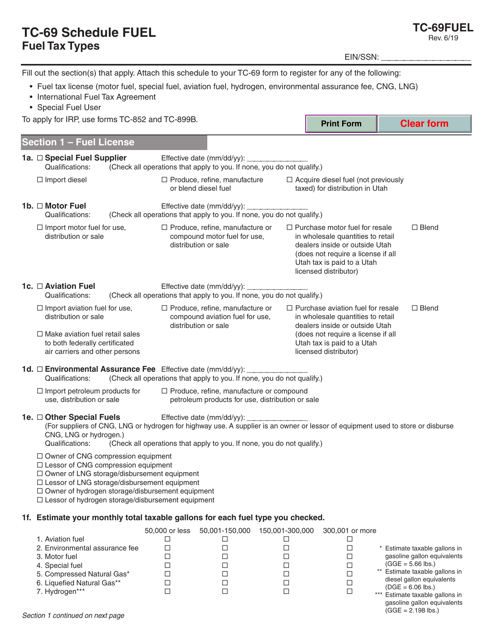

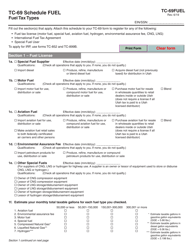

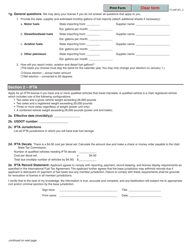

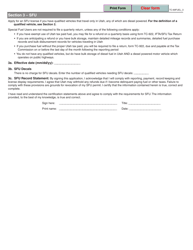

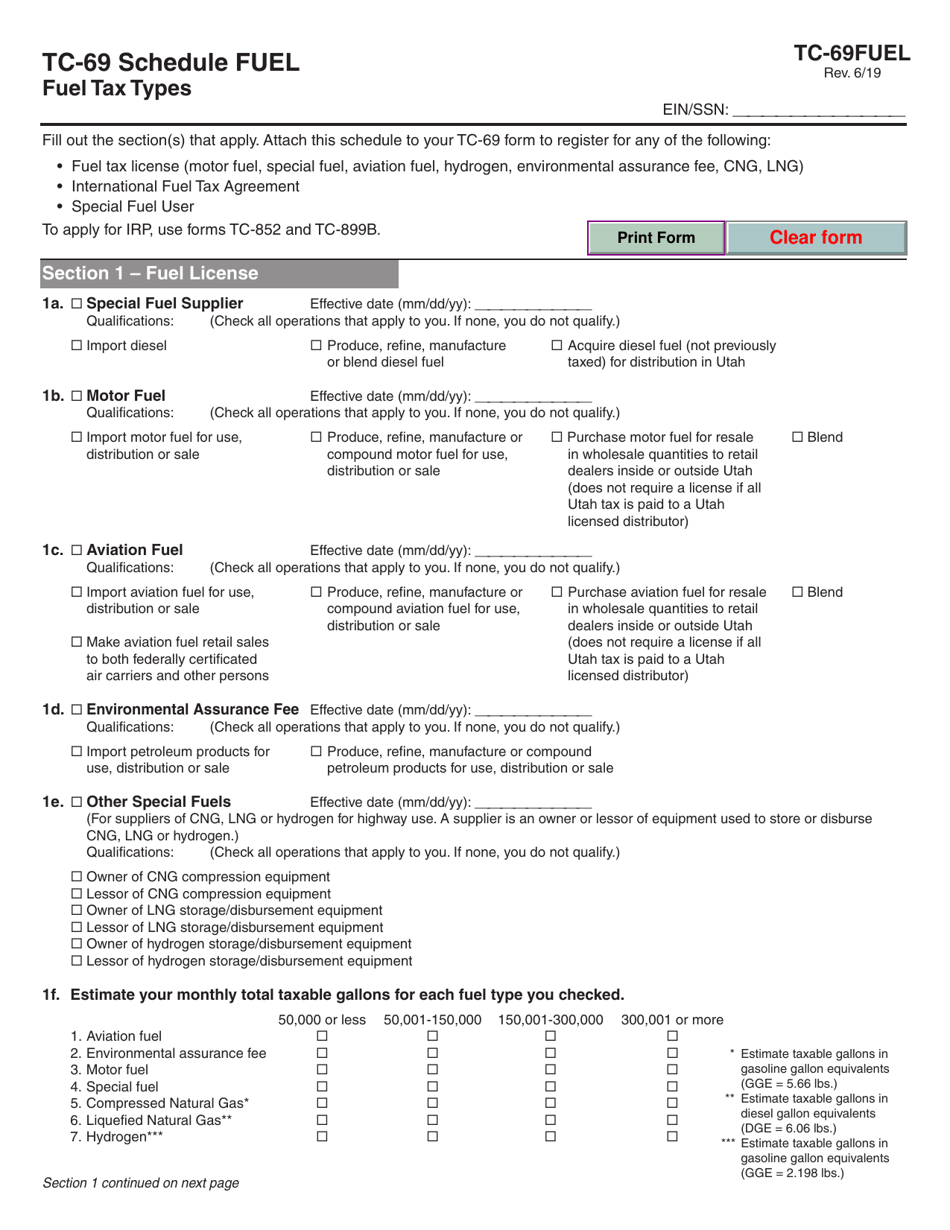

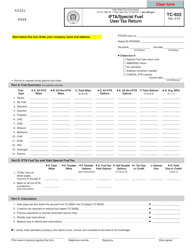

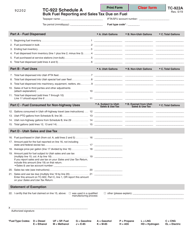

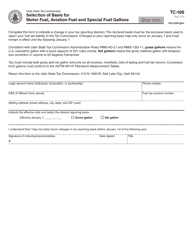

Form TC-69 Schedule FUEL Fuel Tax Types - Utah

What Is Form TC-69 Schedule FUEL?

