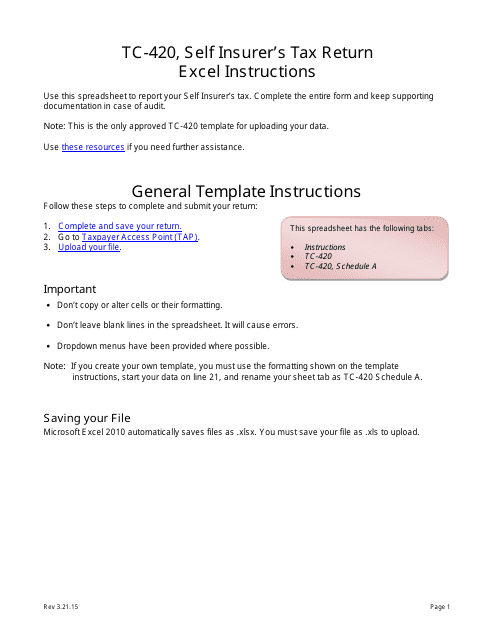

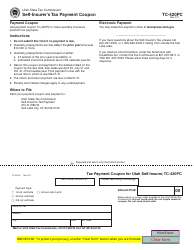

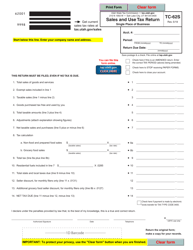

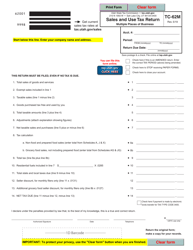

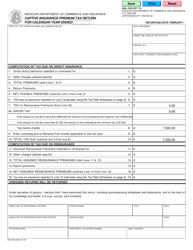

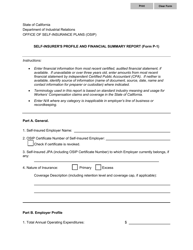

Instructions for Form TC-420 Self-insurer's Tax Return - Utah

This document contains official instructions for Form TC-420 , Self-insurer's Tax Return - a form released and collected by the Utah State Tax Commission.

FAQ

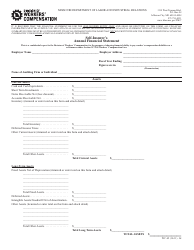

Q: What is Form TC-420?

A: Form TC-420 is the Self-insurer's Tax Return in Utah.

Q: Who needs to file Form TC-420?

A: Self-insurers in Utah need to file Form TC-420.

Q: What is a self-insurer?

A: A self-insurer is a company or organization that chooses to provide its own workers' compensation coverage instead of purchasing insurance from an insurance company.

Q: What is the purpose of Form TC-420?

A: Form TC-420 is used by self-insurers in Utah to report and pay their workers' compensation taxes.

Q: When is the deadline for filing Form TC-420?

A: The deadline for filing Form TC-420 is generally on or before March 1st of each year.

Q: Are there any penalties for late filing of Form TC-420?

A: Yes, there are penalties for late filing of Form TC-420. It is important to file the form on time to avoid these penalties.

