Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

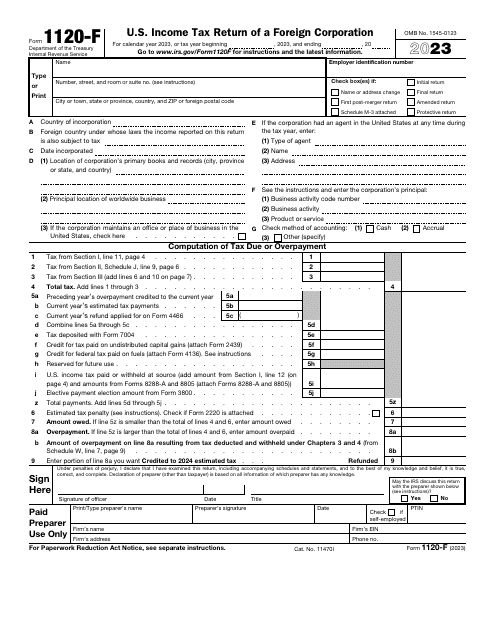

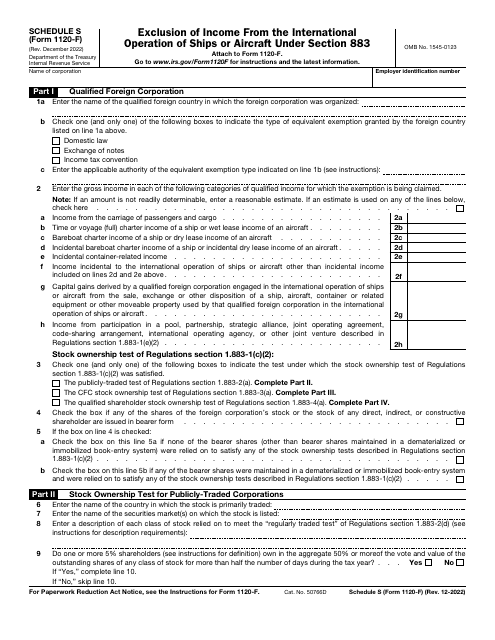

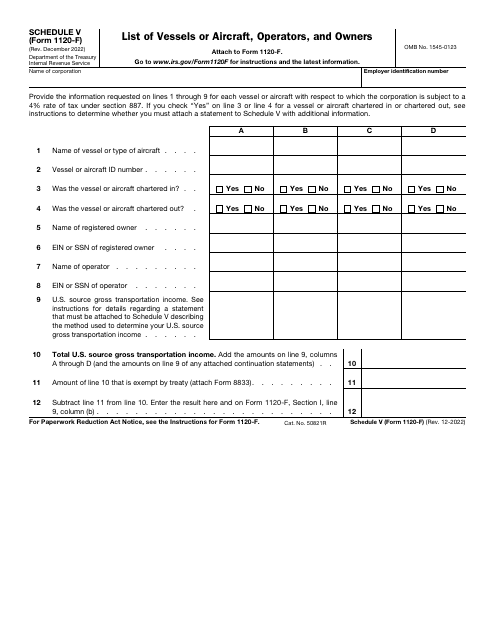

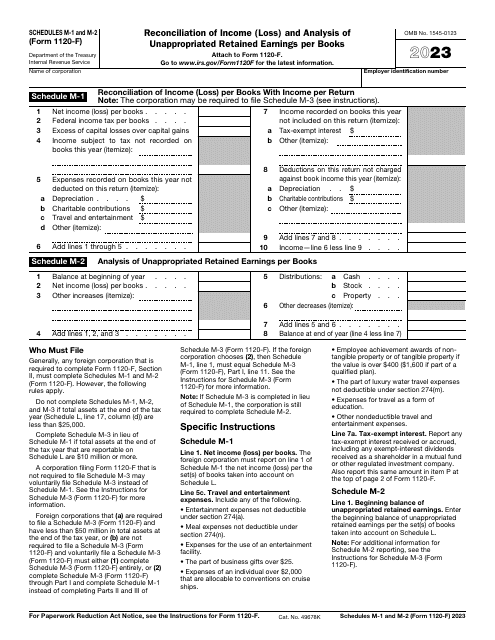

File this form if you are a foreign corporation and maintain an office within the United States in order to report your income, deductions, and credits to the Internal Revenue Service (IRS), as well as to figure your U.S. income tax liability.

