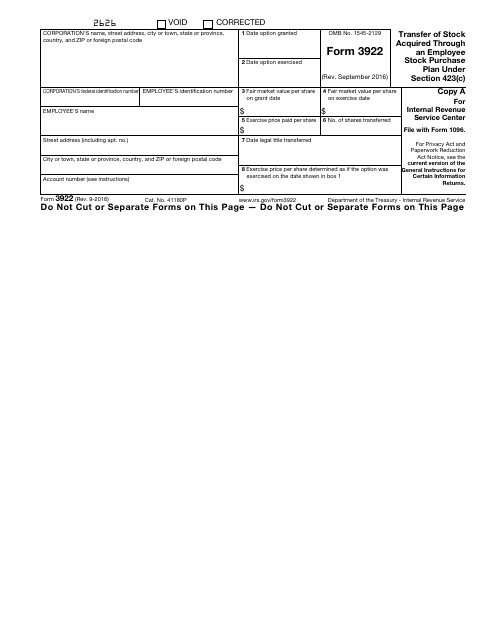

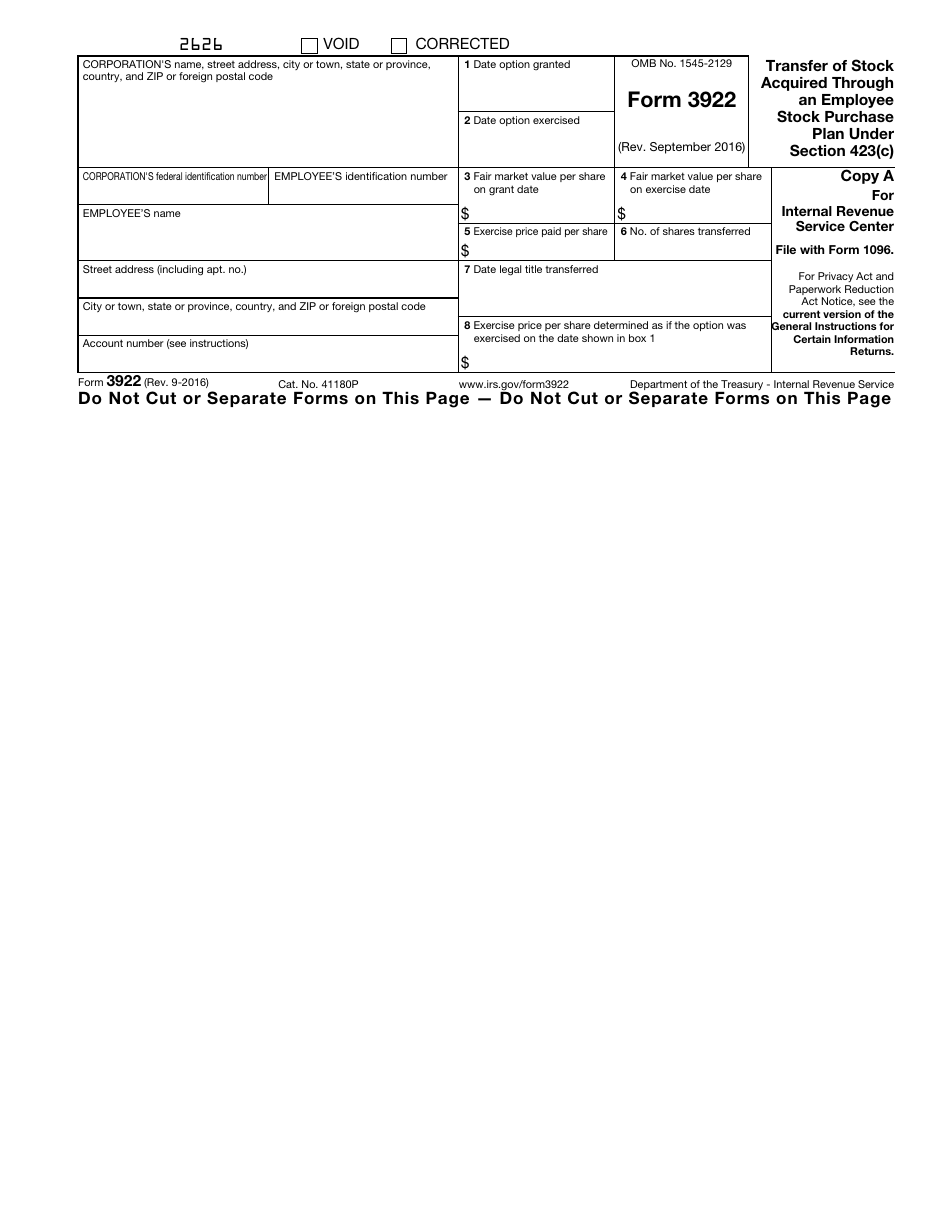

