United States Tax Forms and Templates

Related Articles

Documents:

2432

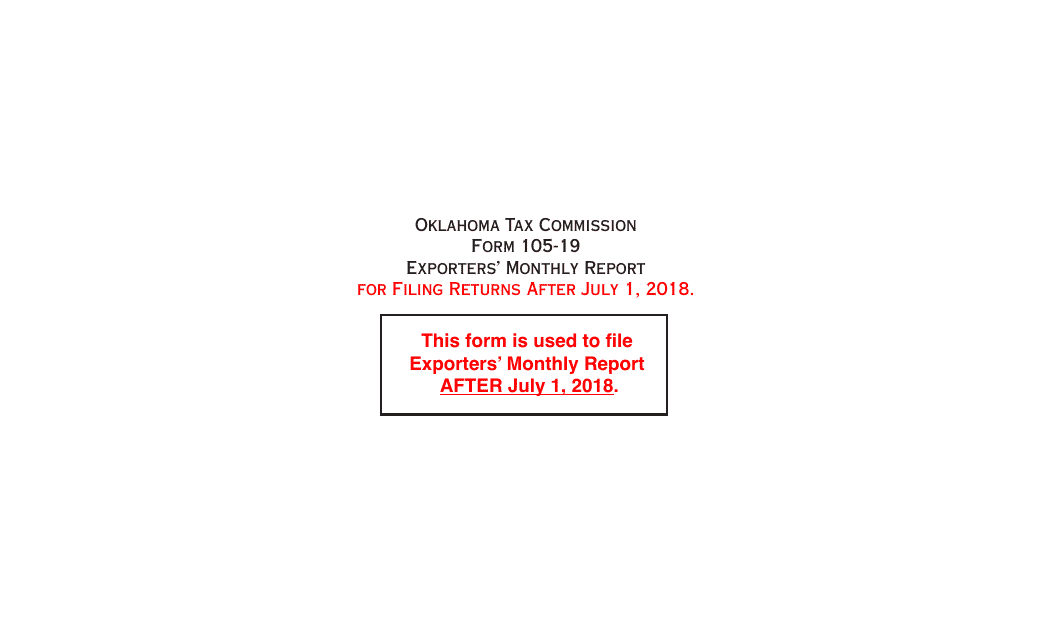

This form is used for exporters in Oklahoma to file a monthly report on their export activities.

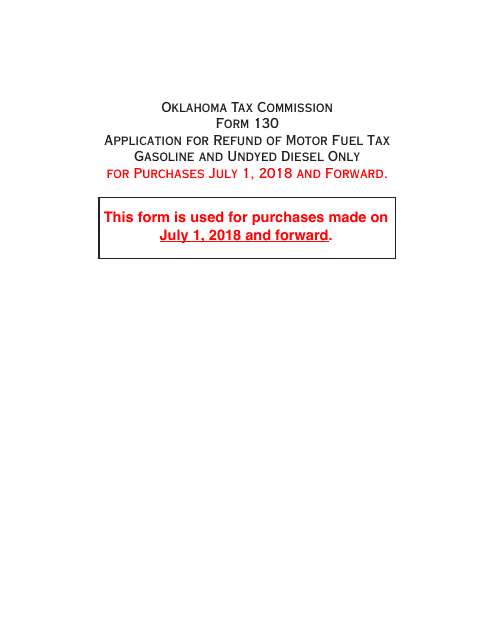

This type of document, OTC Form 130, is used for applying for a refund of motor fuel tax for gasoline and undyed diesel in the state of Oklahoma.

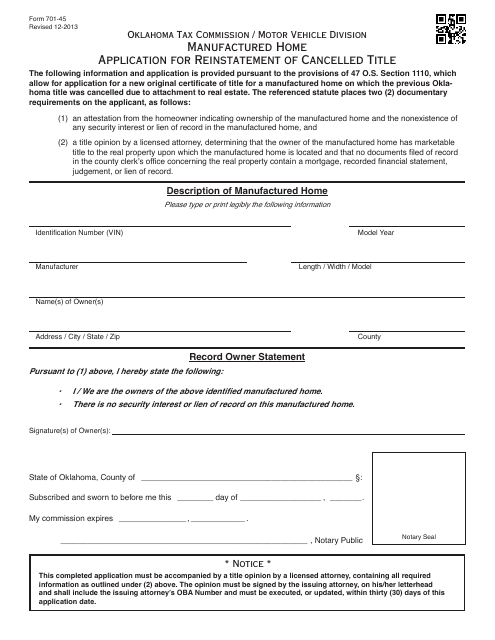

This form is used for reinstating the cancelled title of a manufactured home in Oklahoma.

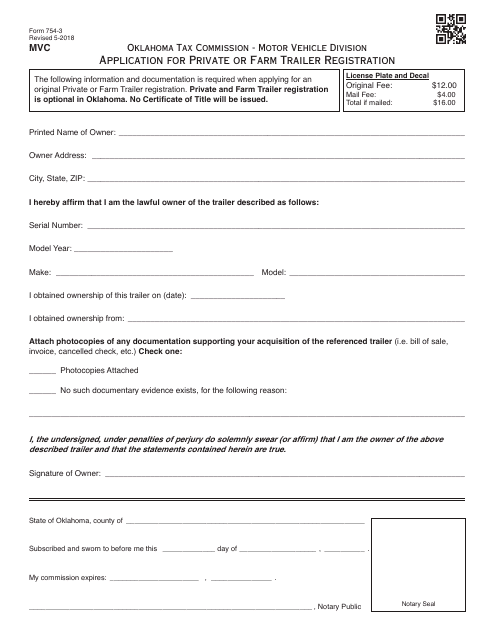

This Form is used for applying for private or farm trailer registration in Oklahoma.

