United States Tax Forms and Templates

Related Articles

Documents:

2432

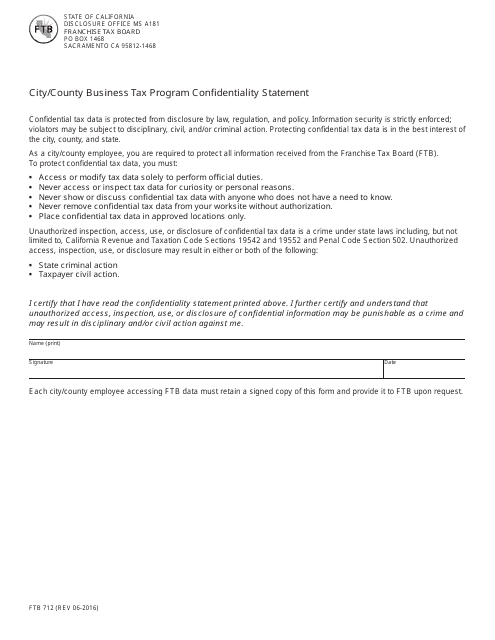

This form is used for the City/County Business Tax Program in California and contains a confidentiality statement.

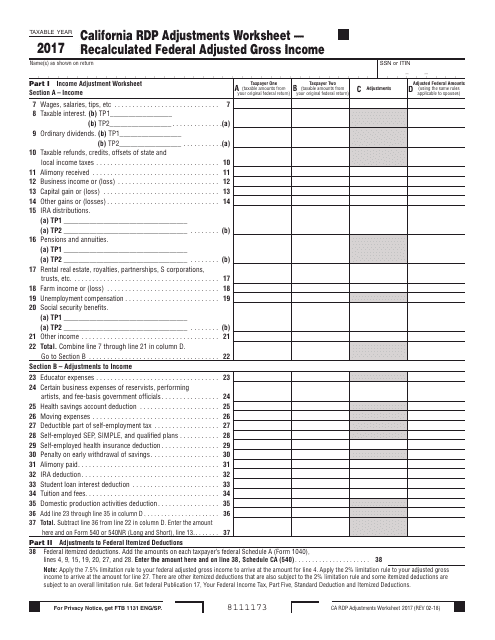

California Rdp Adjustments Worksheet " Recalculated Federal Adjusted Gross Income - California, 2017

This document is used for calculating the recalculated Federal Adjusted Gross Income for California state taxes.

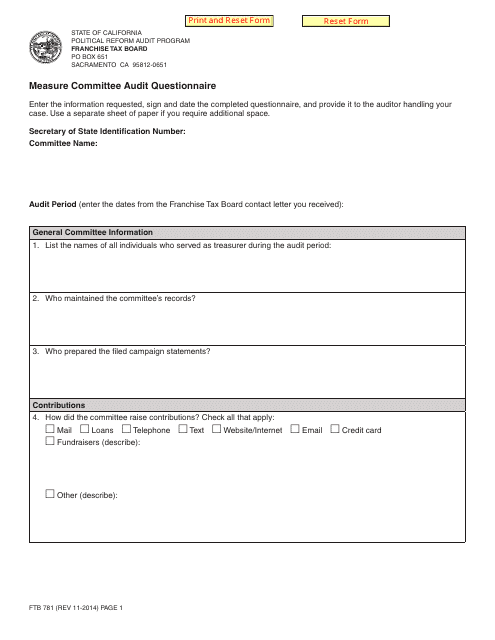

This document is a form used for conducting an audit questionnaire by the Measure Committee in California.

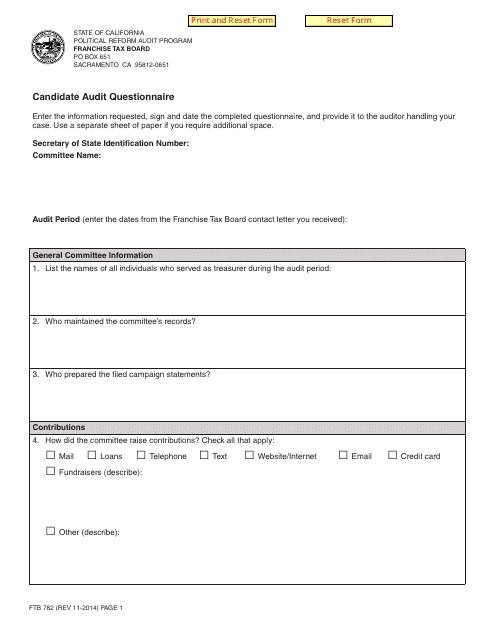

This form is used for conducting audits on candidates in the state of California.

