Offer in Compromise Application for Self Employed Individuals - Mississippi

Offer in Compromise Application for Self Employed Individuals is a legal document that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi.

FAQ

Q: What is an Offer in Compromise?

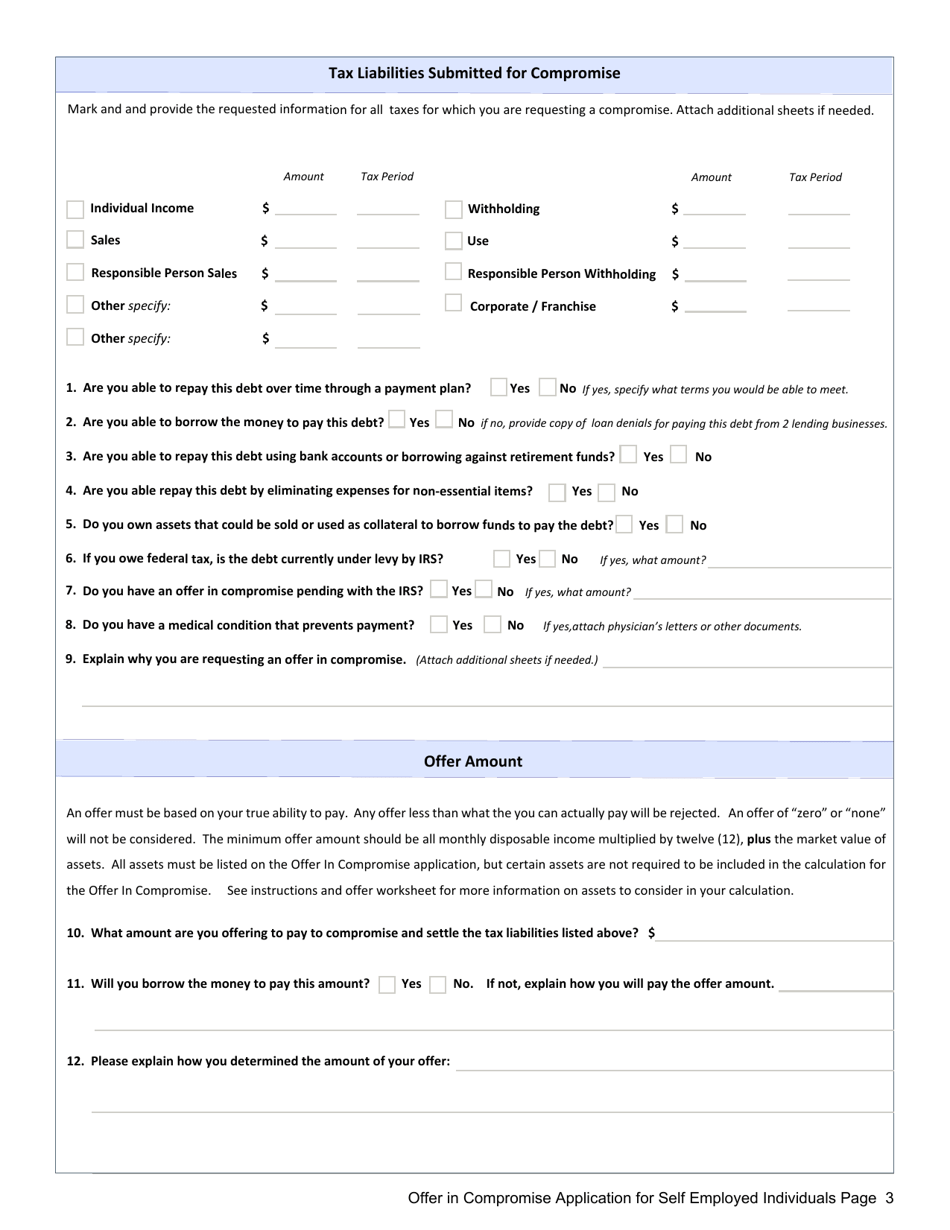

A: An Offer in Compromise is a program offered by the Internal Revenue Service (IRS) that allows taxpayers to settle their tax debt for less than the full amount owed.

Q: Who is eligible for an Offer in Compromise?

