Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

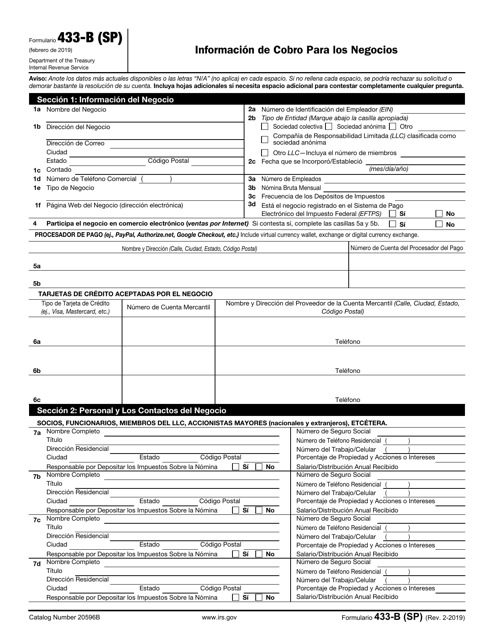

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

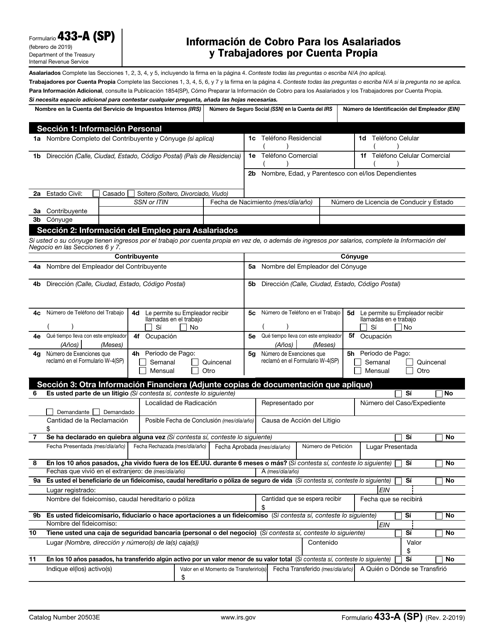

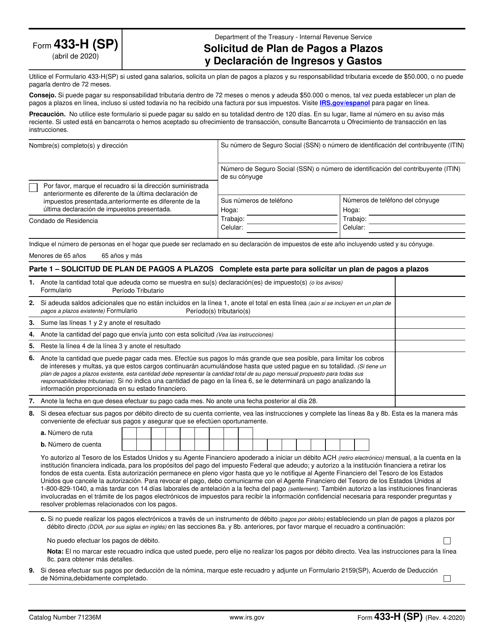

Formulario 433-A (SP) Informacion De Cobro Para Los Asalariados Y Los Individuos Autonomos (Spanish)

This document is a form used for gathering payment information from employees and self-employed individuals.

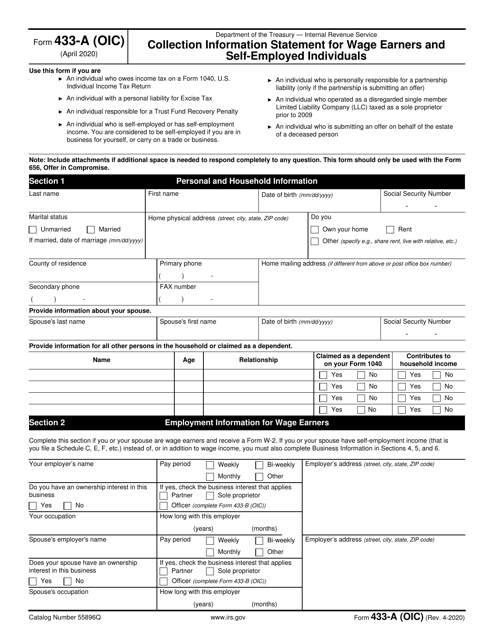

This Form is used for individuals who owe taxes to provide detailed financial information to the IRS in order to request an offer in compromise (OIC) and settle their tax debt.