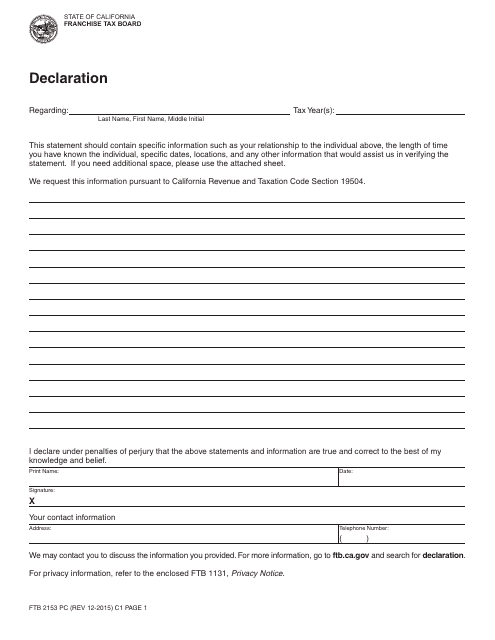

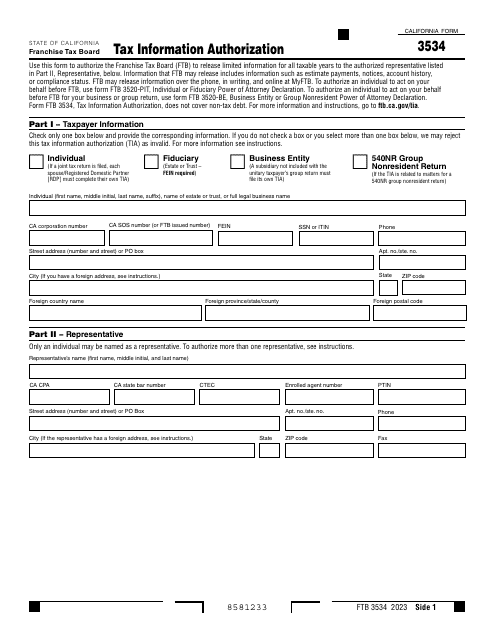

This form is used for filing a declaration of payment and/or communication of your personal income tax with the California Franchise Tax Board.

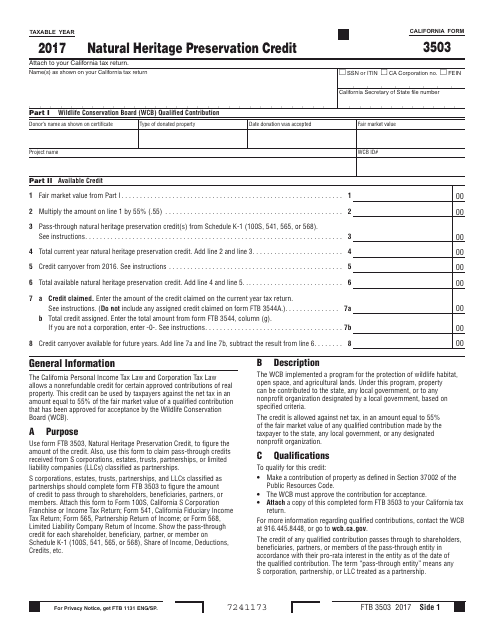

This form is used for claiming the Natural Heritage Preservation Credit in California. It allows individuals or businesses to receive a tax credit for contributing to the preservation of natural heritage sites in the state.

