Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

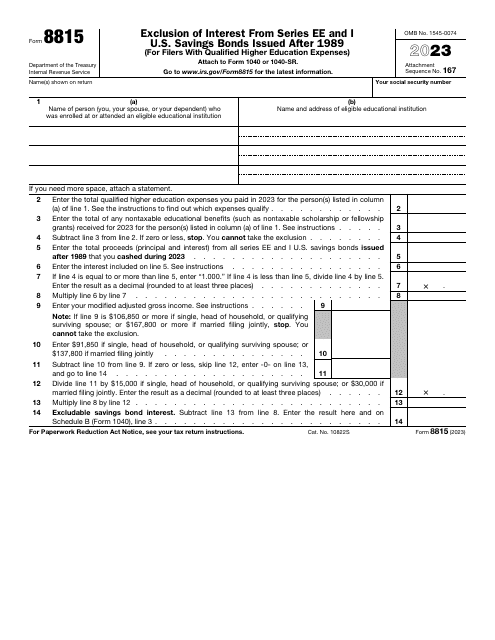

This is a fiscal document used by individual taxpayers to exclude the specific bond interest from their income.

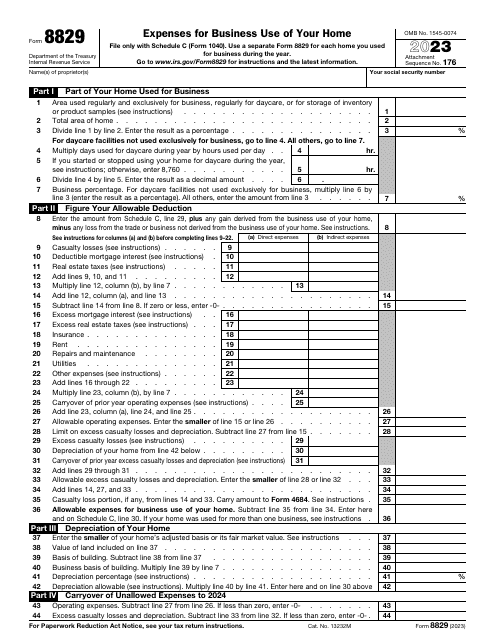

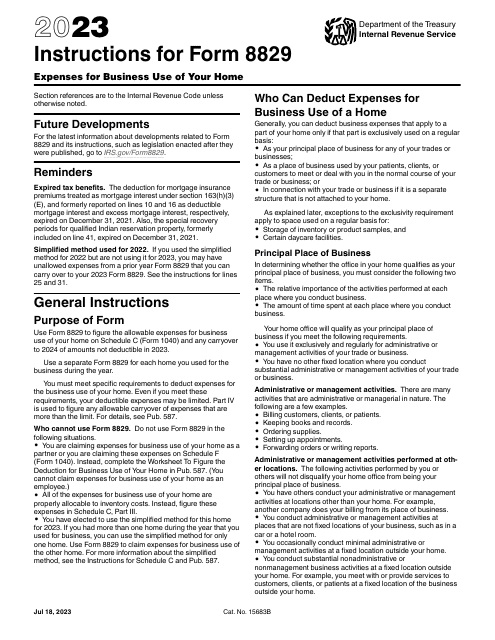

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

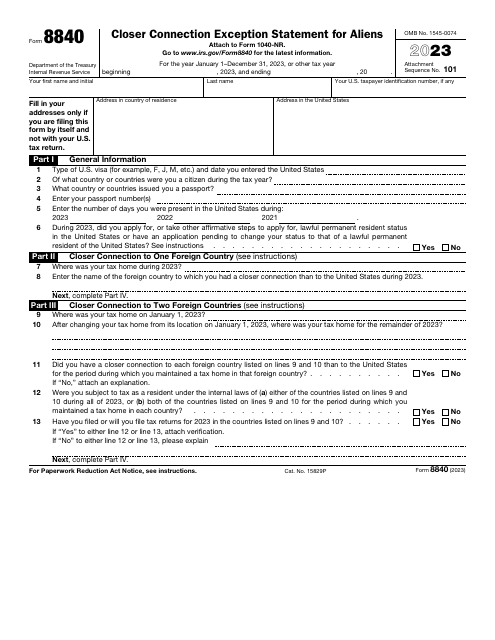

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

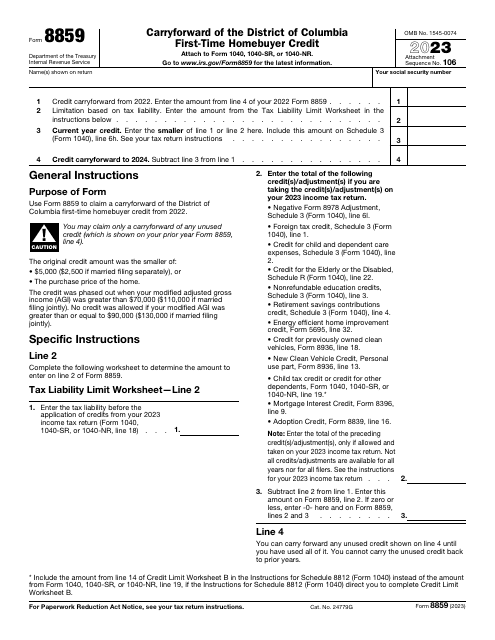

