United States Tax Forms and Templates

Related Articles

Documents:

2432

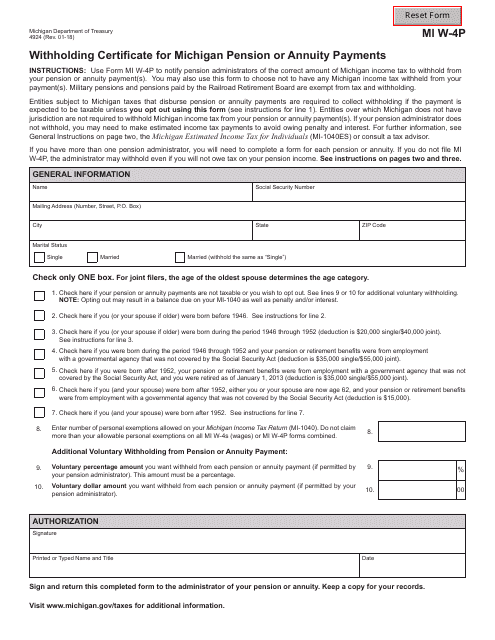

This form is used for declaring the amount of state income tax to be withheld from pension or annuity payments in Michigan. It is necessary for Michigan residents who receive pension or annuity income to ensure proper withholding of state taxes.

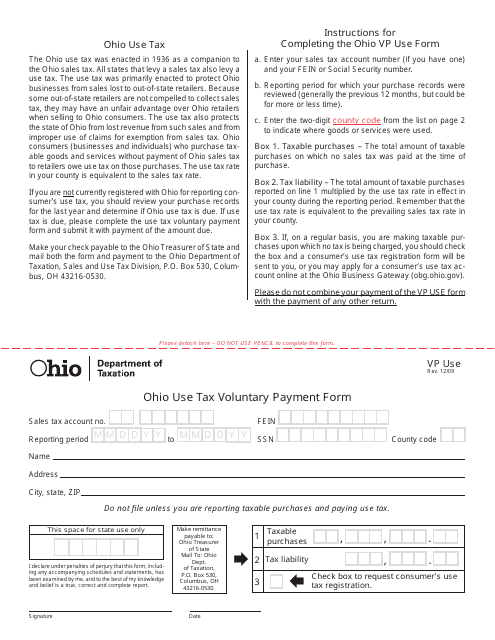

This Form is used for voluntarily paying Ohio Use Tax.

