Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

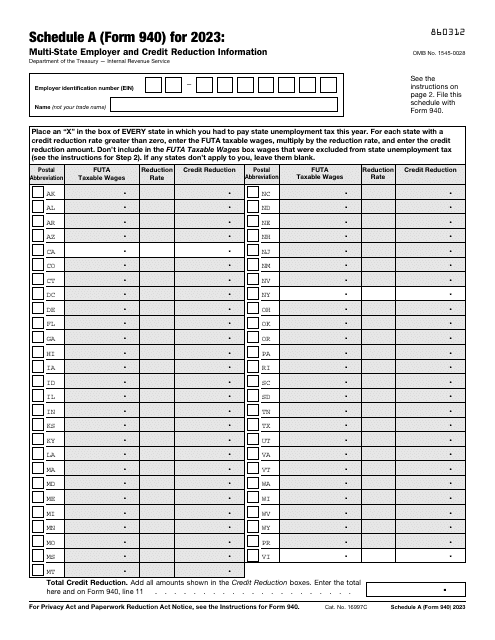

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

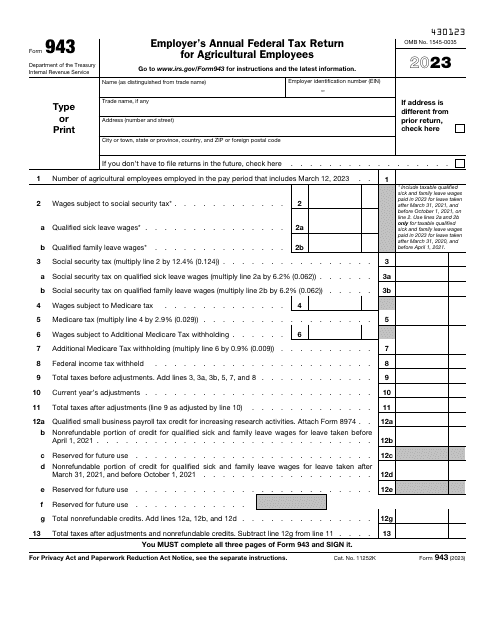

