Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

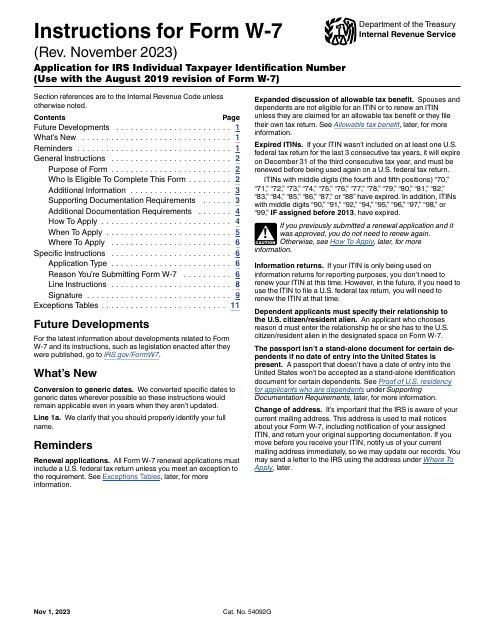

These are the IRS-issued Instructions for the IRS Form W-7, Application for IRS Individual Taxpayer Identification Number - also known as the individual tax identification number application.

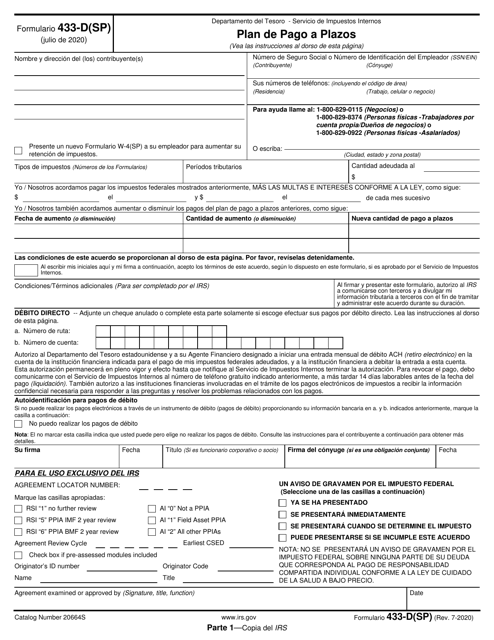

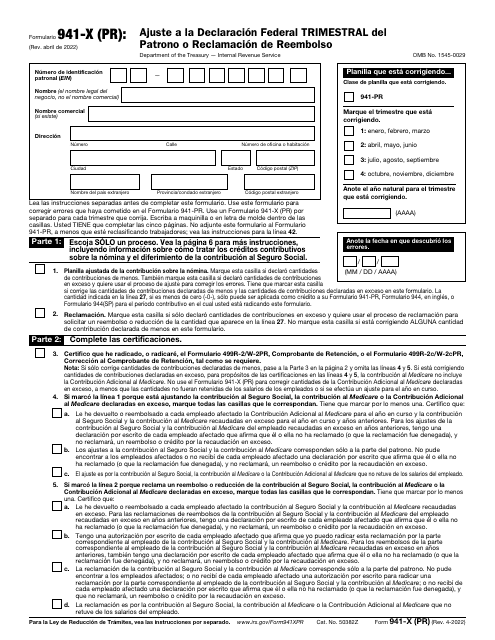

This Form is used for creating a payment plan with the IRS for Spanish-speaking individuals.

