Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

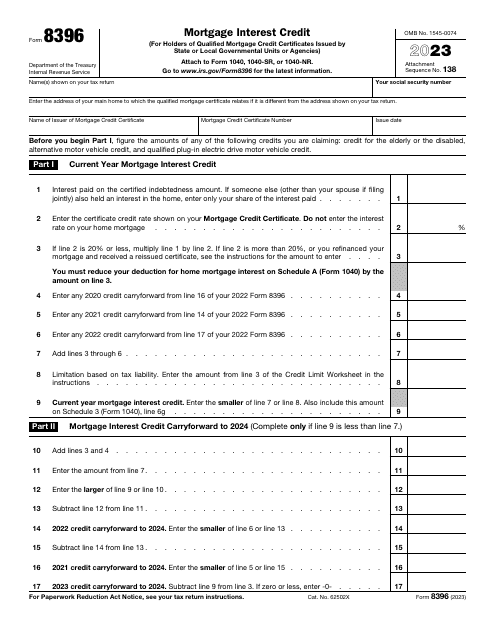

This is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.

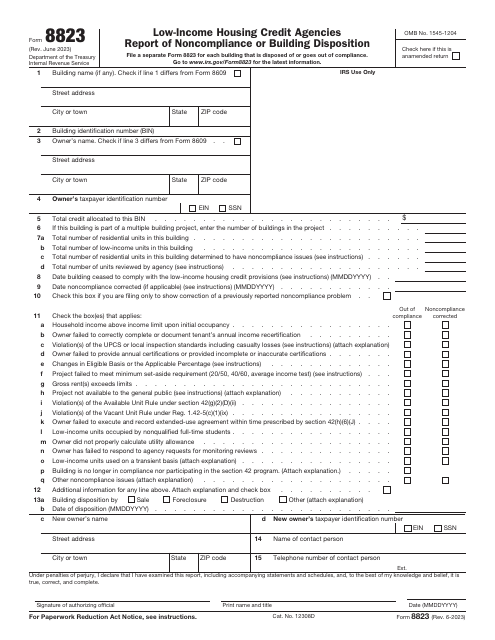

This is a formal document a housing credit agency is supposed to use to inform the tax authorities about certain noncompliance issues discovered during the inspection of a building and its units or specific instances of building disposition

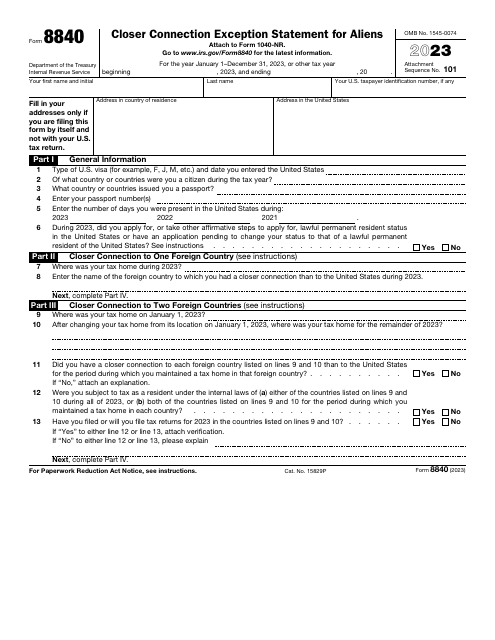

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

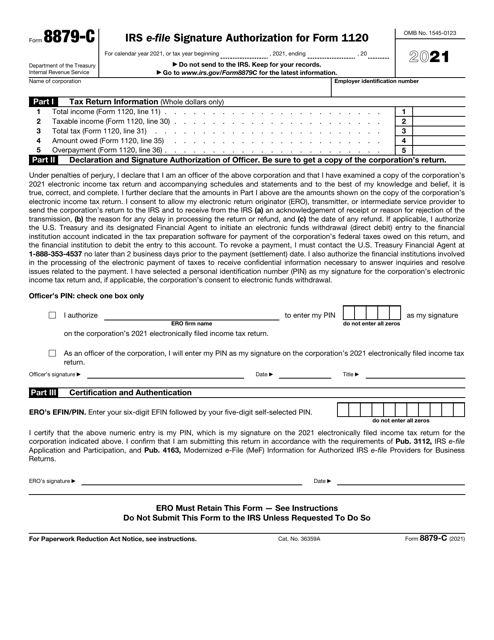

This is a fiscal document corporations use to create personal identification numbers in order to let electronic return originators sign tax returns on their behalf.

