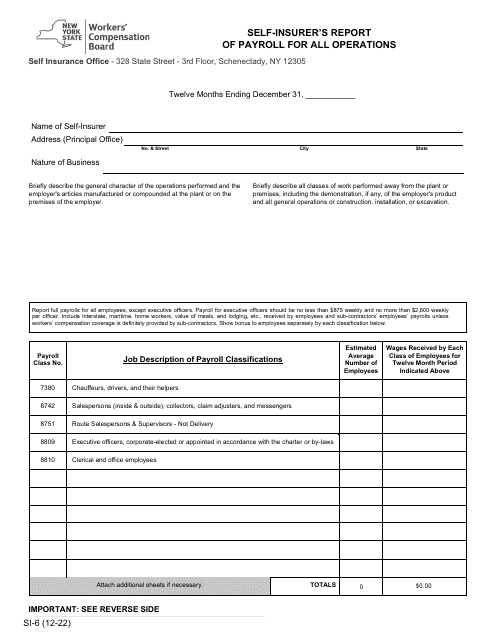

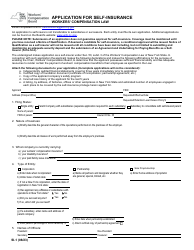

Form SI-6 Self-insurer's Report of Payroll for All Operations - New York

What Is Form SI-6?

This is a legal form that was released by the New York State Workers' Compensation Board - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SI-6?

A: Form SI-6 is the Self-insurer's Report of Payroll for All Operations.

Q: Who needs to file Form SI-6?

A: Self-insurers in New York need to file Form SI-6.

Q: What is the purpose of Form SI-6?

A: Form SI-6 is used to report payroll information for all operations to the New York State Workers' Compensation Board.

Q: When should Form SI-6 be filed?

A: Form SI-6 must be filed annually by March 31st.