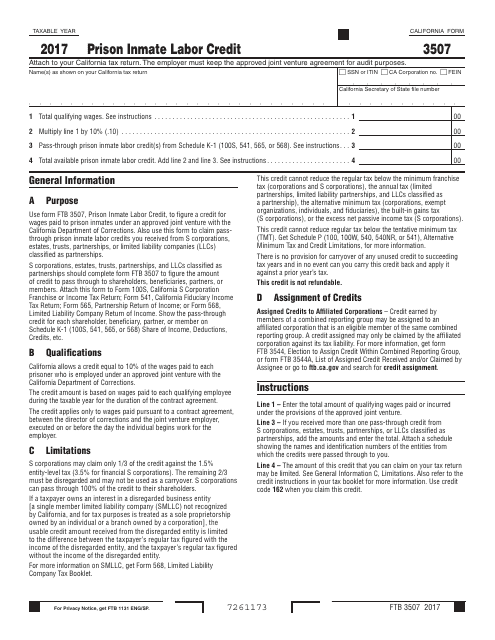

This form is used for claiming the Prison Inmate Labor Credit in California.

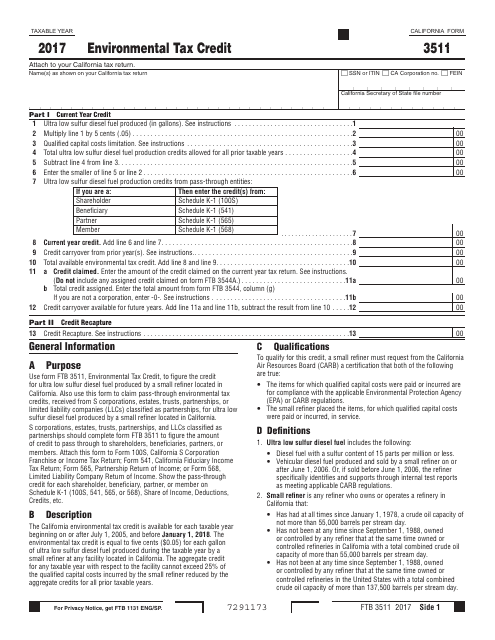

This Form is used for claiming the Environmental Tax Credit in the state of California.

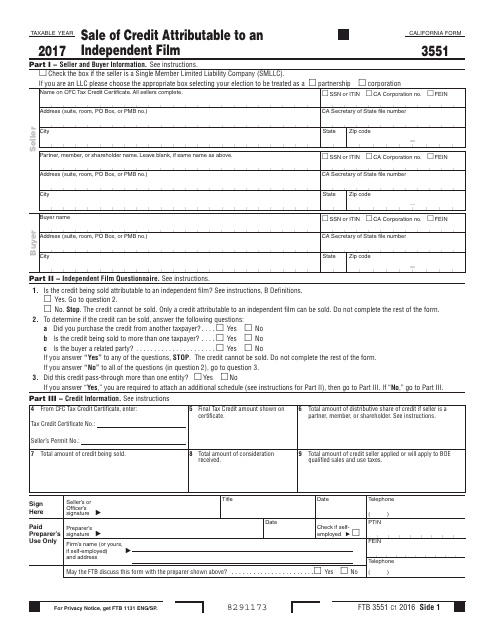

This form is used for reporting the sale of credits related to an independent film in California.

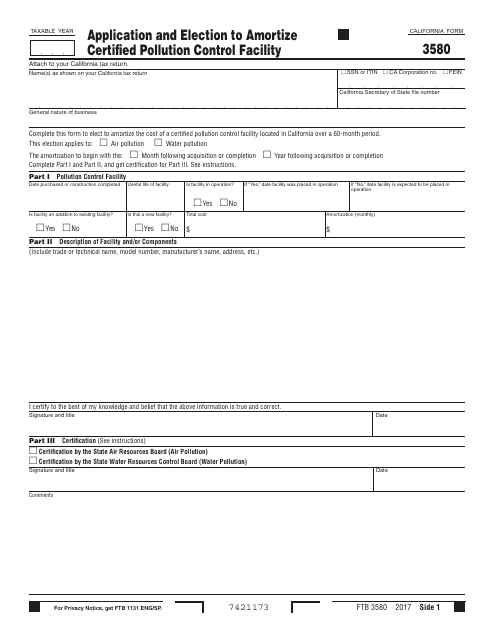

This form is used for applying and electing to amortize a certified pollution control facility in the state of California.