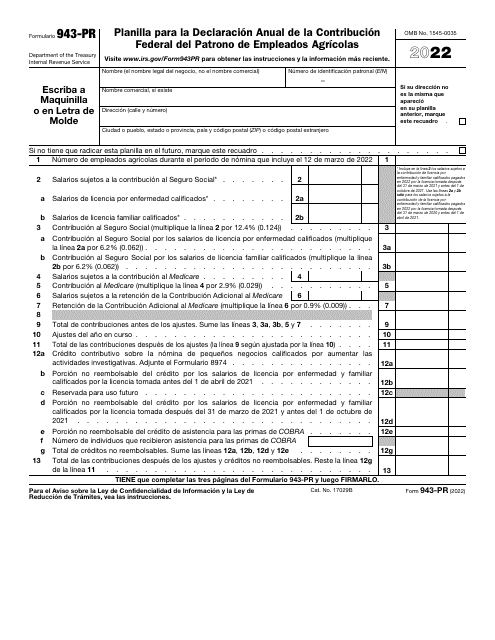

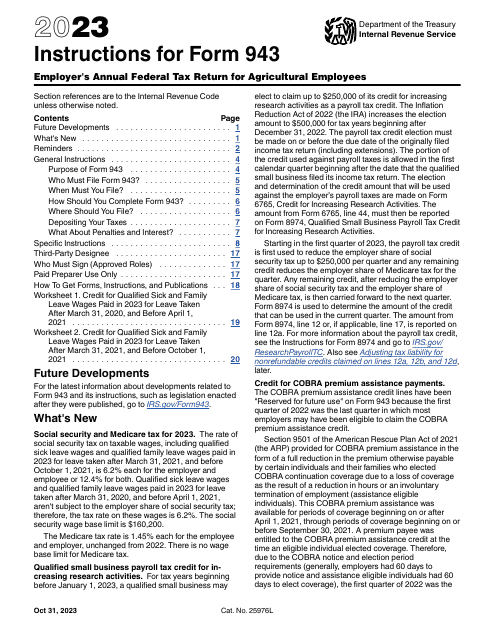

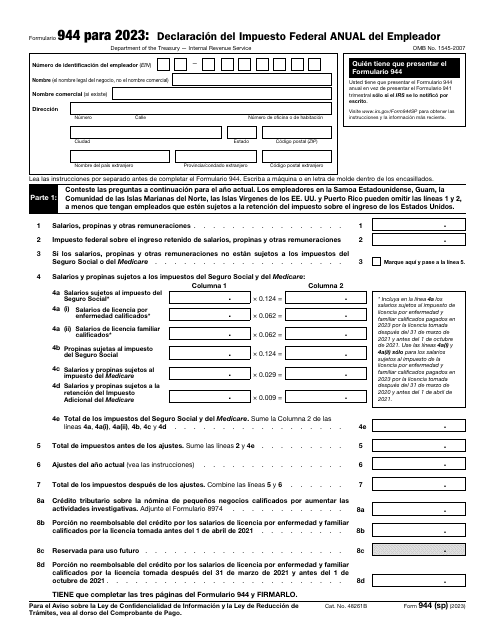

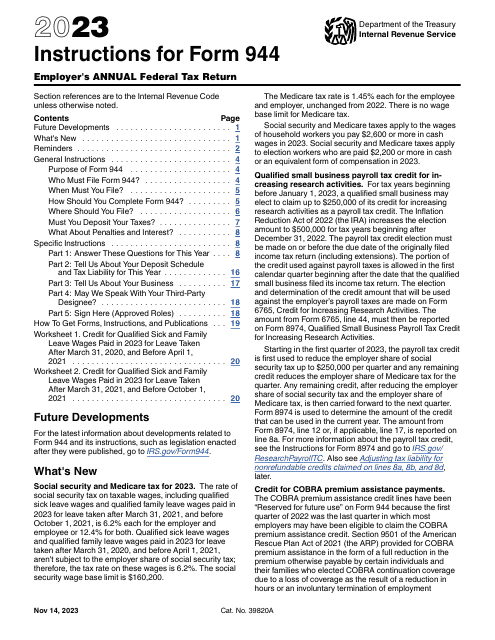

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.

