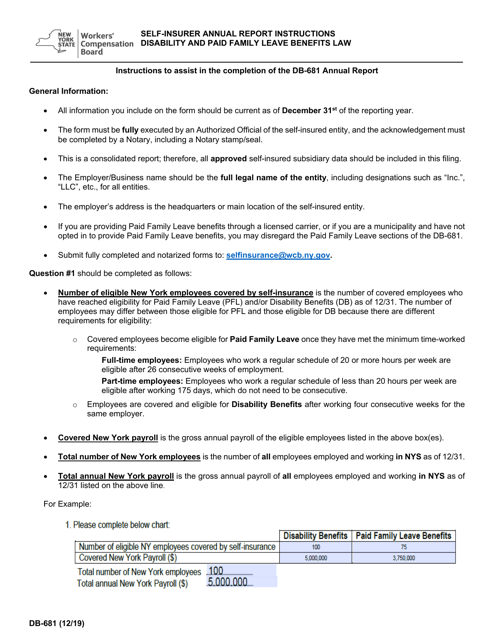

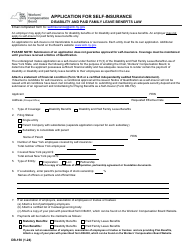

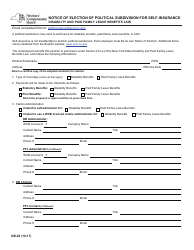

Form DB-681 Self-insurer's Annual Report for Calendar Year - New York

What Is Form DB-681?

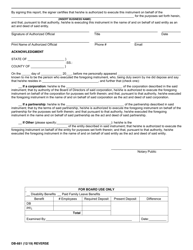

This is a legal form that was released by the New York State Workers' Compensation Board - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DB-681?

A: Form DB-681 is the Self-insurer's Annual Report for Calendar Year in New York.

Q: Who needs to file Form DB-681?

A: Self-insurers in New York need to file Form DB-681.

Q: What is the purpose of Form DB-681?

A: The purpose of Form DB-681 is to report self-insurance activities for the calendar year.

Q: When is Form DB-681 due?

A: Form DB-681 is due by March 1st of the following year.

