Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.

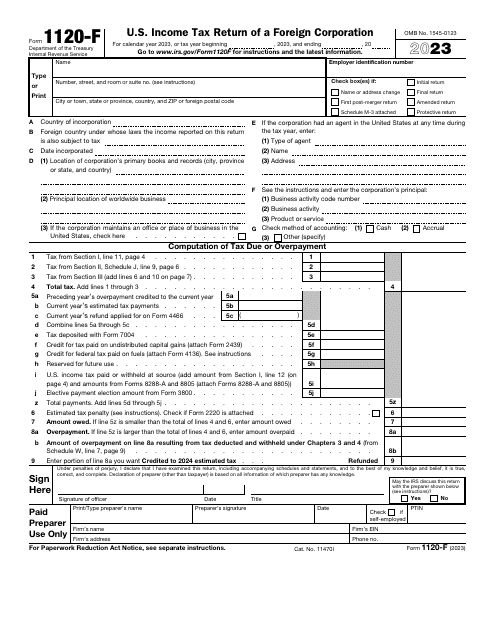

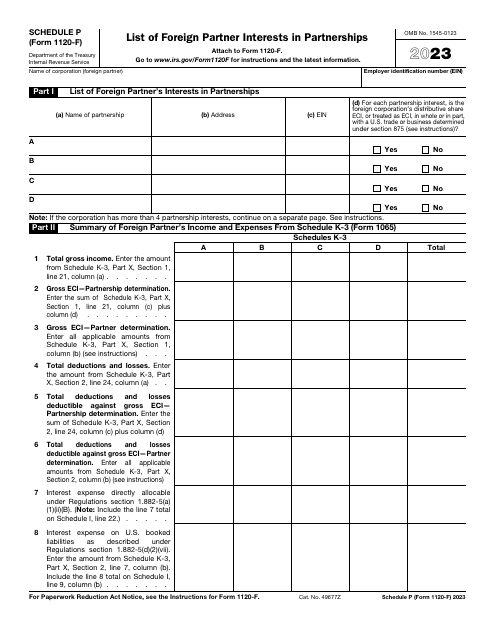

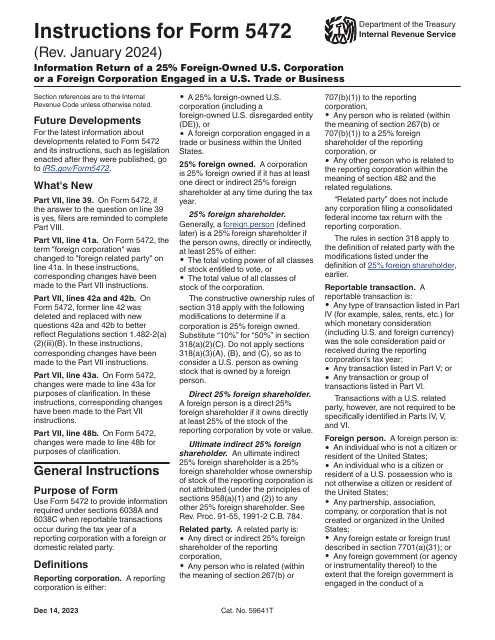

File this form if you are a foreign corporation and maintain an office within the United States in order to report your income, deductions, and credits to the Internal Revenue Service (IRS), as well as to figure your U.S. income tax liability.

This Form is used for reporting information about residential rental properties to the IRS. It provides instructions on how to fill out Form 527.

