Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

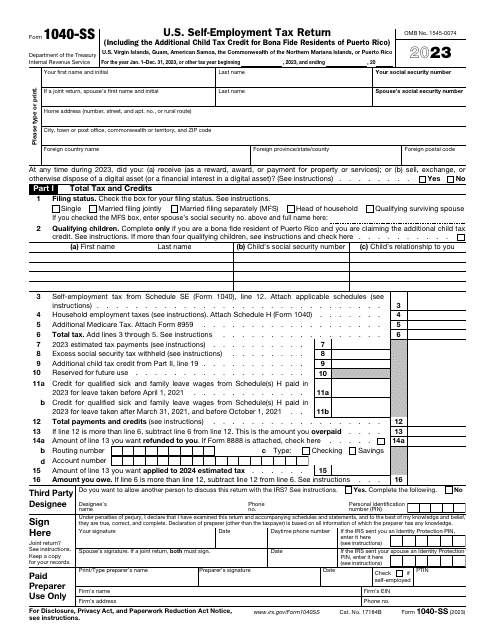

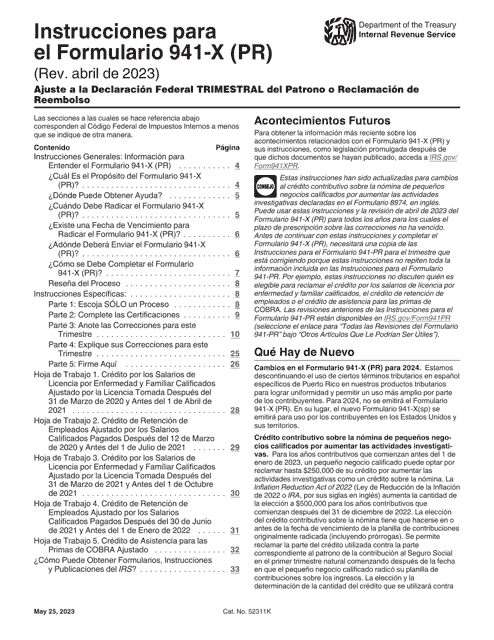

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.

