Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

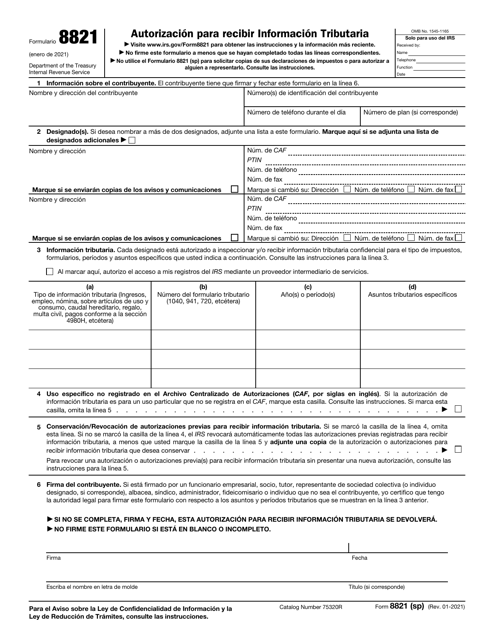

This Form is used for granting authorization to receive tax information.

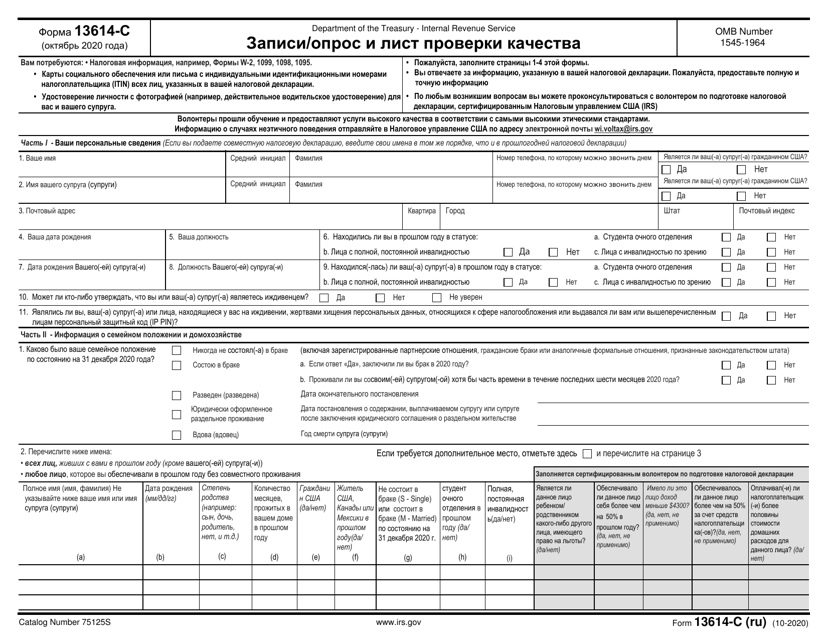

This Form is used for conducting intake interviews and quality review for tax purposes, specifically for Russian-speaking individuals.

