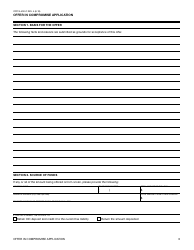

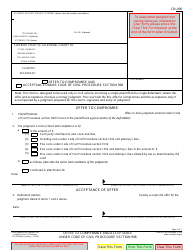

Form CDTFA-490-C Offer in Compromise Application - California

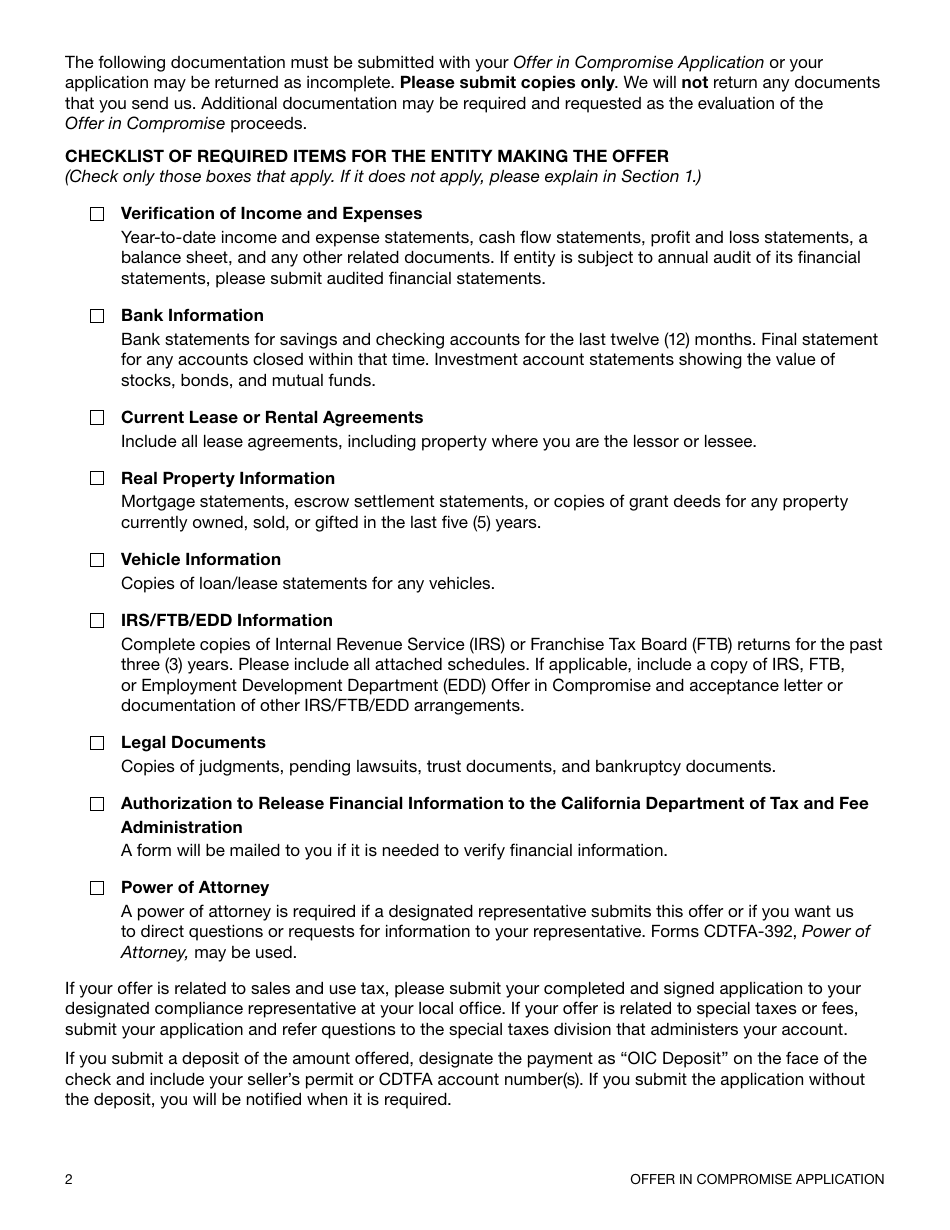

What Is Form CDTFA-490-C?

