Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

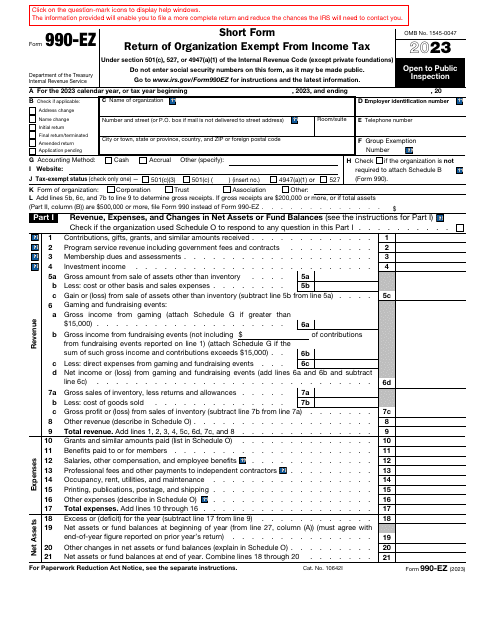

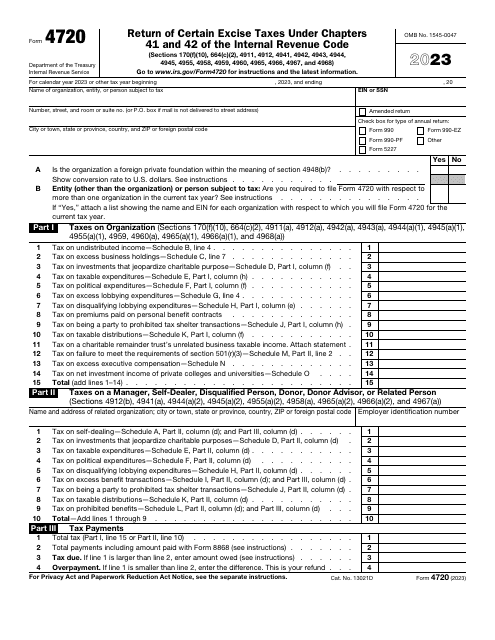

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

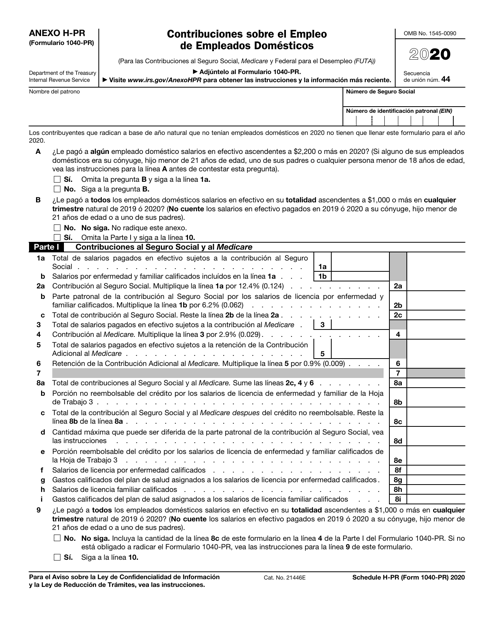

This document is for reporting contributions on domestic employee employment (Spanish).

