Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

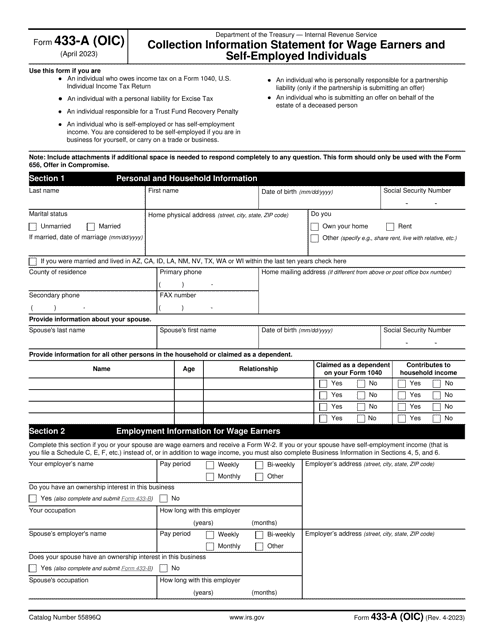

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

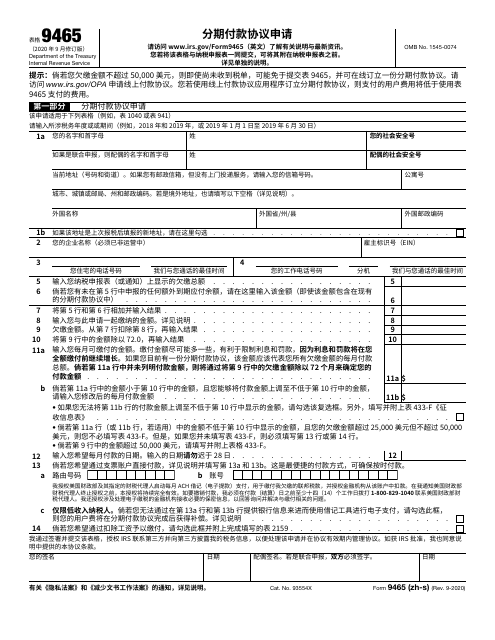

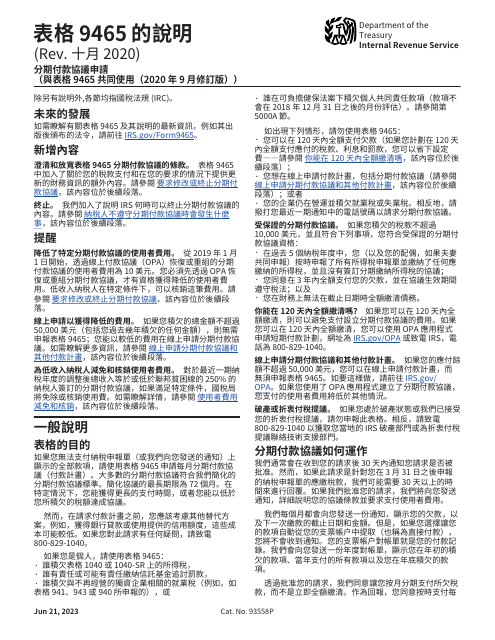

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

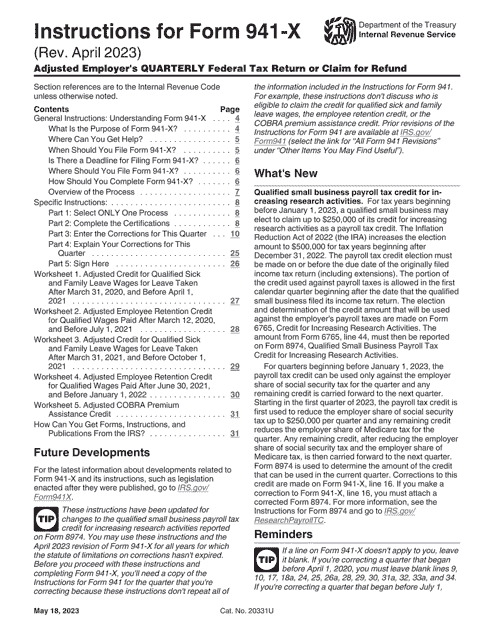