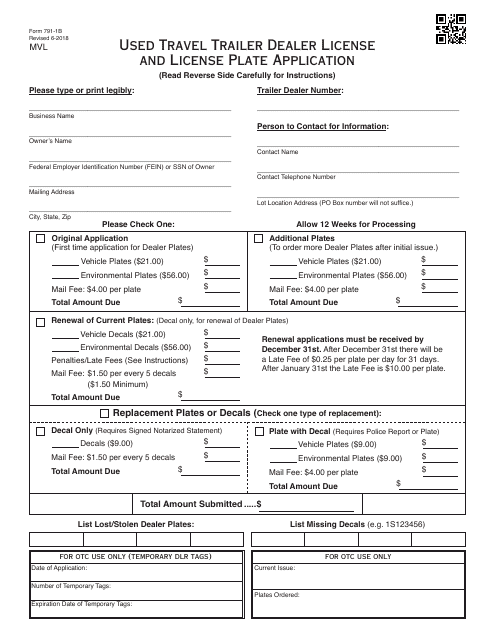

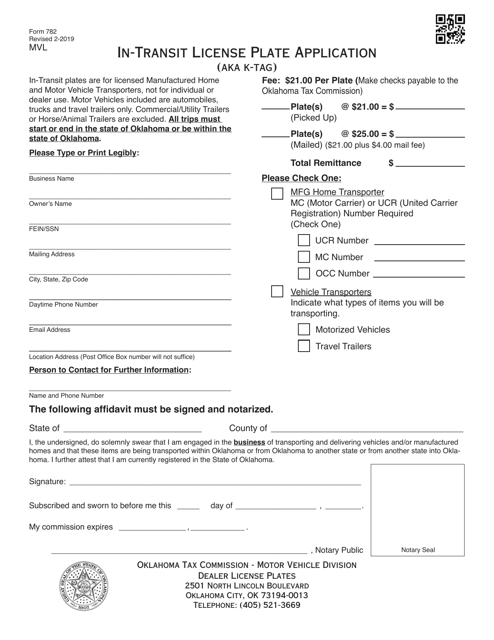

This form is used for applying for a new travel trailer dealer license plate in Oklahoma. It is specifically for dealers who sell travel trailers and need a license plate for their inventory vehicles.

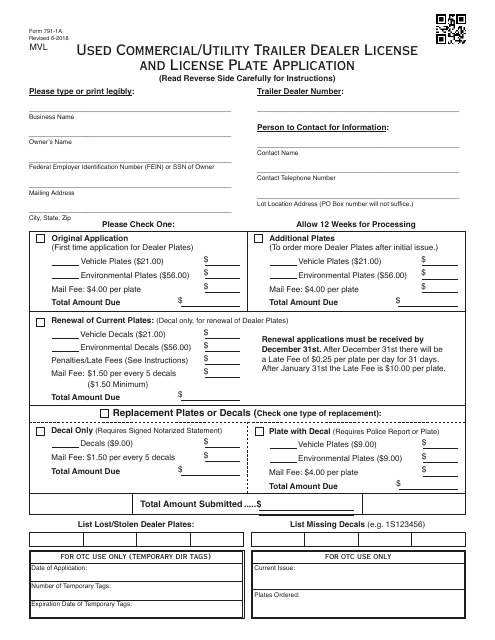

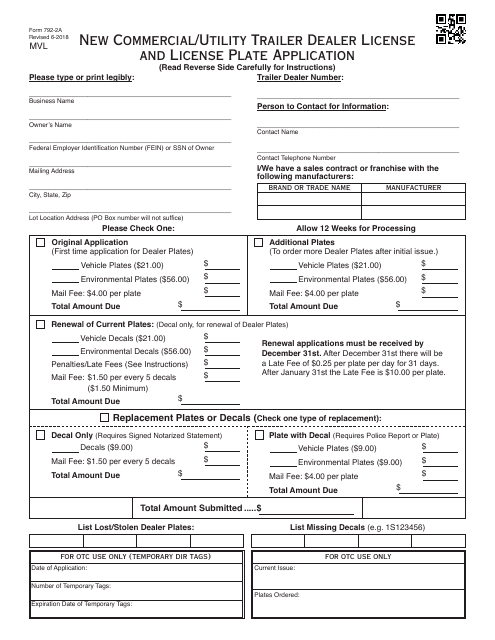

This Form is used for applying for a commercial/utility trailer dealer license and license plate in Oklahoma.

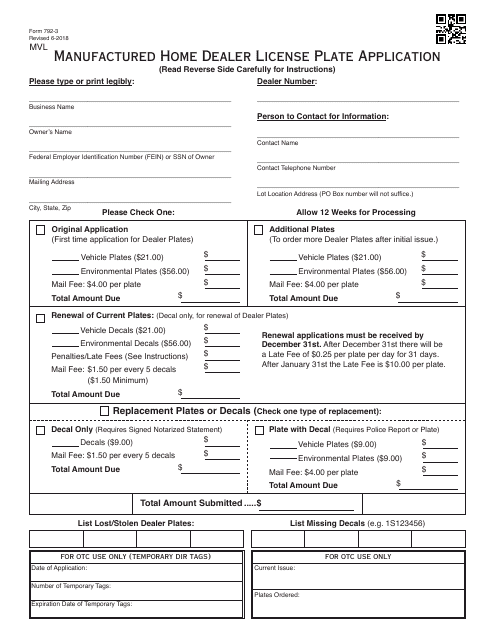

This document is for applying for a license plate for manufactured home dealers in Oklahoma.