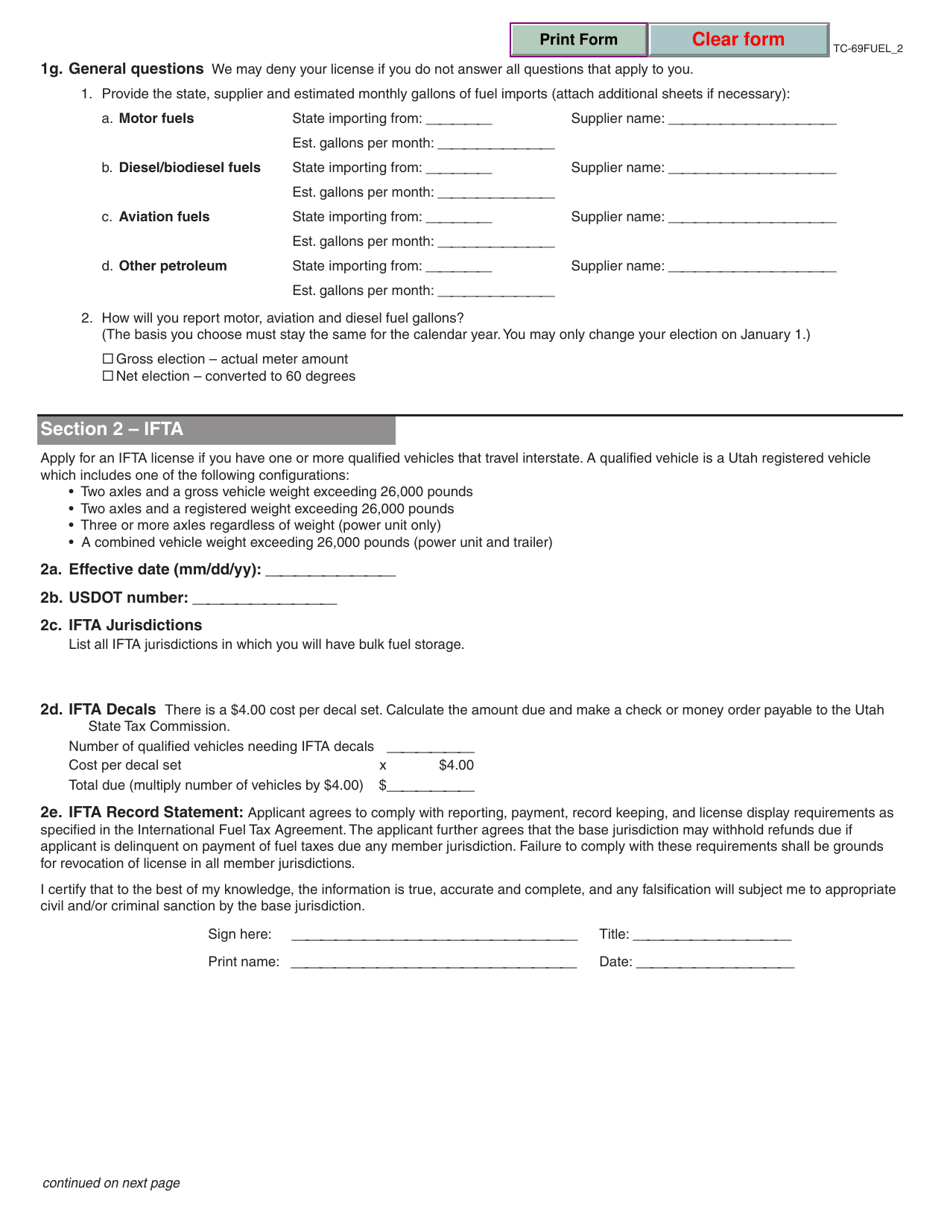

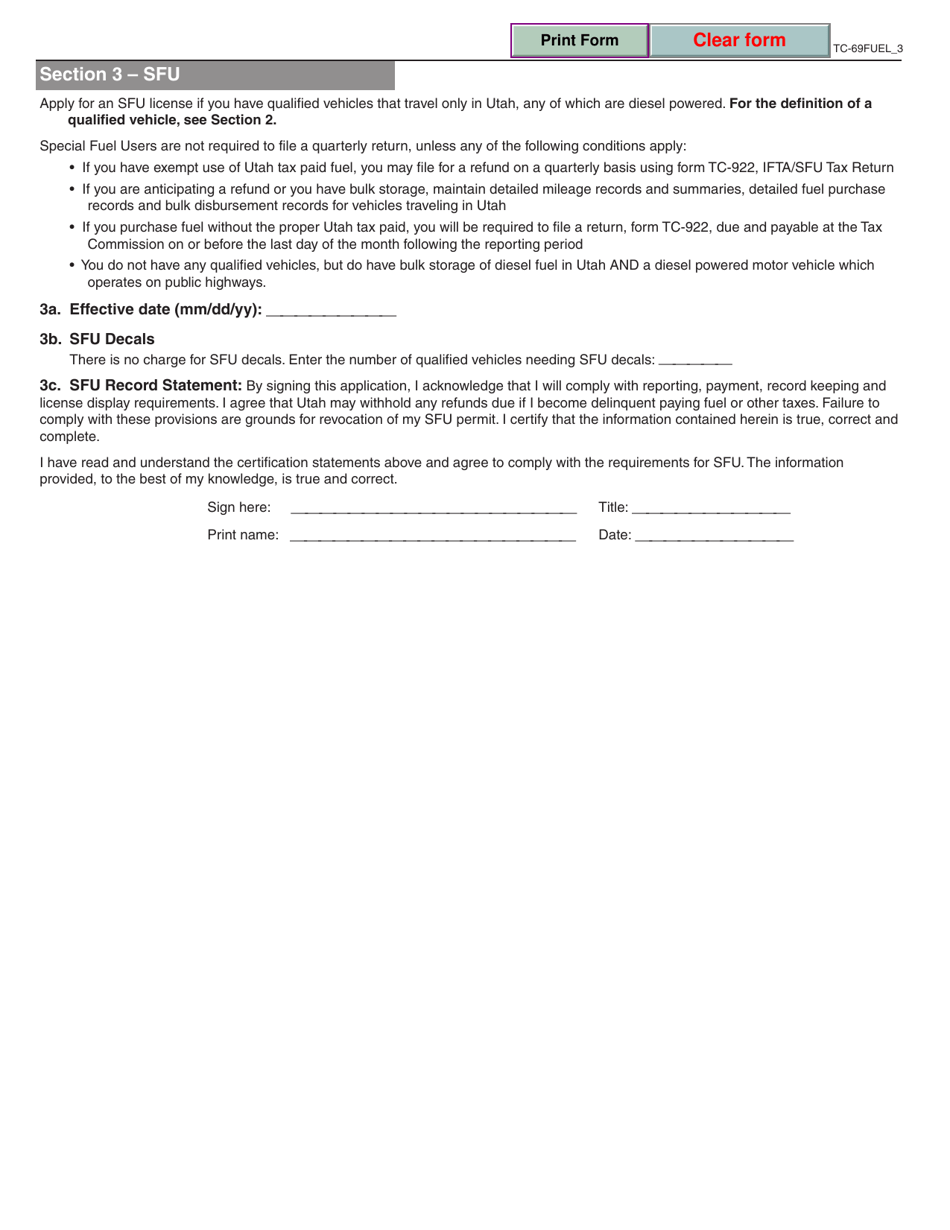

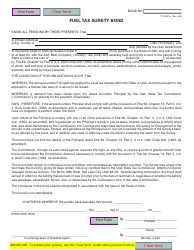

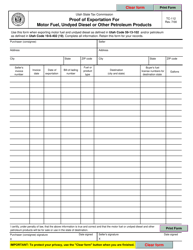

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-69, Utah State Business and Tax Registration. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-69 Schedule FUEL?

A: Form TC-69 Schedule FUEL is a form used in Utah to report fuel tax types.

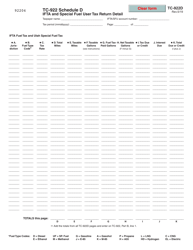

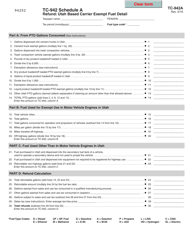

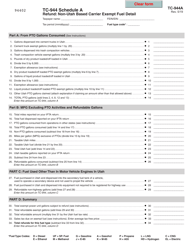

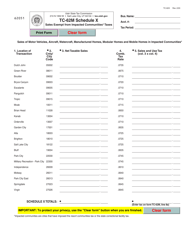

Q: What are fuel tax types in Utah?

A: Fuel tax types in Utah include gasoline, diesel, compressed natural gas (CNG), liquefied natural gas (LNG), and propane.

Q: Why do I need to report fuel tax types?

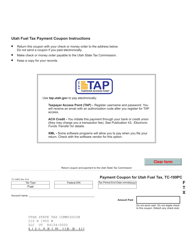

A: Reporting fuel tax types is required by the state of Utah to calculate and pay the appropriate fuel taxes based on the type of fuel used.

Q: When do I need to submit Form TC-69 Schedule FUEL?

A: Form TC-69 Schedule FUEL should be submitted on a quarterly basis, by the last day of the month following the end of the quarter.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-69 Schedule FUEL by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.