United States Tax Forms and Templates

Related Articles

Documents:

2432

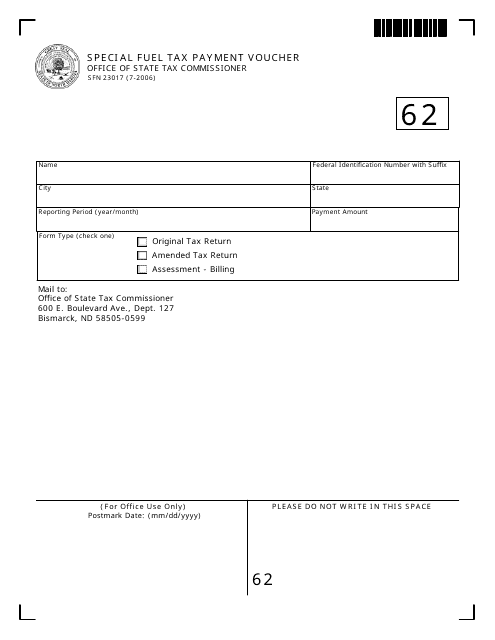

This form is used for making special fuel tax payments in North Dakota.

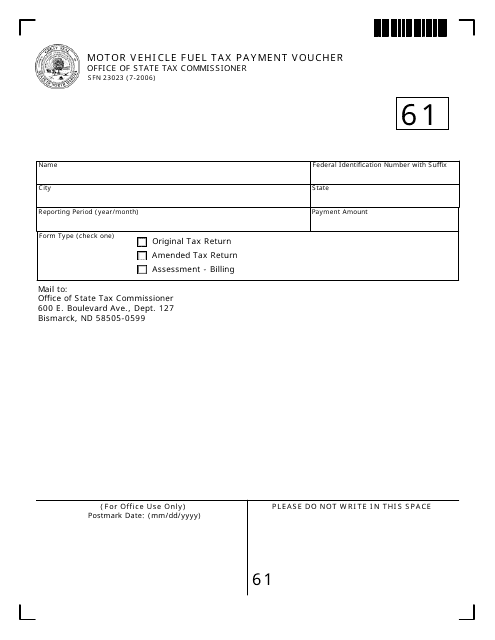

This form is used for submitting motor vehicle fuel tax payments in North Dakota.

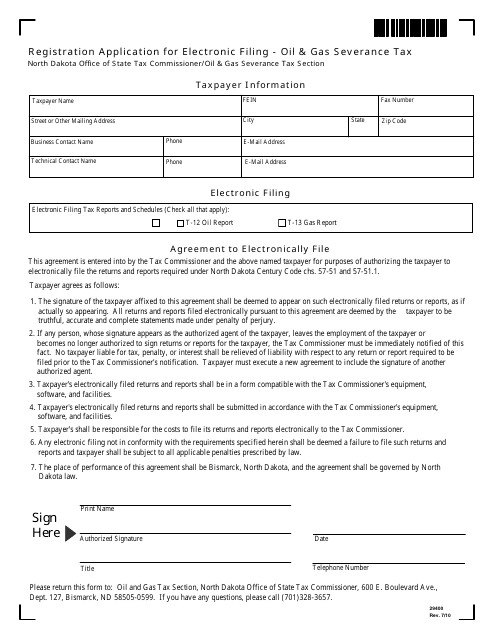

This Form is used for registering electronic filing of oil & gas severance tax in North Dakota.

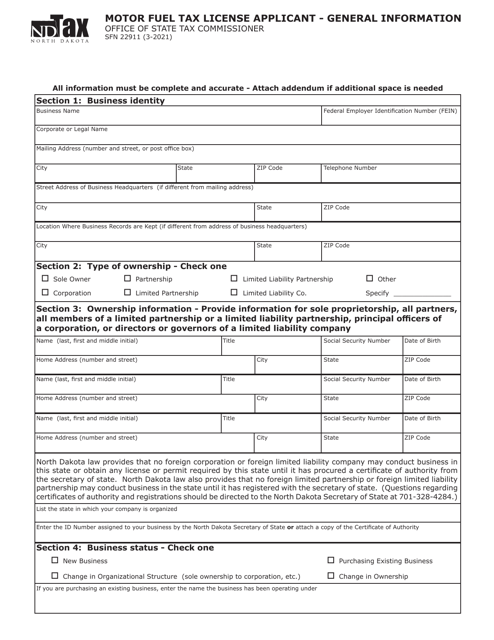

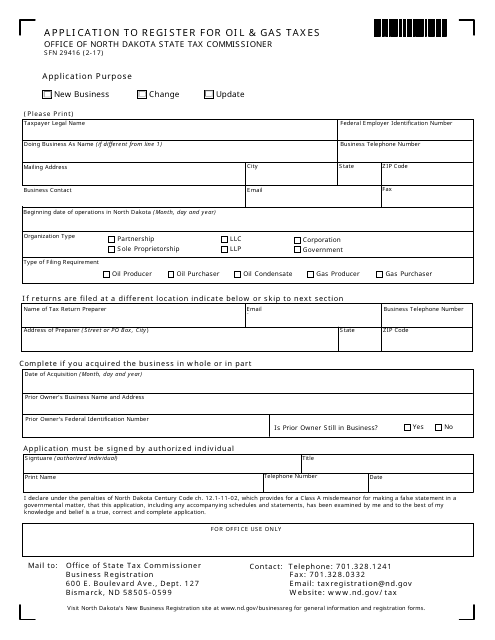

This form is used for registering for oil and gas taxes in North Dakota.

