2019 Tax Return Due Dates for Business Owners

Having your tax year planned out will save you plenty of awkward moments. Tax deadlines are set for every specific situation, whether you are a business entity, a foreign investor or a corporation owner. A corporation tax deadline may be set differently than the general tax deadline and your last day to file taxes may surprise you. The due dates for paper forms will also widely differ from their electronic versions and IRS extensions may be granted only once.

Looking to map out a personal business tax schedule? Spare yourself the hassle of a last-minute filing - get on track now and have all your documents in place.

What Is Business Tax?

The term business tax is self-explanatory: it is a tax on business income. There are five major types of business taxes:

- Corporate franchise tax.

- Employment (withholding) tax.

- Excise tax.

- Gross-receipts tax.

- Value-added tax (VAT).

The form you use to file your income tax depends on the type of your business. In any case, you are expected to pay taxes as you receive income throughout the year. If you do not have your tax withheld from your pay, you may have to pay estimated tax, otherwise, pay any tax when you file your return. All businesses except partnerships must file an annual income tax return. Partnerships file an information return.

When Are Business Taxes Due?

All of the filing dates and forms below are sorted by quarter. Click on the forms you need to find out more about specific rules and applicable filing penalties set by the IRS.

First Quarter Tax Payments - January, February, and March

January 31, 2019 - Give an annual information statement to the recipients of certain payments you made during 2018 with the appropriate version of Form 1099 . These payments include fish bought from fishermen, compensation paid to non-employees, interest, royalties, rent, and retirement plan distributions among other things.

File Form 1099-MISC for rental income, royalties, Indian gaming profits and nonemployee compensation paid in 2018.

The other forms in the series include the following:

- Form 1099-A , Acquisition or Abandonment of Secured Property.

- Form 1099-C , Cancellation of Debt.

- Form 1099-CAP , Changes in Corporate Control and Capital Structure.

- Form 1099-DIV , Dividends and Distributions.

- Form 1099-G , Certain Government Payments.

- Form 1099-H , Health Coverage Tax Credit (HCTC) Advance Payments.

- Form 1099-INT , Interest Income.

- Form 1099-K , Payment Card and Third Party Network Transactions.

- Form 1099-LS , Reportable Life Insurance Sale.

- Form 1099-OID , Original Issue Discount.

- Form 1099-PATR , Taxable Distributions Received From Cooperatives.

- Form 1099-Q, Payments from Qualified Education Programs (Under Sections 529 and 530).

- Form 1099-QA , Distributions from ABLE Accounts.

- Form 1099-R , Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Form 1099-S , Proceeds from Real Estate Transactions.

- Form 1099-SA , Distributions From an HSA, Archer MSA, or Medicare Advantage MSA.

- Form 1099-SB , Seller's Investment in Life Insurance Contract.

February 15, 2019 – File Form 1099-B to report all proceeds from broker transactions and barter exchanges. Give an annual information statement to the recipients of certain payments you made during 2018 with the appropriate version of Form 1099 or any other information return. These payments include all payments reported on Form 1099-B , Form 1099-S and in Boxes 8 and 14 of Form 1099-MISC .

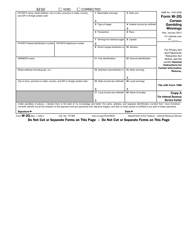

February 28, 2019 – File information returns (including all 1099 Forms except for Form 1099-MISC) along with the accompanying Form 1096 , which is used to summarize and transmit forms for each type of payment

This due date also applies to Forms 1097-BTC, 1098, 3921, 3922, and W-2G if filed on paper.

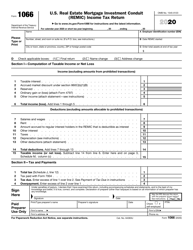

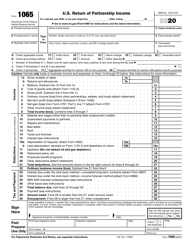

March 15, 2019 – File a 2018 calendar year return via Form 1065 for Partnerships, Form 1120S for S Corporations, Form 1065-B for Electing Large Partnerships or Form 1066 for Real Estate Mortgage Investment Conduits. Form 1065X may be filed to correct information on a previously filed Form 1065, Form 1065-B, or Form 1066.

File Form 7004 to request an automatic 6-month extension of time to file any of the returns above, shifting the date to September 16, 2019.

File Form 2553 to elect to be treated as an S corporation beginning with 2019. S Corporation treatment will start in 2020 if the form is submitted to the IRS after March 15.

Foreign trusts with U.S.-based owners must file Form 3520-A to provide information about the trust and its beneficiaries.

Second Quarter Tax Payments - April, May, and June

April 1, 2019 – This is the due date for the electronic filing of Forms 1097-BTC, 1098, 1099 (except a Form 1099-MISC reporting nonemployee compensation), 3921, 3922, and W-2G

April 15, 2019 – File Form 1041 to report all deductions, income, losses, and gains from the operation of a trust or an estate. File Form 3520 to report certain transactions with foreign trusts or gifts from foreign citizens to the IRS. This is also the 2019 tax day for all individual tax returns.

This due date also applies to Form1120, Form 1120-FSC, Form 1120-H, Form 1120-L, Form 1120-ND , and Form1120-PC. E-file the Foreign Bank and Financial Accounts Report (FBAR) that replaces the now obsolete Form TD F 90-22.1 - FinCEN Report 114 , used to report financial interest in or signature authority over foreign financial accounts.

Corporations must file a 2018 calendar year income tax return via Form1120 and deposit the first of four installments of estimated income tax for 2019. The correct amounts can be estimated using Form 1120-W .

May 15, 2019 – Most nonprofits (excluding all churches and church-related organizations), must file one of the following forms for the previous year:

- Form 990-N , filed by organizations with gross receipts of $50,000 or less, and Form 990-EZ , filed by companies with a gross receipt lower than $200,000 and total assets exceed $500,000, are filed on the IRS website.

- Paper copies of Form 990 and Form 990-PF are filed by companies exempt from income tax and filed by private foundations.

June 17, 2019 – Corporations must estimate their tax for the year with Form 1120-W and deposit the second installment of estimated income tax for 2019. Form 1120-F must be filed by foreign corporations to report their income, gains, losses, deductions, and credits.

Third Quarter - July, August, and September

September 16, 2019 – Extended due dates for Partnerships, S Corporations and Electing large partnerships 2018 income tax returns if the taxpayer filled and submitted Form 7004 by March 15, 2019. The extended Corporation 2018 calendar year income tax return due date per IRS Form 7004 Instructions and the IRS website. This is also the extended deadline for filing FinCEN Report 114 , Foreign Bank and Financial Accounts Report.

Corporations must estimate their tax for the year with Form 1120-W and deposit the third installment of estimated income tax for 2018. Form 1120-IC-DISC must be filed by interest charge domestic international sales corporations.

This is the extended deadline for foreign trusts with a U.S.-based owner to file and submit Form 3520-A .

September 30, 2019 – This is the extended deadline to report all income, gains, losses, deductions, and credits from the operation of a trust or an estate via Form 1041 .

Fourth Quarter - October, November, and December.

November 15, 2019 – Extended deadline given to nonprofit organizations to file any form of the Form 990 Series .

December 16, 2019 – Corporations must estimate their fourth and final installment of estimated income tax for 2018. The amounts are estimated via Form 1120-W .

2019 Payroll Tax Calendar for Employers

Are you an employer? It's crucial to know whether the people who work for you are your employees or self-employed. This affects certain payments and deductions you are legally obligated to make.

Figure out your tax responsibilities and build a simple structured calendar for any applicable tax returns via our tax deadline schedule for employers.