Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

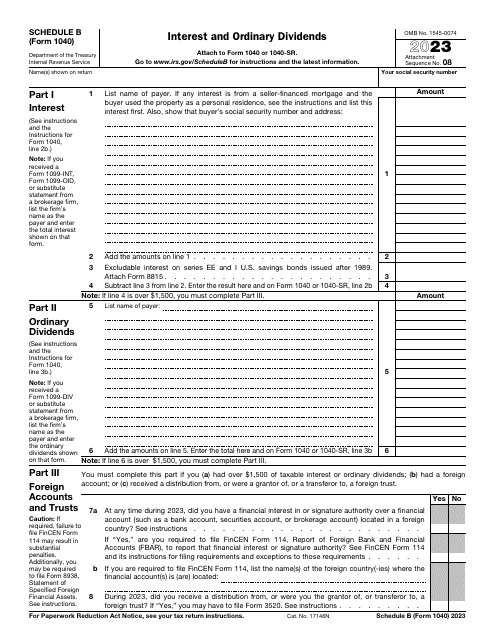

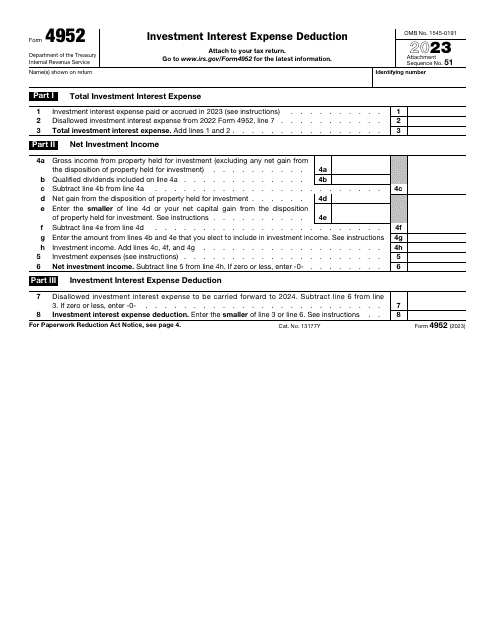

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

This is a formal IRS document that outlines the details of a property foreclosure.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