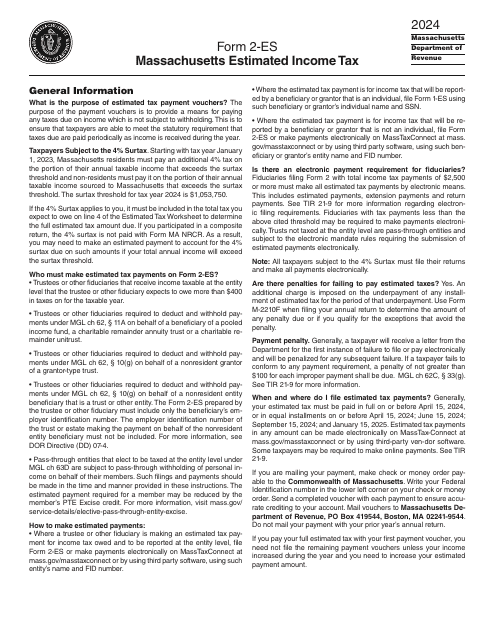

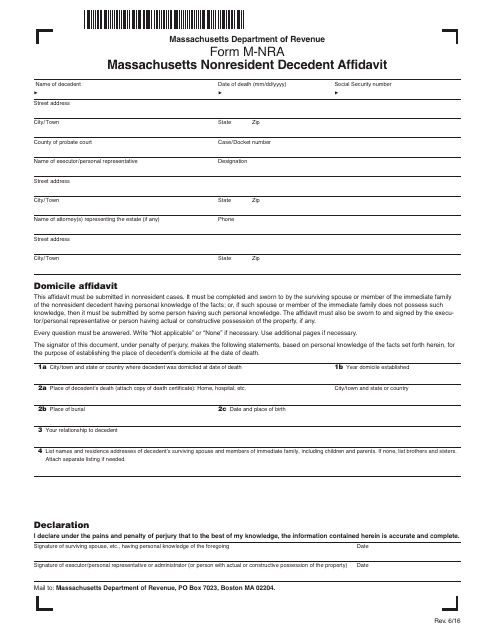

This form is used for Massachusetts nonresidents who have passed away to declare their residency status.

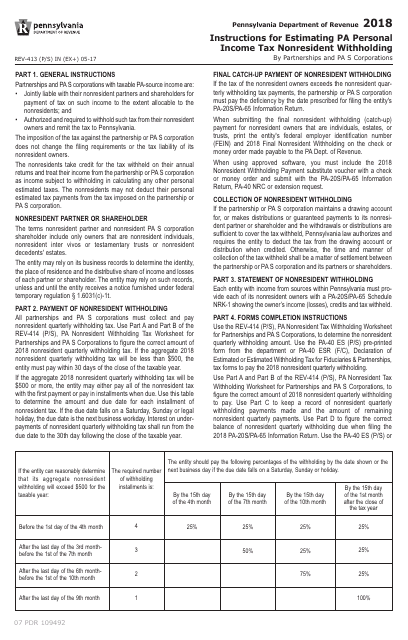

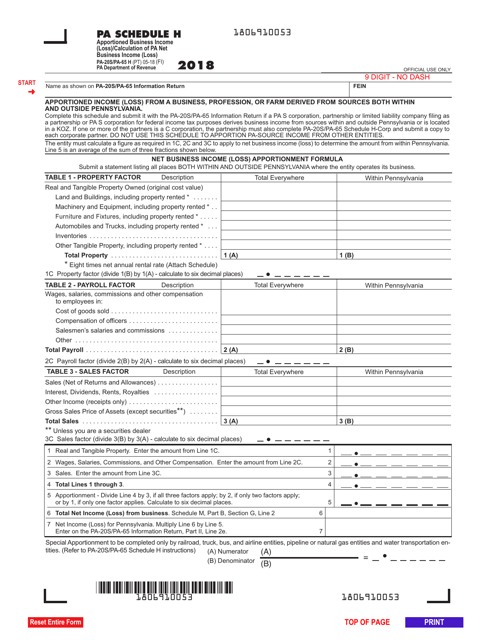

This Form is used for estimating the Pennsylvania personal income tax nonresident withholding for individuals. It provides instructions on how to calculate and pay the appropriate amount of withholding tax for nonresident individuals in Pennsylvania.