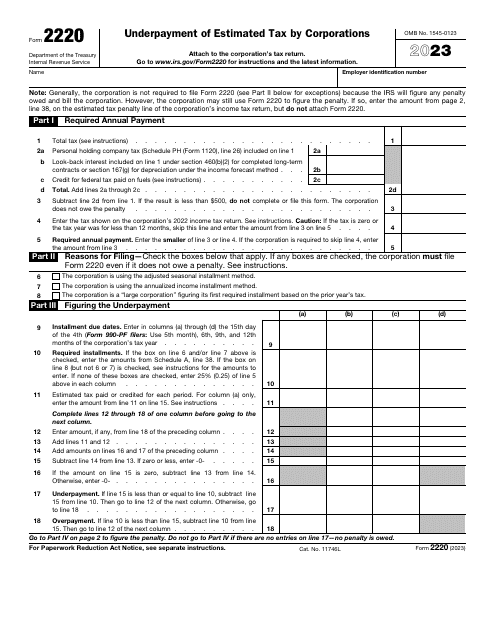

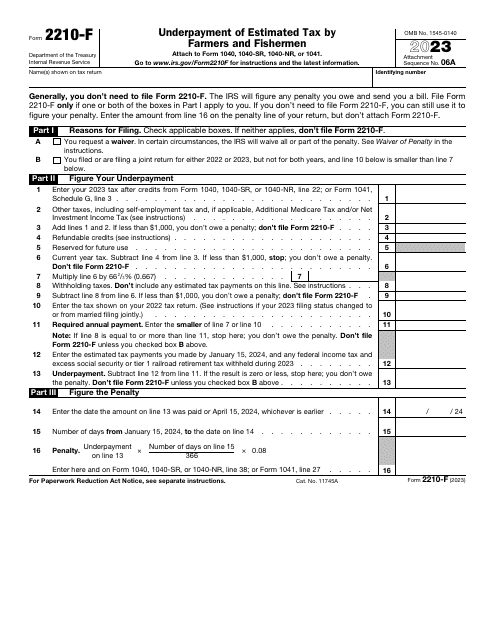

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

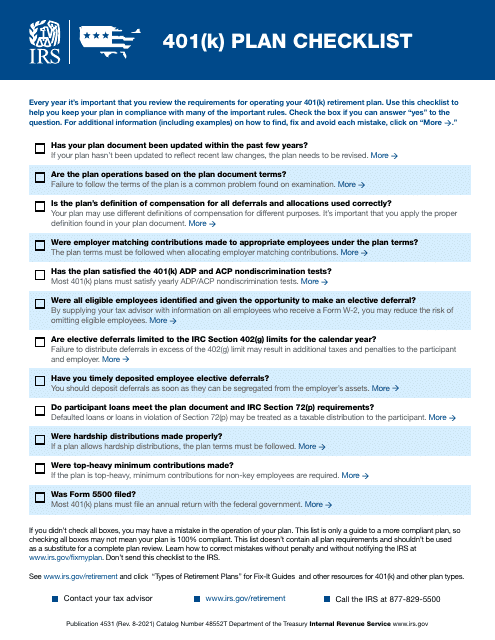

This document is a checklist that outlines the key steps and considerations for setting up and managing a 401(k) retirement plan. It provides guidance on eligibility, contribution limits, investment options, and other important factors to consider when establishing a 401(k) plan for your employees. Use this checklist to ensure compliance and maximize the benefits of your company's retirement plan.

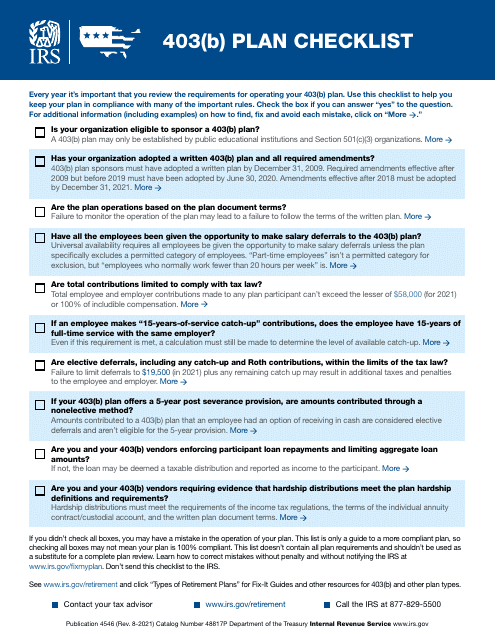

This document is a checklist for individuals who have or are interested in a 403(b) retirement plan. It provides a list of important items to consider and actions to take when managing a 403(b) plan.

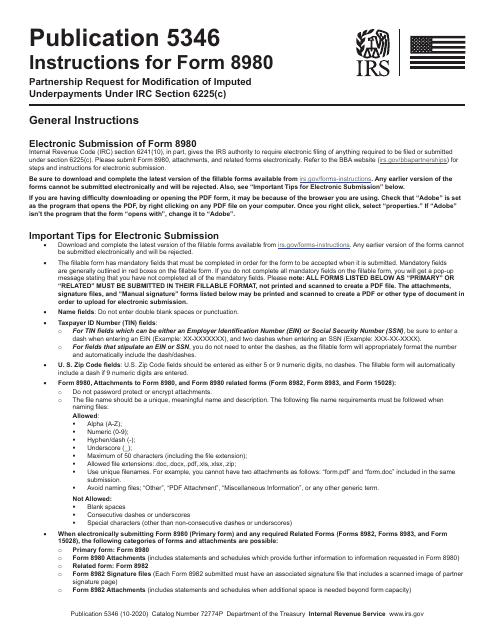

This form is used for partnership to request modification of imputed underpayments under IRC Section 6225(C).

