Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

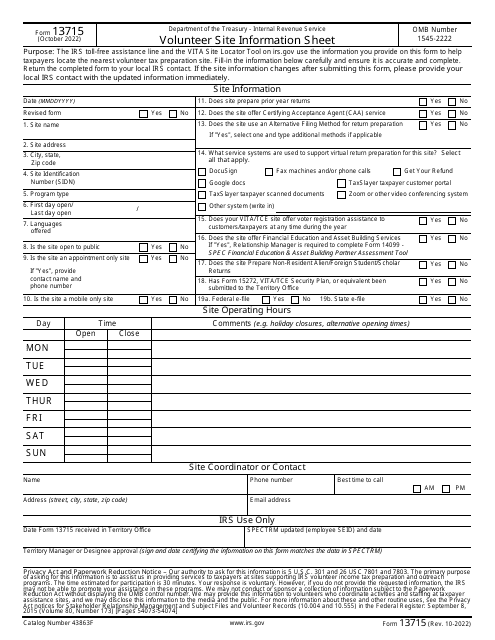

Documents:

4644

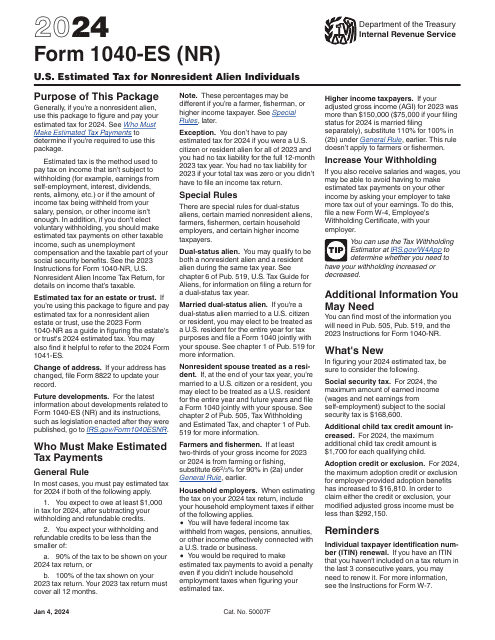

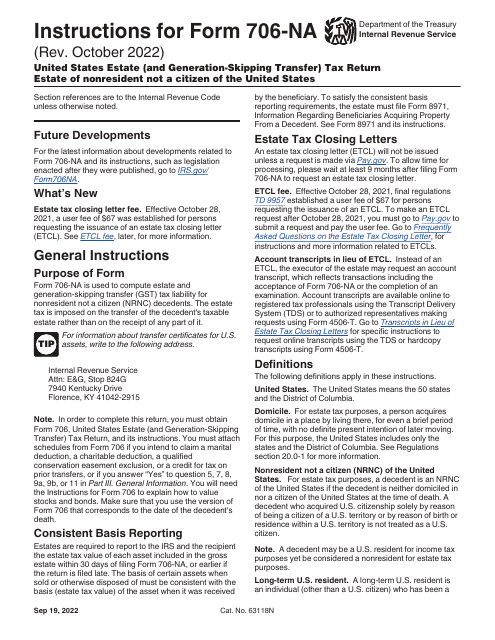

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

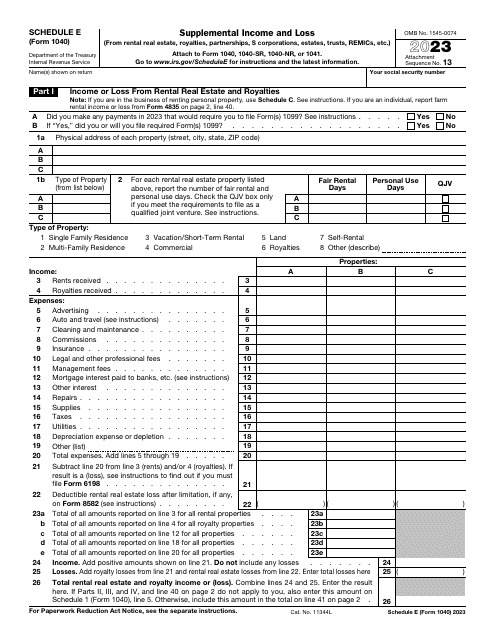

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

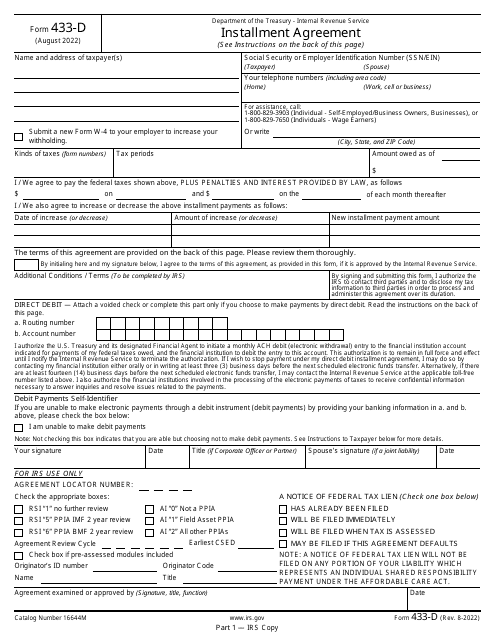

This is a fiscal form used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

