Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

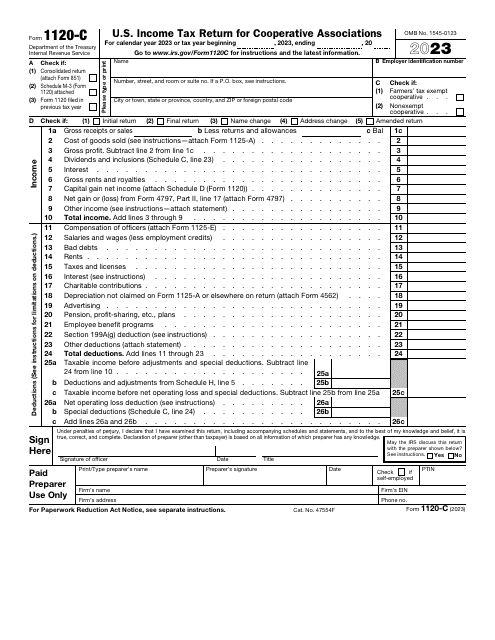

Use this form if you are a corporation that operates on a cooperative basis, to report your information (such as income, gains, losses, deductions, and credits) to the Internal Revenue Service (IRS), and to figure your income tax liability.

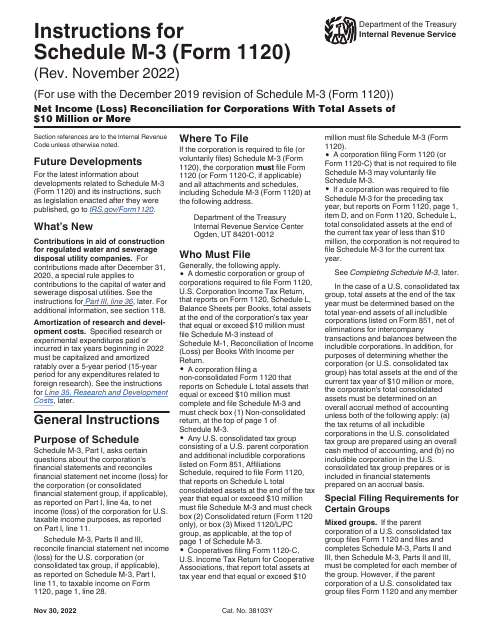

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