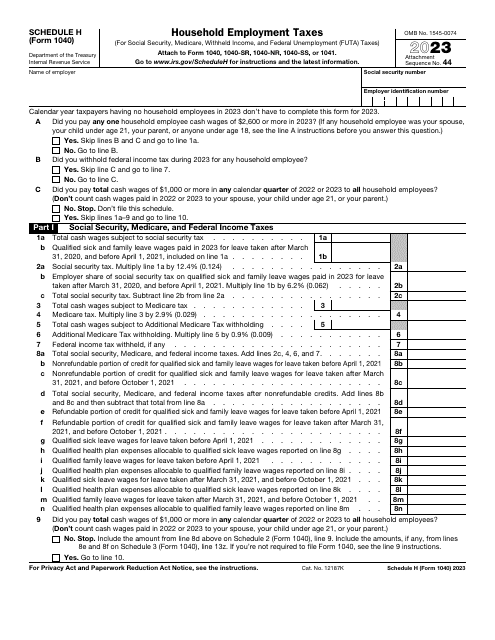

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

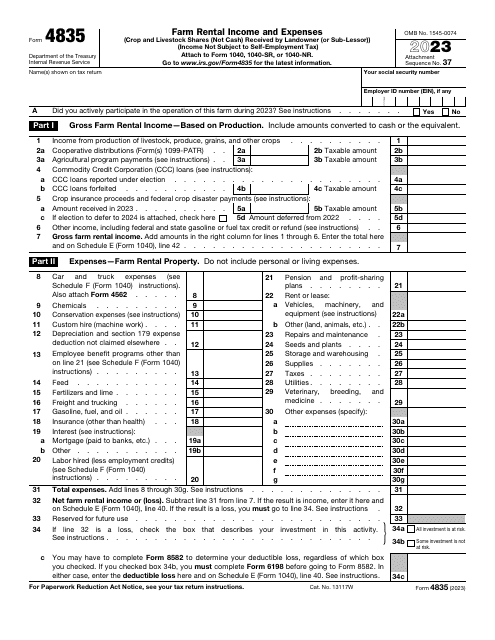

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

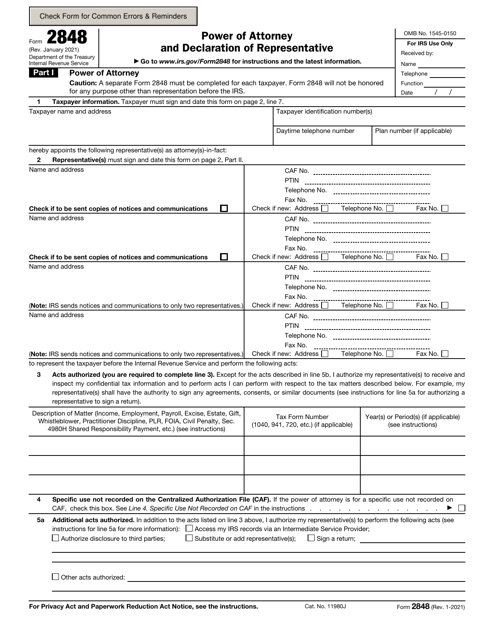

This is a formal statement used by a taxpayer to entrust their representative to perform specific actions in their name.