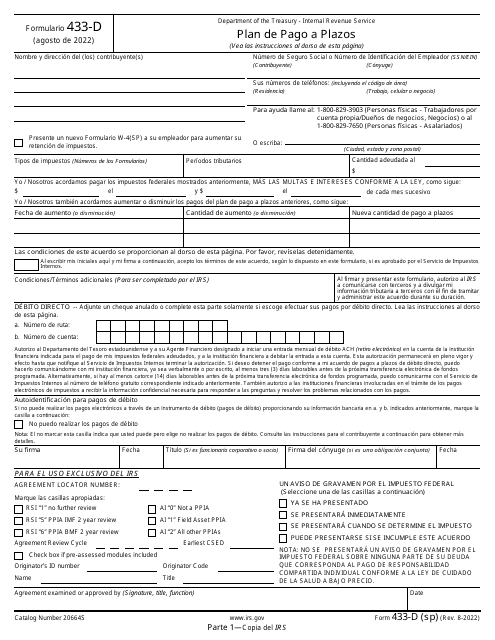

This Spanish document is used for setting up a installment payment plan with the IRS. It is known as IRS Form 433-D.

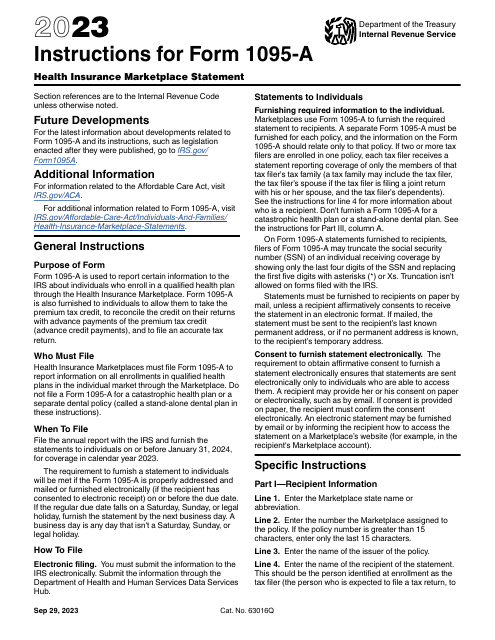

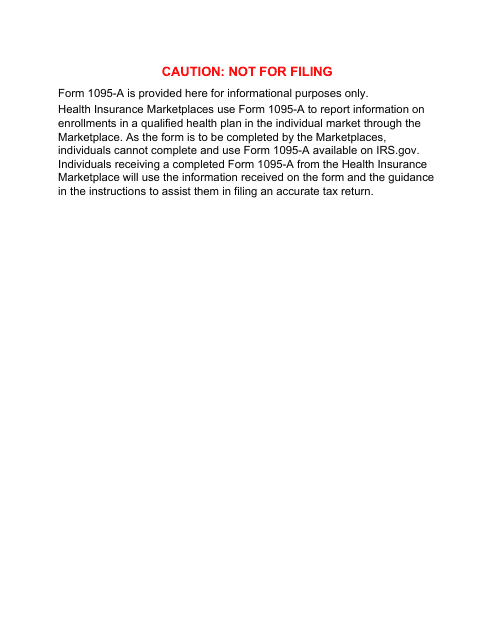

This form is also known as the healthcare marketplace tax form. It is used to inform the IRS about individuals and families enrolled in a health plan via the Health Insurance Marketplace.

