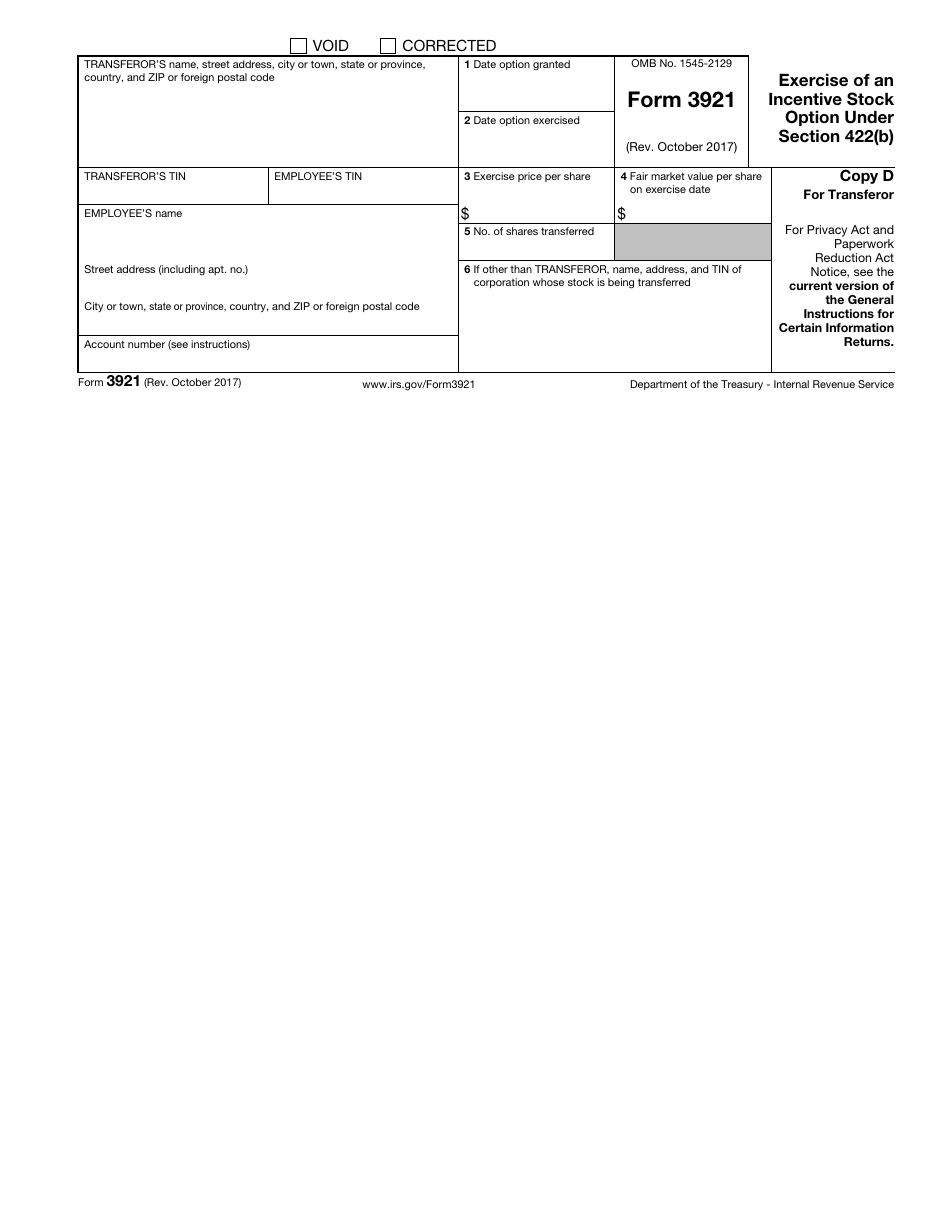

IRS Form 3921 Exercise of an Incentive Stock Option Under Section 422(B)

What Is IRS Form 3921?

