Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

This is a document you may use to figure out how to properly complete IRS Form 6765

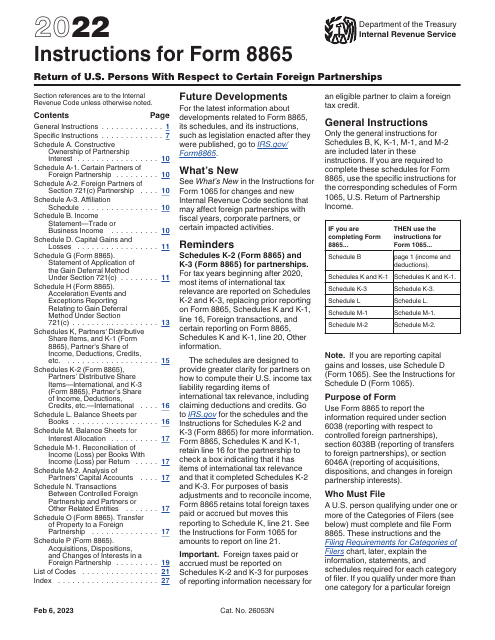

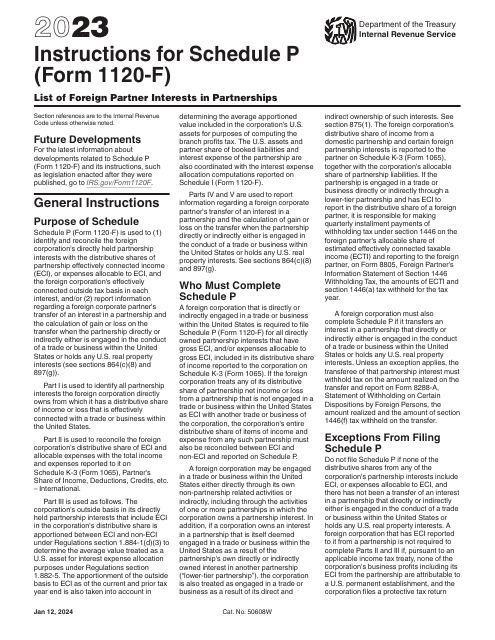

Instructions for Form 8865 Return of U.S. Persons With Respect to Certain Foreign Partnerships, 2022

This form is used for reporting information about foreign partnerships and the activities of U.S. persons related to these partnerships.

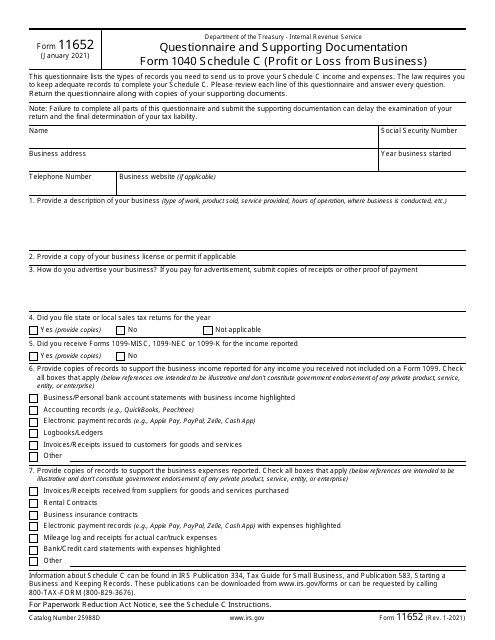

This document is used to provide additional information and supporting documents for individuals who file Form 1040 Schedule C, which reports the profit or loss from a business. It is a questionnaire that helps the IRS gather more information about the business income and expenses reported on Schedule C.