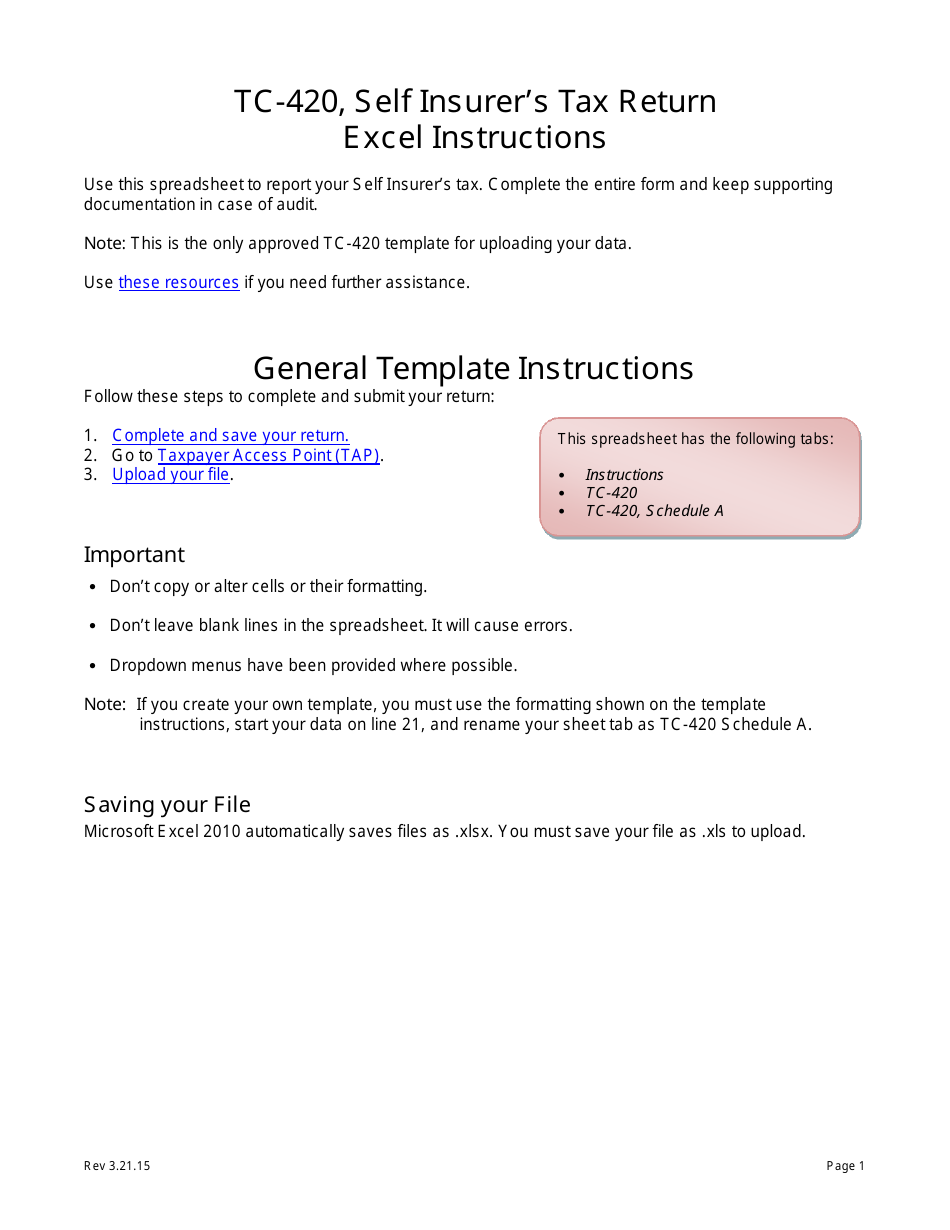

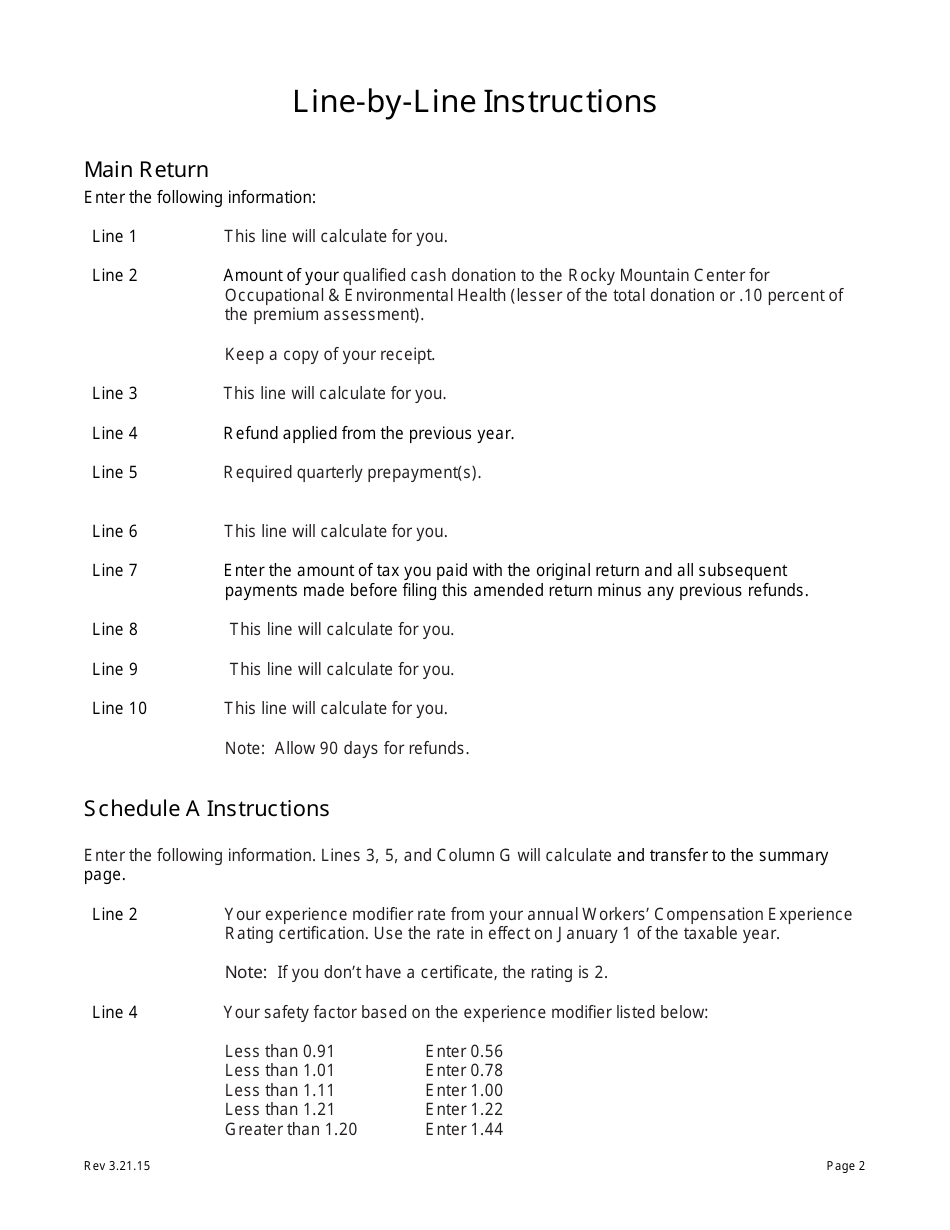

Q: Are there any deductions or credits available on Form TC-420?

A: No, Form TC-420 does not have any deductions or credits. It is used solely for reporting and paying workers' compensation taxes.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Utah State Tax Commission.