IRS Form 3921, Exercise of an Incentive Stock Option Under Section 422(b) , is a fiscal instrument used by corporations to outline the purchase of an incentive stock option by their worker.

Alternate Name:

- Tax Form 3921.

Employees that get to exercise this option are permitted to acquire the stock of the company at a pre-established price from their employer. The transferor of stock is obliged to assist tax authorities in tracking the number of options exercised and monitor the amount of compensation the employees are receiving each year.

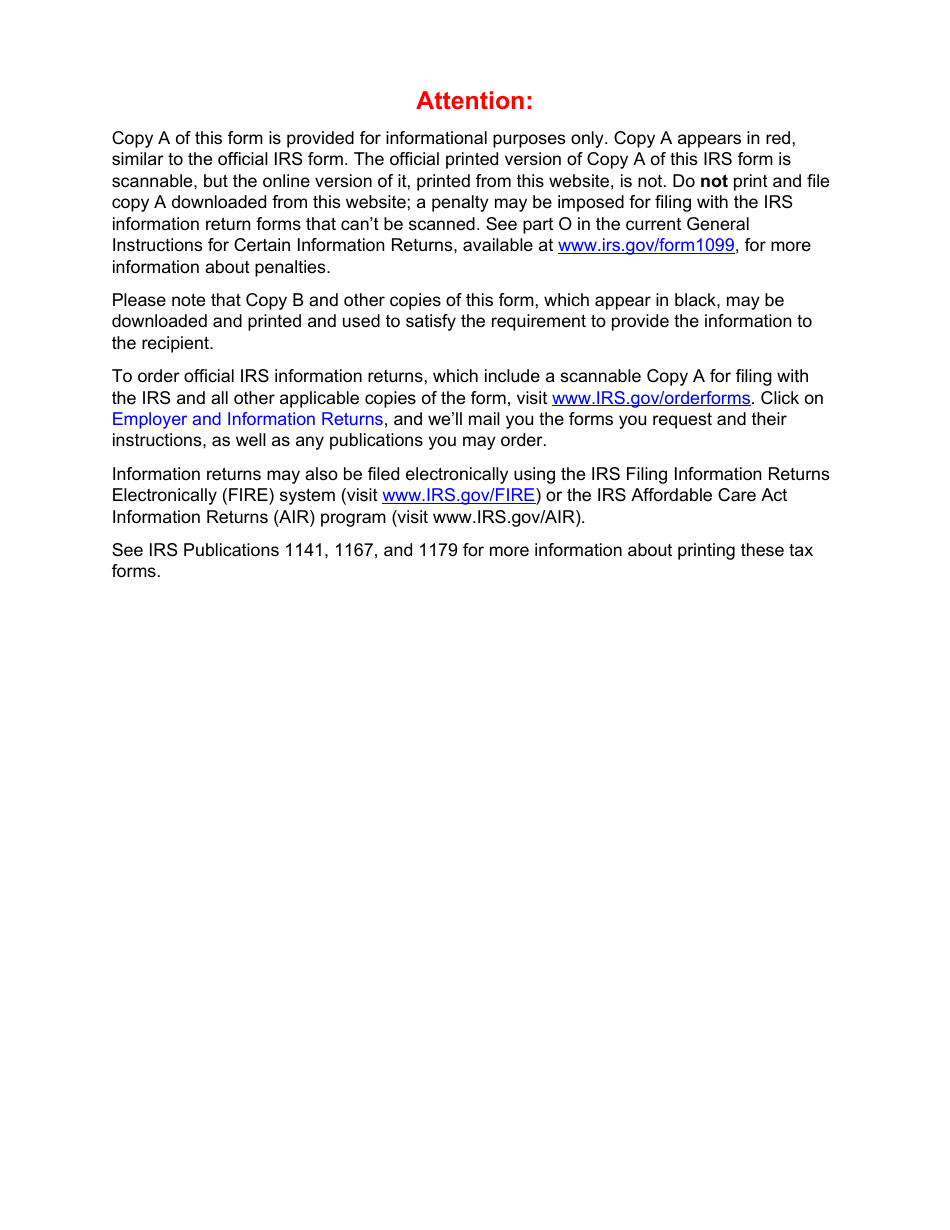

This form was released by the Internal Revenue Service (IRS) on October 1, 2017 - older editions of the form are now obsolete. An IRS Form 3921 fillable version is available for download below.