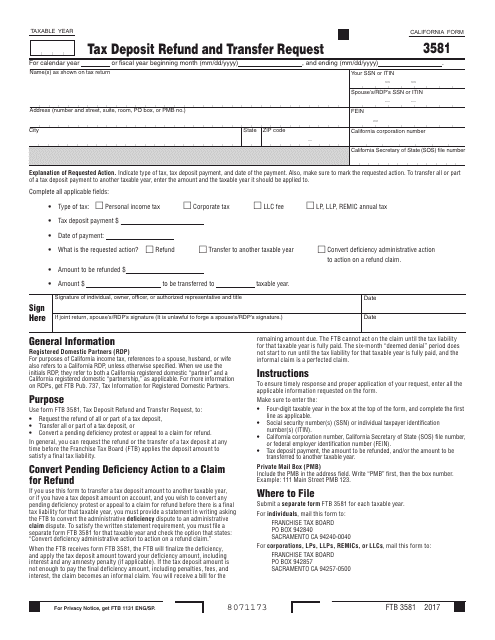

This Form is used for requesting a refund or transferring tax deposits in the state of California.

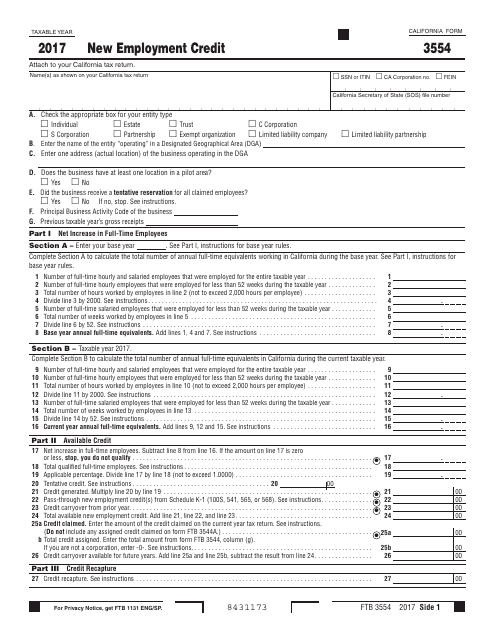

This Form is used for claiming the New Employment Credit in the state of California. It helps businesses report and calculate their eligibility for this tax credit.

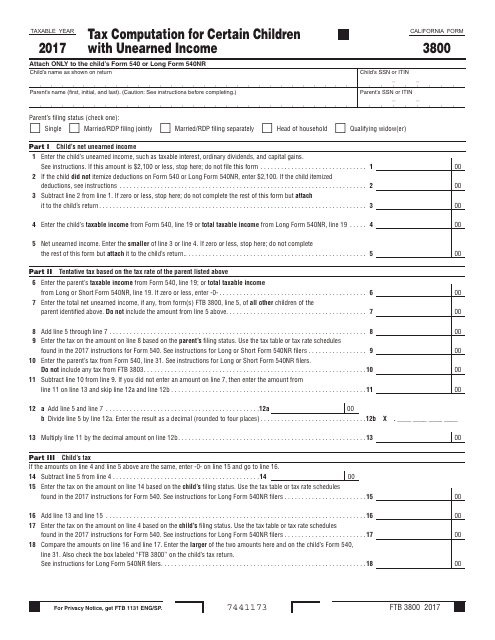

This form is used for calculating the tax for certain children in California who have unearned income. It helps determine the correct amount of tax owed based on the child's income.

