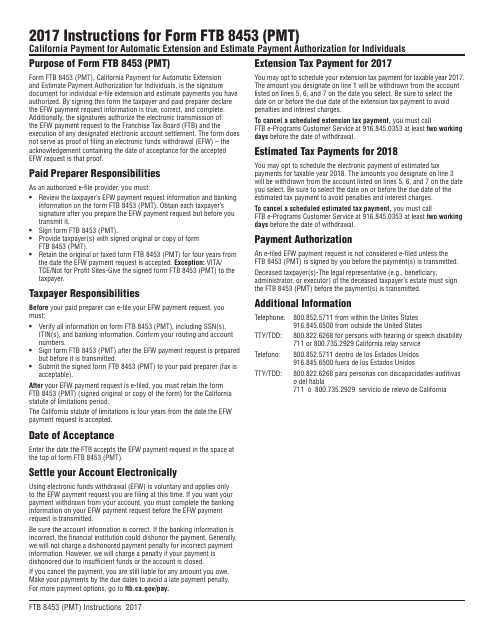

This document is for individuals in California who need to make a payment for an automatic tax extension or estimate payment authorization. It provides instructions on how to fill out and submit Form FTB8453 (PMT).

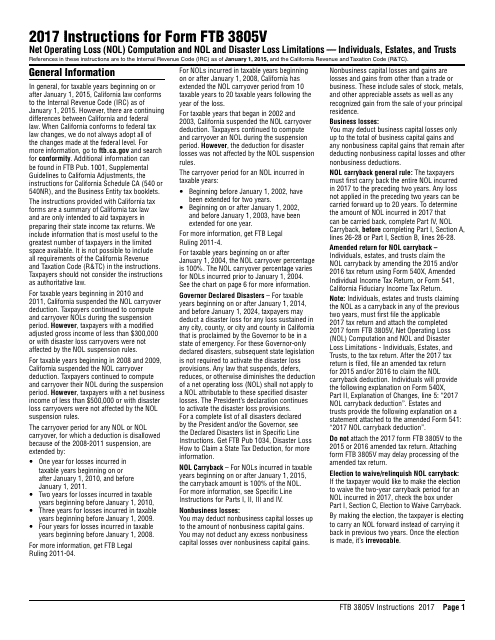

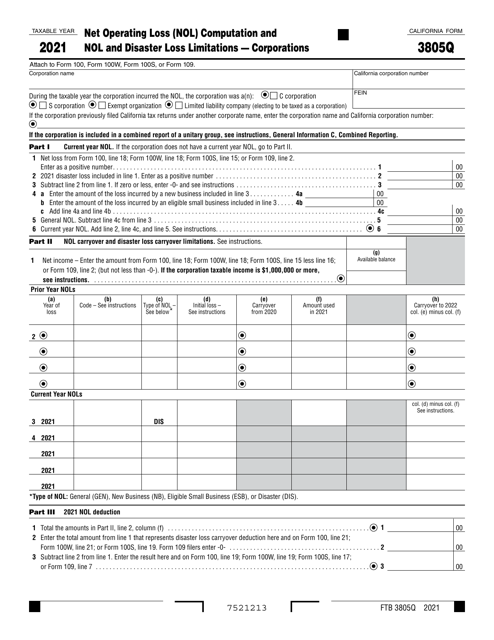

This Form is used to calculate the net operating loss (NOL) and determine the limitations on NOL and disaster losses for individuals, estates, and trusts in California.

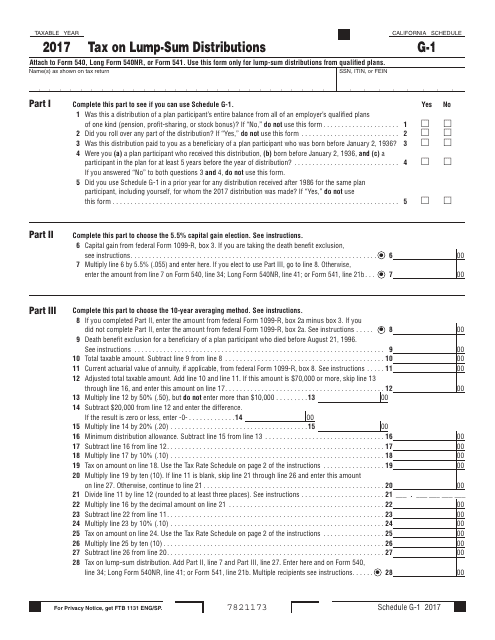

This Form is used for reporting and calculating the tax on lump-sum distributions in the state of California.