What Is Form 3921 Used For?

Complete IRS Form 3921 to inform tax organizations about your employees that chose to exercise their incentive stock option. Every year that comes after the year when the worker did so the corporation must disclose information about this action to the IRS and prepare a separate document for the person who purchased stock at a discounted price.

Incentive stock options have become a popular type of compensation many businesses use, especially when it comes to top managers of the organization and important employees. These individuals are given an opportunity to obtain the stock of the entity at a lower price in the future - this way, the business can be sure those employees continue working for them and contributing to the development of the company.

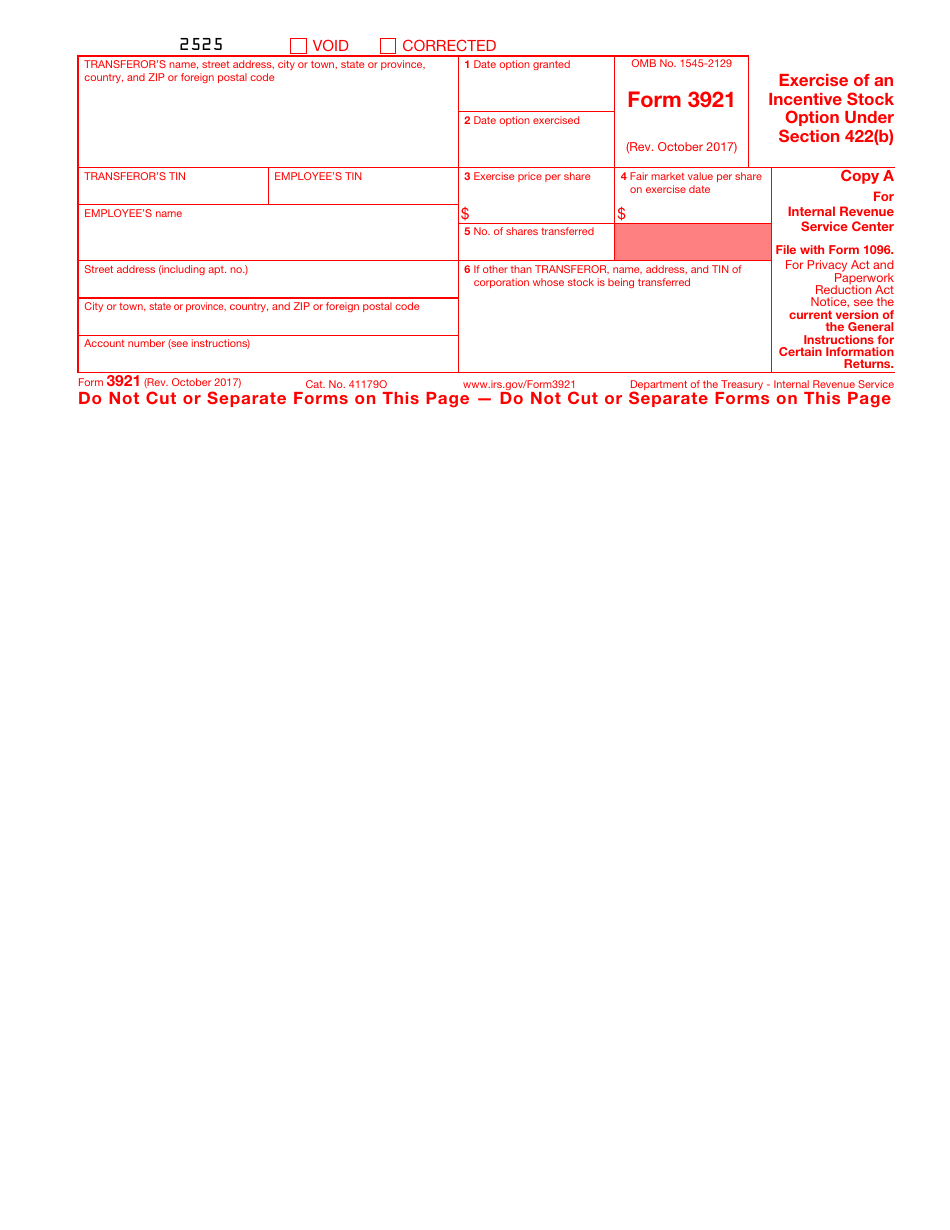

It is necessary to send Tax Form 3921 to the IRS to make sure they know how much tax every worker owes annually once the value of the stock grows. Besides, it is likely the person who obtained the stock will sell it within twelve months after the option is exercised which means they will have to pay income taxes on the amount. Alternatively, the worker may want to keep the stock in their ownership for more than one or two years which will lead to their responsibility to pay capital gains taxes. The corporation is required to send a copy of the document to the worker for their personal records - let the individual know how much tax they are supposed to include on their annual income statement.

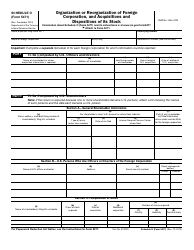

Form 3921 vs 3922