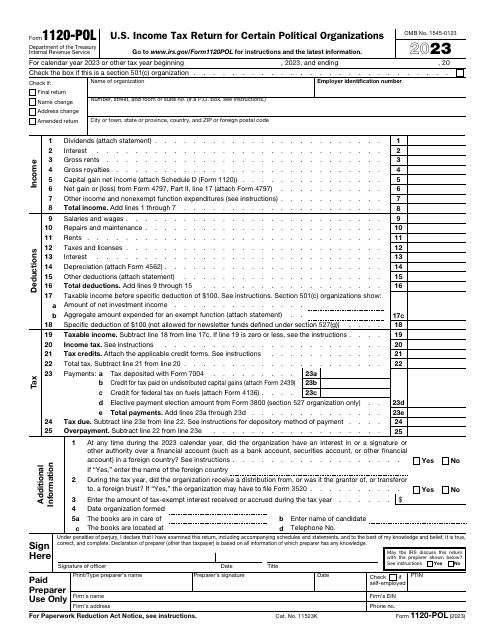

Use this form to inform the Internal Revenue Service (IRS) about the taxable income of your political organization, as well as about your tax liability according to Section 527.

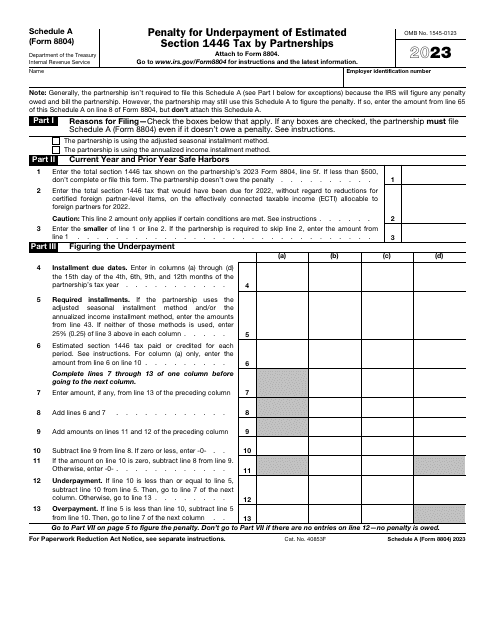

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

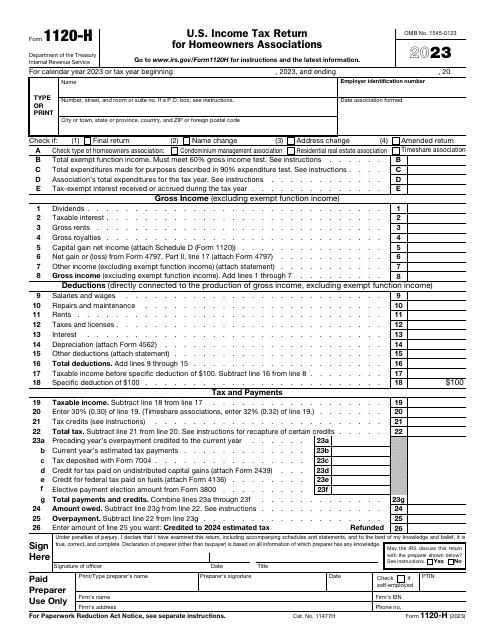

Fill out this form if you represent a homeowner's association in order to make use of certain tax benefits. That means, that the association can exclude the Exempt Function Income from its gross income.