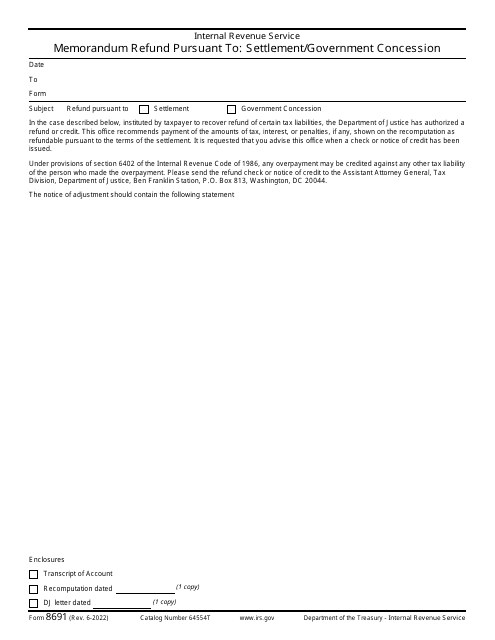

This document is used for requesting a refund from the Internal Revenue Service (IRS) for a settlement or government concession.

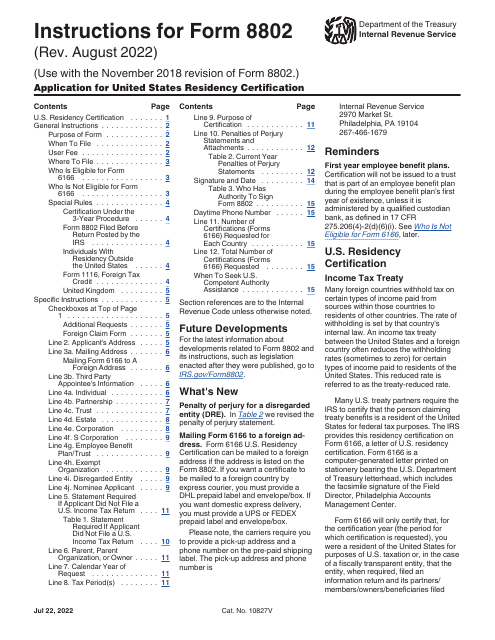

These are the official instructions for IRS Form 8802 and is used to help certify an applicant's United States residency.

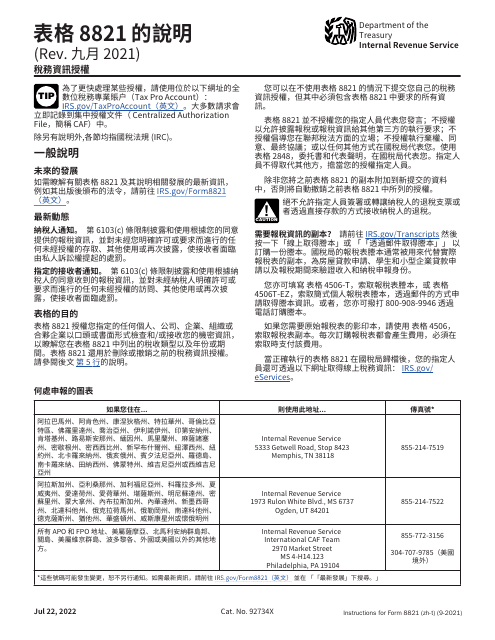

This document provides instructions for completing the IRS Form 8821 Tax Information Authorization in Chinese. It explains how to authorize someone to access your tax information and guide you through the form filling process.

