Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

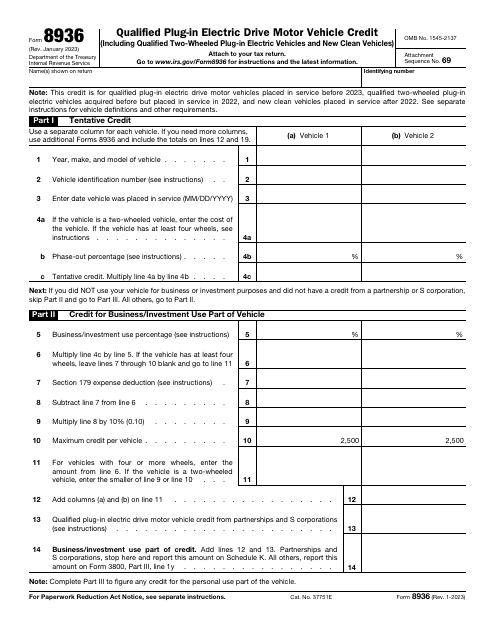

This is a formal IRS form used by taxpayers that purchased electric vehicles in order to claim a tax credit when filing their tax returns.

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

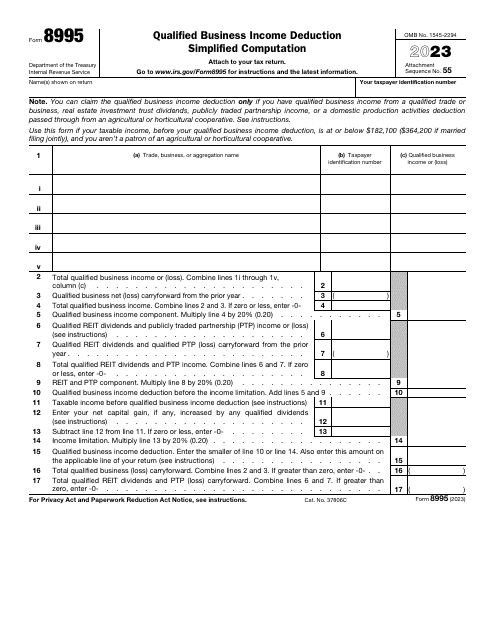

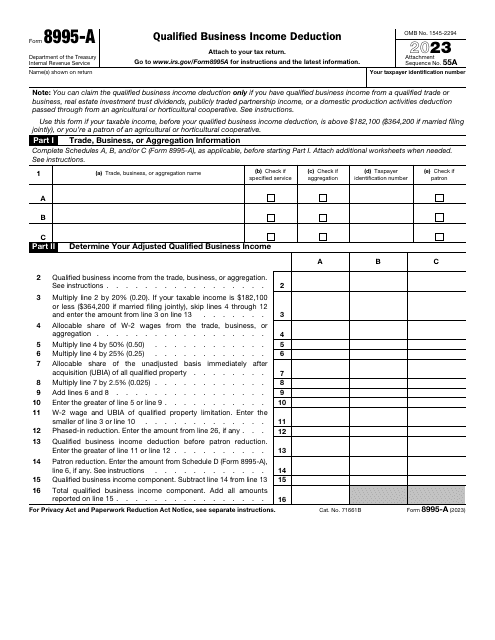

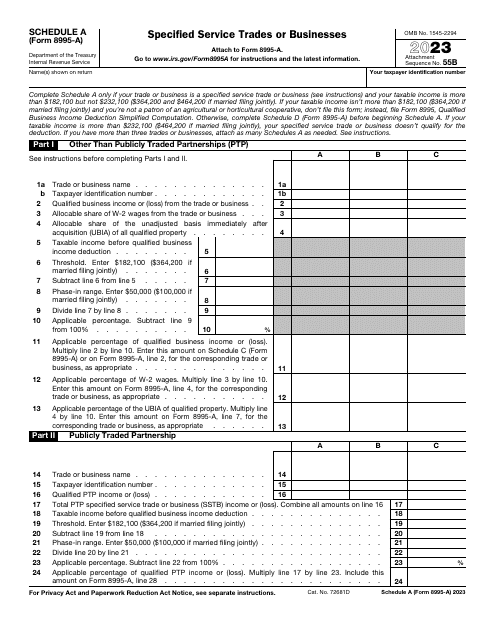

