Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

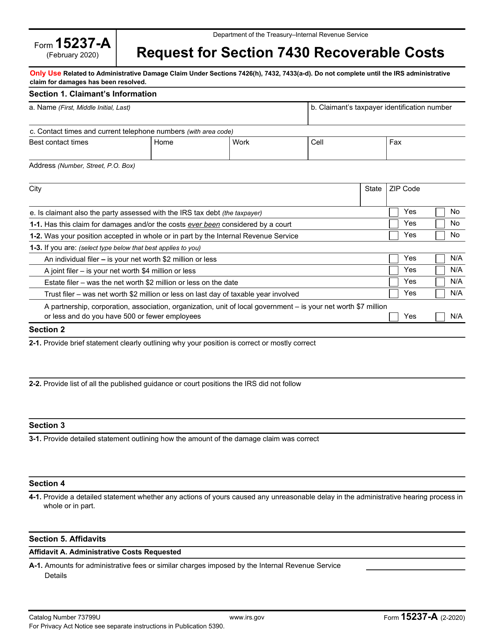

This form is used for requesting recoverable costs under Section 7430 from the Internal Revenue Service (IRS).

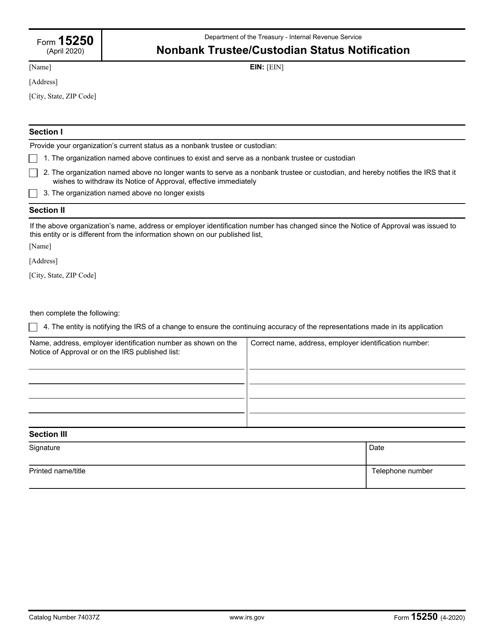

This document is used to notify the IRS about the status of a nonbank trustee or custodian.

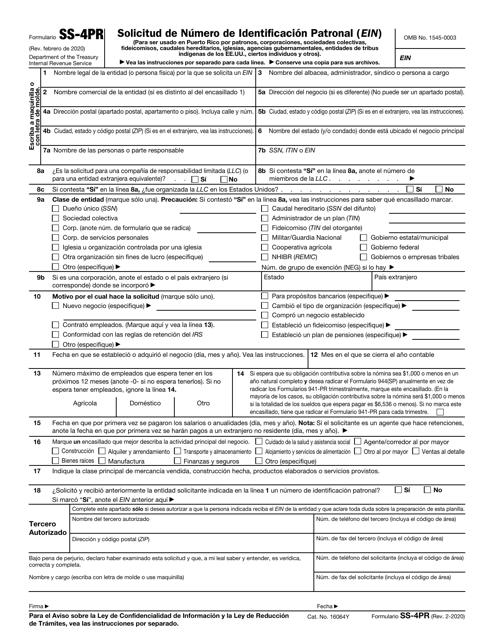

This Form is used for applying for an Employer Identification Number (EIN) for businesses located in Puerto Rico. It is written in Spanish.

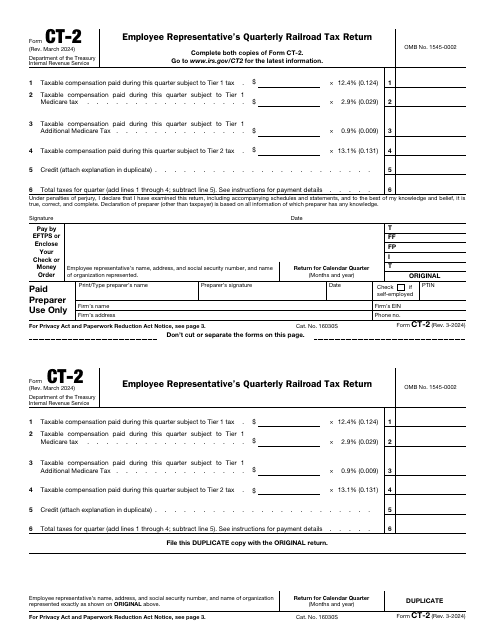

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

This Form is used for employees to provide their withholding information to their employer. It helps determine the amount of federal income tax to be withheld from their paycheck.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

