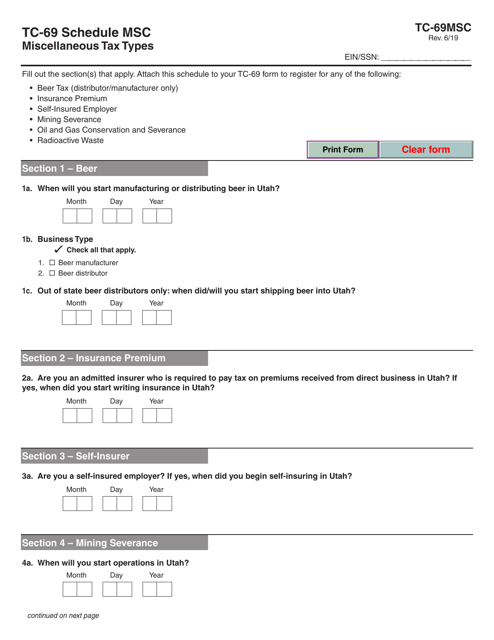

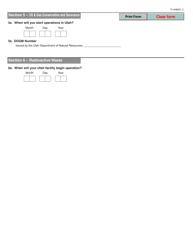

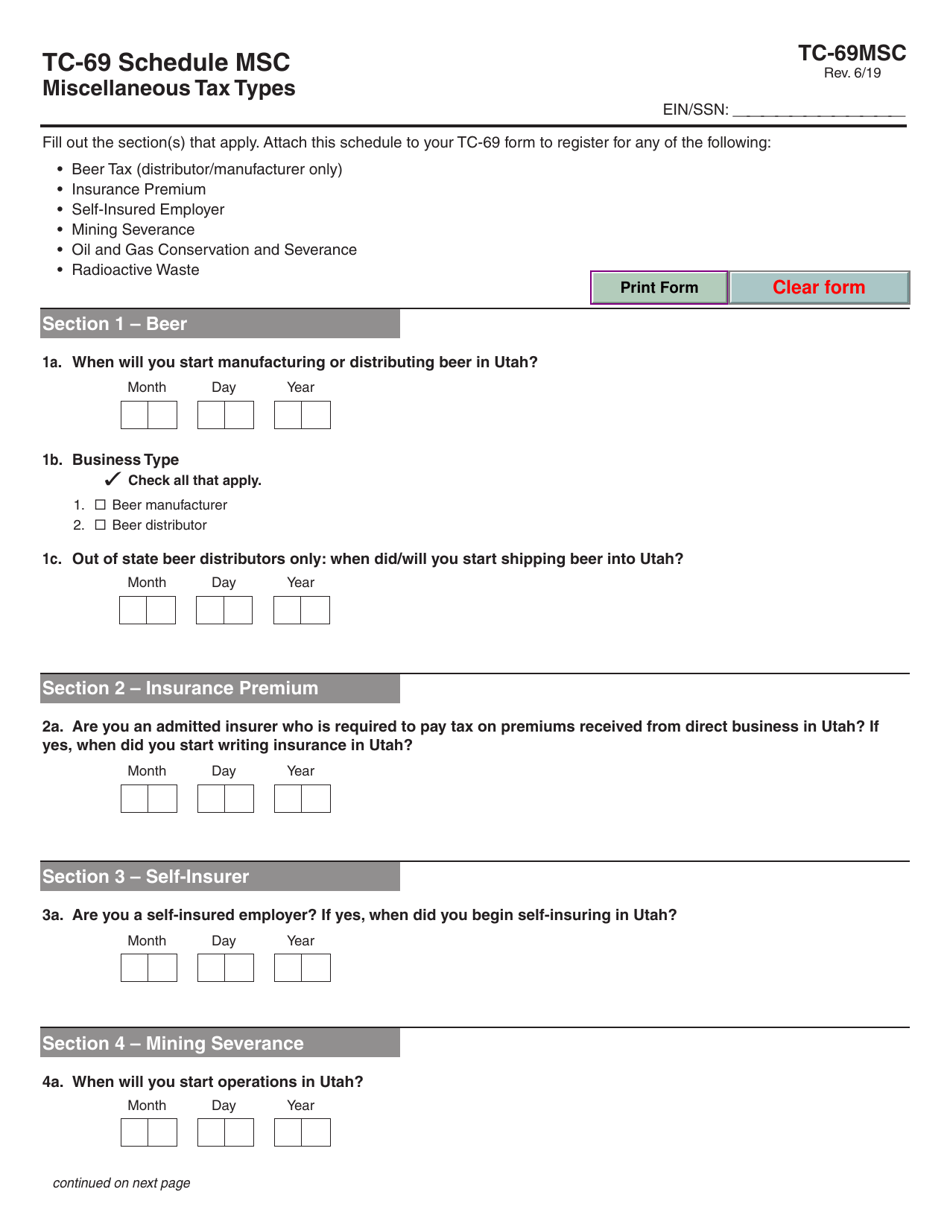

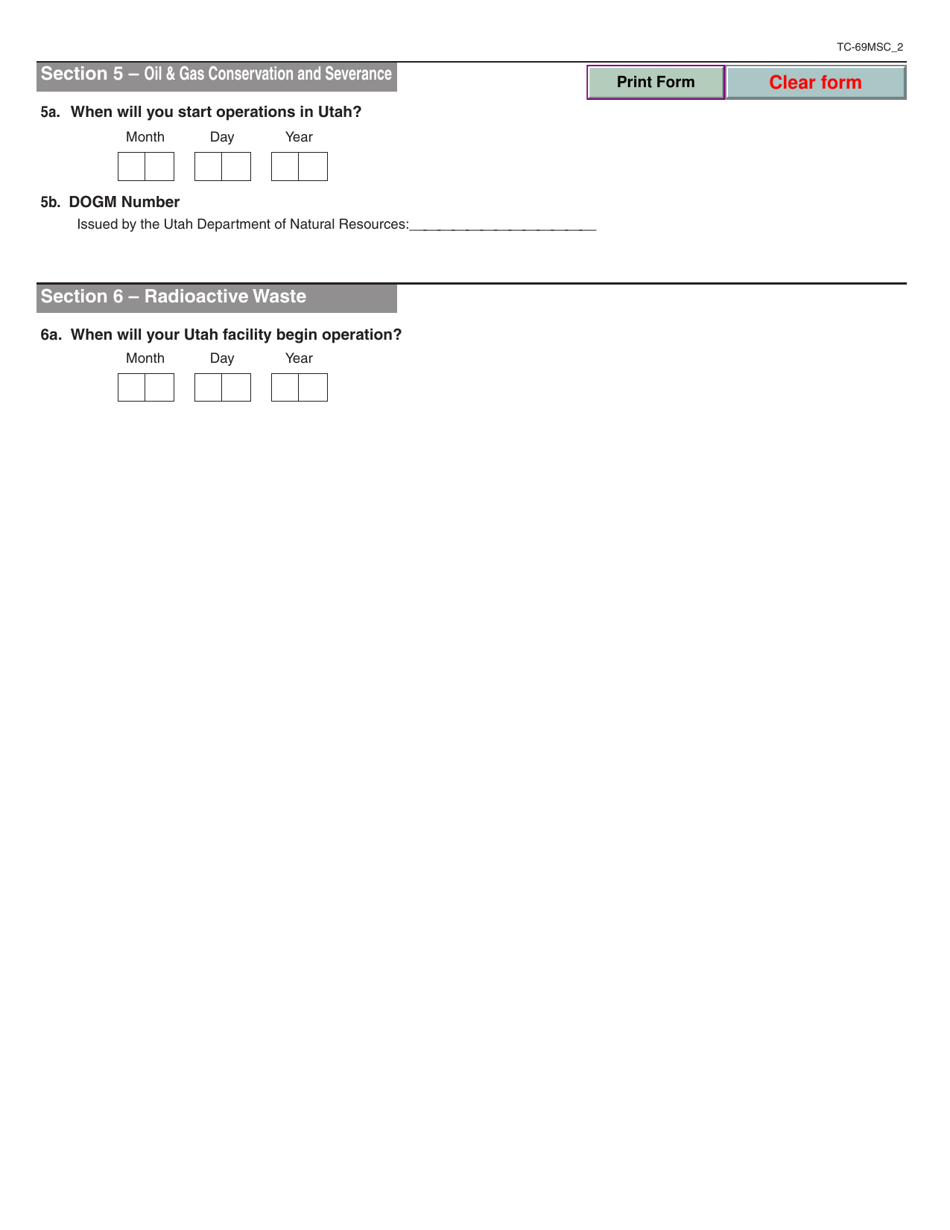

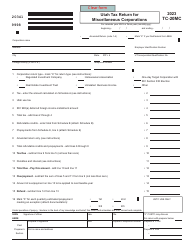

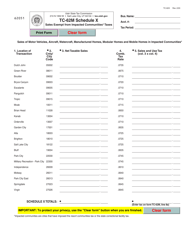

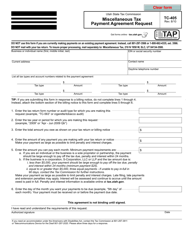

Form TC-69 Schedule MSC Miscellaneous Tax Types - Utah

What Is Form TC-69 Schedule MSC?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-69, Utah State Business and Tax Registration. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC-69 Schedule MSC?

A: TC-69 Schedule MSC is a form used for reporting miscellaneous tax types in Utah.

Q: What are miscellaneous tax types?

A: Miscellaneous tax types refer to specific taxes that are not included on other tax schedules.

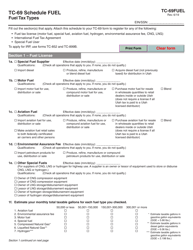

Q: What taxes can be reported on TC-69 Schedule MSC?

A: TC-69 Schedule MSC can be used for reporting taxes such as severance tax, cigarette tax, liquor tax, and motor fuel tax.

Q: Why do I need to use TC-69 Schedule MSC?

A: You need to use TC-69 Schedule MSC to accurately report and pay the miscellaneous taxes that apply to your business.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-69 Schedule MSC by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.