Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

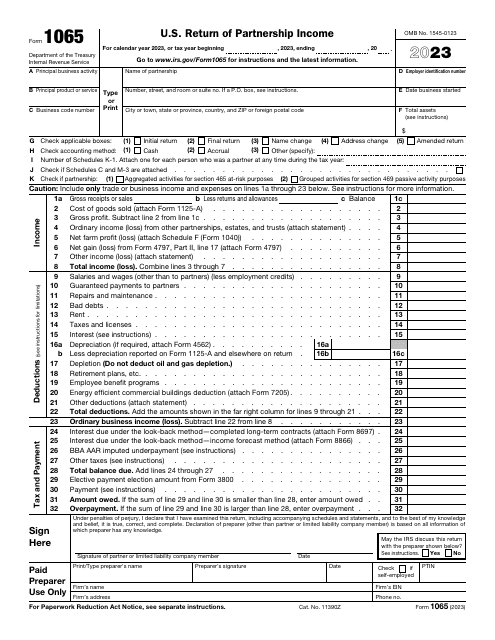

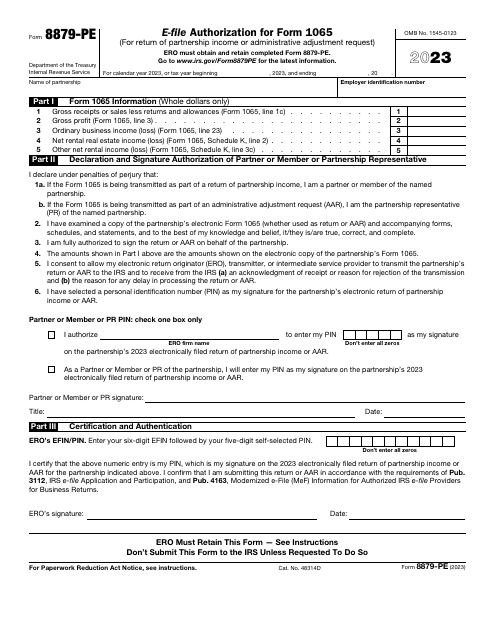

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

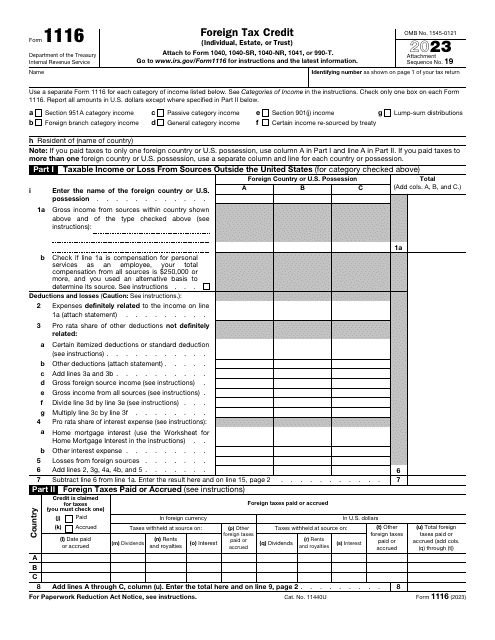

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

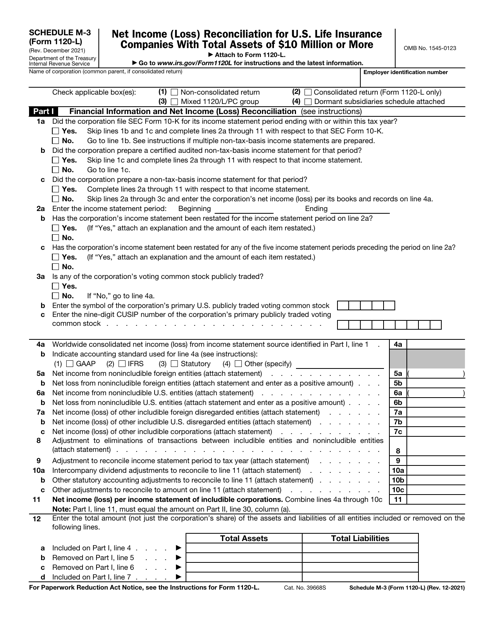

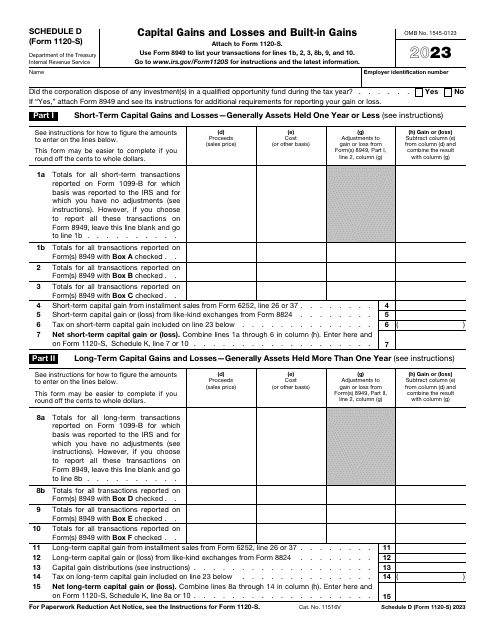

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

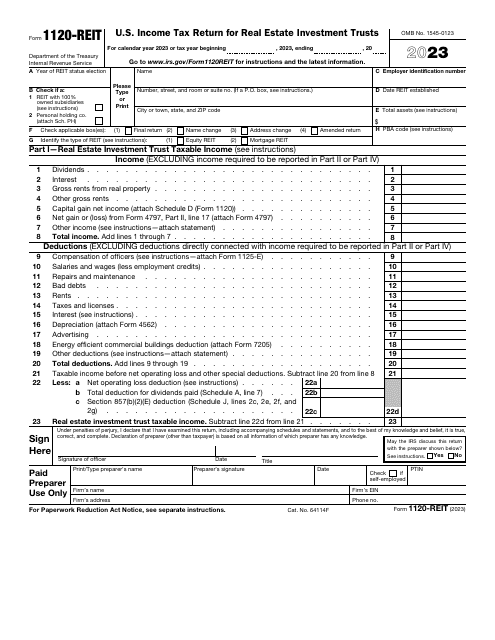