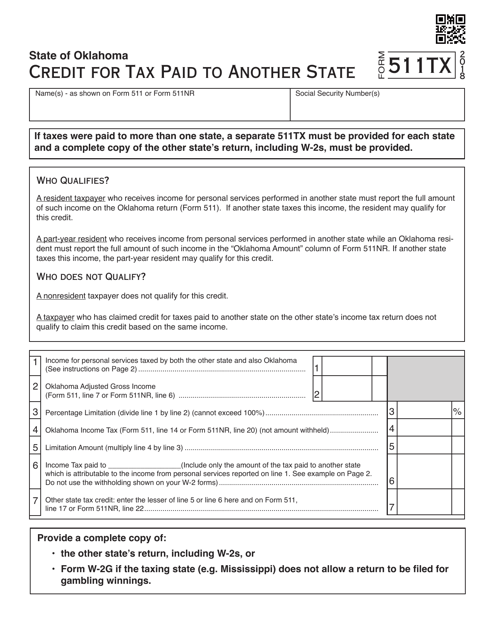

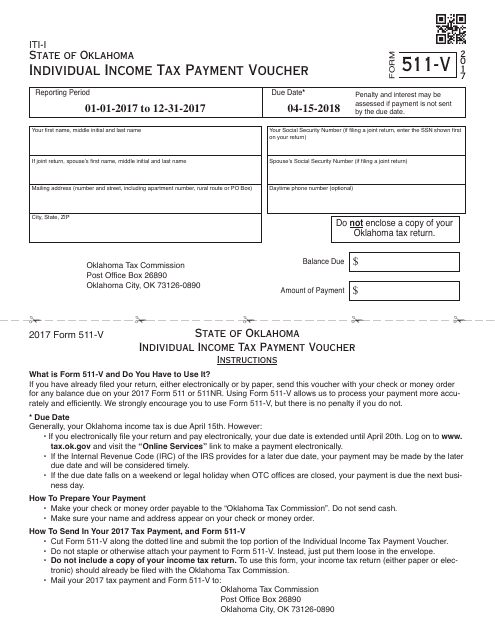

This form is used for making individual income tax payments in the state of Oklahoma. It is used by residents to submit their tax payments to the Oklahoma Tax Commission.

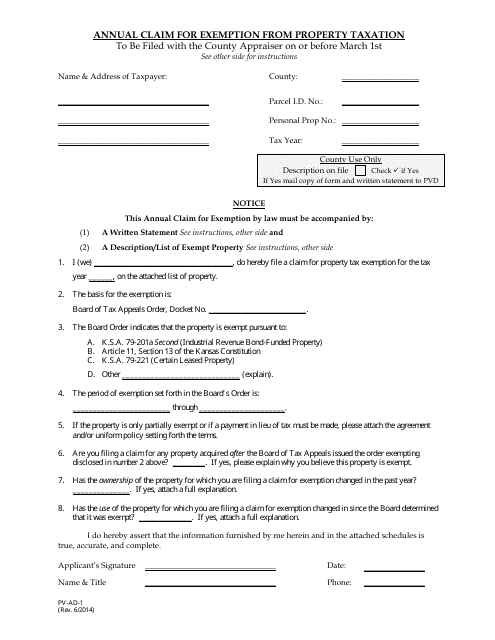

This Form is used for filing an annual claim for exemption from property taxation in the state of Kansas. It allows qualifying individuals or organizations to request an exemption from property taxes on their eligible property.

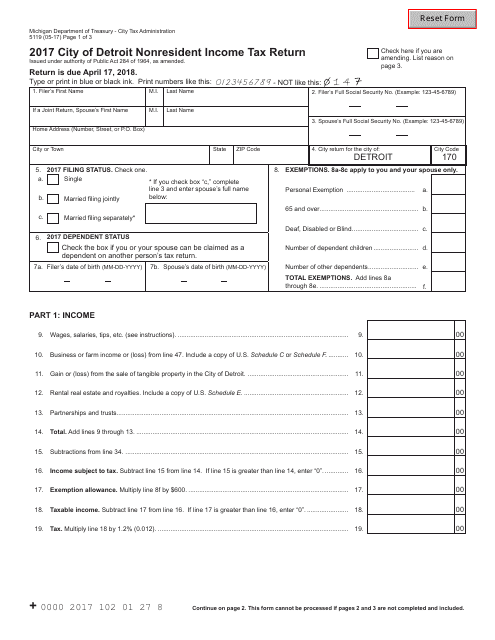

This form is used for filing your nonresident income tax return for the City of Detroit in the state of Michigan. It is specifically for individuals who live outside of Detroit but earned income within the city.

