2019 Tax Return Due Dates And Deadlines

The first step towards a successful tax return is to start early so that you have all your documentation in place and avoid paying late fees. The Internal Revenue Service (IRS) confirmed this January that it will process tax returns starting January 28 (or before this date for software companies and tax professionals), so taxpayers may very well get their refunds as scheduled.

Click on the forms below for information on late filing penalties and remember to file electronically to minimize errors and speed up refunds.

When Are Taxes Due in 2019?

The 2019 tax return due date falls on Monday, April 15, 2019, for most taxpayers. Some states have certain exceptions: taxpayers from Maine or Massachusetts have until April 17, 2019, to file their returns, since April 15 is Patriots' Day and April 16 is Emancipation Day.

You can request a six-month extension from the IRS if you need additional time to prepare and file your return. This would shift your filing deadline to October 15, 2019.

When to File 2019 Businesses Taxes?

Form 1099 Series Due Date - January 31 - used to prepare and file an information return to report various types of income other than wages, salaries, and tips.

The series consists of the following forms:

- Form 1099-A , Acquisition or Abandonment of Secured Property.

- Form 1099-C , Cancellation of Debt.

- Form 1099-CAP , Changes in Corporate Control and Capital Structure.

- Form 1099-DIV , Dividends and Distributions.

- Form 1099-G , Certain Government Payments.

- Form 1099-H , Health Coverage Tax Credit (HCTC) Advance Payments.

- Form 1099-INT , Interest Income.

- Form 1099-K , Payment Card and Third Party Network Transactions.

- Form 1099-LS , Reportable Life Insurance Sale.

- Form 1099-OID , Original Issue Discount.

- Form 1099-PATR , Taxable Distributions Received From Cooperatives.

- Form 1099-Q, Payments from Qualified Education Programs (Under Sections 529 and 530).

- Form 1099-QA , Distributions from ABLE Accounts.

- Form 1099-R , Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Form 1099-S , Proceeds from Real Estate Transactions.

- Form 1099-SA , Distributions From an HSA, Archer MSA, or Medicare Advantage MSA.

- Form 1099-SB , Seller's Investment in Life Insurance Contract.

The other two forms in the series - Form 1099-MISC and 1099-B - have separate specific filing deadlines:

- Form 1099-MISC Due Date - January 31 (Extension Date - February 15, if reporting payments in Boxes 8 or 14 and to April 1, if filing electronically) - used to report rental income, royalties, Indian gaming profits, and nonemployee compensation.

- Form 1099-B Due Date - February 15 (Extension Date - April 1, if filing electronically) - used by brokers and barter exchanges to report all proceeds from transactions.

Due Date for Forms 1097-BTC, 1098, 3921, 3922, and W-2G - on paper by February 28, or April 1, if filing electronically.

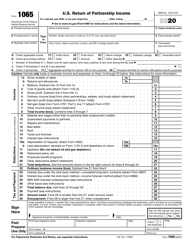

Form 1065 Due Date - March 15 (Extension Date - September 16) - used to report the profits, losses, and deductions of business partnerships.

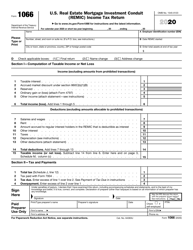

Form 1066 Due Date - March 15 - used by U.S. Real Estate Mortgage Investment Conduits (REMIC) as an income return.

Form 1065-B Due Date - March 15 (Extension Date - September 16) - an information return to report electing large partnerships' income, gains, deductions, and losses.

Form 1065X Due Date - March 15 (Extension Date - September 16) - used to correct information on a previously filed Form 1065, Form 1065-B, or Form 1066.

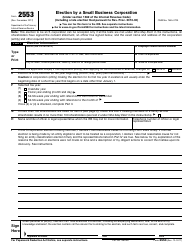

Form 2553 Due Date - March 15 - a necessary step in order to qualify as an S-corporation.

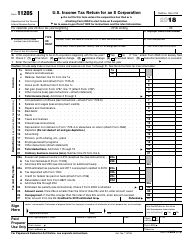

Form 1120S Due Date - March 15 (Extension Date - September 16) - used by corporations that elect to be S corporations to report income, deductions, gains, and losses.