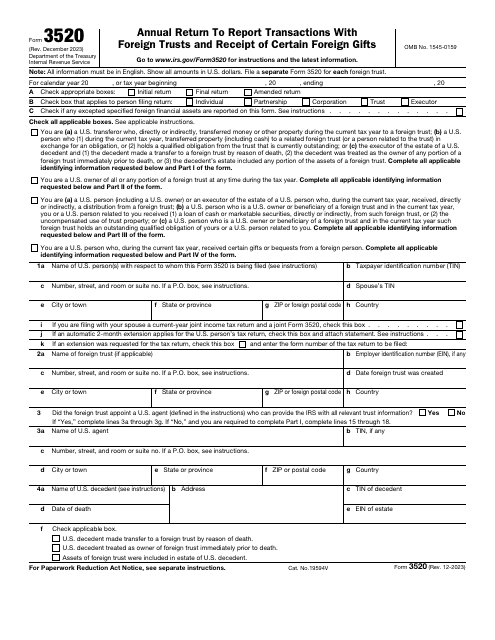

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

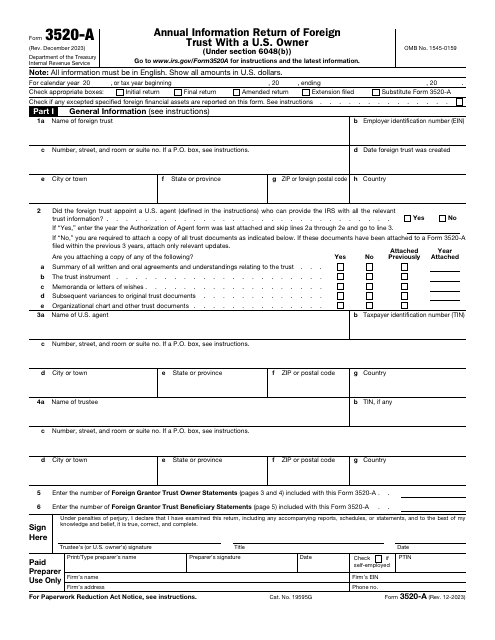

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

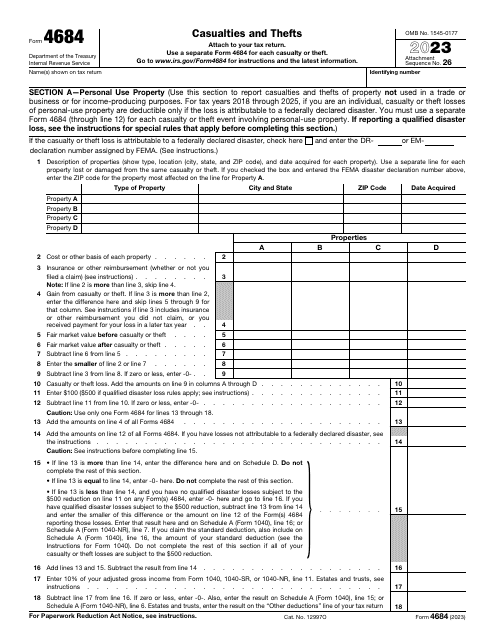

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

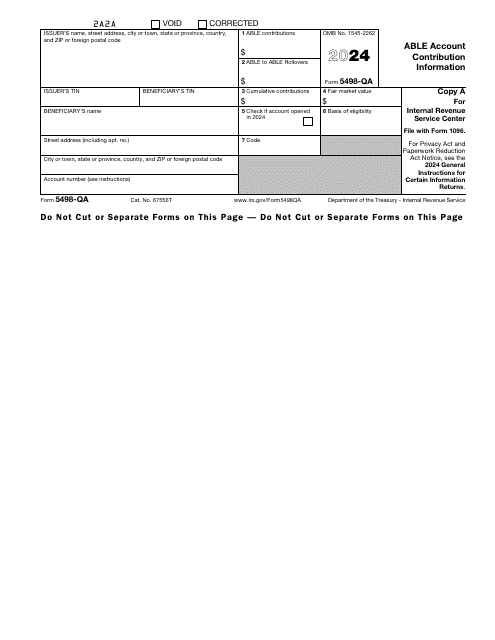

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

This is an IRS form that includes the details of an installment sale.