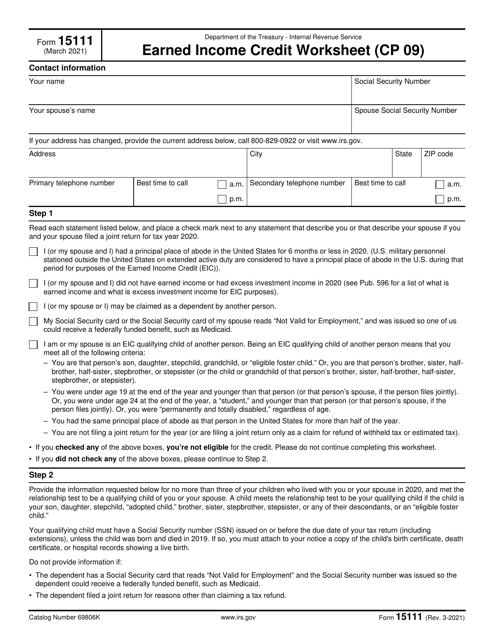

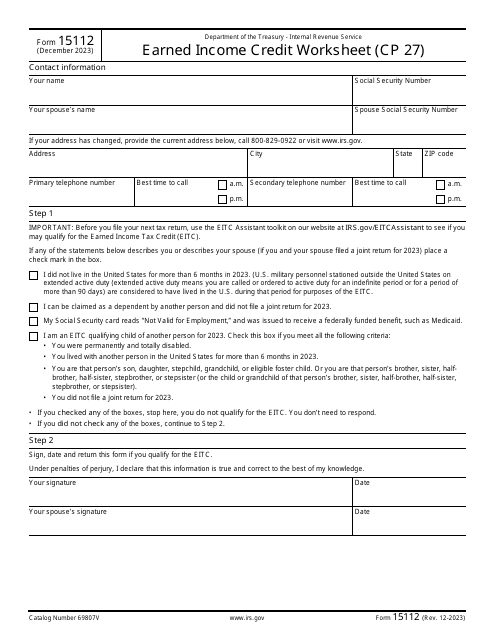

This form is used to calculate the Earned Income Credit for eligible taxpayers.

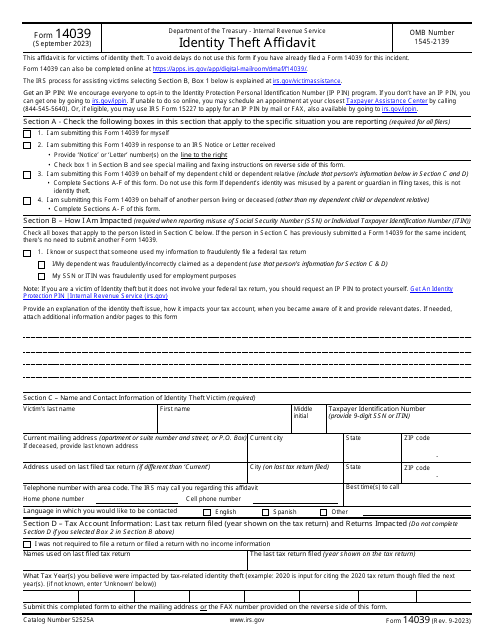

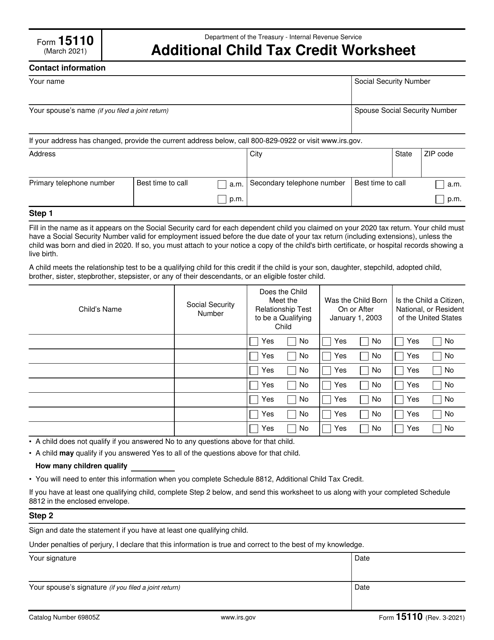

This form is used for calculating the additional child tax credit.