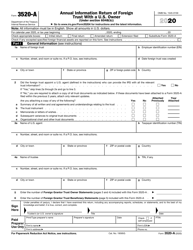

Form 3520-A Due Date - March 15 (Extension Date - September 16) - used by foreign trusts with a U.S. owner to provide information about the trust, its beneficiaries, and owners.

Form 3520 Due Date - April 15 - used for reporting certain transactions with foreign trusts or gifts from foreign citizens.

Form 1041 Due Date - April 15 (Extension Date - September 30) - used to report all income, gains, losses, deductions, and credits from the operation of a trust or an estate.

FinCEN Report 114 Due Date - April 15 (Extension Date - September 16) - required if the taxpayer has a financial interest in or signature authority over a financial account located outside of the U.S. and if the aggregate value of the foreign accounts has exceeded $10,000 at any time during 2018.

Form 1120 Due Date - April 15 (Extension Date - September 16) - used by corporations to report the income, gains, losses, deductions, credits, and to figure the income tax liabilities.

Form 1120-FSC Due Dates - April 15 - used by a foreign sales corporation to report their annual income, gains, losses, and deductions.

Form 1120-H Due Dates - April 15 - is an income returned filed by homeowners associations.

Form 1120-L Due Dates - April 15 - is a return filed by life insurance companies.

Form 1120-ND Due Dates - April 15 - used by nuclear decommissioning funds to report received contributions, earned income and operating expenses.

Form 1120-PC Due Dates - April 15 - is a return filed by all insurance companies, other than life insurance companies.

Form 1120-W Due Dates - April 15, June 17, September 16, December 16 - used by a corporation to determine tax liabilities and required payments.

Form 990 Series (Form 990 and Form 990-PF) Due Date - May 15 (Extension Date - November 15) - used to file an annual return depending on the financial activity of an organization. As of this year, Form 990-N and Form 990-EZ for 2018 must be submitted electronically.

Form 1120-F Due Dates - June 17 - used by foreign corporations to report their income, gains, losses, deductions, and credits.

Form 1120-IC-DISC Due Dates - September 16 - filed by interest charge domestic international sales corporations.

Individual Tax Filing Deadlines and Due Dates

The first step in filing your taxes is to figure out if you need to file at all. The three main factors that determine the need to file are your age, filing status, and gross annual income. If you are a single adult under the age of 65, you have to file taxes if you’ve made over $12,000 this year. You also have to file if you are currently married, filing together with your spouse and have a household income over $24,000.

When to File 2019 Individual Taxes?

Form 4070 Due Date - January 10, February 11, March 11, April 10, May 10, June 10, July 10, August 12, September 10, October 10, November 12, December 10 - used by employees who are compensated by tips to summarize and report those tips to their employer. Use Form 4070A, Employee’s Daily Record of Tips to monitor and track the total number of tips received.

Form 1040 Due Date - January 15, January 31, March 1, April 15, June 17 - used to file your 2018 income tax return. Since 2018, taxpayers will no longer use Form 1040A or Form 1040-EZ but instead use the redesigned Form 1040 .

Form 1040-ES (Individuals, farmers, and fishermen) Due Dates - January 15, April 15, June 17, September 16, December 16 - used to calculate and pay estimated taxes for the current year.

Form 1040 (Farmers and fishermen) Due Date - January 15, March 1, April 15 - used by farmers and fishermen to report their annual taxes.

Form W-4 and Form W-4(SP) Due Date - February 15 - used by employees to indicate their tax situation to the employer.

Additional related forms that are used for calculating taxes but are NOT sent to the IRS include:

- Form W-4P - used by U.S. residents who receive pensions, annuities, or other deferred compensation.

- Form W-4S - completed by all employees and given to third-party payers of sick pay.

- Form W-4V - filed by recipients of government payments to ask the payer to withhold federal income tax.

Schedule H (Form 1040) Due Date - April 15 or April 17 - used by household employers to report household employment taxes.