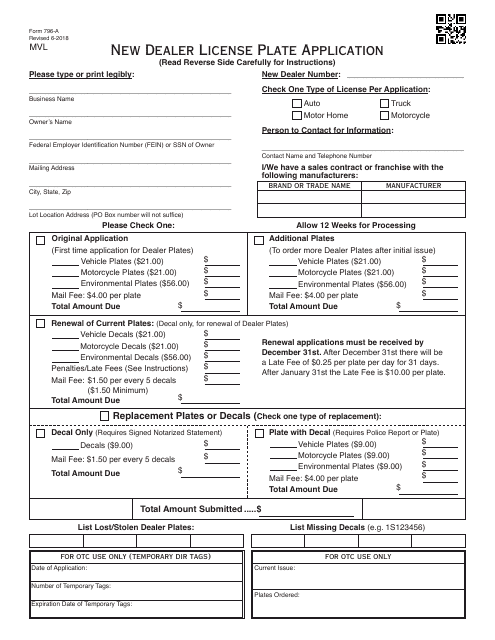

This form is used for applying for a new dealer license plate in Oklahoma.

This Form is used for applying for a travel trailer dealer license and license plate in Oklahoma.

This Form is used for applying for a commercial/utility trailer dealer license and license plate in Oklahoma

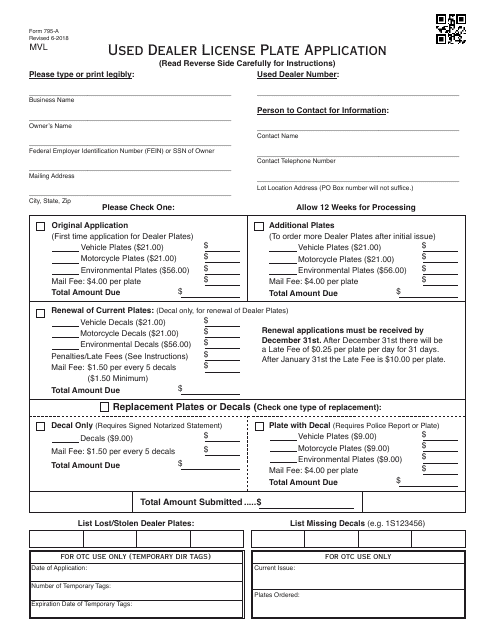

This form is used for applying for a used dealer license plate in Oklahoma.

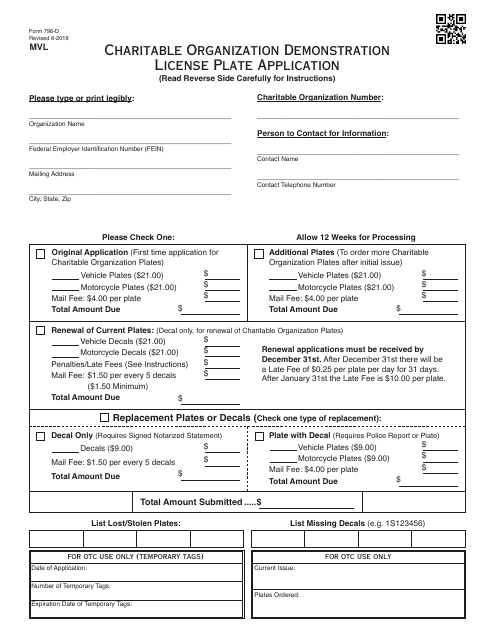

This Form is used for applying for a Charitable Organization Demonstration License Plate in Oklahoma.

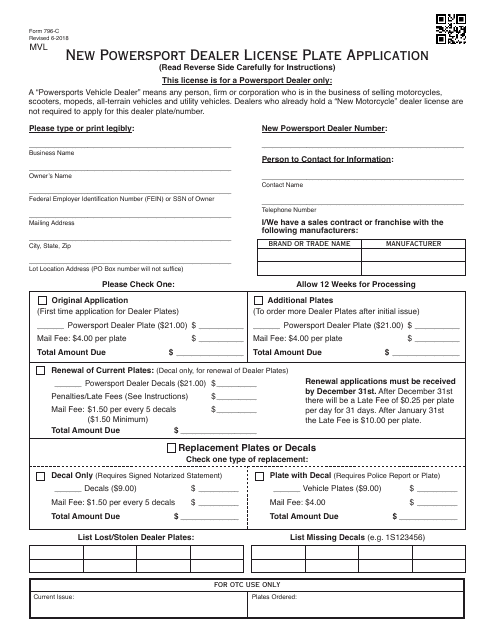

This document is for applying for a new powersport dealer license plate in Oklahoma.

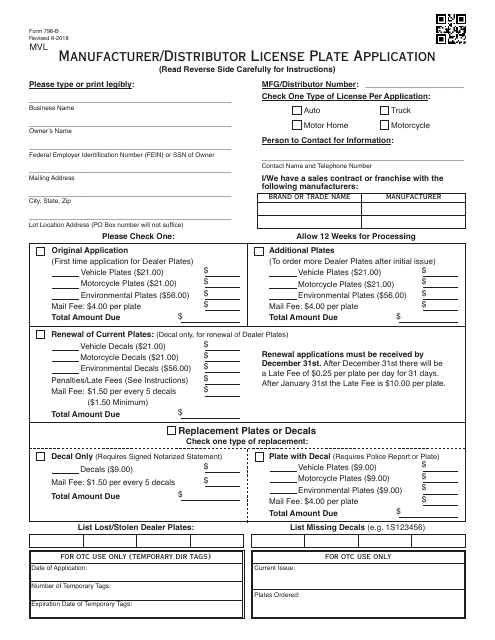

This Form is used for applying for a Manufacturer/Distributor License Plate in Oklahoma.