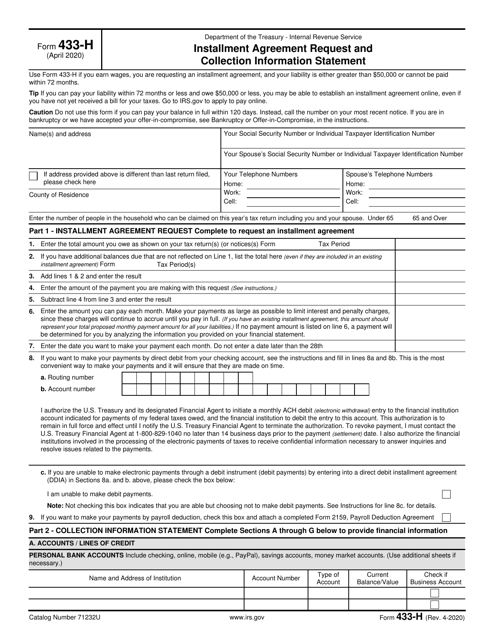

This is a formal IRS statement used by taxpayers to ask the fiscal authorities to let them pay off their tax debts in monthly payments.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

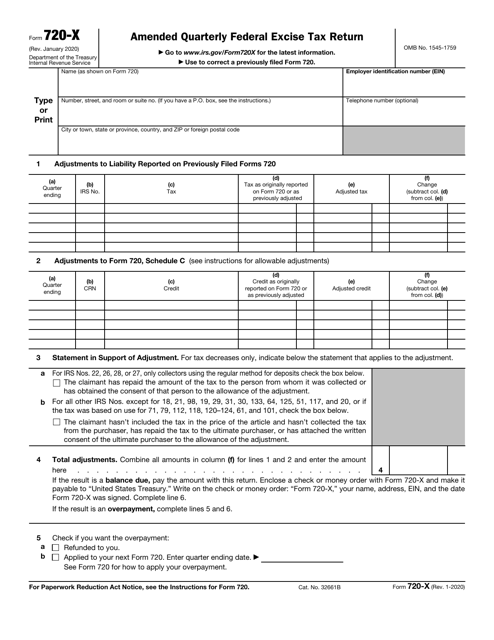

This is a supplementary document taxpayers are expected to use to modify the initial version of the return they submitted to report the excise tax they owe to the fiscal authorities.