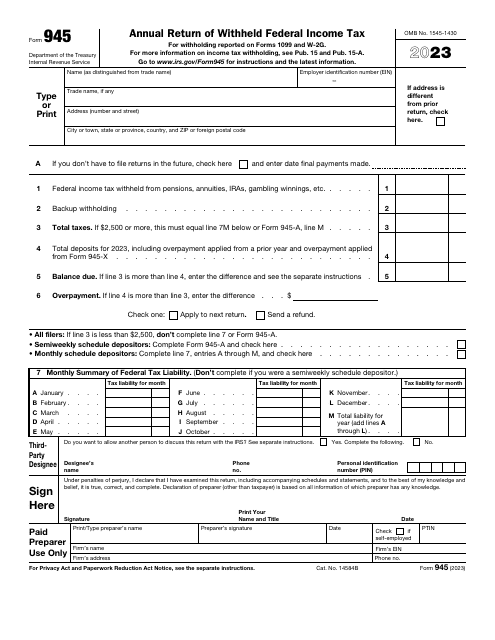

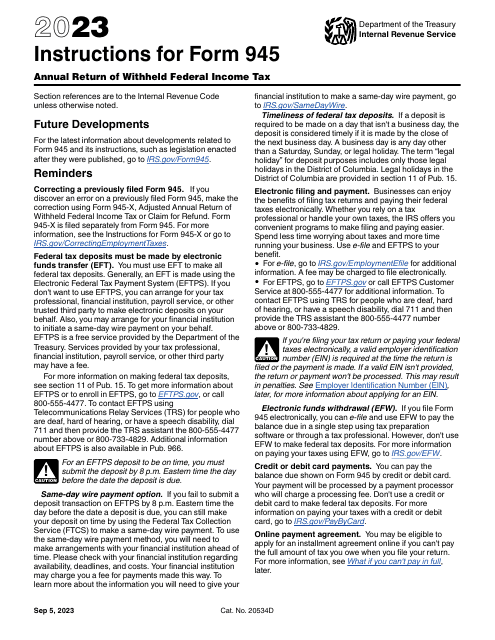

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.

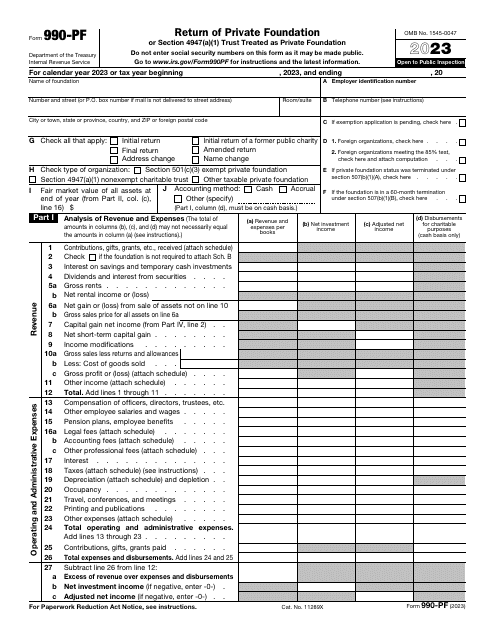

This form, also known as the private foundation tax return, can also substitute Form 1041, if a trust has no taxable income. Use this form to calculate the tax on the income from an investment and to report charitable activities and distributions.