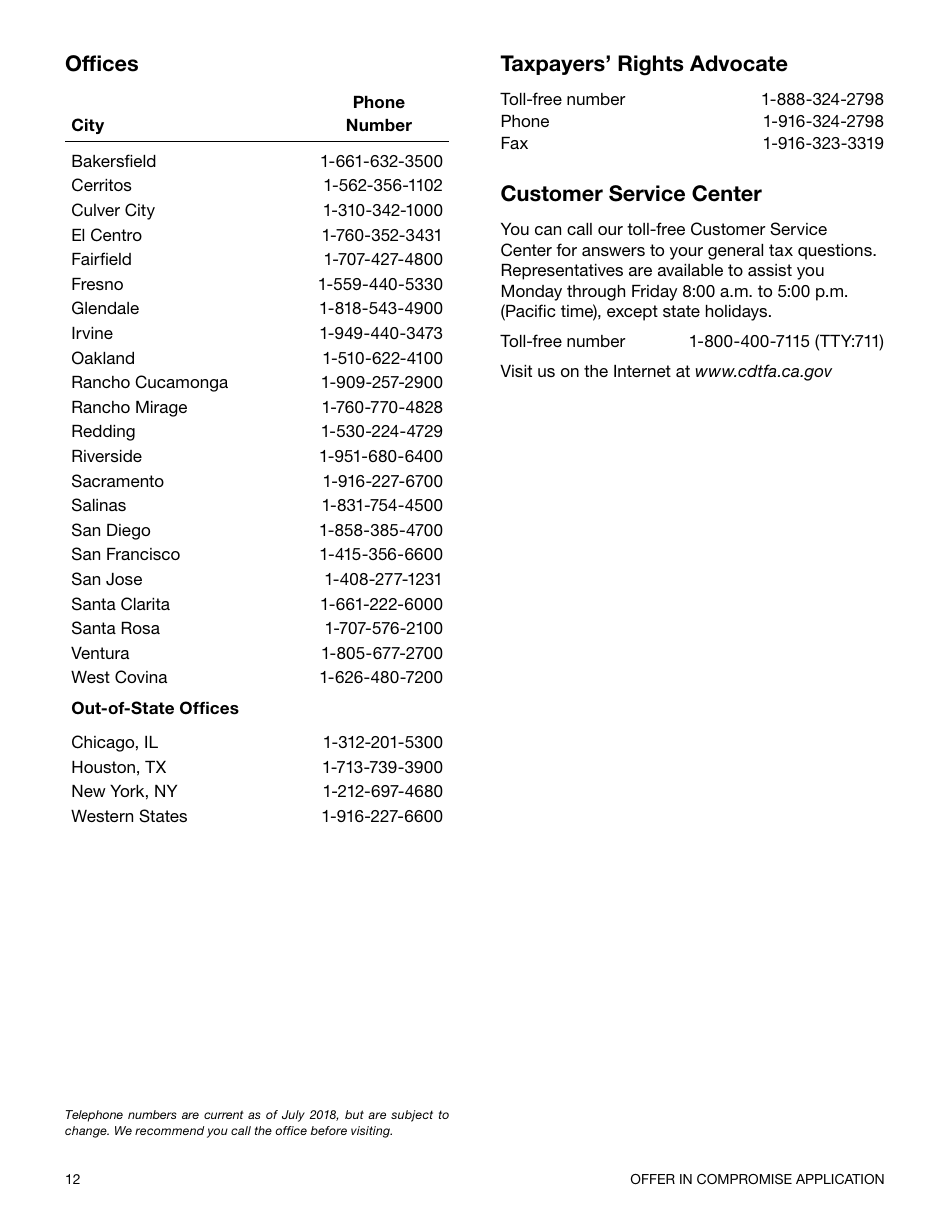

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-490-C?

A: Form CDTFA-490-C is the Offer in Compromise Application used in California.

