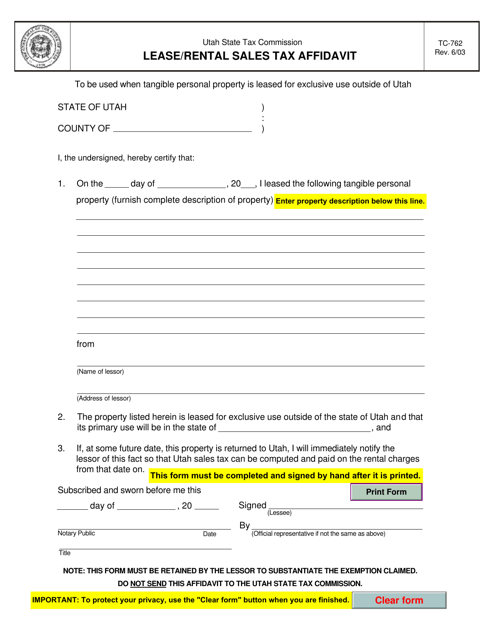

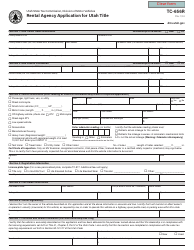

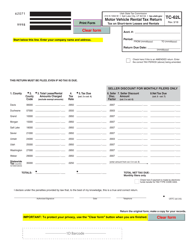

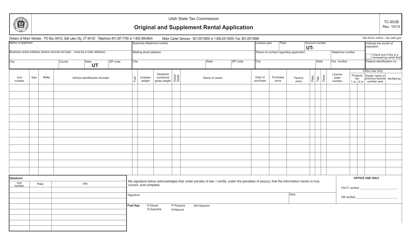

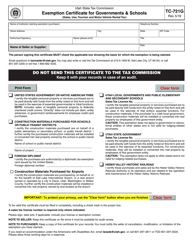

Form TC-762 Lease / Rental Sales Tax Affidavit - Utah

What Is Form TC-762?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC-762?

A: TC-762 is the Lease/Rental Sales Tax Affidavit form used in Utah.

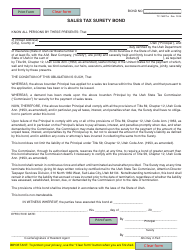

Q: What is the purpose of TC-762?

A: The purpose of TC-762 is to report and pay sales tax on lease or rental transactions in Utah.

Q: Who needs to fill out TC-762?

A: Anyone who is engaged in leasing or renting taxable items in Utah needs to fill out TC-762.

Q: When should TC-762 be filed?

A: TC-762 should be filed on a monthly basis and must be submitted by the end of the month following the taxable period.

Q: What information is required on TC-762?

A: TC-762 requires the information of the lessor, lessee, leased or rented item details, and the amount of sales tax due.

Q: What happens if I don't file TC-762?

A: Failure to file TC-762 or pay the sales tax on lease or rental transactions can result in penalties and interest.

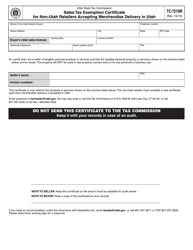

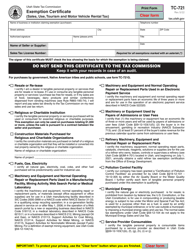

Q: Are there any exemptions or deductions available for lease or rental sales tax?

A: Some exemptions and deductions may be available for lease or rental sales tax. It is recommended to consult the Utah State Tax Commission or a tax professional for specific information.

Form Details:

- Released on June 1, 2003;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-762 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.