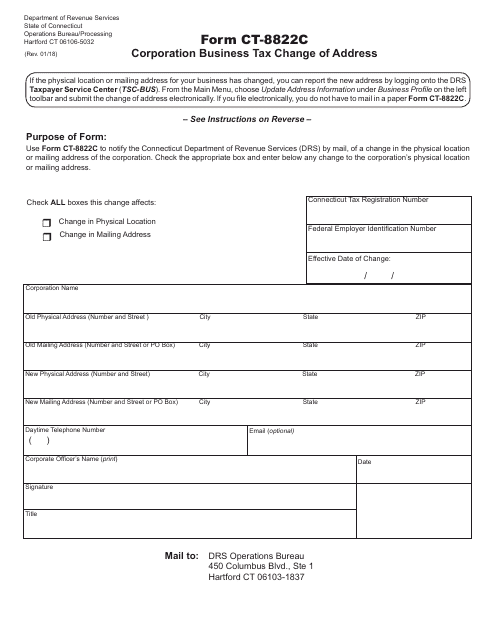

This Form is used for corporations to notify the state of Connecticut about changes in their business address for tax purposes.

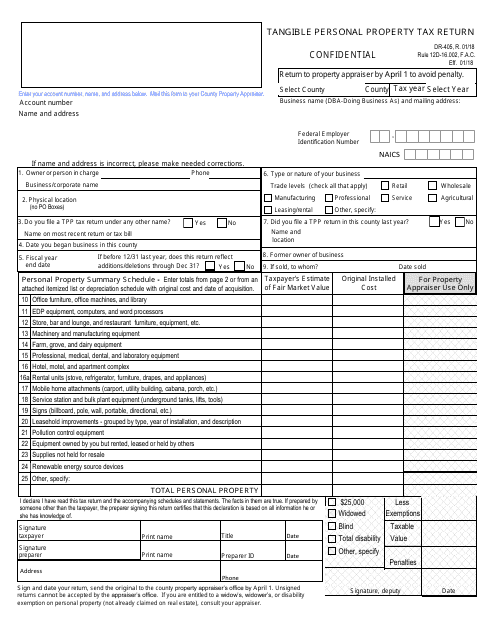

This Form is used for reporting tangible personal property and calculating tax owed in the state of Florida.

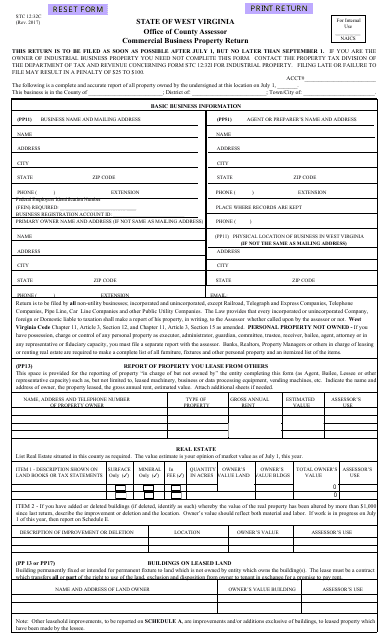

This form is used for filing a Commercial Business Property Return in West Virginia. It is necessary for businesses to assess the value of their commercial property for taxation purposes.

