Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

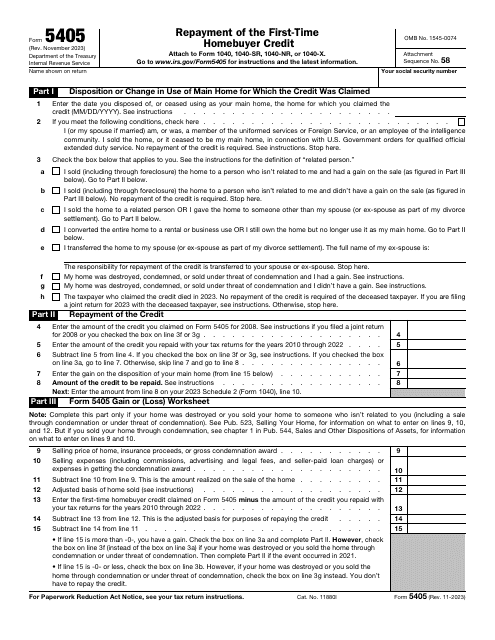

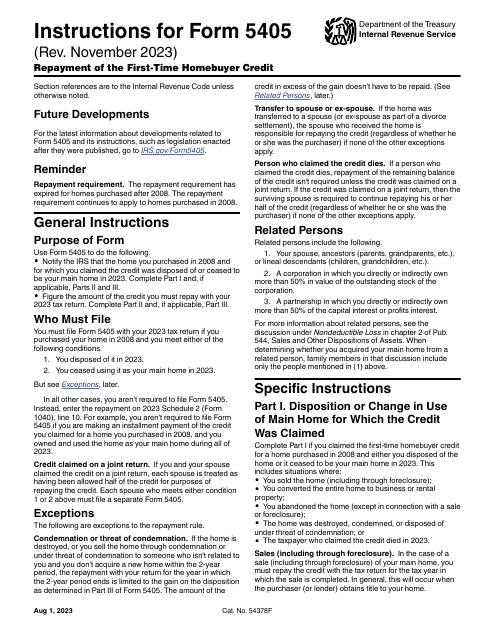

This is a fiscal instrument used by taxpayers who are responsible for computing and repaying the credit they used to purchase residential property in the past.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