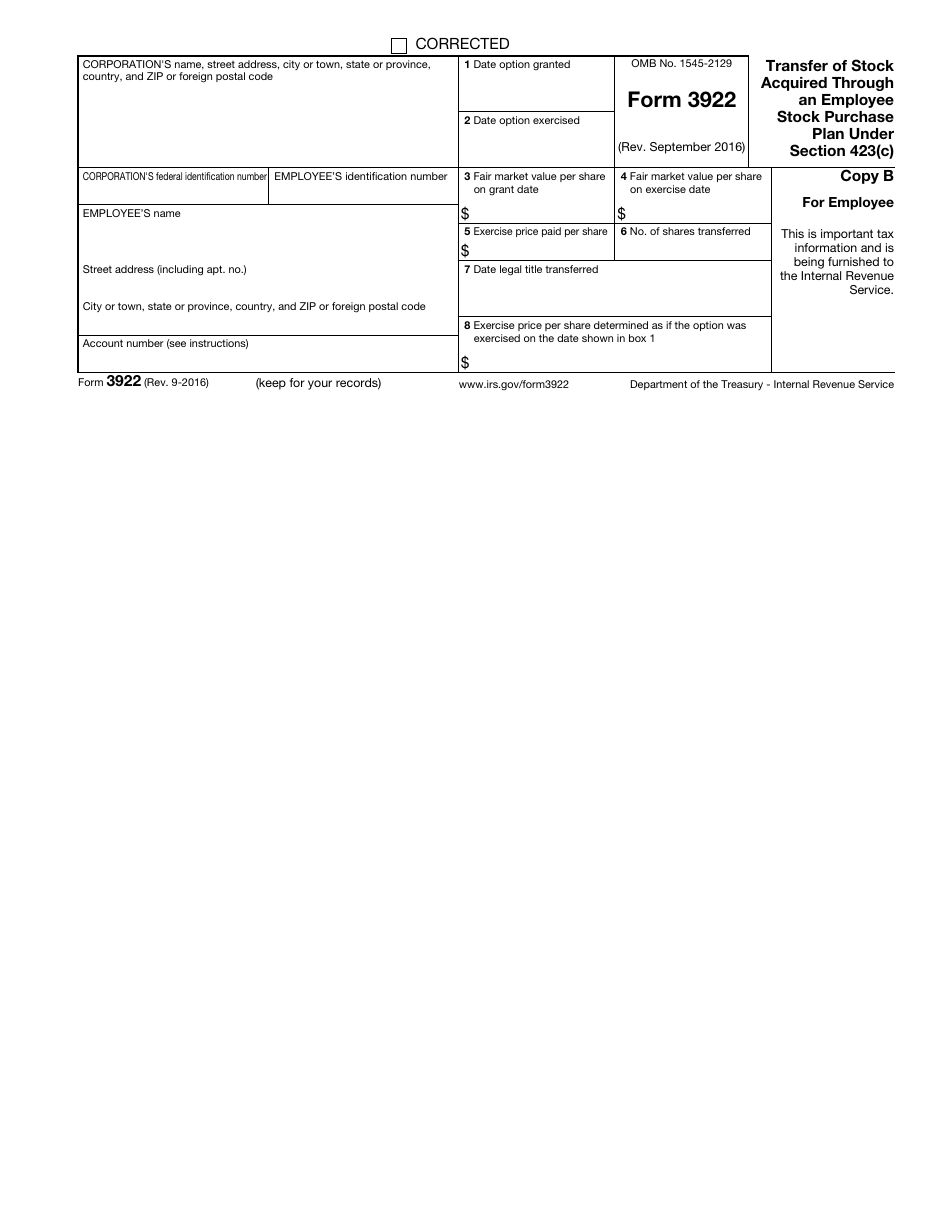

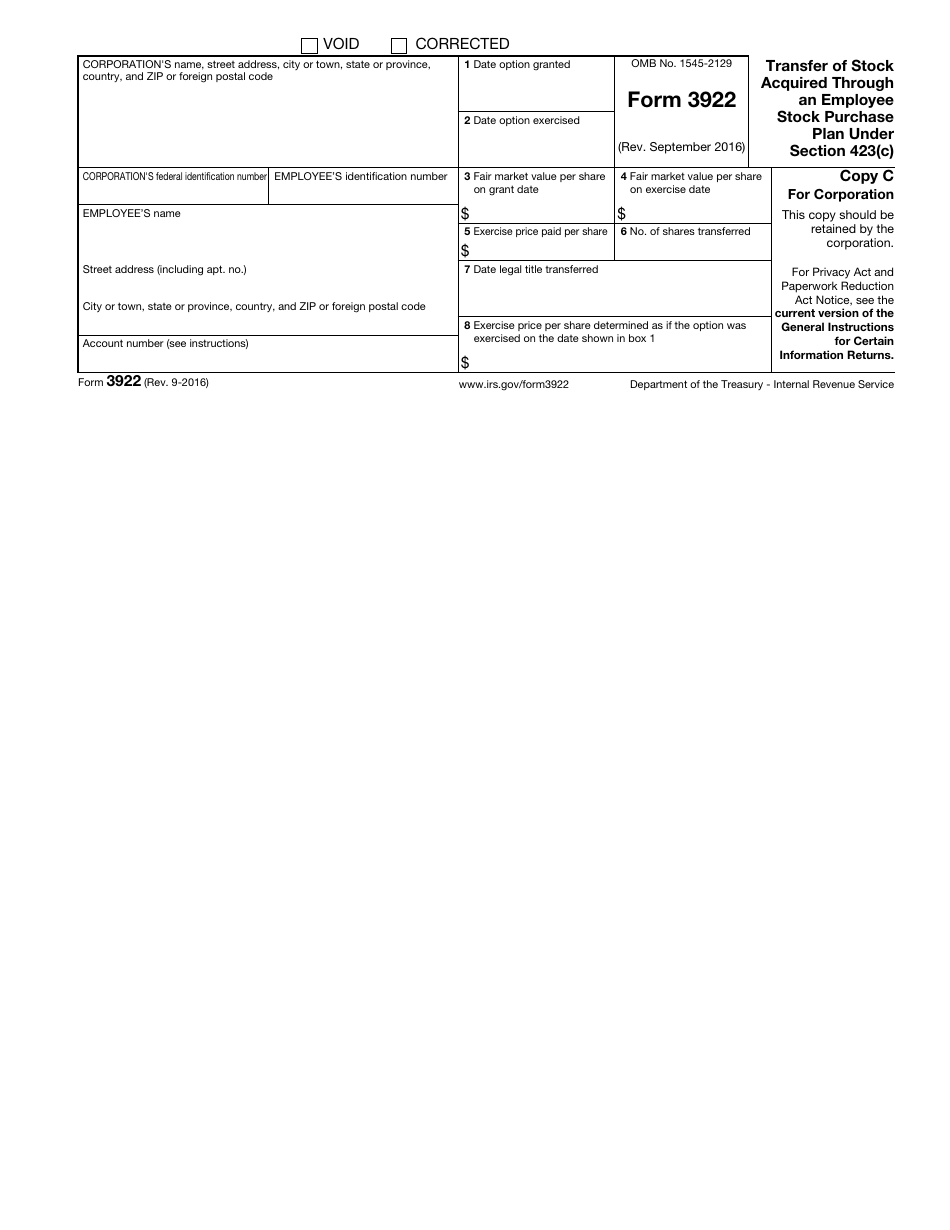

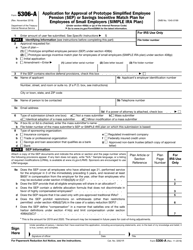

IRS Form 3922 Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(C)

What Is IRS Form 3922?