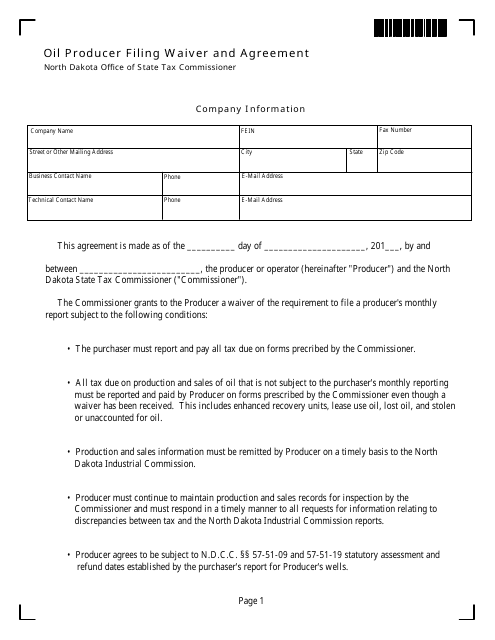

This Form is used for oil producers in North Dakota to file a waiver and agreement.

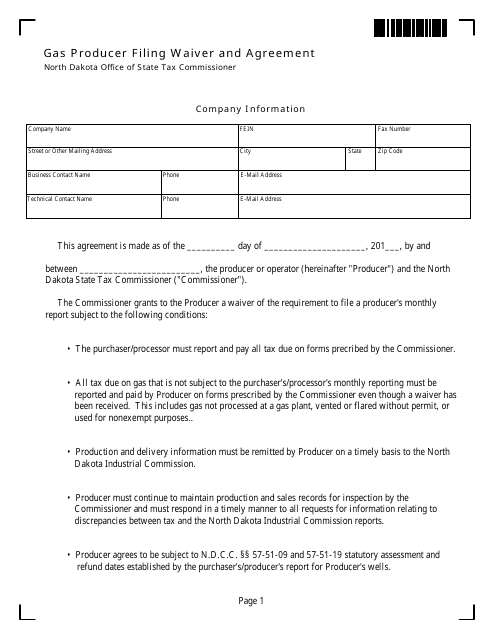

This Form is used for gas producers in North Dakota to file a waiver and agreement.

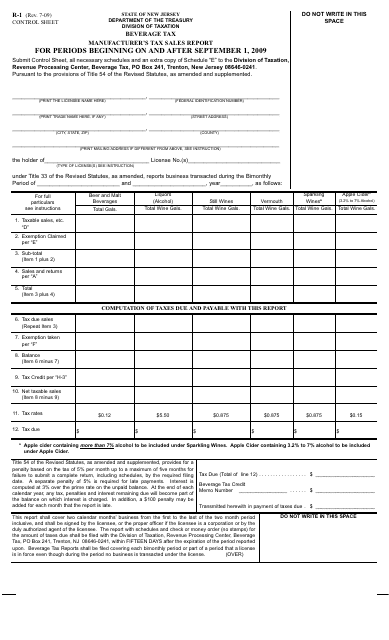

This form is used for reporting the sales of beverages and calculating the manufacturer's tax in New Jersey for periods beginning on or after September 2009.

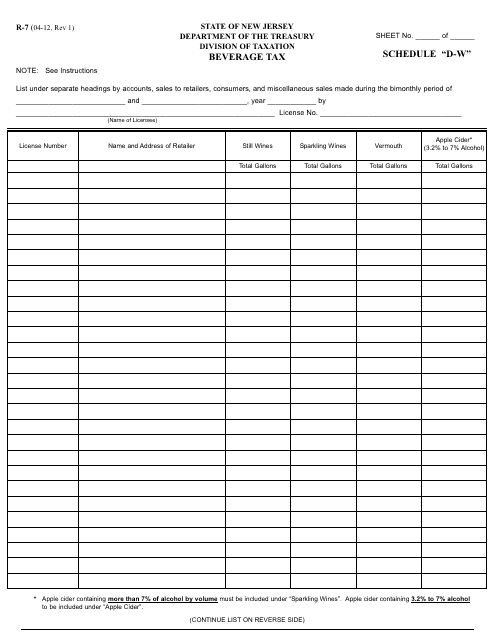

This form is used for reporting and paying beverage tax in New Jersey. It is specifically for Schedule D-W, which applies to wholesalers.