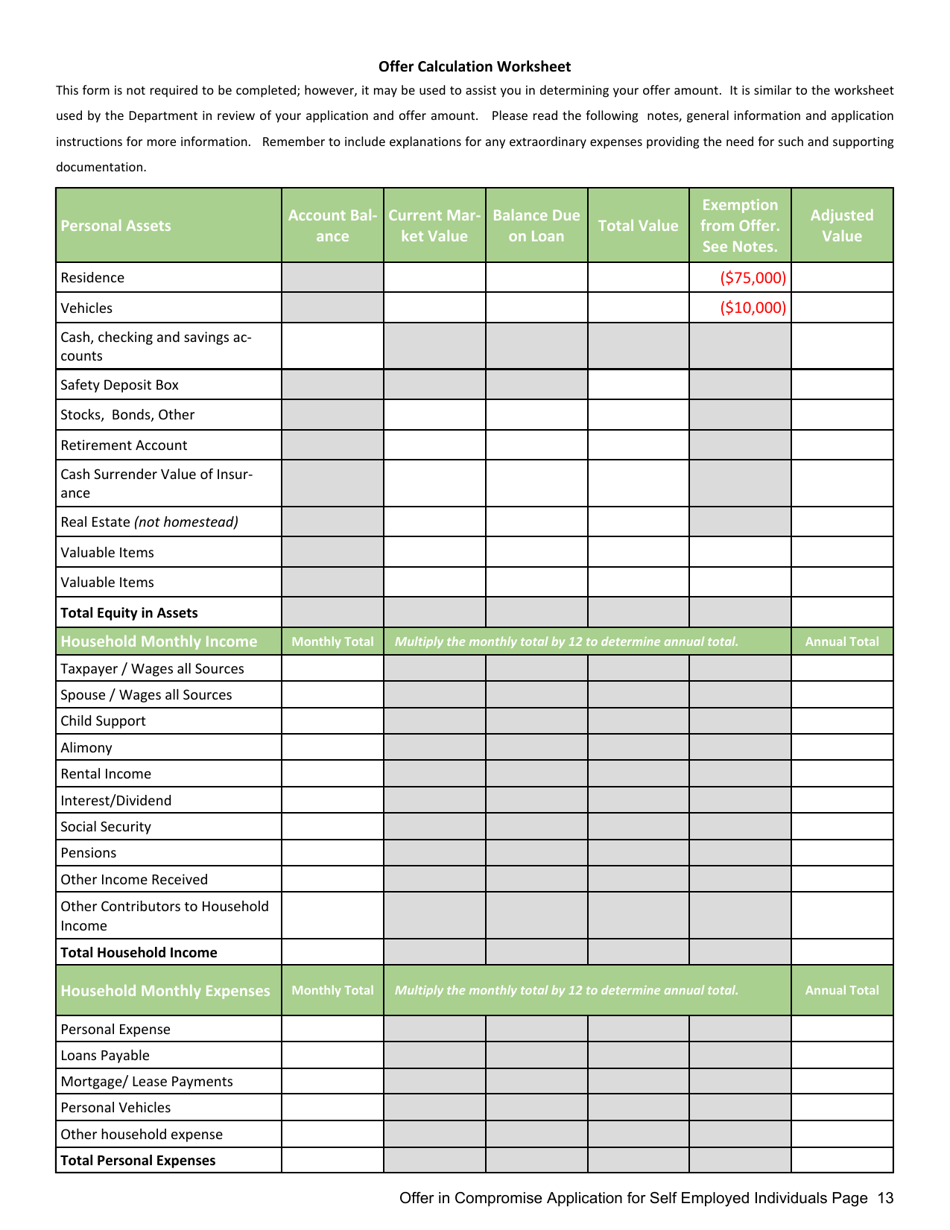

A: Self-employed individuals in Mississippi who are unable to pay their full tax debt and meet certain criteria may be eligible for an Offer in Compromise.

Q: How do I apply for an Offer in Compromise?

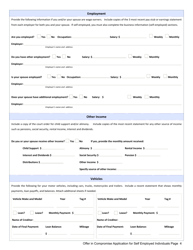

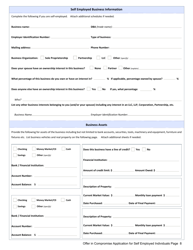

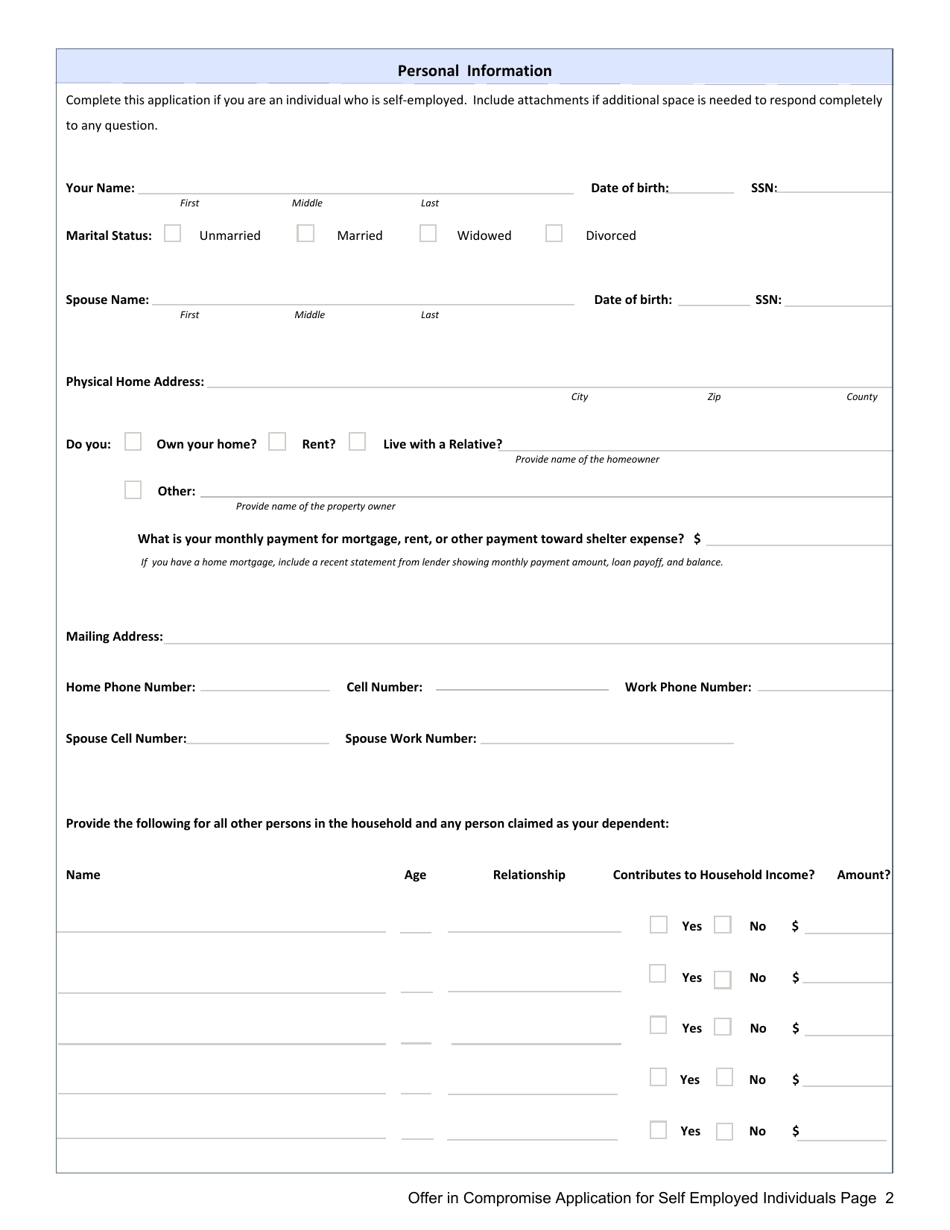

A: To apply for an Offer in Compromise, self-employed individuals in Mississippi need to complete Form 656, Offer in Compromise, with the necessary documentation and submit it to the IRS.