File this form if you are a corporation, trust, or an association electing to be treated as Real Estate Investment Trusts (REITs) in order to report your income, deductions, credits, penalties, as well as your income tax liability.

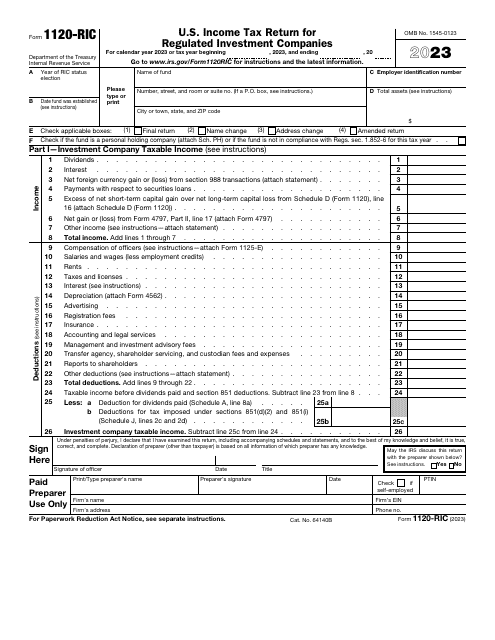

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

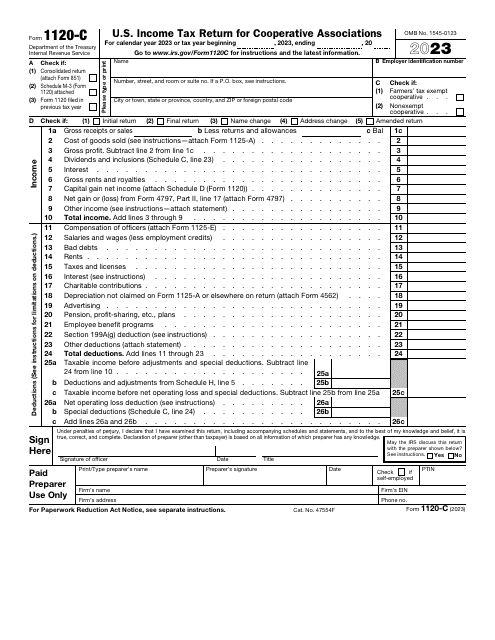

Use this form if you are a corporation that operates on a cooperative basis, to report your information (such as income, gains, losses, deductions, and credits) to the Internal Revenue Service (IRS), and to figure your income tax liability.