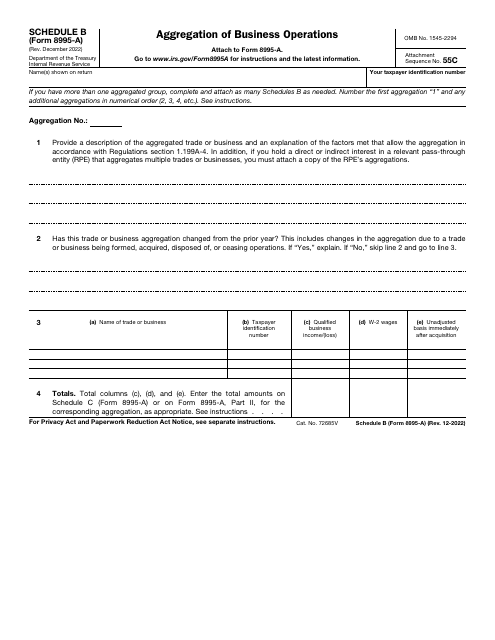

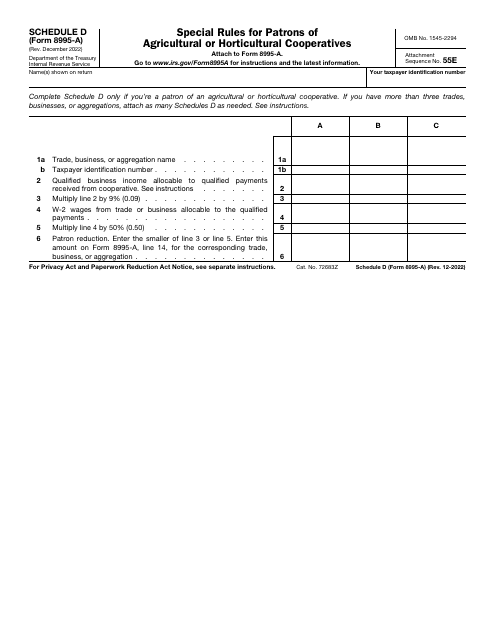

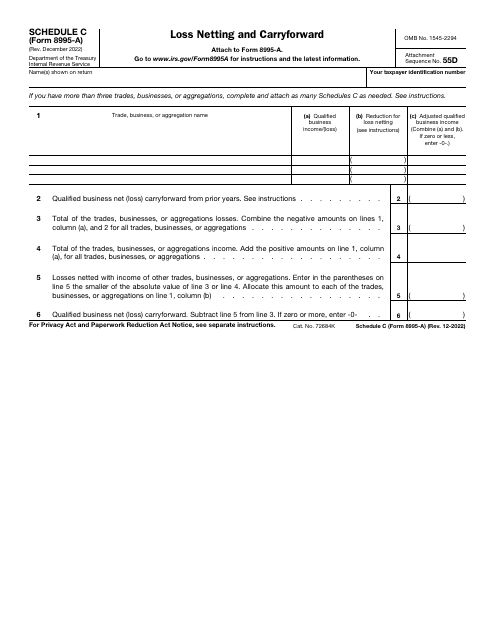

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

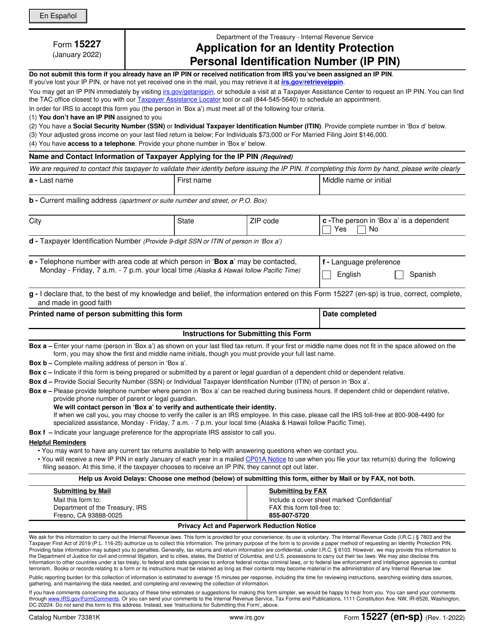

This is a formal document used by taxpayers to request the issuance of a unique identification number they will later use to submit income statements.

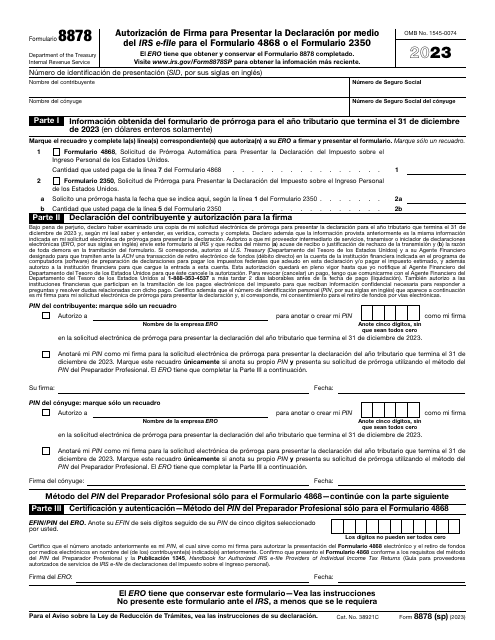