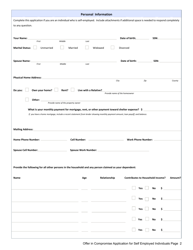

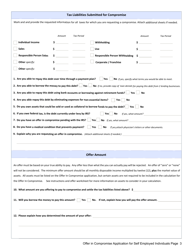

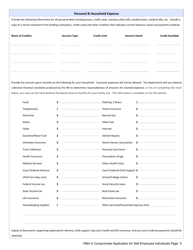

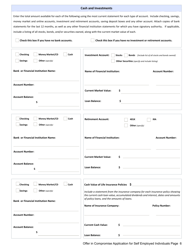

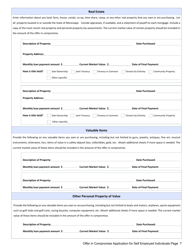

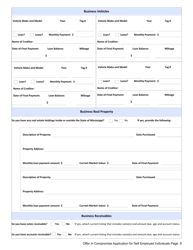

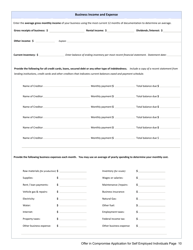

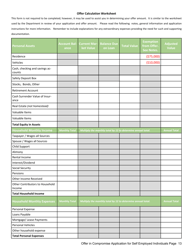

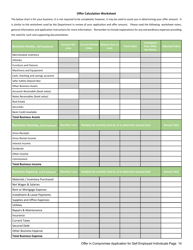

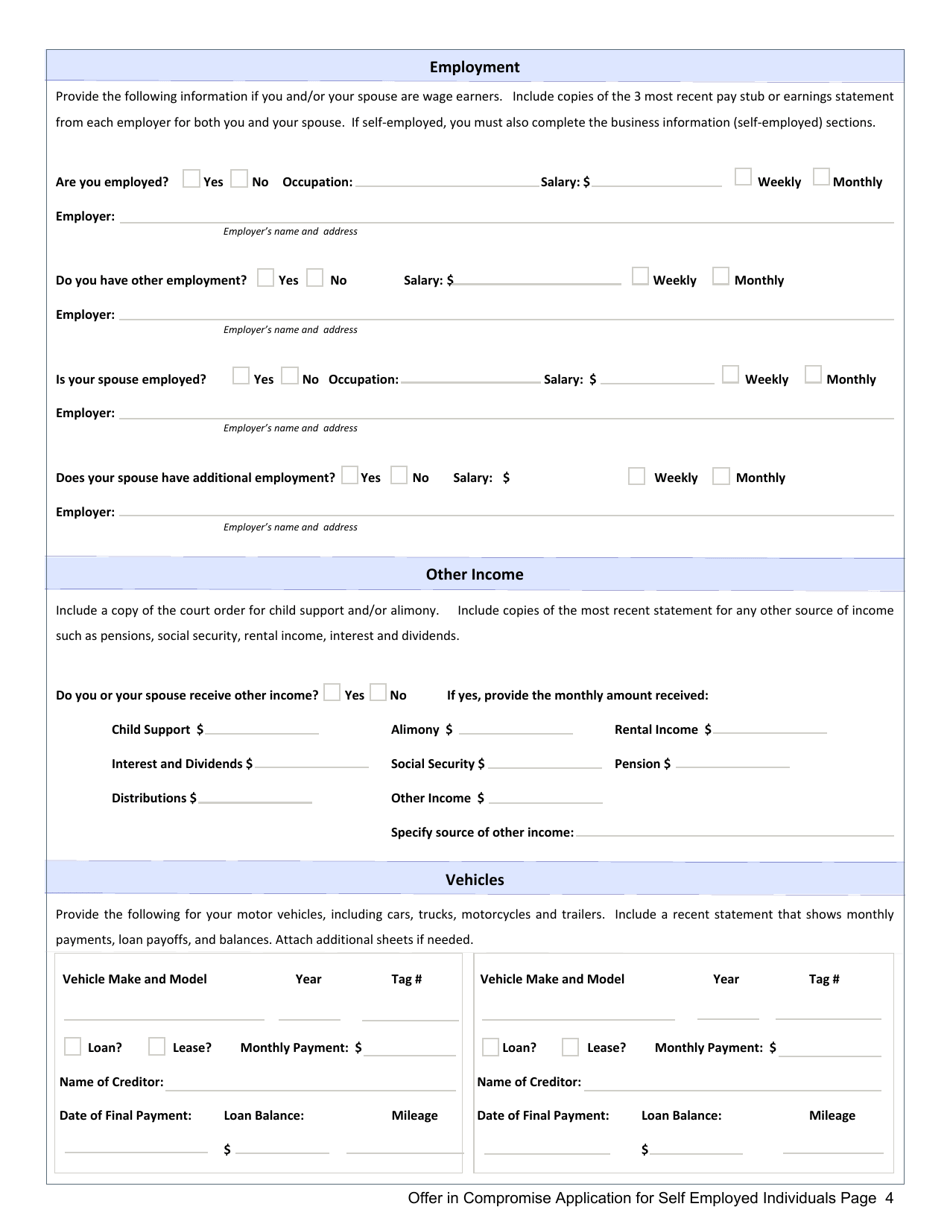