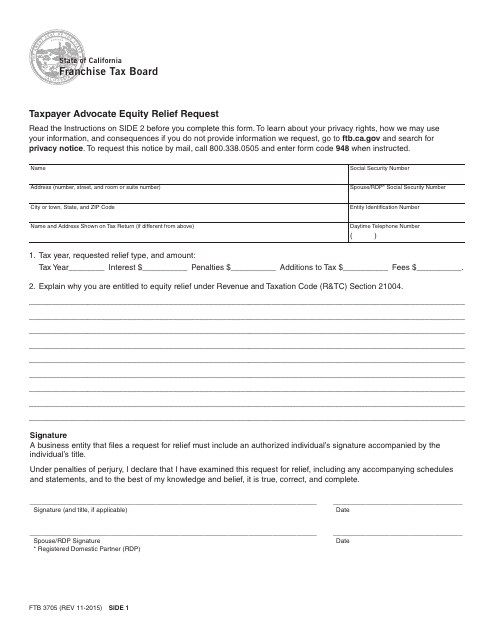

This form is used for taxpayers in California to request relief from tax-related issues through the Taxpayer Advocate program.

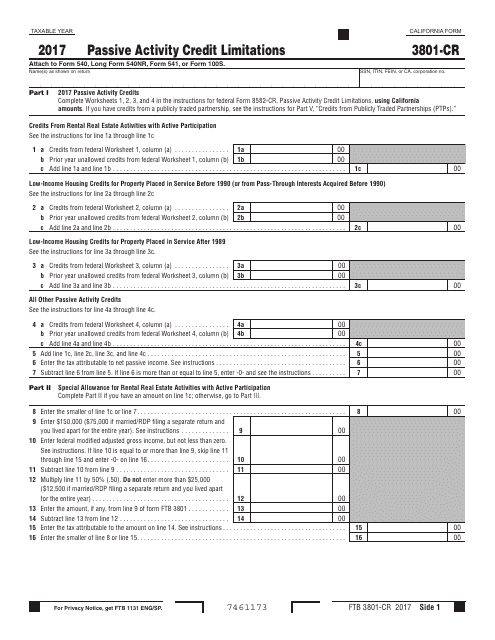

This form is used for calculating passive activity credit limitations specific to the state of California.

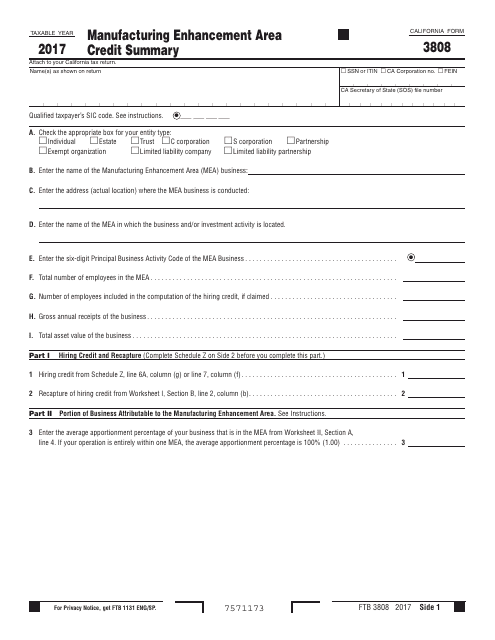

This form is used for summarizing the manufacturing enhancement area credits in California.

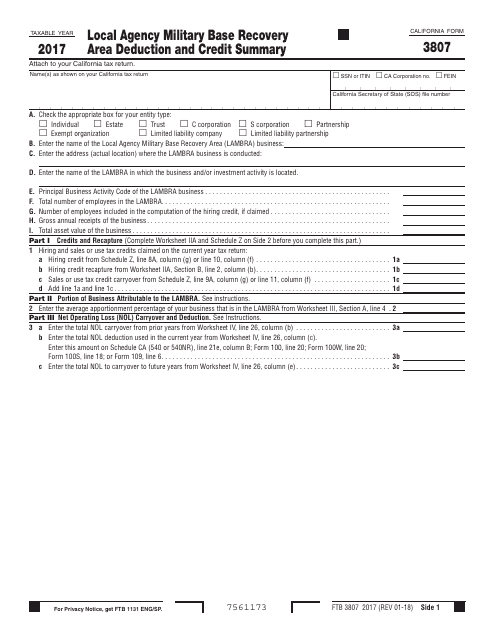

This form is used for reporting and summarizing the deductions and credits related to local agency military base recovery areas in California.