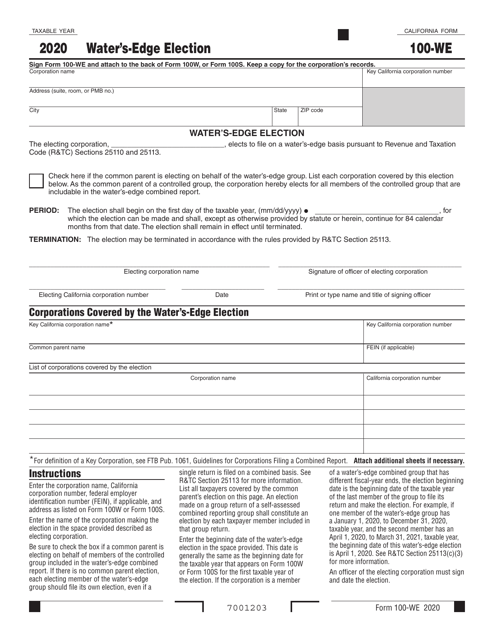

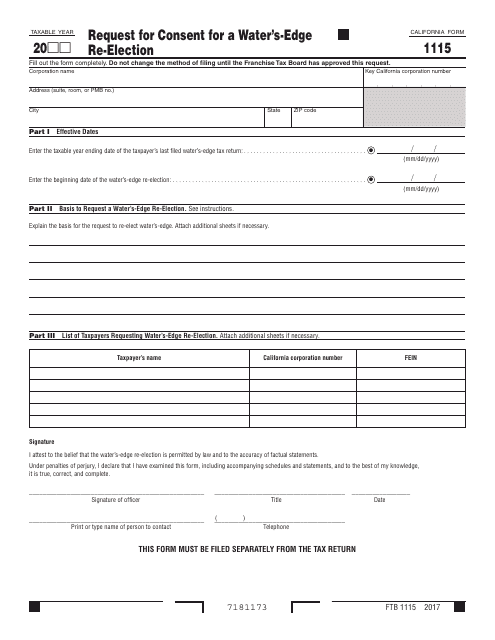

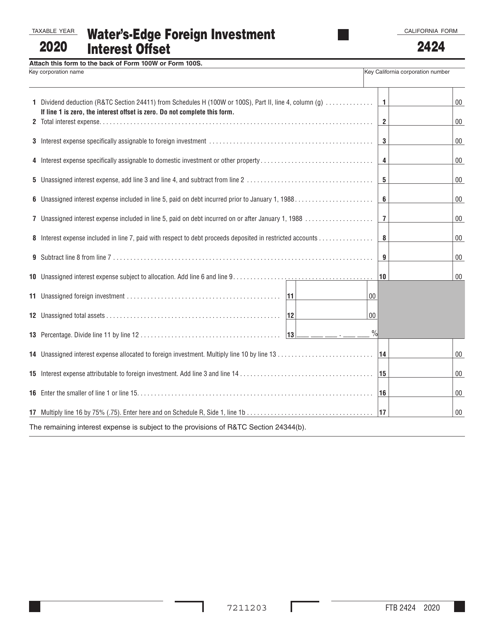

This form is used for requesting consent to re-elect California's water's-edge election method.

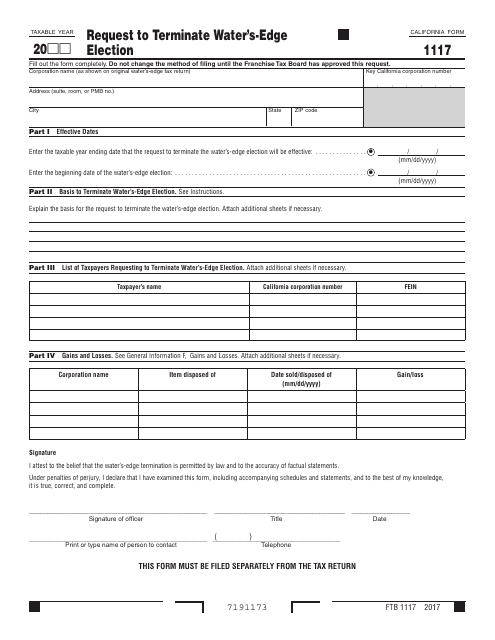

This form is used for requesting to terminate the Water's-Edge Election in California.