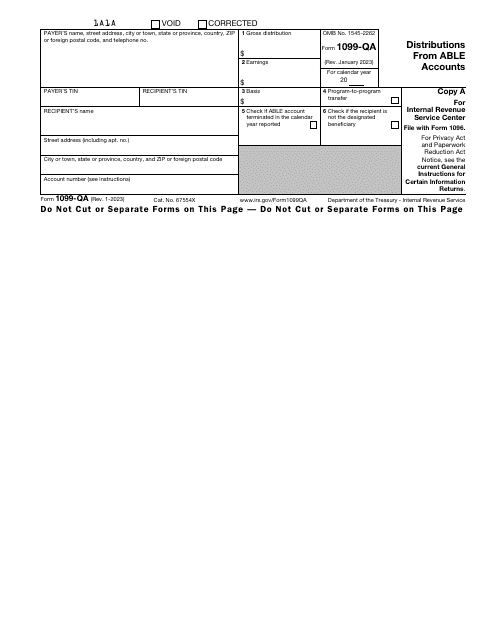

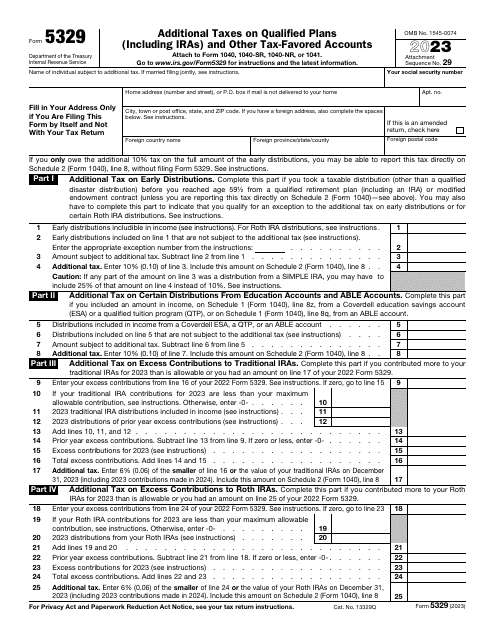

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

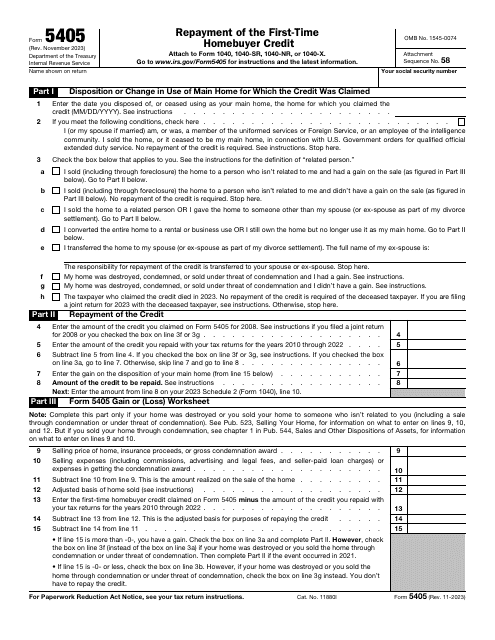

This is a fiscal instrument used by taxpayers who are responsible for computing and repaying the credit they used to purchase residential property in the past.

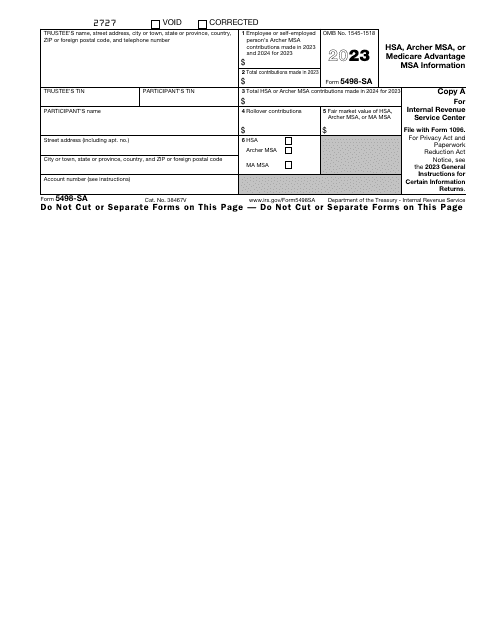

This is a formal document used by particular healthcare-related savings account custodians and trustees to furnish information about the contributions made to those accounts.