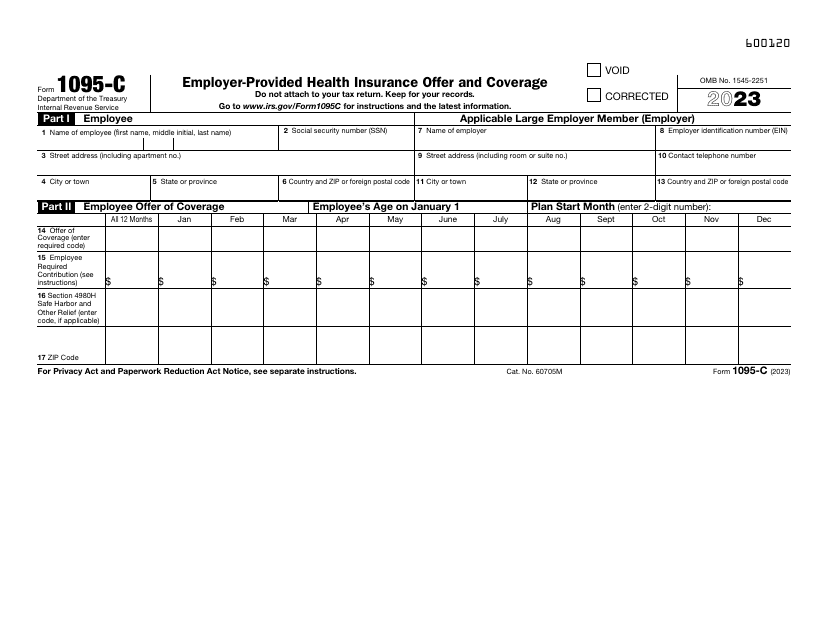

This form is filed by employers with 50 or more full-time employees in order to provide information about their enrollment in health coverage required under sections 6055 and 6056 of the Internal Revenue Code.