This is a fiscal document residents of the District of Columbia are permitted to complete in order to claim a carryforward credit they will be able to use in the future.

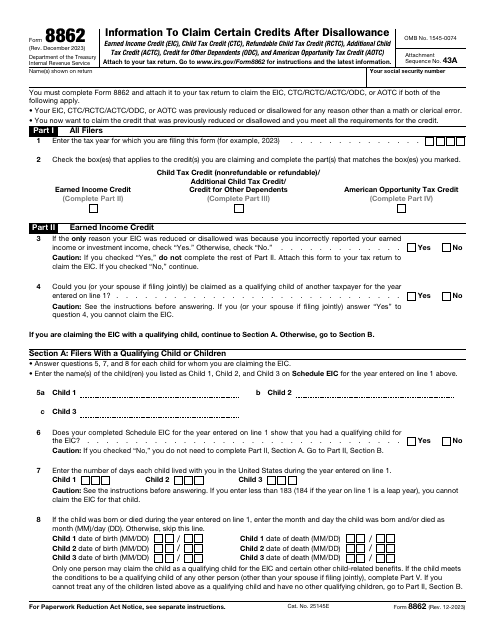

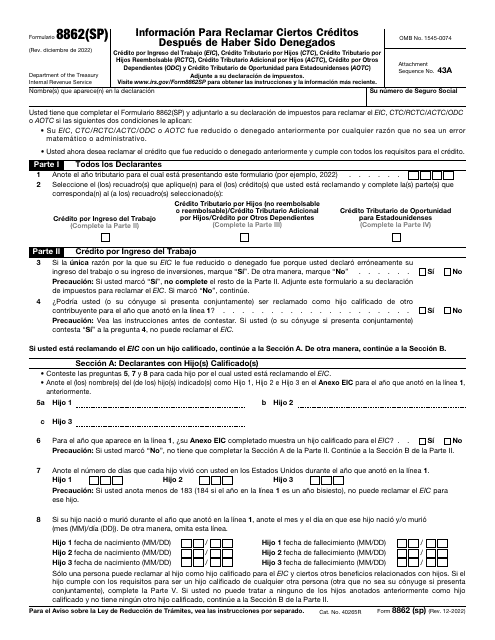

This is a fiscal form used by taxpayers to request the payment of a tax credit that was disallowed in the past.

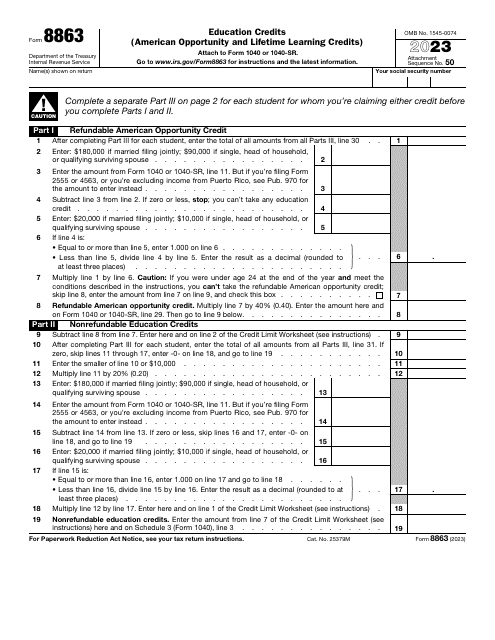

Fill in this form to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.