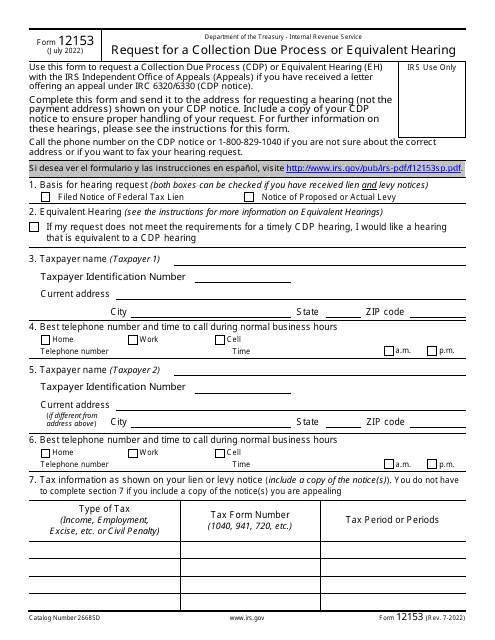

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

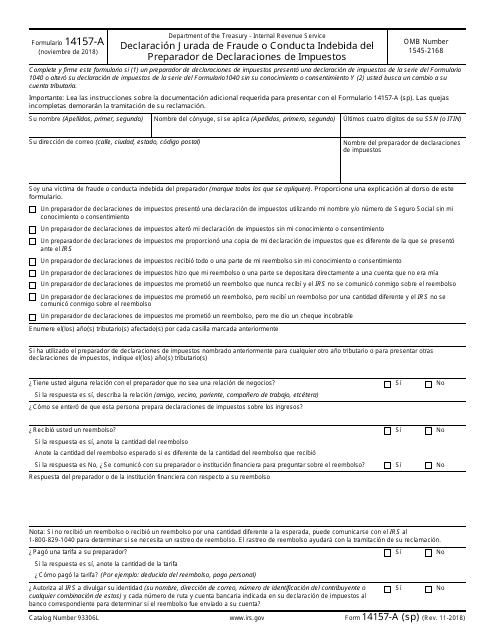

This type of document is a Spanish version of IRS Form 14157-A used for reporting fraud or misconduct by tax preparers.

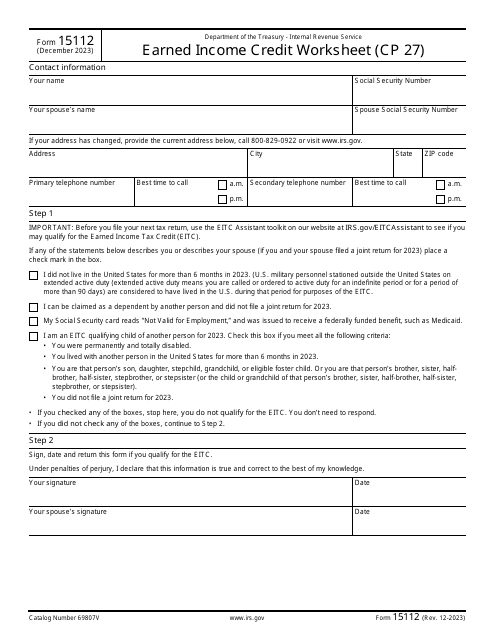

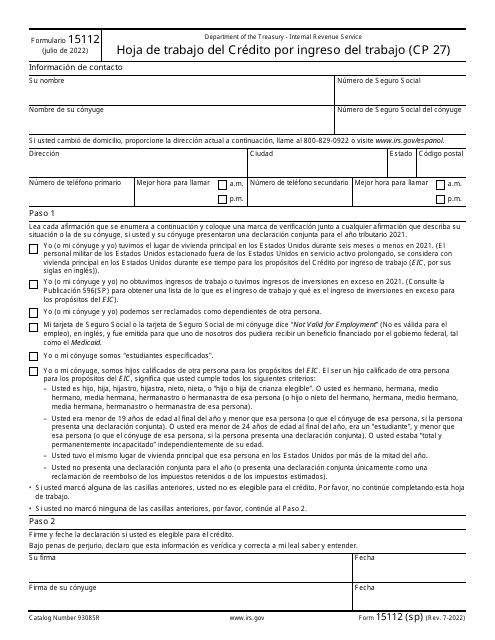

This Form is used for calculating the Earned Income Credit on your tax return.