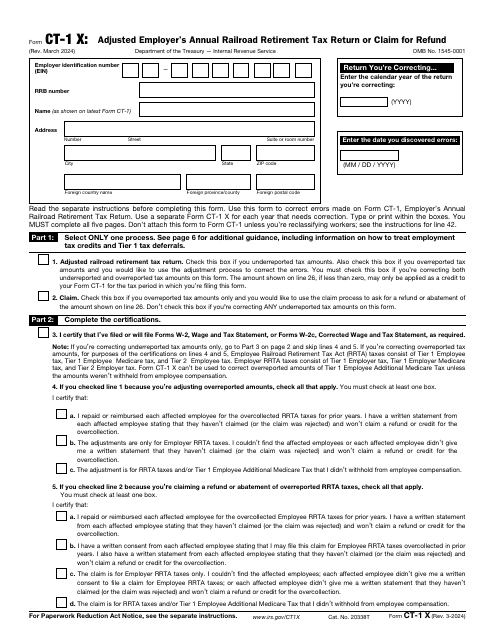

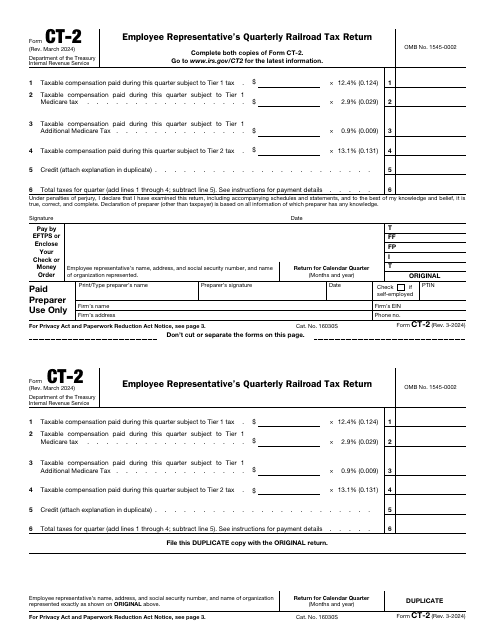

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

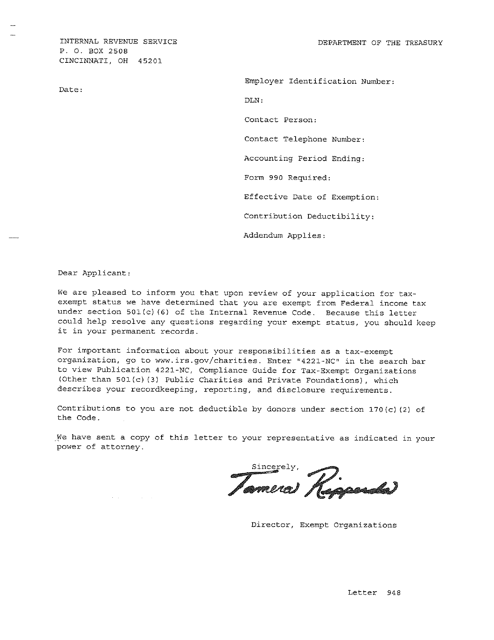

Obtain this letter from the IRS in order to be recognized as a nonprofit organization that offers employees company-sponsored retirement, medical, vacation, or other benefit plans.

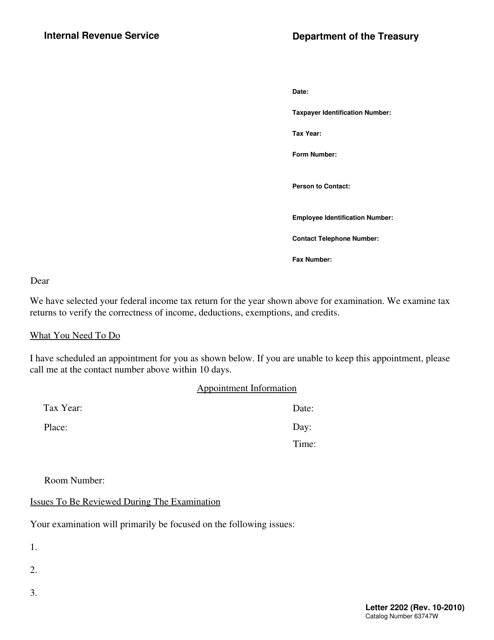

The IRS can initiate a review of the information you submit via your tax return by sending you an IRS Audit Letter in the mail.