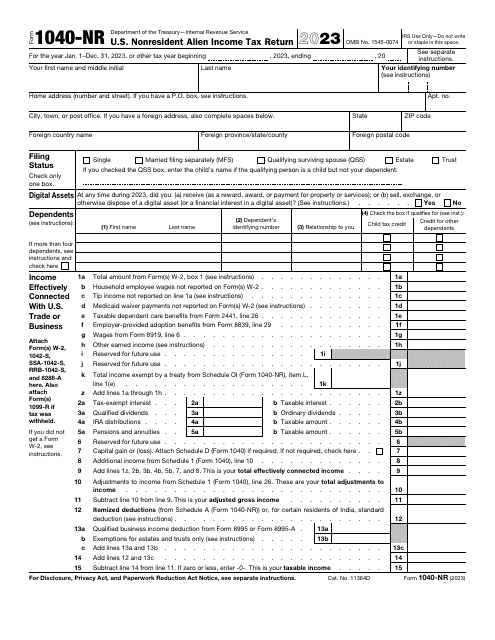

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

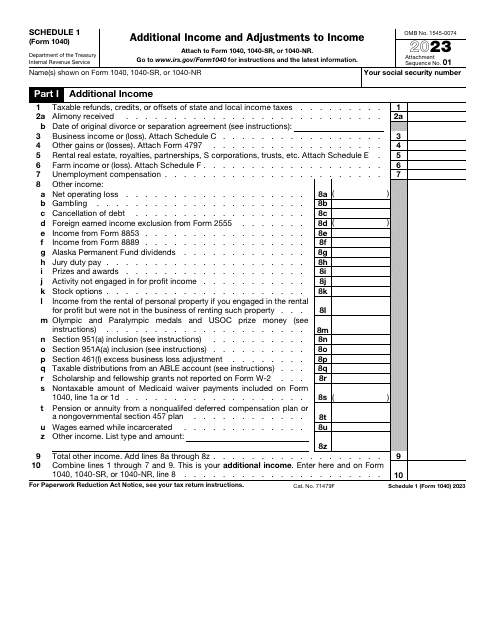

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

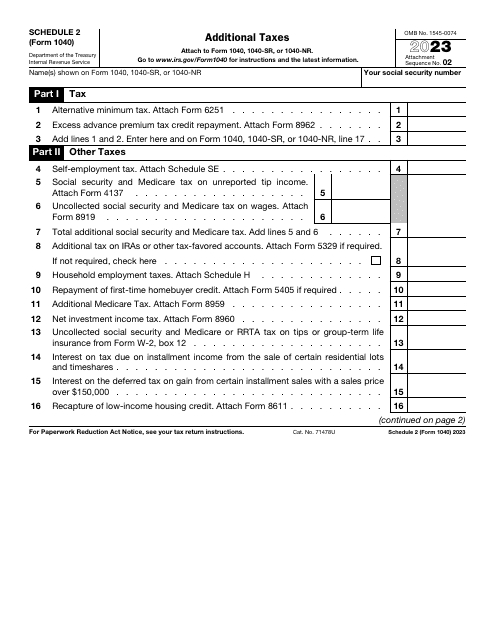

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

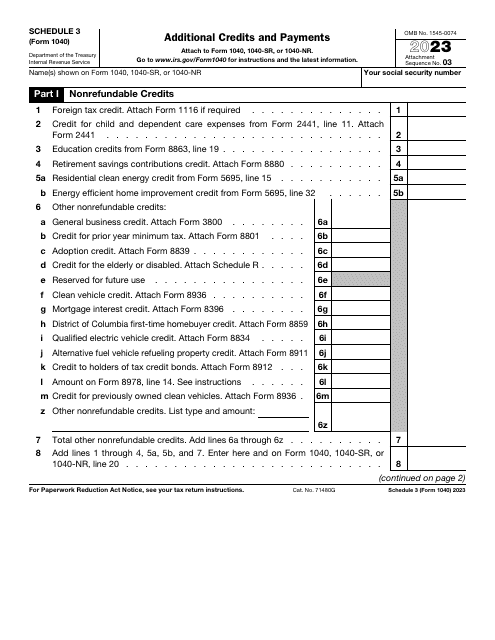

This is a fiscal form that elaborates on payments and credits that may let an individual lower the taxes they would otherwise have to pay in full or add to the amount of tax refund they are claiming.