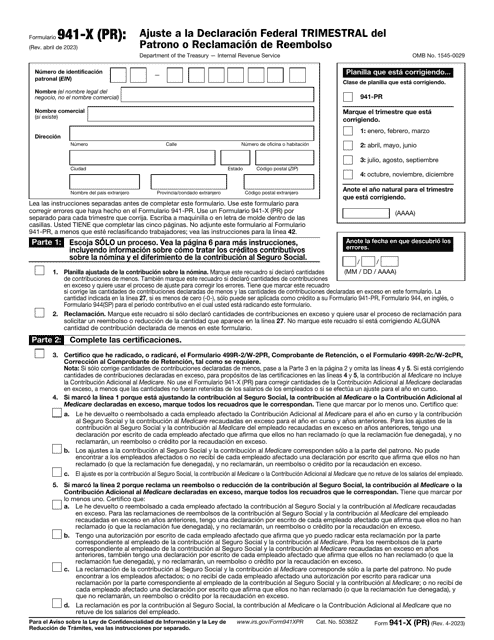

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

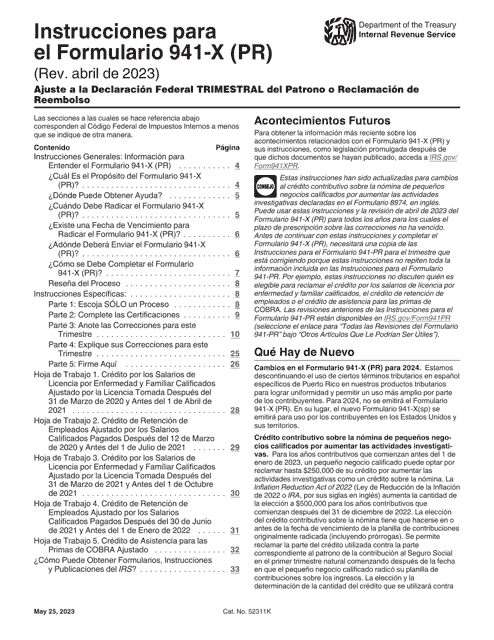

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

This Form is used for making adjustments or claiming refunds on the quarterly federal employer's declaration.