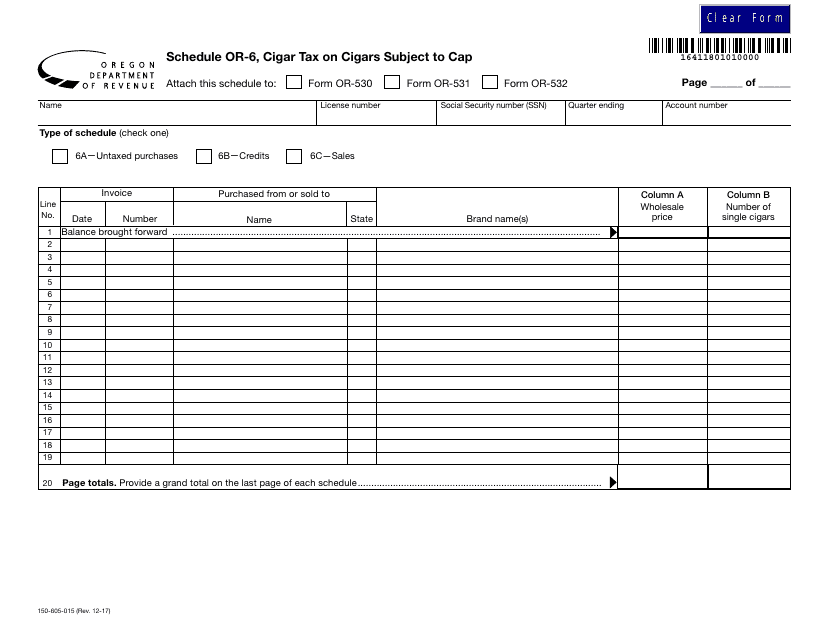

This document is used for calculating and reporting the cigar tax for cigars that are subject to a cap in the state of Oregon.

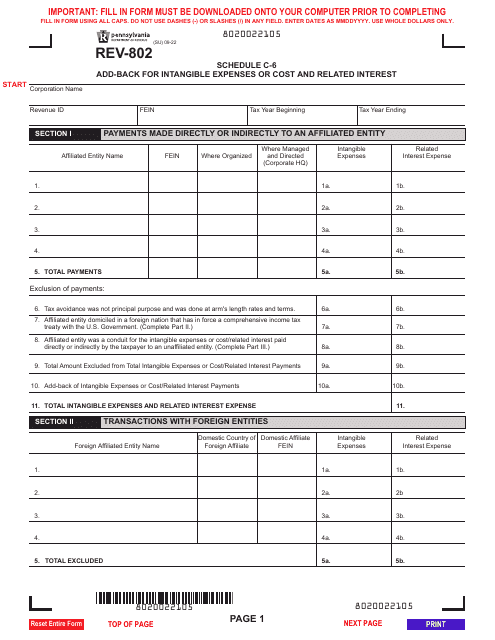

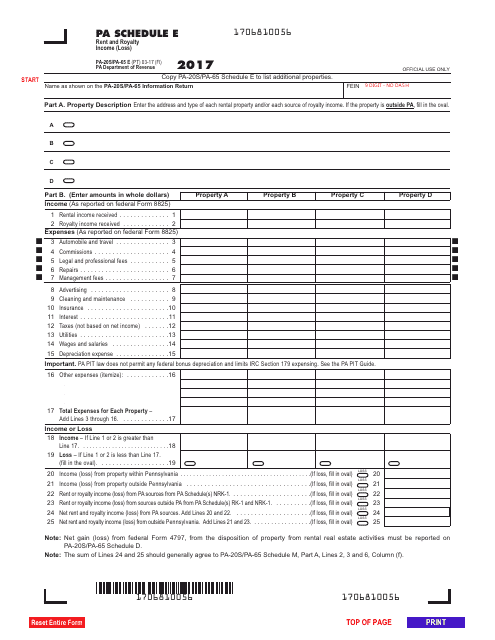

This form is used for reporting rental and royalty income or loss in the state of Pennsylvania for partnerships or S corporations.

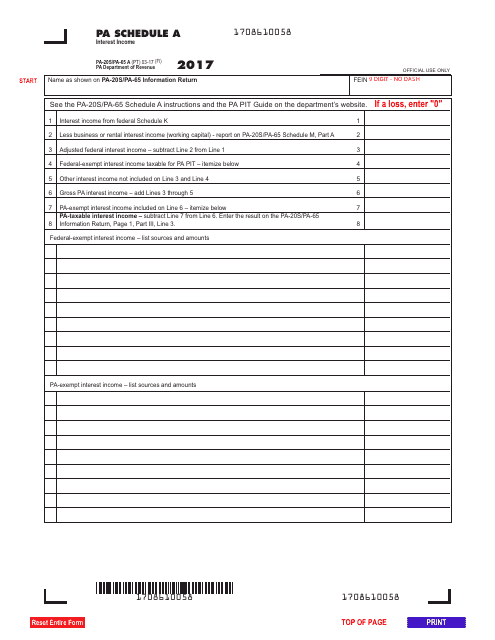

This form is used for reporting interest income in the state of Pennsylvania.