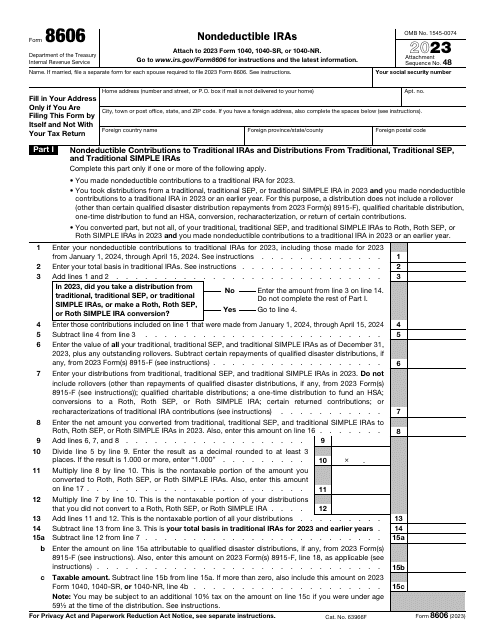

The purpose of this form is to provide the IRS with information on taxpayers who make nondeductible contributions to their Individual Retirement Account (IRA).

This Form is used for reporting and paying the heavy vehicle use tax in Spanish. It is specifically designed for Spanish-speaking individuals or businesses who operate heavy vehicles on US highways.

These are the official instructions for IRS Form 8802 and is used to help certify an applicant's United States residency.

