Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

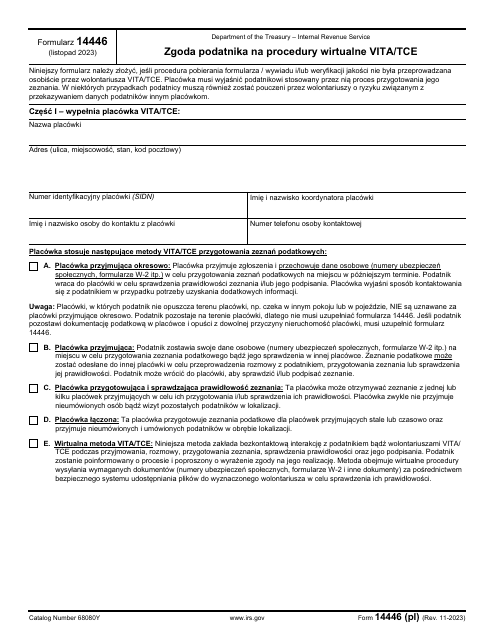

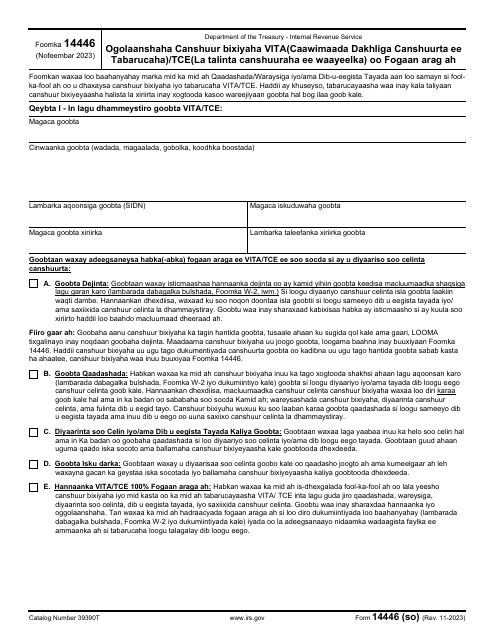

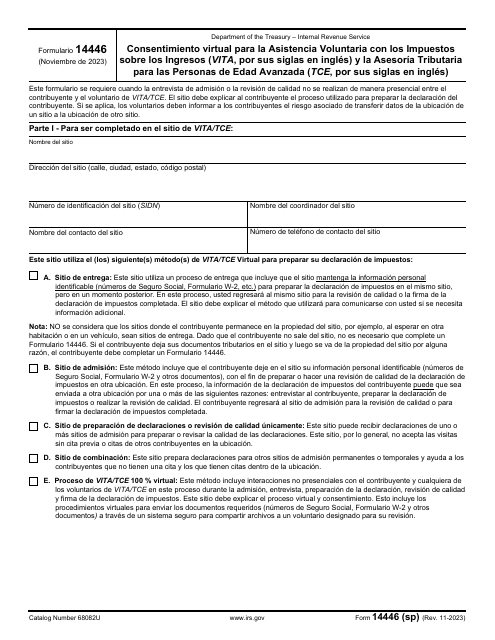

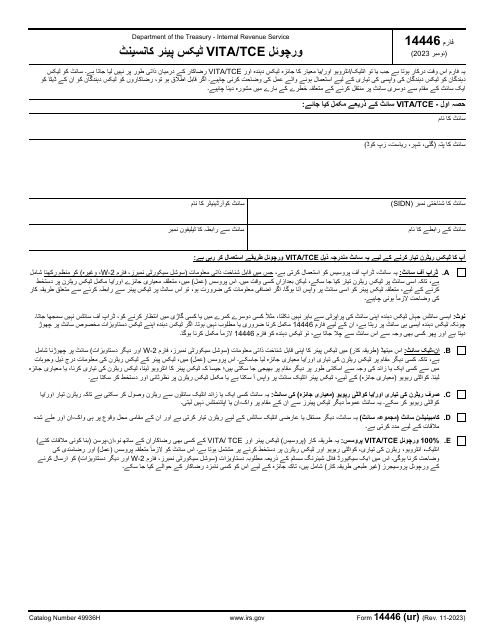

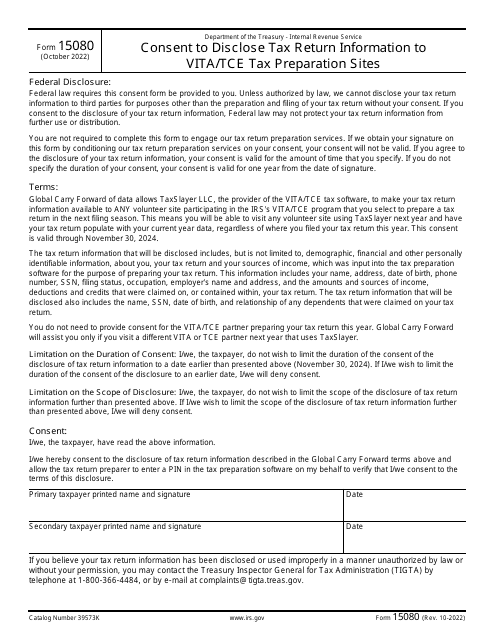

This form is used for granting consent to share tax return information with Vita/Tce tax preparation sites.

