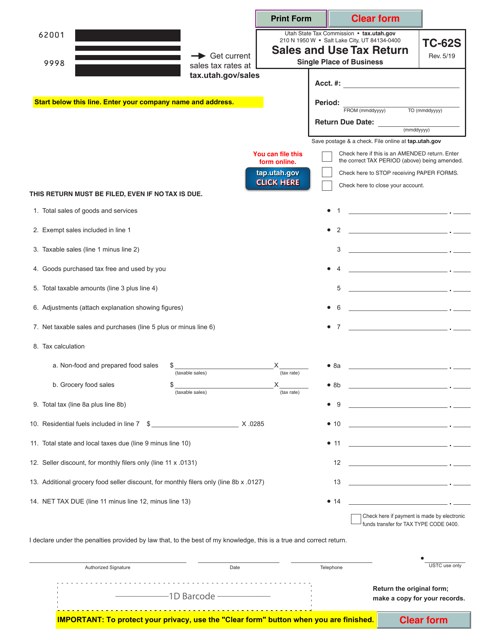

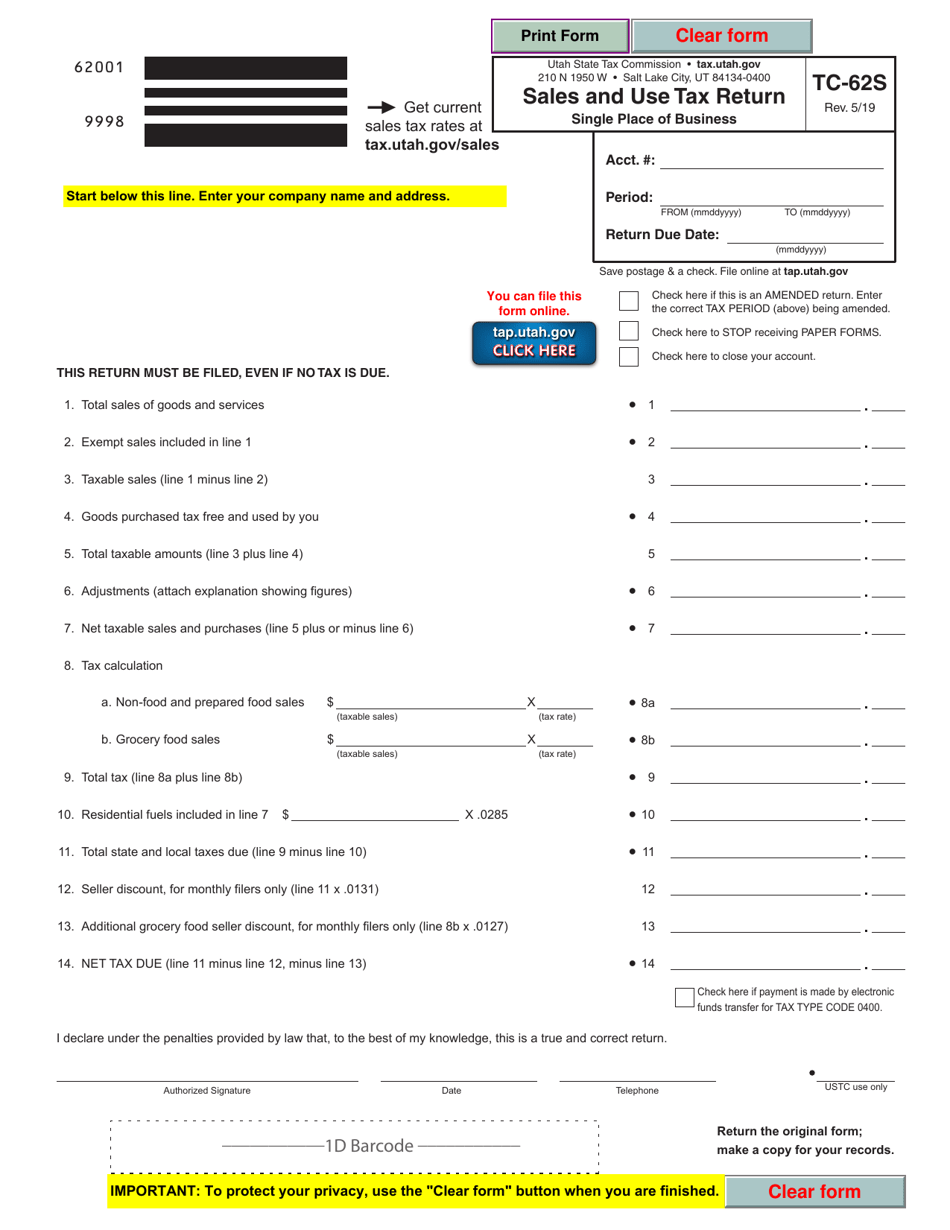

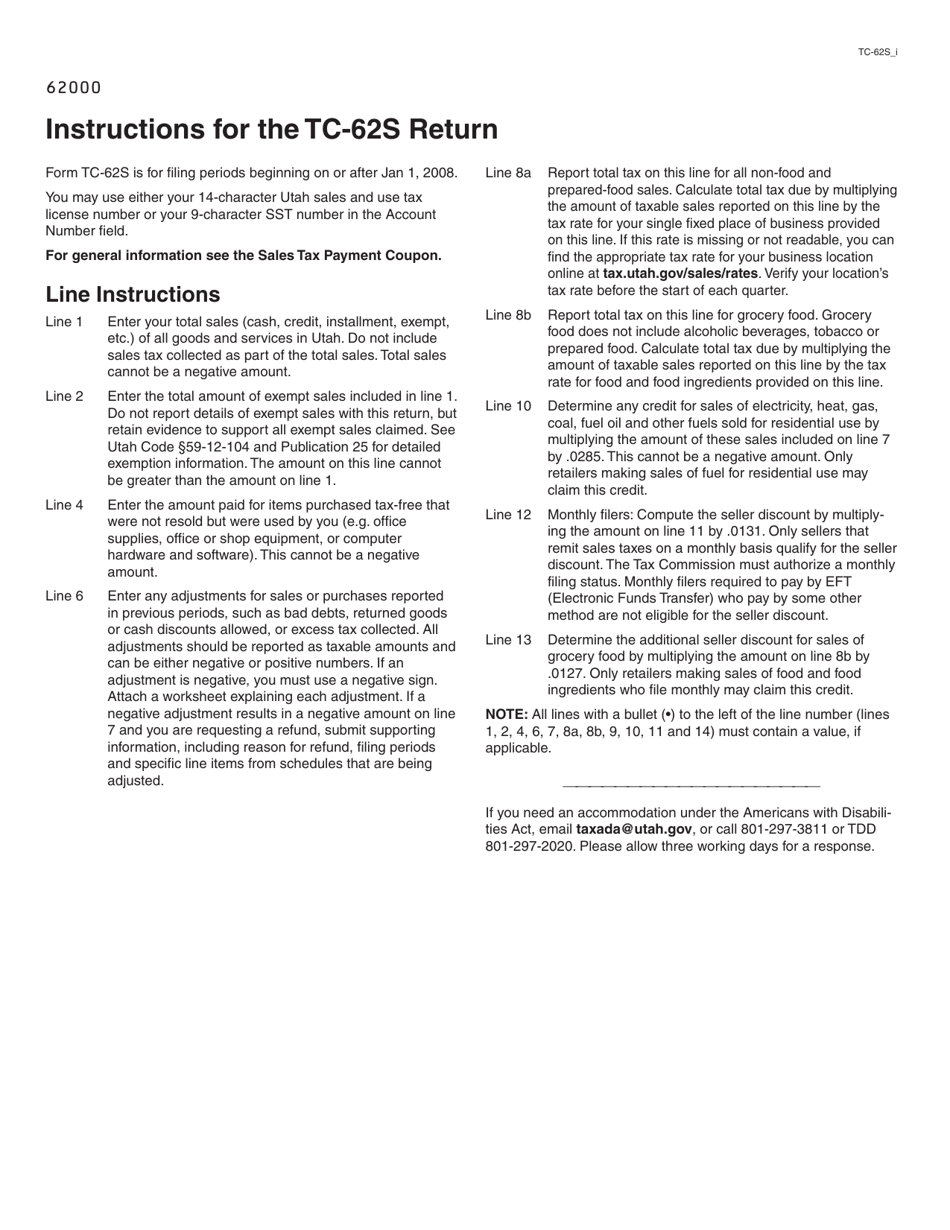

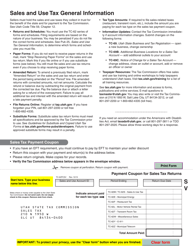

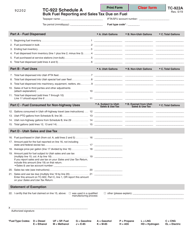

Form TC-62S Sales and Use Tax Return for Single Places of Business - Utah

What Is Form TC-62S?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-62S?

A: Form TC-62S is the Sales and Use Tax Return for Single Places of Business in Utah.

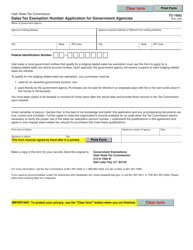

Q: Who needs to file Form TC-62S?

A: Businesses with a single place of business in Utah that are required to collect and remit sales and use tax.

Q: When is Form TC-62S due?

A: Form TC-62S is due on the 15th day of the month following the reporting period.

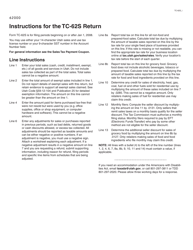

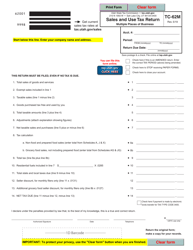

Q: What information is required on Form TC-62S?

A: Form TC-62S requires information about sales and use tax collected, taxable sales, and other relevant details.

Q: How do I file Form TC-62S?

A: Form TC-62S can be filed electronically or by mail.

Q: Are there any penalties for filing Form TC-62S late?

A: Yes, there are penalties for filing Form TC-62S late, including possible interest charges on unpaid taxes.

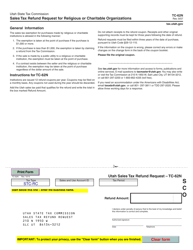

Q: Can I claim a refund on Form TC-62S?

A: No, Form TC-62S is for reporting and remitting sales and use tax, not for claiming refunds.

Q: Are there any exemptions or deductions on Form TC-62S?

A: Yes, there may be exemptions and deductions that can be claimed on Form TC-62S. Please refer to the instructions for more information.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-62S by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.