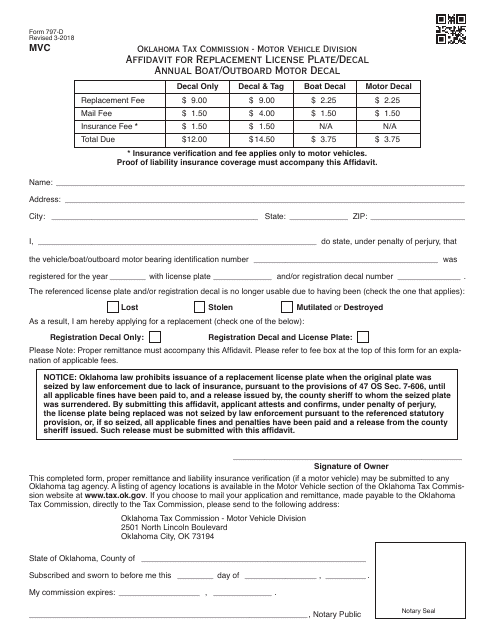

This document is for applying for a replacement license plate or decal for your boat or outboard motor in Oklahoma.

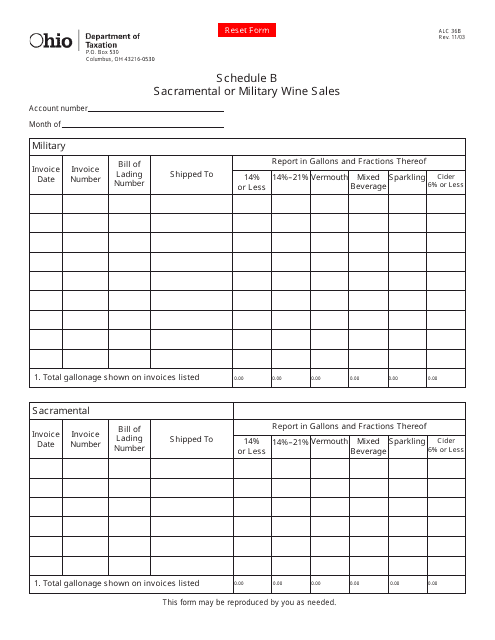

This form is used for sacramental or military wine sales in Ohio.

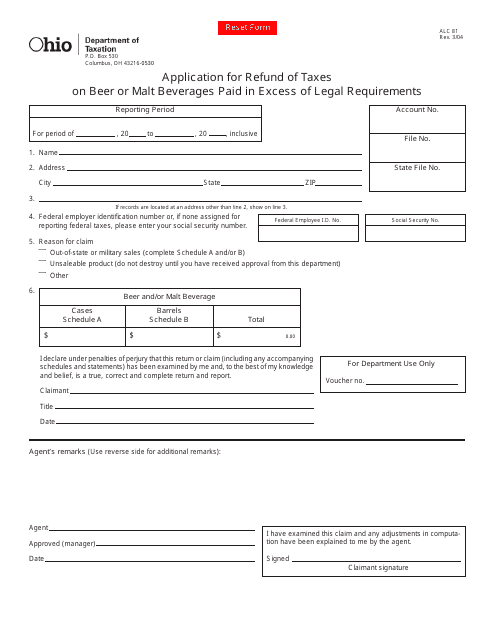

This form is used for applying for a refund of taxes paid on beer or malt beverages that exceed the legal requirements in Ohio.

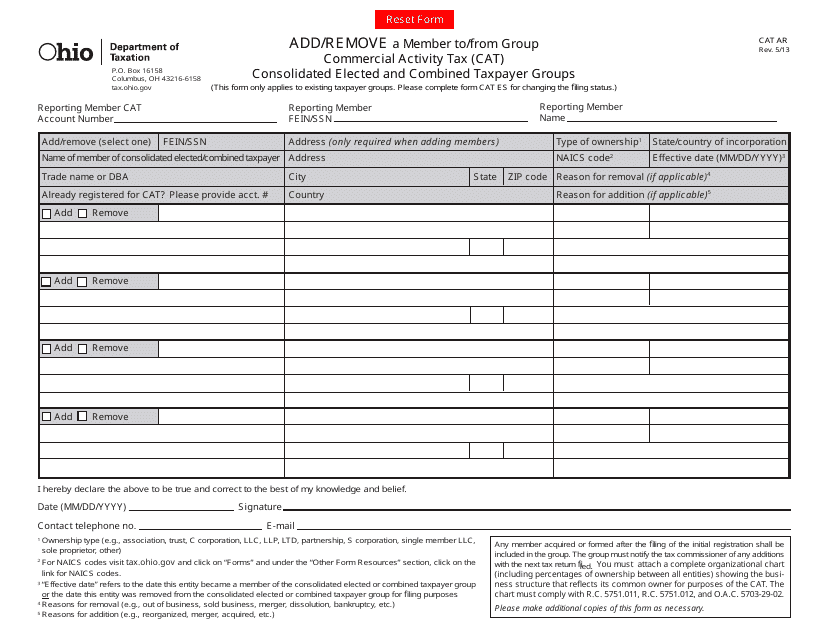

This Form is used for adding or removing a member to/from a Group Commercial Activity Tax (CAT) Consolidated Elected and Combined Taxpayer Groups in Ohio.