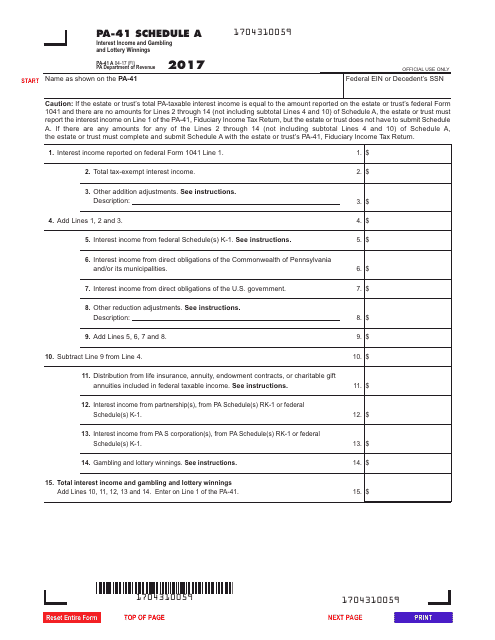

This Form is used for reporting interest income and gambling and lottery winnings in Pennsylvania.

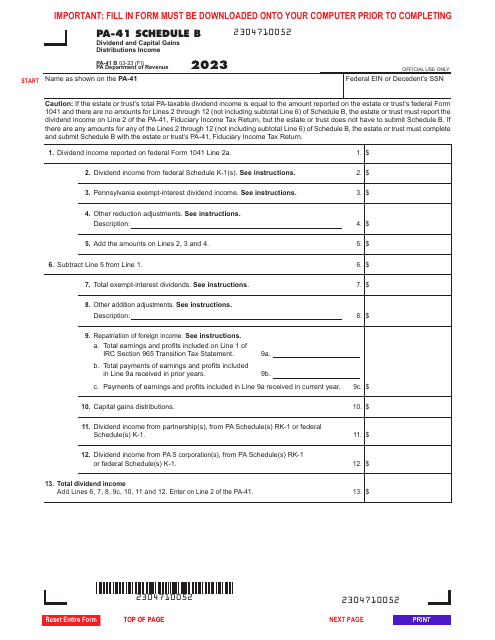

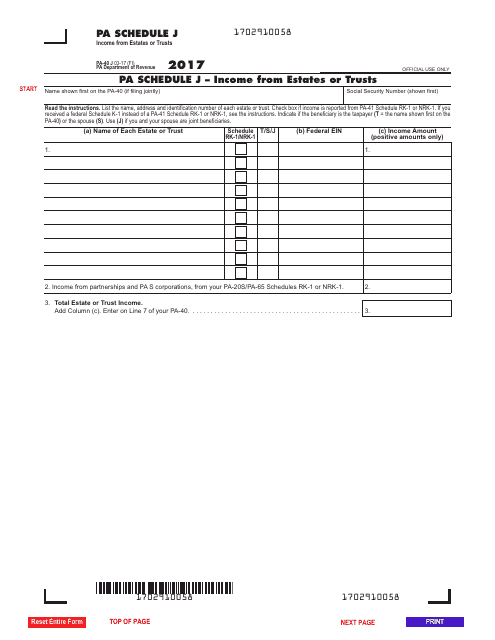

This form is used for reporting income from estates or trusts in Pennsylvania. It helps individuals to calculate and report their income from these sources for tax purposes.

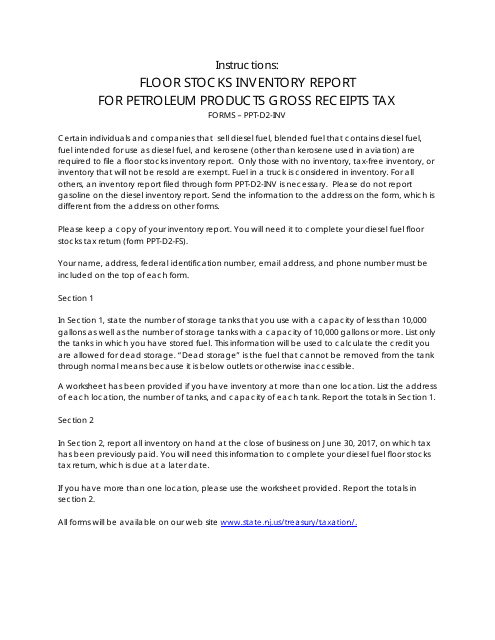

This document provides instructions for completing Form PPT-D2-INV, which is used to report floor stocks inventory for petroleum products gross receipts tax in New Jersey.