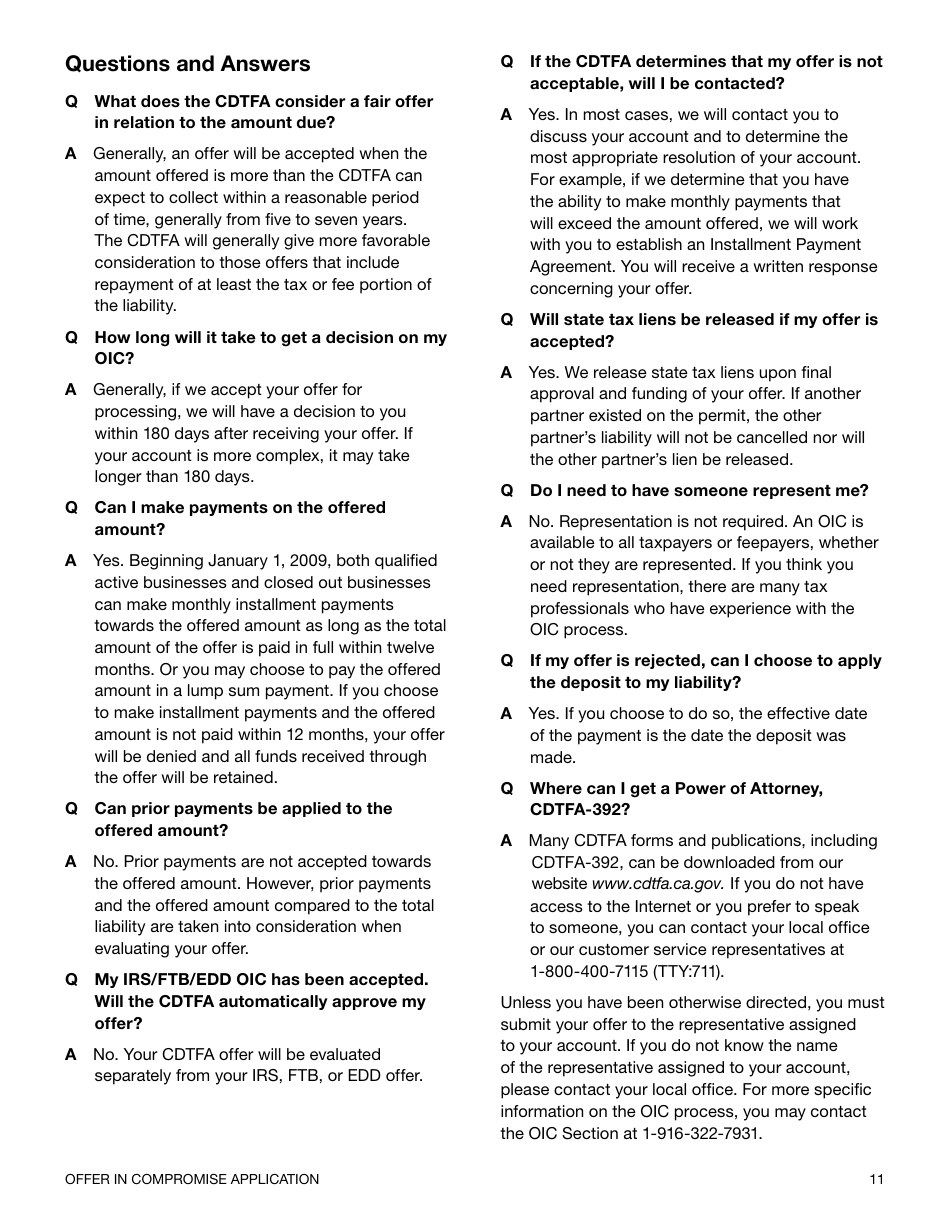

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program that allows taxpayers to settle their tax liabilities for less than the full amount owed.

Q: Who can use Form CDTFA-490-C?

A: Form CDTFA-490-C is used by taxpayers in California who want to apply for an Offer in Compromise.