2019 Payroll Tax Calendar for Employers

All employers have various tax-reporting responsibilities depending on the type of organization, the number of staff and the location of the business. It's essential to track the ever-changing deadlines to avoid any pricey tax penalties for filing late.

Figuring out your taxes and the IRS guidelines might feel intimidating. Keeping track of tax filing deadlines, having a comprehensive filing strategy, and sticking to a rigid schedule is guaranteed to help you stay on top and organized this tax season.

Essential Employer Tax Filing Deadlines

Form W-2 Due Date - January 31 - used in the United States to report wages or other compensation paid to employees and the taxes withheld from them. Form W-2 may be filed electronically on the SSA’s website.

Other region-specific forms in the W-2 series include the following:

- Form W-2AS (American Samoa Wage and Tax Statement) - due on January 31;

- Form W-2GU (Guam Wage and Tax Statement) - due on January 31;

- Form W-2VI (U.S. Virgin Islands Wage and Tax Statement) - due on January 31.

Form W-2G Due Date - January 31 - used to report gambling winnings and any federal income tax withheld on those winnings.

Form W-3 and Form W-3PR Due Date - January 31 - the form is a list of employee information provided on Form W-2. Form W-3 may also be filed electronically on the SSA’s website. Additional forms include the following:

- Form W-3C (Transmittal of Corrected Wage and Tax Statements) is used to correct errors on Forms W-2, W-2AS, W-2GU, or W-2VI .

- Form W-3SS (Transmittal of Wage and Tax Statements) - due on January 31 - is used to transmit Copy A of the most recent Form W-2C .

Form 1099-MISC Due Date - January 31 - used to report rent payments, royalties, prizes and awards, and other fixed determinable income.

Form 940 Due Date - January 31 (Extension Date - February 11) - used by employers to file annual Federal Unemployment Tax Act tax.

Form 941 Due Dates - January 31, February 11, April 30, May 10, July 31, August 12, October 31, November 12 - used by employers who withhold income taxes from wages or pay social security or Medicare tax.

Form 941-SS is filed by employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands.

Form 941-X is used to report and correct errors on all previously-filed Form 941 and 941-SS .

Form 943 and 943-PR Due Date - January 31 (Extension Date - February 11) - used to report income tax withheld and employer and employee social security and Medicare taxes on wages paid to farm workers.

Form 944 and 944 (SP) Due Date - January 31 (Extension Date - February 11) - an annual filing report for smaller employers to use instead of Form 941 for filing payroll tax reports.

Form 944-X and 944-X (SP) used to claim the credit for COBRA premium assistance payments and to correct errors on a previously filed Form 944.

Form 945 Due Date - January 31 (Extension Date - February 11) - used to report withheld federal income tax from non-payroll payments.

Form 945-A is used to report a federal tax liability for Forms 944, 944-X, 945, 945-X, CT-1, CT-1 X.

Form 945-X is used to correct administrative errors only on a previously filed Form 945 .

Form W-4 and Form W-4 (SP) Due Date - February 15 - completed by an employee so that the employer can withhold the correct federal income tax from their pay. Begin withholding income tax from the pay of employees who did not submit Form W-4 on February 16.

Form 1096 Due Date - February 28 - filed by payers of gambling winnings along with Copy A of all W-2G Forms issued for 2018.

Form 8027 Due Date - February 28 - filed by food and beverage establishment employers to report IRS that record wages and tips earned by the employees of large food or beverage organizations.

Form 8027-T Due Date - February 28 - used by restaurants or bars to summarize and transmit paper Forms 8027 if you have more than one establishment.

Form 1094-C, 1095-C, 1094-B, 1095-B Due Date - February 28 - used to report health coverage.

Form 1095-A (Health Insurance Marketplace Statement) is used to report information about individuals who enroll in qualified health plans through the Health Insurance Marketplace.

Electronic filing of Forms W-2G, 8027, 1094-C, 1095-C, 1094-B, and 1095-B Due Date - April 1 - this due date applies only when filing electronically.

Schedule H (Form 1040) Due Date - April 15 - used by household employers to report household employment taxes.

Form 5500 or 5500-EZ Due Date - July 31 - used by employers that maintain pension or welfare benefit plans to report their financial condition, investments and operations.