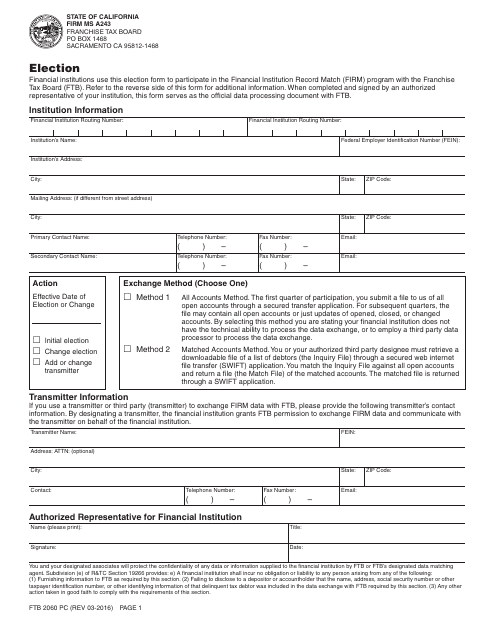

This Form is used for financial institutions in California to elect firm record match with the Franchise Tax Board.

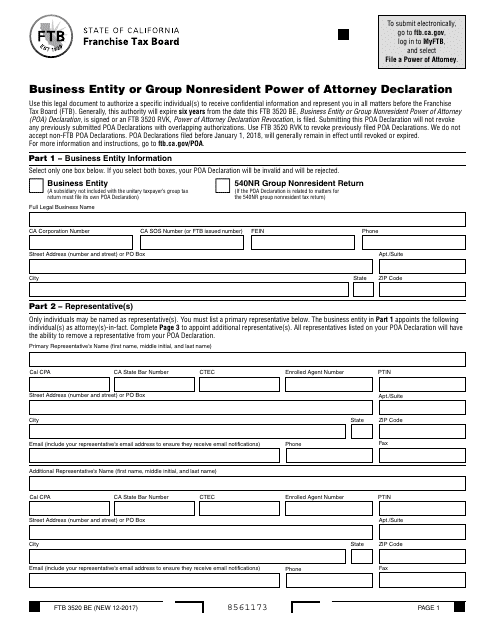

This Form is used for declaring a power of attorney for nonresident business entities or groups in California.

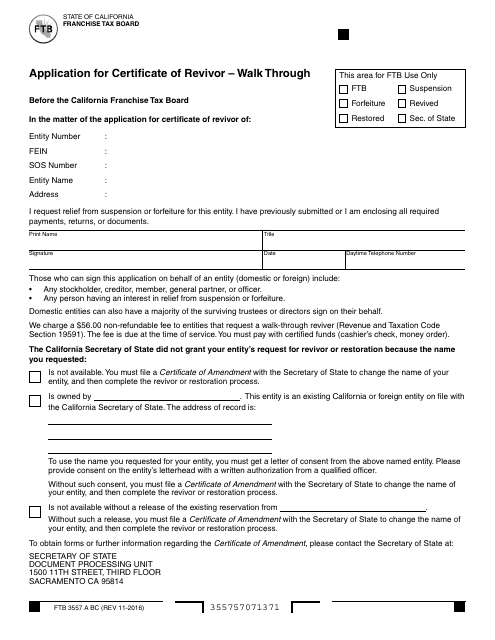

This Form is used for applying for a Certificate of Revivor in California. It is a step-by-step walkthrough guide for completing the application process.