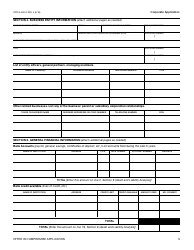

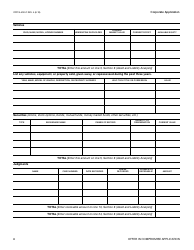

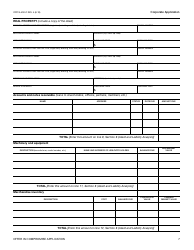

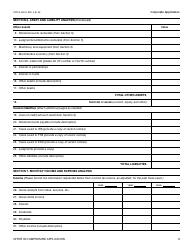

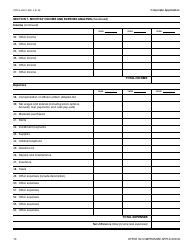

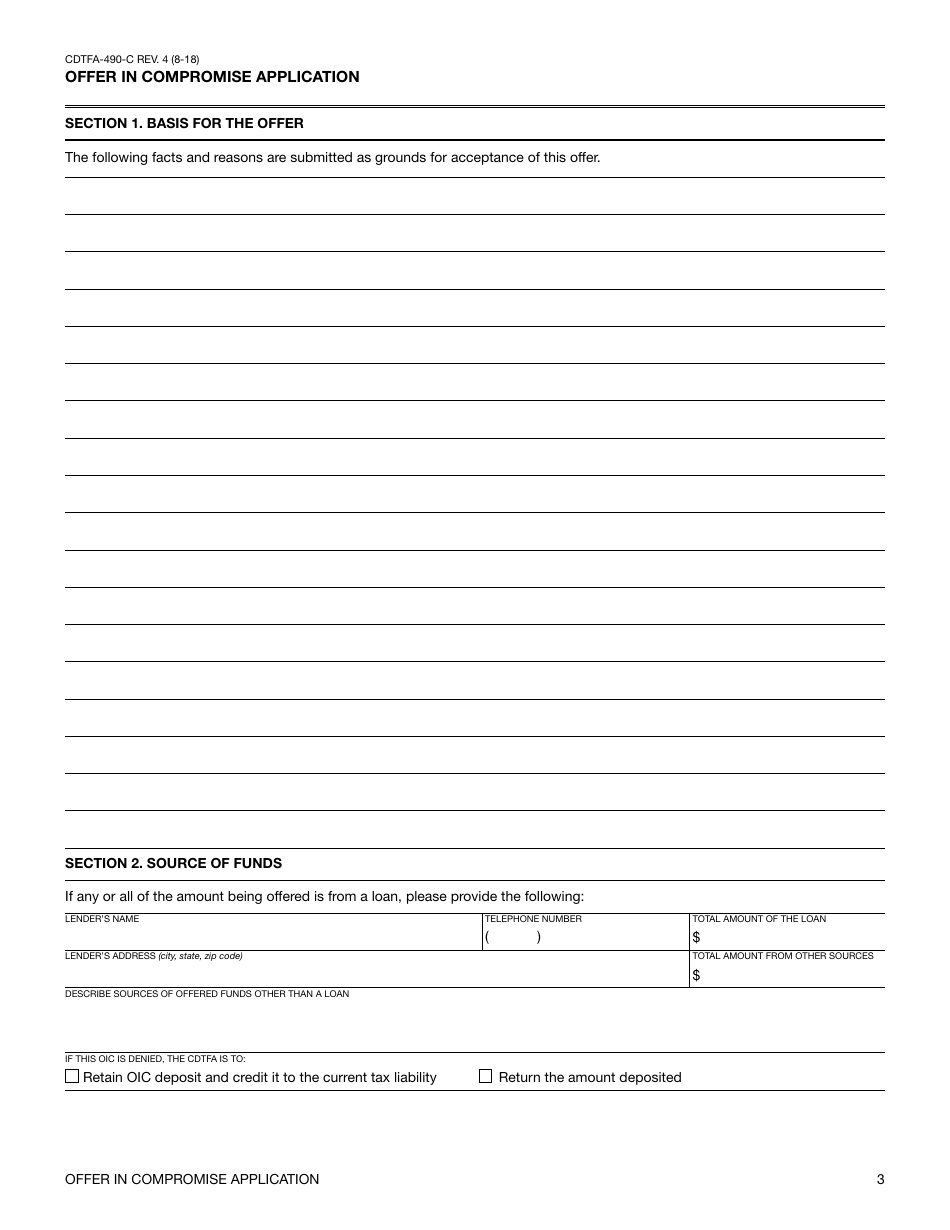

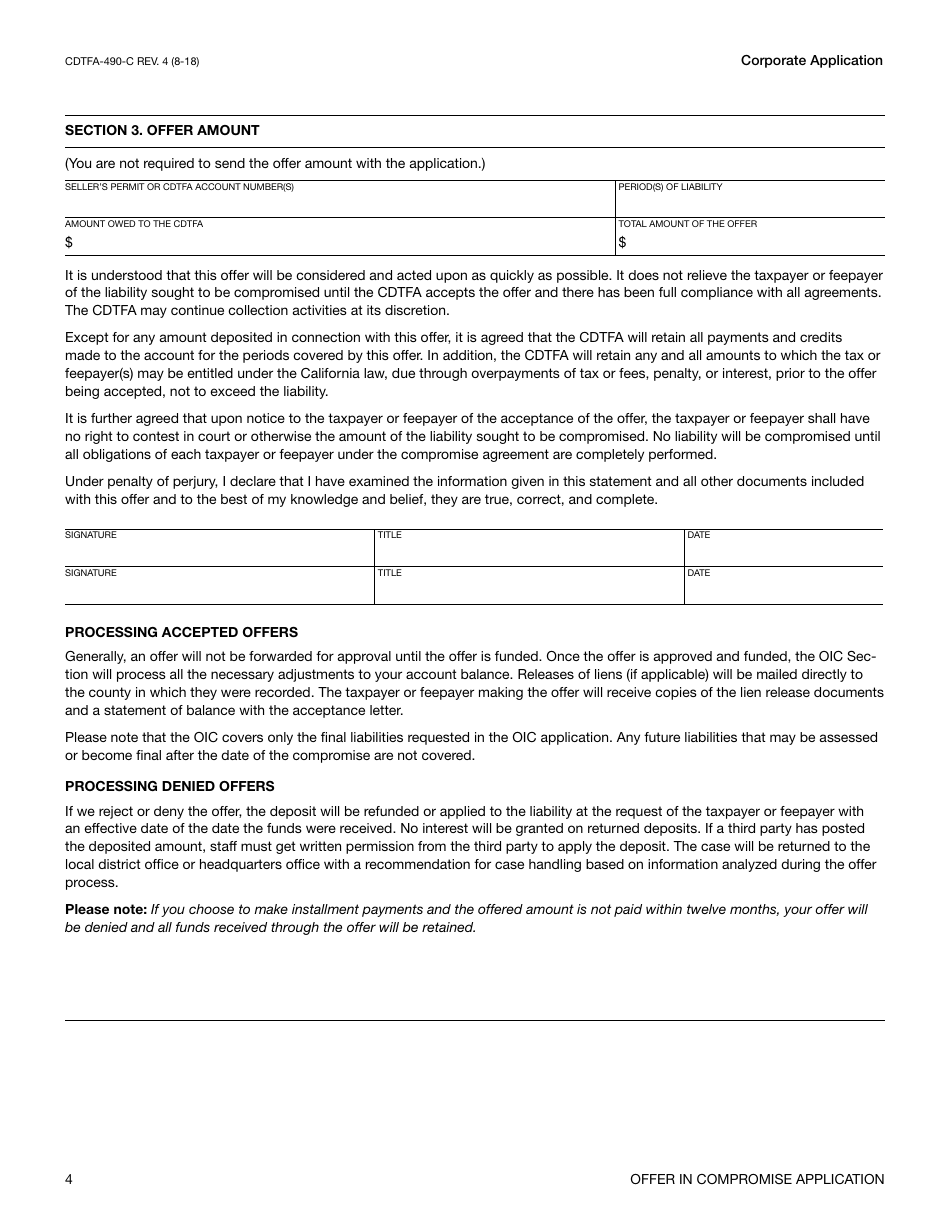