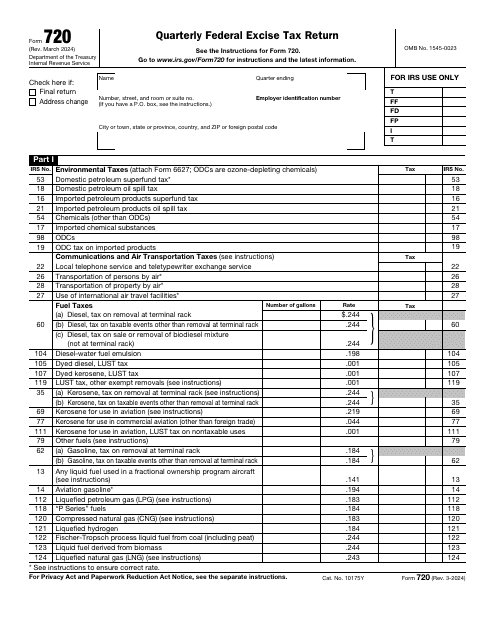

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

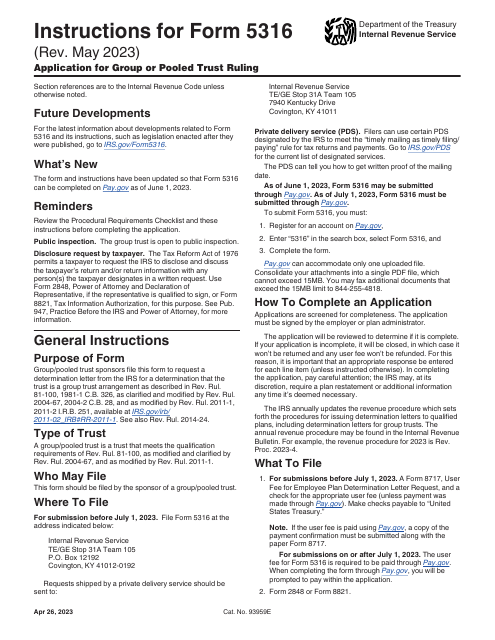

This Form is used for applying for a ruling from the IRS for a group or pooled trust.

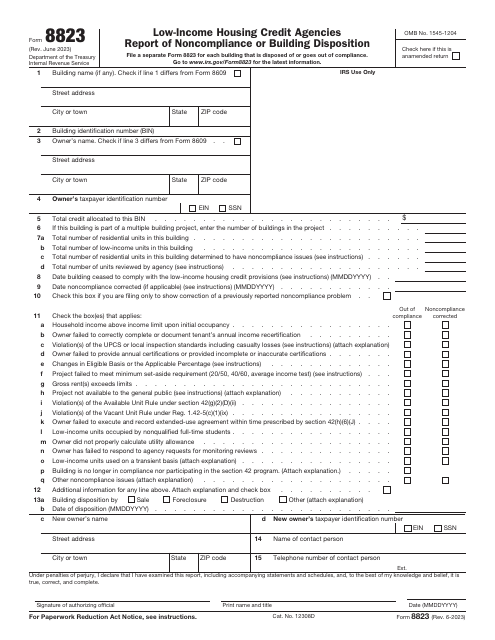

This is a formal document a housing credit agency is supposed to use to inform the tax authorities about certain noncompliance issues discovered during the inspection of a building and its units or specific instances of building disposition

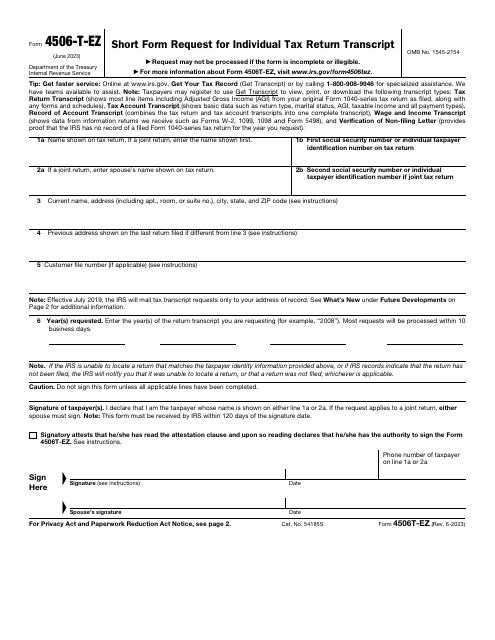

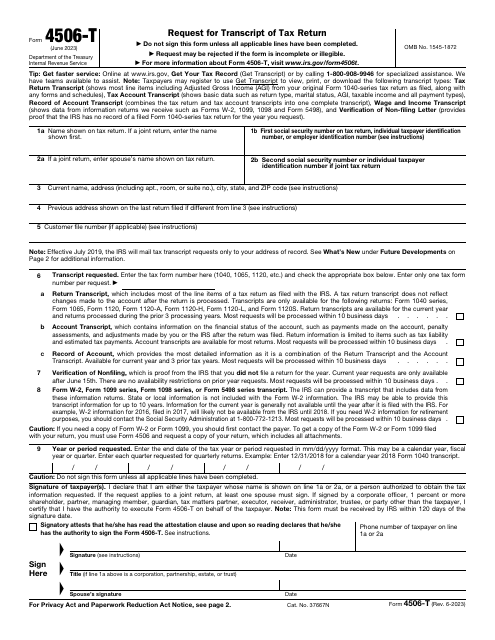

Fill in this form if you would like to request tax return information, such as different types of transcripts, a record of an account, and/or verification of nonfiling.