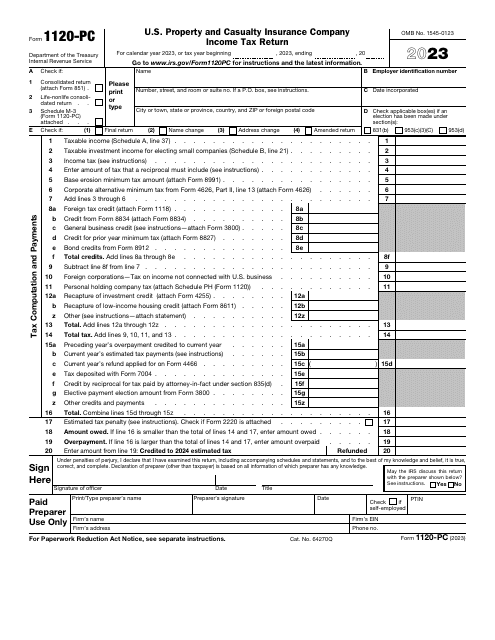

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

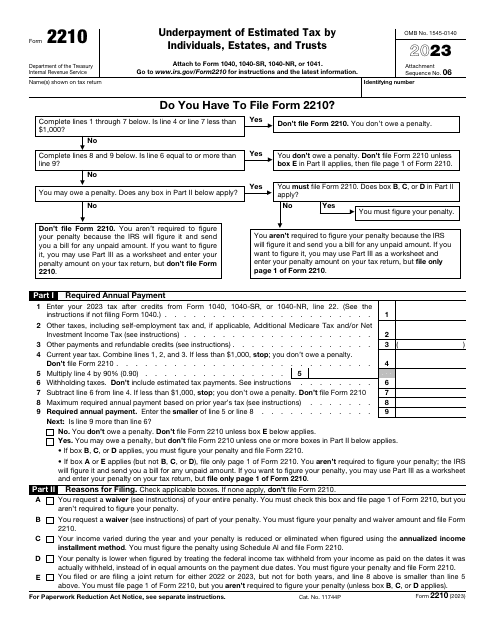

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

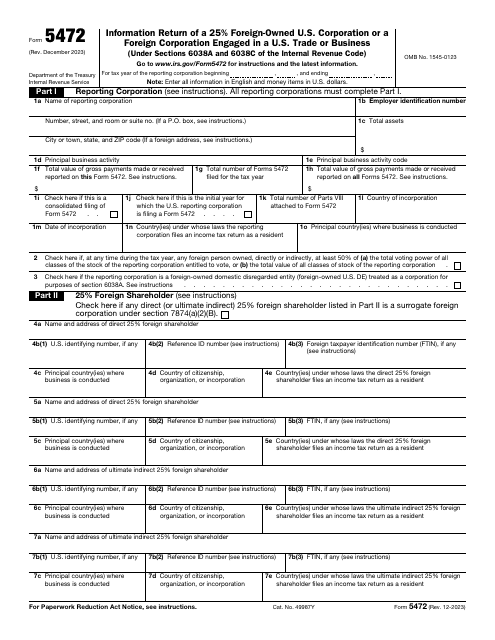

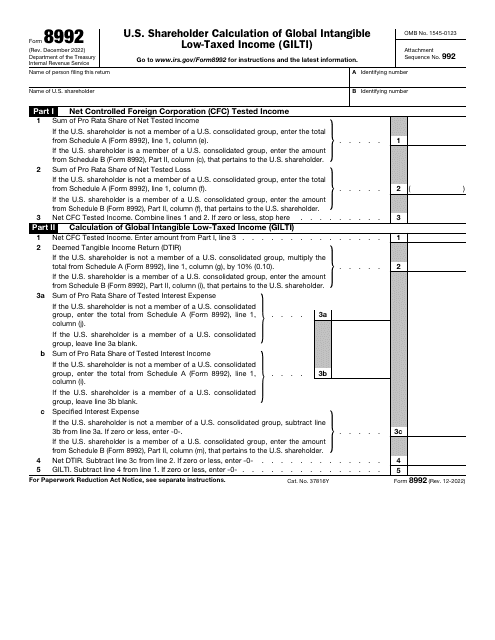

This form is used for U.S. shareholders to calculate their Global Intangible Low-Taxed Income (GILTI).

