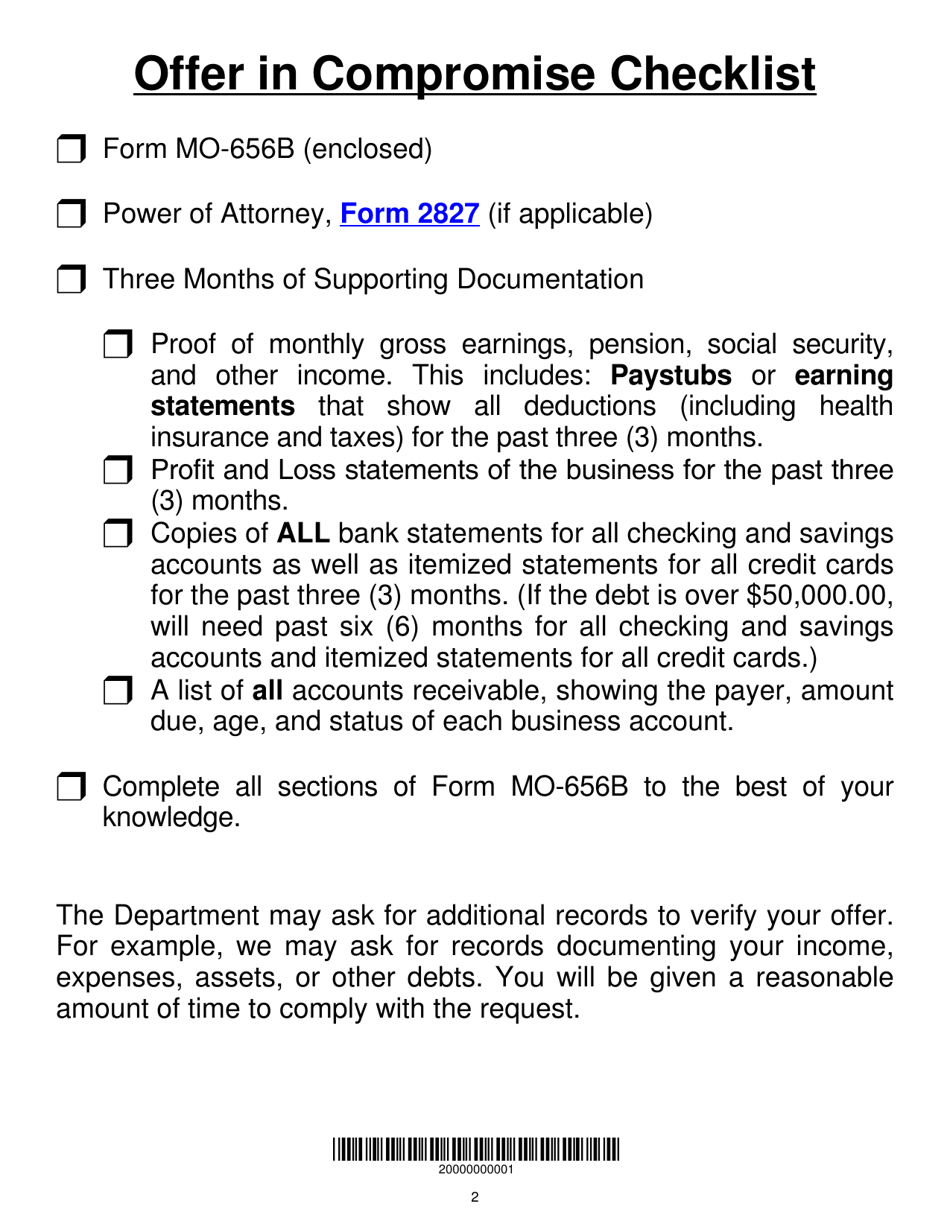

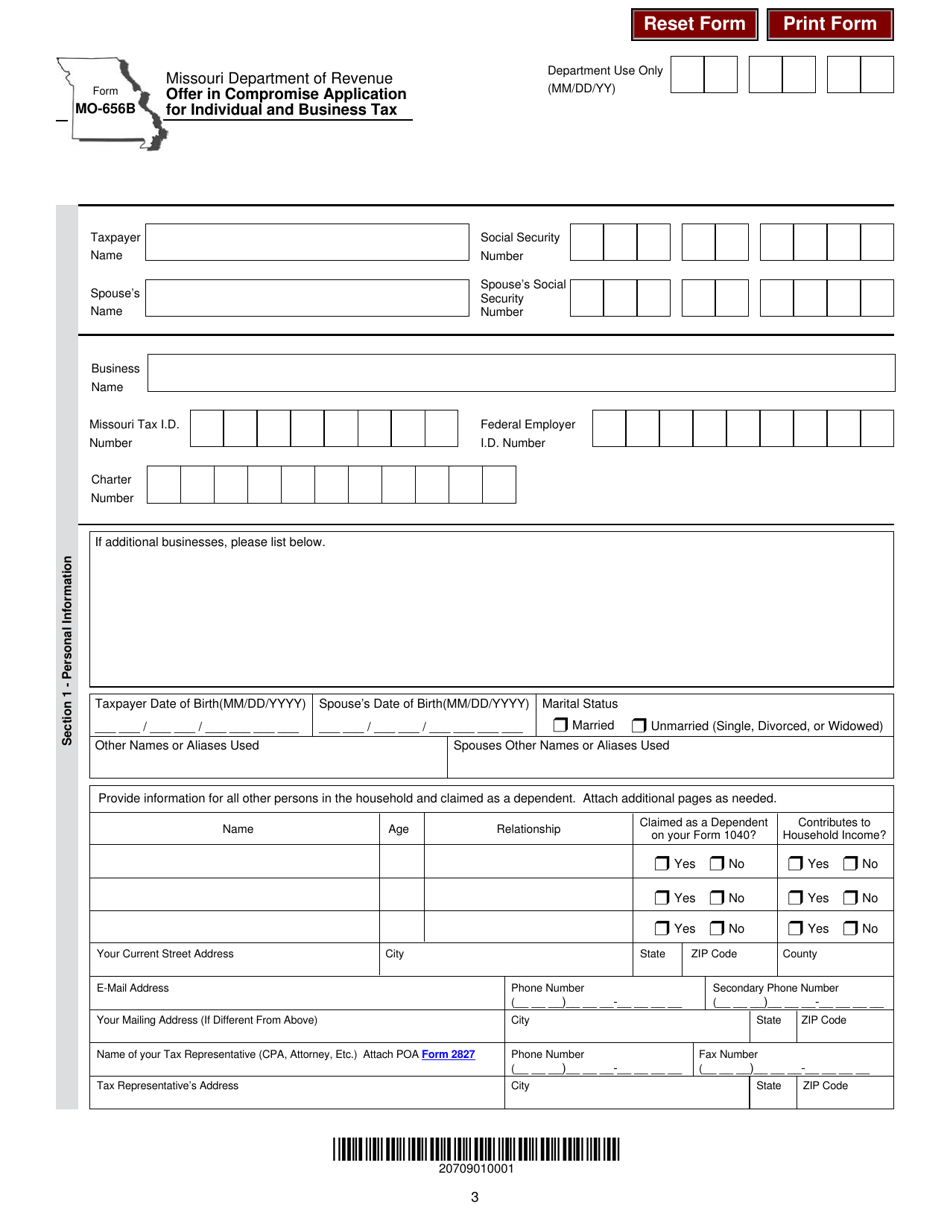

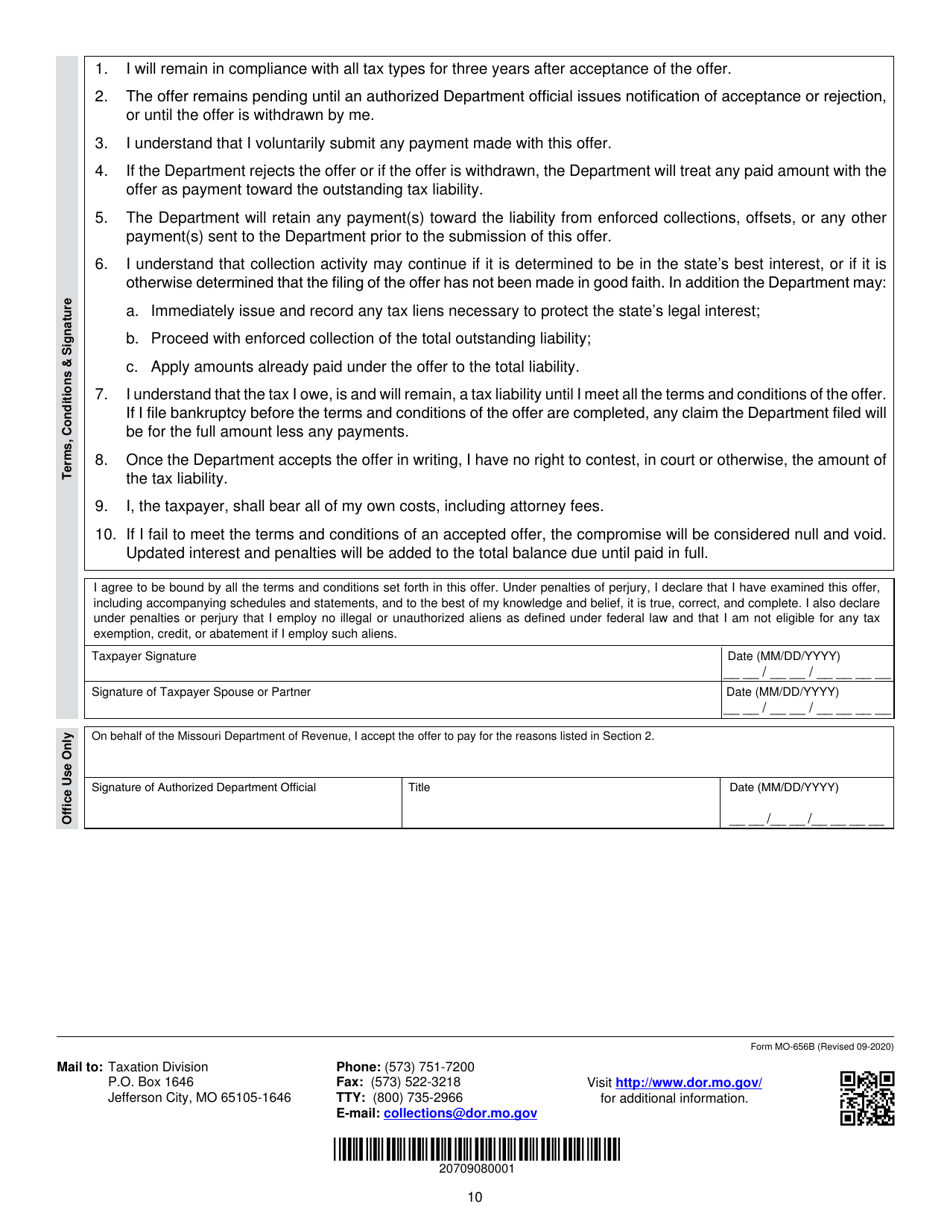

Form MO-656B Offer in Compromise Application for Individual and Business Tax - Missouri

What Is Form MO-656B?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-656B Offer in Compromise Application?