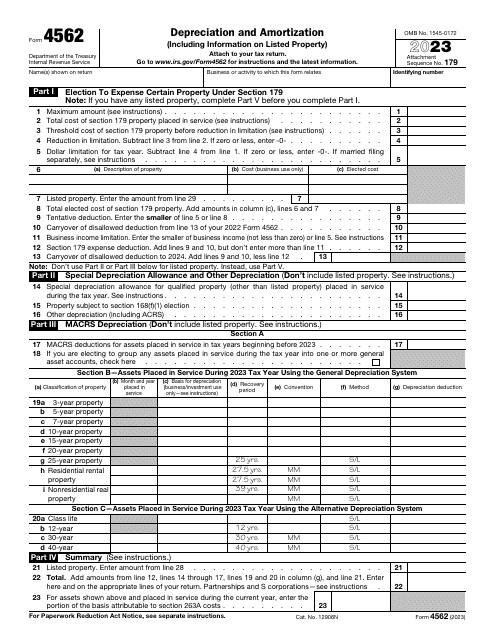

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

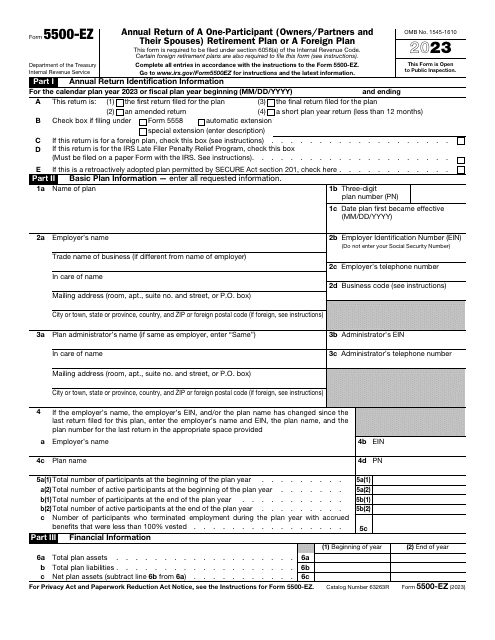

This form should be filled out by one-participant plans and by foreign plans. You are not required to file the form with attachments or schedules. File this form for an annual return if you do not file it electronically on a related Form 5500-SF.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

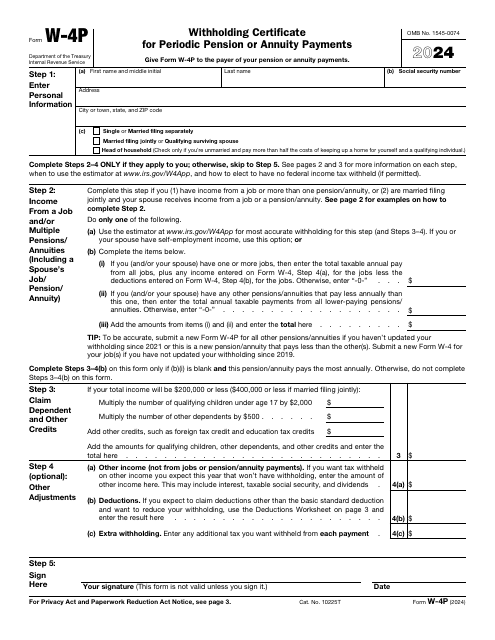

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

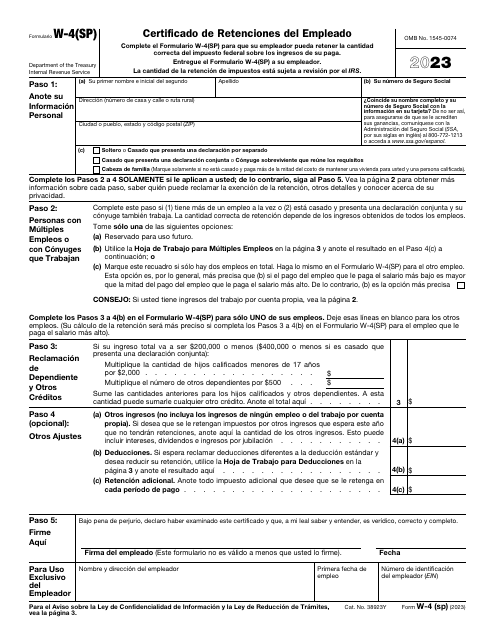

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.