IRS Form 3922, Transfer of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(c) , is a formal statement used by employers to describe the details of a stock transfer if the shares were acquired by their employee.

Alternate Names:

- Tax Form 3922;

- Employee Stock Purchase Plan Tax Form.

While the main purpose of this document is to share information with the authorities and the person who purchased the stock in question, both parties may need to comply with the Form 3922 reporting requirement and demonstrate how the transfer of shares affected their financial standing.

This form was issued by the Internal Revenue Service (IRS) on September 1, 2016 - previous editions of the document are now obsolete. An IRS Form 3922 fillable version can be found through the link below.

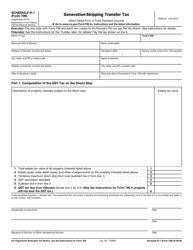

What Is Form 3922 Used For?

Complete and submit Tax Form 3922 for every employee who decided to acquire the stock of your corporation in line with the conditions of the employee stock purchase plan. Entities are obliged to disclose the details of the stock transfer to fiscal organs and remind the employee about the possible need to include the information about the acquisition on their income statement. Employees are entitled to purchase stock as soon as they are hired - apart from receiving usual wages and benefits, they also get access to this option which lets them obtain shares at a lower price contributing via deductions made to their payroll so that every person working for the company has a chance to make a profit.

While tax authorities do not recognize the purchase of stock in this manner as additional income individuals have to report, the situation is different when the person decides to dispose of these shares - they must outline their financial gain or loss when filing the tax return in April. All participating employees that receive Tax Form 3922 are advised to keep a copy of the document in their records until they choose to sell the stock - the income statement submitted after this transaction has to reflect the details of the new transfer.

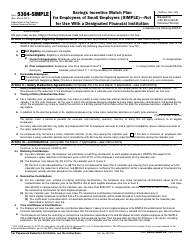

Form 3921 vs 3922

Occasionally, employers fail to differentiate between Form 3922 and a similar document - IRS Form 3921, Exercise of an Incentive Stock Option Under Section 422(b). While both forms allow employees to purchase stock that belongs to the corporation they work for, Form 3921 is typically used as a reward given by the company to employees it values the most since the purchase of the stock is usually delayed which allows the individual to earn money via buying shares.

On the other hand, Form 3922 outlines the specifics of the stock transfer available to all employees, not just a few chosen ones the business wants to employ for many years in order to prevent market rivals from hiring them in the future.

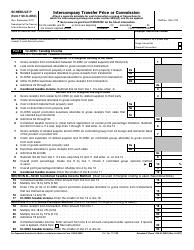

Form 3922 Instructions

Follow these Form 3922 instructions to document the acquisition of stock via an employee stock purchase plan:

-

Check the box that applies in your case if necessary - you have an opportunity to void the form you previously filed or submit a corrected version of the document.

-

List the name, address, and taxpayer identification number of your corporation . Write down the full name, taxpayer identification number, and mailing address of the employee as well. Note that the form needs to include the number of their account if you have to distinguish between several accounts registered in the name of the employee.

-

Specify when the option was granted and exercised. Record the market value of the share - the papers have to list two numbers, both the value at the time the option was presented and at the time the stock was purchased. Indicate the price of the share that was actually paid, clarify how many shares were transferred to the employee, and state when the legal title was formalized. If you cannot determine the price of the share on the date of acquisition, it is obligatory to enter the price that would be correct on the date the option was granted.

-

Prepare several copies of Form 3922 - retain one in the records of your business, send the other to the employee that acquired stock, and report the information to the IRS . Employers are obliged to submit the document to tax authorities with IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns, attached to it before February 28 of the year that follows the year when the stock was acquired. Ensure the employee gets the documentation earlier - they are supposed to receive a copy of the form by January 31 so that they have enough time to prepare their own tax paperwork and avoid penalties.