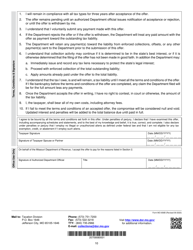

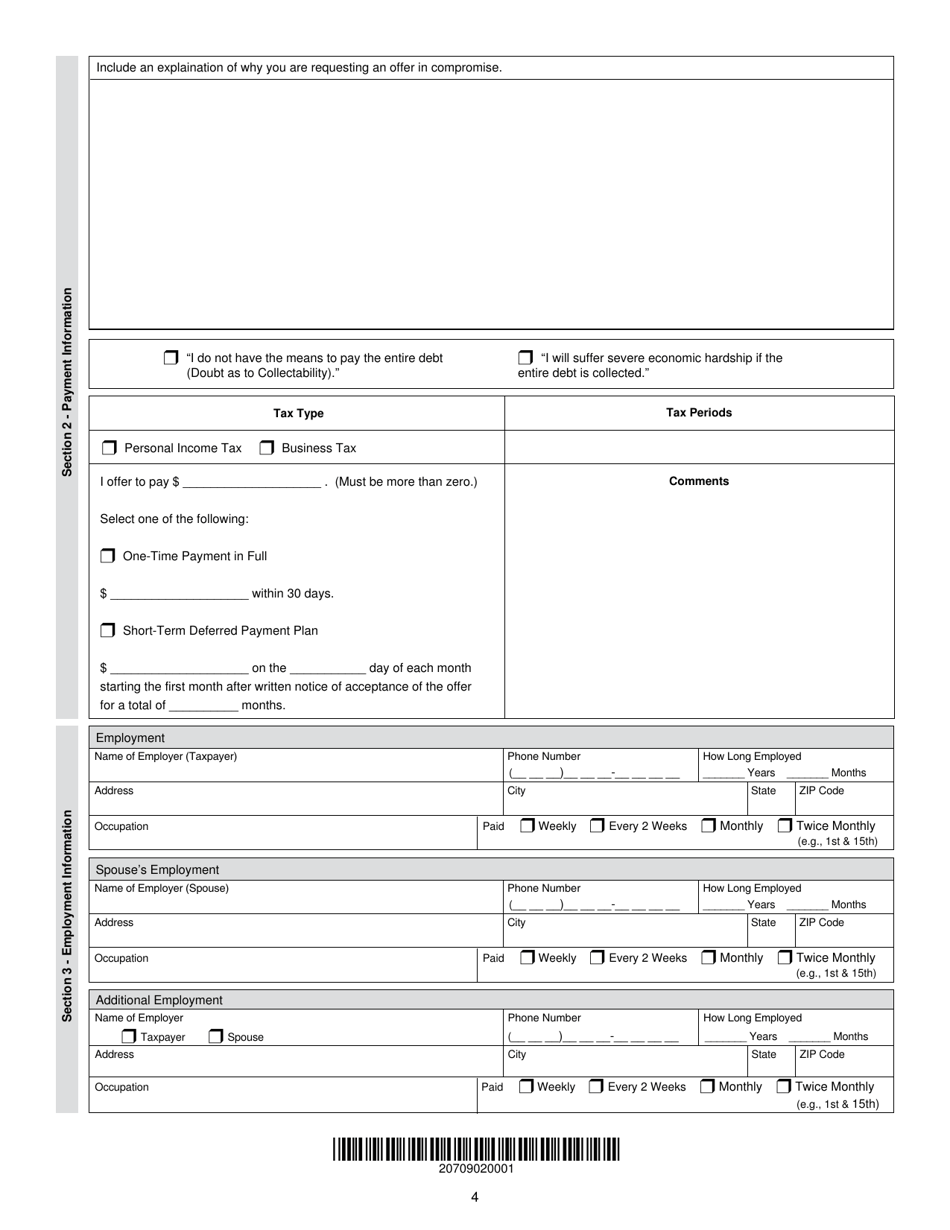

A: The MO-656B Offer in Compromise Application is a form used for individuals and businesses in Missouri to request a settlement with the state tax authorities for an amount less than what is owed.

Q: Who can use the MO-656B Offer in Compromise Application?

A: Individuals and businesses in Missouri who are unable to pay their full tax liability and can demonstrate financial hardship may be eligible to use the MO-656B Offer in Compromise Application.

Q: How does the MO-656B Offer in Compromise work?

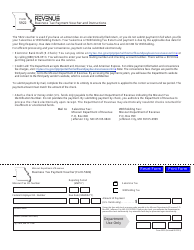

A: The MO-656B Offer in Compromise allows individuals and businesses to propose a lump-sum payment or a payment plan to the Missouri Department of Revenue as a settlement for their tax debt.