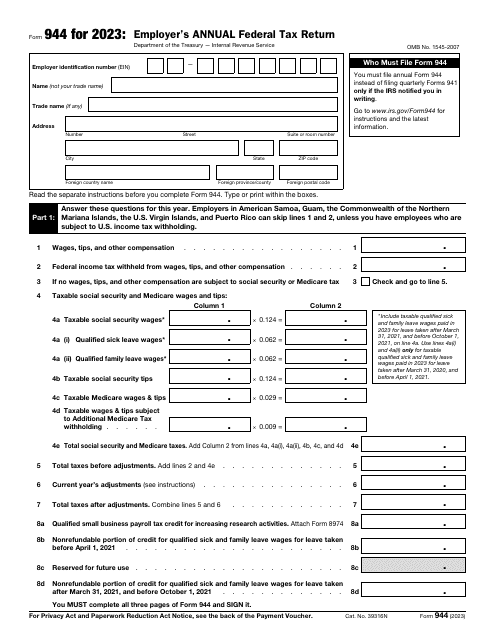

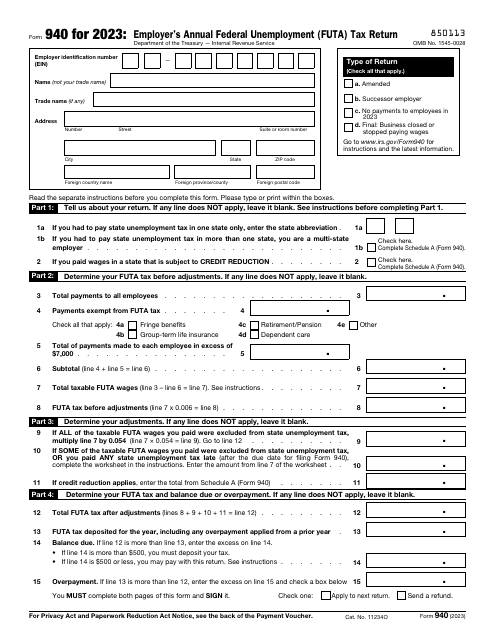

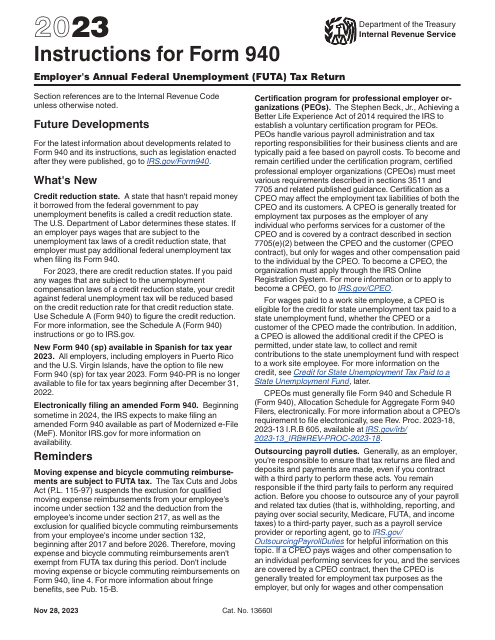

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

Use this form if you are an insurance provider and wish to inform the IRS about taxpayers who are eligible to receive minimum essential health coverage that meet the standards of the Affordable Care Act.