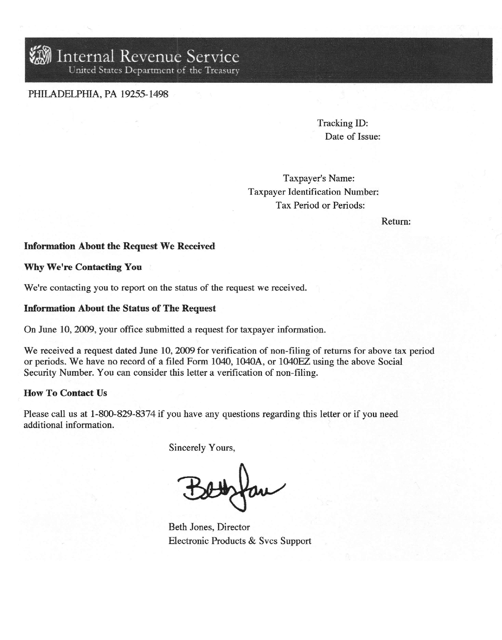

This document confirms that the taxpayer did not any of the IRS 1040 forms for the specific year.

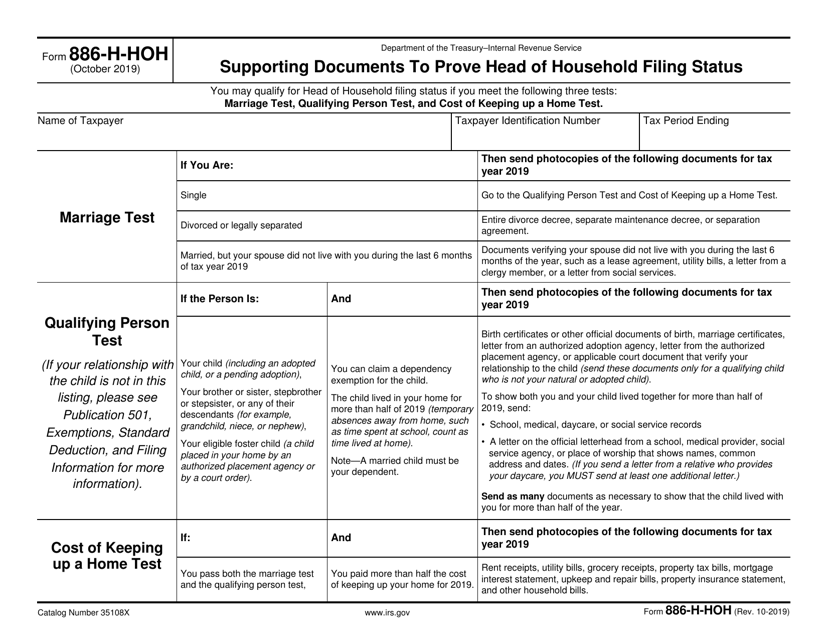

This document is used for providing supporting documents to prove your head of household filing status with the IRS. It is necessary to demonstrate your eligibility for certain tax benefits.