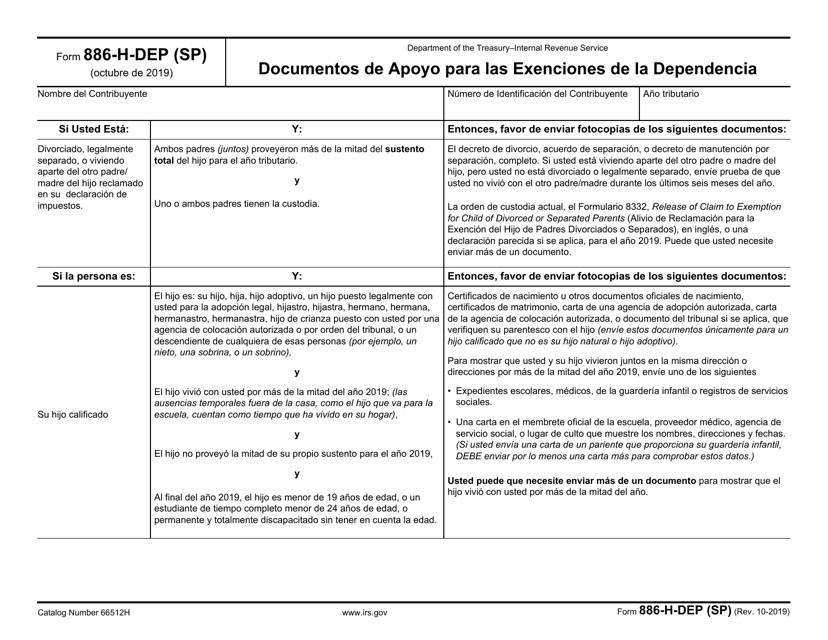

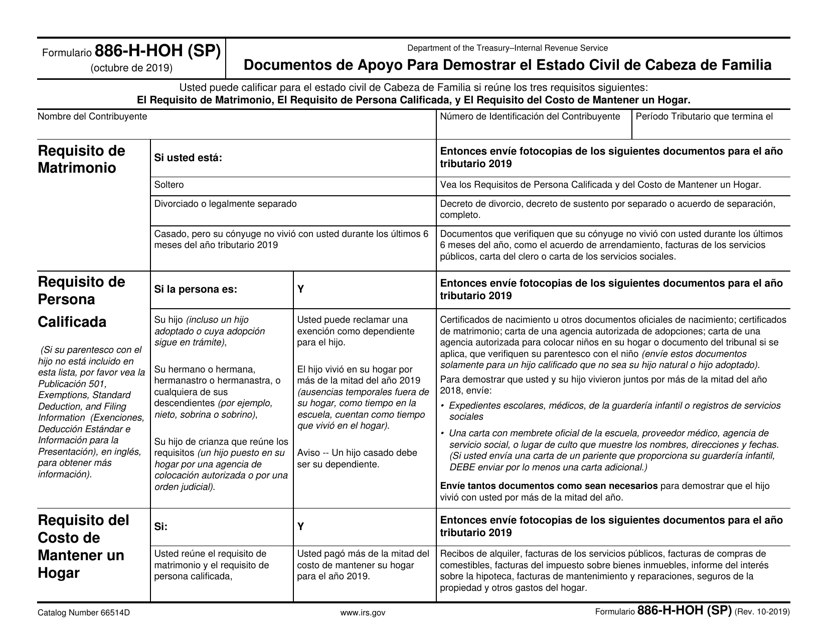

This document provides supporting documentation for dependency exemptions for taxpayers.