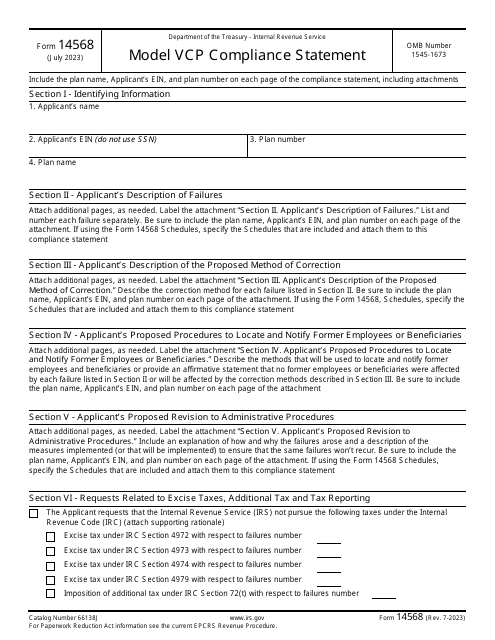

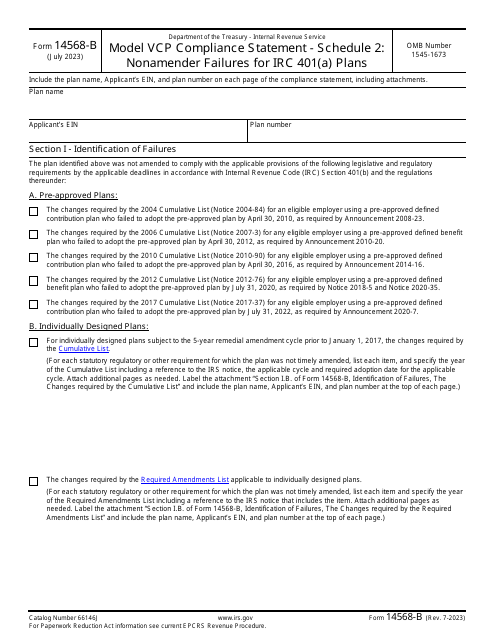

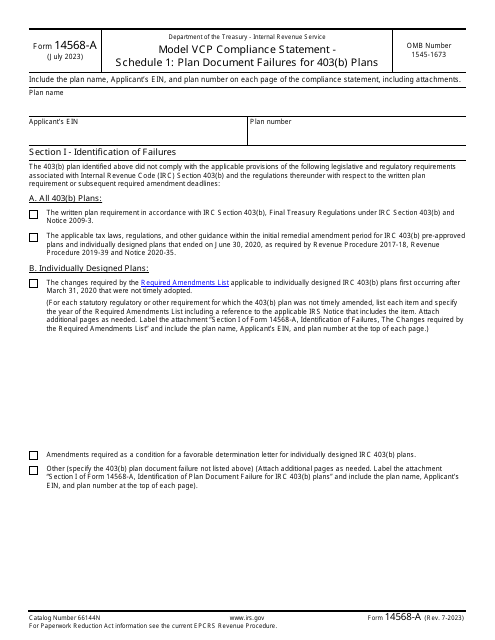

IRS Form 14568-A Addendum 1 Model Vcp Compliance Statement - Plan Document Failures for 403(B) Plans

This is a supplementary document used by taxpayers to file IRS Form W-2C, Corrected Wage and Tax Statement. This form works as a summary of changes you have made to IRS Form W2, Wage and Tax Statement.

This is a supplementary form used by employers to handle errors they have made upon filing IRS Form W-2, Wage and Tax Statement.