Instructions for Offer in Compromise Application for Individuals Who Are Not Self-employed - Mississippi

This document was released by Mississippi Department of Revenue and contains the most recent official instructions for Offer in Compromise Application for Individuals Who Are Not Self-employed .

FAQ

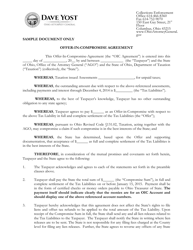

Q: What is an Offer in Compromise (OIC) application?

A: An Offer in Compromise (OIC) is a program that allows individuals who are unable to pay their full tax liability to settle for a lesser amount.

Q: Who can apply for an Offer in Compromise (OIC) in Mississippi?

A: Any individual who is not self-employed and owes back taxes to the state of Mississippi can apply for an Offer in Compromise (OIC).

Q: What is the purpose of the Offer in Compromise (OIC) application?

A: The purpose of the OIC application is to provide detailed financial information to the Mississippi Department of Revenue to determine if the taxpayer qualifies for a reduced tax liability.

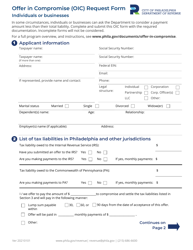

Q: What forms do I need to submit for an Offer in Compromise (OIC) application?

A: You will need to submit Form 78-514, Offer in Compromise (OIC) Application, along with supporting documentation such as income statements, bank statements, and tax returns.

Q: How long does it take to process an Offer in Compromise (OIC) application?

A: The processing time can vary, but it typically takes several months to complete the review and decision-making process for an OIC application.

Q: Is there a fee to apply for an Offer in Compromise (OIC) in Mississippi?

A: Yes, there is a non-refundable fee of $200 that must be submitted with the OIC application.

Q: Can I make installment payments if my Offer in Compromise (OIC) is accepted?

A: Yes, if your OIC is accepted, you will have the option to make installment payments to satisfy the reduced tax liability.

Q: What happens if my Offer in Compromise (OIC) application is rejected?

A: If your OIC application is rejected, you can appeal the decision within 30 days.

Q: Can I still file for bankruptcy if I have an active Offer in Compromise (OIC) application?

A: Yes, you can still file for bankruptcy even if you have an active OIC application; however, you should consult with a bankruptcy attorney for specific guidance.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Mississippi Department of Revenue.