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

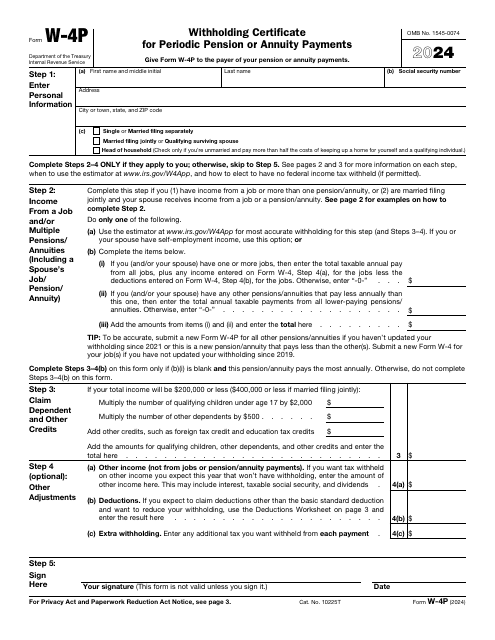

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

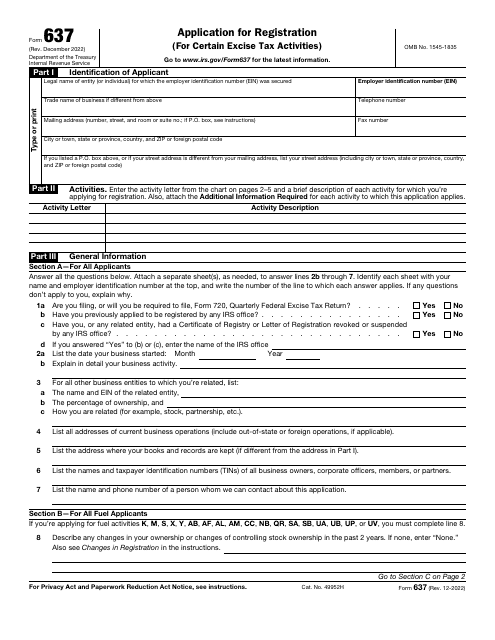

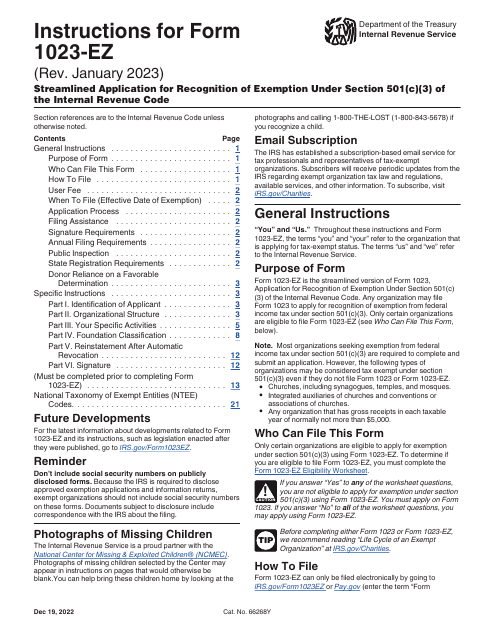

The purpose of this form is to provide filers with a Certificate of Registry or a Letter of Registration issued by the Internal Revenue Service (IRS), which they will then receive after the IRS processes and approves their application.

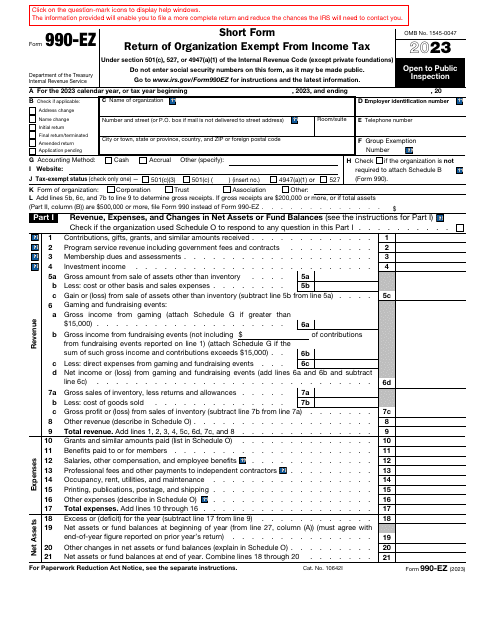

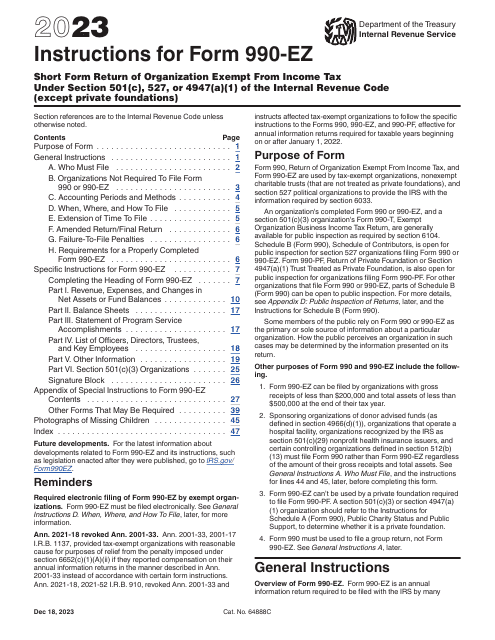

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

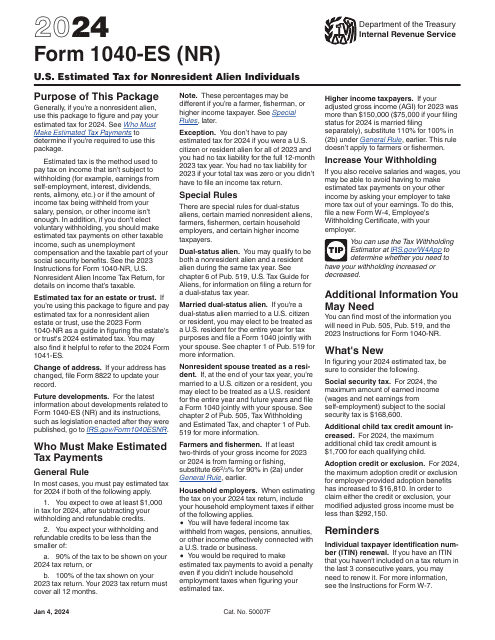

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.