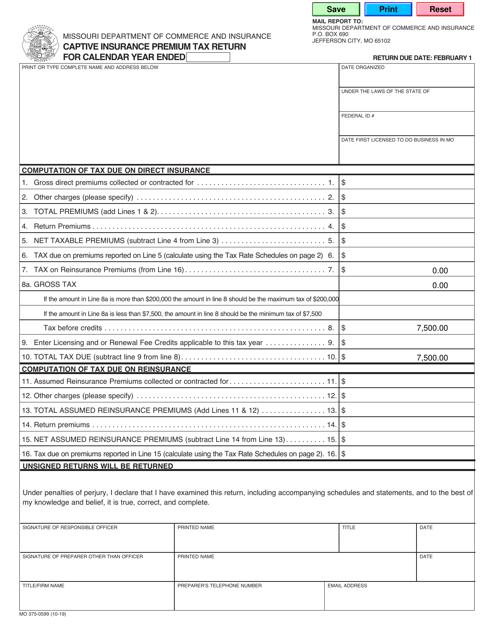

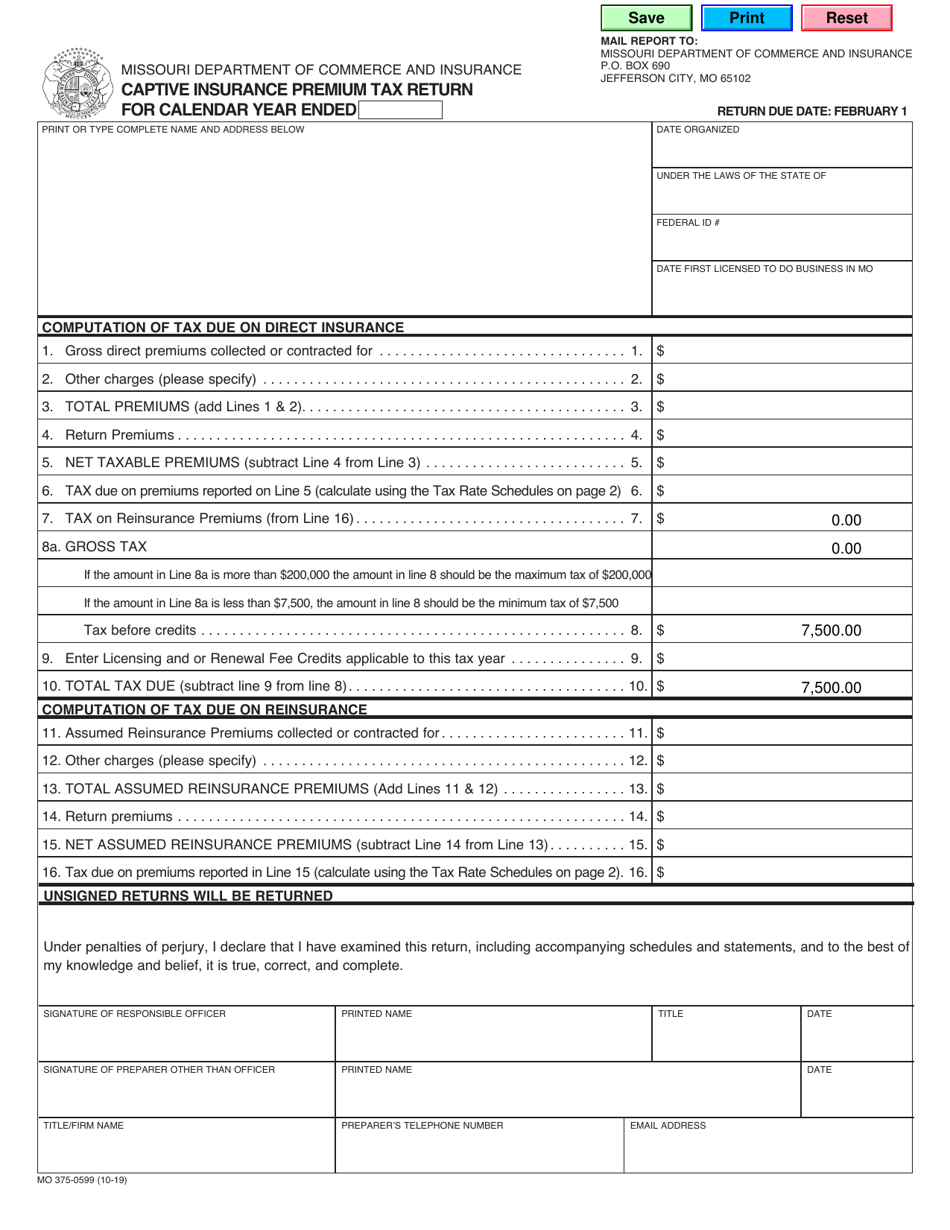

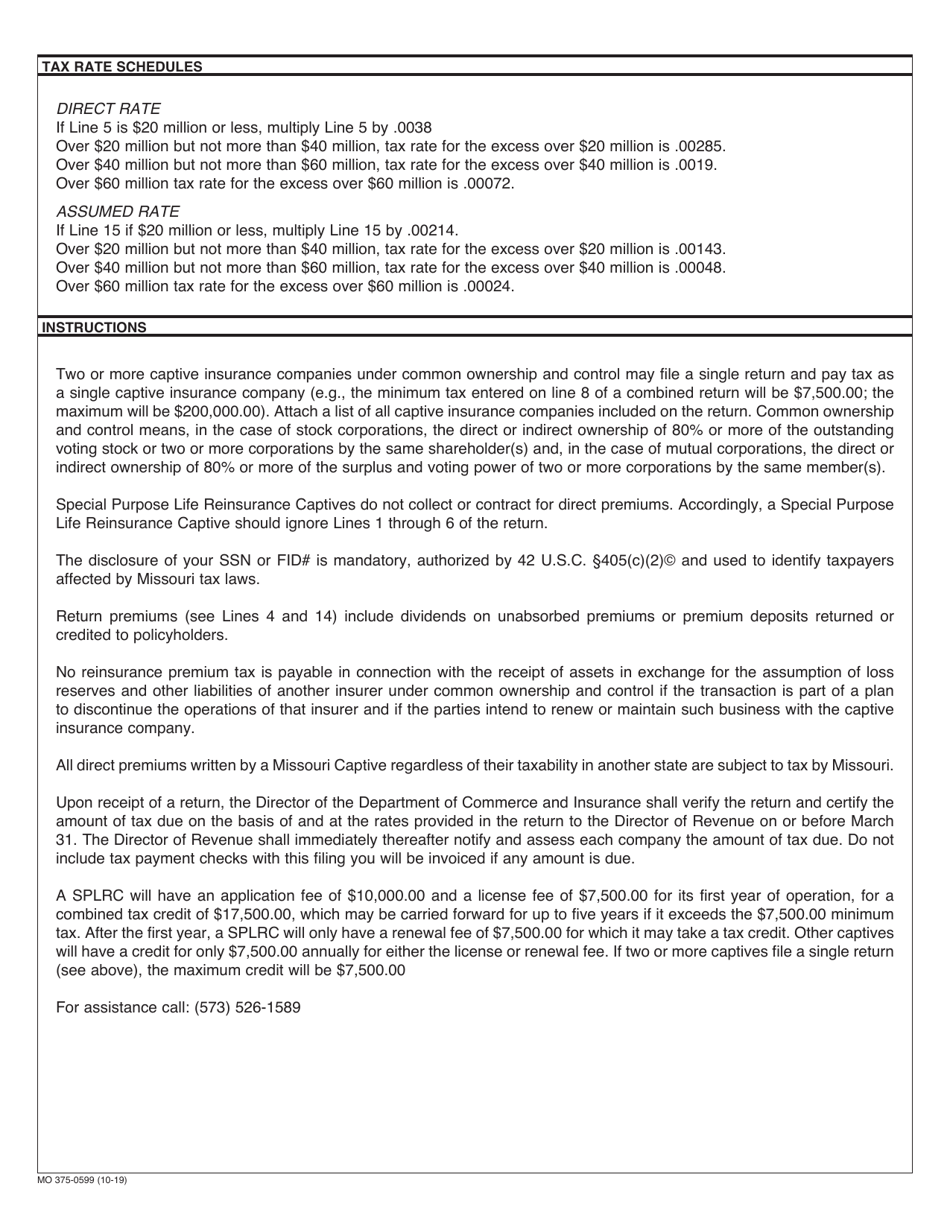

Form MO375-0599 Captive Insurance Premium Tax Return - Missouri

What Is Form MO375-0599?

This is a legal form that was released by the Missouri Department of Commerce and Insurance - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MO375-0599 Captive Insurance Premium Tax Return?

A: MO375-0599 Captive Insurance Premium Tax Return is a tax return form used in Missouri for reporting captive insurance premium taxes.

Q: Who needs to file MO375-0599?

A: Any captive insurance company operating in Missouri needs to file MO375-0599.

Q: What is a captive insurance company?

A: A captive insurance company is an insurance company established by a parent company to insure risks of the parent company or its affiliates.

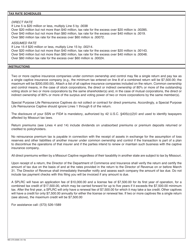

Q: What are captive insurance premium taxes?

A: Captive insurance premium taxes are taxes paid on insurance premiums collected by captive insurance companies.

Q: What information is required to complete MO375-0599?

A: To complete MO375-0599, you will need to provide information about your captive insurance company's premiums and other relevant financial data.

Q: When is the deadline to file MO375-0599?

A: The deadline to file MO375-0599 is usually April 15th of the following year.

Q: Are there any penalties for late filing of MO375-0599?

A: Yes, late filing of MO375-0599 can result in penalties and interest charges.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Missouri Department of Commerce and Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO375-0599 by clicking the link below or browse more documents and templates provided by the Missouri Department of Commerce and Insurance.