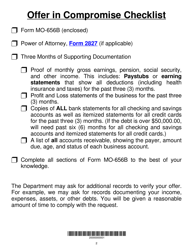

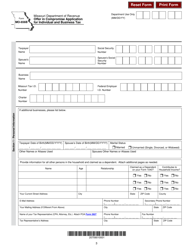

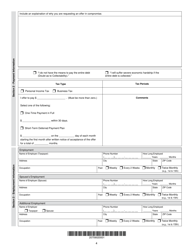

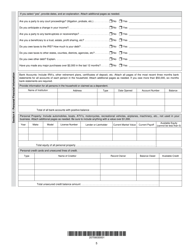

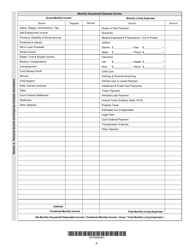

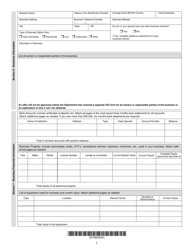

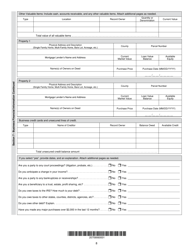

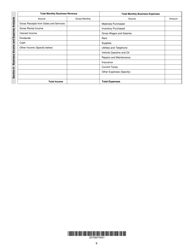

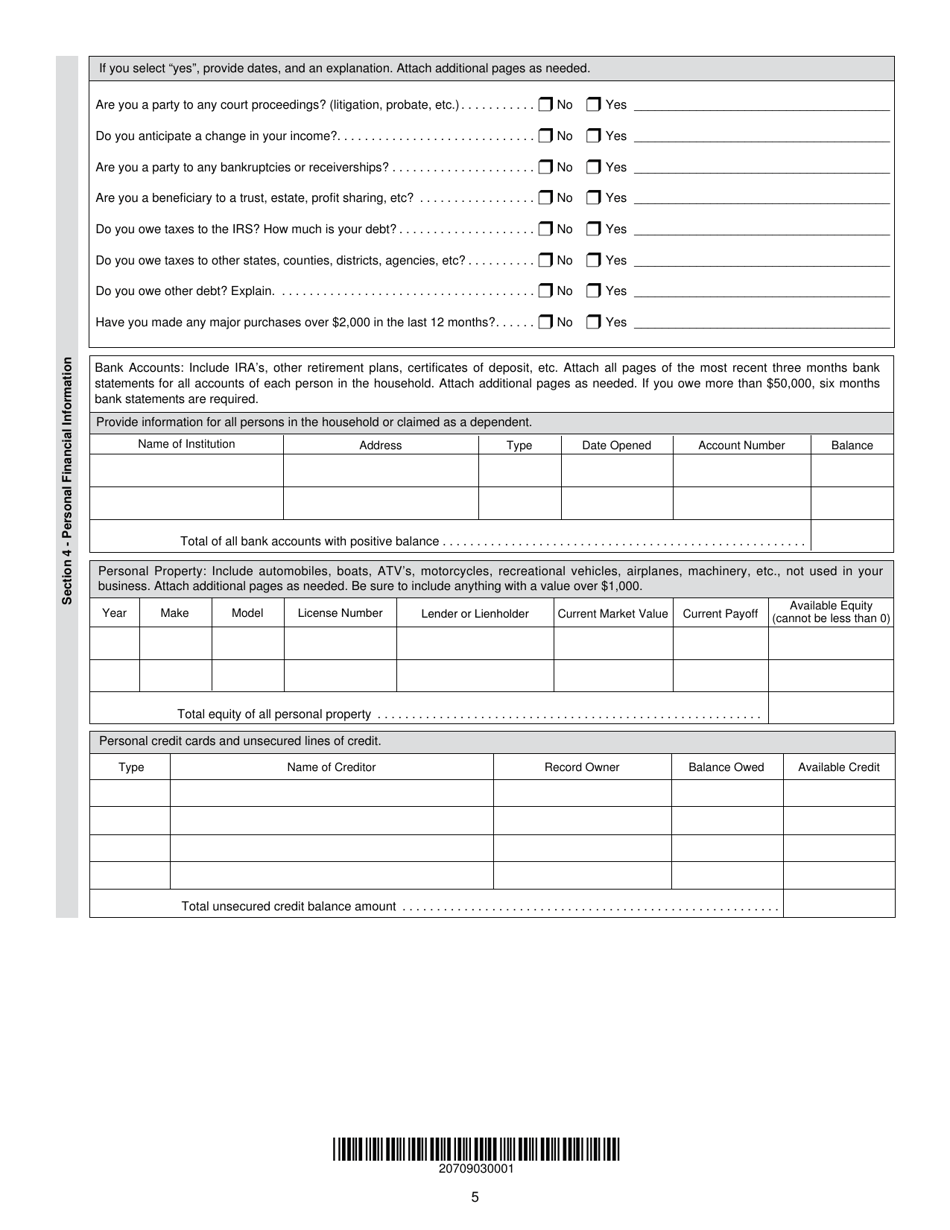

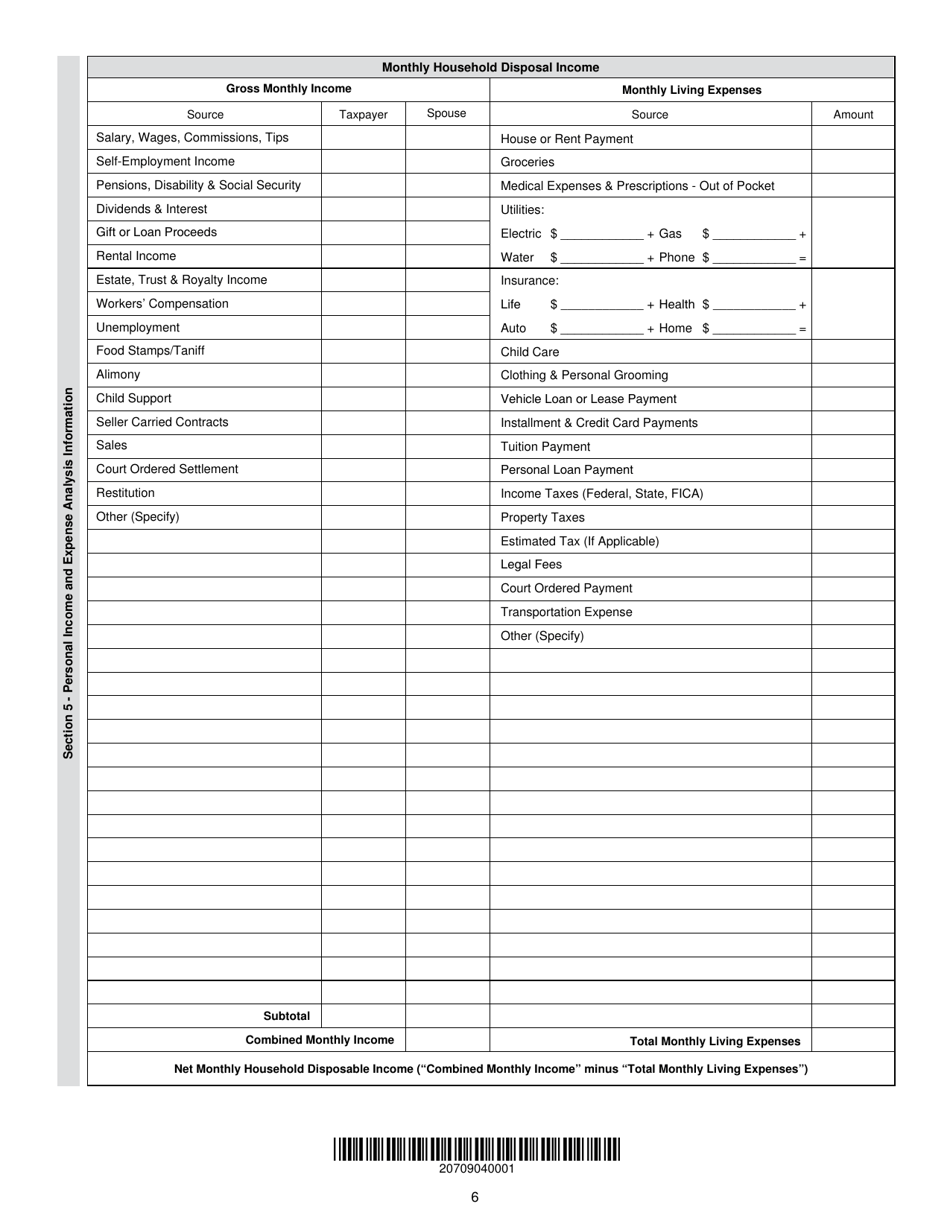

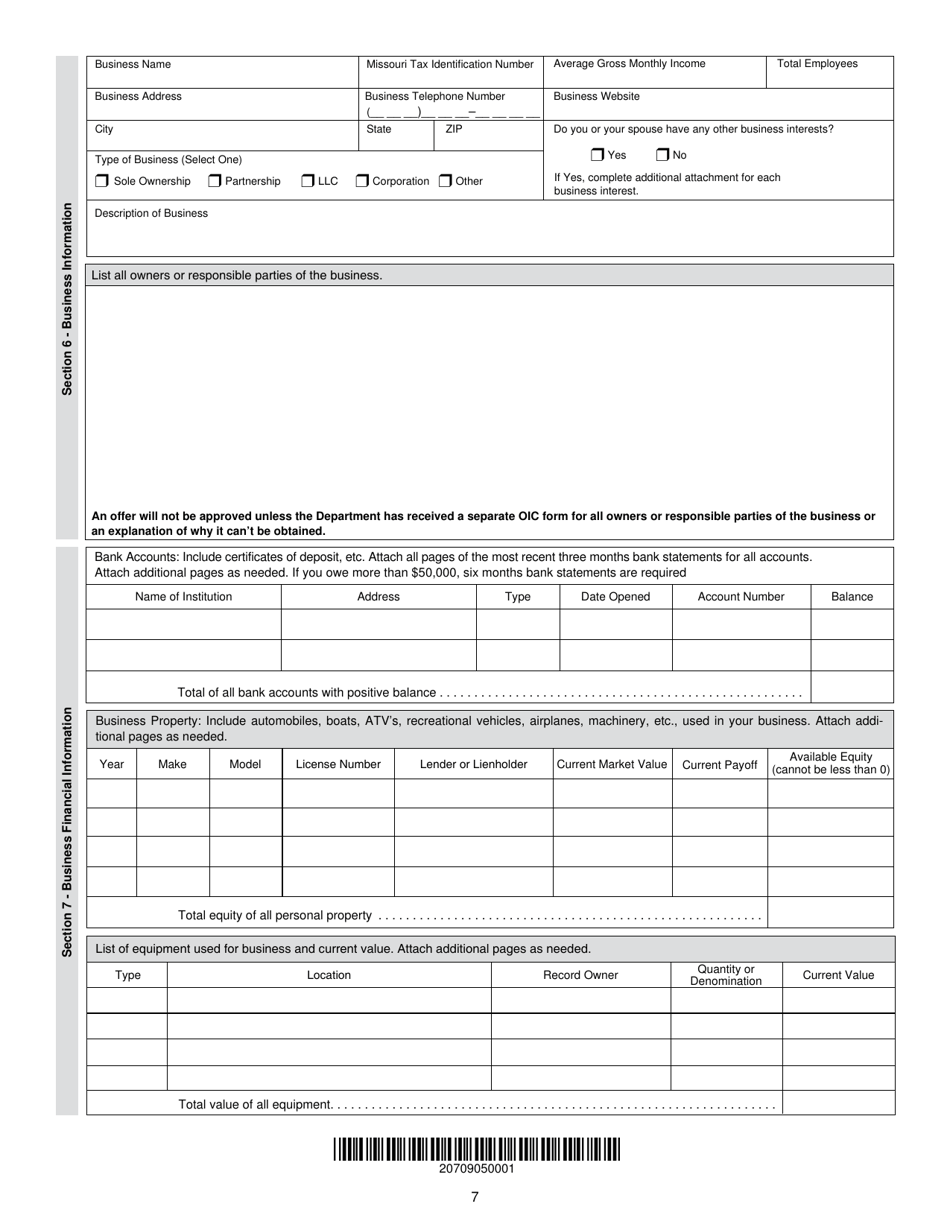

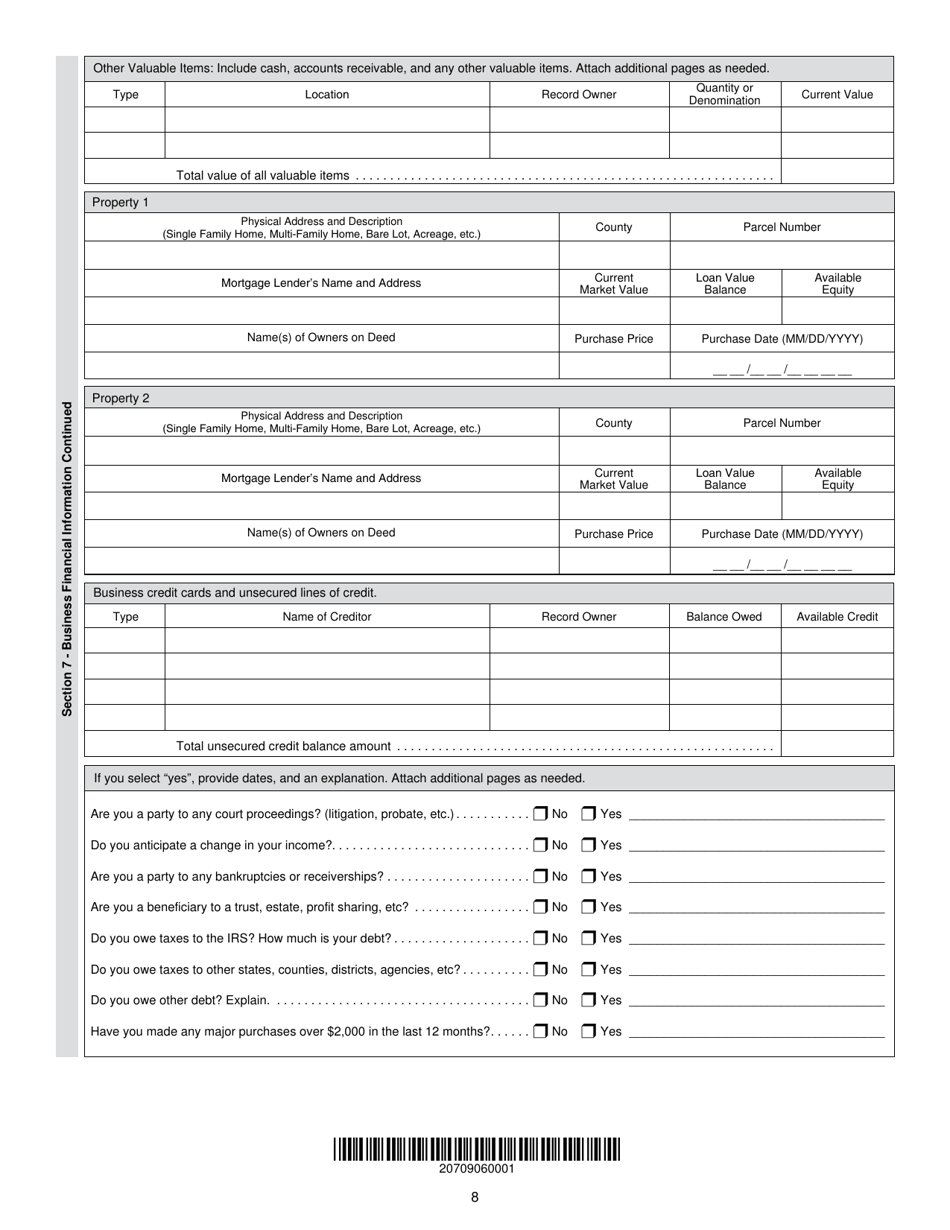

