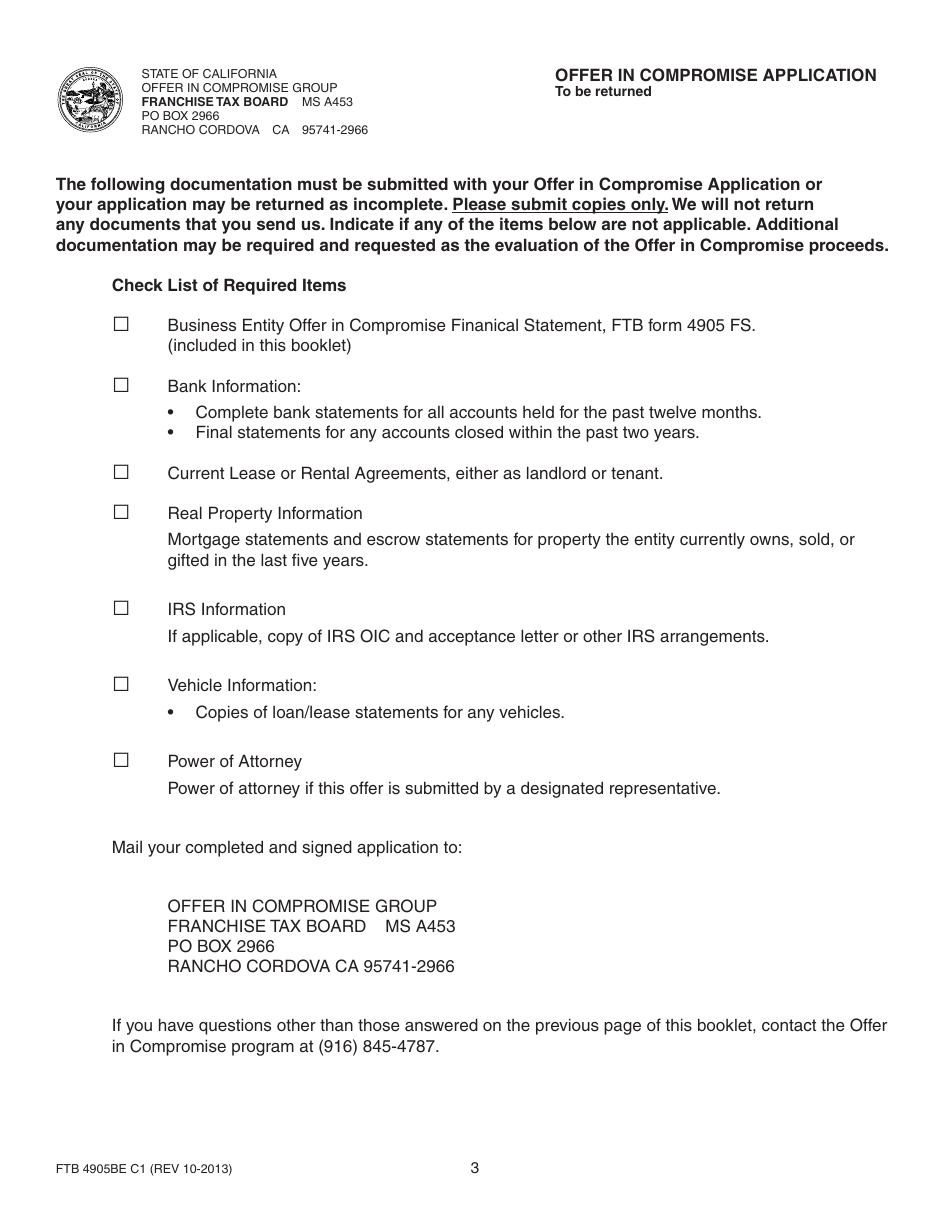

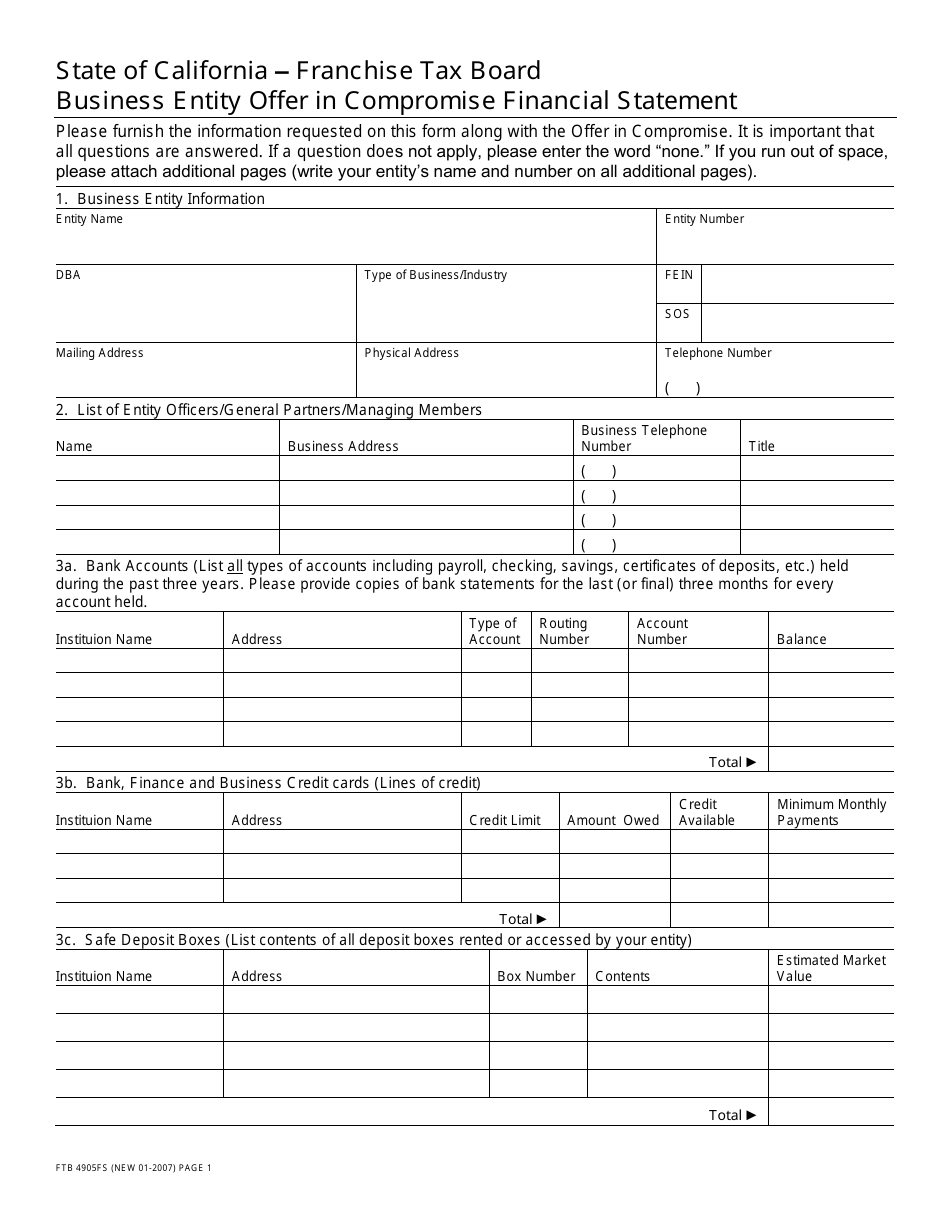

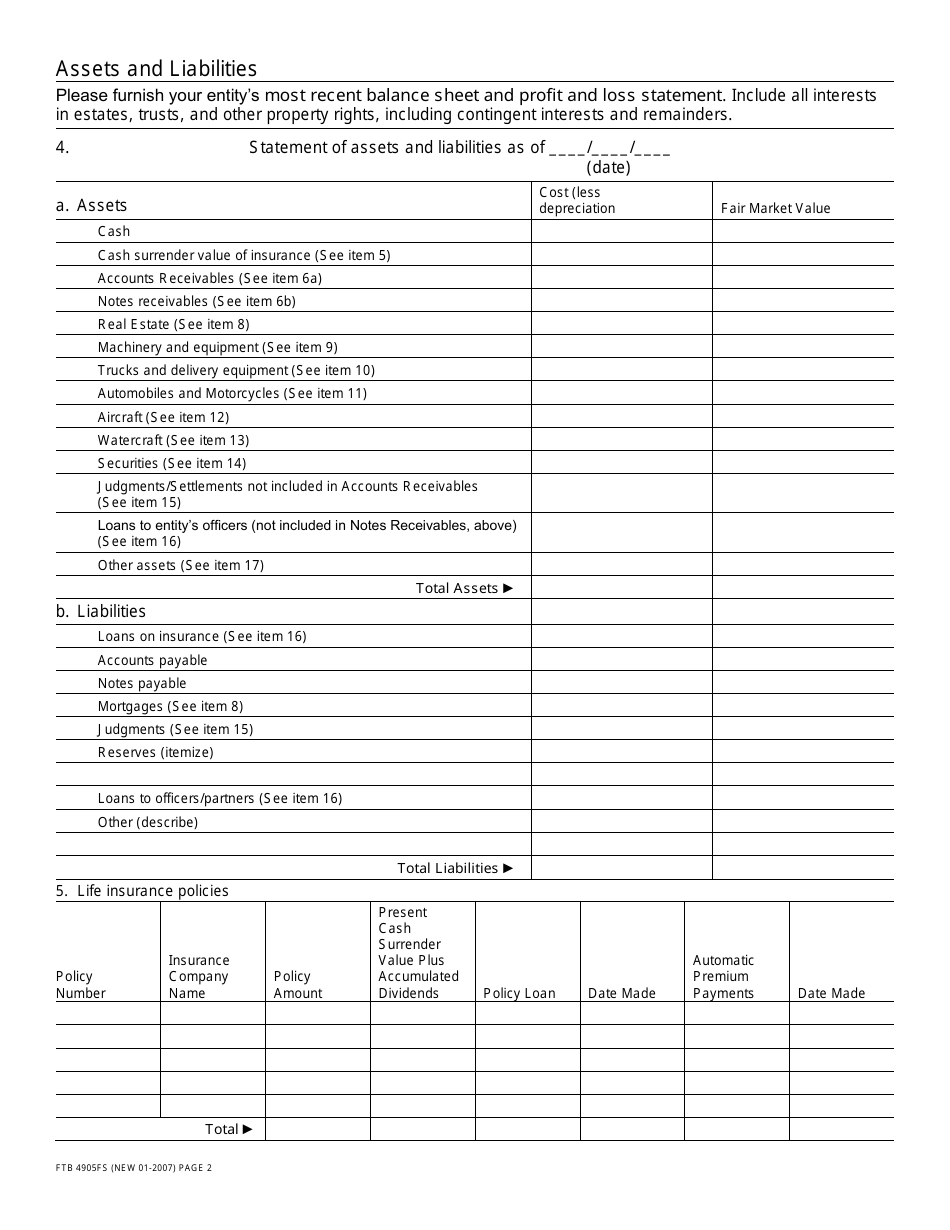