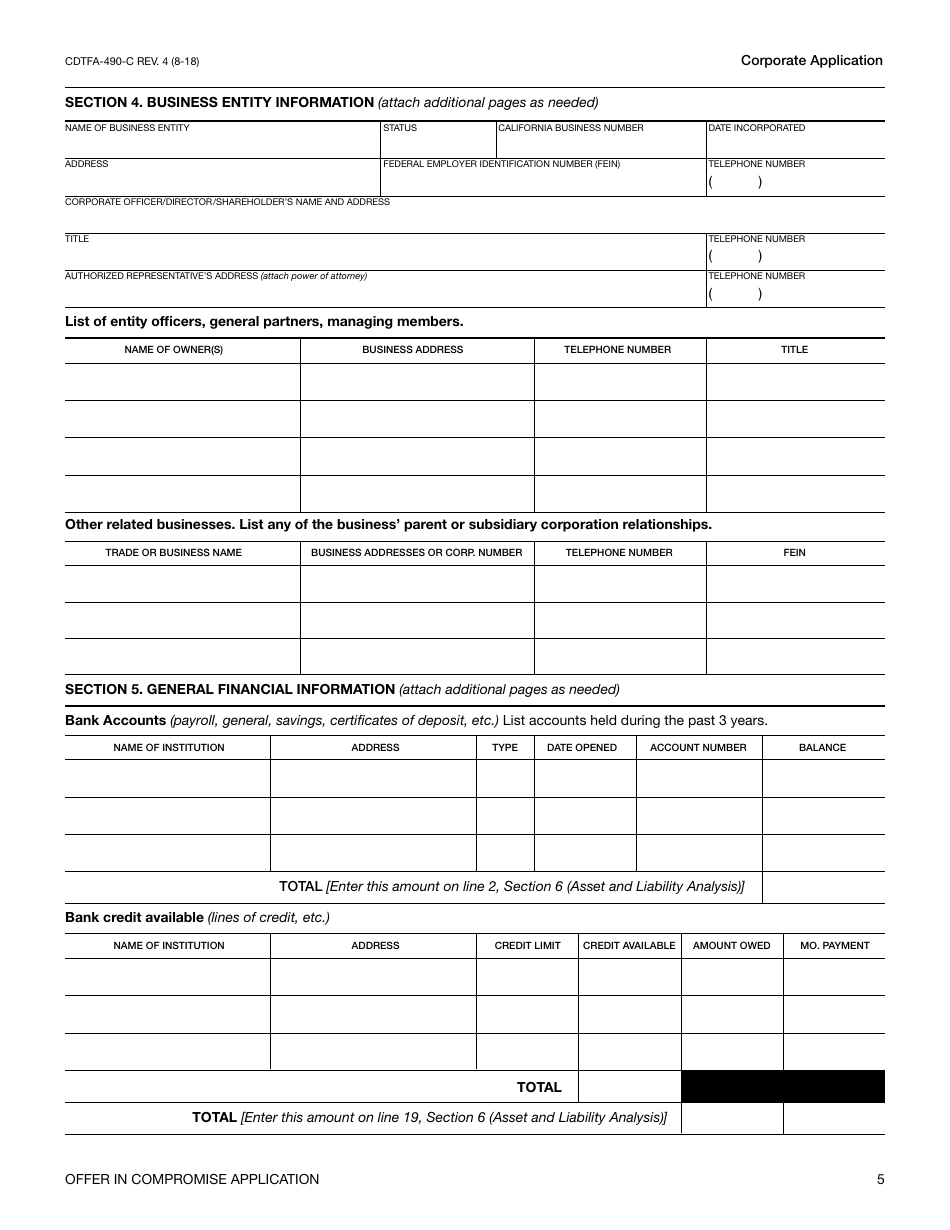

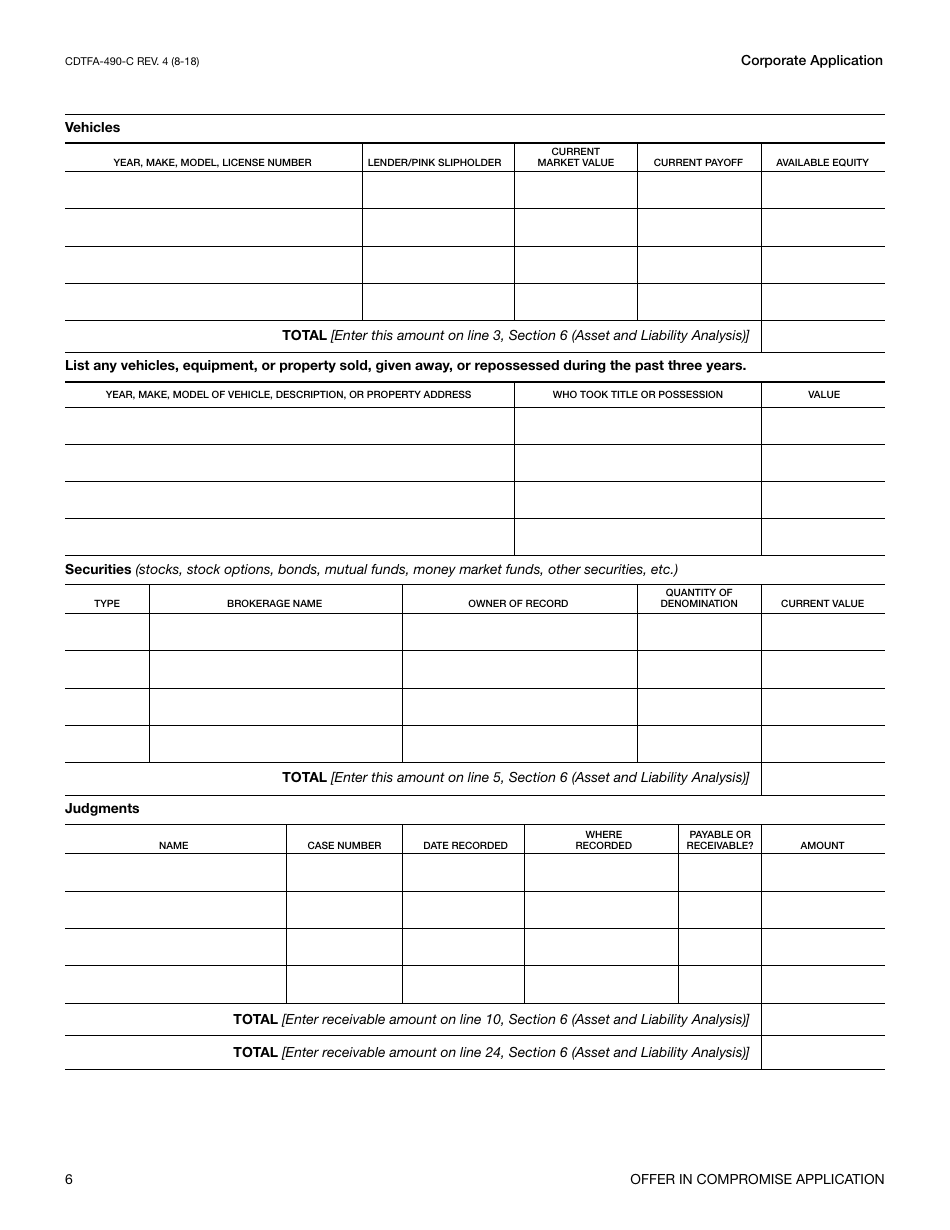

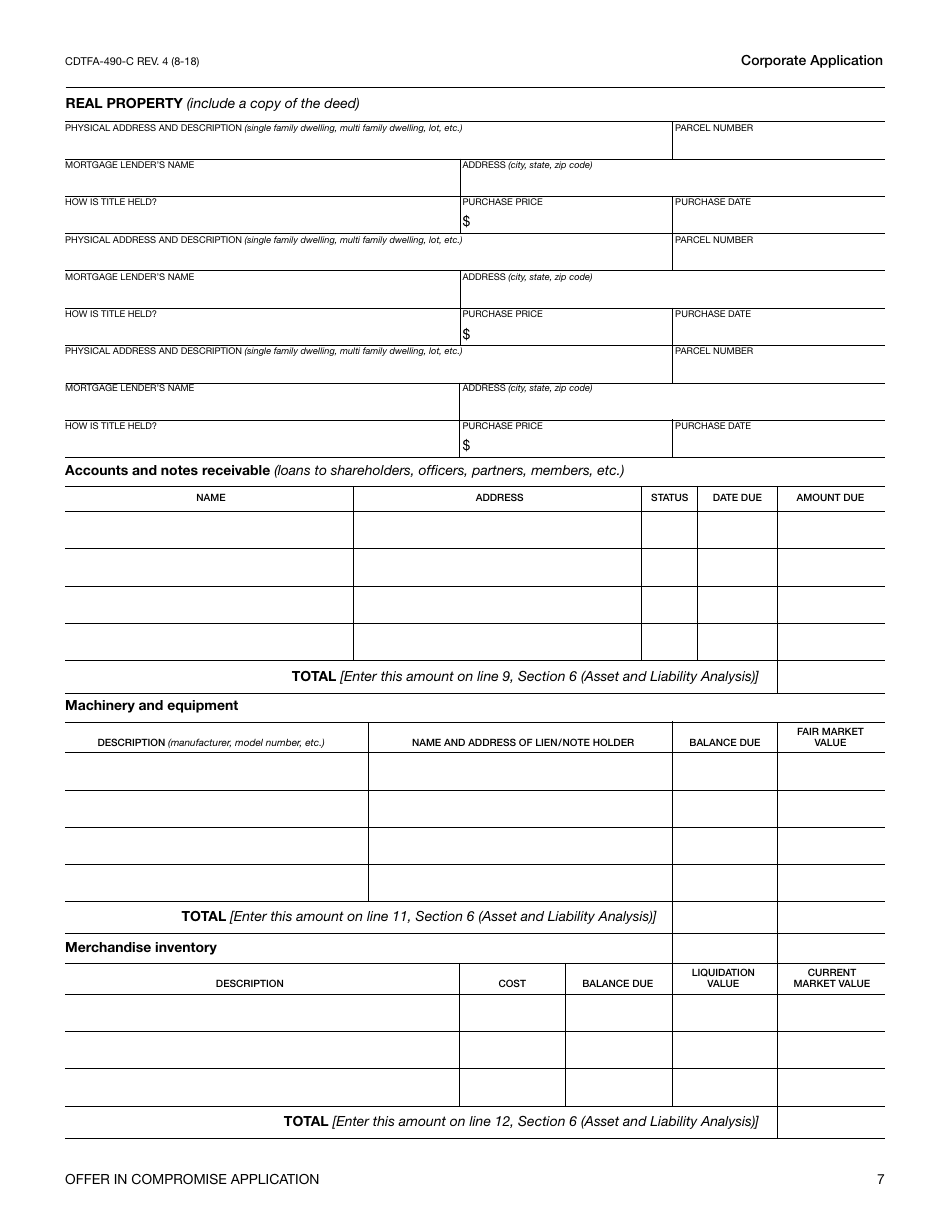

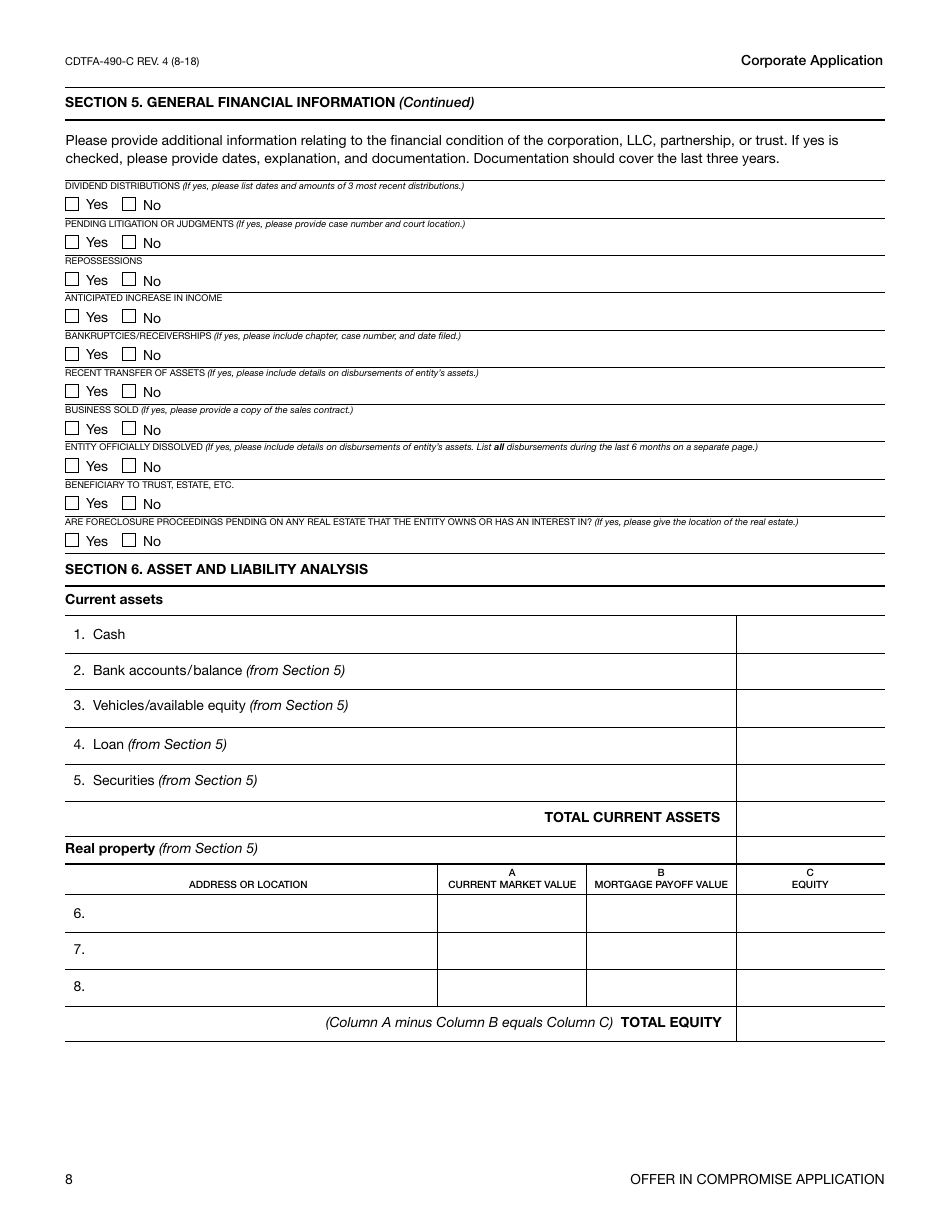

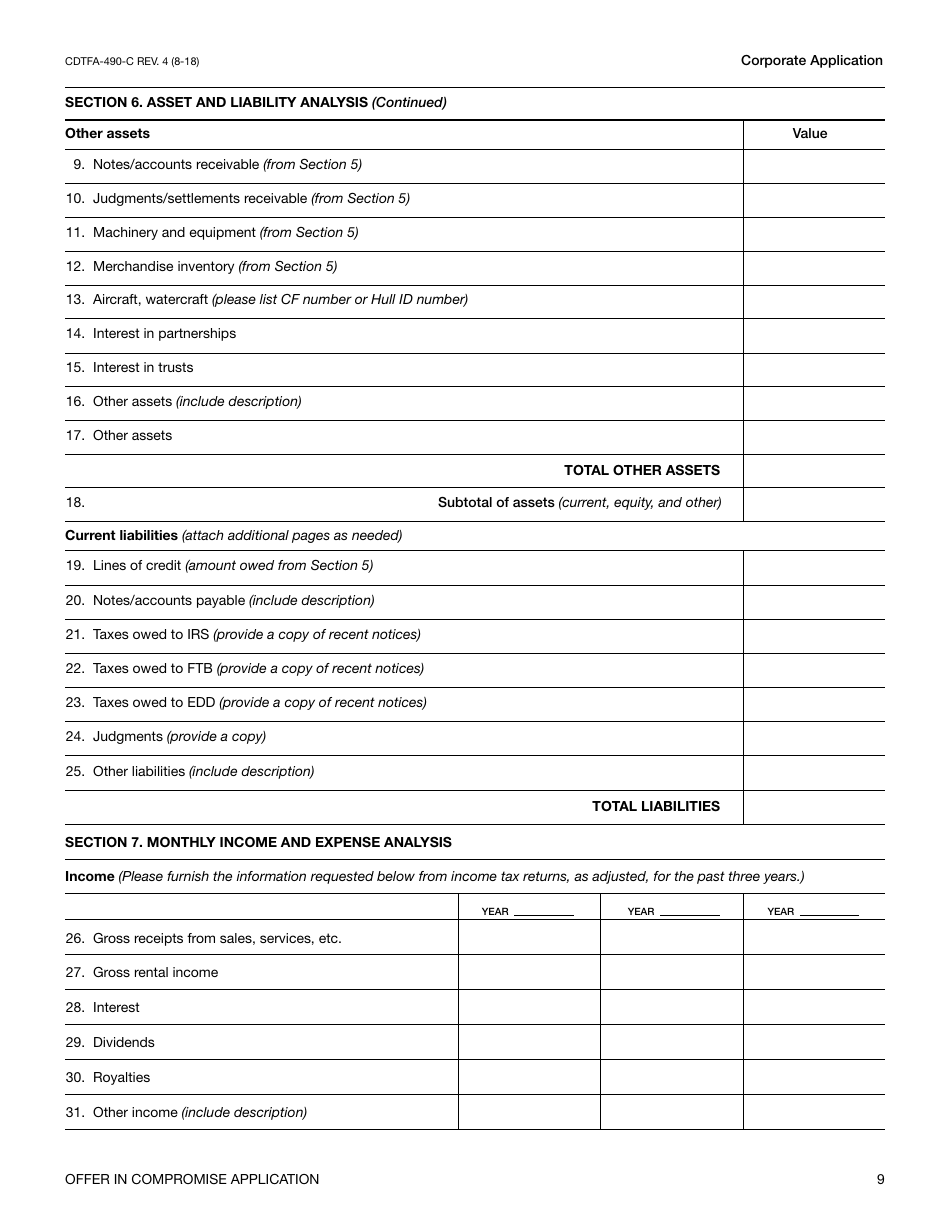

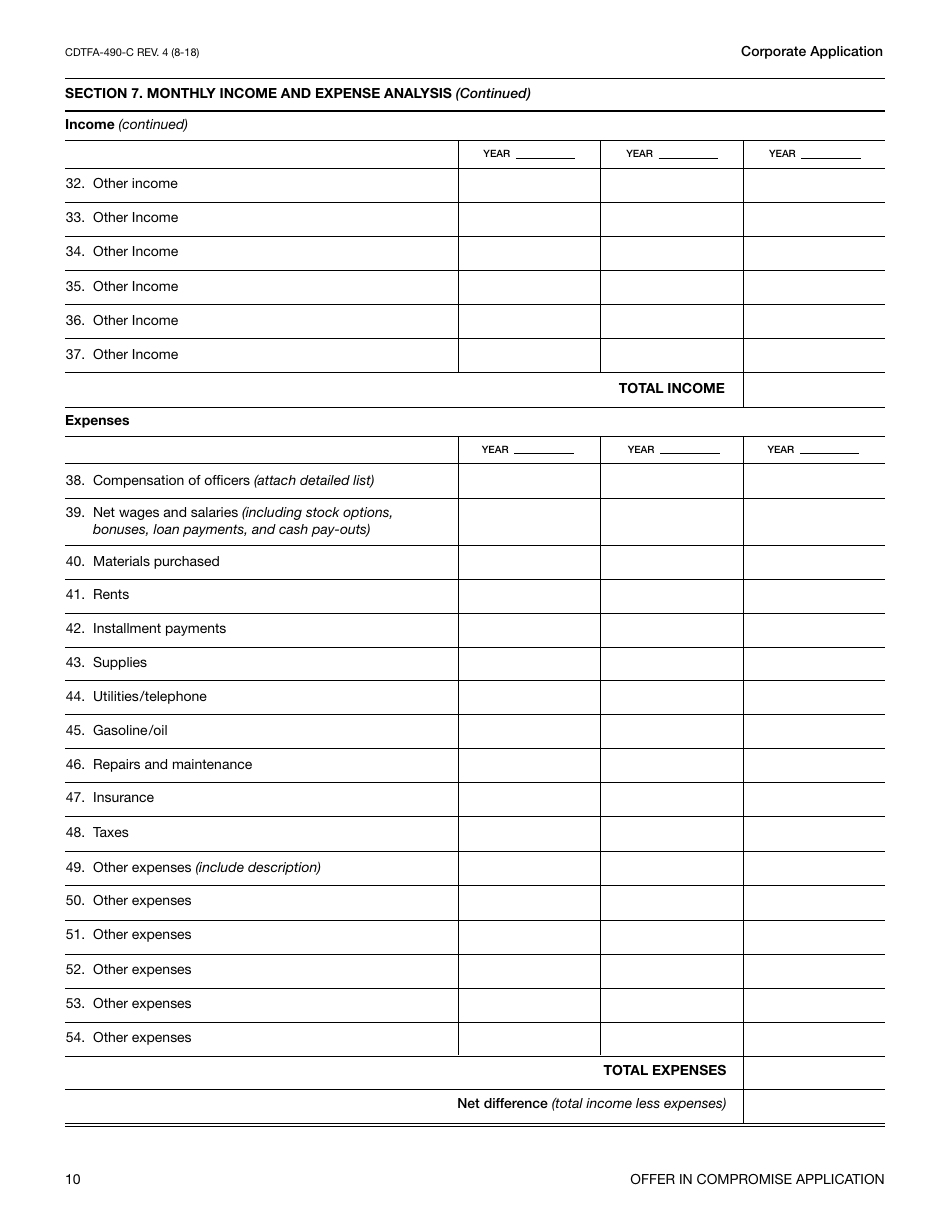

Q: What information is required on Form CDTFA-490-C?

A: Form CDTFA-490-C requires information about the taxpayer's financial situation, including income, expenses, assets, and liabilities.

Q: Are there any fees associated with submitting Form CDTFA-490-C?

A: Yes, there is a non-refundable $25 application fee for submitting Form CDTFA-490-C.

Q: What is the deadline for submitting Form CDTFA-490-C?

A: There is no specific deadline for submitting Form CDTFA-490-C, but it is recommended to submit it as soon as possible.

Q: What happens after submitting Form CDTFA-490-C?

A: After submitting Form CDTFA-490-C, the CDTFA will review the application and may request additional documentation or information.

Q: Can I appeal if my Offer in Compromise is rejected?

A: Yes, taxpayers have the right to appeal if their Offer in Compromise is rejected by the CDTFA.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-490-C by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.