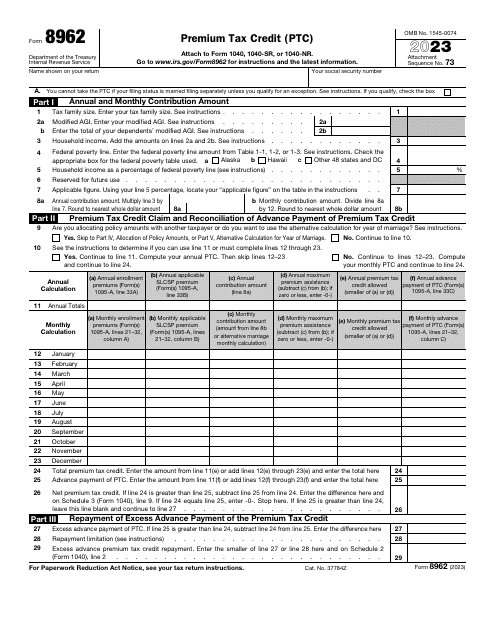

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.

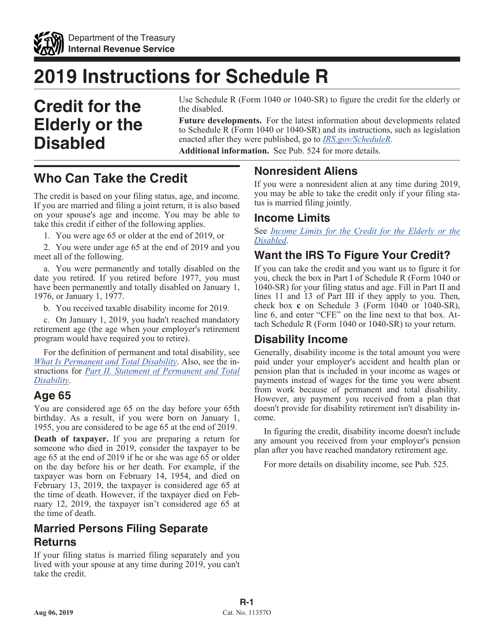

This type of document provides instructions for IRS Form 1040 and 1040-SR regarding the Credit for the Elderly or the Disabled. It contains important information on how to claim this tax credit for eligible individuals who meet specific criteria based on age or disability.

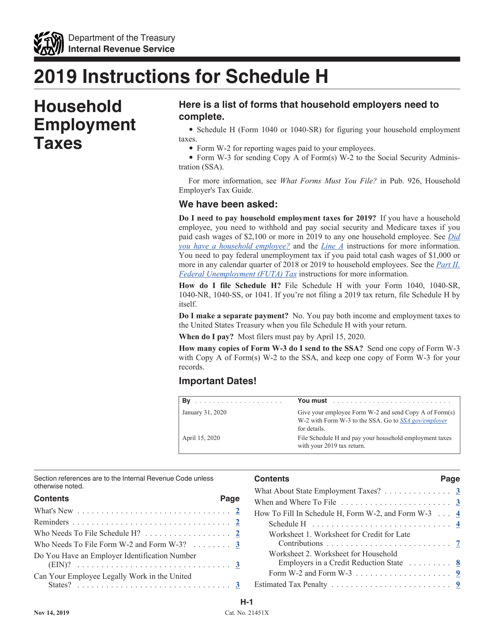

This Form is used for reporting household employment taxes on IRS Form 1040 or 1040-SR Schedule H. It provides instructions on how to calculate and report taxes for individuals who employ household help such as nannies, caretakers, or domestic workers.

This Form is used for reporting contributions of motor vehicles, boats, and airplanes to the IRS. It provides instructions on how to properly report the donation for tax purposes.