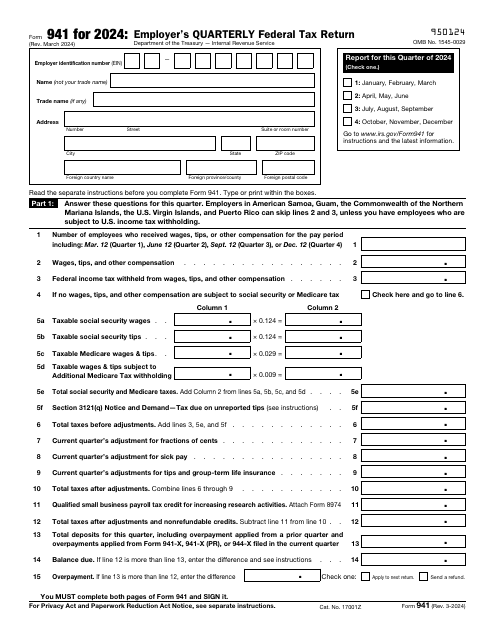

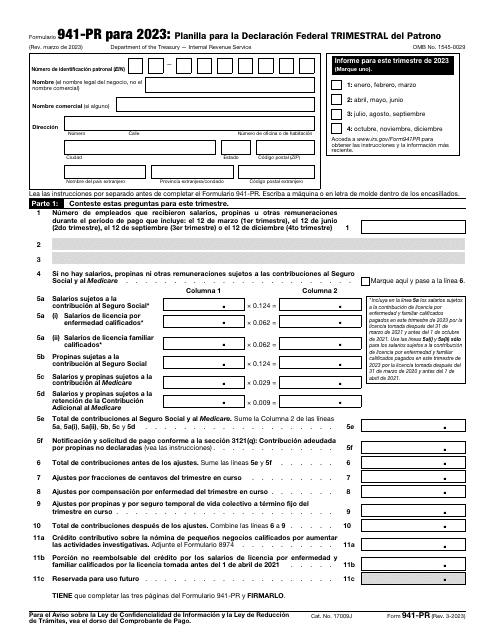

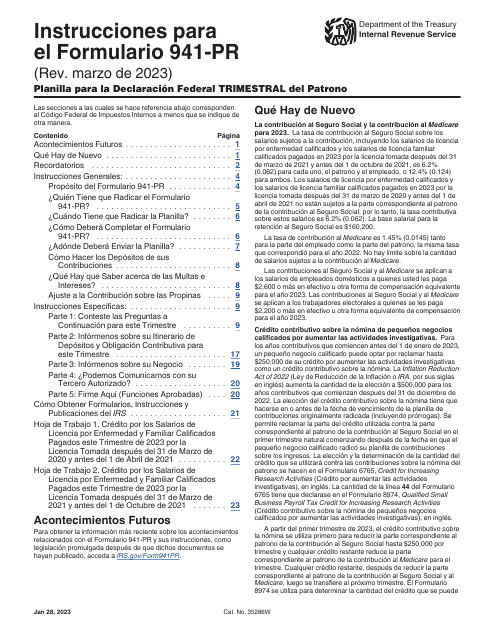

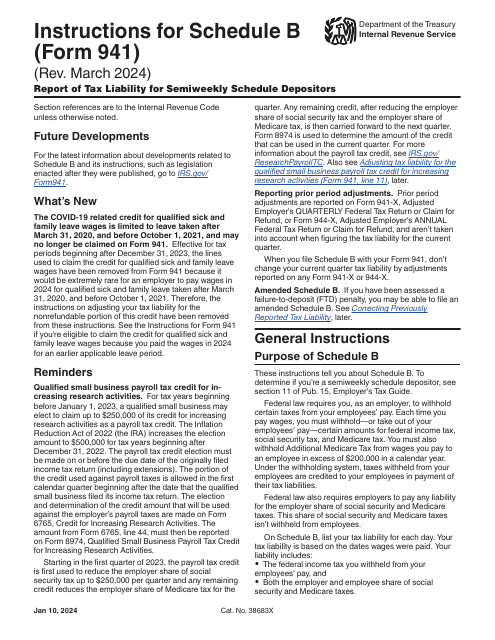

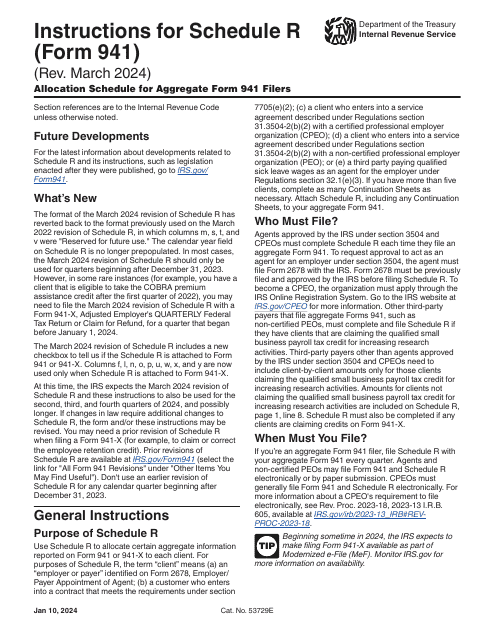

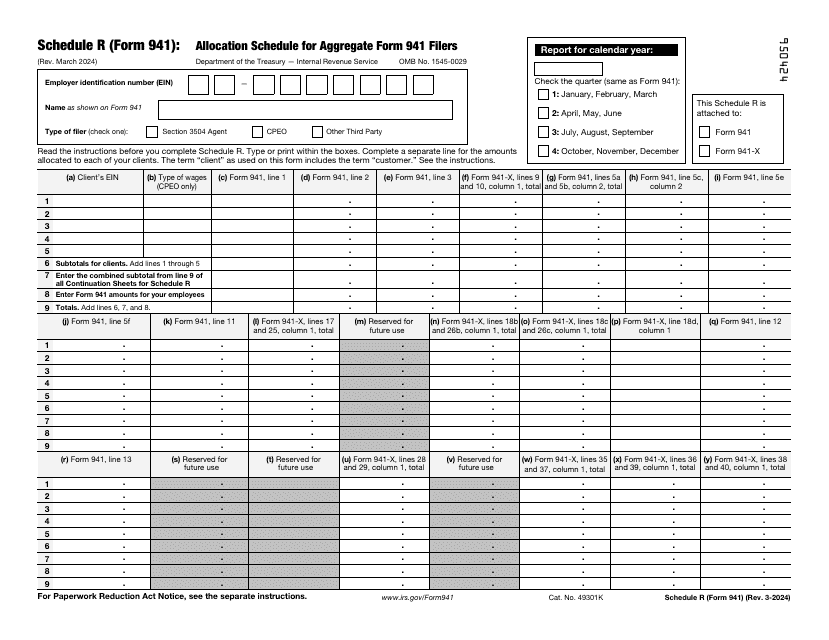