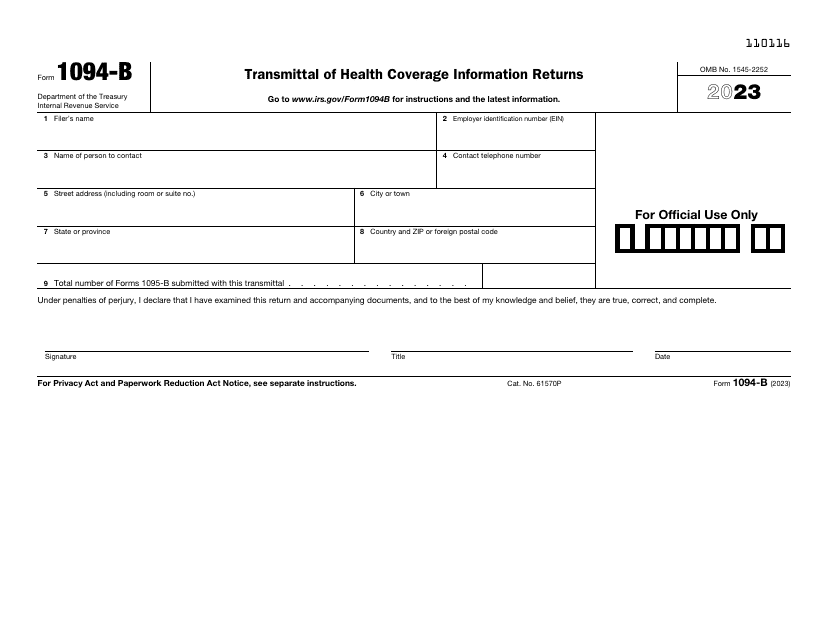

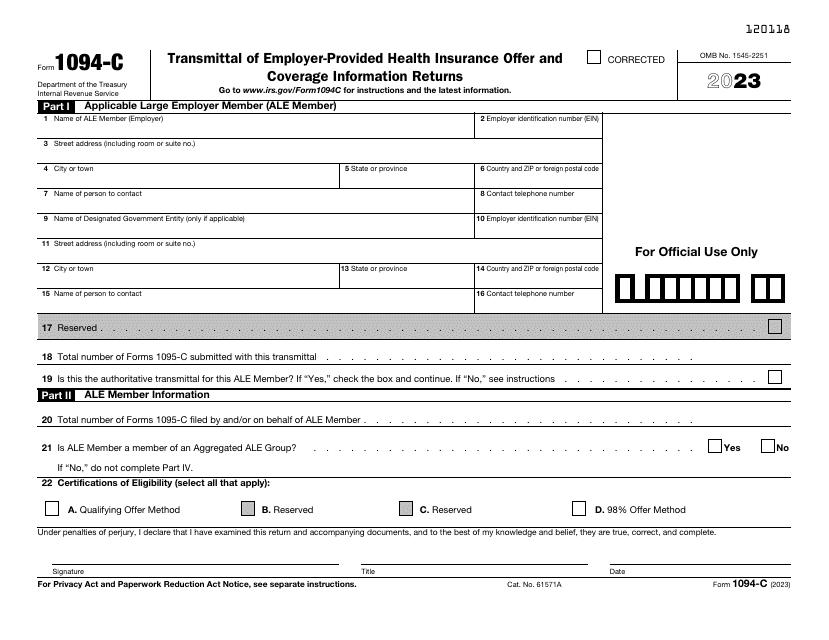

Download these cover sheets in order to report a summary about the Applicable Large Employer (ALE) and to transmit Form 1095-C, Employer-Provided Health Insurance Offer and Coverage to the Internal Revenue Service (IRS).