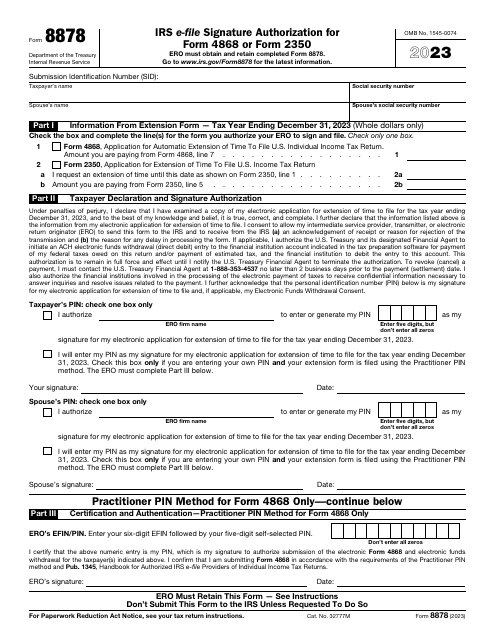

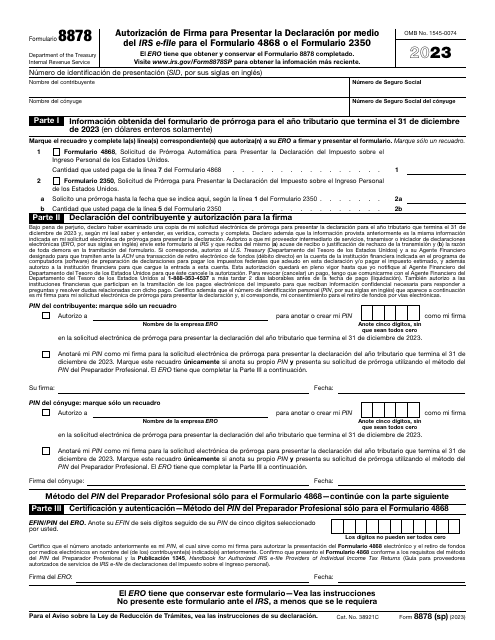

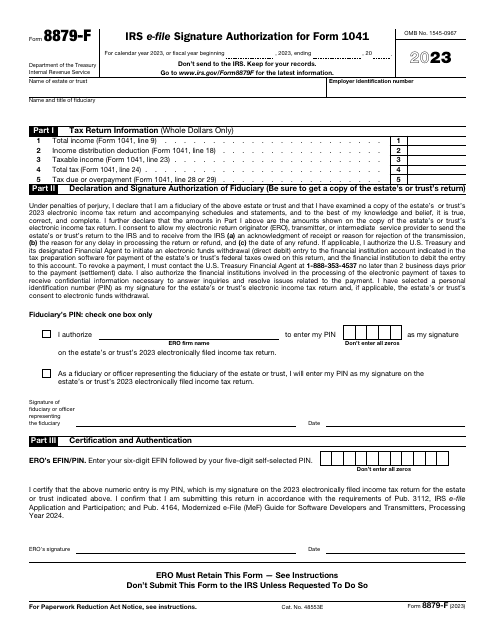

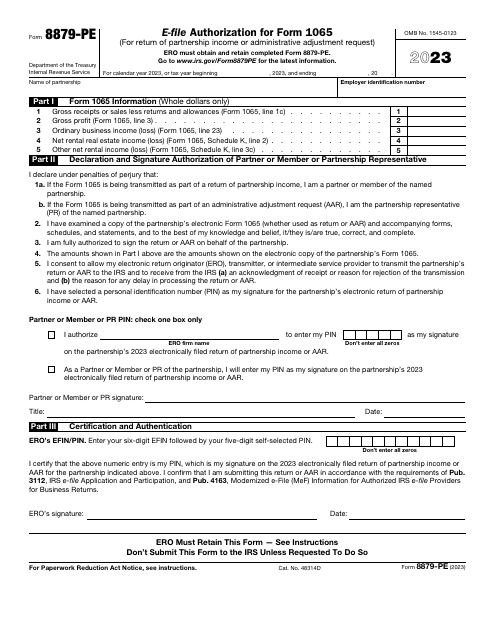

This is a form designed for taxpayers that want to grant an electronic return originator the right to use a unique identification number when filing tax documentation on behalf of the person that hired them.

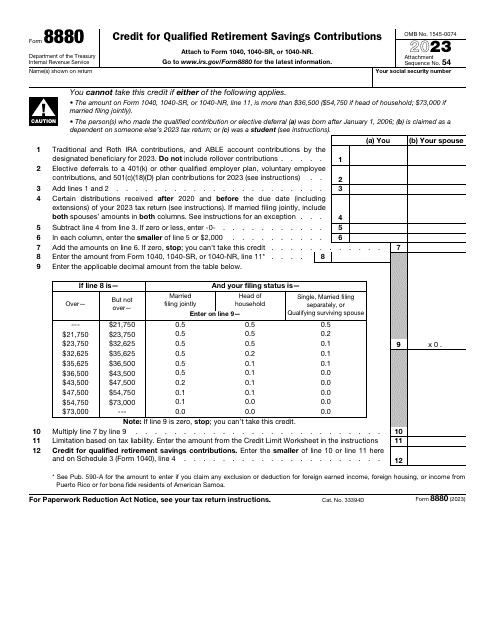