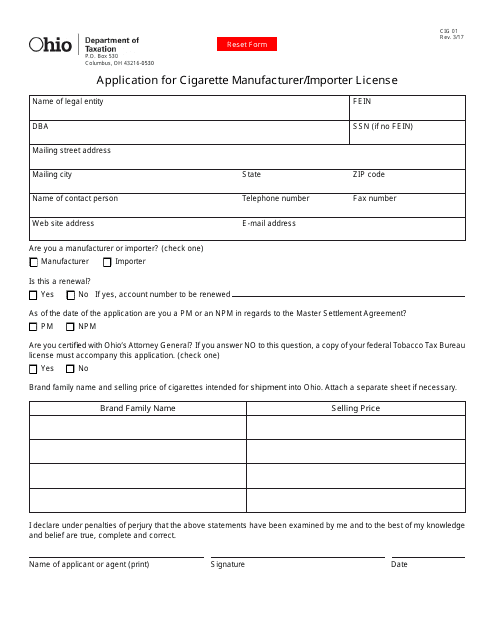

This form is used for applying for a license to manufacture or import cigarettes in the state of Ohio.

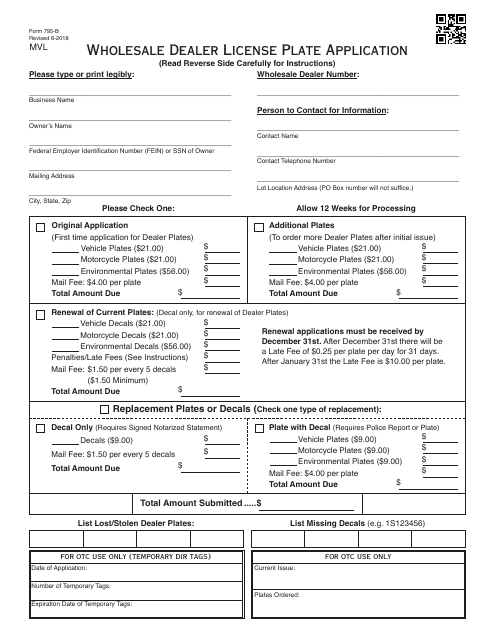

This Form is used for applying for a wholesale dealer license plate in Oklahoma.

This Form is used for applying for a wholesale cigarette dealer's license in the state of Ohio. It is necessary for anyone who wishes to engage in the wholesale sale of cigarettes in the state.

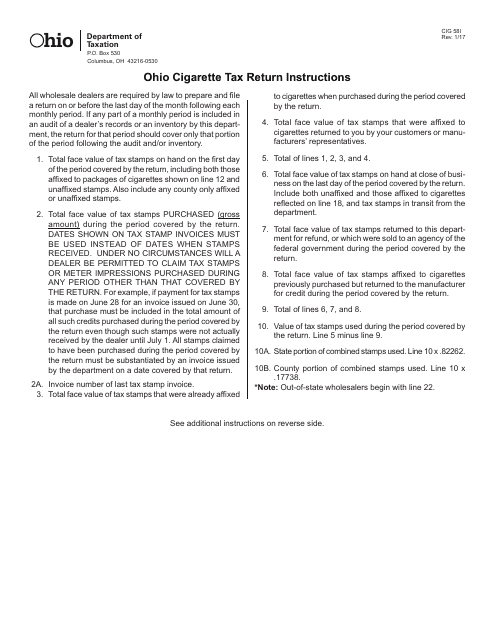

This Form is used for reporting and paying cigarette taxes in the state of Ohio. It provides instructions on how to fill out and submit the CIG58 Ohio Cigarette Tax Return.

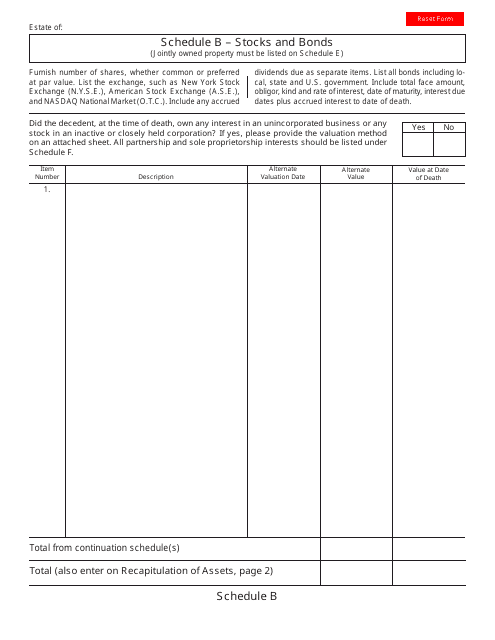

This document is used for reporting stocks and bonds owned by residents of Ohio on their Schedule B tax form.

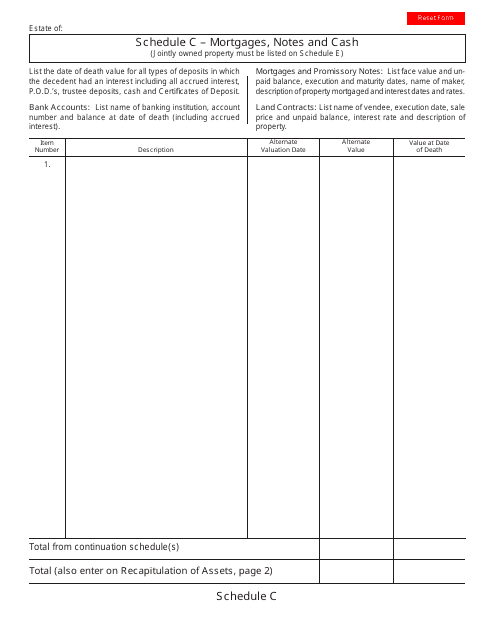

This document is used for reporting mortgages, notes, and cash related to Schedule C income in the state of Ohio.