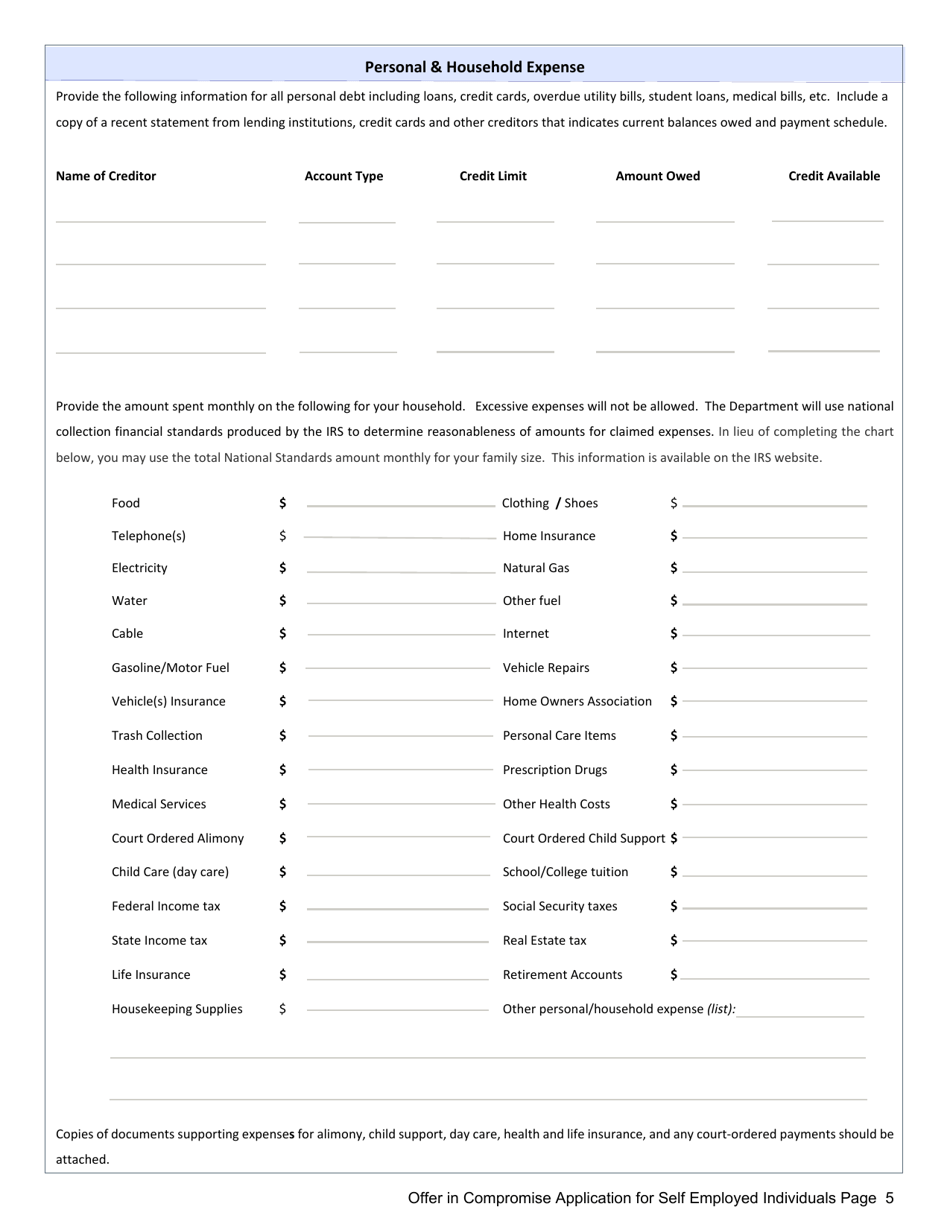

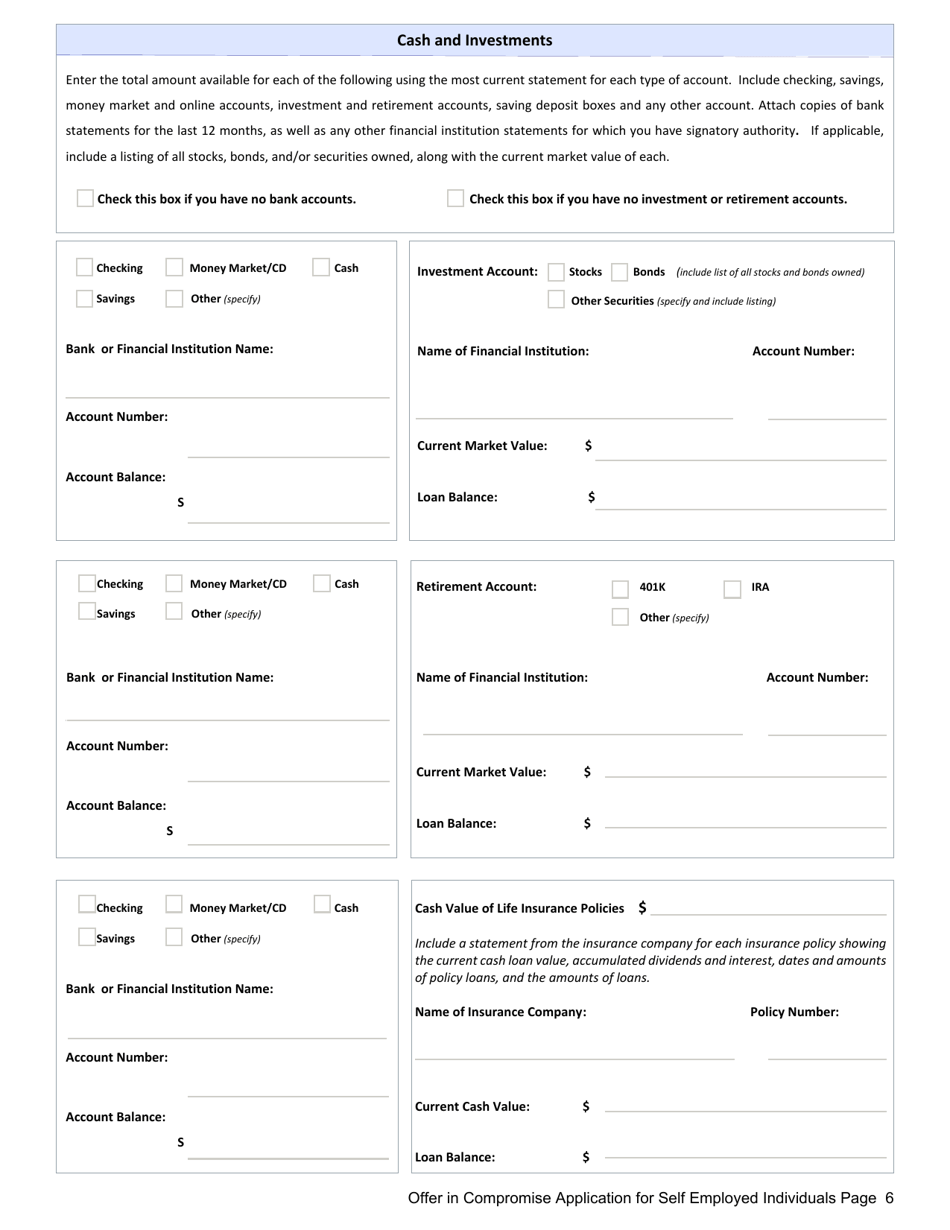

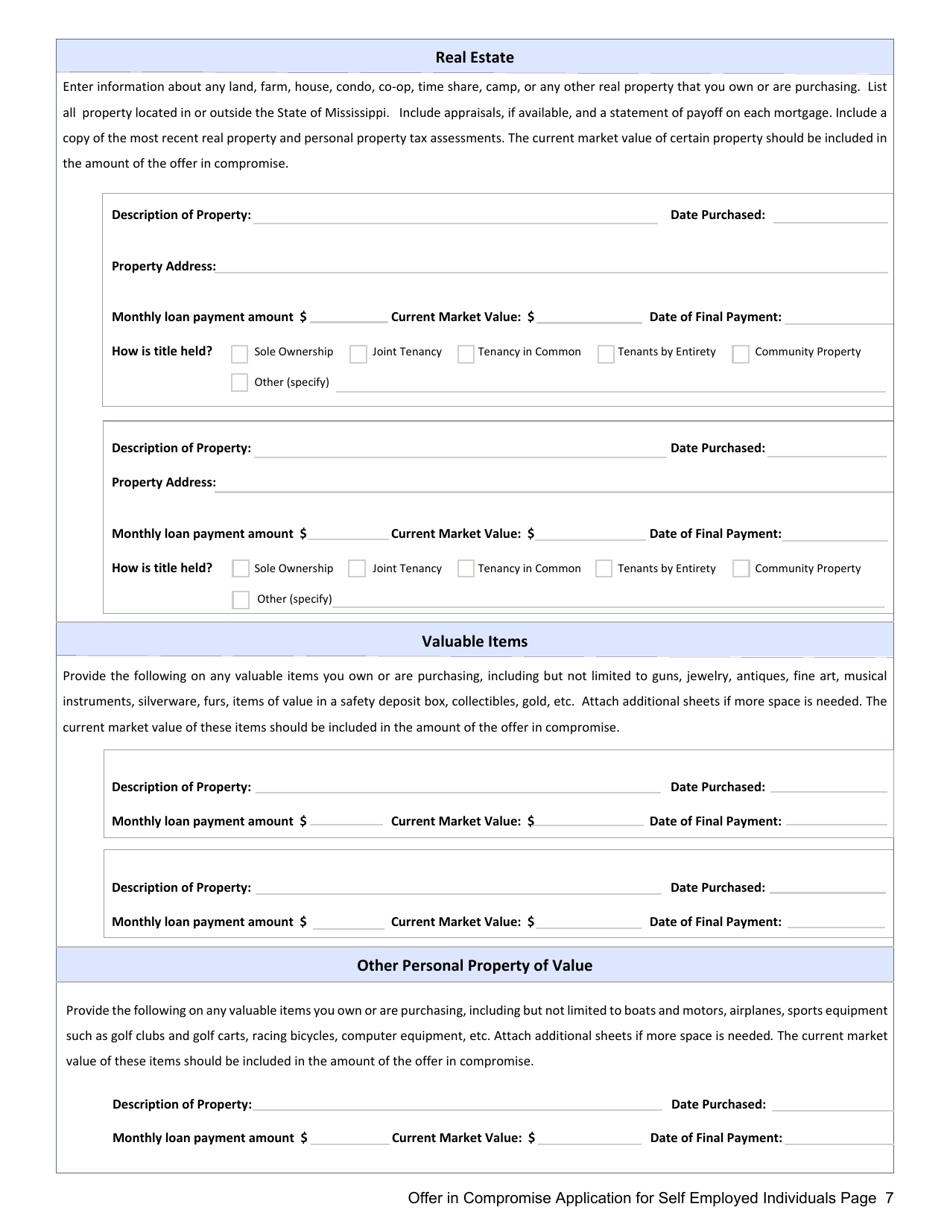

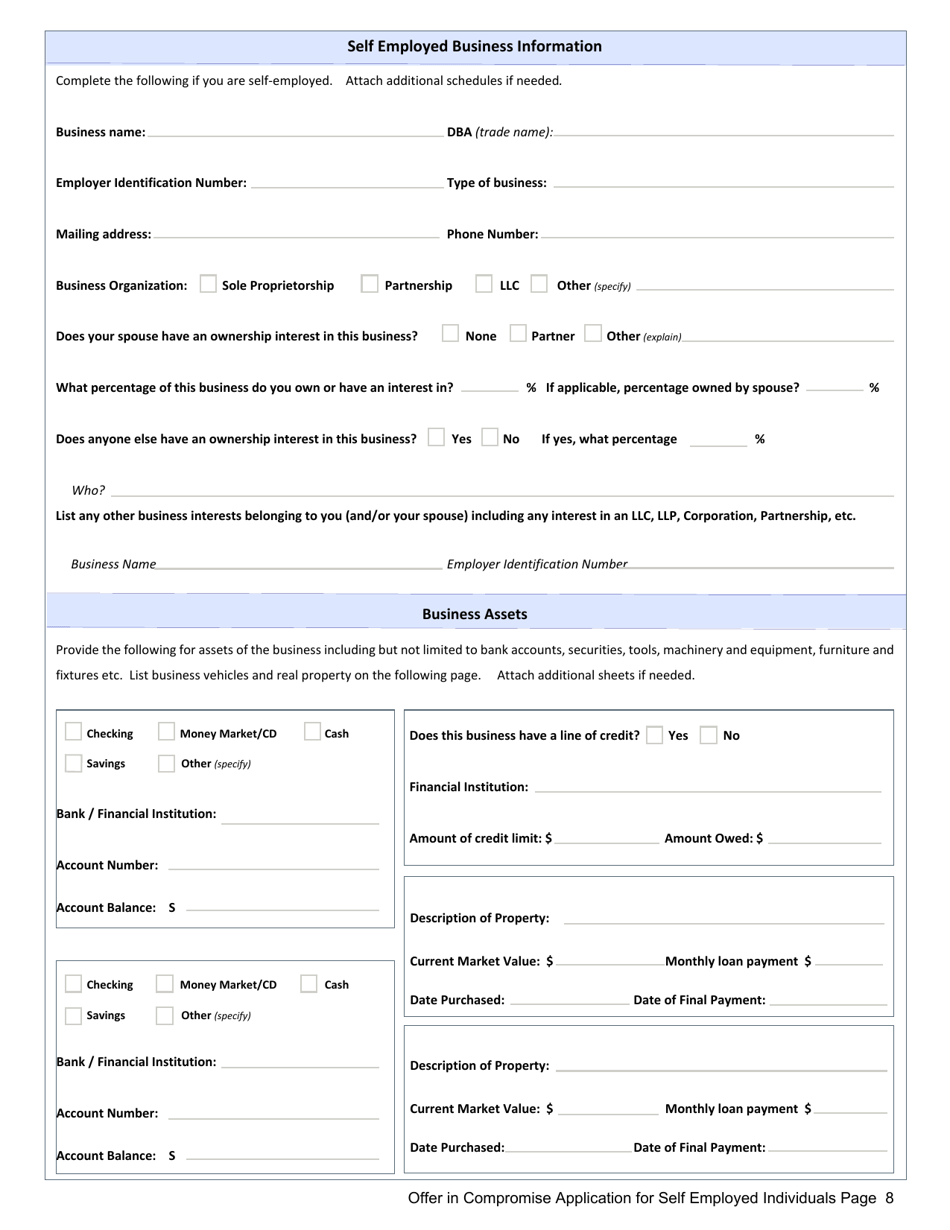

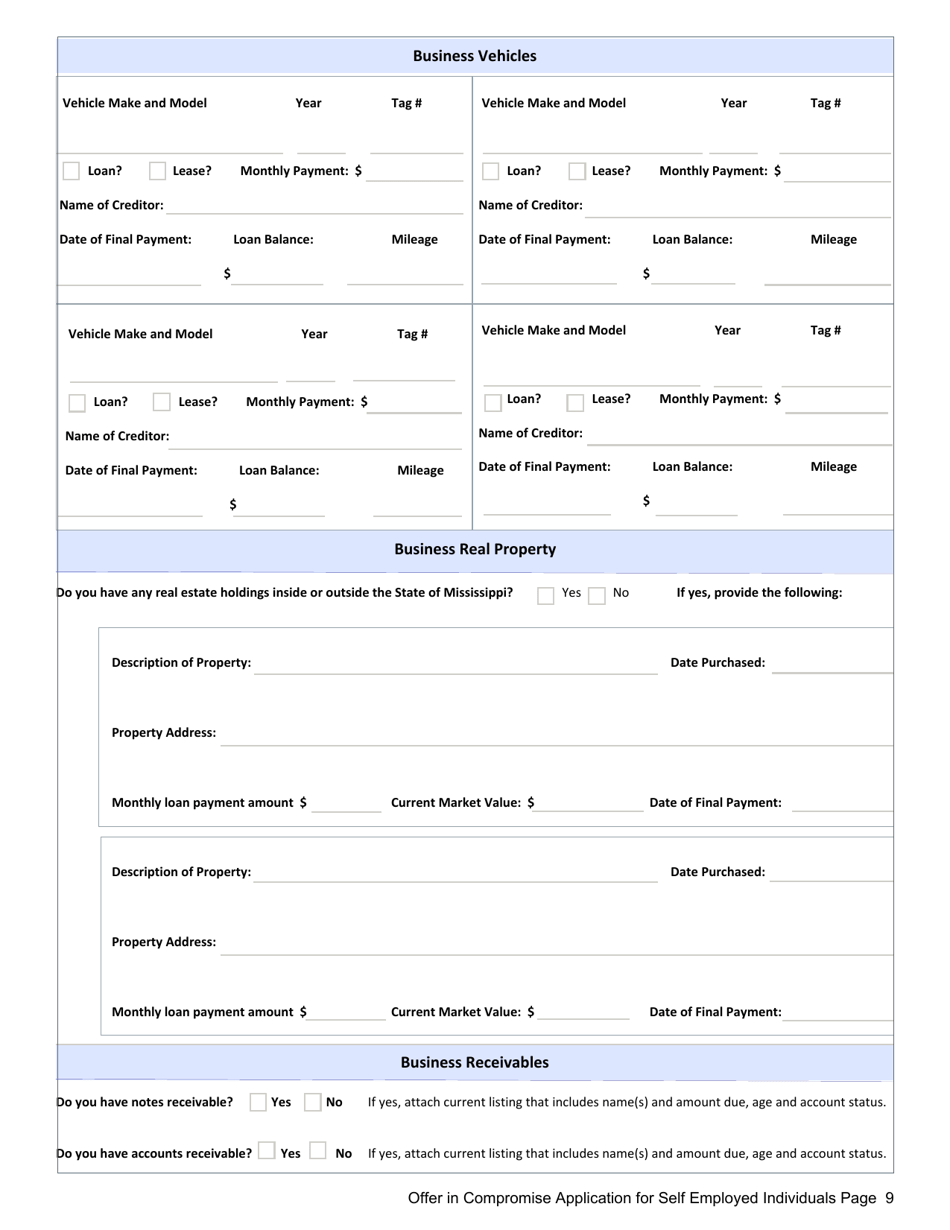

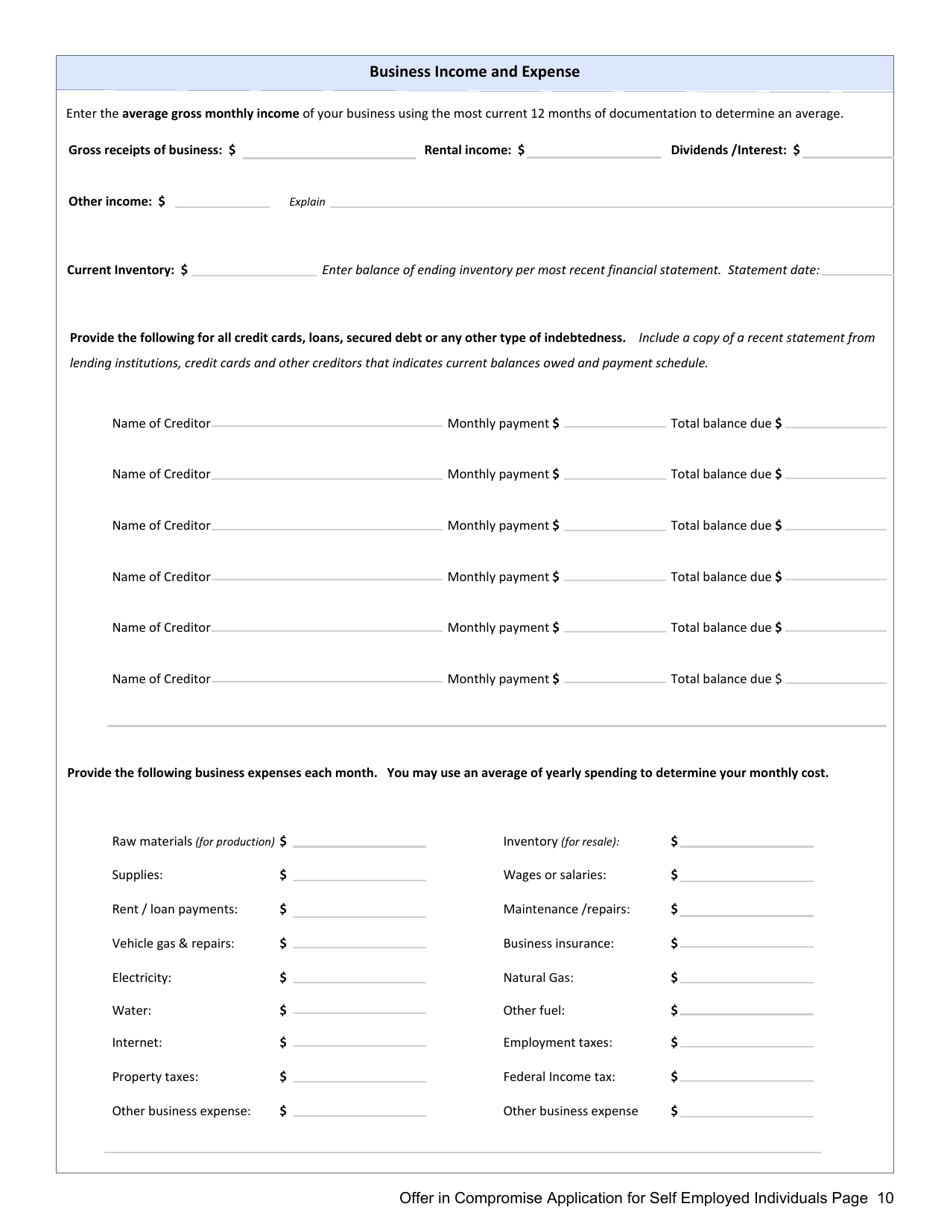

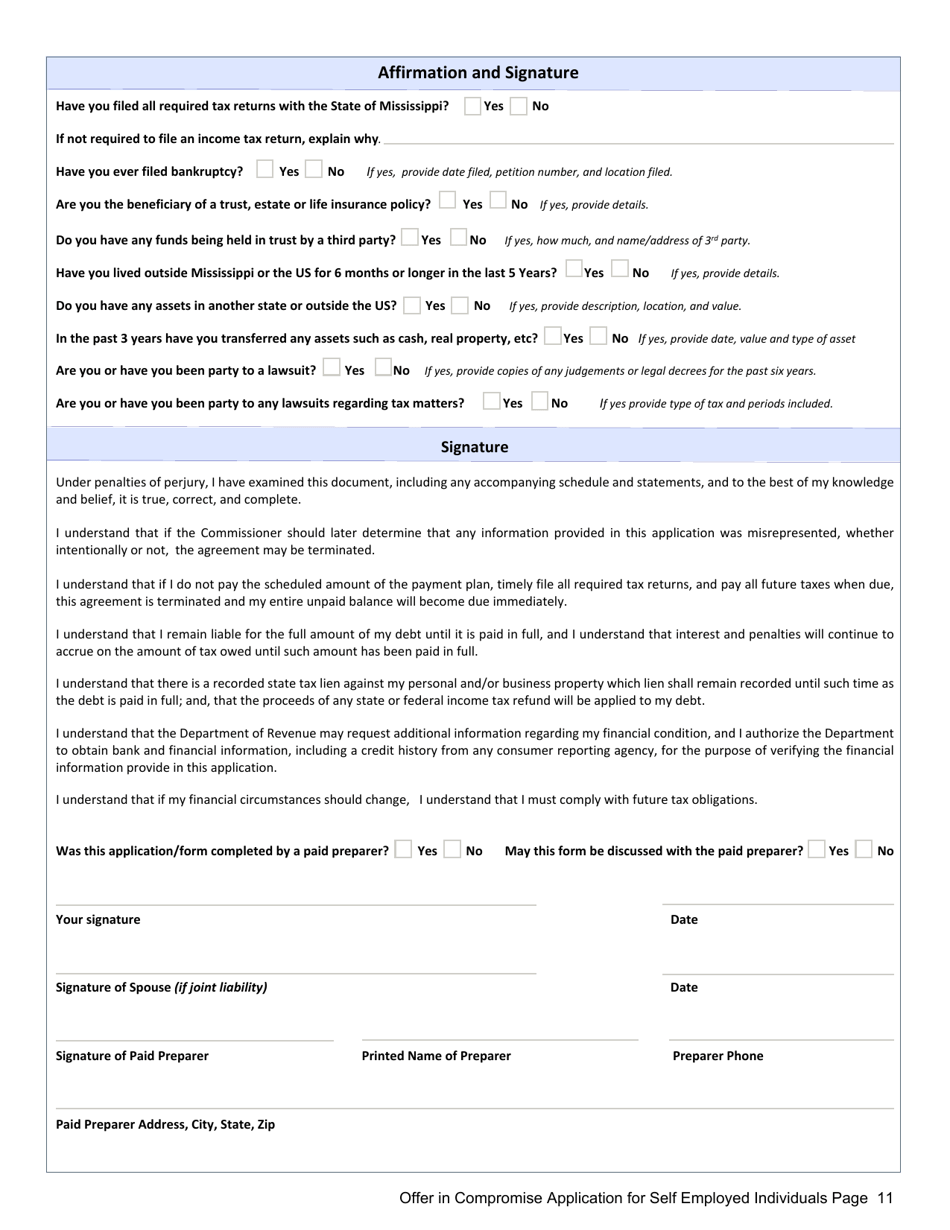

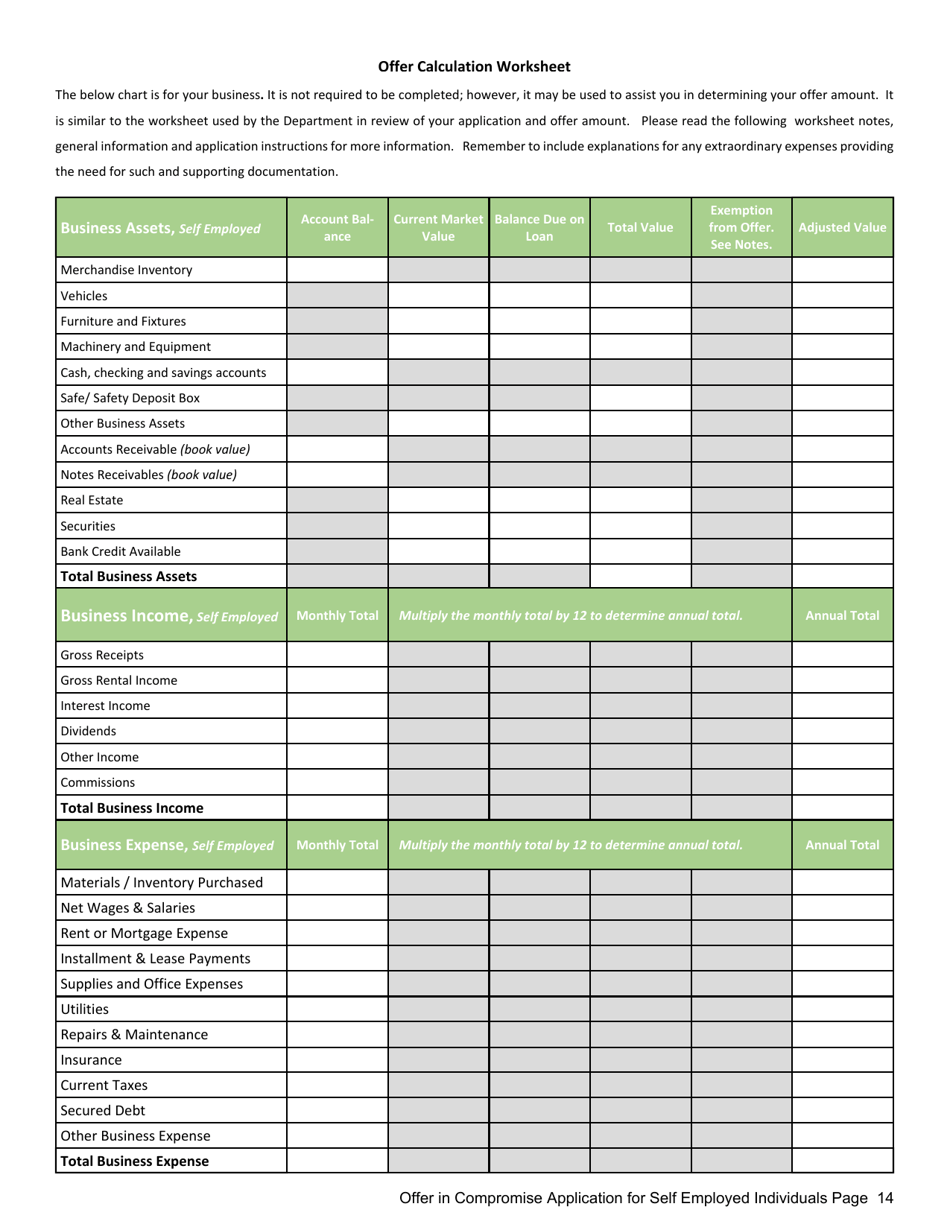

Q: What documentation is required for an Offer in Compromise application?