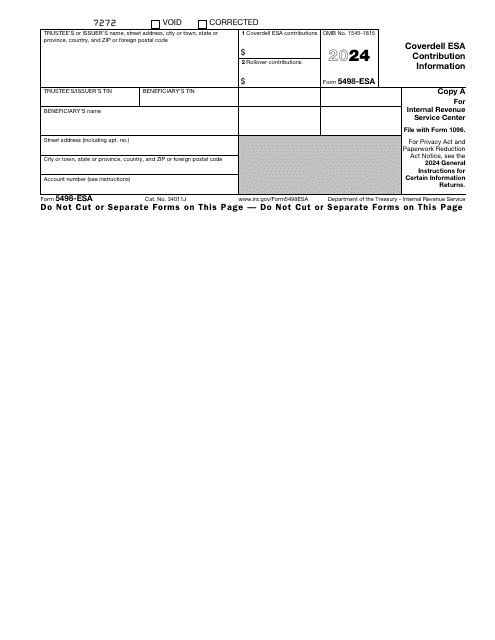

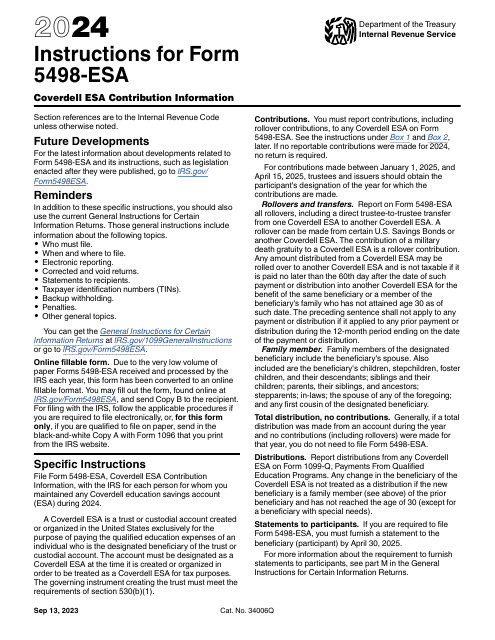

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

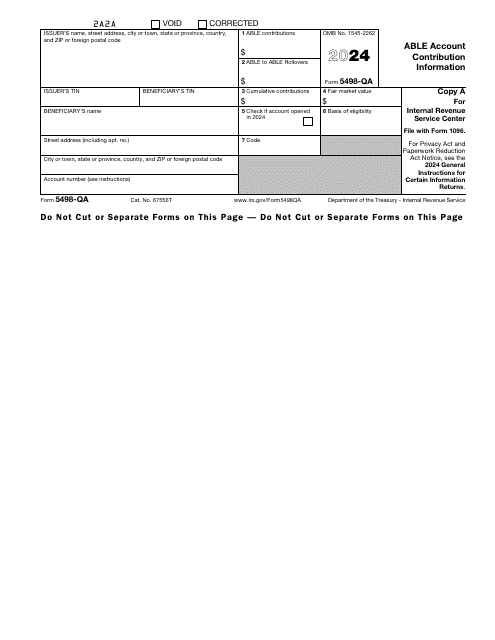

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

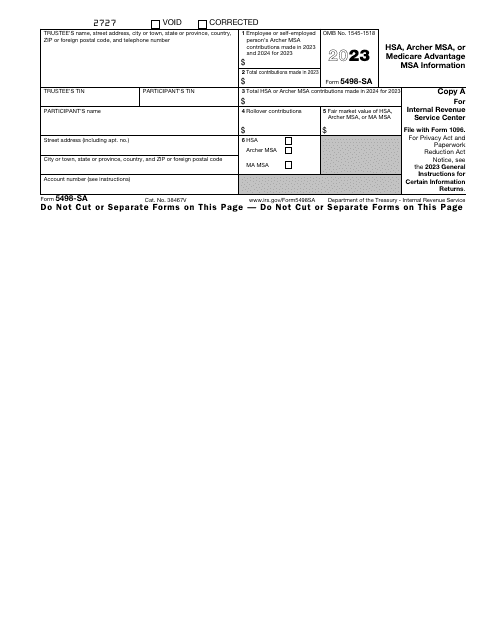

This is a formal document used by particular healthcare-related savings account custodians and trustees to furnish information about the contributions made to those accounts.

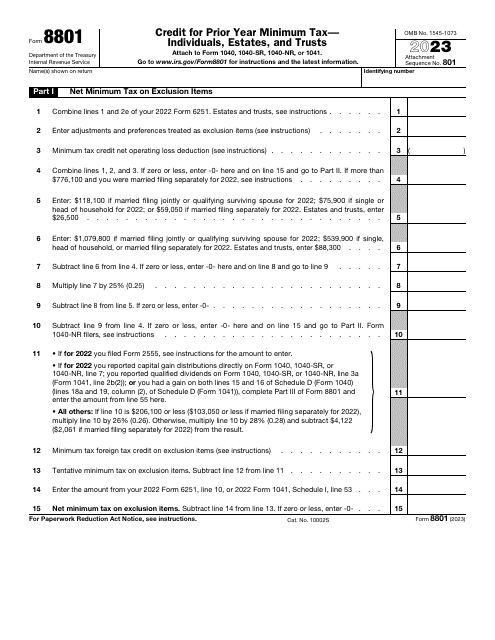

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

This is an IRS form that includes the details of an installment sale.

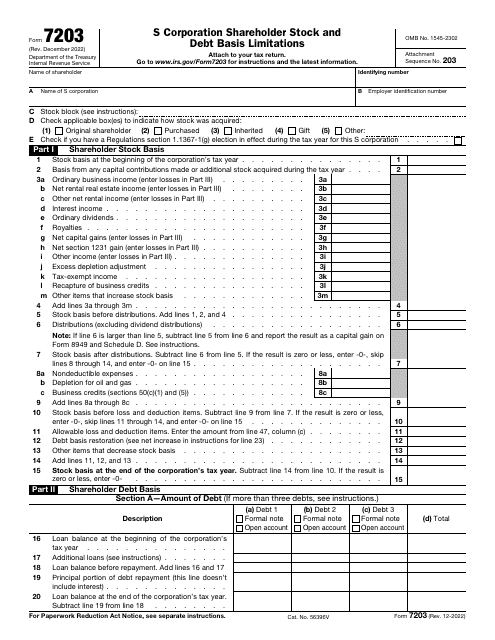

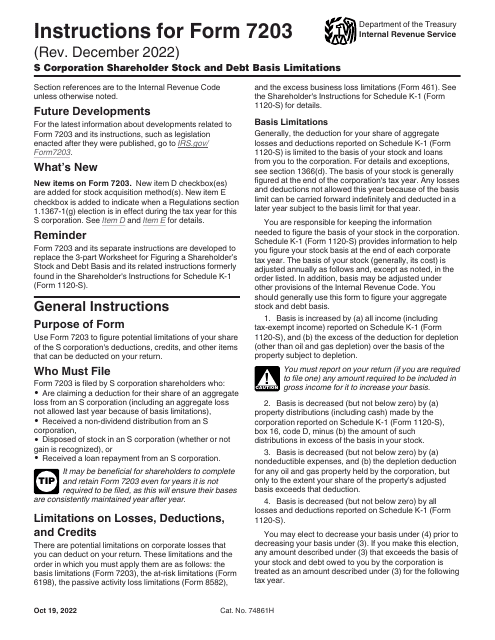

This is a fiscal document prepared and submitted by every S corporation stockholder to inform the government about their share of the entity's credits, deductions, and other items that will be up for deduction on their annual income statement.