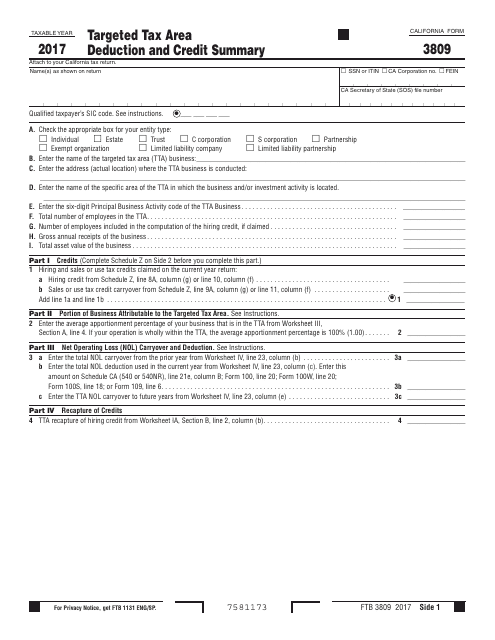

This form is used for summarizing the targeted tax area deduction and credit in California.

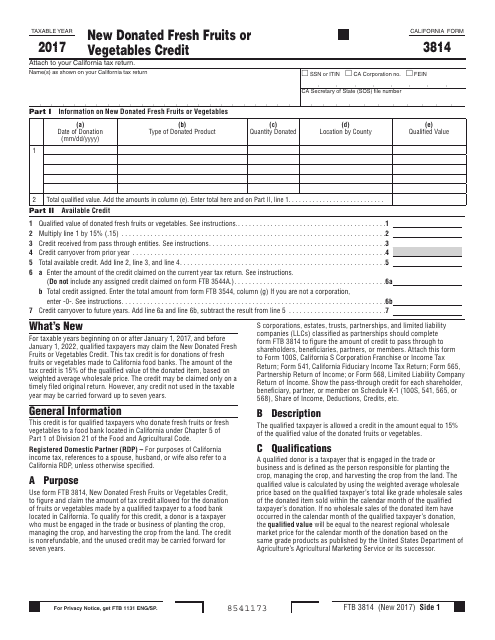

This form is used for claiming the New Donated Fresh Fruits or Vegetables Credit in California. It allows individuals or businesses to receive tax credits for donating fresh fruits or vegetables to California food banks or charitable organizations.

This form is used for filing a claim to replace a personal computer under warranty in the state of California.

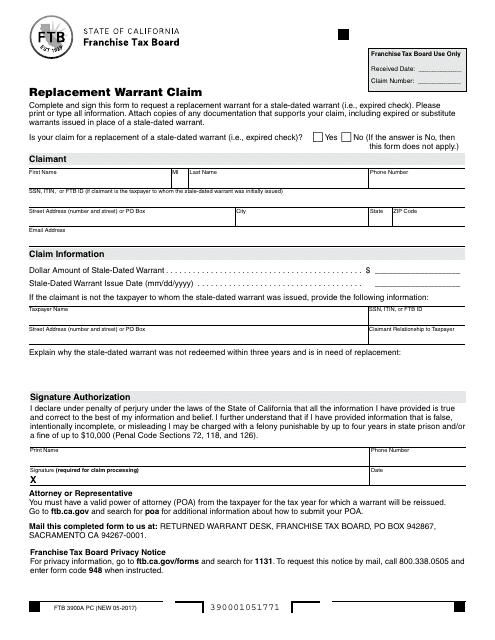

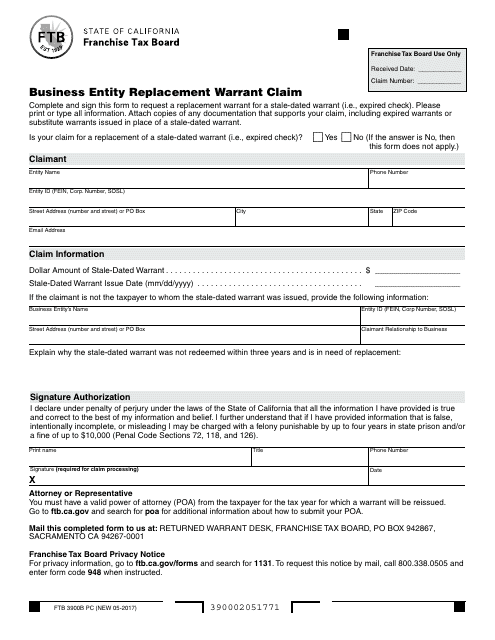

This form is used for filing a warrant claim for a business entity replacement in California.