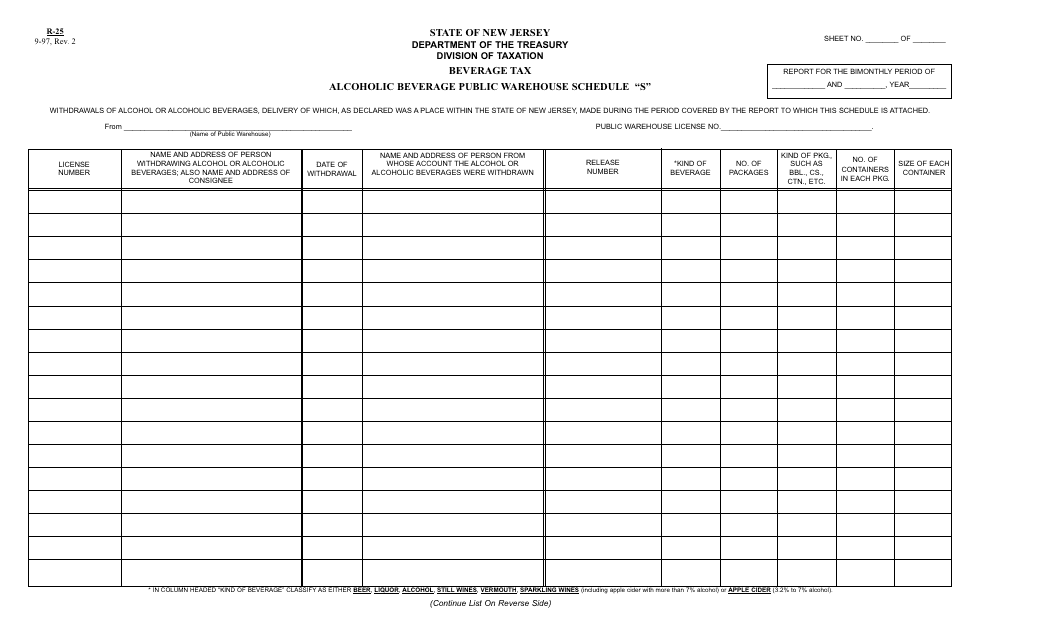

This Form is used for reporting information about an alcoholic beverage public warehouse in New Jersey. It is required by the state government to ensure compliance with regulations related to the storage and distribution of alcoholic beverages.

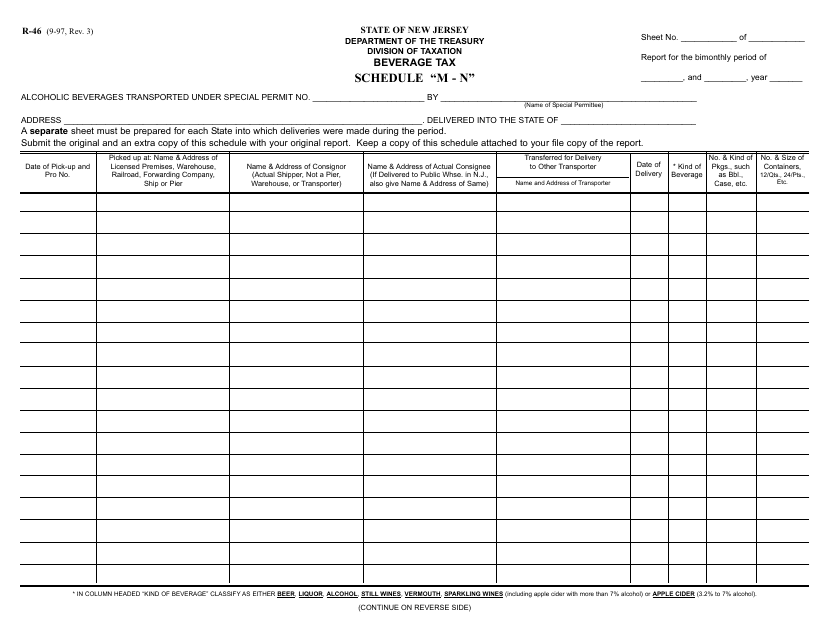

This form is used for reporting and paying alcohol beverage taxes in the state of New Jersey. It is specifically for Schedule M-N.

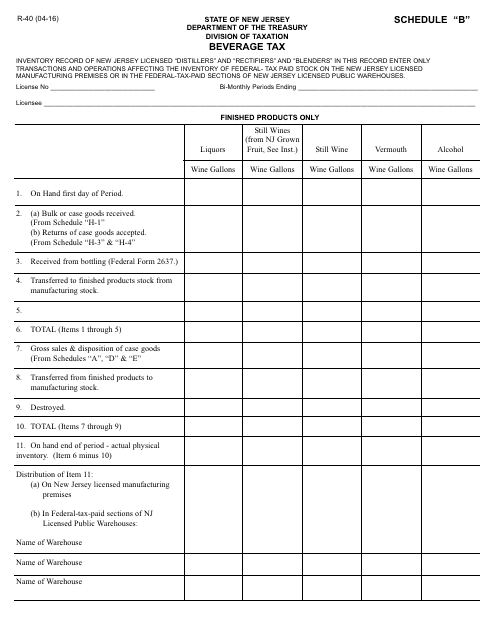

This Form is used for keeping records of inventory for licensed distillers, rectifiers, and blenders in New Jersey.

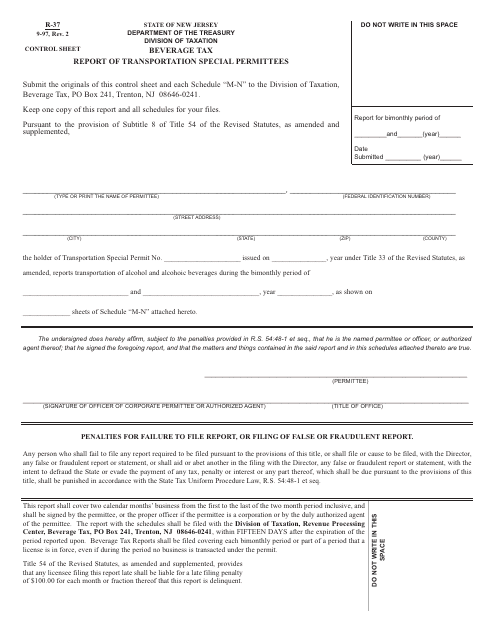

This form is used for reporting transportation special permittees in the state of New Jersey. It is used to gather information about companies or individuals that hold special permits for transportation services.