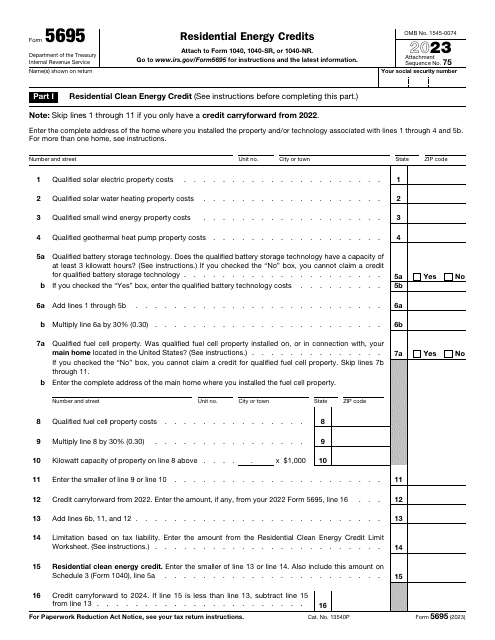

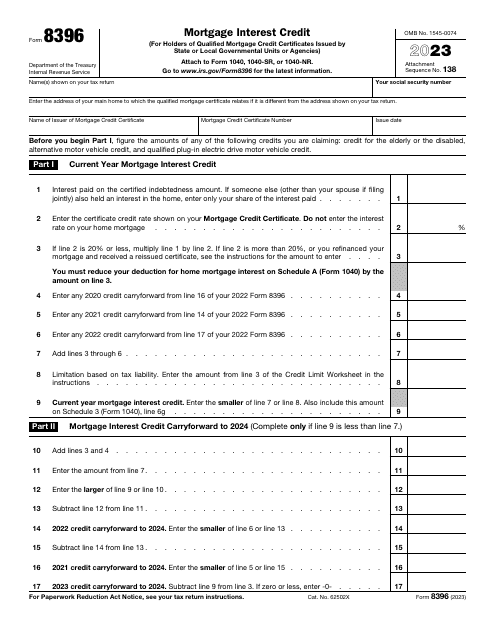

This is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.

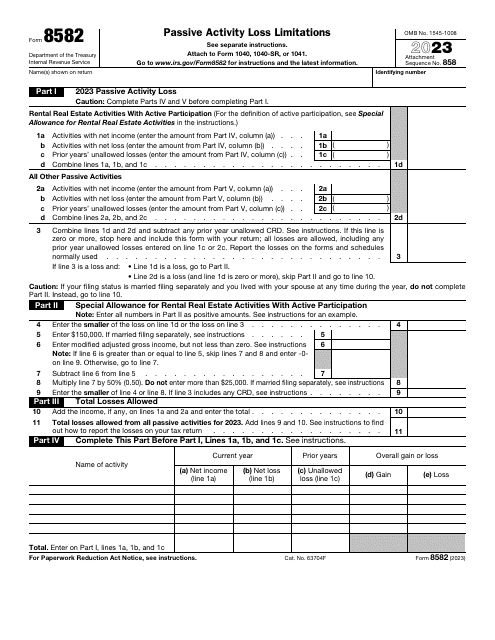

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

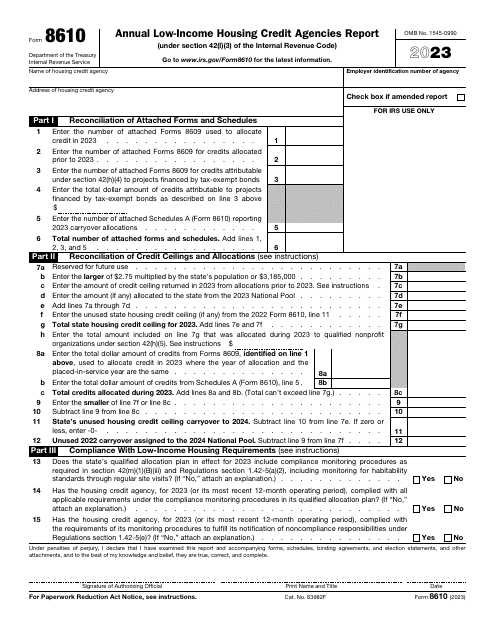

This is a formal IRS statement a housing credit agency is supposed to complete to inform the fiscal authorities about the total amount of housing credits their entity has allocated during the twelve months outlined in the form.