Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

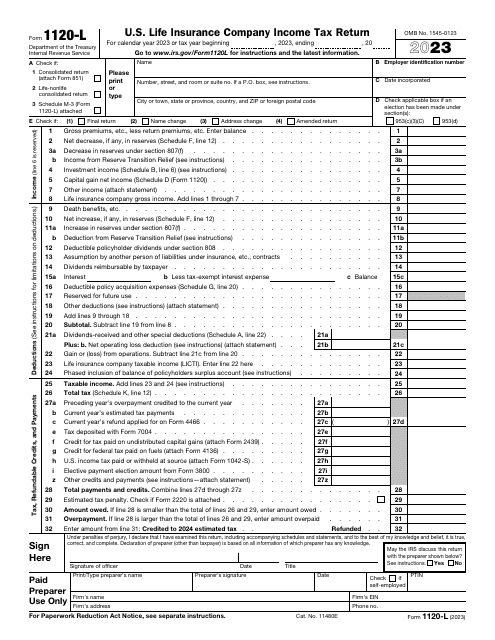

File this form if you are the owner of a domestic life insurance company to report to the IRS on your income, deductions, and credits for the tax year, and to figure your income tax liability.

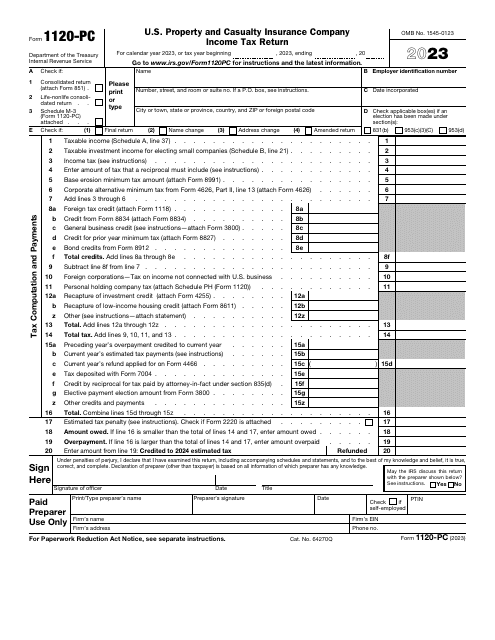

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

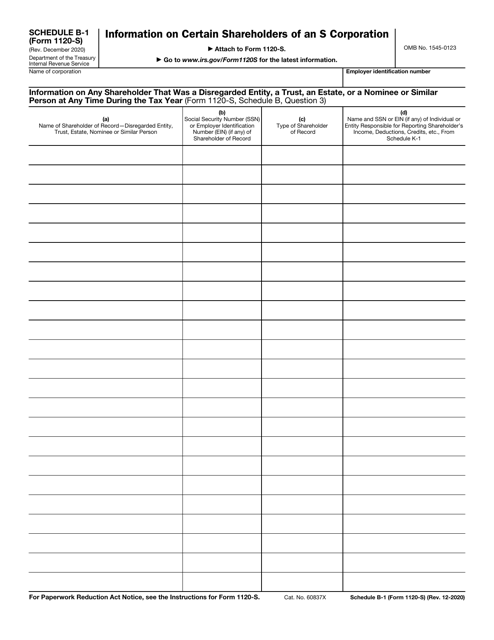

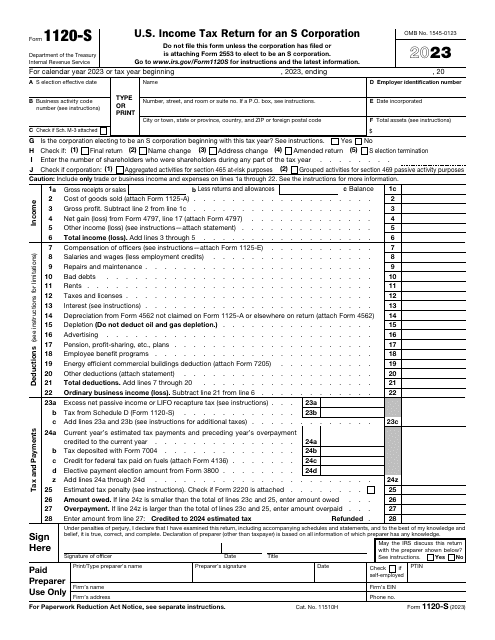

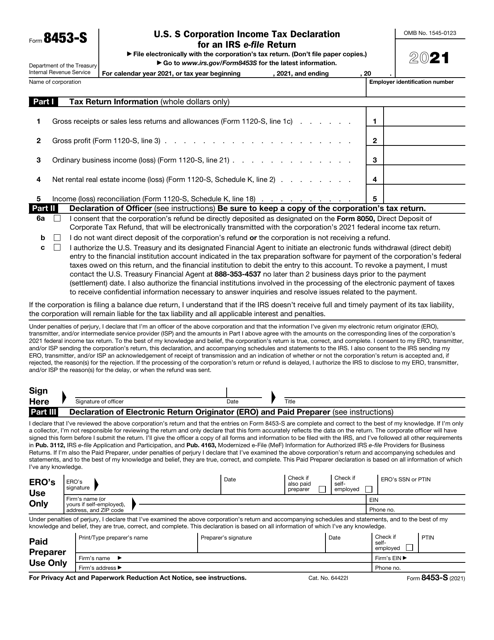

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