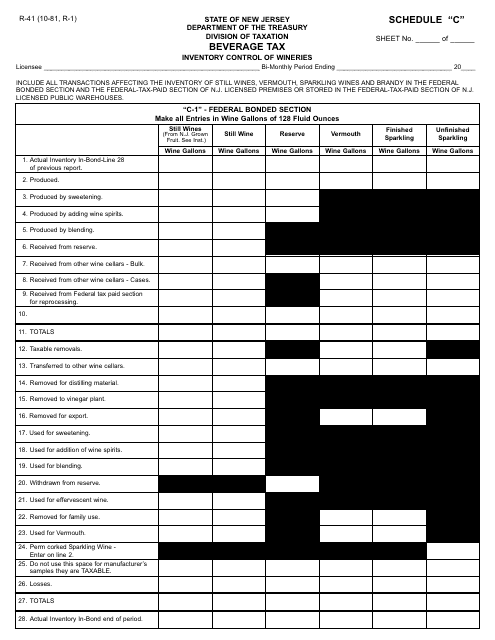

This form is used for inventory control of wineries in New Jersey for the purpose of beverage tax.

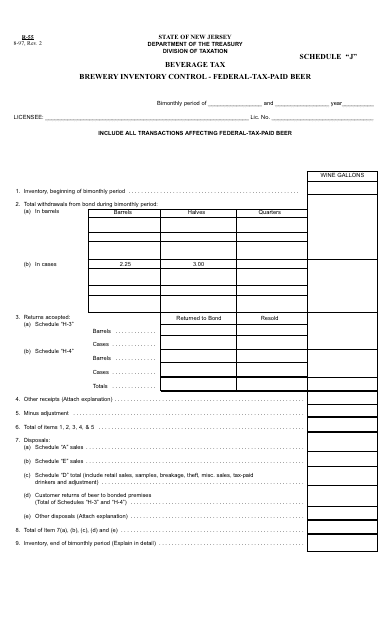

This type of document is used by breweries in New Jersey to maintain control over their inventory of federally taxed beer.

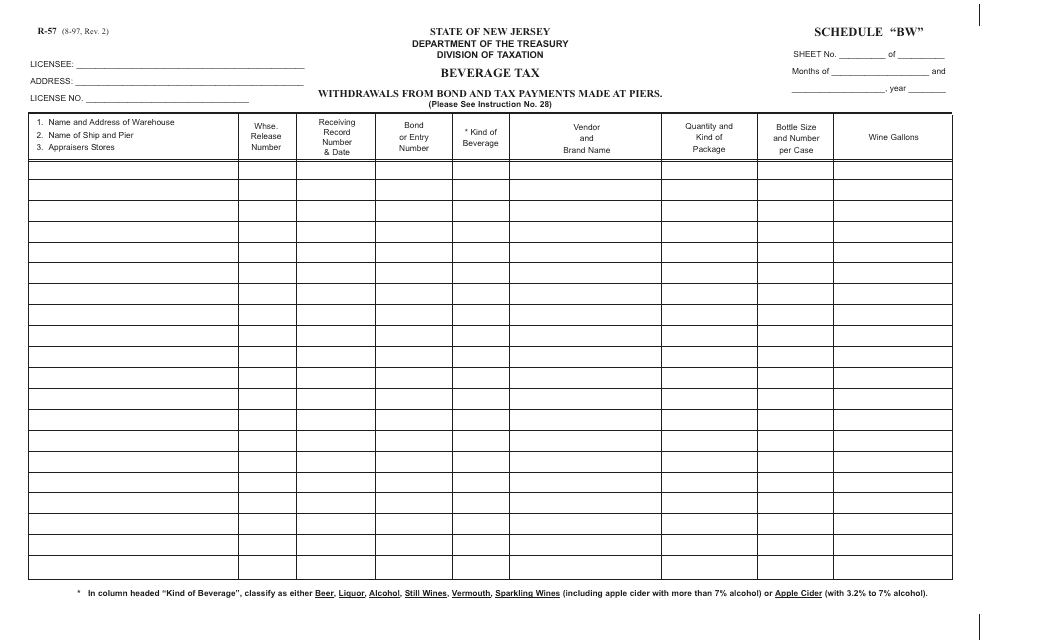

This Form is used for reporting withdrawals from bonds and tax payments made at piers in New Jersey.

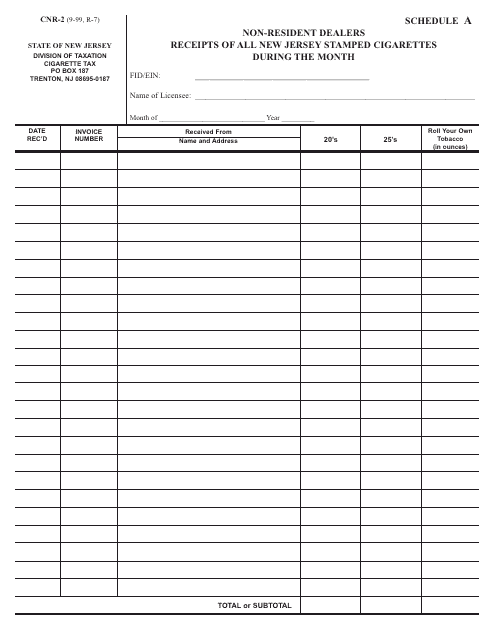

This form is used for reporting the receipts of all New Jersey stamped cigarettes by non-resident dealers during a specific month in New Jersey.

