Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

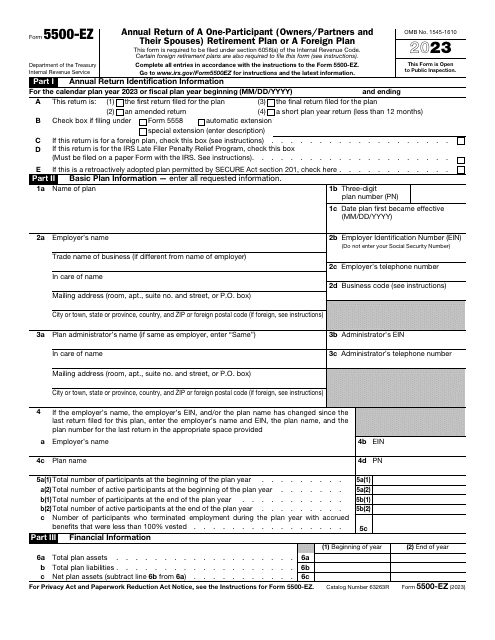

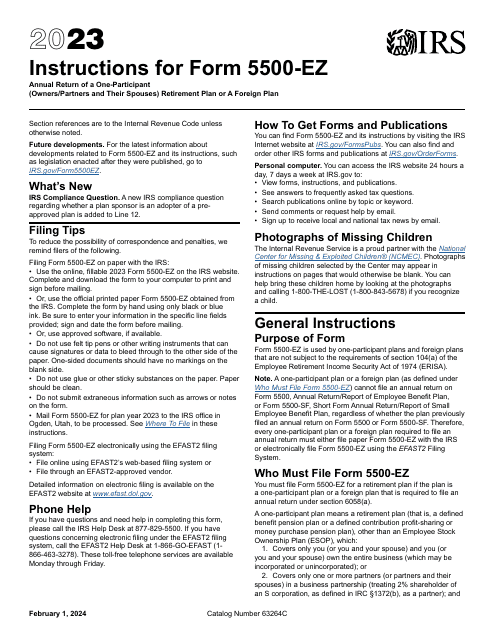

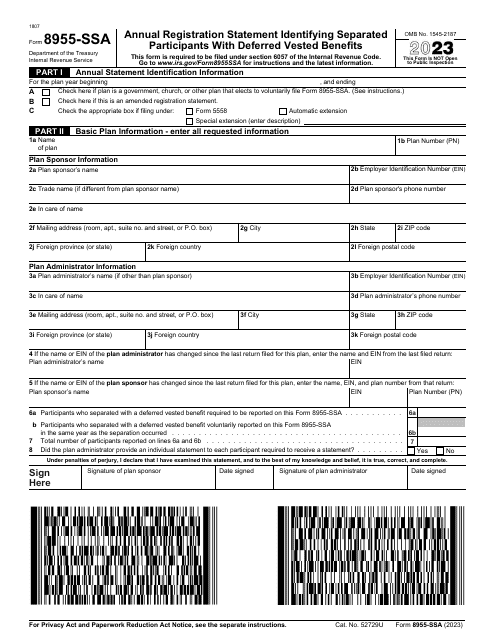

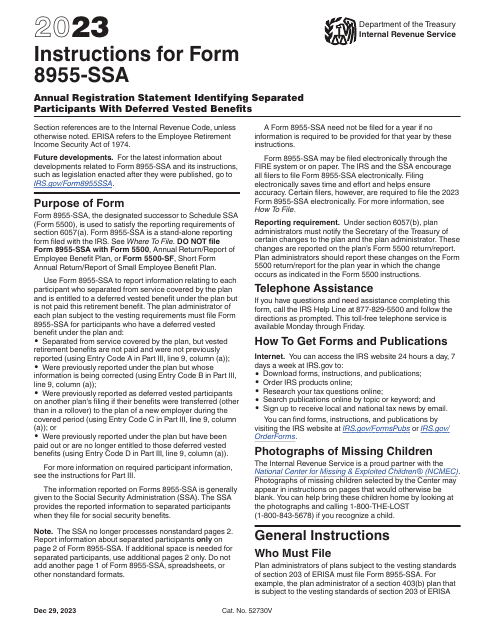

This form should be filled out by one-participant plans and by foreign plans. You are not required to file the form with attachments or schedules. File this form for an annual return if you do not file it electronically on a related Form 5500-SF.