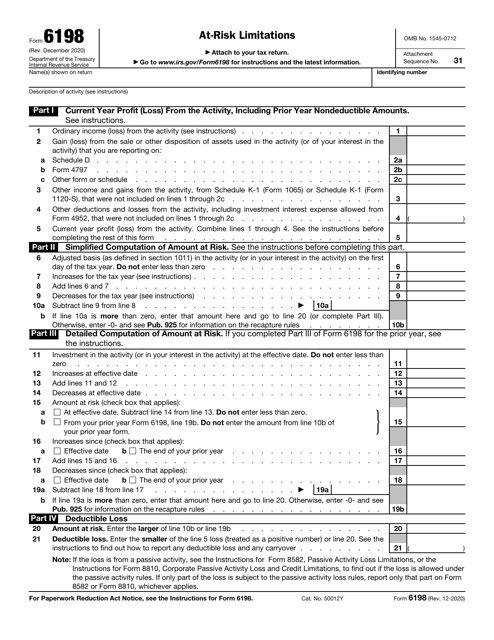

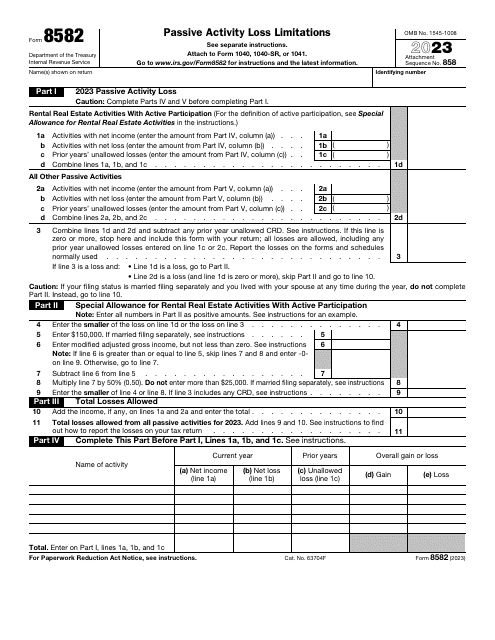

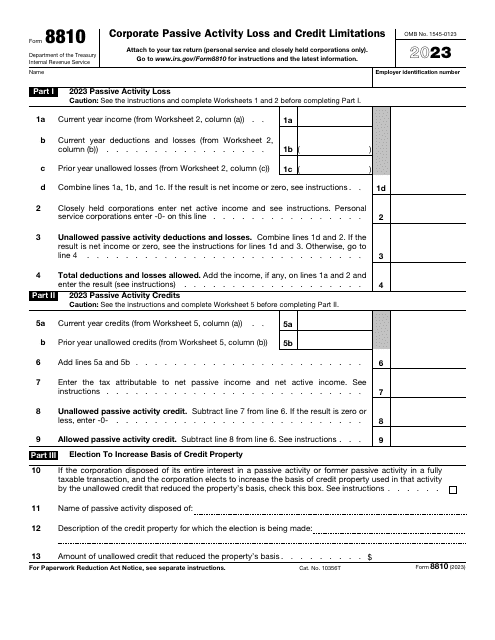

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

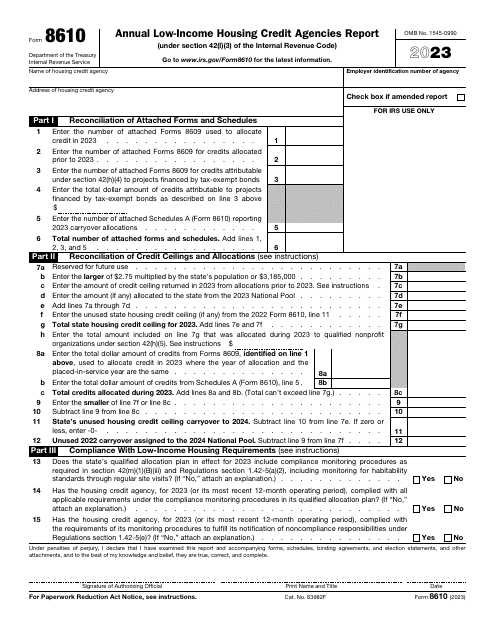

This is a formal IRS statement a housing credit agency is supposed to complete to inform the fiscal authorities about the total amount of housing credits their entity has allocated during the twelve months outlined in the form.

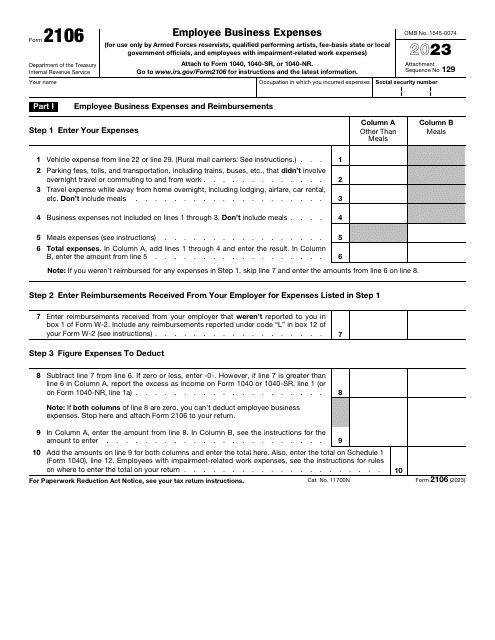

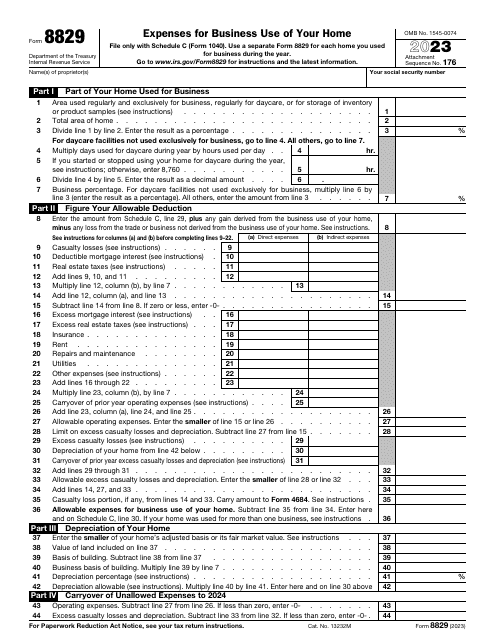

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.