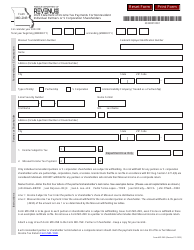

Form MO-656 Offer in Compromise Application for Individual Income Tax - Missouri

What Is Form MO-656?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

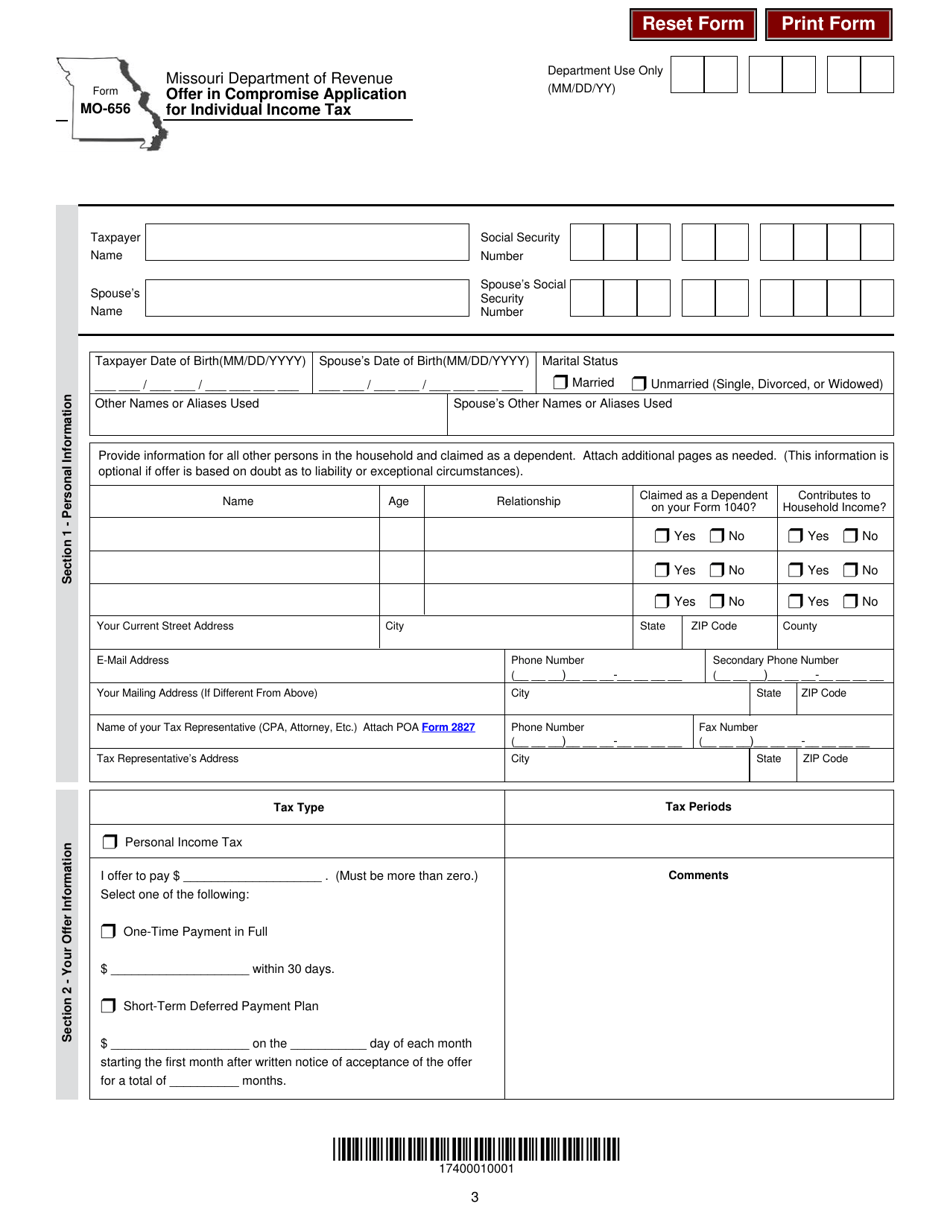

Q: What is Form MO-656?

A: Form MO-656 is the Offer in Compromise application for individual income tax in Missouri.