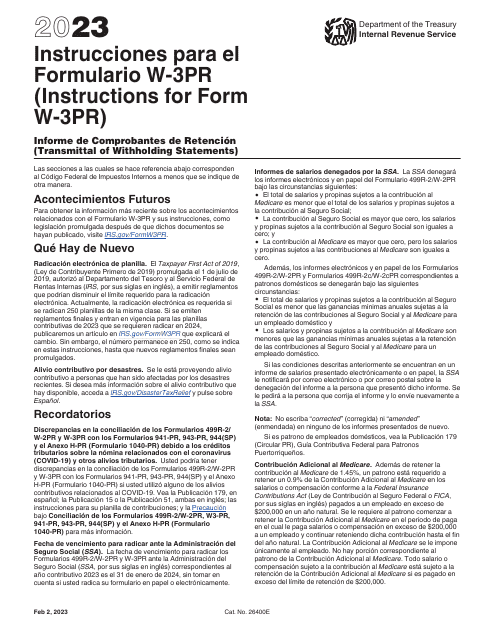

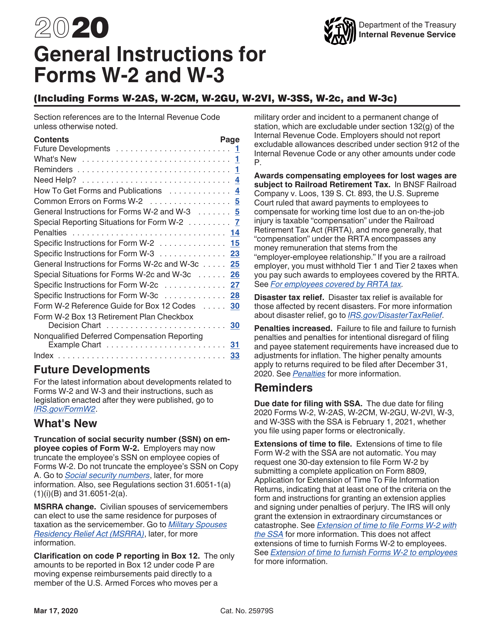

This type of document is used for reporting wages and taxes withheld for employees. It is required by the Internal Revenue Service (IRS) for employers to file annually. The different variations of the form (W-2, W-3, W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2C, W-3C) correspond to specific circumstances and requirements.

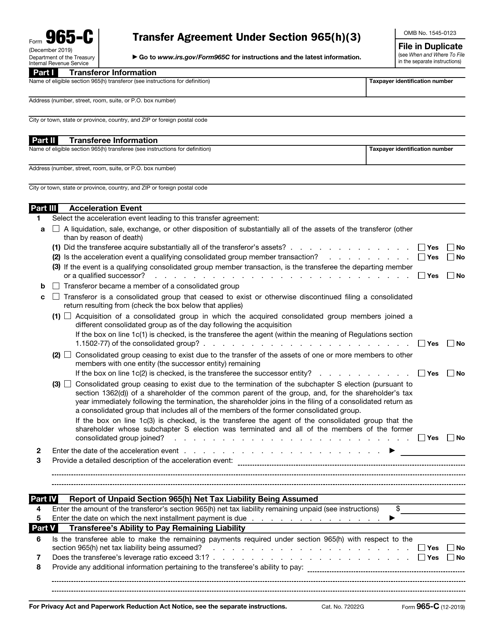

This Form is used for transferring agreements under Section 965(H)(3) of the Internal Revenue Code.