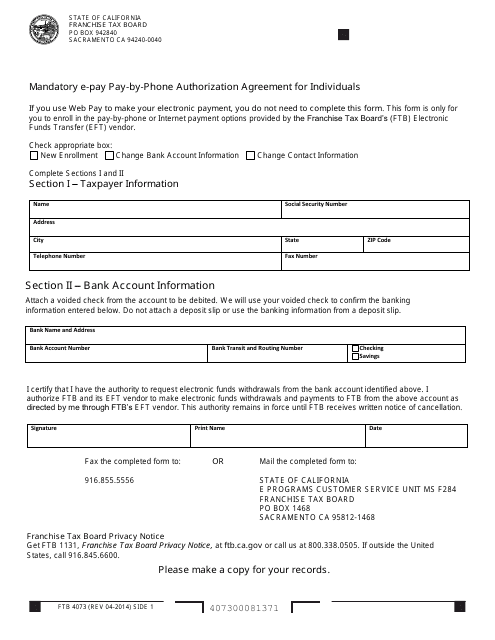

This form is used for individuals in California to authorize mandatory electronic payments via phone.

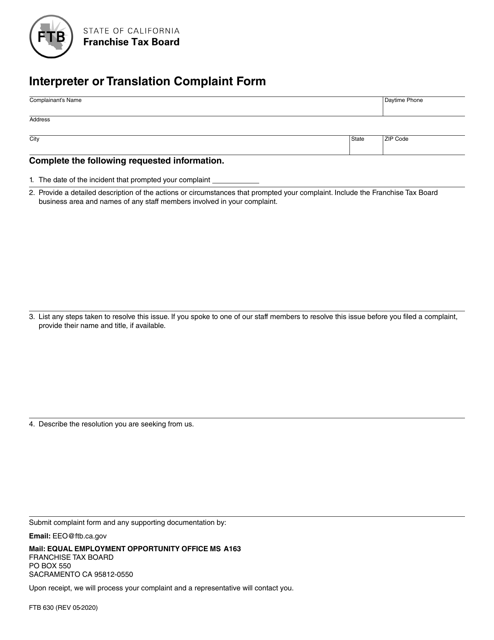

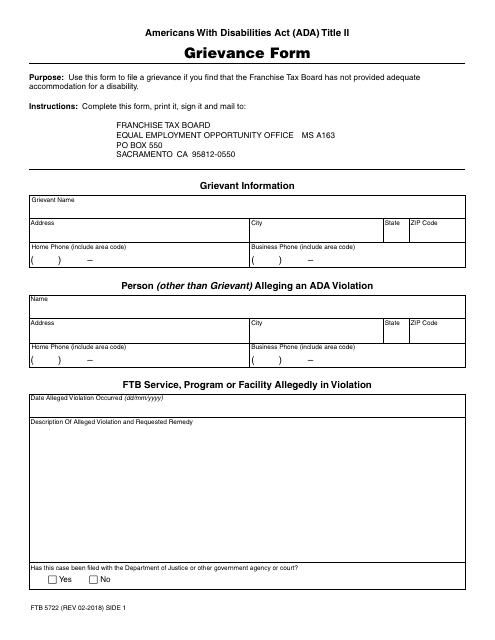

This form is used for filing a grievance with the California Franchise Tax Board (FTB).