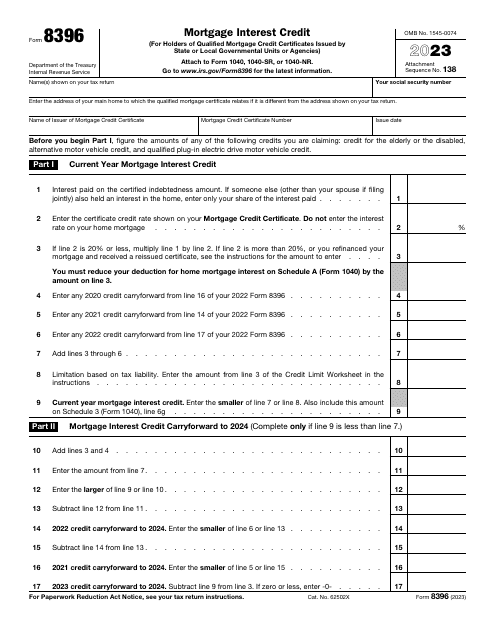

This is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.

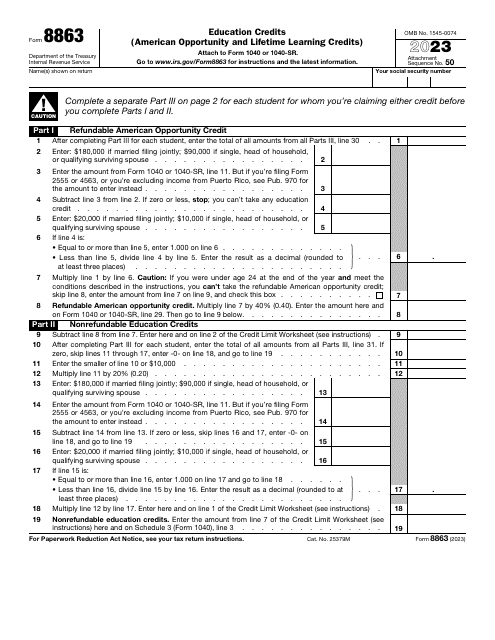

Fill in this form to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.

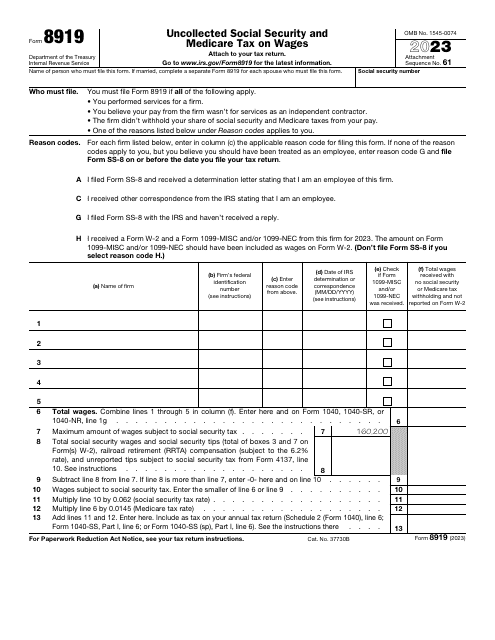

This is a formal report filed by an individual who believes they have to receive compensation in the form of social security and Medicare taxes.

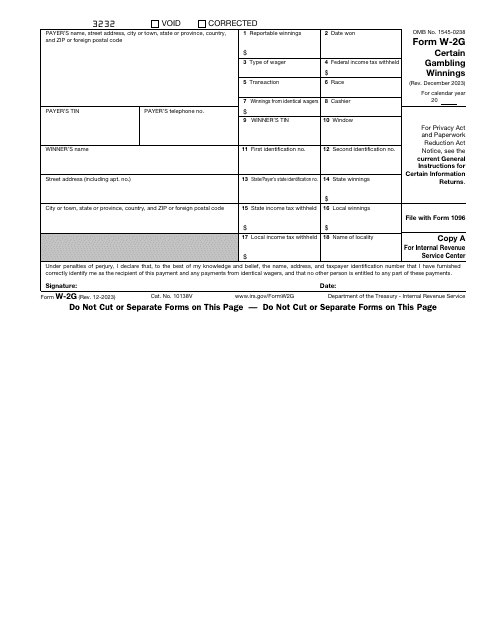

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

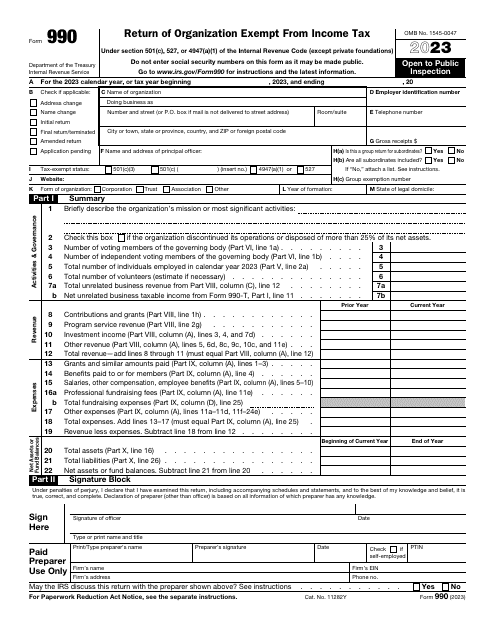

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.