Many taxpayers confuse IRS Form 3921 with another form - IRS Form 3922, Transfer of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(c). Unlike the former document, this form describes the specifics of the stock title transfer to a worker that was given the chance to exercise a stock purchase plan. The corporation determines whether to allow its employees to participate in an incentive stock option purchase while the stock purchase plan is for all eligible employees. This corporation-run program is considered an employment benefit that will allow the individual to acquire stock paying less than the current market price for the company shares.

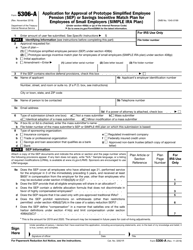

Form 3921 Instructions

Follow these Form 3921 instructions to elaborate on the incentive stock option purchase that took place during the tax period you are supposed to report to the IRS:

-

Tick the box if you want to void the previously completed form that contains mistakes or confirm you are amending the document you filed before so that fiscal authorities do not process the incorrect version.

-

State the details of the transferor - their name, address, and taxpayer identification number . Identify the worker as well - indicate their name, address, taxpayer identification number, and the number of their account if they have multiple accounts. Note that it is recommended to designate separate accounts for every Tax Form 3921 you file. The worker's identity should be protected - when you complete the form you will send them, write down the last four digits of their taxpayer identification number.

-

Specify when the option was given and exercised respectively . Record the stock price per share and the fair market value relevant on the date the option was exercised. State how many shares of the stock were transferred and identify the corporation that used to own the stock. The latter field must be filled out only if the entity in question is not the transferor you described in the form above.