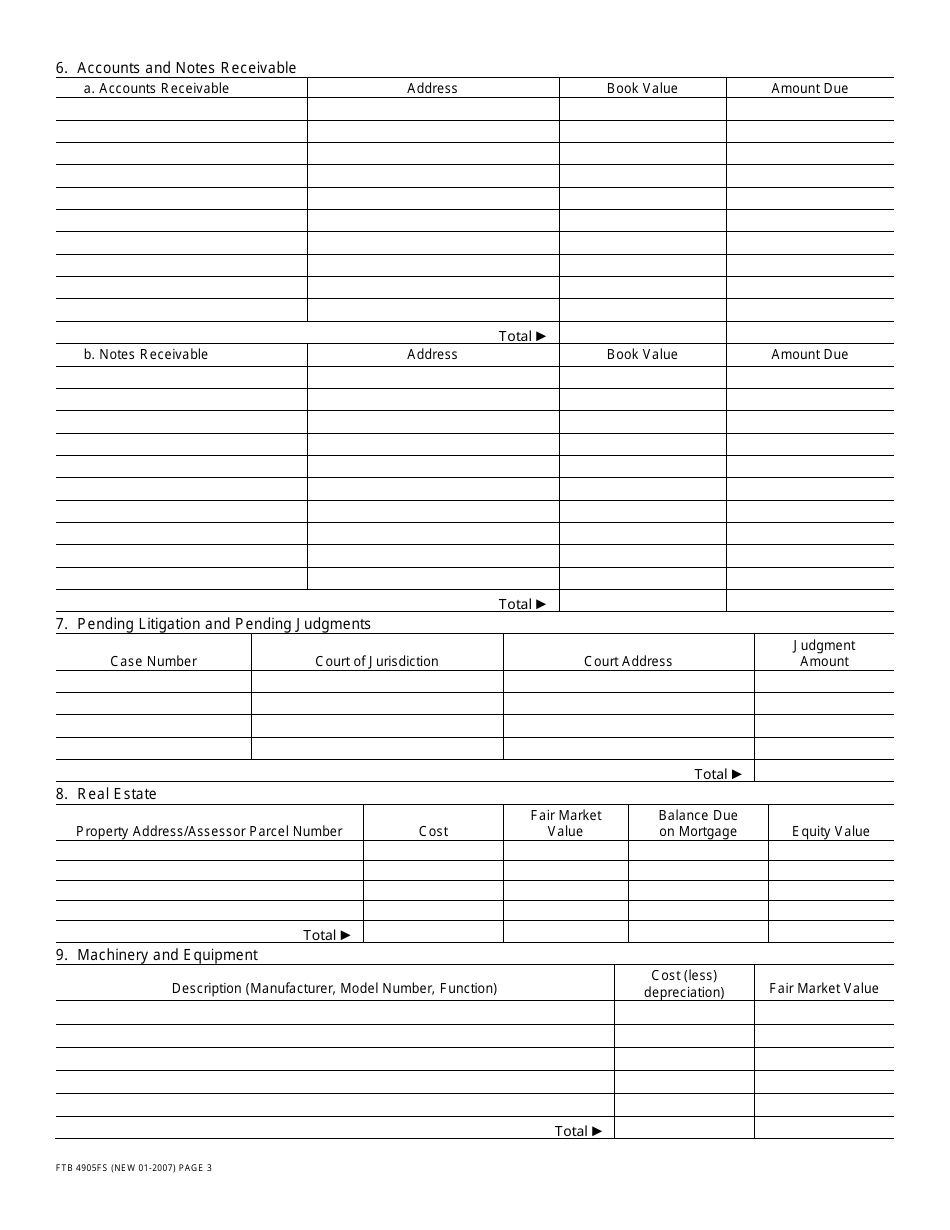

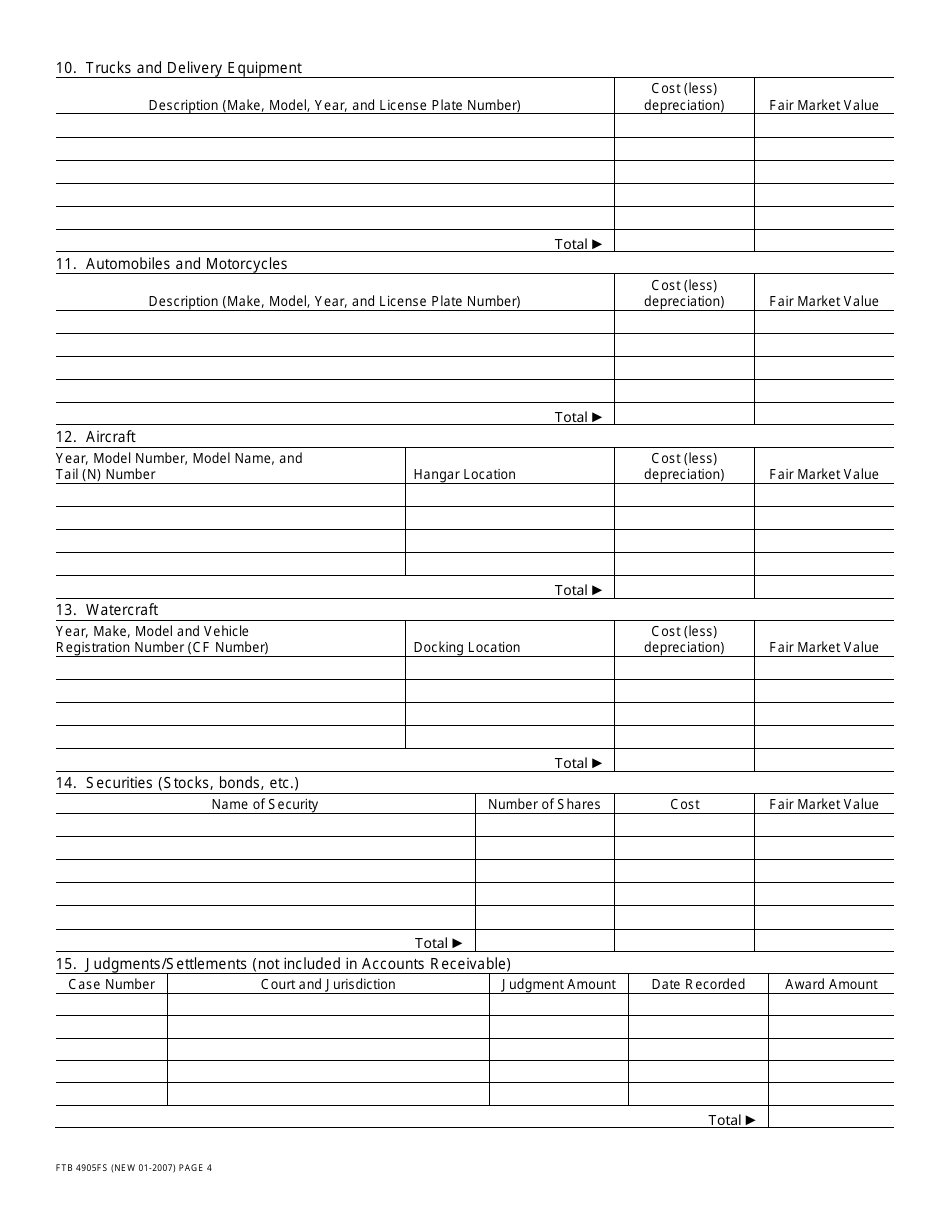

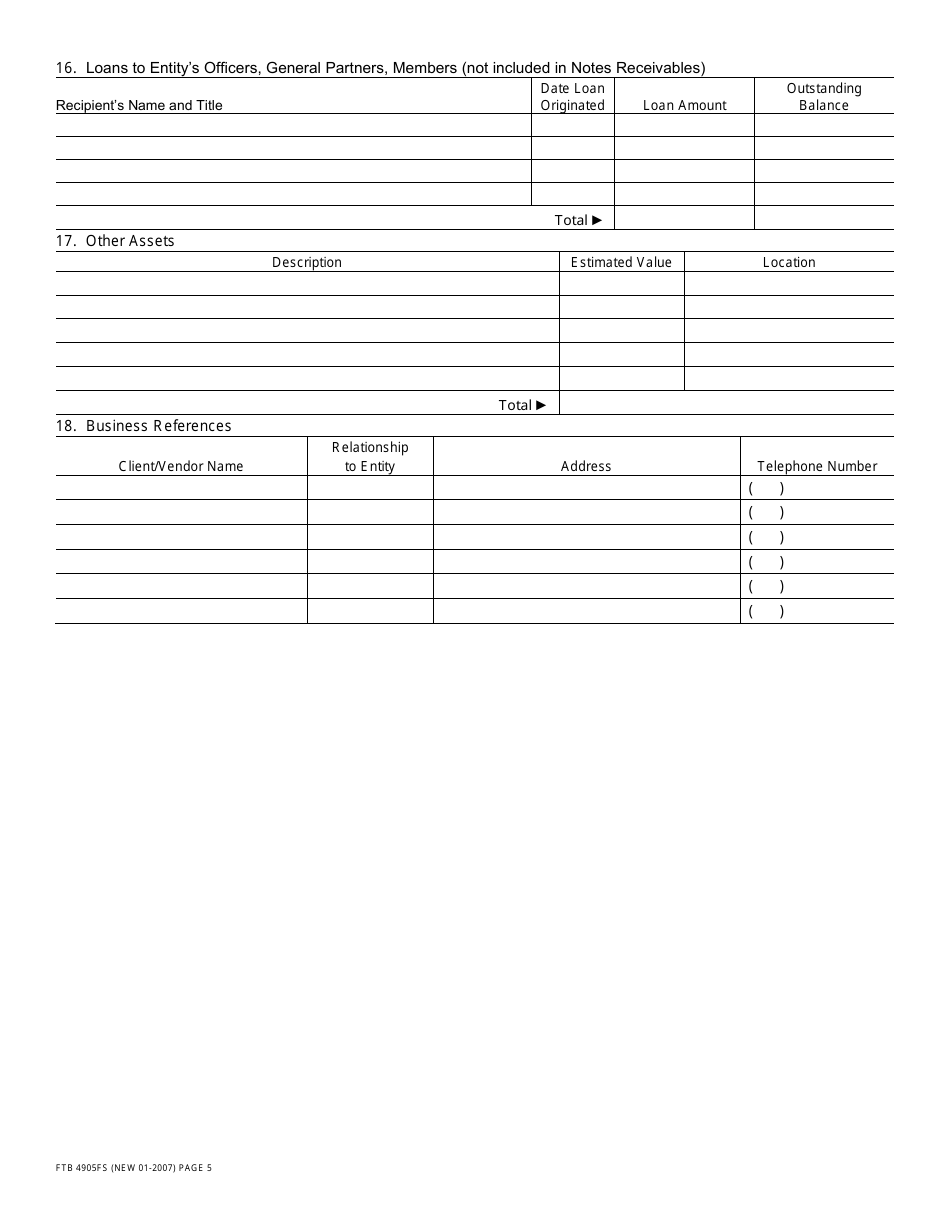

Form FTB4905BE Offer in Compromise for Business Entities Booklet - California

What Is Form FTB4905BE?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB4905BE?

A: Form FTB4905BE is the Offer in Compromise for Business Entities booklet used in California.

Q: Who can use Form FTB4905BE?

A: Business entities in California can use Form FTB4905BE.