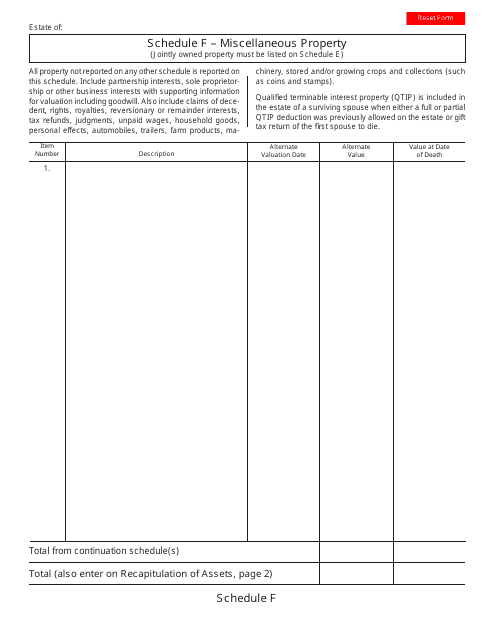

This form is used for reporting miscellaneous property in the state of Ohio. It is used to report items such as unclaimed funds, abandoned property, and safe deposit box contents.

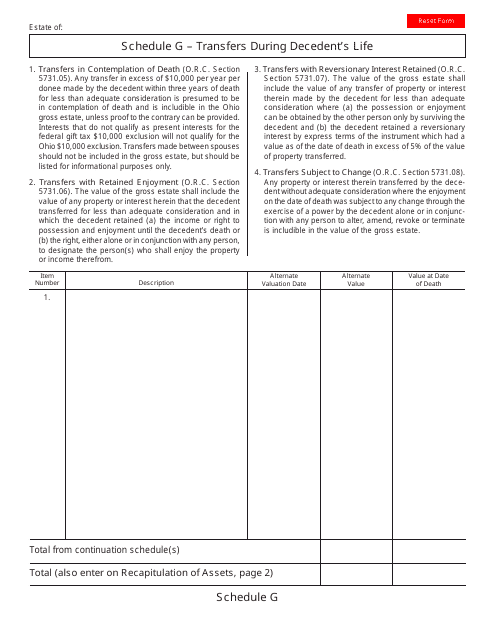

This type of document is used for recording transfers of property made by the decedent while they were still alive in the state of Ohio.

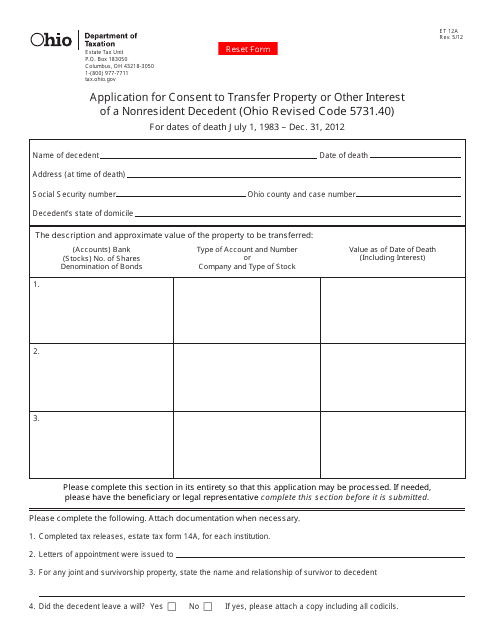

This application form is used in Ohio when seeking consent to transfer property or other interests of a nonresident decedent. It is necessary to complete this form to ensure a smooth transfer of assets.

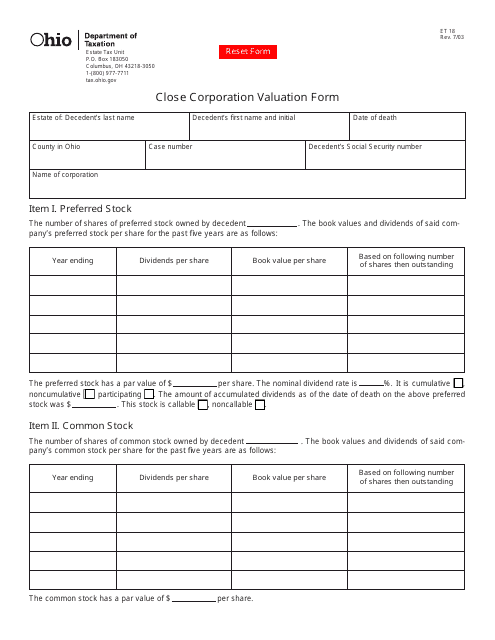

This Form is used for valuating a close corporation in Ohio.