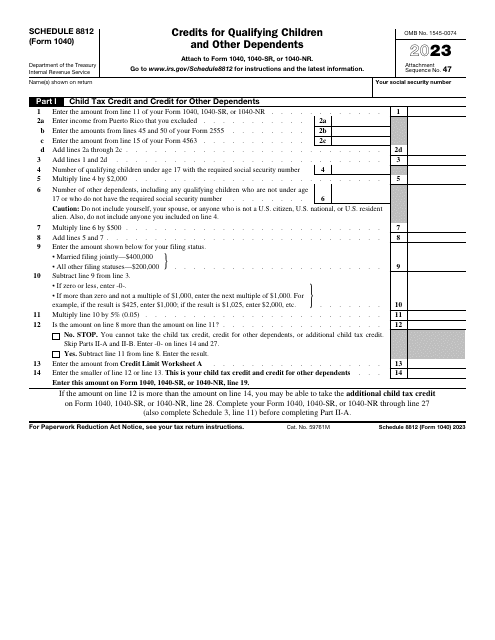

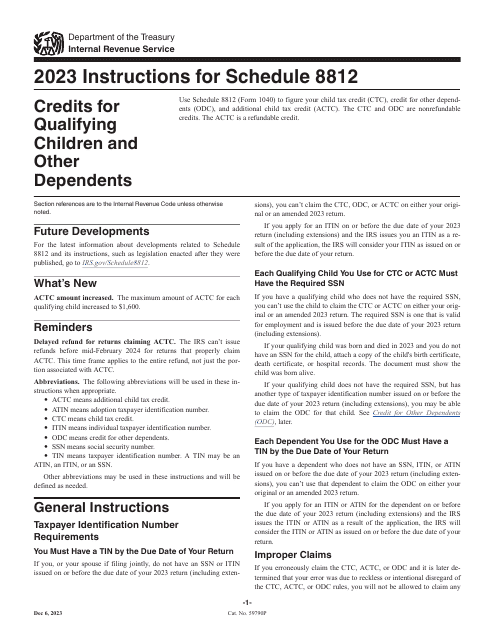

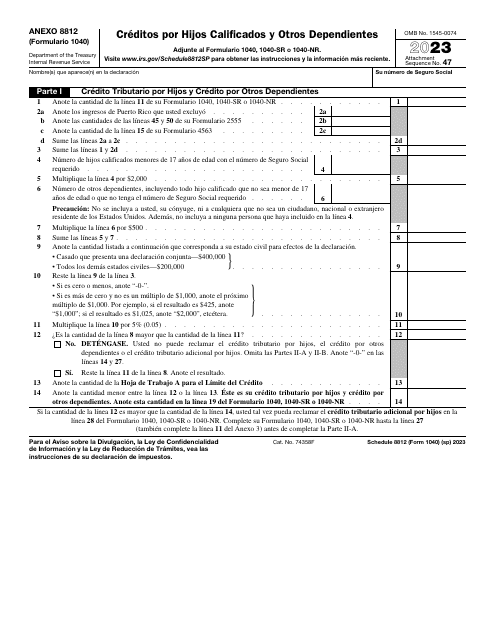

This is a fiscal statement created to let taxpayers with children make the most of the tax benefits they qualify for via extra tax credit.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

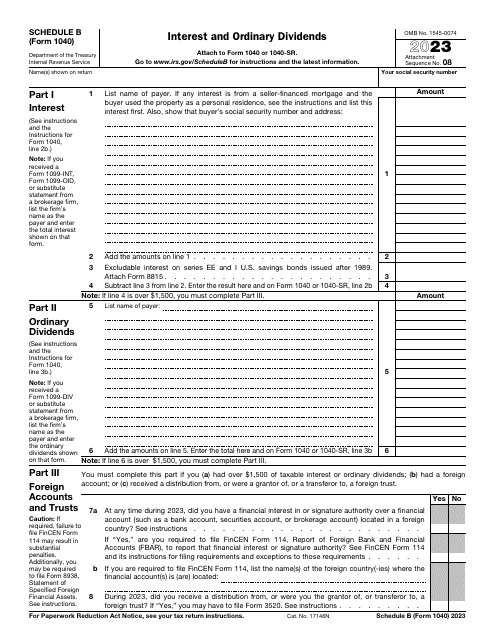

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

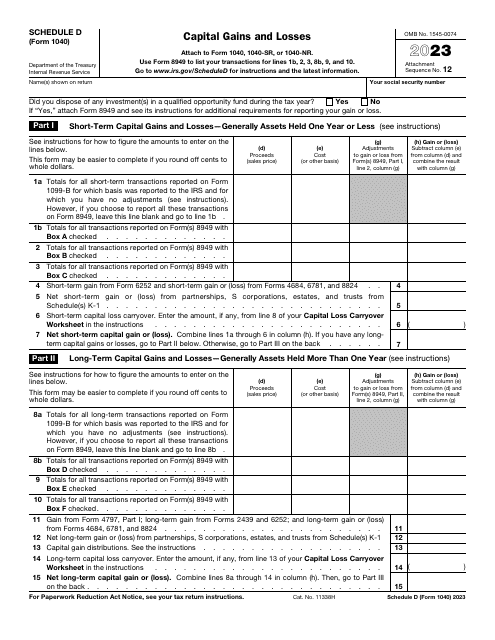

This is a supplementary document taxpayers have to attach to their tax return to outline capital gains and losses that were the result of property sales.