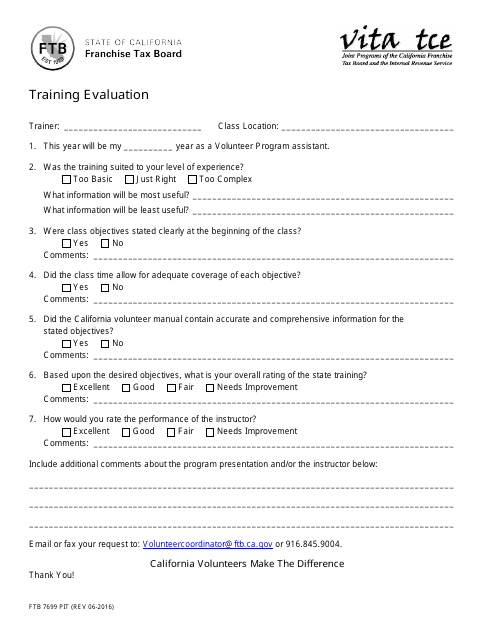

This document is used for conducting training evaluations for California's Personal Income Tax (PIT) program.

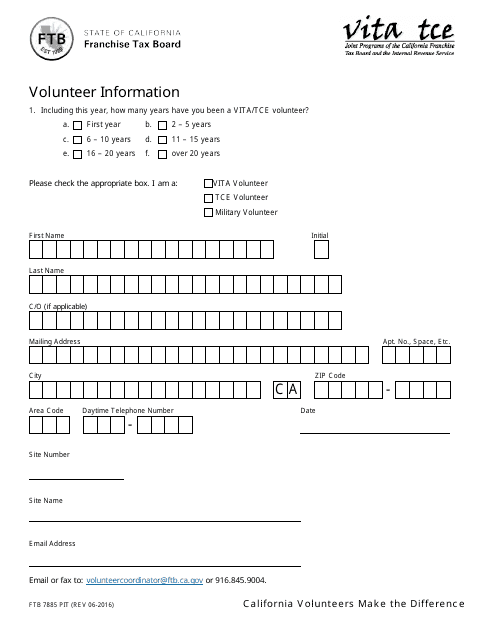

This form is used for providing volunteer information to the California Franchise Tax Board (FTB) for the Personal Income Tax (PIT) program.

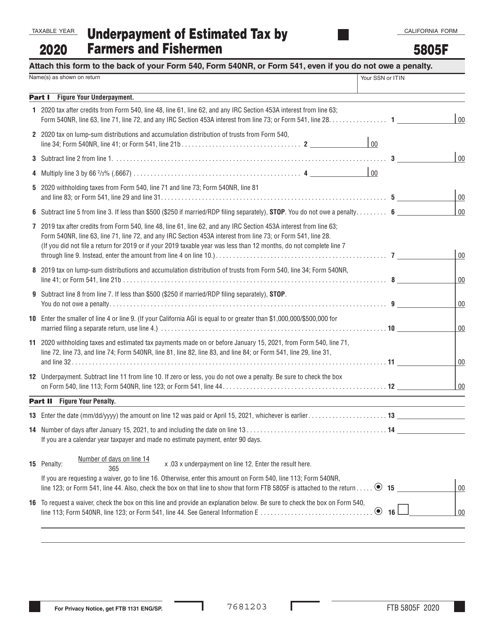

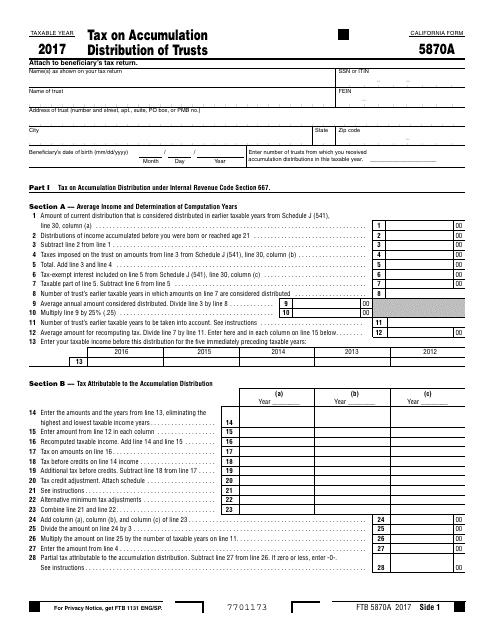

This form is used for reporting and calculating the tax on accumulation distribution of trusts in the state of California.