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

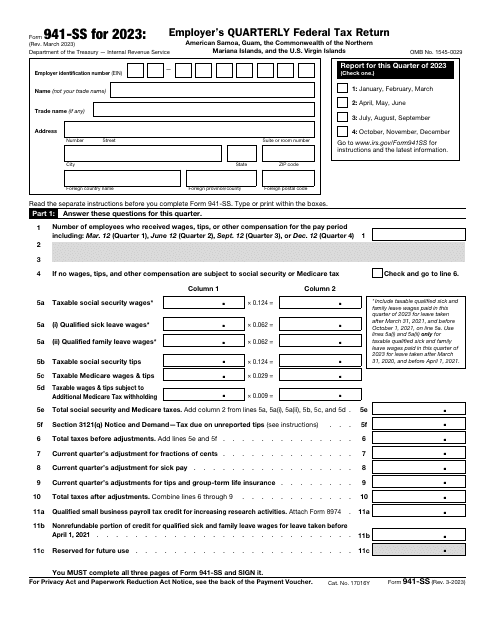

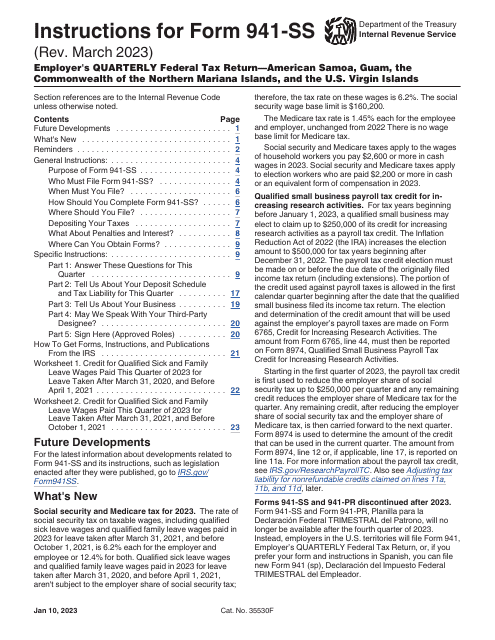

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

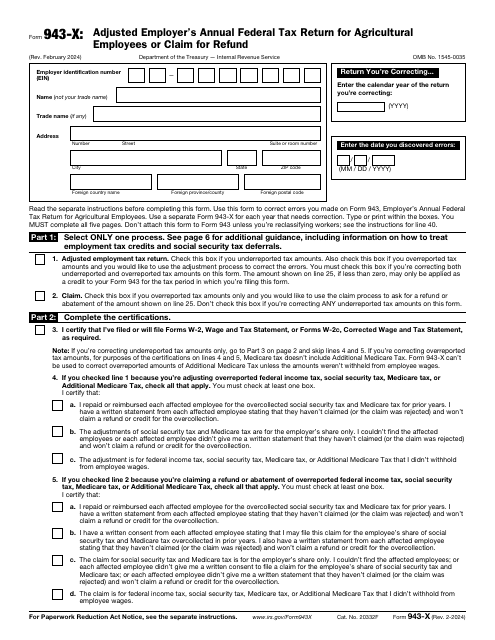