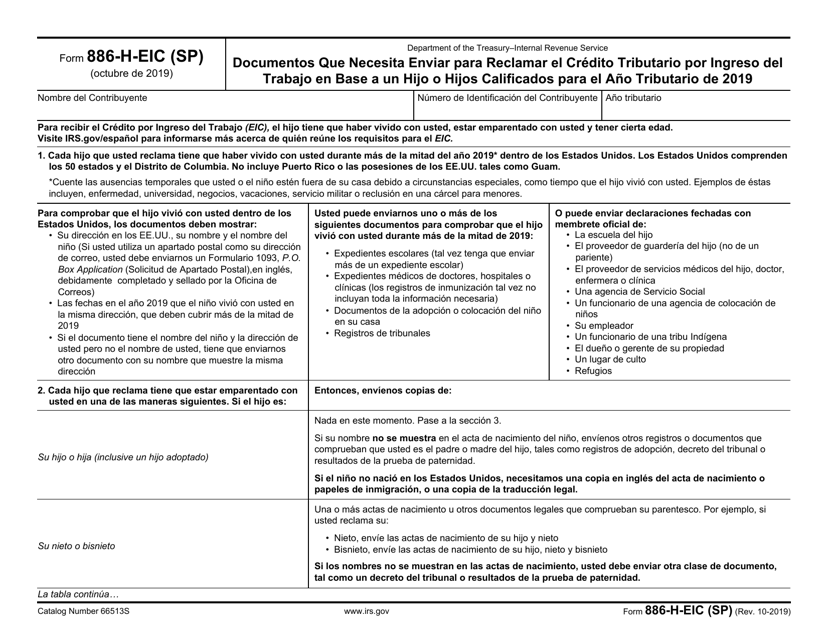

This document is for Spanish-speaking individuals who need to submit documents to claim the Earned Income Tax Credit based on a qualified child or children.

This form is also known as the healthcare marketplace tax form. It is used to inform the IRS about individuals and families enrolled in a health plan via the Health Insurance Marketplace.