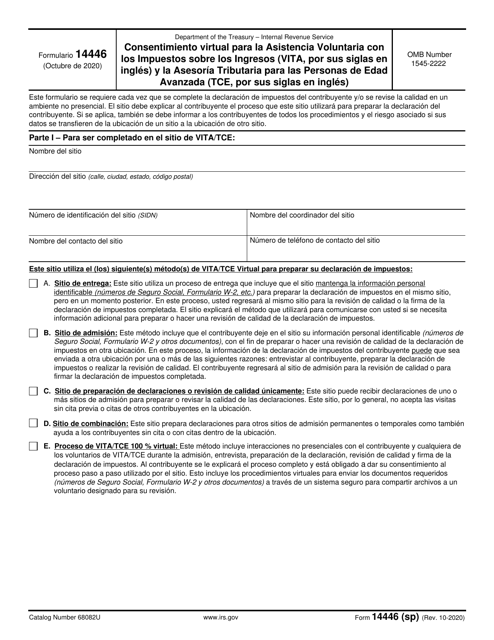

This Form is used for providing virtual consent for voluntary assistance with income taxes (VITA) and tax counseling for the elderly (TCE) for Spanish-speaking individuals.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

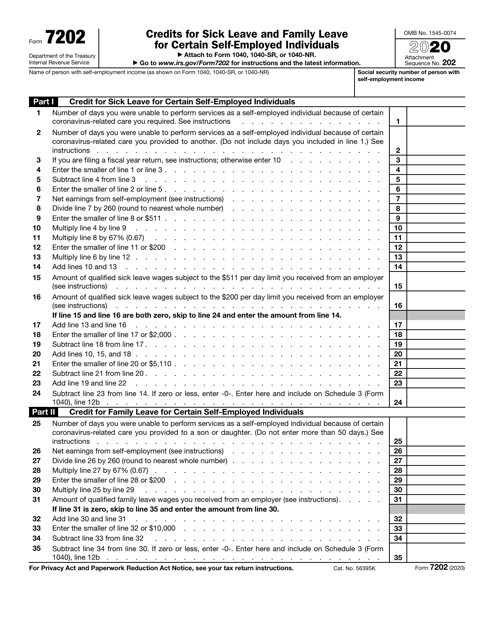

This IRS form is used for claiming credits related to sick leave and family leave for self-employed individuals.