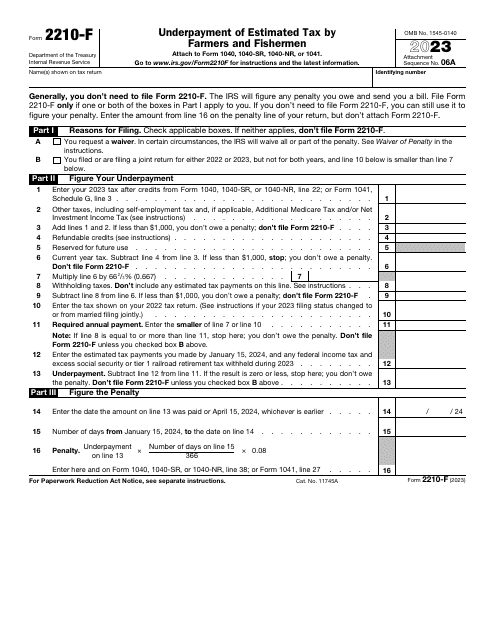

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

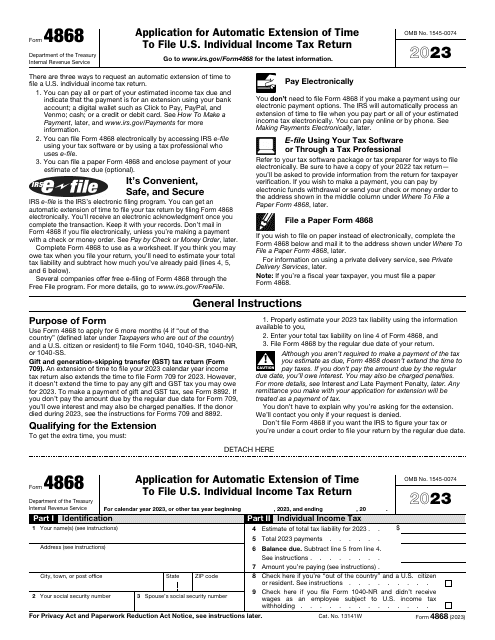

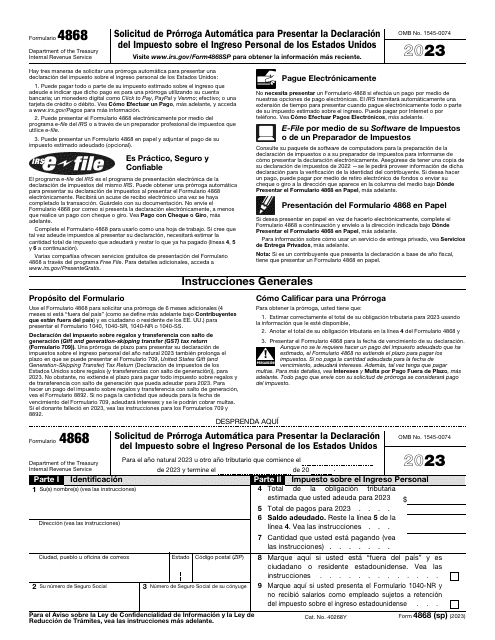

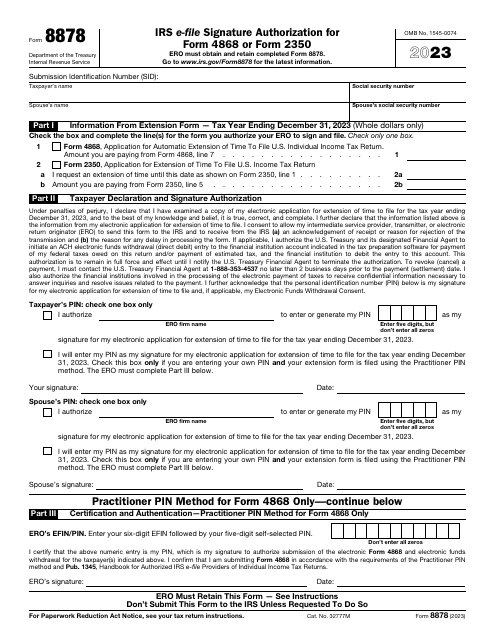

This is an IRS form that needs to be filled out to request an automatic extension to submit income tax return forms.

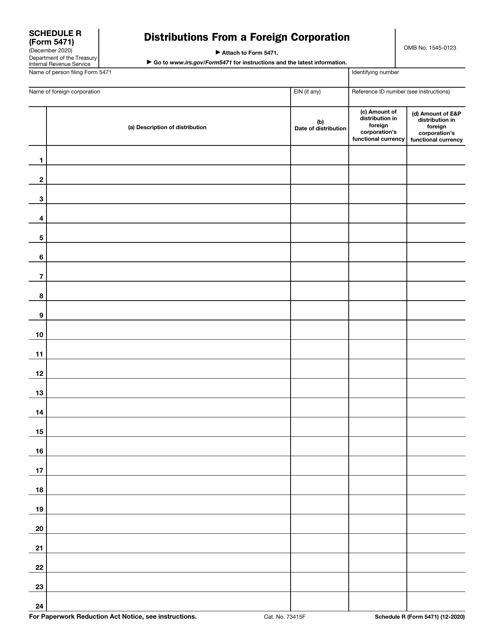

This document is used for reporting distributions from a foreign corporation on IRS Form 5471 Schedule R.

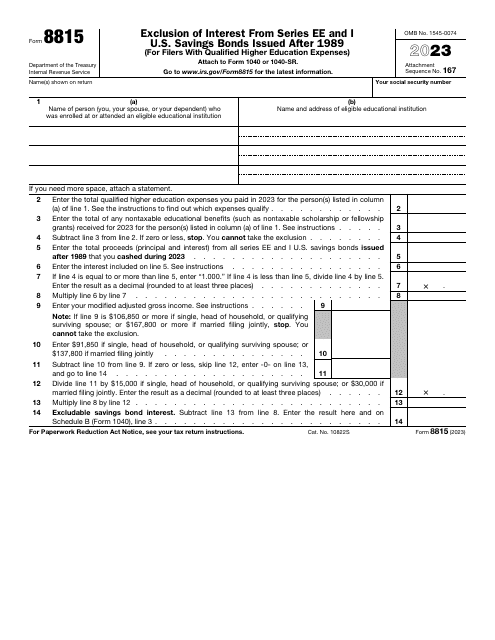

This is a fiscal document used by individual taxpayers to exclude the specific bond interest from their income.