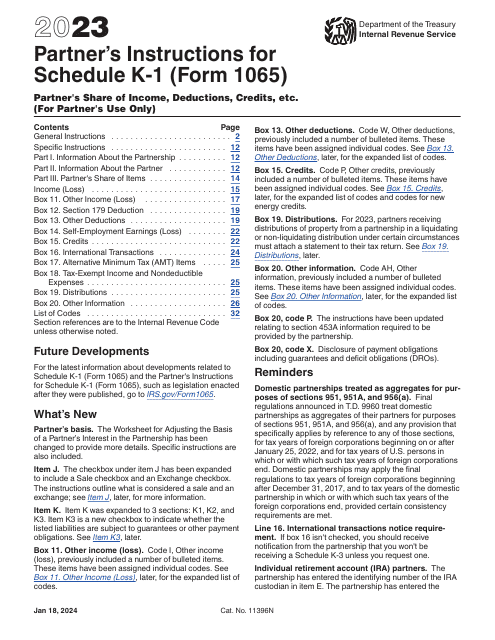

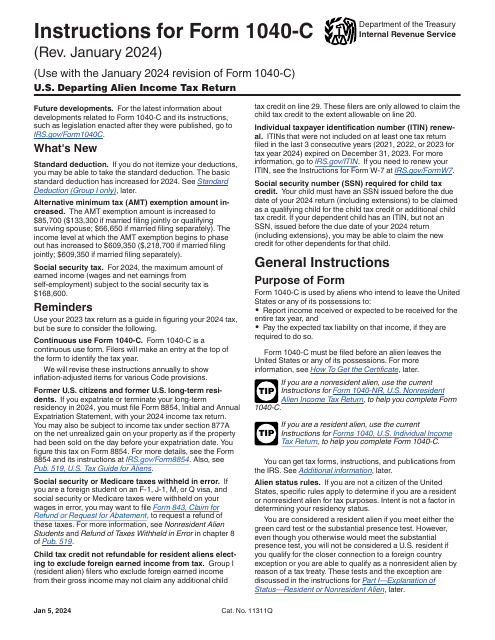

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).

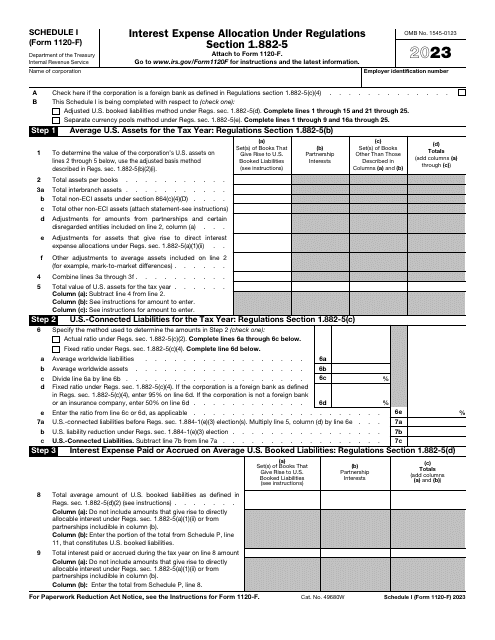

This Form is used for allocating interest expenses on Form 1120-F to determine the taxable income of a foreign corporation.