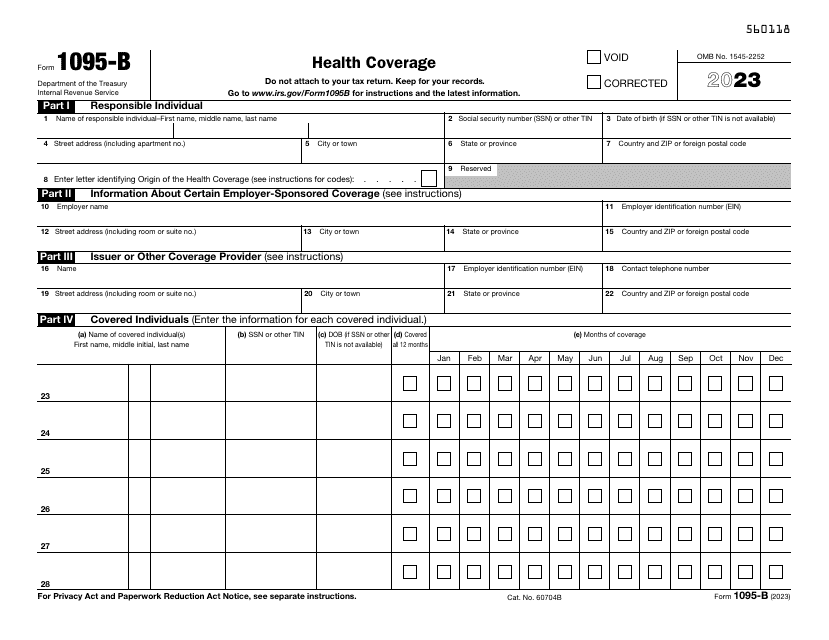

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

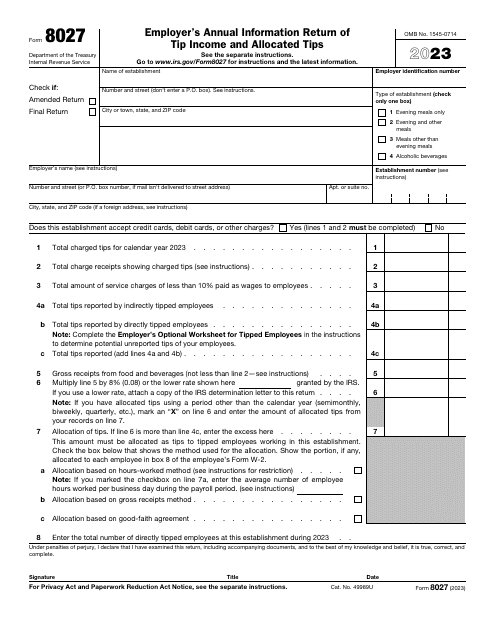

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

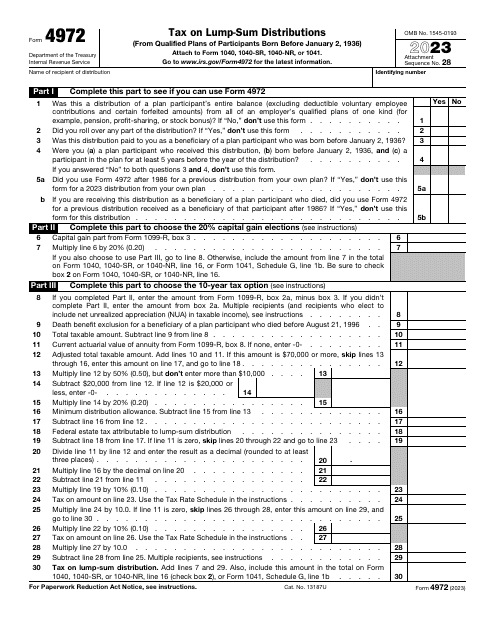

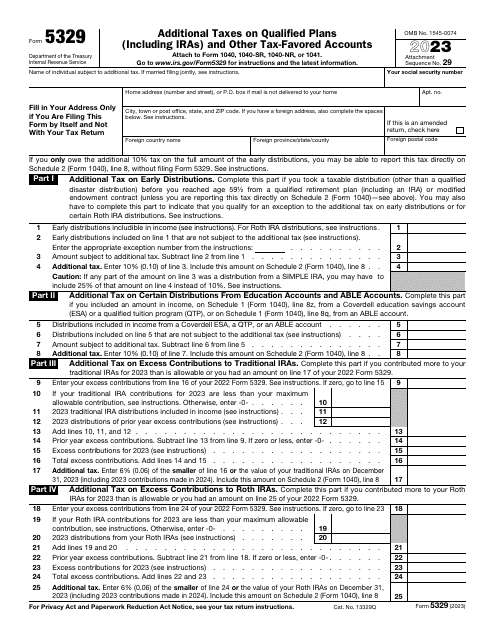

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

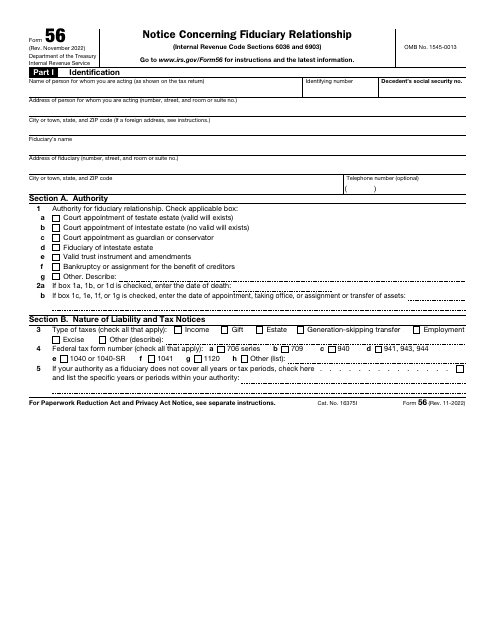

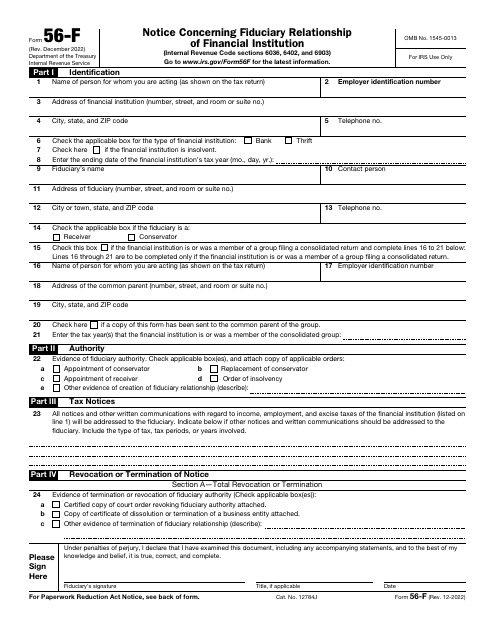

This is a fiscal statement prepared by a person or organization to tell the government about the fiduciary arrangement that was formed with them serving as a fiduciary.