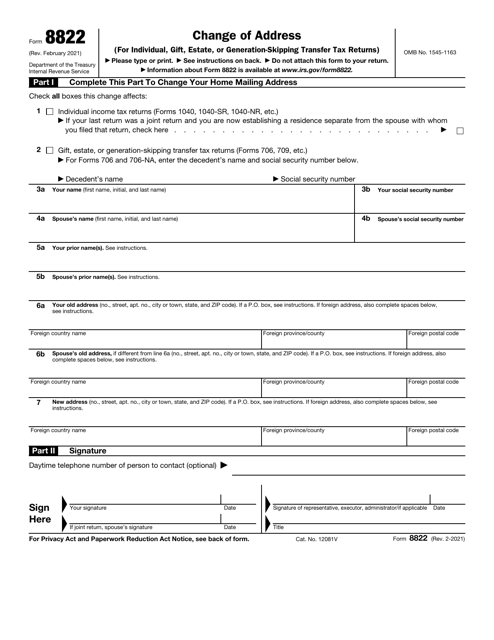

This is a fiscal IRS form filed by a taxpayer who has a new address and wants to ensure all future mail from the tax authorities arrives at the right residence.

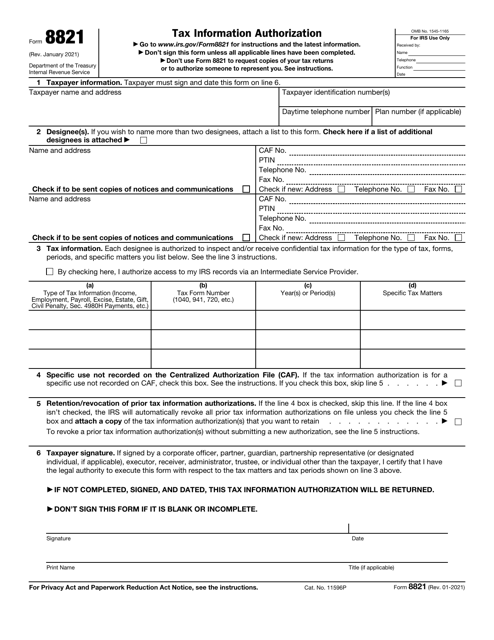

This is a formal document filled out by a taxpayer who wants another individual or company to obtain access to their tax information.

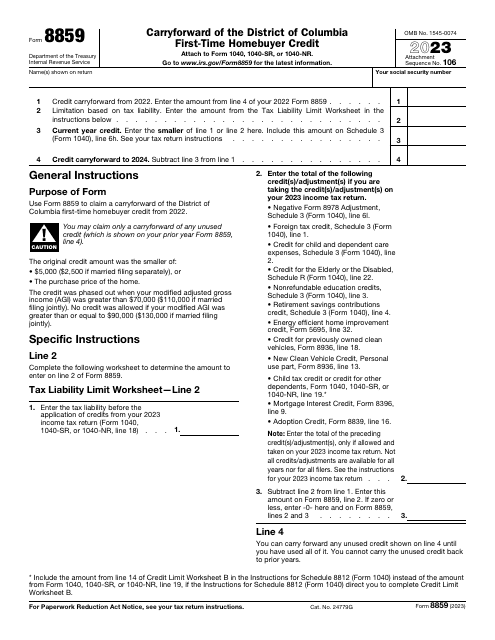

This is a fiscal document residents of the District of Columbia are permitted to complete in order to claim a carryforward credit they will be able to use in the future.