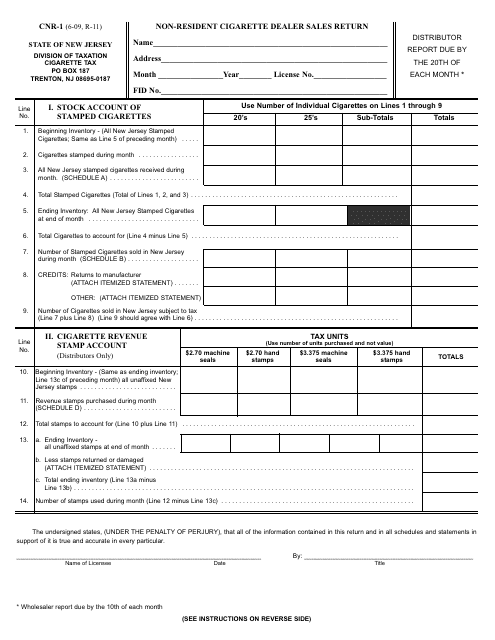

This Form is used for non-resident cigarette dealers in New Jersey to report sales returns.

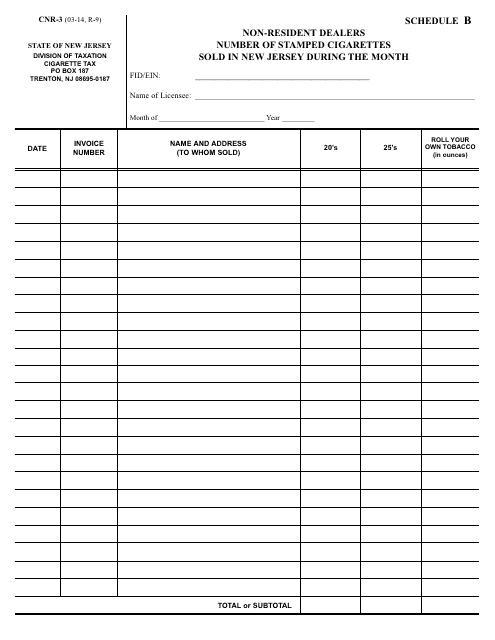

This Form is used for reporting the number of stamped cigarettes sold by non-resident dealers in New Jersey during a specific month.

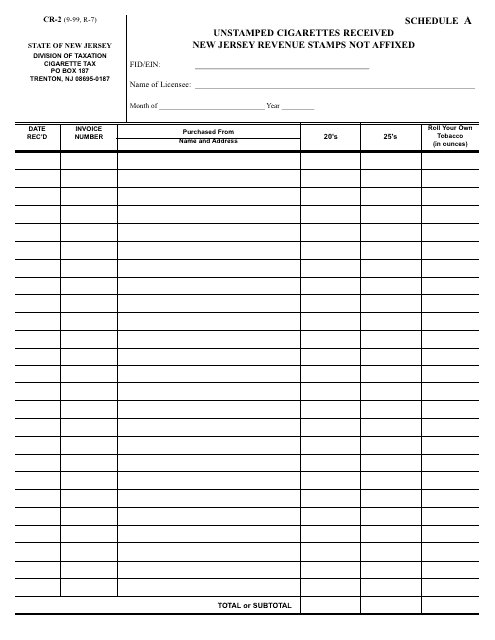

This form is used to report unstamped cigarettes received in New Jersey without the required revenue stamps affixed.

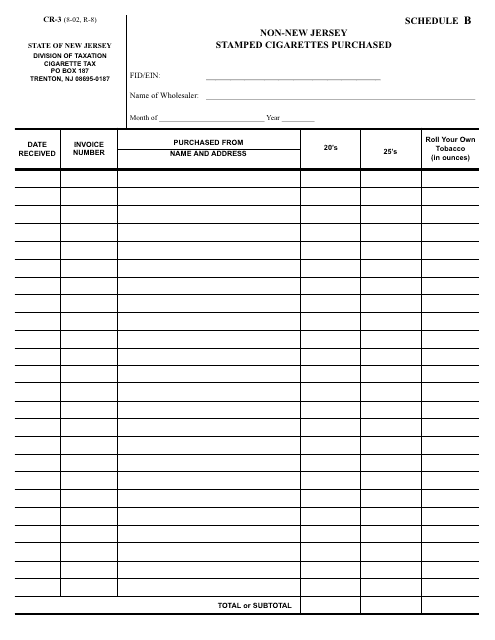

This form is used for reporting the purchase of stamped cigarettes that were not bought in the state of New Jersey.

