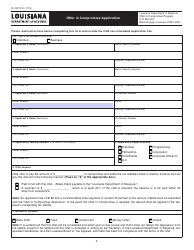

Instructions for Offer in Compromise Application for Entities - Mississippi

This document was released by Mississippi Department of Revenue and contains the most recent official instructions for Offer in Compromise Application for Entities .

FAQ

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program that allows eligible entities to settle their tax debt for less than the full amount owed.

Q: Can entities in Mississippi apply for an Offer in Compromise?

A: Yes, entities in Mississippi can apply for an Offer in Compromise.

Q: Who is eligible to apply for an Offer in Compromise?

A: Entities that are unable to pay their tax debt in full and show financial hardship may be eligible to apply.

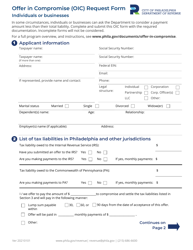

Q: What forms do entities need to submit for an Offer in Compromise?

A: Entities need to submit Form OIC-1, Offer in Compromise Application, along with all required supporting documentation.

Q: What documentation is required for an Offer in Compromise?

A: Entities need to provide information about their financial situation, including income, assets, and expenses.

Q: How much should entities offer in their Offer in Compromise?

A: Entities should offer an amount that reflects their ability to pay and is reasonable based on their financial situation.

Q: Is there a fee for applying for an Offer in Compromise?

A: Yes, there is a non-refundable application fee that must be submitted with the application.

Q: What happens after an Offer in Compromise is submitted?

A: The tax authority will review the application and determine whether to accept or reject the offer.

Q: Can entities appeal the decision on their Offer in Compromise?

A: Yes, entities can appeal the decision if their offer is rejected.

Q: Is it recommended to seek professional assistance for an Offer in Compromise application?

A: Yes, it is recommended to seek the assistance of a tax professional or attorney when applying for an Offer in Compromise.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Mississippi Department of Revenue.