2019 Tax Filing Deadlines for Individuals

Filing your taxes has never been easier, but there are certain pitfalls to watch out for. We’ve got your back!

Knowing about extensions for tax return dates and particularities of paper and e-forms is a must. The Internal Revenue Service (IRS) charges a late filing and late payment penalties if you do not file your tax return or apply for an extension on time. Filing all returns by the IRS-prescribed due dates will help you avoid additional penalties and interest.

When Are Taxes Due in 2019?

To make it clear: taxes are calculated and paid for the previous year.

According to the Internal Revenue Service (IRS), the 2018 tax due date falls on April 15, 2019. However, although this is true for most taxpayers, some states have exceptions: taxpayers from Maine or Massachusetts have until April 17, 2019, to file their returns.

The first step in filing your taxes is to figure out whether or not you need to file at all. The three main factors that determine the need to file are your age, marital status, and yearly income.

| Marital Status | Age (as of December 31, 2018) | Must an income tax return if annual income for 2018 was |

| Single | Under 65 | over $12,000 |

| 65 or over | over $13,600 | |

| Married and filing jointly | Both spouses under 65 | over $24,000 |

| Both spouses 65 or over | over $26,600 | |

| One spouse under 65 | over $25,300 | |

| Head of a household | Under 65 | over $18,000 |

| 65 or over | over $19,600 | |

| Widow or widower | Under 65 | over $24,000 |

| 65 or over | over $25,300 |

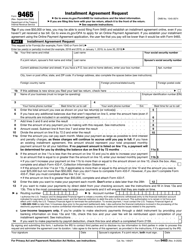

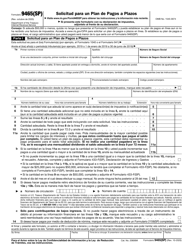

File Form 9465 (Installment Agreement Request) or Form 9465 (SP) if you can't pay your tax bill to the IRS. An installment agreement is an option 120 days to collect the required funds to pay your tax bill. Depending on the amount you owe, you may or may not be required to undergo an interview with an IRS official. Individuals owning $50,000 or less in income tax can apply for an installment agreement online.

First Quarter Tax Payments - January, February, and March

January 10, 2019 – File Form 4070 to summarize and report any tips earned during the month of December. This report is due on the 10th of every month and summarizes tip income for the month prior. No report is required from an employee for months when tips are less than $20. Use Form 4070A, Employee’s Daily Record of Tips to track the total amount of tips earned.

January 15, 2019 – Individuals, farmers, and fishermen must file Form 1040-ES and make an estimated tax payment for 2018 if the income tax for 2018 had not been paid through withholding. You do not have to make this payment if you file your annual return and pay any due tax by January 31, 2019.

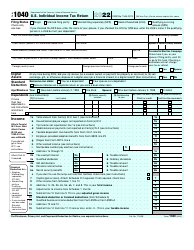

January 31, 2019 – Individuals who must make estimated tax payments may file their income tax return for 2018 via Form 1040 . Doing so by January 31 prevents any penalties for late payments of the last installment.

If you can't file and pay your tax by January 31 the next and final deadline is April 15, 2019 (April 17 if you live in Maine or Massachusetts).

February 11, 2019 - Report any tips earned during the month of January.

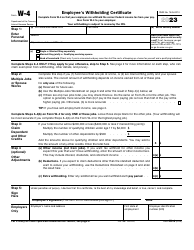

February 15, 2019 - Employees must file Form W-4 or Form W-4(SP) to indicate their tax situation to the employer.

File these forms to calculate the amounts required to be indicated on the W-4:

-

Form W-4P - filed by U.S. residents who receive annuities, pensions, and other deferred compensation.

-

Form W-4S - filled out by all employees and given to third-party payers of sick pay.

-

Form W-4V - completed by recipients of government payments to ask the payer to withhold federal income tax.

March 1, 2019 – Calendar farmers or fishermen must file their 2018 income tax return via Form 1040 if the appropriate form was submitted on January 15, 2019.

March 11, 2019 - Report any tips earned during the month of February.

Second Quarter Tax Payments - April, May, and June

April 10, 2019 - Report any tips earned during the month of March.

April 15, 2019 – This is the 2019 tax day for individual tax returns. File Form 1040 and pay any taxes due to the IRS. Since 2018, taxpayers will no longer use Form 1040A or Form 1040-EZ and must use the redesigned Form 1040 instead.

File Schedule H (Form 1040) if you paid cash wages of $1,000 or more to a household employee in 2018. Individuals, farmers, and fishermen must file Form 1040-ES and make an estimated tax payment.

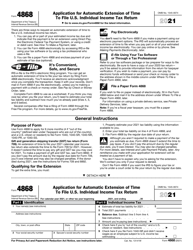

You may be able to get an automatic six-month extension to file your return, shifting the due date to October 15, 2019. To do so, you must file Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return) or Form 4868(SP) , its Spanish version. Form 4868 must be filed and submitted by the regular date of the return in order to qualify for the extension.

May 10, 2019 - Report any tips earned during the month of April.

June 10, 2019 - Report any tips earned during the month of May.

June 17, 2019 – This is the 2019 tax day for U.S. citizens or resident aliens living and working outside of the U.S. and Puerto Rico. June 17 is the second installment date for estimated tax. Use Form 1040-ES and make an estimated tax payment for 2018 if you’re not paying your income tax for the year through withholding.

Third Quarter Tax Payments - July, August, and September

July 10, 2019 - Report any tips earned during the month of June.

August 12, 2019 - Report any tips earned during the month of July.

September 10, 2019 - Report any tips earned during the month of August.

September 16, 2019 – This is the third installment date for paying estimated taxes in 2019. Use Form 1040-ES and make an estimated tax payment if you’re not paying your income tax for the year through withholding.

Fourth Quarter Tax Payments - October, November, and December.

October 10, 2019 - Report any tips earned during the month of September.

October 15, 2019 - The extended date for filing Form 1040 for 2019 and paying any interest and penalties due.

November 12, 2019 - Report any tips earned during the month of October.

December 10, 2019 - Report any tips earned during the month of November.

December 16, 2019 - This is the last time in 2019 that individuals, farmers, and fishermen must file Form 1040-ES .

2019 Tax Return Due Dates for Business Owners

Are you a business owner? If so - there's a lot of due dates and paperwork to keep track of. Use our 2019 tax calendar to keep track of vital corporate and business tax deadlines and not miss a thing.