-

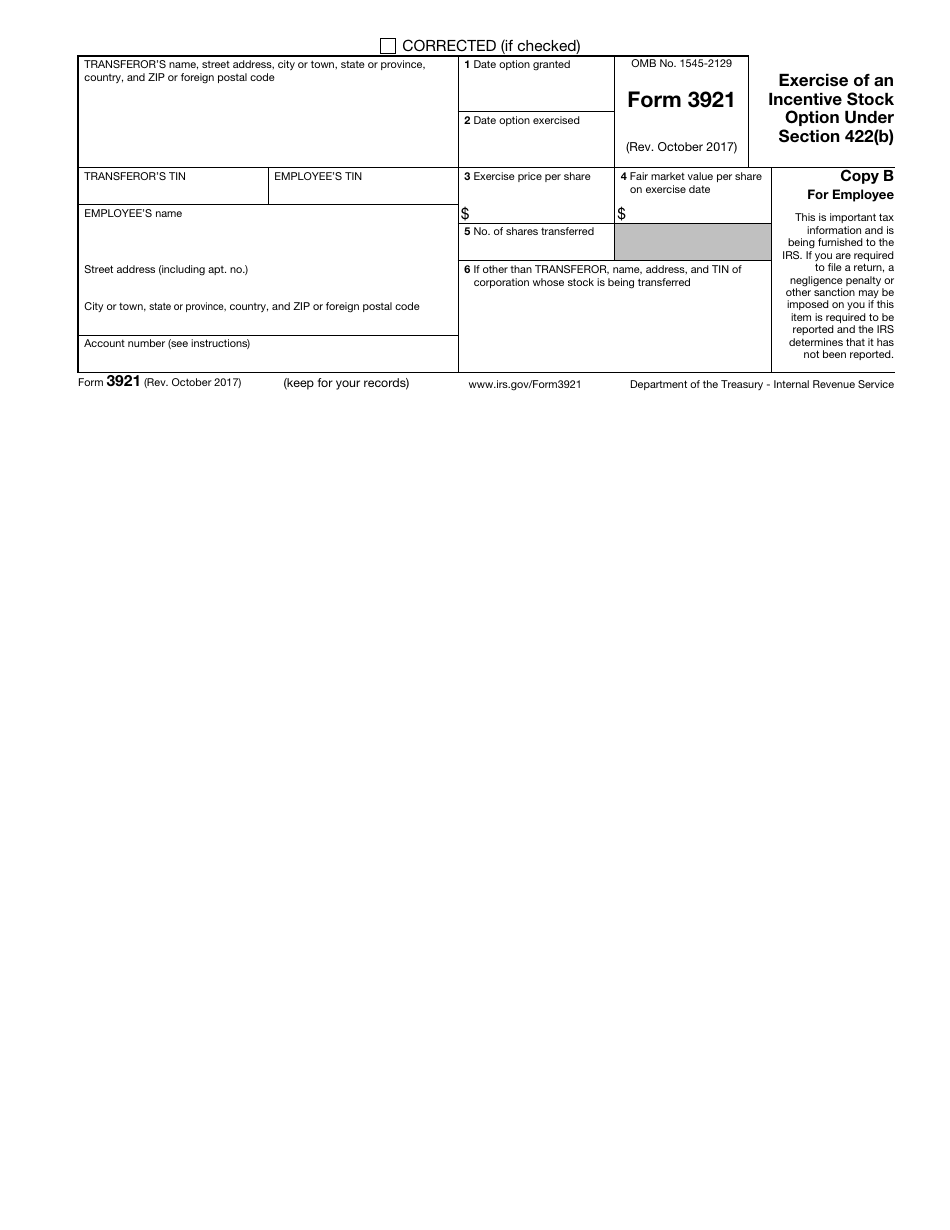

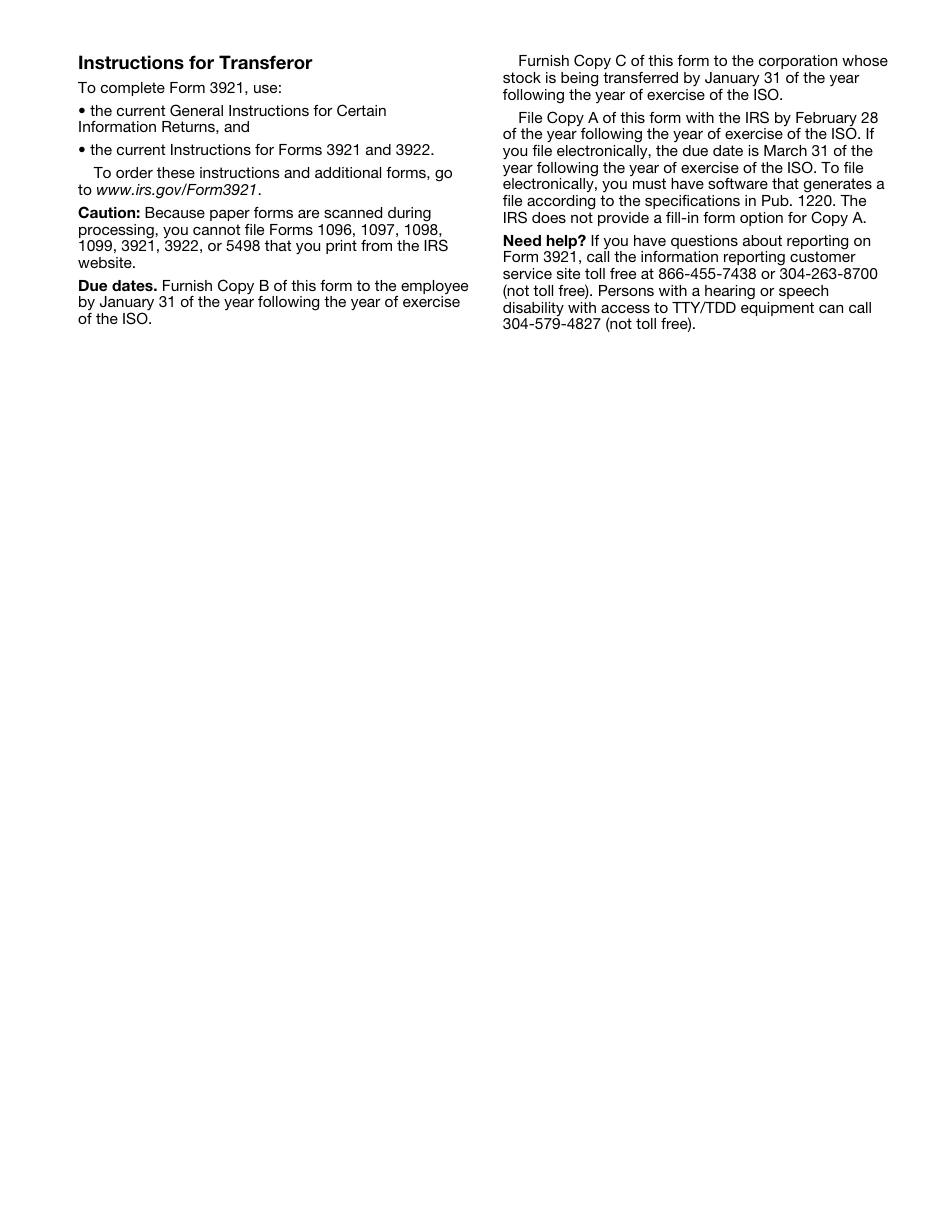

Prepare four identical copies of the document - one will be sent to the IRS, the other remains in the records of the transferor, the next copy goes to the person that got the compensation outlined in writing, and the fourth instrument must be given to the corporation . Form 3921 due date differs for filers. If you prefer to submit the documentation electronically, you will have more time to complete the paperwork since the deadline is April 1. Otherwise, you are obliged to send the paper form to the IRS by February 28. In the latter instance, do not forget to attach an IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns, to your document. Note that the worker and the corporation must be given a copy of the form earlier, by January 31 so that they have enough time to fill out their own tax documentation.

When Is Form 3921 Due?

The corporation will comply with their filing requirement as long as this form is properly addressed and mailed on or before the due date. The Tax Form 3921 due date is February 28, if filed on paper, or March 31, if the form is filed electronically. Should the filing due date fall on a weekend day or legal holiday, the form may be filed by the next business day. It is possible to get an automatic 30-day time extension to file by filing IRS Form 8809, Application for Extension of Time to File Information Returns.

If the corporation does not file a correct information return by the due date and no reasonable cause can be demonstrated, it may be subject to a late filing penalty. The amount of the penalty will be different depending on when the corporation files the 3921 form correctly. The penalty shall be as follows: (a) $50 per information return if they are correctly filed within 30 days (by March 30 if the due date is February 28); (b) $110 per information return if they are correctly filed more than 30 days after the due date but by August 1st; or $270 per information return if they are correctly filed after August 1st.