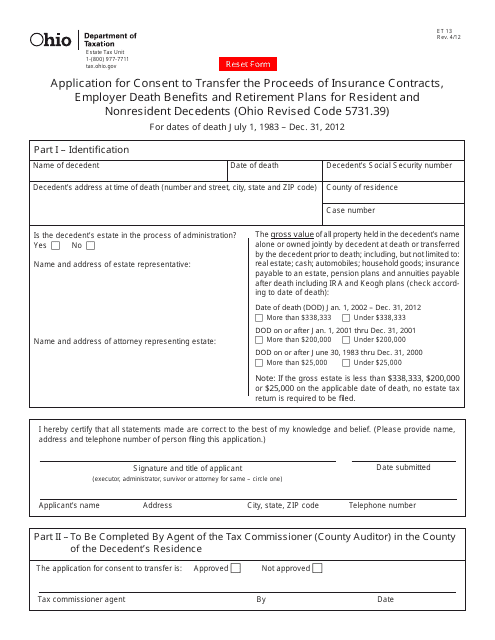

This form is used for applying for consent to transfer the proceeds of insurance contracts, employer death benefits, and retirement plans for both resident and nonresident decedents in the state of Ohio.

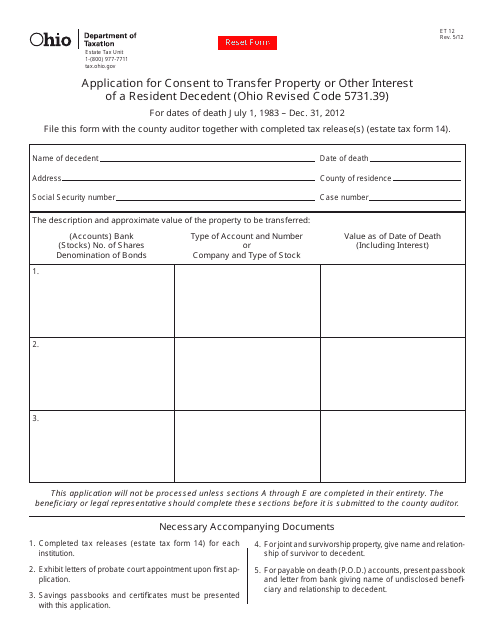

This form is used for applying for consent to transfer property or other interest of a deceased resident in Ohio who passed away between July 1, 1983, and December 31, 2012.

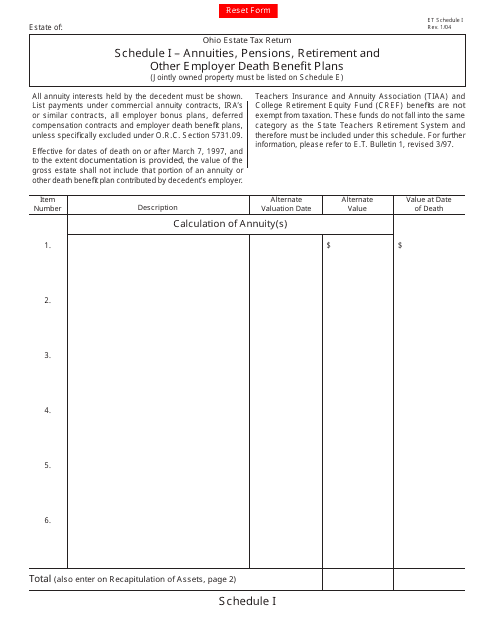

This form is used for reporting annuities, pensions, retirement, and other employer death benefit plans in Ohio. It is important for individuals to accurately report their income from these sources for tax purposes.

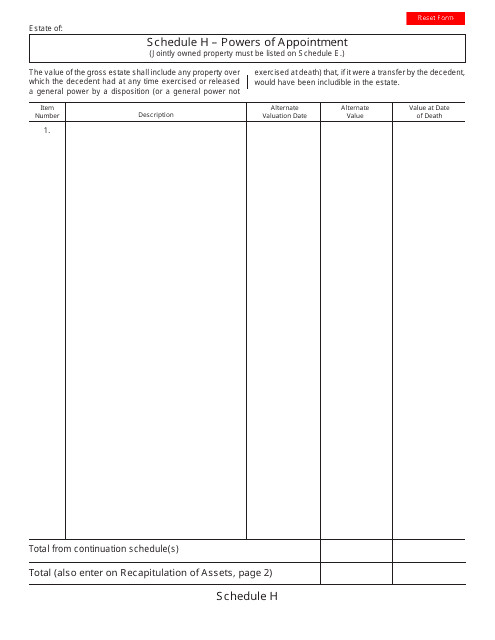

This document for granting powers of appointment in the state of Ohio.

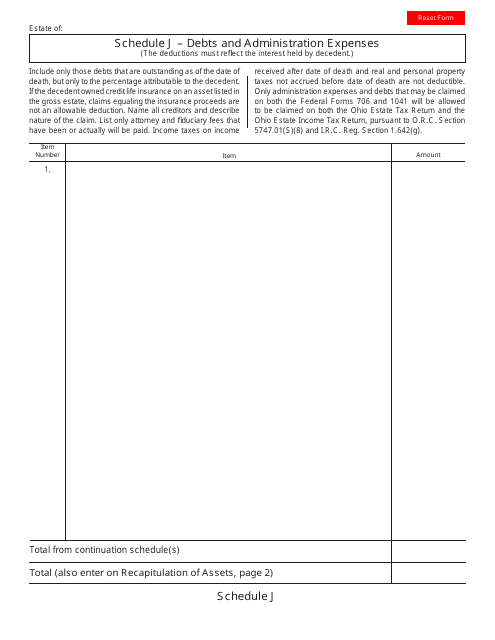

This form is used for listing debts and administration expenses in the state of Ohio. It is a part of the bankruptcy filing process.