Q: What is an Offer in Compromise?

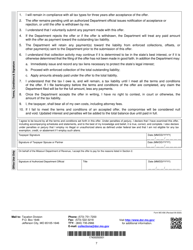

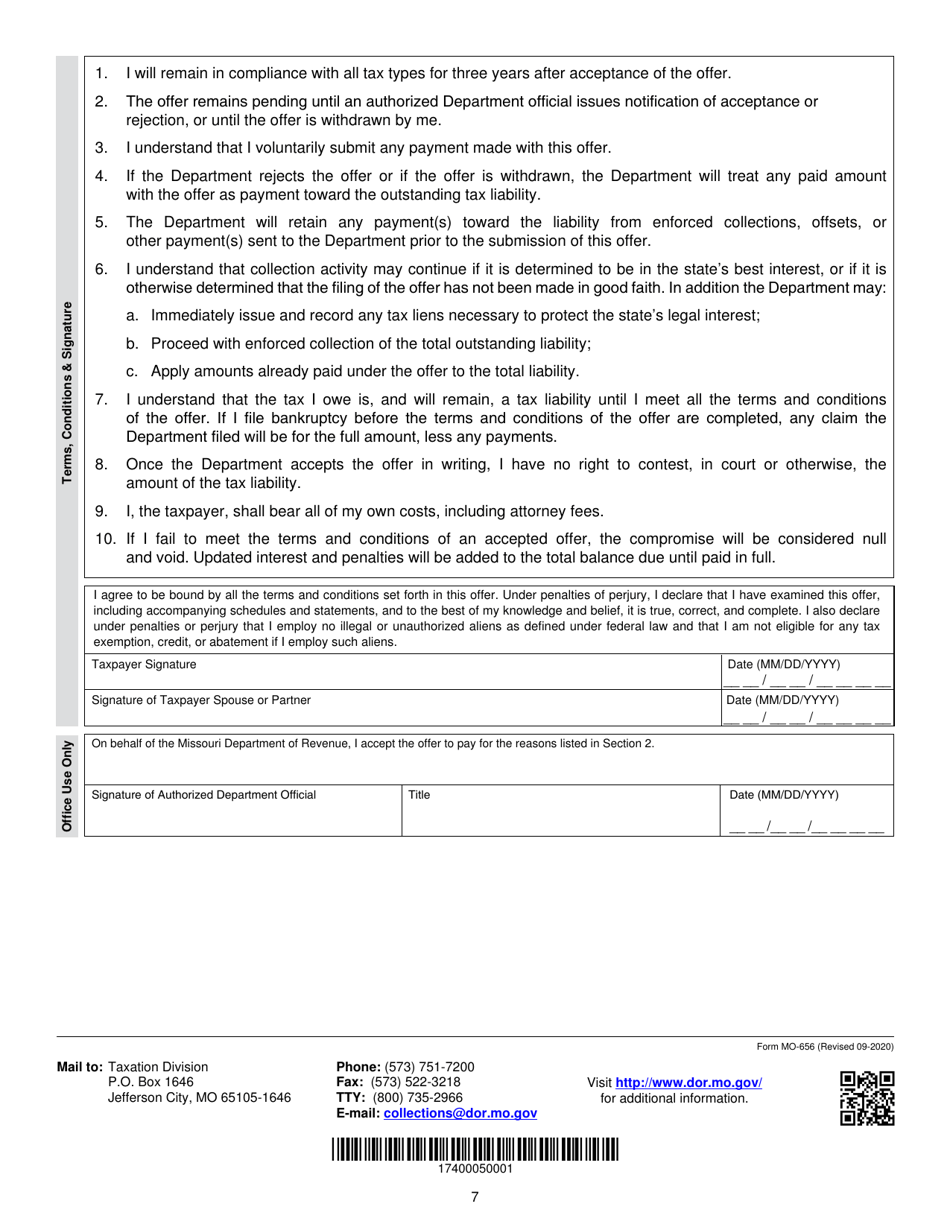

A: An Offer in Compromise is a program that allows taxpayers to settle their tax debt for less than the full amount owed.

Q: Who can use Form MO-656?