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

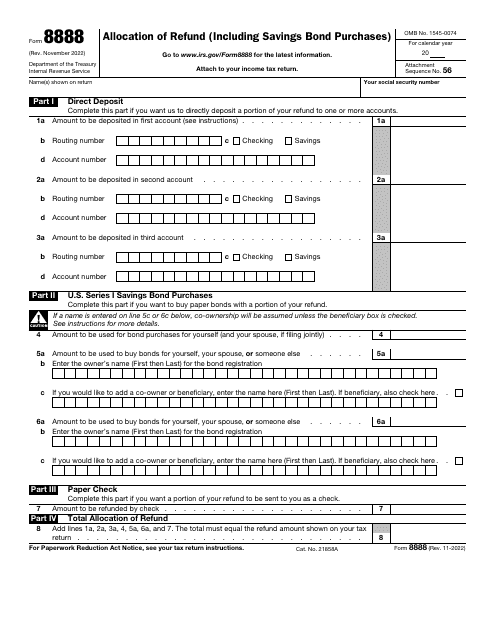

This is an IRS form filled out and submitted by a taxpayer that chooses to spread their tax refund across several accounts.

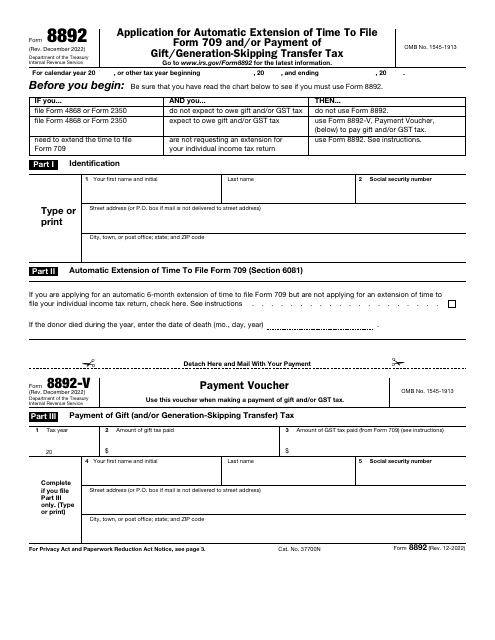

This is a fiscal document generally used by taxpayers in order to request six months of extra time to file IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return.