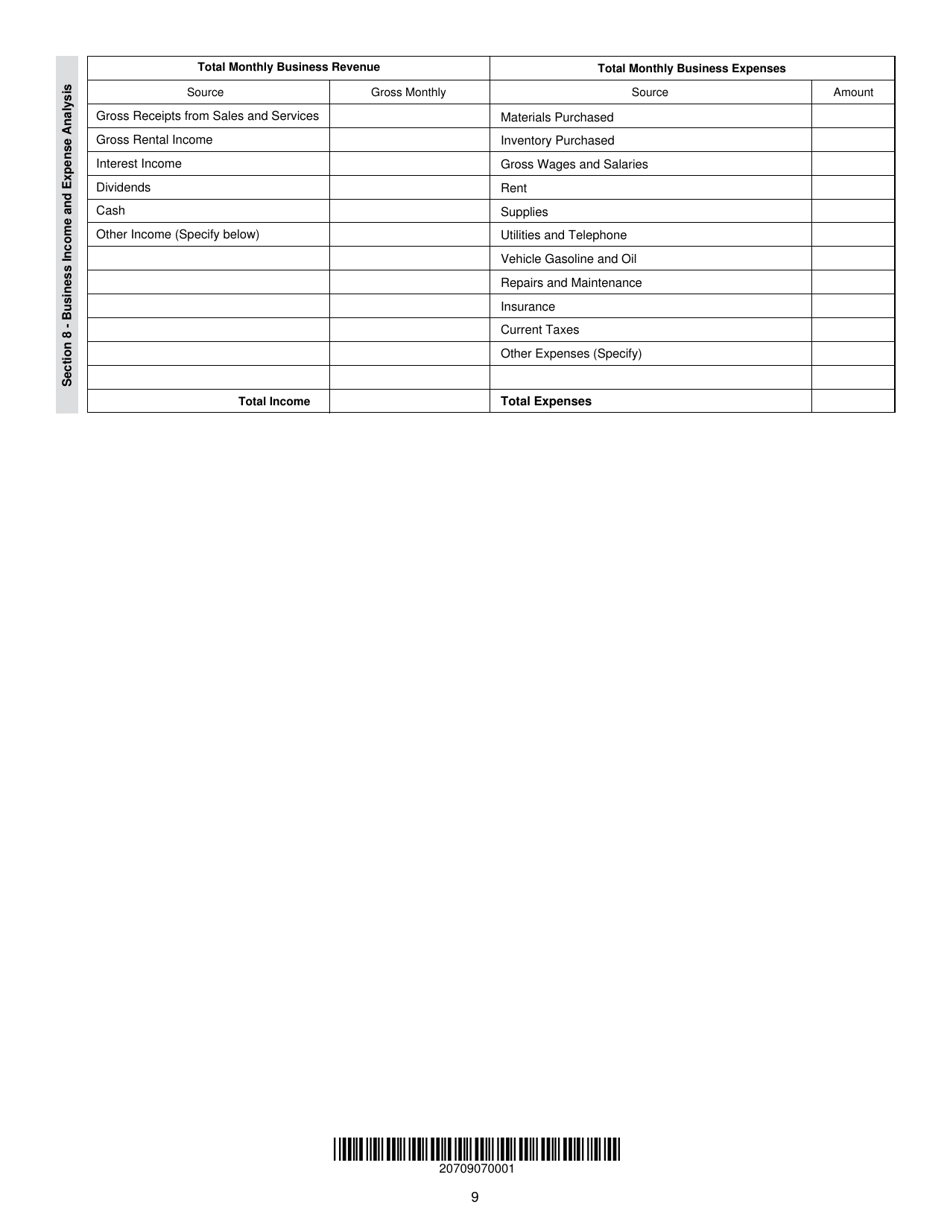

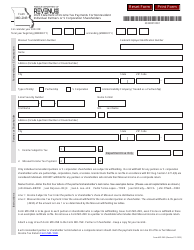

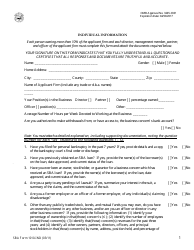

Q: What information is required on the MO-656B Offer in Compromise Application?

A: The MO-656B Offer in Compromise Application requires detailed financial information, including income, expenses, assets, and liabilities, to determine the taxpayer's ability to pay.

Q: Are there any fees associated with the MO-656B Offer in Compromise Application?

A: Yes, there is a non-refundable $50 fee to submit the MO-656B Offer in Compromise Application.

Q: How long does it take to process the MO-656B Offer in Compromise Application?

A: The processing time for the MO-656B Offer in Compromise Application can vary depending on the complexity of the case, but it typically takes several months.

Q: What happens after submitting the MO-656B Offer in Compromise Application?

A: After submitting the MO-656B Offer in Compromise Application, the Missouri Department of Revenue will review the proposal and make a determination on whether to accept or reject the offer.

Q: Can the MO-656B Offer in Compromise Application stop collection activities?

A: Yes, the submission of the MO-656B Offer in Compromise Application generally suspends collection activities while the application is being reviewed.

Q: What happens if the MO-656B Offer in Compromise Application is accepted?

A: If the MO-656B Offer in Compromise Application is accepted, the taxpayer will be required to make the agreed-upon payment(s) to settle their tax debt.

Q: What happens if the MO-656B Offer in Compromise Application is rejected?

A: If the MO-656B Offer in Compromise Application is rejected, the taxpayer will need to explore other options, such as setting up a payment plan or considering other forms of relief.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-656B by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.