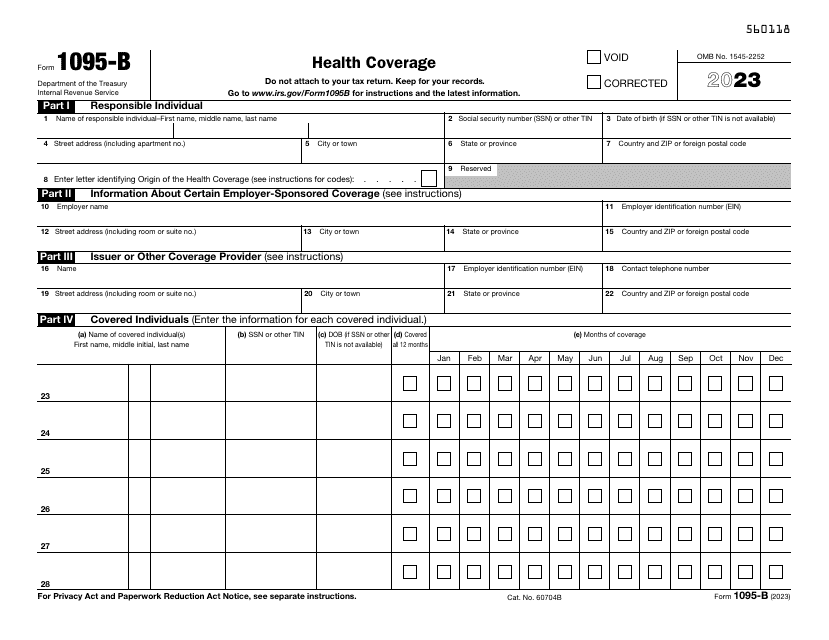

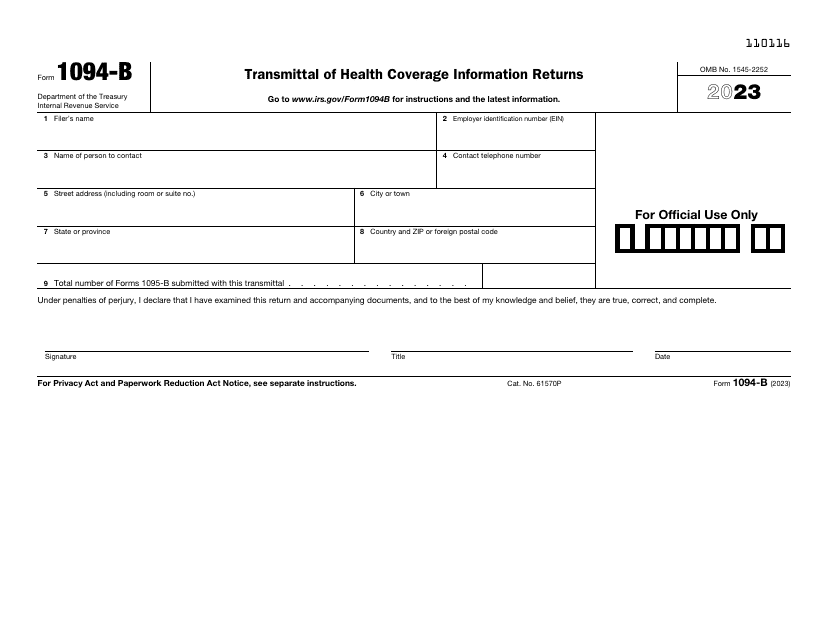

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

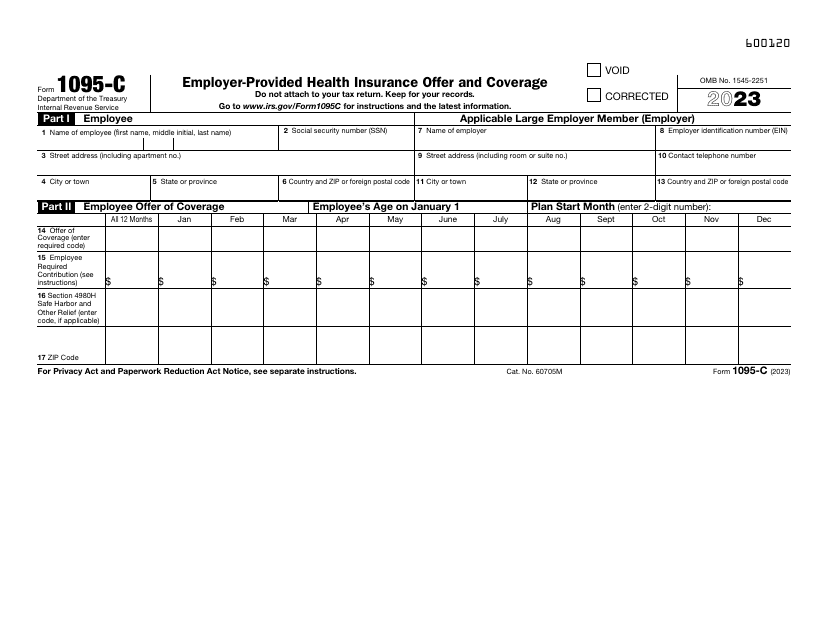

This form is filed by employers with 50 or more full-time employees in order to provide information about their enrollment in health coverage required under sections 6055 and 6056 of the Internal Revenue Code.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

Use this form if you are an insurance provider and wish to inform the IRS about taxpayers who are eligible to receive minimum essential health coverage that meet the standards of the Affordable Care Act.