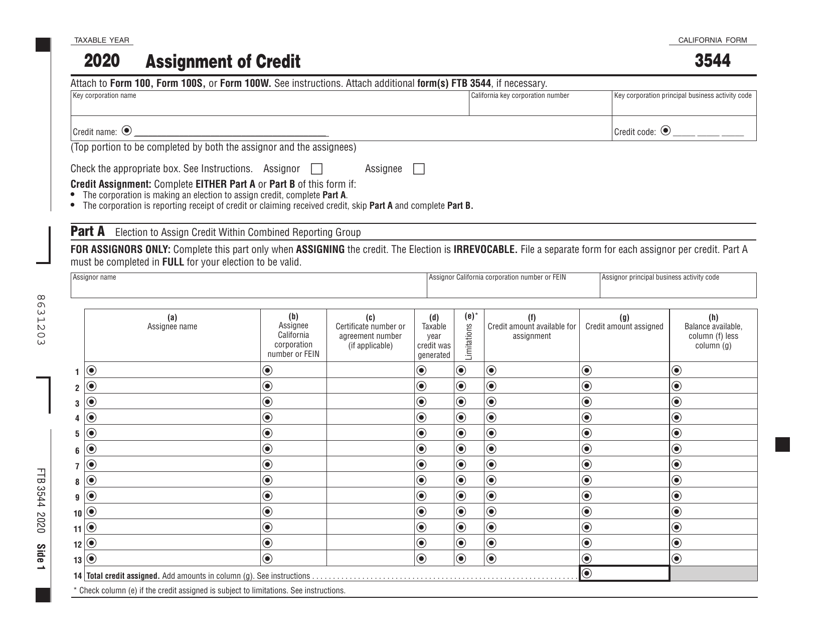

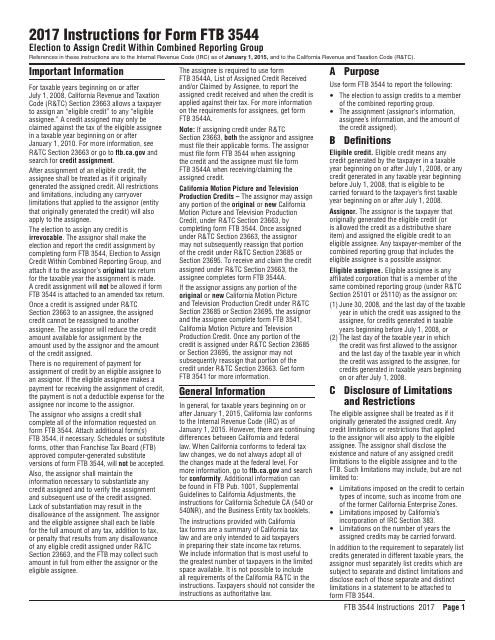

This Form is used for making an election to assign credit within a combined reporting group in California. The form provides instructions on how to complete the election process.

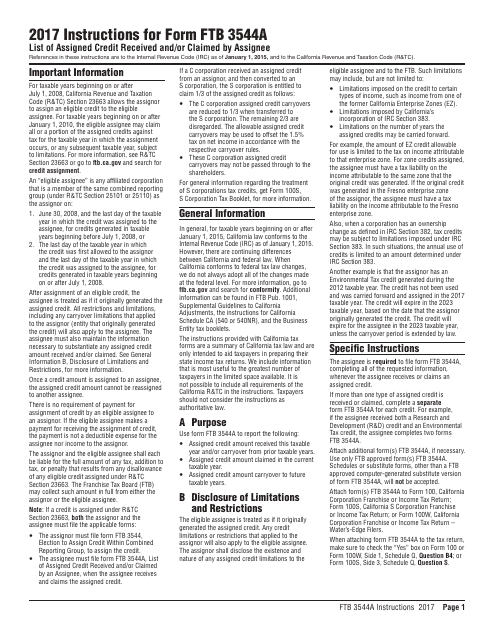

This Form is used for listing the assigned credits received and/or claimed by an assignee in California. It provides instructions on how to properly fill out the form to report the assigned credits.