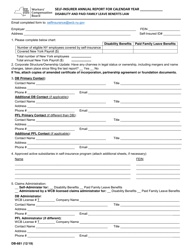

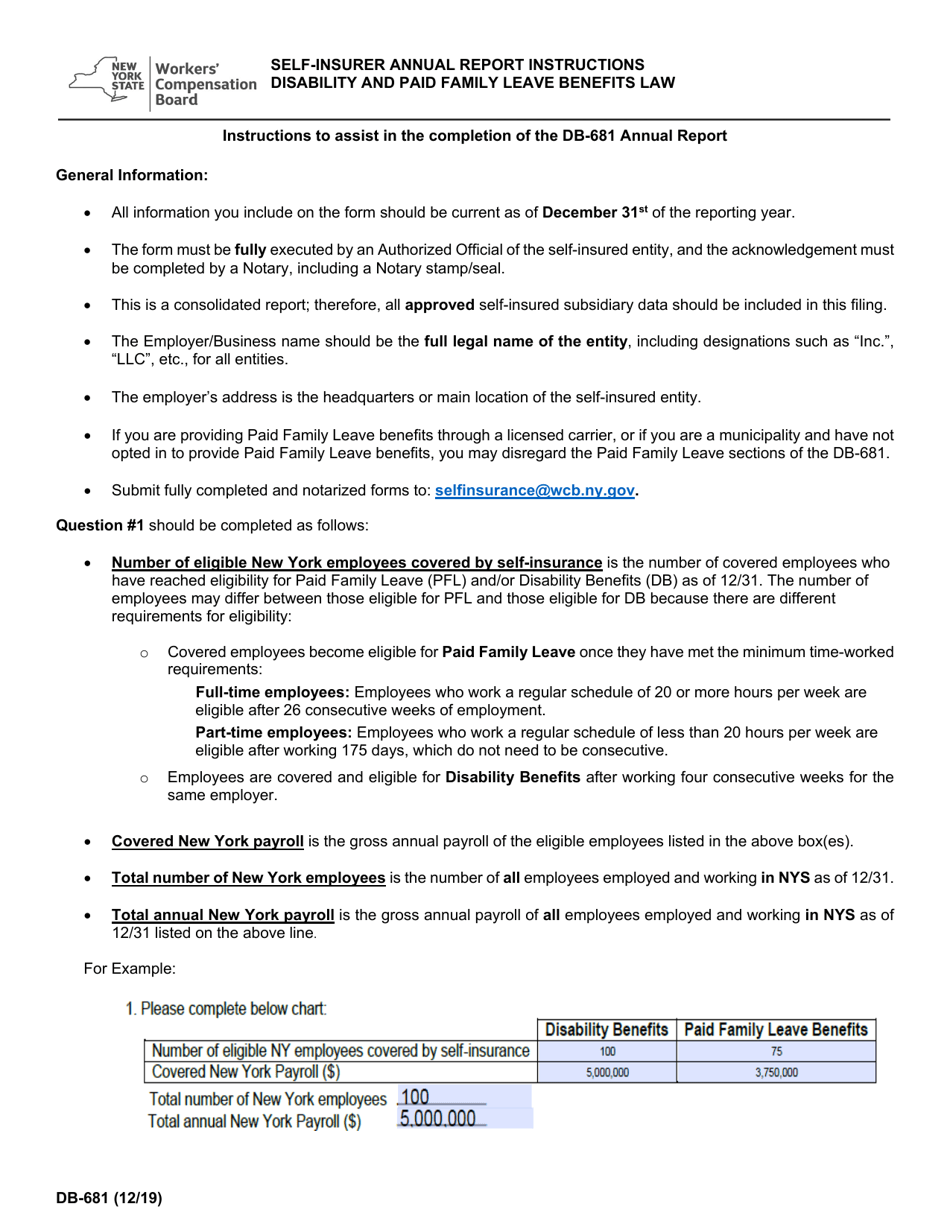

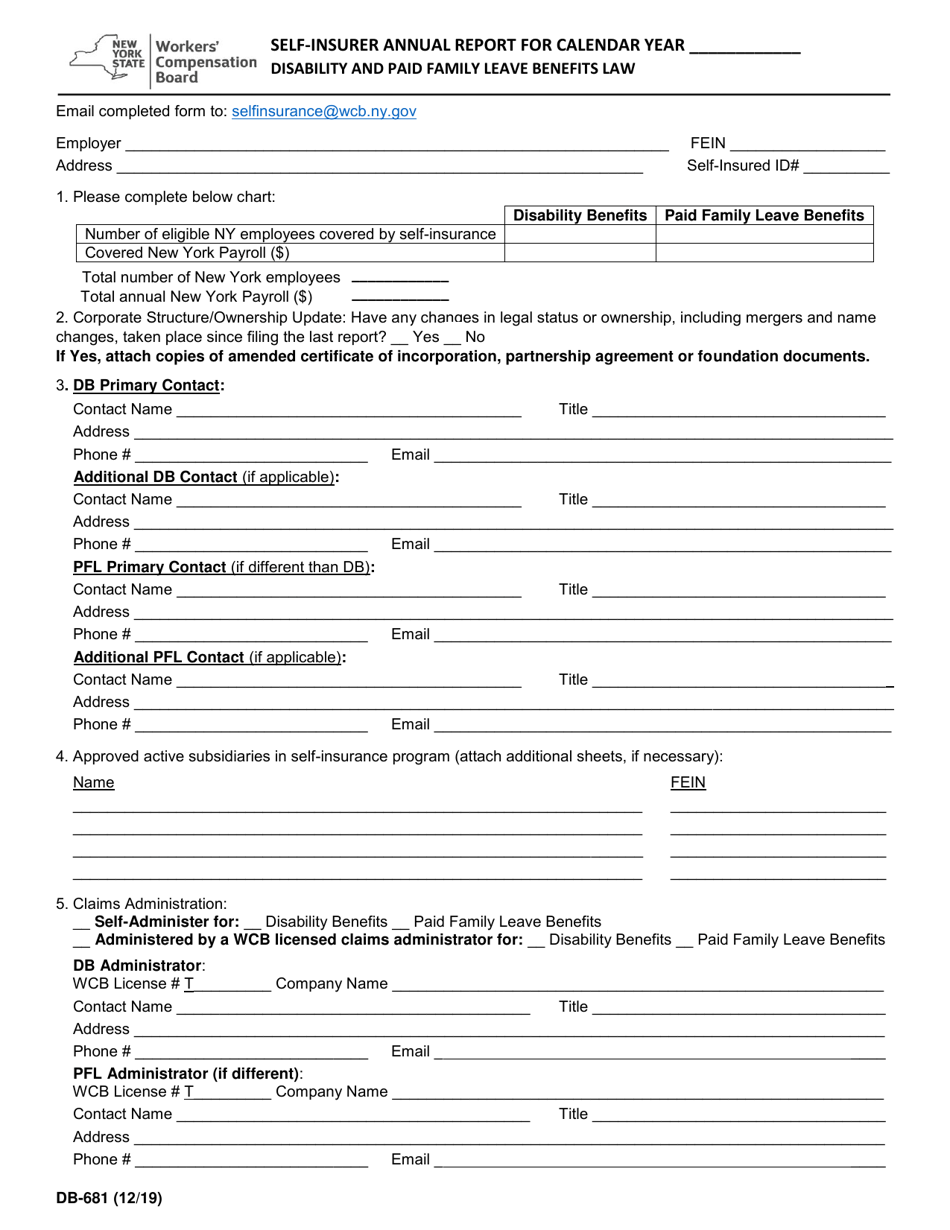

Q: What information do I need to complete Form DB-681?

A: You will need to provide information about your self-insurance program, including the number of employees covered, claims information, and financial data.

Q: Are there any penalties for not filing Form DB-681?

A: Yes, failure to file Form DB-681 may result in penalties or other legal consequences.

Q: Is there a fee to file Form DB-681?

A: No, there is no fee to file Form DB-681.

Q: Can I request an extension to file Form DB-681?

A: Yes, you can request an extension to file Form DB-681, but it must be done before the original due date of March 1st.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New York State Workers' Compensation Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DB-681 by clicking the link below or browse more documents and templates provided by the New York State Workers' Compensation Board.