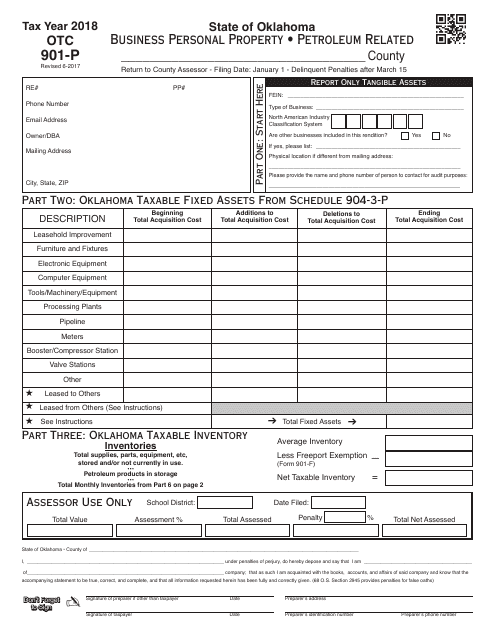

This Form is used for reporting business personal property related to petroleum in the state of Oklahoma.

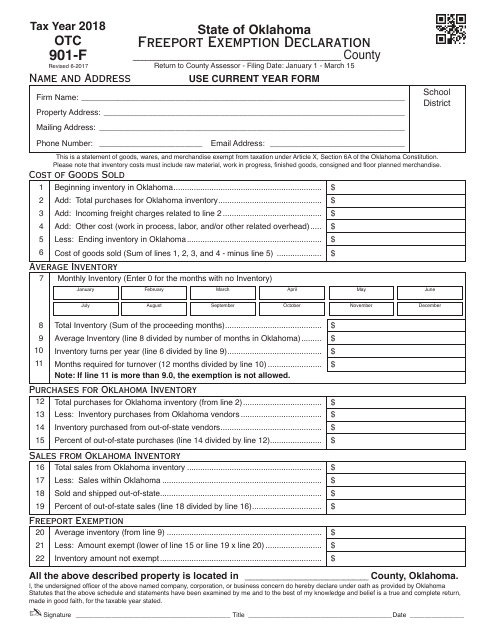

This document is used for declaring a Freeport exemption in the state of Oklahoma.

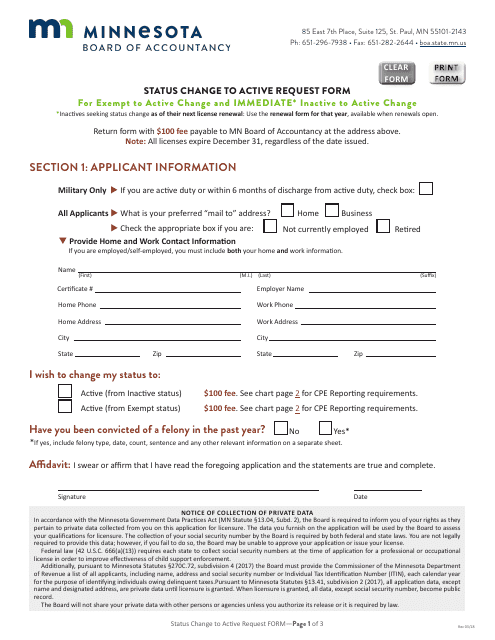

This form is used for requesting a status change from inactive to active in the state of Minnesota.