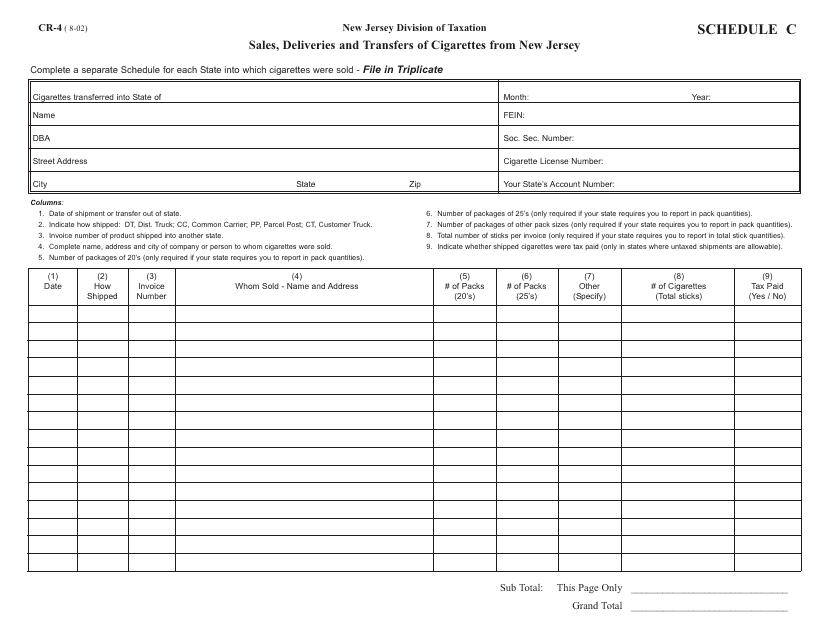

This form is used for reporting sales, deliveries, and transfers of cigarettes from New Jersey.

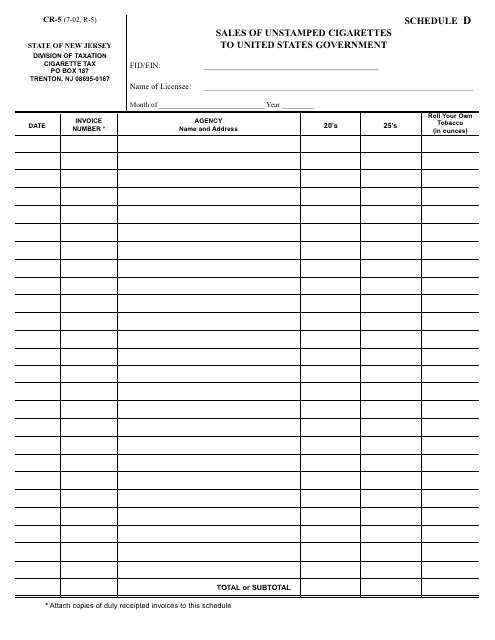

This form is used for reporting sales of unstamped cigarettes to the United States Government in New Jersey.

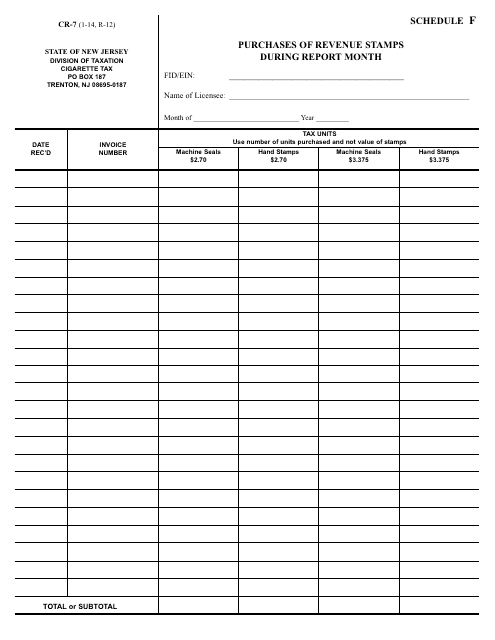

This form is used for reporting the purchases of revenue stamps during a specific month in the state of New Jersey.

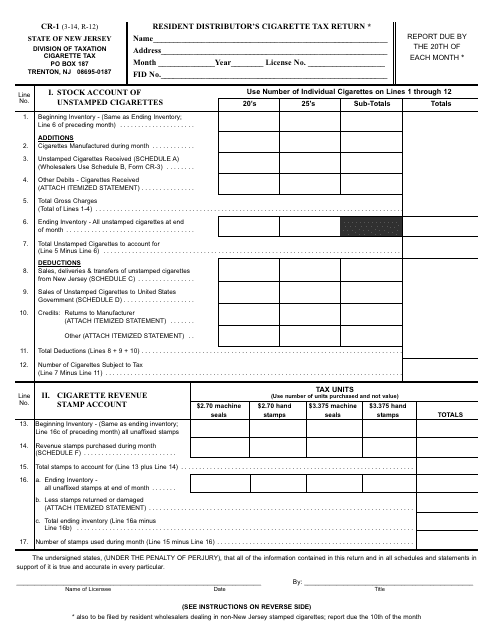

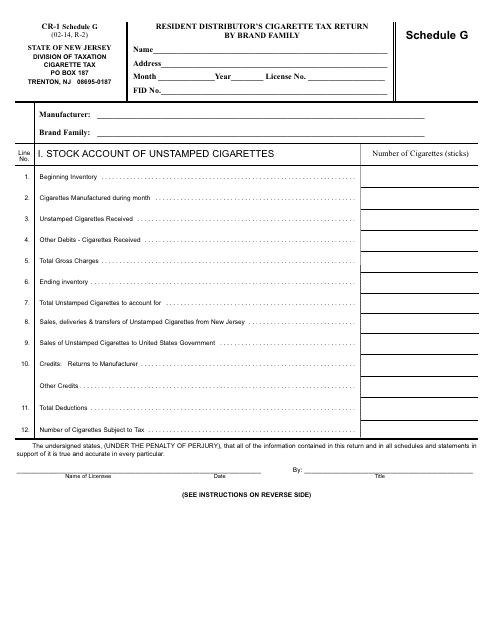

This form is used for the residents of New Jersey who are distributors of cigarettes to report and pay their cigarette tax.