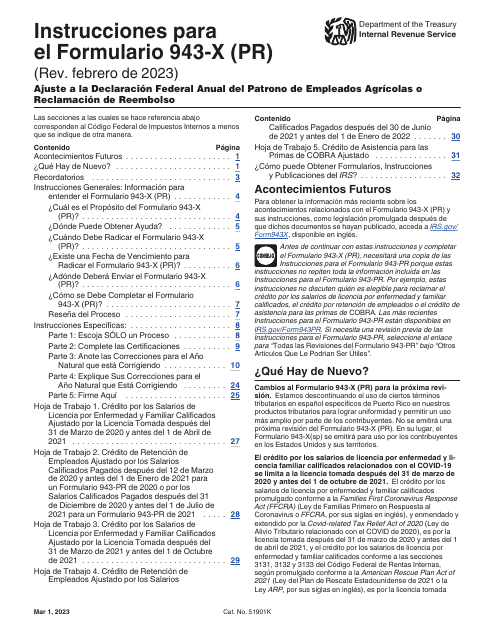

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

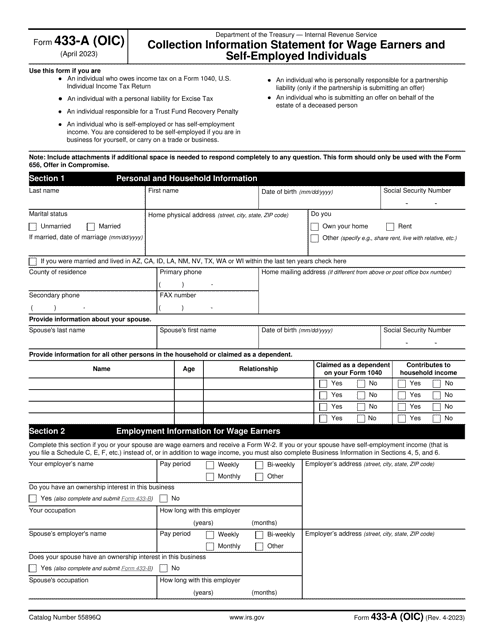

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

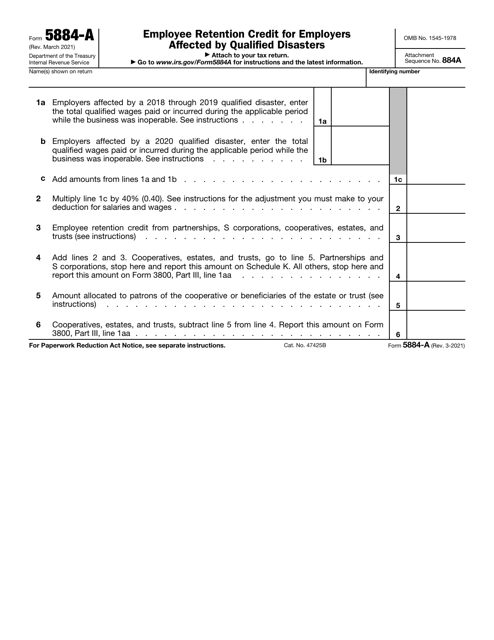

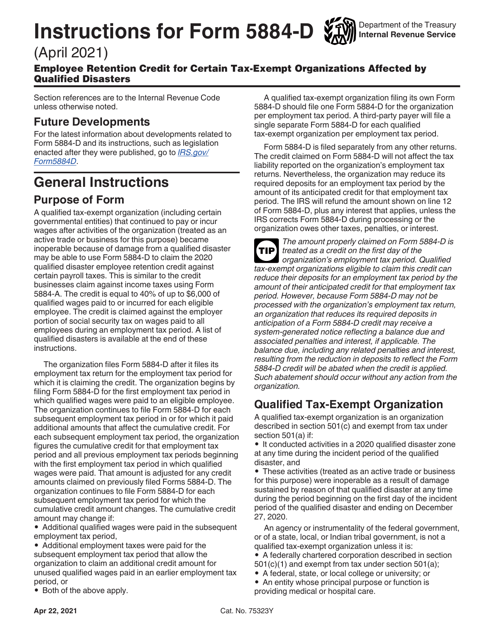

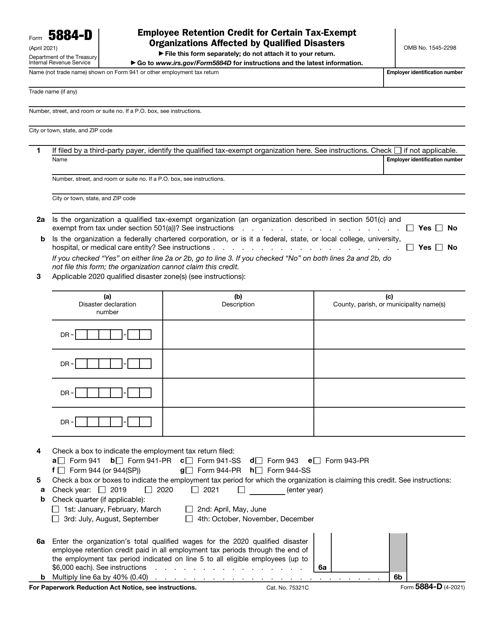

This form is used for claiming the Employee Retention Credit for certain tax-exempt organizations affected by qualified disasters. It provides instructions on how to fill out the form and claim the credit.

This form is used for claiming the Employee Retention Credit by certain tax-exempt organizations that have been affected by qualified disasters. The credit is meant to provide financial relief to these organizations in order to retain their employees.