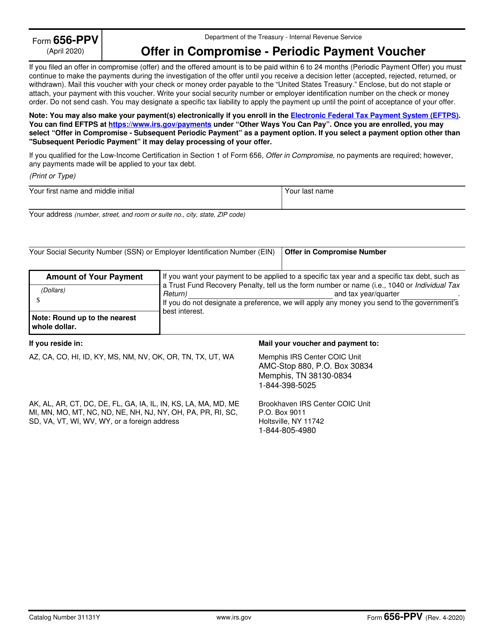

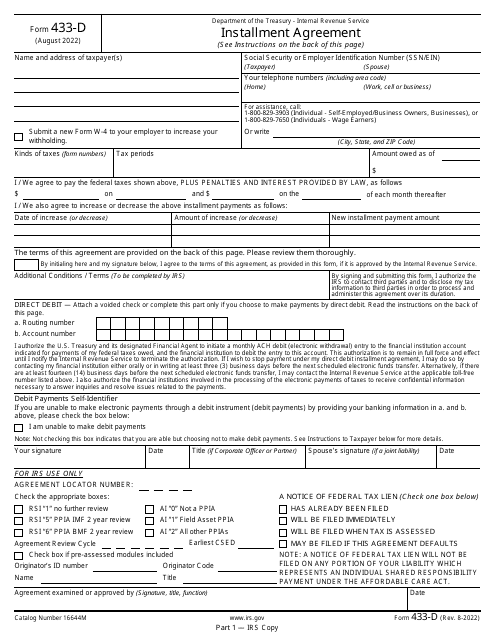

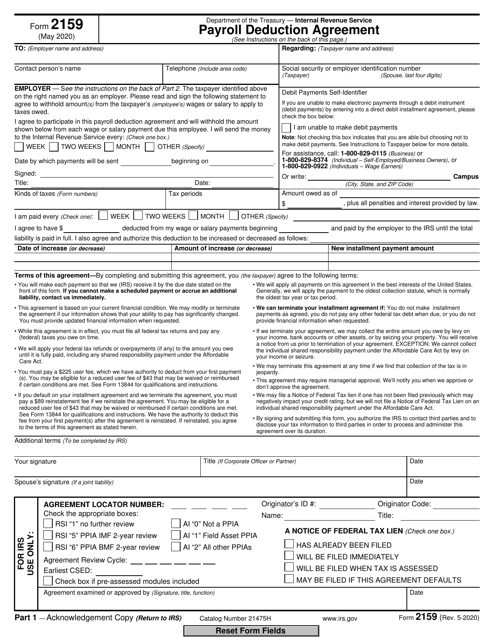

This is a fiscal form used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

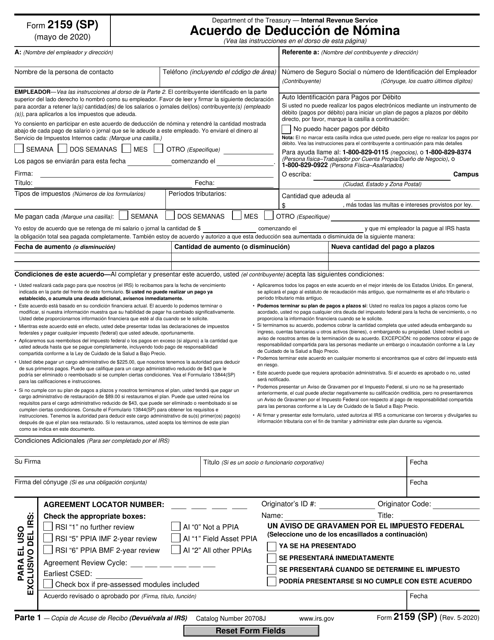

This Form is used for Spanish-speaking taxpayers to agree to a payroll deduction agreement.

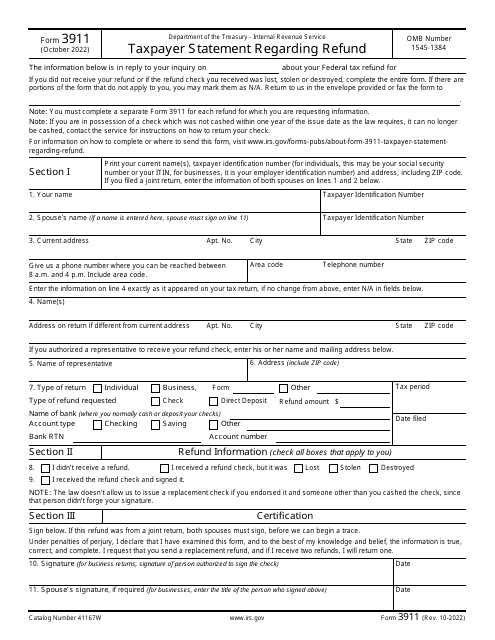

This is an IRS legal document completed by individuals who want to inquire about the status of an expected tax refund.

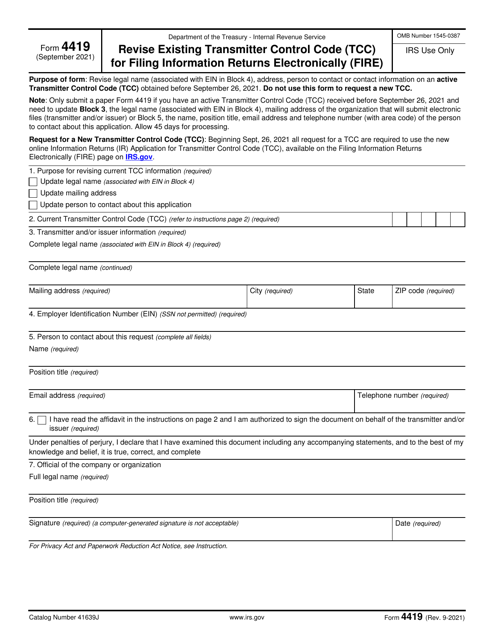

This is a formal IRS statement prepared and submitted by taxpayers that have active Transmitter Control Codes.