Small Business Tax Deductions: Tax Relief for Small Business Owners

How Tax Deductions Work for Small Business

A tax deduction is an expense that you can write off from your taxable income. The expense you write off has to fit the Internal Revenue Service (IRS) guidelines These write-offs essentially allow you to pay a smaller annual tax.

Check out the list below for a comprehensive list of available tax deduction categories for small business owners.

What Can Small Business Claim as Tax Deductions?

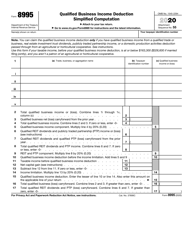

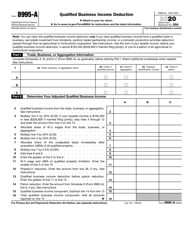

- Income Deduction for Qualifying Small Businesses

The new 2018 tax law changed how tax deductions work for owners of small businesses. Under the new guidelines, small businesses organized as sole proprietorships, LLCs, S-corporations or partnerships will be able to deduct 20% of their income on their taxes if profits were less then $157,500 for the previous year. Almost all small businesses qualify for this small business tax deduction except for three specific instances:

- C corporations;

- Individuals performing services as an employee;

- Specified-services trades or businesses (SSTBs).

An SSTB is any business performing services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, investing, and investment management.

Use IRS Form 8995 or IRS Form 8995-A to figure out if you’re qualified for a business income deduction.

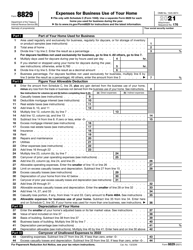

- Home Office Small Business Tax Deduction

Filing taxes for a home-based business? You may be able to save money on your taxes if you meet certain IRS-set requirements and keep accurate accounting records. You may get a refund for rent, utilities, real estate taxes, repairs, maintenance, and other similar costs in the case you use part of your home for business activities exclusively and regularly, meaning family and guests do not use this room.

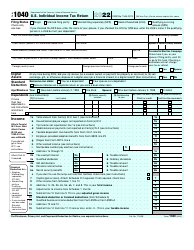

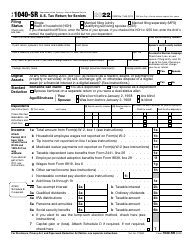

You can use IRS Form 8829, Expenses for Business Use of Your Home, to figure the expenses you can deduct. You can claim your deduction through form Schedule C, Profit or Loss From Business. It is part of the individual income tax return (IRS Form 1040 and 1040-SR) that's used to report the income of the at-home business for the tax year, as well as deductible expenses.

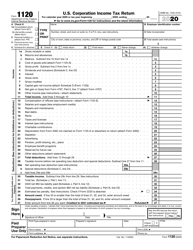

- Deducting Rental Costs

If you rent the space you use to run your business, the rental expenses are fully deductible on your business income taxes:

- Sole proprietors typically file all income taxes together on IRS Form 1040, specifically - in the "Expenses" section of Schedule C, Profit or Loss From Business;

- Partnerships or LLC Partnerships can write off rental expenses in the "Deductions" section on IRS Form 1065. Calculate your total income or loss and transfer this amount to the line labeled "Rental Real Estate, Royalties, Partnership, S Corporations or Trusts" on Form 1040;

- Corporations or LLC Corporations must enter the amount of rent paid in the "Deductions" section of IRS Form 1120;

- S corporations file a tax return as an entity: enter the amount of your rental expense in the "Deductions" section of IRS Form 1120-S.

- Deducting Advertising and Marketing Expenses

Small businesses can deduct advertising costs on their small business tax returns. The form you use to claim deduction depends on your business entity:

- Sole proprietorships and one-member LLCs record these expenses on Line 8 of Schedule C (IRS Form 1040);

- Partnerships and LLC Partnerships deduct advertising expenses via IRS Form 1065 (Line 20);

- Corporations or LLCs must enter the amounts on Line 22 of IRS Form 1120;

- S corporations report advertising and marketing expenses on Line 16 of IRS Form 1120-S.

- Business Use of Cars

A “Business vehicle” refers to any car, SUV, or pickup truck that is used in your day-to-day business activities. There are several exceptions to this rule: the costs associated with vehicles that are used as equipment (like dump trucks or bulldozers) and vehicles used for hire (like taxi cabs) cannot be written off.

Here’s what costs you can deduct:

- Oil and gas costs.

- Maintenance and repairs (including money paid for renting a garage).

- Registration fees.

- Licenses.

- Vehicle loan interest.

- Insurance.

- Rental or lease payments.

- Depreciation.

- Tolls and parking fees.

These expenses related to business use of vehicles are typically written off on IRS Form 1040 or 1040-SR.

- Salaries and Perks

Any compensation you pay to your employees - from salaries and bonuses to retirement plan contributions and education assistance - is considered a tax-deductible expense for your business. Here’s a list of what you can deduct on your annual return:

- Health plans (Affordable Care Act Plans);

- Life insurance coverage;

- Dependent care assistance;

- Cafeteria plans;

- Gifts;

- Bonuses;

- Education assistance.

When deducting employee benefits, the form you use and how you record these expenses will depend on the type of small business you have:

Sole proprietors record these expenses in the "Expenses" section of Schedule C (Form 1040);

Partnerships and multiple-member LLCs record these expenses in the "Deductions" section of Form 1065;

Corporations (C corporations and S corporations) show these expenses in the "Deductions" section of Form 1120.

Not the topic you were looking for? Check out these related articles:

- Research the types of small business debt relief are available to U.S. companies;

- Find out how to convert personal property to business use;

- Learn more about 2020 business tax deadlines.