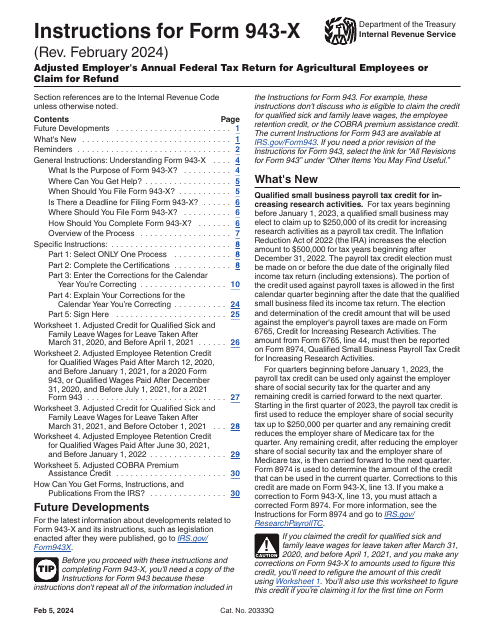

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

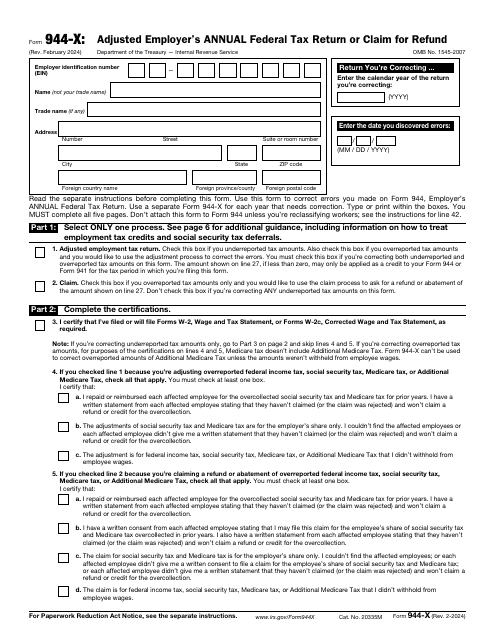

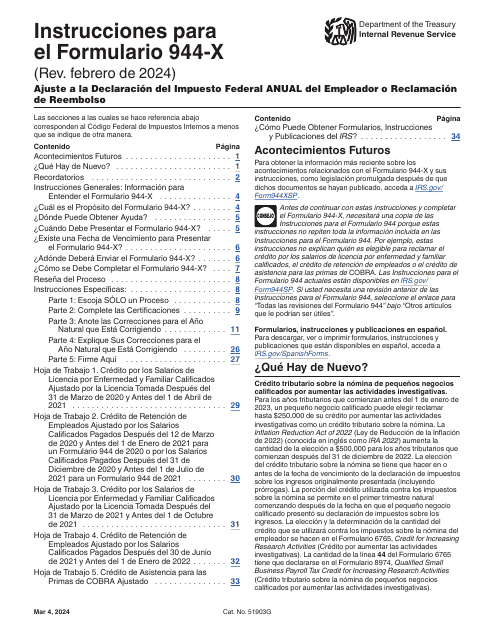

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.