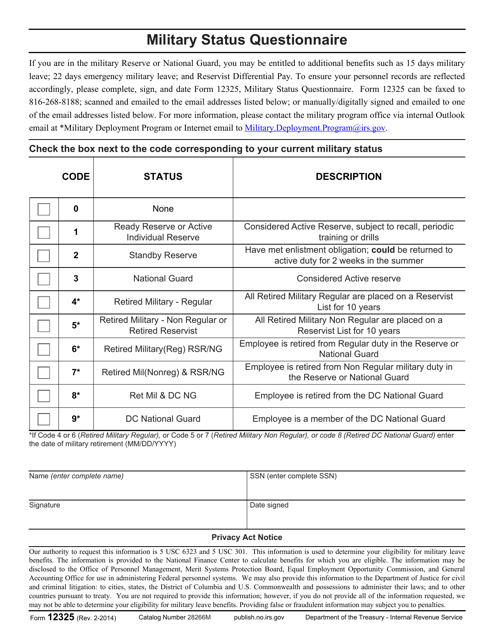

This form is used for determining military status and eligibility for certain tax benefits.

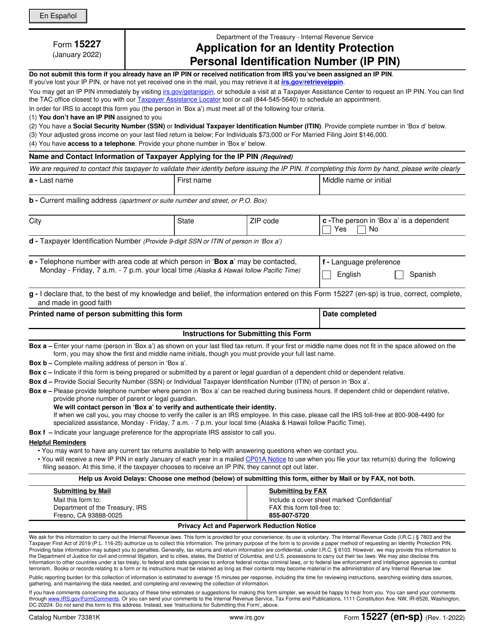

This is a formal document used by taxpayers to request the issuance of a unique identification number they will later use to submit income statements.

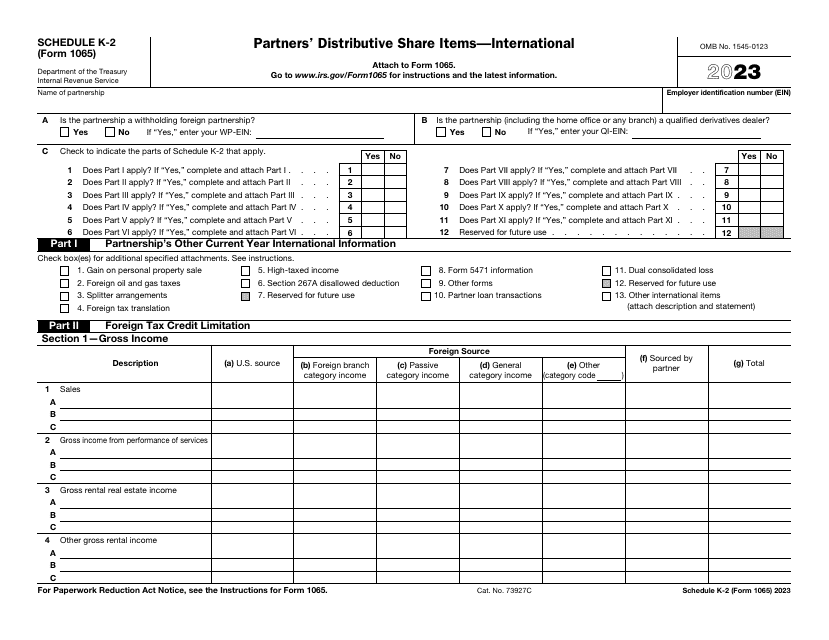

This is a fiscal IRS form designed to specify a partner's distributive share of various items that have international tax relevance.