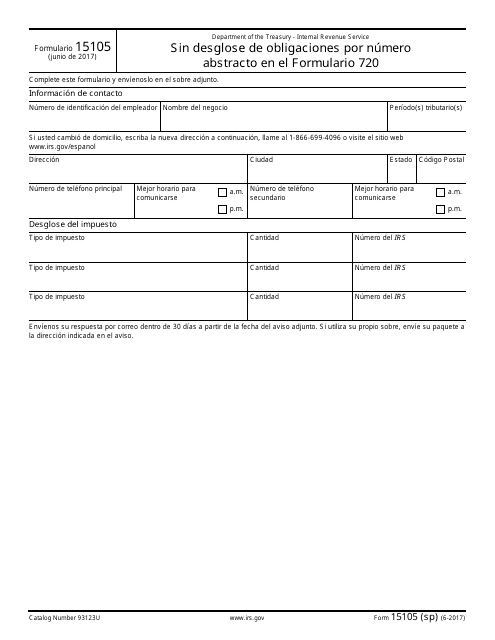

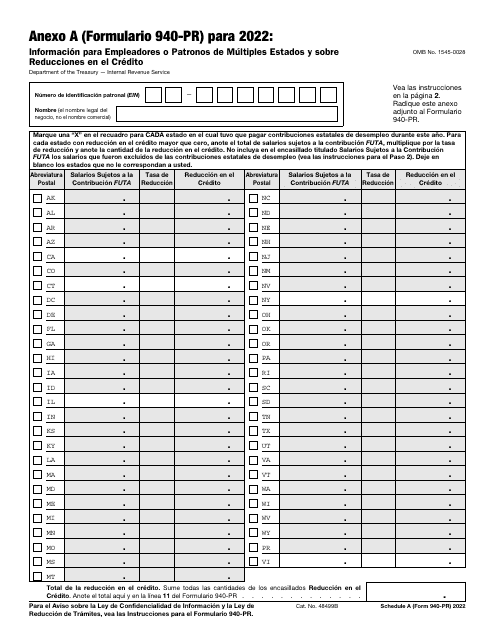

This document is a Spanish version of IRS Form 15105 (SP) used for reporting abstract number obligations on Form 720 without itemizing them.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

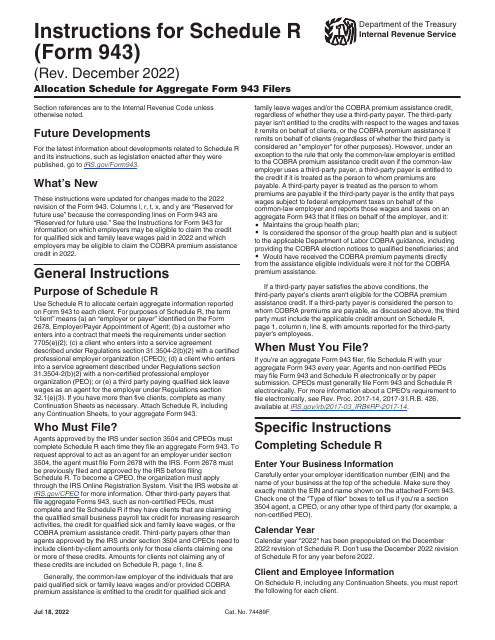

This form is used for allocating wages and taxes for employers who file an Aggregate Form 943 with the IRS. It provides instructions on how to accurately report employee wages and taxes for agricultural workers.