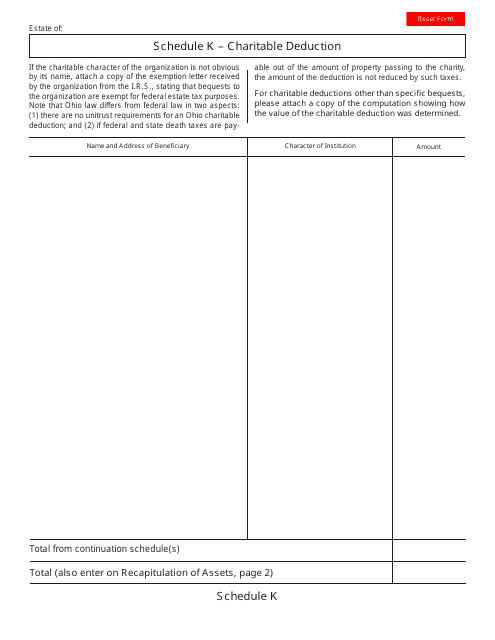

This document is used for reporting charitable deductions on Schedule K in Ohio. It is used to claim deductions for donations made to qualified charitable organizations.

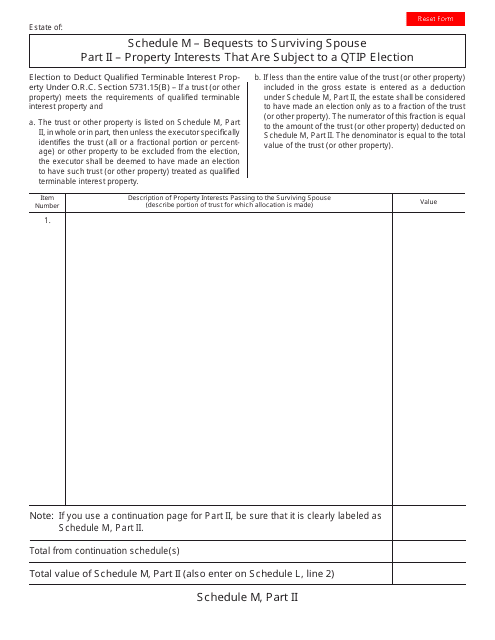

This document is used for reporting bequests to a surviving spouse in the state of Ohio.

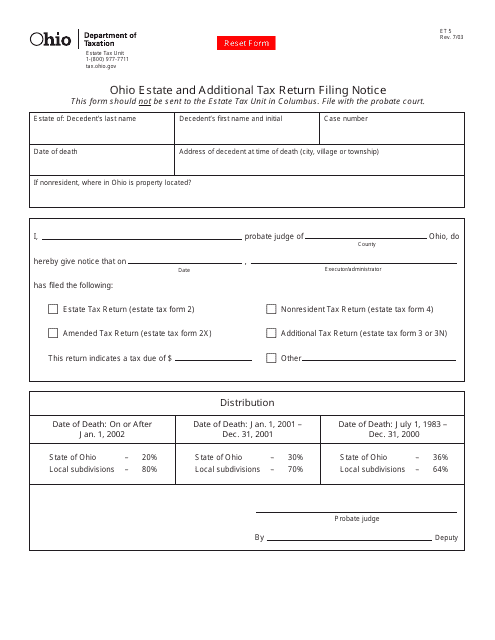

This Form is used for filing the Estate and Additional Tax Return Notice in Ohio. It is required for reporting estate and additional taxes.

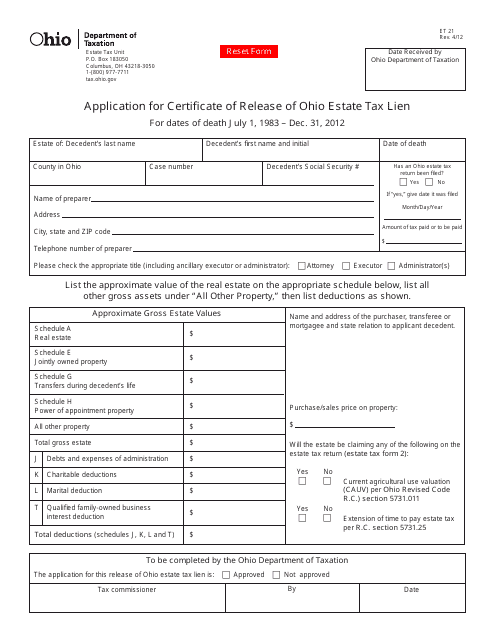

This form is used for applying for a certificate of release of Ohio estate tax lien in Ohio.

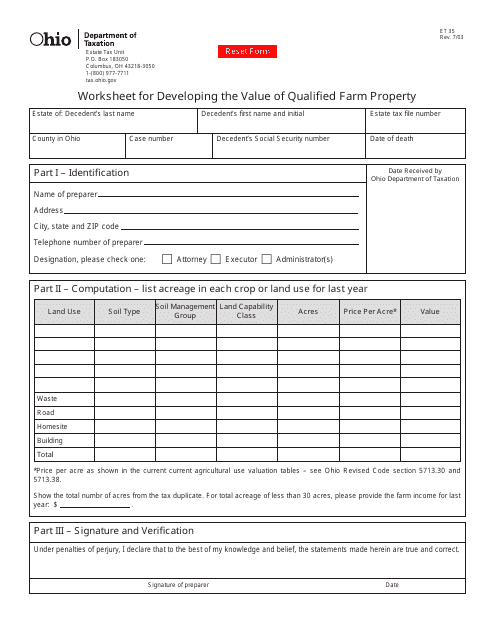

This form is used for developing the value of qualified farm property in Ohio. It is a worksheet that helps calculate the value of the property for tax purposes.