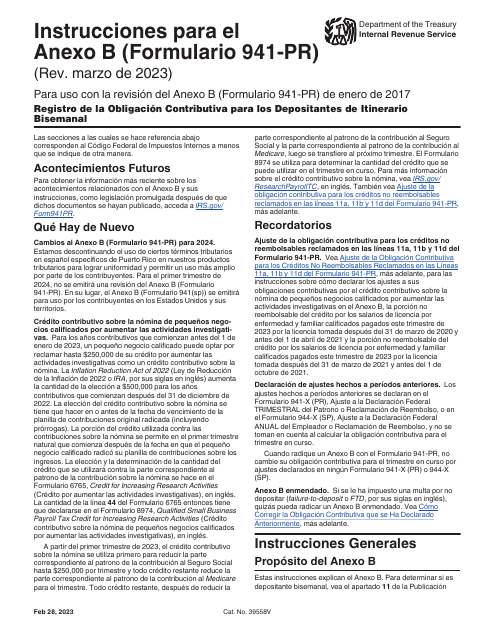

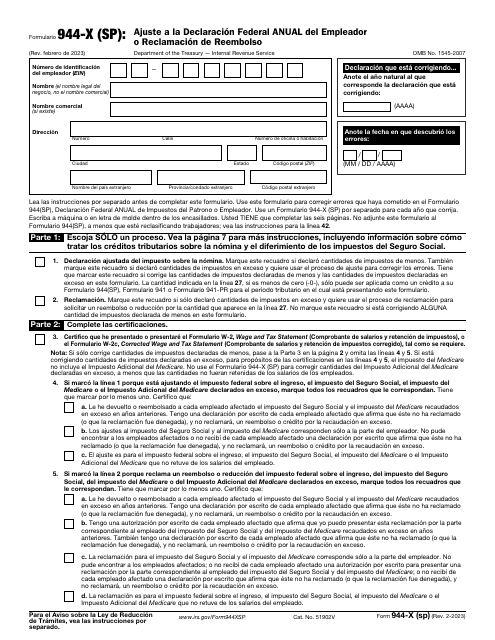

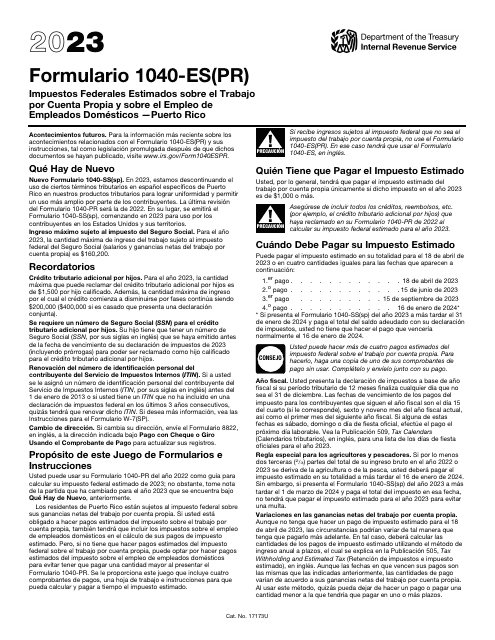

This Form is used for making adjustments to the employer's annual federal declaration or claiming a refund in Puerto Rico (in Spanish).