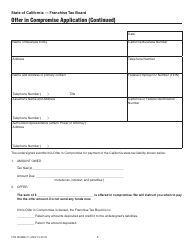

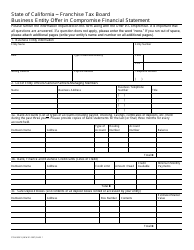

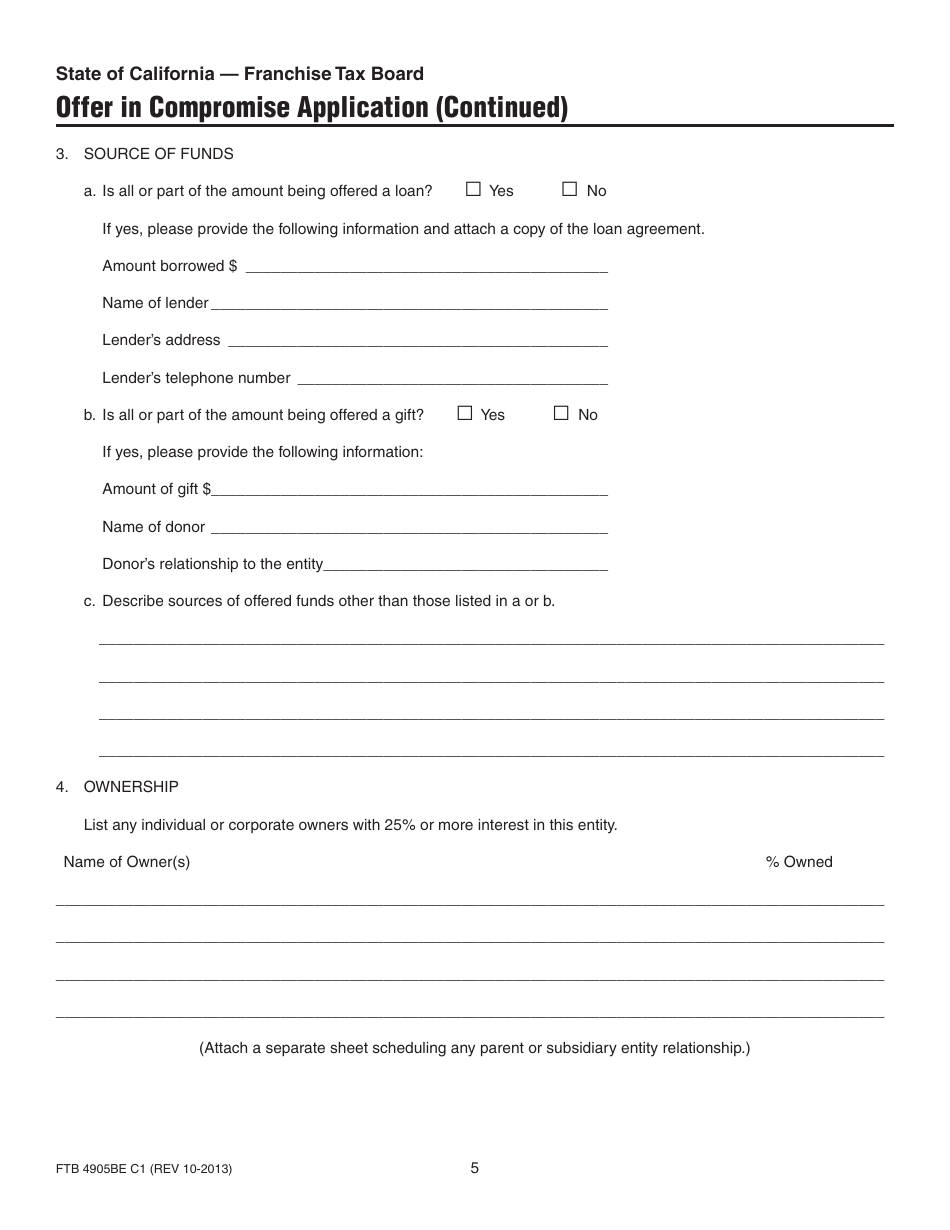

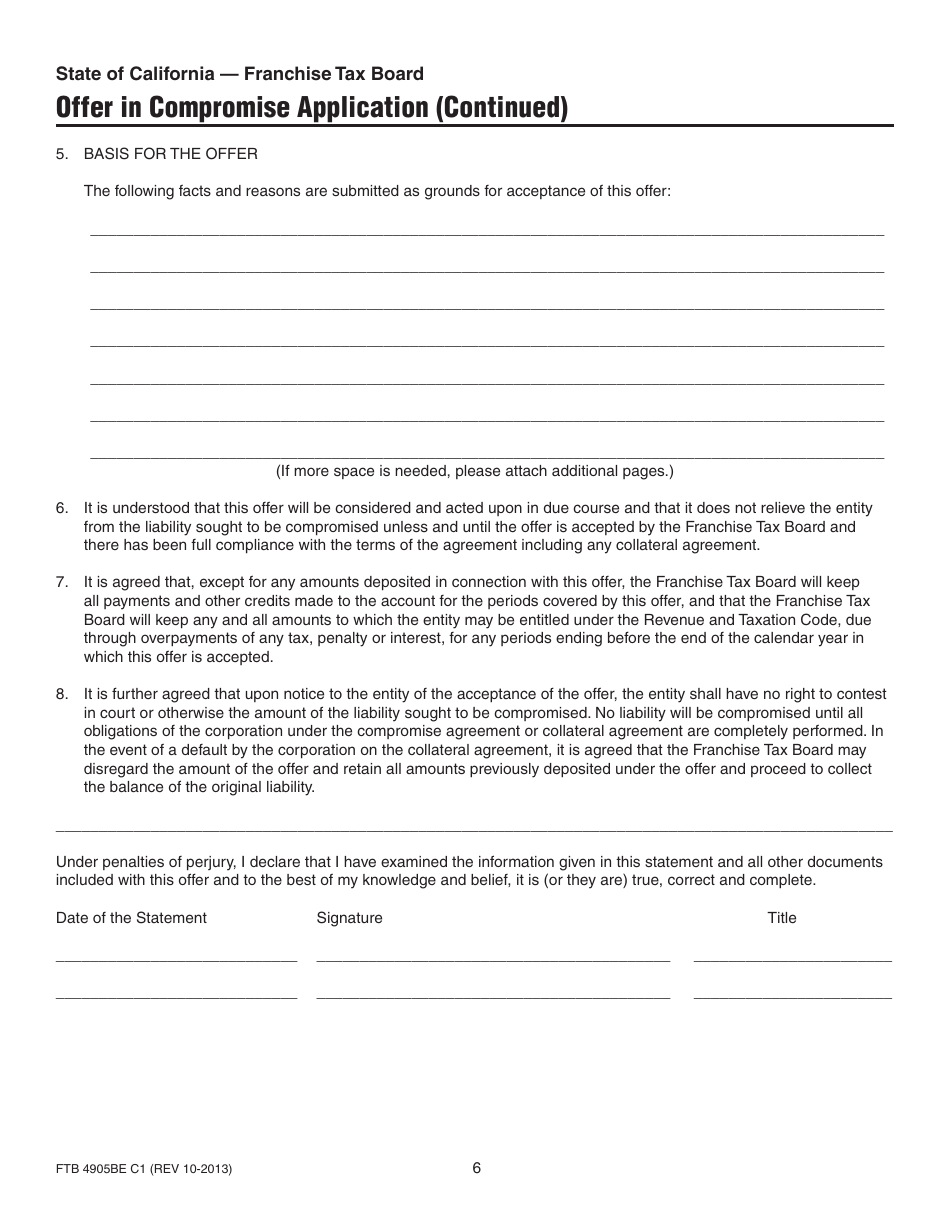

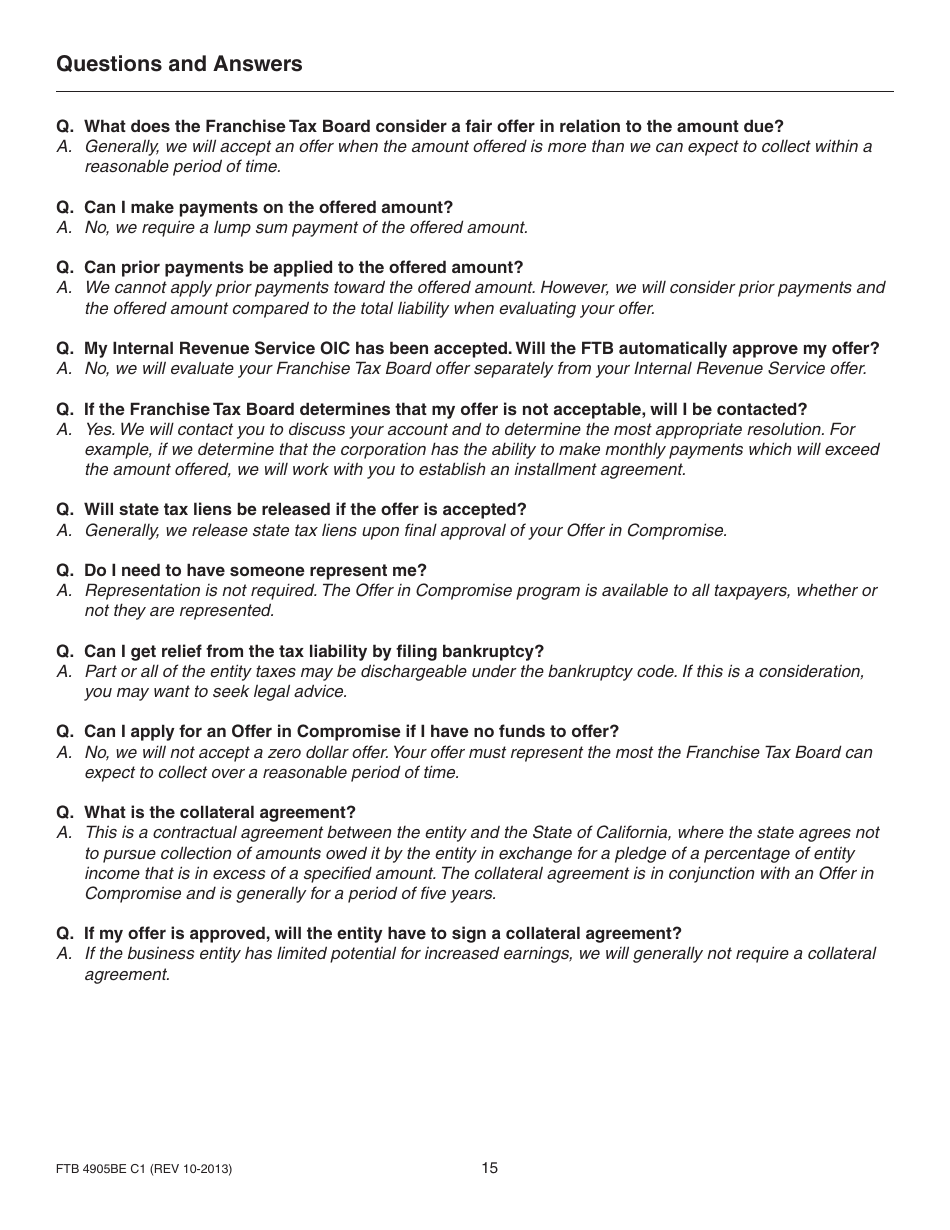

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program that allows taxpayers to settle their tax debt for less than the full amount owed.

Q: How can I obtain Form FTB4905BE?

A: You can obtain the Form FTB4905BE Offer in Compromise for Business Entities booklet from the California Franchise Tax Board.

Q: What are the requirements to qualify for an Offer in Compromise?

A: To qualify for an Offer in Compromise, you must have filed all required tax returns and made all required estimated tax payments.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB4905BE by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.