A: Individuals who owe income tax in Missouri and are unable to pay the full amount may use Form MO-656.

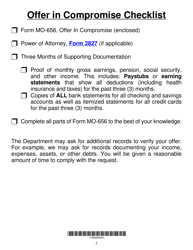

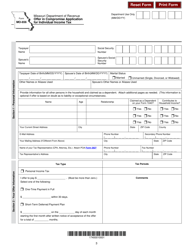

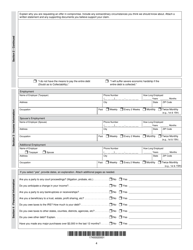

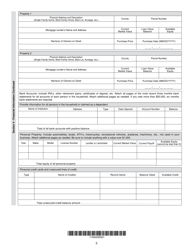

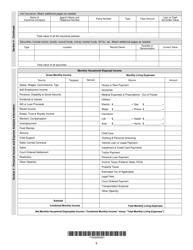

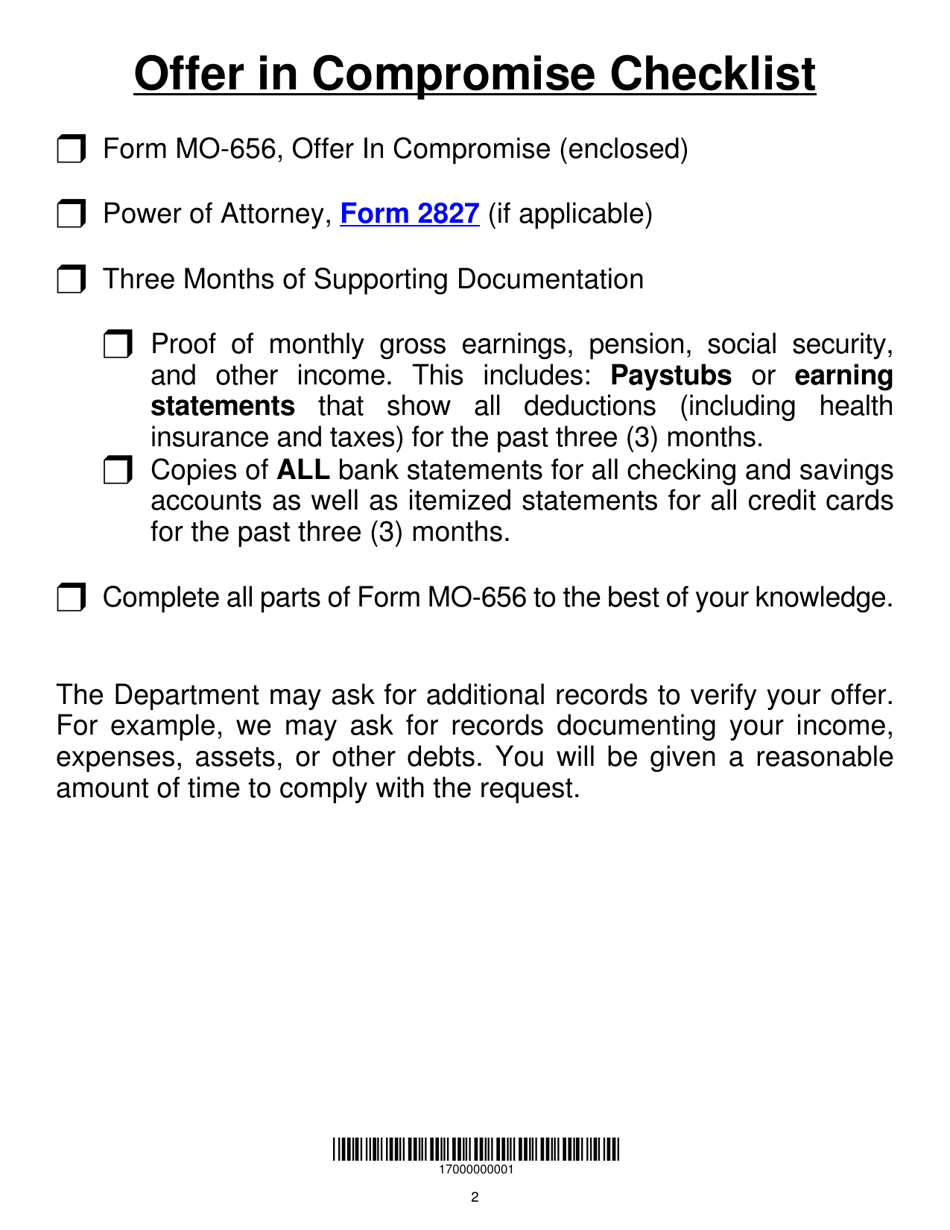

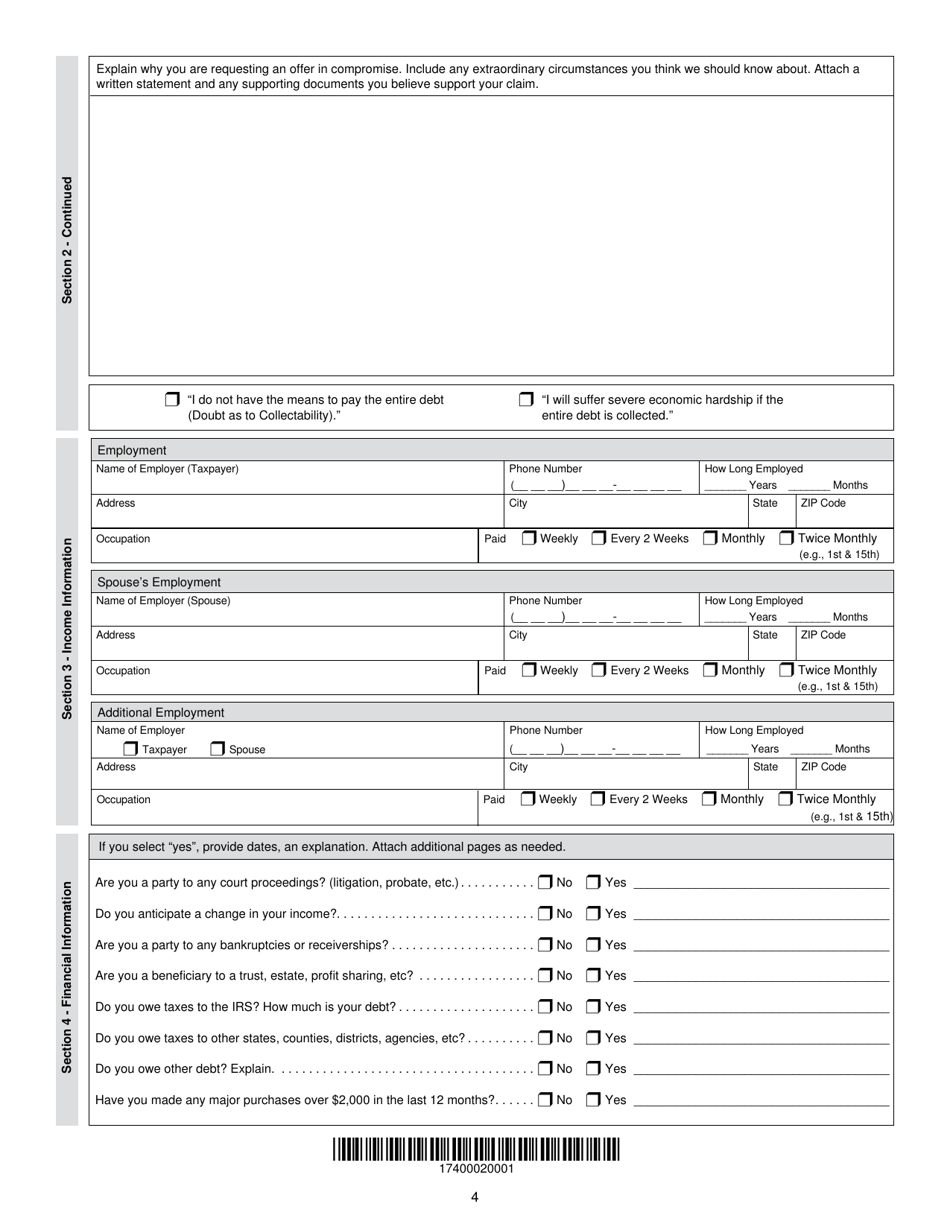

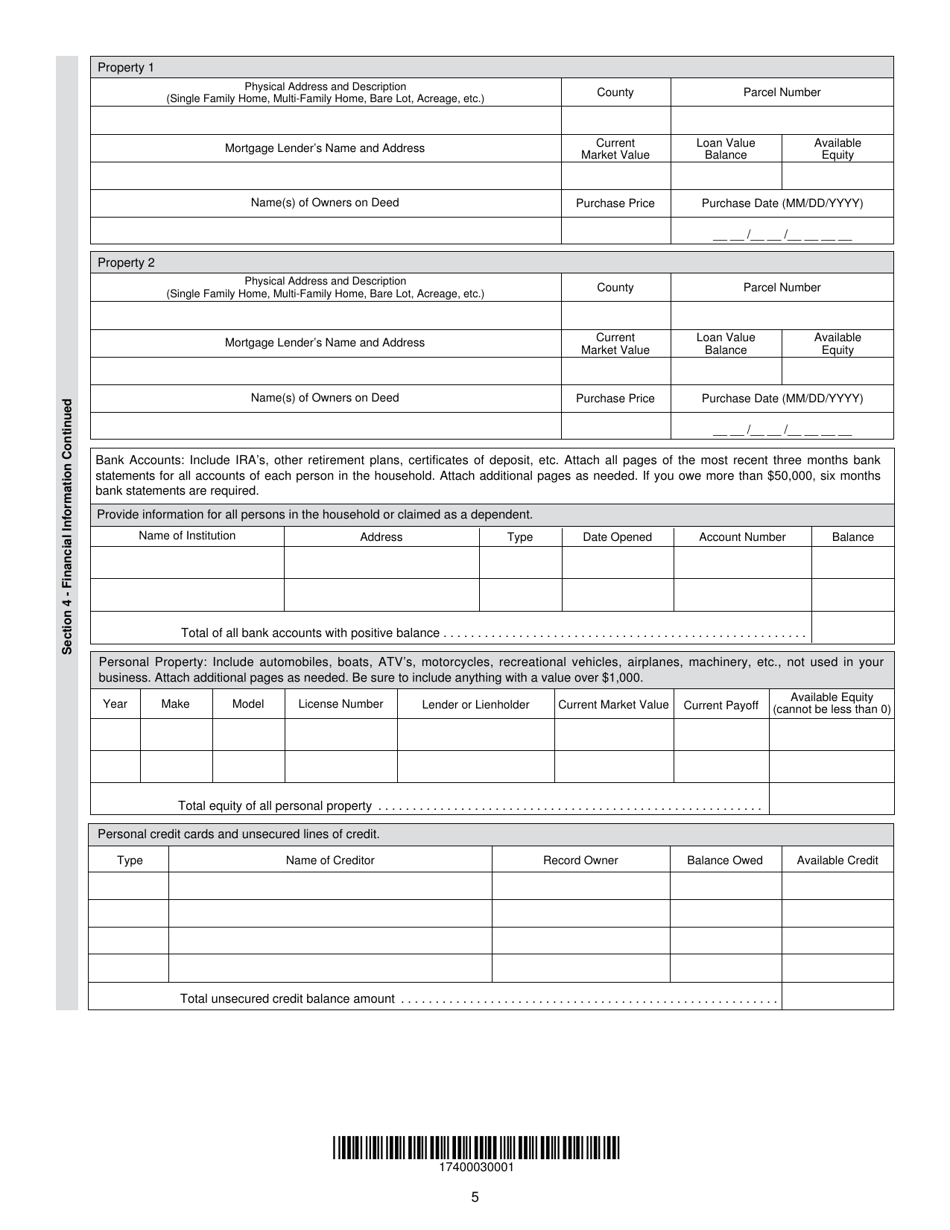

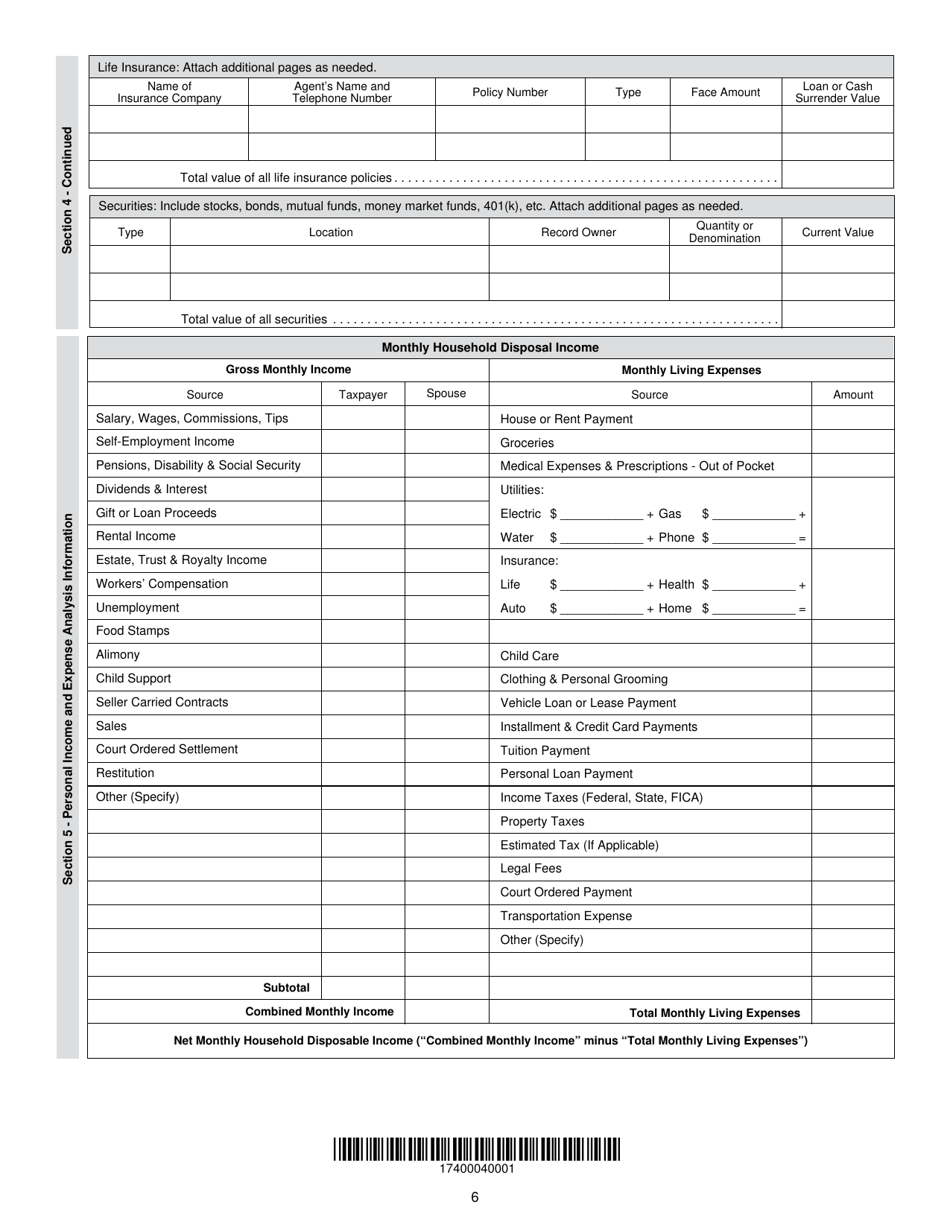

Q: What information is required on Form MO-656?

A: Form MO-656 requires detailed financial information, including income, expenses, assets, and liabilities.

Q: Are there any fees associated with submitting Form MO-656?

A: Yes, there is a non-refundable $50 application fee for submitting Form MO-656.

Q: What is the deadline for submitting Form MO-656?

A: Form MO-656 must be submitted before the expiration of the statute of limitations for collecting the tax debt.

Q: Can I appeal if my Offer in Compromise is rejected?

A: Yes, if your Offer in Compromise is rejected, you have the right to appeal the decision within 30 days.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-656 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.