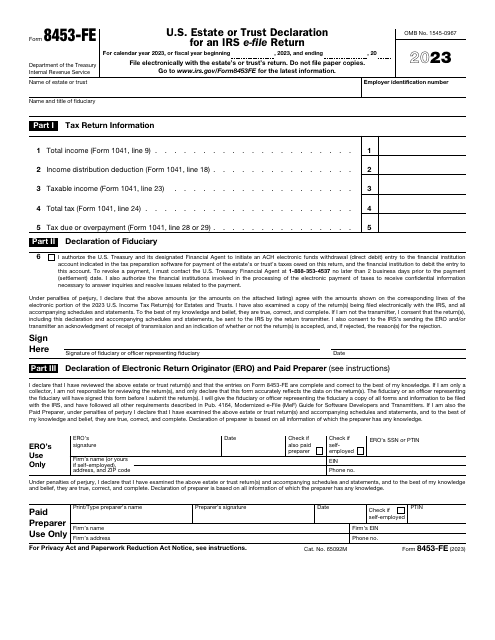

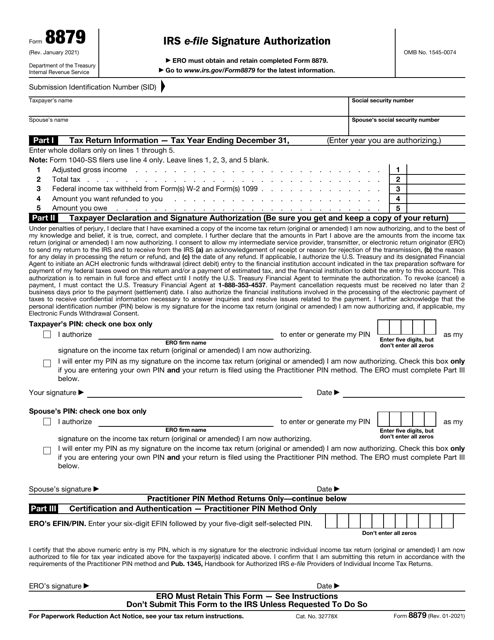

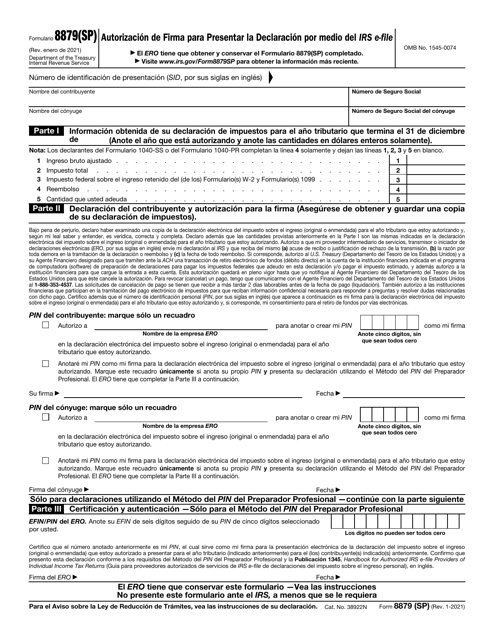

This is an IRS form that allows taxpayers to authorize an electronic return originator to use their e-signature while filing tax returns on behalf of their client.

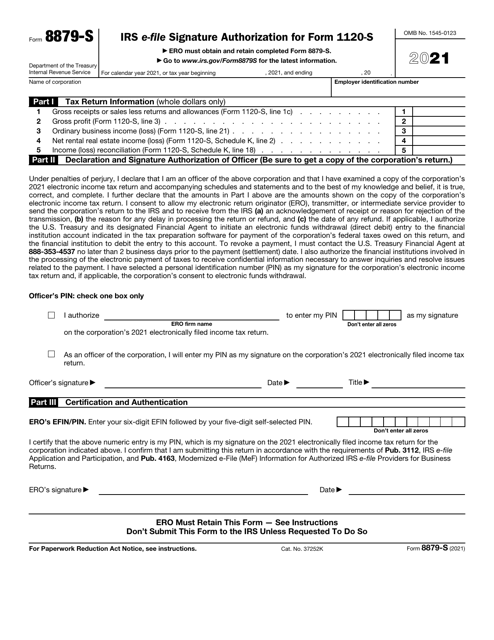

This is a form designed for taxpayers that want to grant an electronic return originator the right to use a unique identification number when filing tax documentation on behalf of the person that hired them.