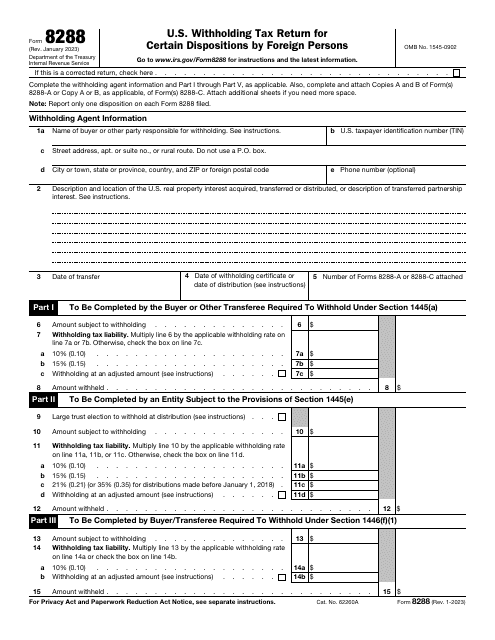

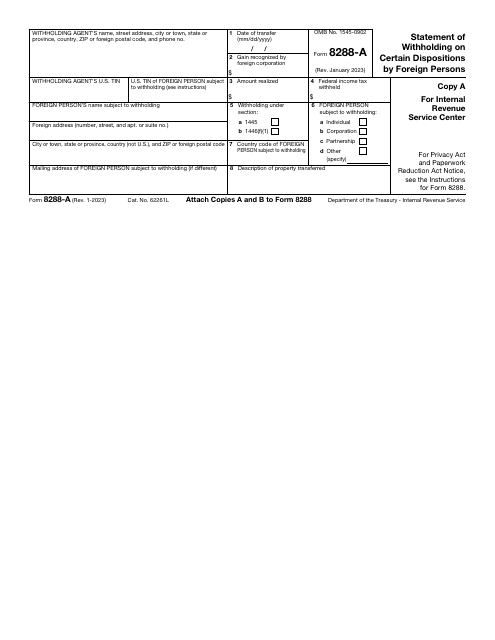

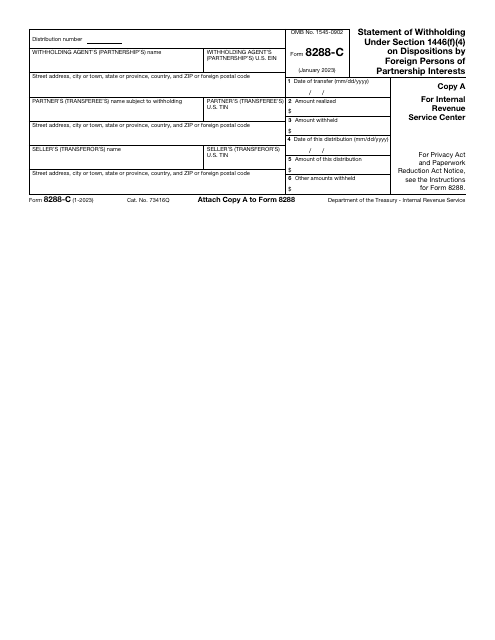

This is a supplementary document used by a withholding agent to describe the disposition of real property and report how much tax was withheld as a result of the transaction.

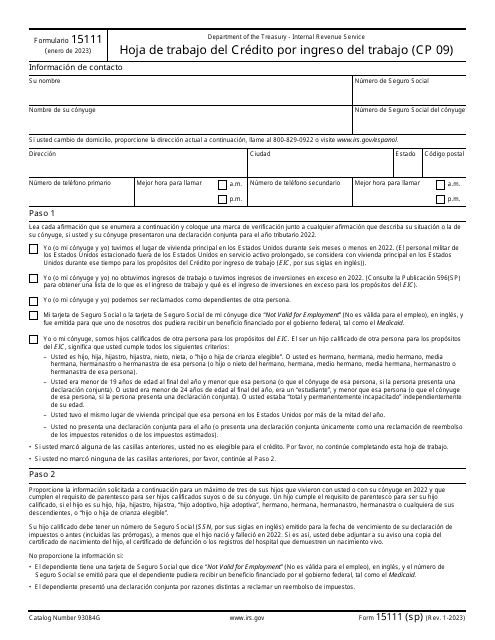

This document is a Spanish version of IRS Form 15111 (SP), which is used for calculating the Earned Income Credit.

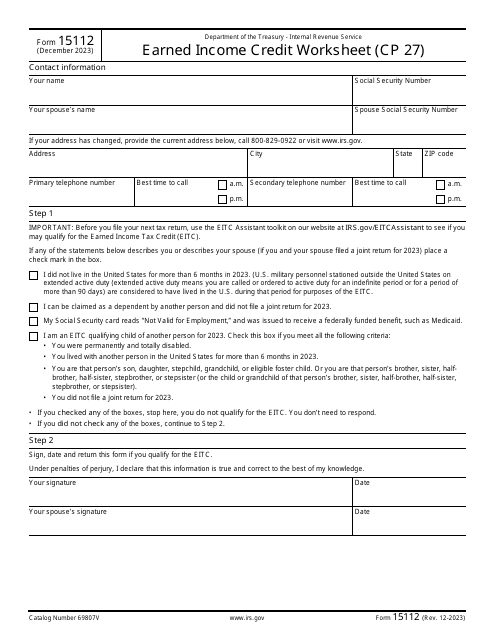

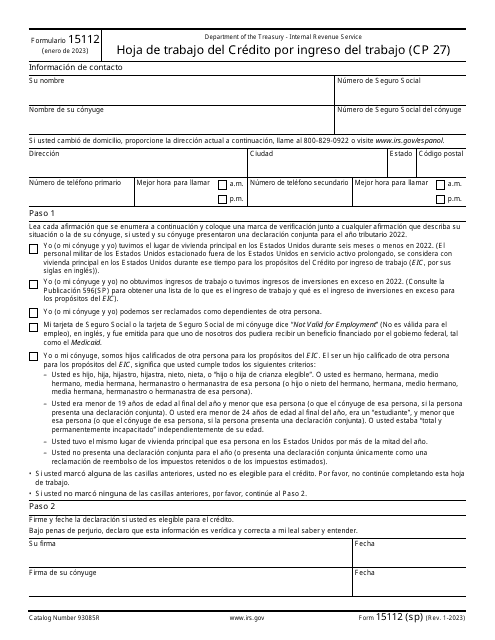

This document is a Spanish version of IRS Form 15112 (SP) and is used for the Worksheet for the Earned Income Credit (CP 27). It is used to calculate and claim the Earned Income Credit, a tax credit for low to moderate-income individuals and families.