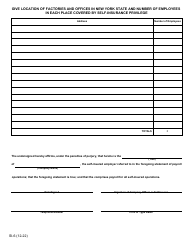

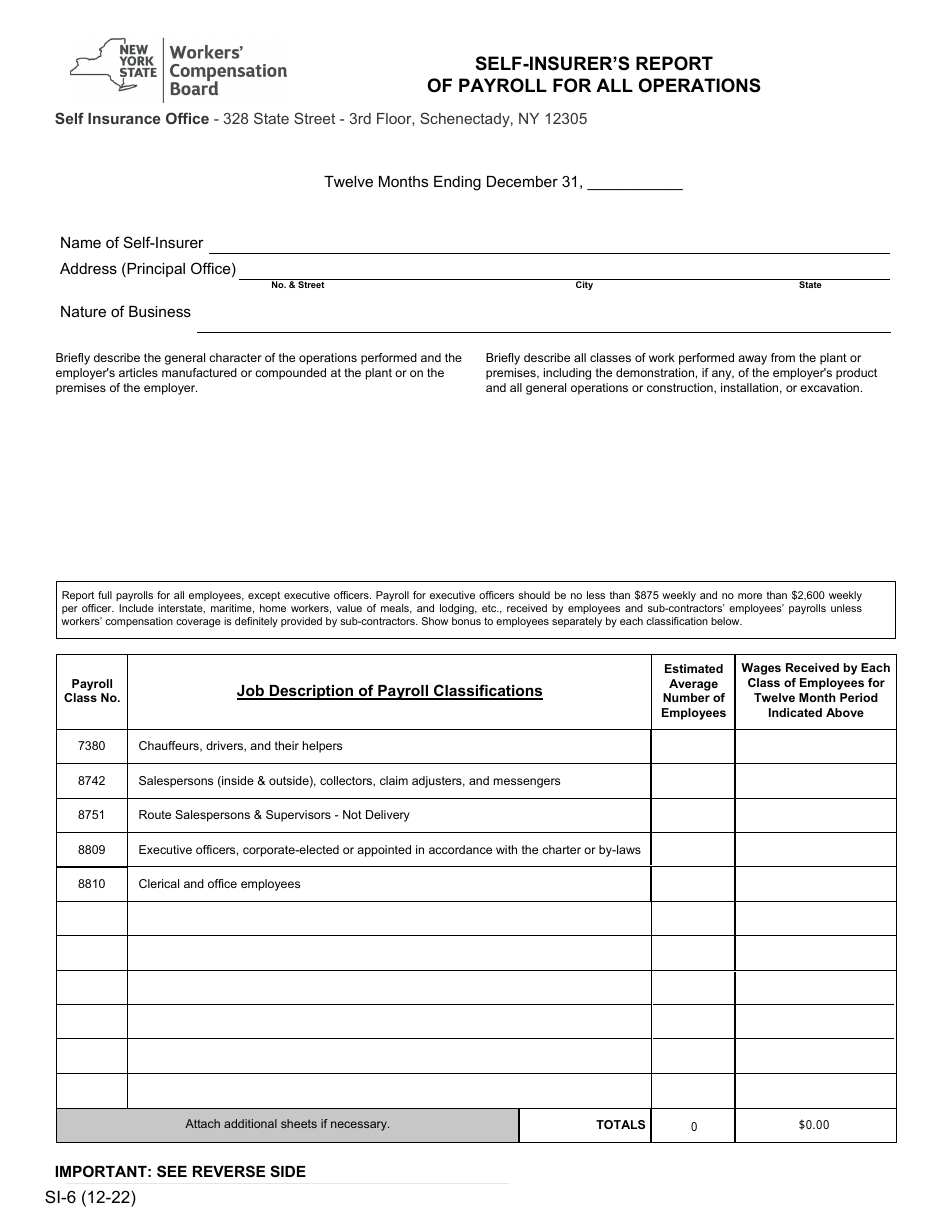

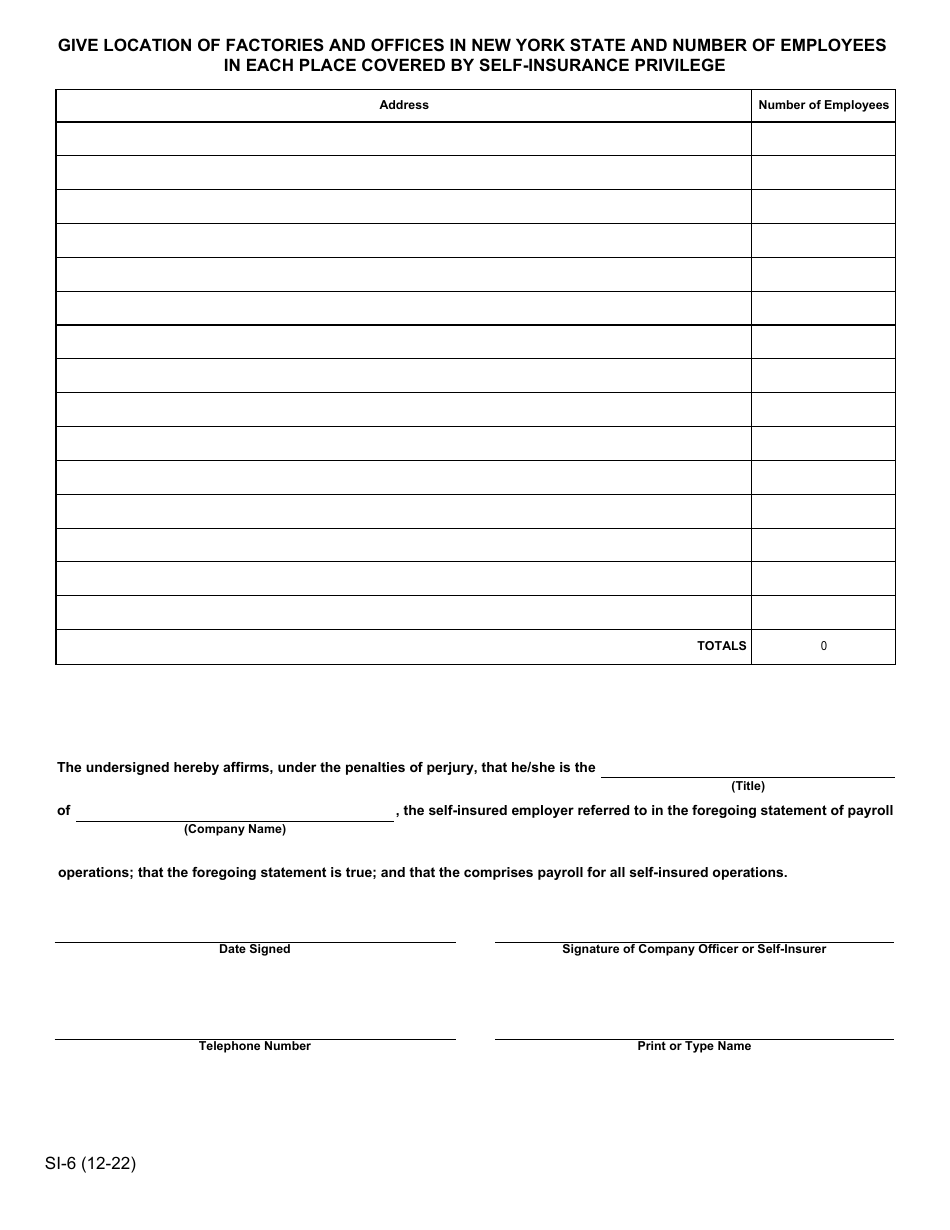

Q: What information should be included in Form SI-6?

A: Form SI-6 requires the reporting of payroll information for all operations, including detailed breakdowns by classification code.

Q: Is there a fee for filing Form SI-6?

A: Yes, there is a fee associated with filing Form SI-6. The fee amount is based on the total payroll reported.

Q: What happens if I fail to file Form SI-6?

A: Failure to file Form SI-6 can result in penalties and may affect your self-insurance status.

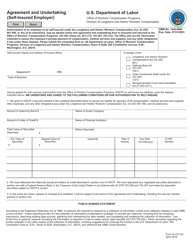

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the New York State Workers' Compensation Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SI-6 by clicking the link below or browse more documents and templates provided by the New York State Workers' Compensation Board.