A: Documentation required for an Offer in Compromise application includes proof of income, assets, and expenses, as well as any other supporting documentation requested by the IRS.

Q: Can I make installment payments on an Offer in Compromise?

A: Yes, it is possible to make installment payments on an accepted Offer in Compromise. However, you must adhere to the agreed-upon payment plan.

Q: How long does it take for the IRS to process an Offer in Compromise application?

A: The processing time for an Offer in Compromise application varies, but it can take several months for the IRS to review and make a decision on the application.

Q: What happens if my Offer in Compromise is accepted?

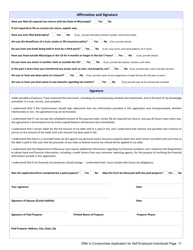

A: If your Offer in Compromise is accepted, you will need to fulfill the terms of the agreement, which typically include making the agreed-upon payment and staying in compliance with your tax obligations for a specified period of time.

Q: What happens if my Offer in Compromise is rejected?

A: If your Offer in Compromise is rejected, you have the option to appeal the decision or explore other payment arrangements with the IRS.

Q: Can I hire a tax professional to help me with my Offer in Compromise application?

A: Yes, many self-employed individuals in Mississippi choose to hire a tax professional, such as a certified public accountant (CPA) or enrolled agent, to assist them with their Offer in Compromise application.

Form Details:

- The latest edition currently provided by the Mississippi Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.