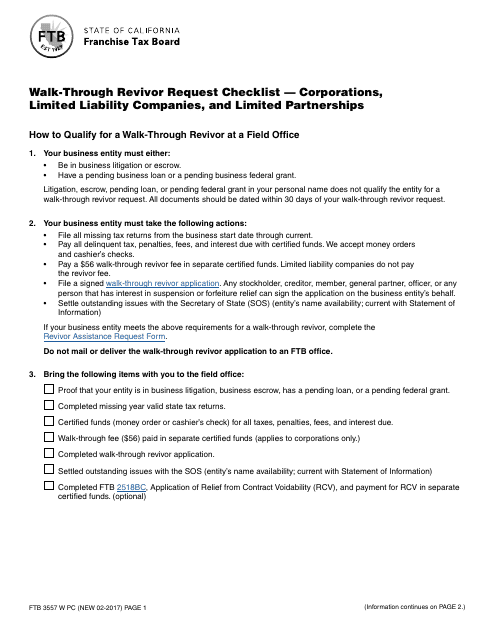

This form is used for the Revivor Request Checklist for Corporations, Limited Liability Companies, and Limited Partnerships in California.

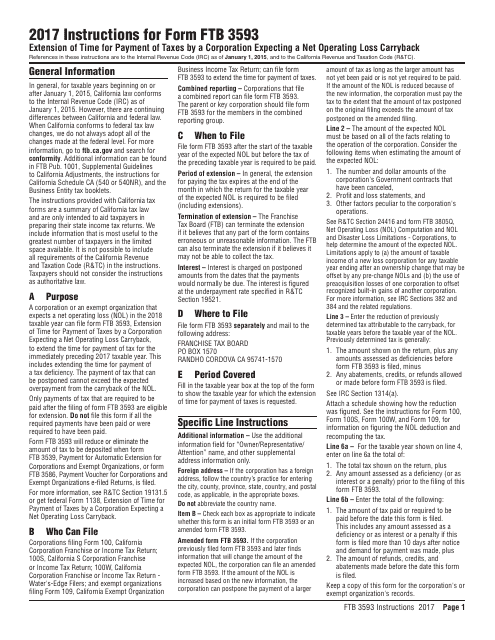

This Form is used for requesting an extension of time to pay taxes by a corporation in California that expects a net operating loss carryback. It provides instructions on how to properly complete the form and submit it to the relevant tax authorities.

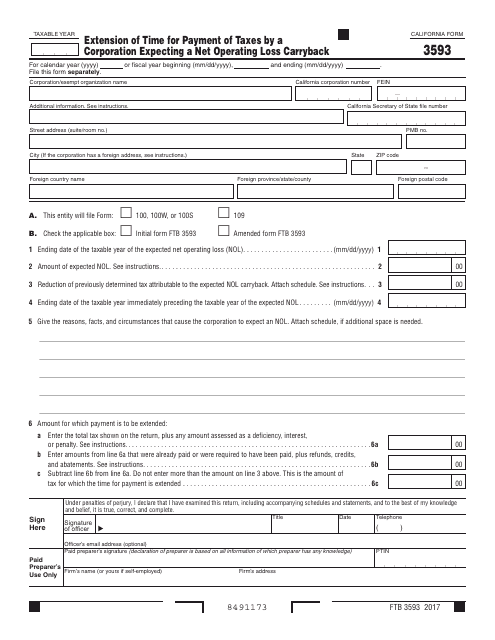

This form is used for corporations in California that are expecting a net operating loss carryback and need an extension of time to pay their taxes.