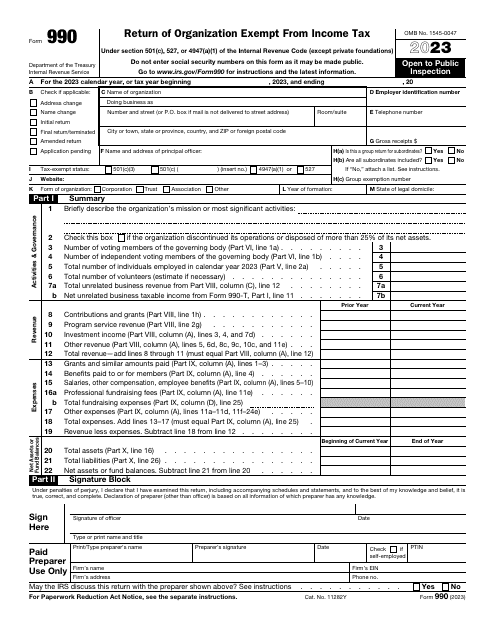

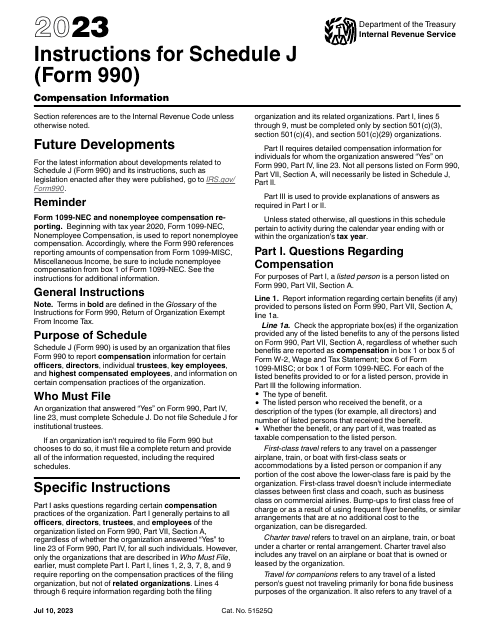

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

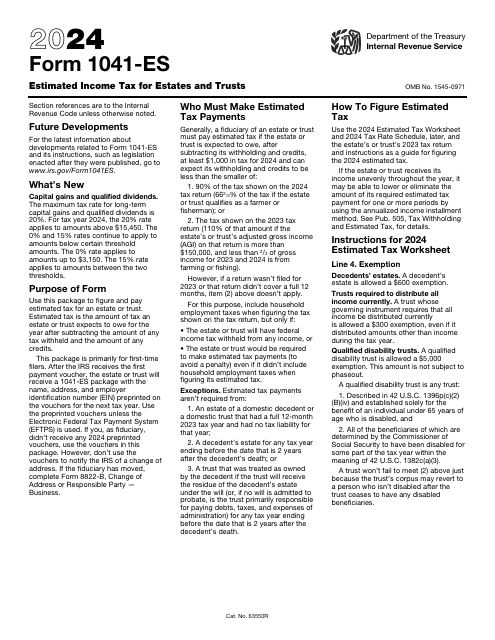

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

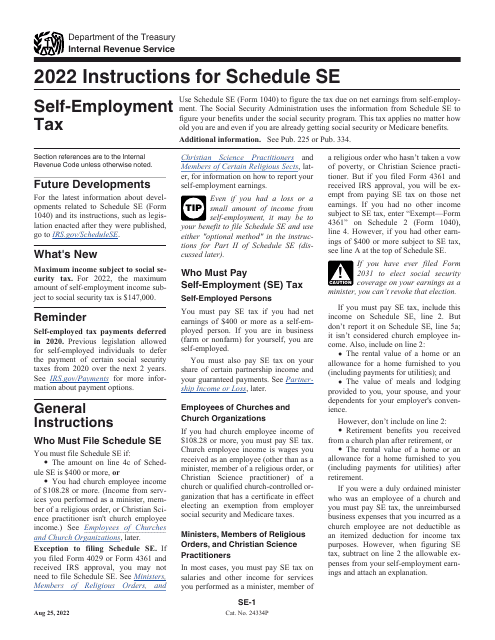

This document provides instructions for filling out Schedule SE, which is used to calculate and report self-employment tax. It covers step-by-step guidance on how to accurately complete this form.

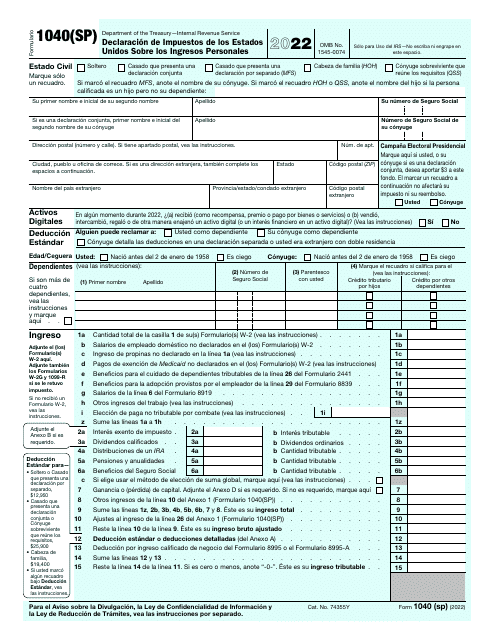

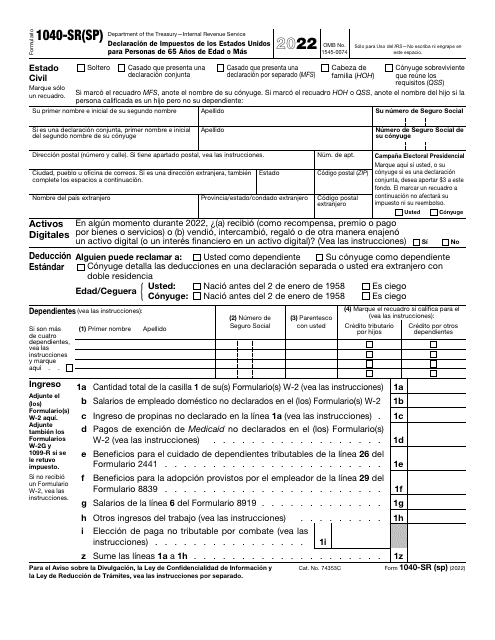

This type of document is the IRS Form 1040-SR(SP) for Puerto Rican Spanish-speaking individuals who are 65 years old or older. It is used to file tax returns with the United States.