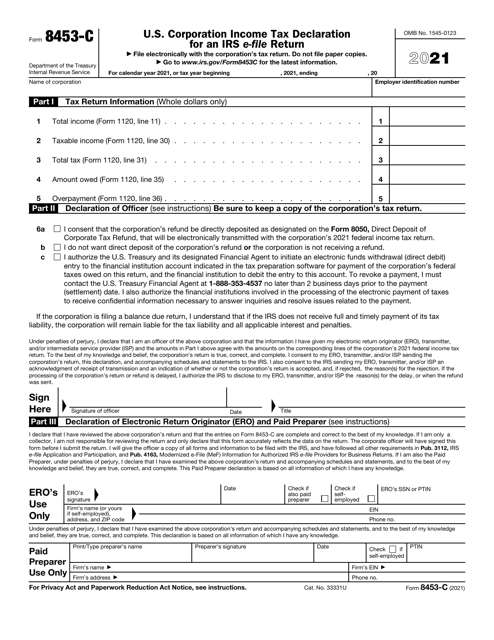

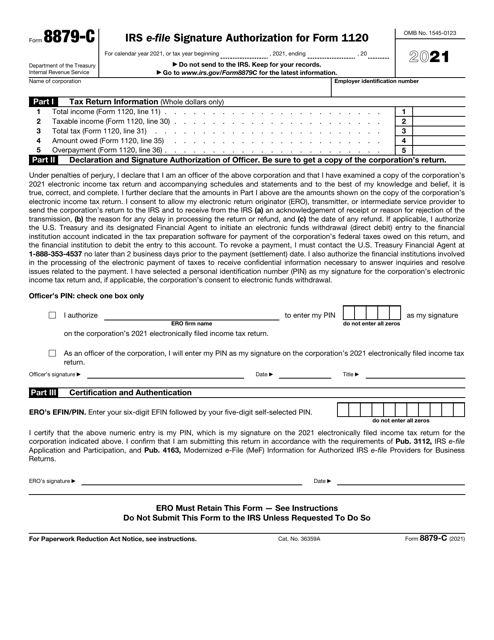

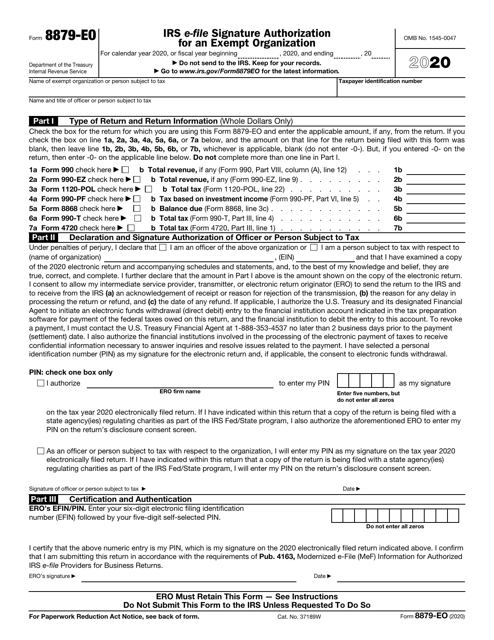

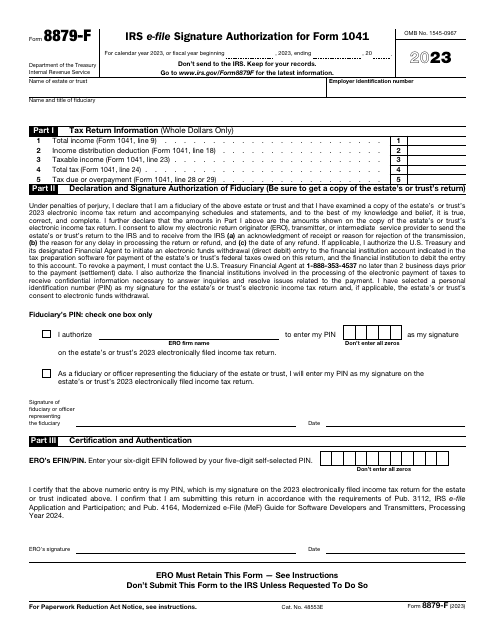

This is a fiscal document corporations use to create personal identification numbers in order to let electronic return originators sign tax returns on their behalf.

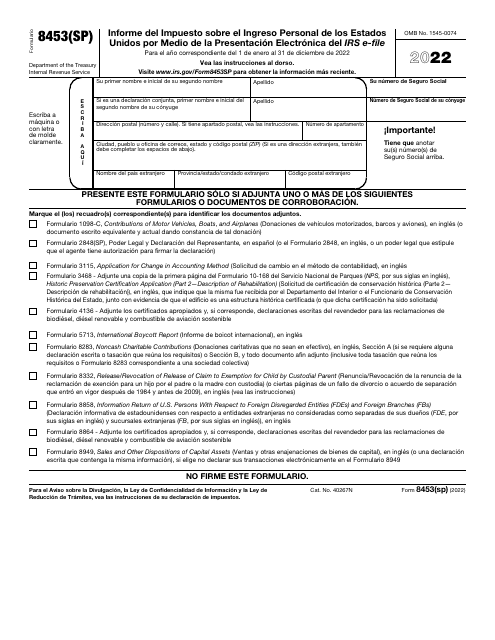

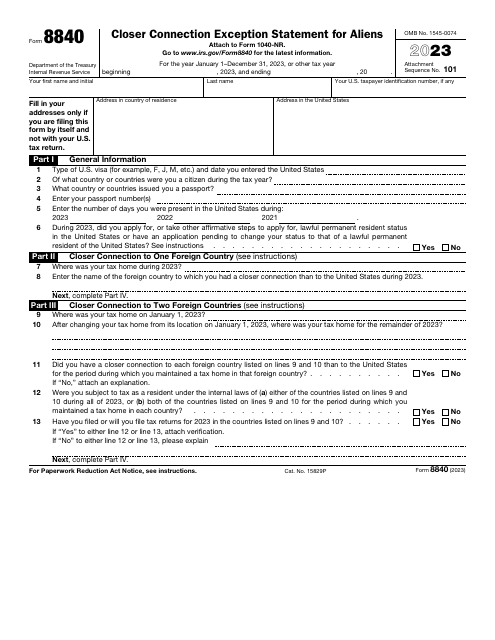

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.