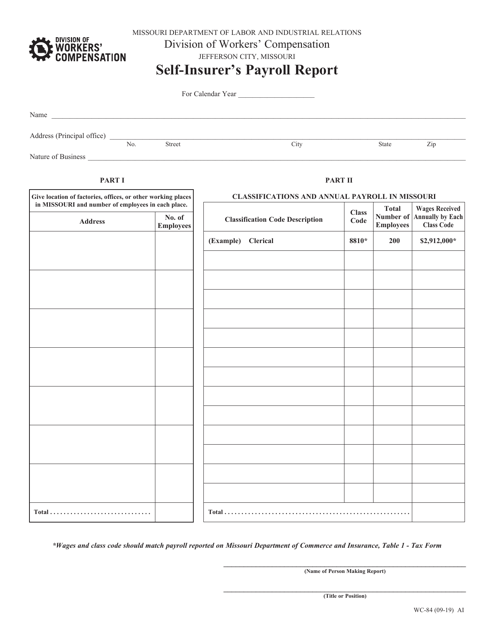

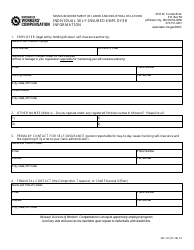

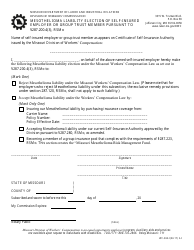

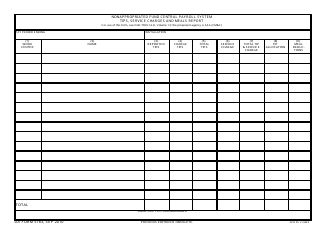

Form WC-84 Self-insurer's Payroll Report - Missouri

What Is Form WC-84?

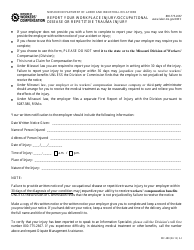

This is a legal form that was released by the Missouri Department of Labor and Industrial Relations - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WC-84 Self-insurer's Payroll Report - Missouri?

A: Form WC-84 Self-insurer's Payroll Report - Missouri is a form used by self-insured employers in Missouri to report their payroll information for workers' compensation purposes.

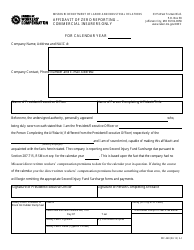

Q: Who needs to file Form WC-84 Self-insurer's Payroll Report - Missouri?

A: Self-insured employers in Missouri need to file Form WC-84 Self-insurer's Payroll Report to report their payroll information for workers' compensation.

Q: When is Form WC-84 Self-insurer's Payroll Report - Missouri due?

A: Form WC-84 Self-insurer's Payroll Report - Missouri is due on April 30th of each year.

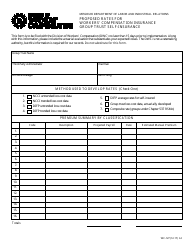

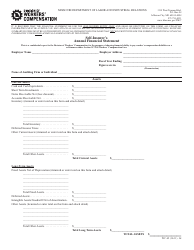

Q: What information is required on Form WC-84 Self-insurer's Payroll Report - Missouri?

A: Form WC-84 Self-insurer's Payroll Report - Missouri requires the employer's information, payroll details, and other relevant information regarding workers' compensation.

Q: Are there any penalties for not filing Form WC-84 Self-insurer's Payroll Report - Missouri?

A: Yes, failure to file Form WC-84 Self-insurer's Payroll Report - Missouri may result in penalties and fines imposed by the Missouri Division of Workers' Compensation.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Missouri Department of Labor and Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WC-84 by clicking the link below or browse more documents and templates provided by the Missouri Department of Labor and Industrial Relations.