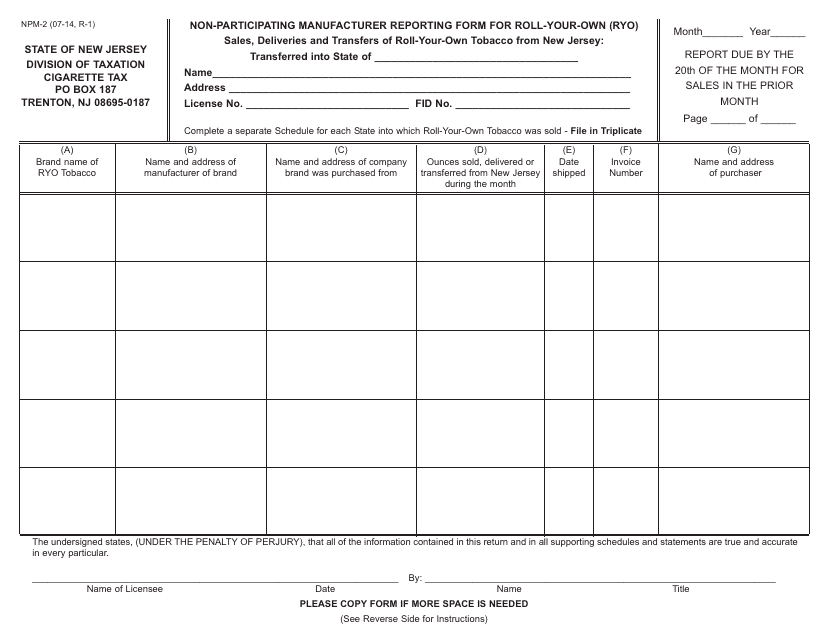

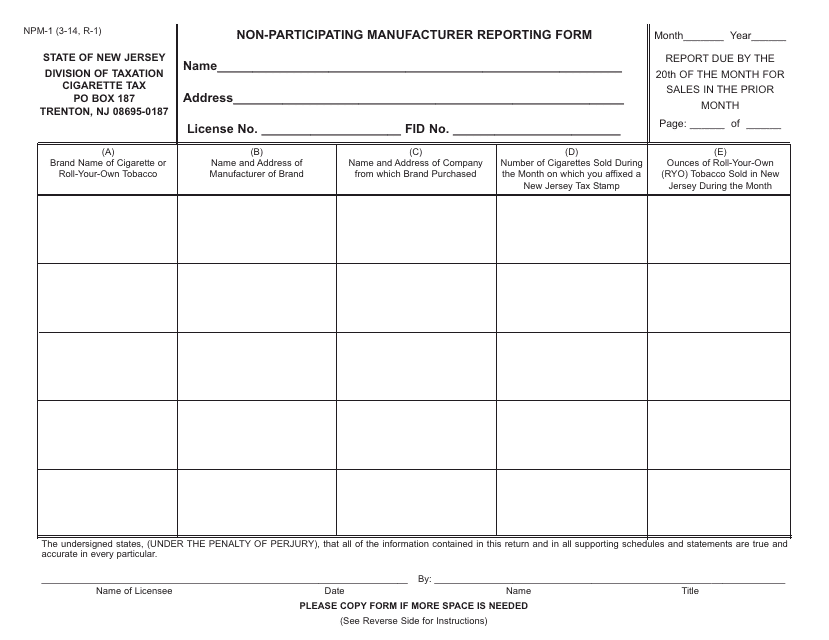

This form is used for non-participating manufacturers to report information related to the roll-your-own tobacco products in New Jersey.

This Form is used for non-participating manufacturers to report information to the state of New Jersey. It is necessary for compliance with the state's tobacco regulations.

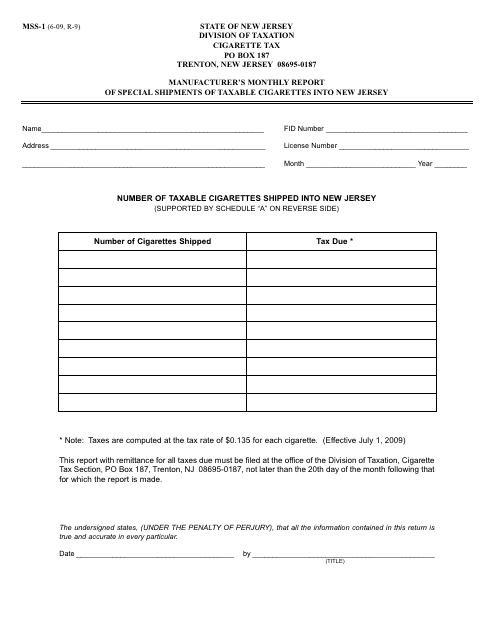

This form is used for manufacturers to report monthly shipments of taxable cigarettes into New Jersey.