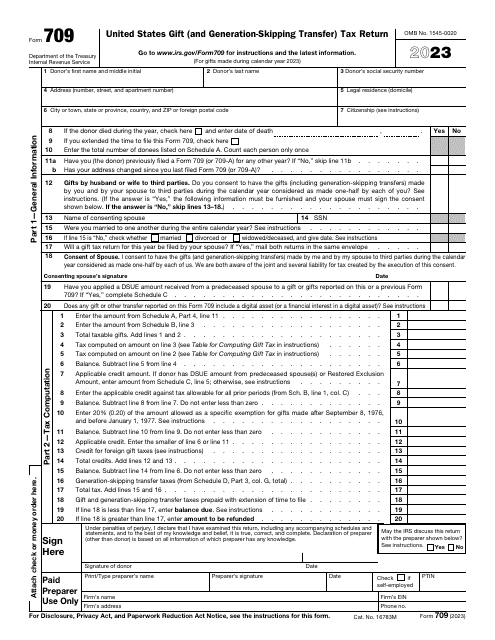

This is a formal document used by taxpayers to outline asset transfers that are considered gifts and are subject to tax.

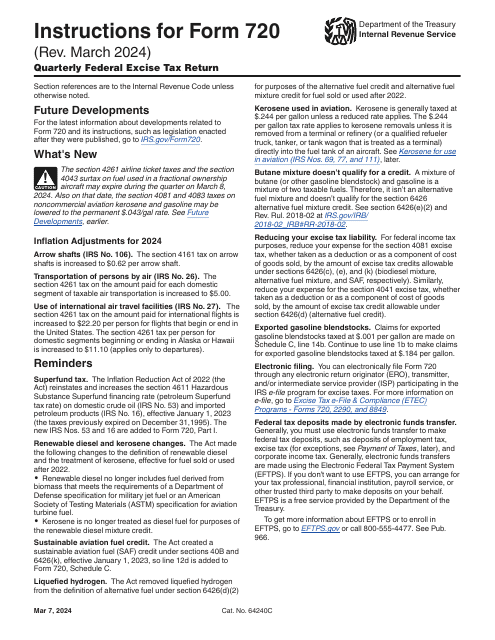

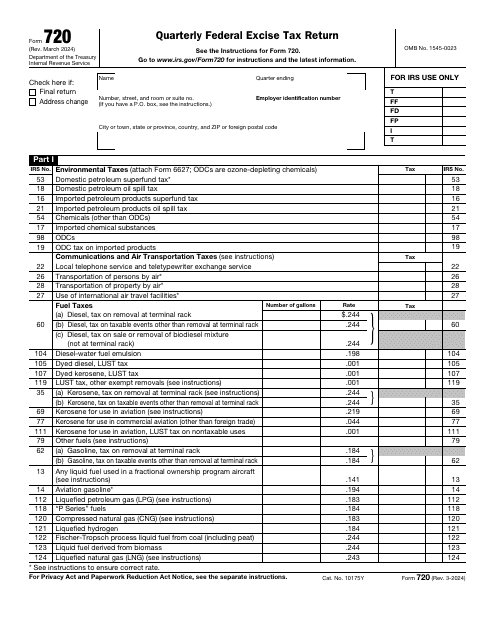

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

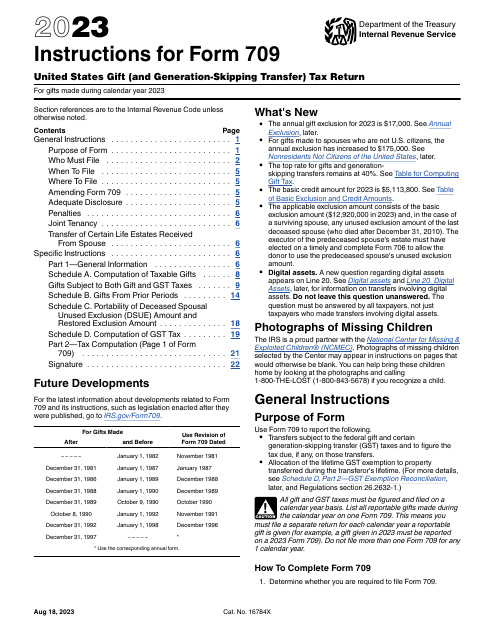

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023