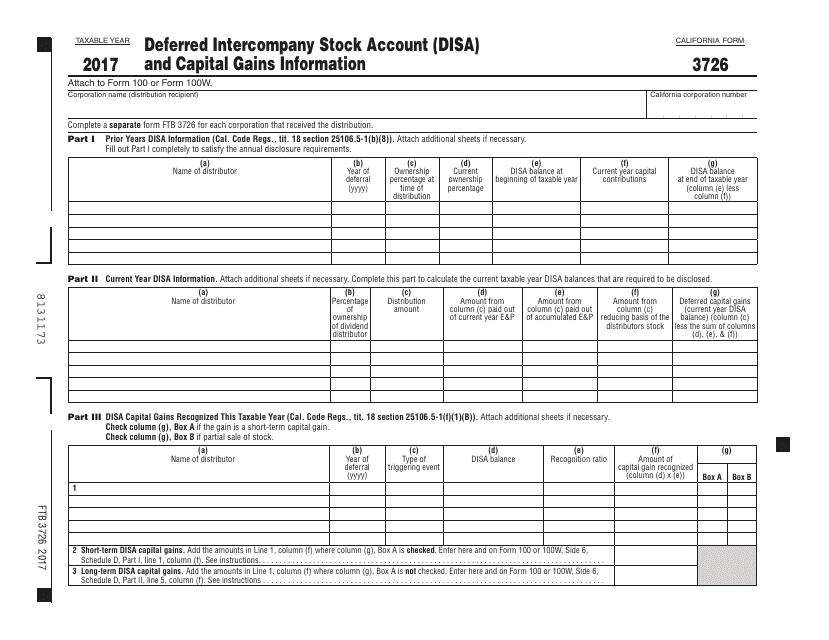

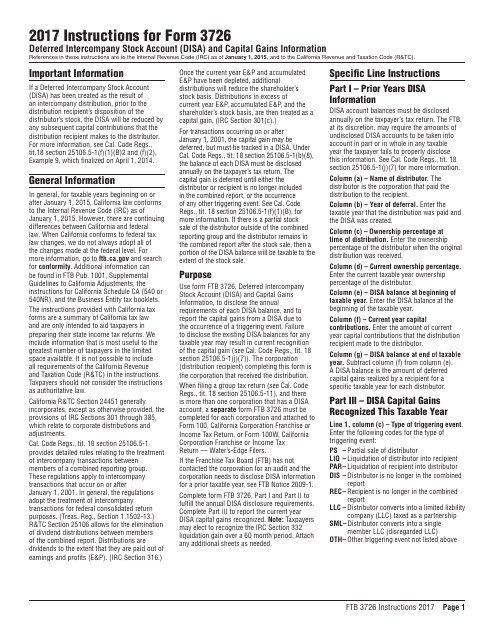

This form is used for reporting deferred intercompany stock account and capital gains information in California.

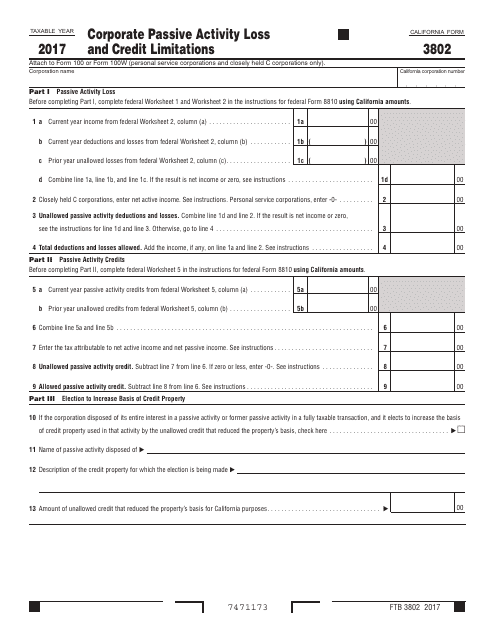

This form is used for reporting passive activity losses and credit limitations for corporations in California.

This Form is used for reporting deferred intercompany stock account (DISA) and capital gains information in California.

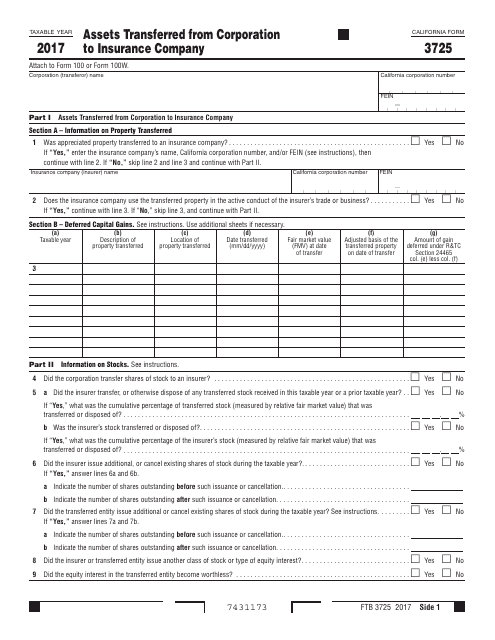

This Form is used for reporting assets transferred from a corporation to an insurance company in the state of California.