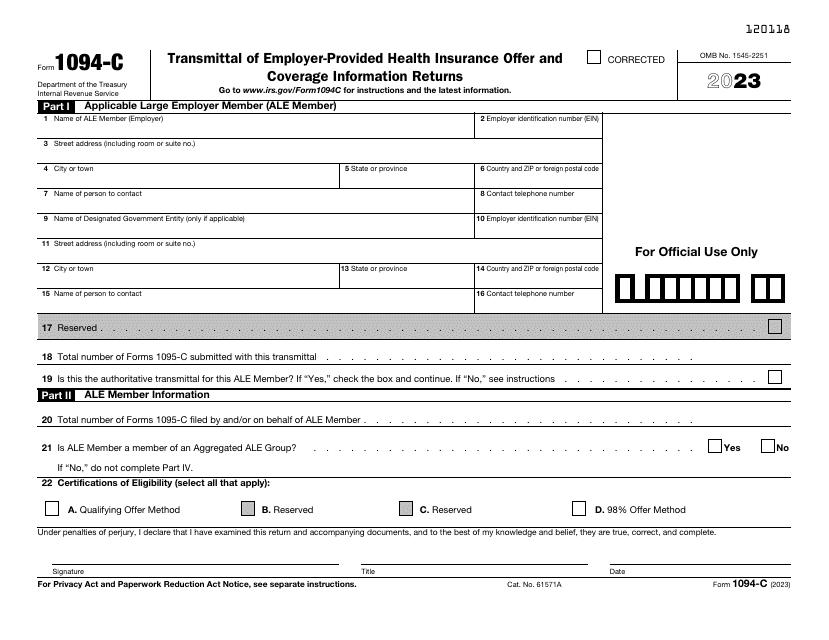

Download these cover sheets in order to report a summary about the Applicable Large Employer (ALE) and to transmit Form 1095-C, Employer-Provided Health Insurance Offer and Coverage to the Internal Revenue Service (IRS).

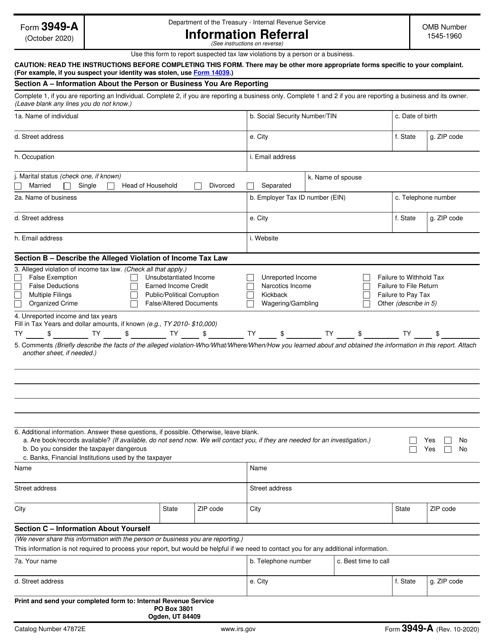

This is a fiscal IRS form any individual is free to use to report an alleged tax violation.

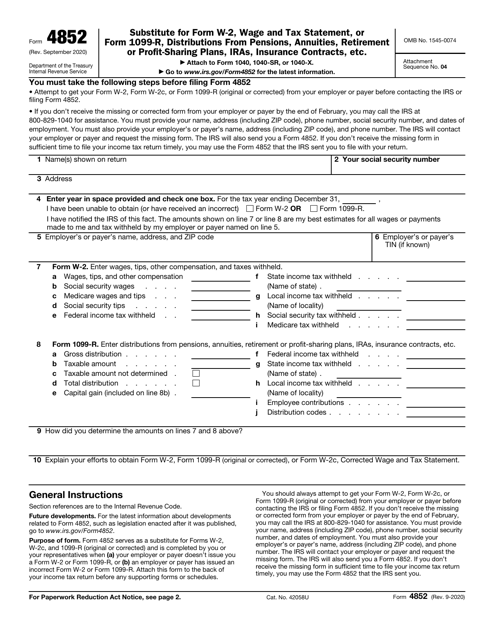

This is a formal statement taxpayers should use to report their income correctly in case they did not receive the main documentation they are expected to file.