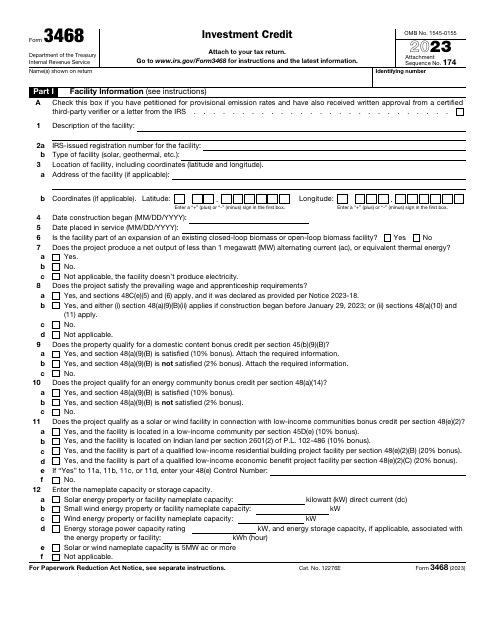

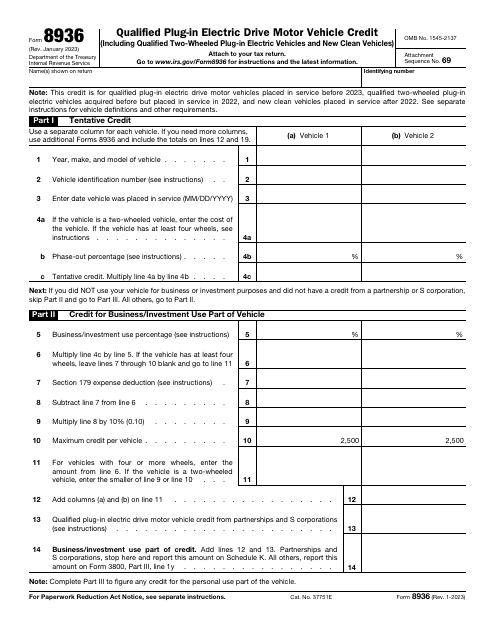

This is a formal IRS form used by taxpayers that purchased electric vehicles in order to claim a tax credit when filing their tax returns.

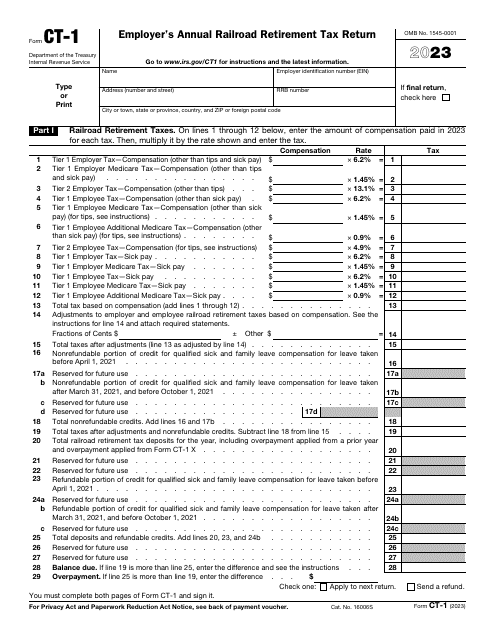

This is a fiscal form railroad industry employers are supposed to fill out in order to report the compensation they paid to their employees if that compensation is taxed in accordance with the Railroad Retirement Tax Act.

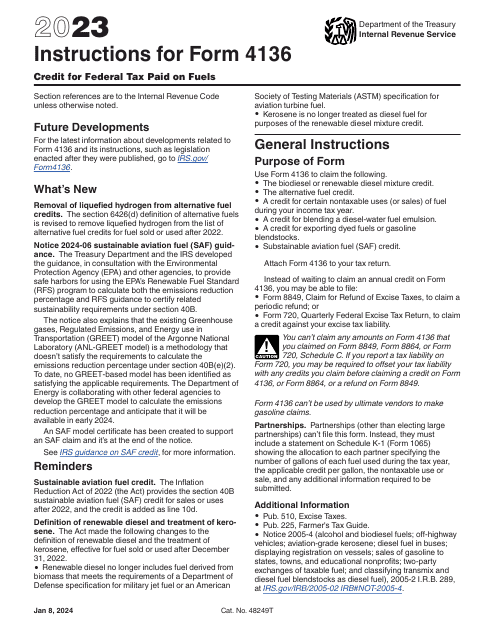

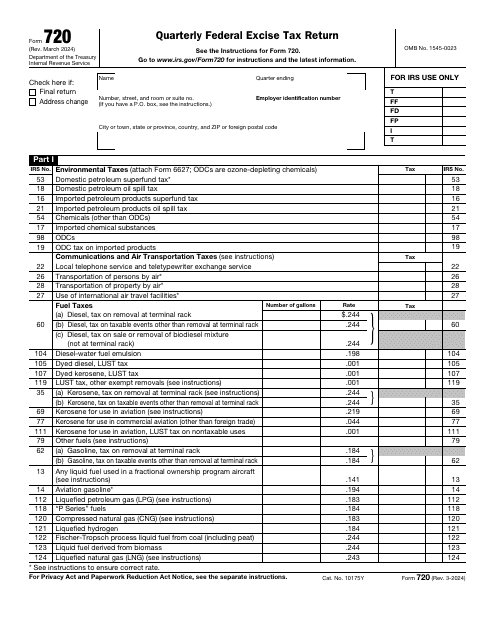

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.