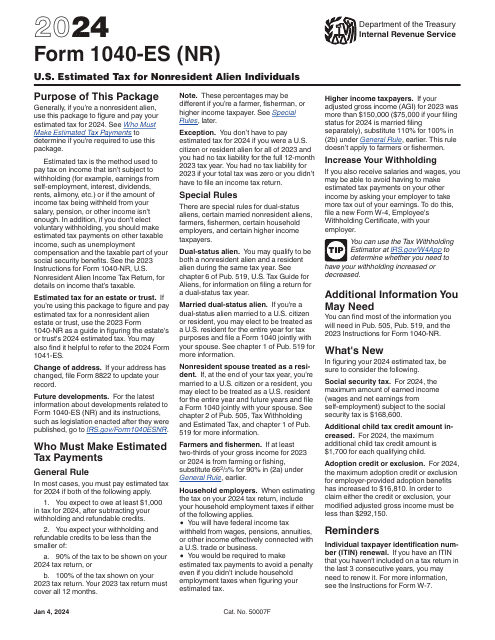

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

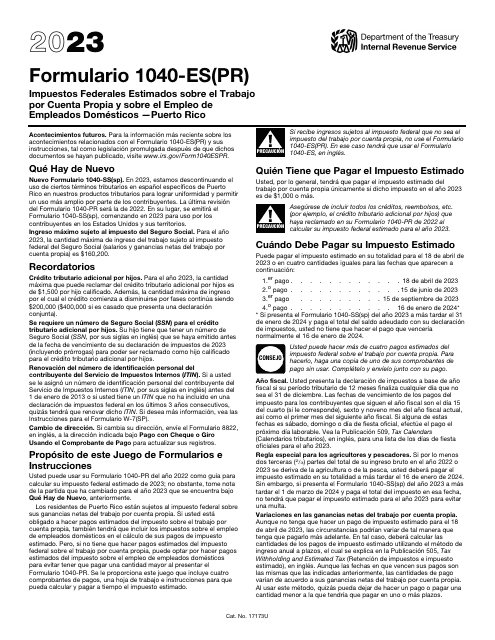

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

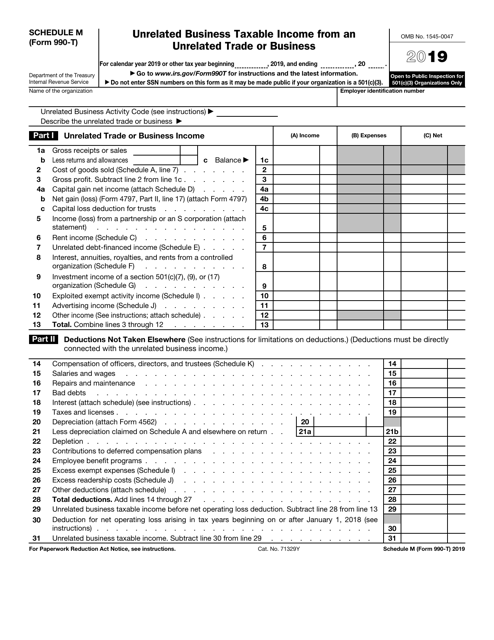

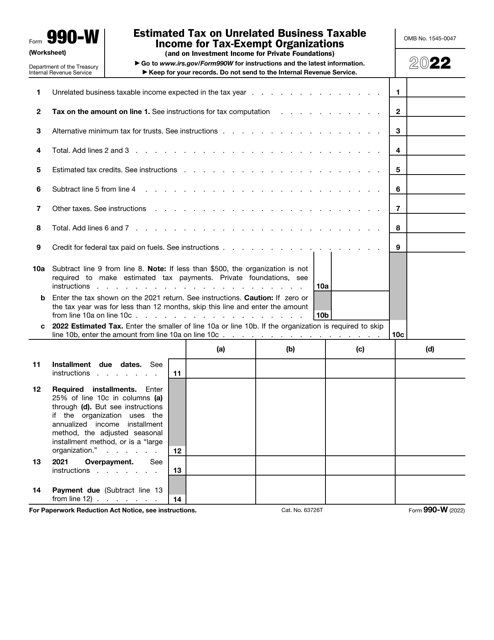

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

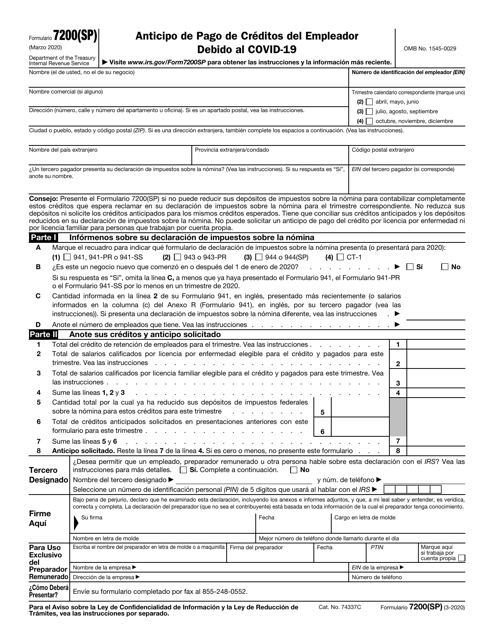

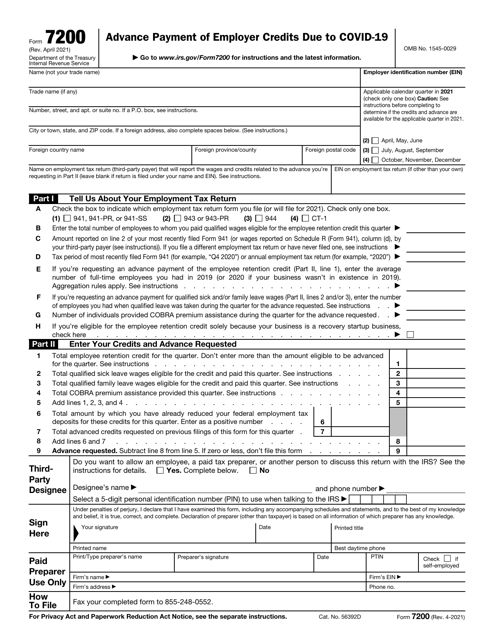

This Form is used for requesting an advance payment of employer credits due to Covid-19.