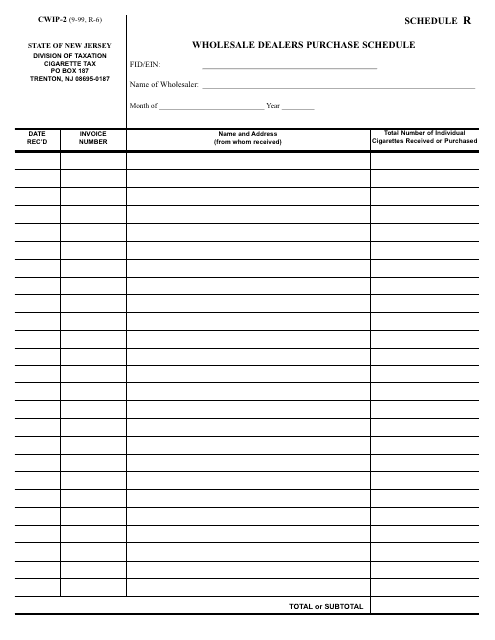

This form is used for reporting wholesale dealers' purchases in New Jersey. It is known as Schedule R and is part of the CWIP-2 form.

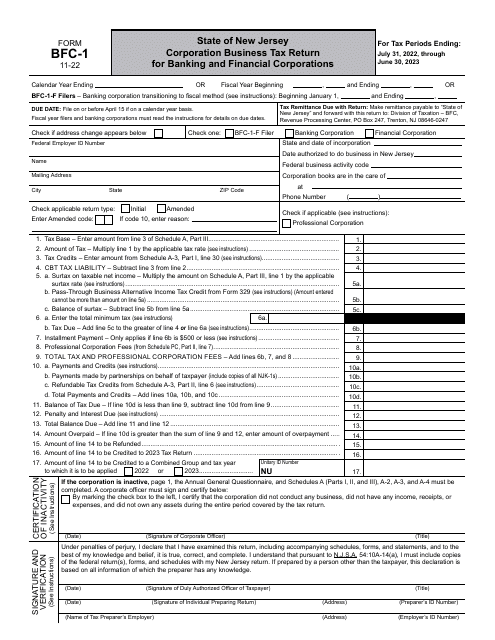

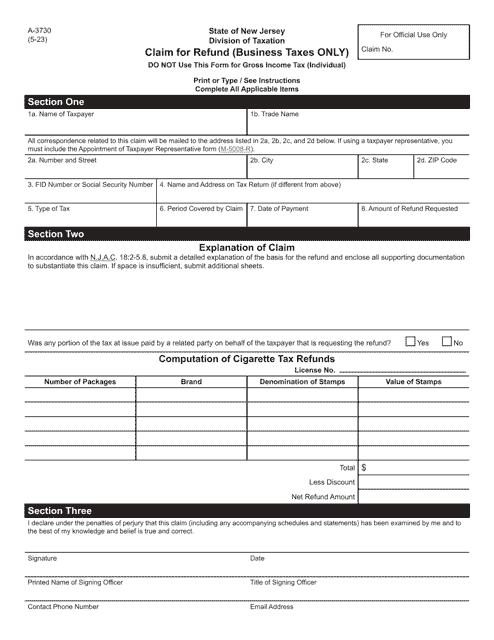

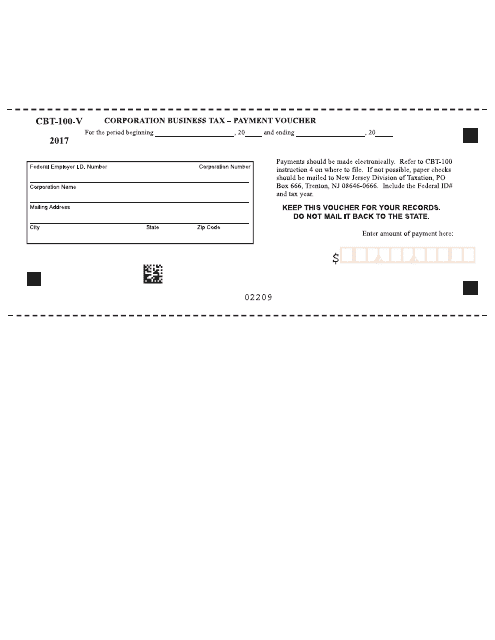

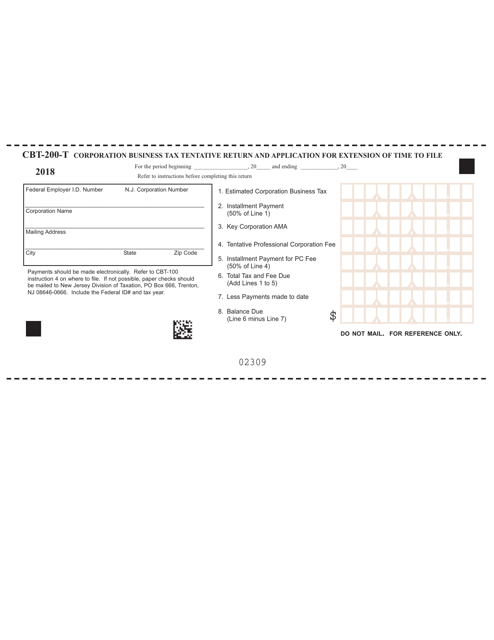

This document is a payment voucher for corporations to pay their business tax in the state of New Jersey.