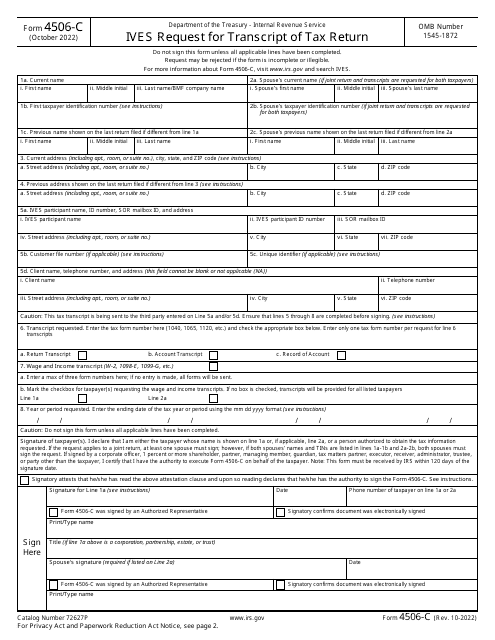

This is a legally binding form prepared by borrowers (individuals and companies alike) that are willing to provide their lenders with their tax return information coming from the tax authorities.

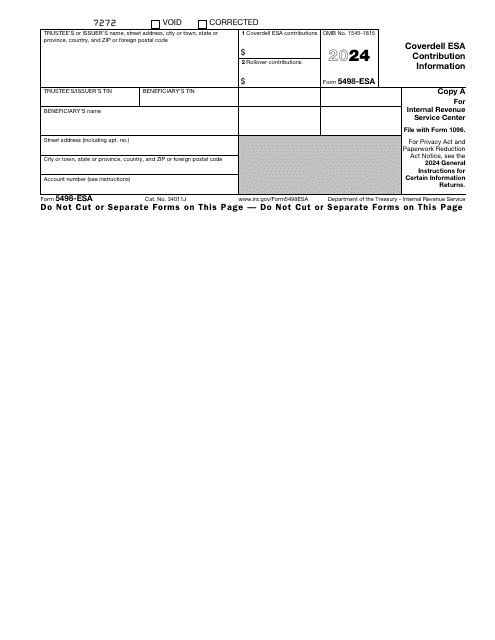

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

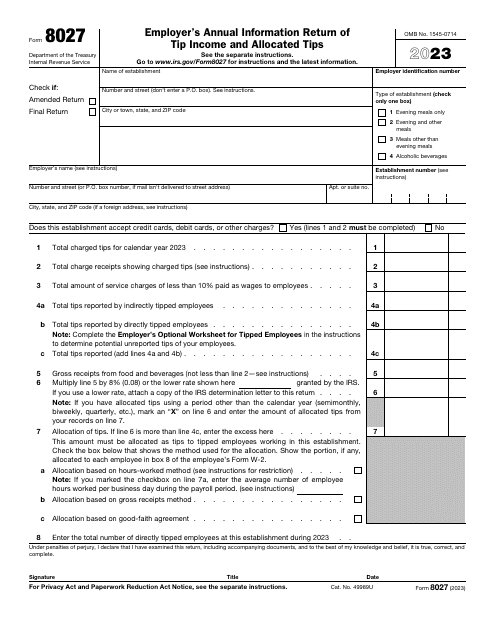

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

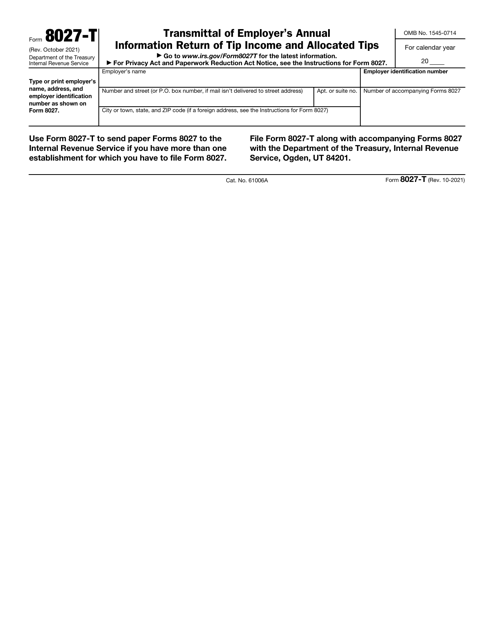

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

Download this supplemental form if you are an employer who owns one or more food or beverage establishments and wishes to submit Form 8027 in a paper format.